City Developments Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

City Developments Bundle

City Developments faces a dynamic competitive landscape, influenced by the bargaining power of buyers and the intensity of rivalry within the property sector. Understanding these forces is crucial for strategic navigation.

The complete report reveals the real forces shaping City Developments’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of landowners is a significant factor for City Developments Limited (CDL), especially in land-scarce markets like Singapore. Prime development sites are limited, and government land sales often see fierce competition, directly impacting CDL's ability to acquire land at favorable prices. For instance, CDL's substantial bids for executive condominium sites in Senja Close and Woodlands Drive 17 in 2024 underscore this intense competition and the rising costs associated with securing new land.

CDL's strategic approach to land replenishment is therefore critical for sustaining its development pipeline. The company demonstrated this commitment by investing $2.2 billion globally in 2024, a move aimed at bolstering its land bank and ensuring future project viability in a competitive landscape.

The bargaining power of suppliers for construction materials and labor for City Developments (CDL) can be a significant factor. In 2024, global supply chain disruptions, particularly impacting steel and concrete, continued to put upward pressure on material costs. For instance, average steel prices in many regions saw a notable increase compared to 2023, directly affecting project budgets.

Labor availability also plays a crucial role. A shortage of skilled construction workers, a trend observed in many developed markets throughout 2024, can drive up wages and extend project timelines. This scarcity can give labor unions or specialized contracting firms greater leverage in negotiations with developers like CDL, potentially squeezing profit margins.

While the real estate sector often benefits from a wide array of suppliers and relatively low switching costs for standard materials, this dynamic can shift. For specialized architectural components or highly skilled trades, CDL might face suppliers with more concentrated power, leading to less favorable terms and increased project costs.

Financing institutions wield considerable bargaining power over City Developments (CDL) due to the capital-intensive nature of real estate. CDL's substantial net gearing of 117% in 2024 highlights its reliance on external funding, giving lenders leverage in negotiating terms.

The need for CDL to divest at least S$600 million in assets during 2025 further emphasizes its dependence on favorable financing. This financial pressure means lenders can influence project viability and CDL's strategic decisions through the cost and availability of capital.

External economic factors, like potential Federal Reserve interest rate cuts, directly impact borrowing costs for developers. Such shifts can alter the attractiveness of CDL's projects and its ability to secure capital on favorable terms, amplifying the bargaining power of financial institutions.

Specialized Consultants and Technology Providers

Suppliers of specialized services, like architectural design, engineering, and cutting-edge construction tech, can hold significant bargaining power, especially when their skills are unique or highly sought after. City Developments Limited (CDL) demonstrates this reliance through its integration of cloud-based AI platforms for biodiversity impact assessment, a clear nod to the influence of technology providers.

The hospitality industry is also increasingly adopting integrated technology systems and AI solutions. This trend amplifies the bargaining power of suppliers in this segment, as CDL, like its peers, seeks to leverage these advancements for operational efficiency and guest experience.

- Specialized expertise drives supplier leverage: Unique architectural or engineering skills can command higher prices and terms.

- Technology adoption increases supplier power: CDL's use of AI for biodiversity management highlights dependence on advanced tech suppliers.

- Hospitality tech trends impact supplier relations: The push for integrated systems and AI in hotels strengthens the hand of technology vendors.

Hotel Operators and Management Services

For City Developments Limited's (CDL) hospitality segment, Millennium & Copthorne Hotels, the bargaining power of suppliers like third-party management service providers, technology vendors, and specialized contractors is a key consideration. The influence these suppliers hold is directly tied to their industry standing, the distinctiveness of their services, and the breadth of their operational reach. CDL's strategic emphasis on boosting operational efficiency and elevating guest satisfaction could potentially amplify the leverage of suppliers who provide innovative and cutting-edge solutions.

The bargaining power of suppliers within CDL's hospitality operations is influenced by several factors:

- Supplier Concentration: A limited number of high-quality management service providers or technology vendors can exert greater influence.

- Switching Costs: High costs associated with changing technology platforms or management contracts can empower existing suppliers.

- Uniqueness of Offerings: Proprietary technology or specialized expertise that is difficult to replicate gives suppliers more leverage.

- Industry Trends: As of 2024, the hospitality sector is seeing increased demand for integrated technology solutions and sustainable operational practices, potentially increasing the power of suppliers in these niches.

The bargaining power of suppliers for City Developments Limited (CDL) is notably influenced by the concentration and uniqueness of their offerings, particularly in specialized areas. In 2024, CDL's investment in advanced technology, such as AI for biodiversity assessments, highlights a growing reliance on tech providers whose expertise can command premium terms. Similarly, the hospitality sector's drive for integrated tech solutions, as seen in Millennium & Copthorne Hotels, strengthens the leverage of suppliers providing these critical systems.

What is included in the product

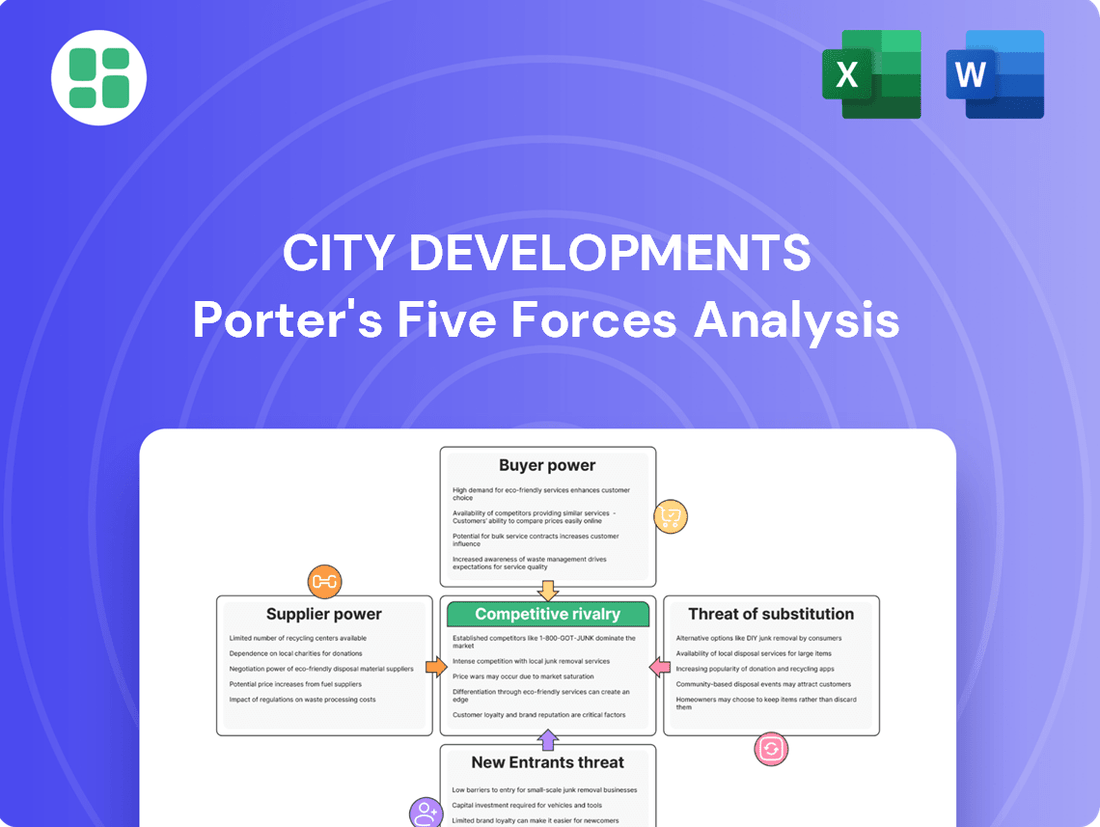

This analysis dissects the competitive forces impacting City Developments, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the real estate sector.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces on a dynamic radar chart.

Customers Bargaining Power

The bargaining power of residential property buyers in Singapore is shaped by several key factors. Market dynamics, including the balance of supply and demand, play a significant role. When there's ample supply and fewer buyers, customers naturally gain more leverage. Conversely, a tight market with high demand tends to reduce buyer power.

Interest rates are another crucial determinant. Lower interest rates make mortgages more affordable, potentially increasing buyer demand and thus reducing their bargaining power. Conversely, rising interest rates can cool the market and empower buyers. For instance, the Monetary Authority of Singapore's (MAS) stance on interest rates directly impacts borrowing costs for potential homeowners.

Government cooling measures, such as the Additional Buyer's Stamp Duty (ABSD), can also significantly influence buyer power. By increasing the cost of purchasing multiple properties or for foreign buyers, these measures can dampen speculative activity and shift power towards local, owner-occupier buyers. CDL's strong Q1 2025 sales, fueled by new launches, indicate robust demand from this segment, suggesting that while overall market conditions are favorable, specific buyer groups might experience varying degrees of bargaining power.

The bargaining power of commercial and retail tenants is significantly influenced by market dynamics like vacancy rates and the broader economic climate. For City Developments (CDL), their Singapore office portfolio experienced a slight dip in committed occupancy to 91.1% by March 2024, indicating a potential increase in tenant leverage. However, prime assets such as Republic Plaza continue to demonstrate resilience with strong occupancy and favorable rental growth.

Hotel and serviced apartment guests wield significant bargaining power. This is largely due to the vast array of choices available, amplified by online travel agencies and comparison websites that offer transparent pricing and easy comparison of services. In 2024, the continued reliance on platforms like Booking.com and Expedia means guests can readily find competitive rates, further pressuring hotels to offer value.

Guests are increasingly seeking personalized experiences and the ability to unbundle services, meaning they want to pay only for what they use. This trend forces hospitality providers, including City Developments' Millennium & Copthorne Hotels, to be more flexible with their offerings and pricing strategies to meet diverse customer needs and preferences.

To counter this, Millennium & Copthorne must differentiate itself not just on price, but on the overall value proposition. This includes focusing on exceptional service quality, unique amenities, and memorable guest experiences that foster loyalty and justify premium pricing, even amidst a competitive landscape.

Institutional Investors (for asset sales)

When City Developments Limited (CDL) sells off assets, institutional investors hold sway based on how easily those assets can be sold (liquidity), how good their quality and returns are, and how much they want to invest. CDL's goal to divest at least S$600 million in assets during 2025 to manage its debt levels suggests they might need buyers, potentially giving these investors more negotiation power.

The strength of Singapore's property market, which often draws substantial foreign investment, could help CDL by creating a competitive environment among buyers, thus moderating the bargaining power of any single institutional investor.

- Market Liquidity: The ease with which CDL's assets can be sold influences investor leverage.

- Asset Quality and Yield: Higher quality and better returns strengthen investor negotiating positions.

- CDL's Divestment Target: CDL's 2025 goal of shedding S$600 million in assets may create buyer opportunities.

- Singapore Real Estate Resilience: A strong market can attract multiple investors, potentially balancing individual bargaining power.

Upgraders and First-Time Homebuyers

The bargaining power of customers, specifically upgraders and first-time homebuyers in Singapore, is a key consideration for City Developments Limited (CDL). This demographic, especially young Singaporeans, significantly influences the property market. Their ability to purchase is heavily tied to economic factors like affordability and prevailing mortgage interest rates.

CDL strategically targets these buyer segments, including those looking at Executive Condominiums, to ensure sustained demand. For instance, in 2024, the Singapore property market has seen a continued interest from these groups, even with the implementation of cooling measures. This sustained demand is crucial for market stability.

- Affordability Concerns: Rising property prices and interest rates in 2024 continue to shape the purchasing decisions of first-time homebuyers and upgraders, impacting their bargaining power.

- Mortgage Rate Sensitivity: Fluctuations in mortgage rates directly affect the borrowing capacity of these buyers, giving them leverage when rates are high and affordability is strained.

- Demand for Diverse Housing: CDL's catering to various needs, from affordable Executive Condominiums to more premium offerings, helps manage customer bargaining power by meeting diverse price points.

- Market Stability Indicator: The consistent demand from these buyer groups in 2024, despite economic headwinds, highlights their collective influence on CDL's sales performance and market positioning.

The bargaining power of customers for City Developments (CDL) is generally moderate but can shift based on market conditions and buyer type. For residential property, factors like interest rates and government policies, such as the Additional Buyer's Stamp Duty, directly influence buyer leverage. In 2024, while demand remains, affordability concerns due to property prices and mortgage rates can empower buyers, particularly first-time homeowners and upgraders.

In the commercial and retail sectors, tenant power is influenced by office vacancy rates and the economic climate. CDL's Singapore office portfolio occupancy stood at 91.1% by March 2024, suggesting some tenant leverage, though prime locations like Republic Plaza maintain strong occupancy.

For hospitality, guests have significant power due to abundant choices and transparent pricing online, pressuring CDL's Millennium & Copthorne Hotels to focus on value and unique experiences rather than just price.

Institutional investors looking to acquire CDL assets in 2025, as CDL aims to divest S$600 million, will have leverage influenced by asset liquidity, quality, and CDL's need to meet its divestment targets.

| Customer Segment | Key Influencing Factors | Customer Bargaining Power (2024/2025 Outlook) |

|---|---|---|

| Residential Buyers (First-time/Upgraders) | Affordability, Mortgage Rates, Government Policies (ABSD) | Moderate to High (sensitive to rates and prices) |

| Commercial/Retail Tenants | Vacancy Rates, Economic Climate, Lease Terms | Moderate (influenced by market vacancy, prime assets stronger) |

| Hotel/Serviced Apartment Guests | Online Competition, Price Transparency, Service Preferences | High (driven by choice and digital platforms) |

| Institutional Investors (Asset Divestment) | Asset Liquidity, Quality, CDL's Divestment Targets | Moderate (dependent on CDL's urgency and market demand) |

Preview Before You Purchase

City Developments Porter's Five Forces Analysis

This preview showcases the complete City Developments Porter's Five Forces Analysis, providing a comprehensive examination of the competitive landscape. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring full transparency and immediate usability for your strategic planning.

Rivalry Among Competitors

The real estate sector in Singapore, where City Developments Limited (CDL) primarily operates, is intensely competitive. Major developers such as CapitaLand, Frasers Property, and UOL Group are significant players, alongside CDL, all actively bidding for land and market share across residential, commercial, and industrial segments.

This crowded landscape means CDL faces constant pressure from numerous well-established firms. For instance, in 2024, Singapore's property market saw robust participation in government land tenders, with developers like GuocoLand and Far East Organization also showing strong interest, underscoring the sheer number of entities vying for prime development opportunities.

While the Singapore real estate market is projected for moderate growth in 2025, competition is particularly fierce in high-demand niches such as luxury residences and large-scale integrated projects. This intense rivalry means companies must continuously innovate and differentiate their offerings to capture market share.

City Developments Limited (CDL) strategically navigates this competitive landscape by maintaining a broad and diversified portfolio. Spanning residential, commercial, and hospitality sectors across numerous global markets, CDL's diversified approach effectively cushions the impact of heightened rivalry within any single segment or geographical area, providing resilience.

In the real estate sector, differentiating products is tough, but companies like City Developments Limited (CDL) stand out through superior design, construction quality, appealing amenities, and comprehensive integrated services. CDL actively focuses on enhancing its existing assets and refining its operational efficiency, all while pushing its fund management growth strategy to capitalize on its core competencies.

The hospitality industry, a key area for CDL, sees intense competition where differentiation hinges on embracing new technologies, offering highly personalized guest experiences, and prioritizing wellness. For instance, in 2024, many hotel groups are investing heavily in AI-driven customer service and sustainable practices to attract and retain guests, reflecting a broader industry trend towards experiential and value-driven offerings.

Land Acquisition and Development Pipeline

Competitive rivalry in the land acquisition and development sector is particularly fierce, as securing prime locations is absolutely critical for future growth and project success. City Developments Limited (CDL) actively engages in aggressive bidding for Government Land Sales plots, a clear indicator of this intense competition for valuable real estate.

CDL's strategic land replenishment efforts are a direct response to this high level of rivalry. A strong launch pipeline, such as CDL's approximately 950 units planned for launch in addition to their existing inventory, is essential for maintaining sustained competitiveness in this dynamic market.

- Intense Competition for Prime Sites: Securing desirable land parcels is a primary battleground for developers.

- Aggressive Bidding Strategies: CDL's participation in Government Land Sales highlights the need for competitive bids.

- Strategic Land Replenishment: Continuous acquisition of new sites is crucial for future development pipelines.

- Launch Pipeline as a Competitive Metric: A robust pipeline of upcoming projects, like CDL's ~950 units, directly impacts market standing.

Global and Regional Expansion

City Developments Limited (CDL) operates in a dynamic competitive environment, significantly shaped by its extensive global and regional expansion. With a presence in 168 locations across 29 countries, CDL encounters a wide array of competitors, varying from local developers to established international players in each market.

CDL's strategic push into the global living sector, particularly in the United Kingdom, Japan, Australia, and the United States, exposes it to intensified competition. For instance, in the UK's private rented sector (PRS), CDL competes with numerous developers and operators who have a long-standing presence and deep understanding of local market nuances. Similarly, the student accommodation sector in these countries features established entities with significant scale and brand recognition.

- Global Footprint: CDL's operations span 29 countries, leading to diverse competitive pressures.

- Living Sector Expansion: Entry into UK, Japan, Australia, and US living sectors introduces new, often well-entrenched, competitors.

- Market Specific Competition: Competition intensity varies greatly, with mature markets like the UK PRS presenting different challenges than emerging markets.

- Diversified Exposure: While diversification reduces reliance on any single market, it broadens the spectrum of competitive forces CDL must navigate.

The competitive rivalry for City Developments Limited (CDL) is substantial, driven by a multitude of established developers in Singapore and globally. This intense competition is evident in land tenders, where multiple firms vie for prime sites, as seen in the robust participation in 2024 government land sales involving major players. CDL's strategy of diversification across sectors and geographies, coupled with a focus on product differentiation through design and services, is crucial for navigating this challenging environment.

| Competitor | Primary Market Focus | 2024 Estimated Revenue (SGD Billion) | Key Competitive Strengths |

|---|---|---|---|

| CapitaLand | Integrated developments, retail, office | ~6.5 | Strong brand, extensive retail portfolio |

| Frasers Property | Residential, commercial, hospitality, logistics | ~5.2 | Diversified asset classes, global presence |

| UOL Group | Residential, commercial, hotels | ~4.8 | Reputation for quality residential projects |

| GuocoLand | Residential, commercial, integrated developments | ~3.1 | Focus on prime land acquisition, integrated projects |

SSubstitutes Threaten

For residential properties, substitutes include renting instead of buying, public housing like HDB flats in Singapore, or co-living spaces. While Singapore's property market is generally stable, escalating prices and interest rates, which saw the prime lending rate average around 5.5% in early 2024, can steer potential buyers toward these more accessible alternatives.

The increasing adoption of flexible work arrangements and the proliferation of co-working spaces present a significant threat of substitutes for traditional office leasing. Many companies are re-evaluating their need for large, long-term office leases, opting instead for hybrid models that incorporate remote work. This shift directly impacts the demand for conventional office spaces, potentially weakening the bargaining power of commercial property owners.

As of 2024, the trend towards flexible workspaces continues to gain momentum. For instance, a significant portion of companies are now offering hybrid work options, with some studies indicating that over 60% of employees expect to work remotely at least part-time. This widespread adoption of alternative work models means that businesses have more choices beyond traditional office leases, directly substituting the need for extensive physical office footprints.

For City Developments Limited's (CDL) hospitality arm, Millennium & Copthorne Hotels, the threat of substitutes is significant. Travelers increasingly opt for short-term rental platforms like Airbnb, which offer unique local experiences and often lower price points. In 2024, Airbnb continued to see robust growth, with bookings in major global cities often outperforming traditional hotel occupancy rates in certain segments.

Beyond rentals, the option of staying with friends or family presents a zero-cost substitute. Furthermore, the proliferation of budget accommodation, including hostels and budget hotel chains, caters to price-sensitive travelers, directly competing with CDL's offerings. This competitive landscape forces the hospitality industry to innovate, with a growing emphasis on personalized service and distinctive guest experiences to differentiate from these readily available alternatives.

Other Investment Vehicles

For investors, real estate is just one of many avenues for capital deployment. Other investment vehicles like stocks, bonds, and mutual funds offer alternative ways to generate returns. In 2024, the S&P 500, a benchmark for US equities, saw significant growth, highlighting the competitive nature of these substitute investments.

City Developments Limited (CDL) is actively working to make its real estate offerings more appealing. By focusing on enhancing recurring income streams through rental properties and expanding its fund management capabilities, CDL aims to present real estate as a more stable and attractive option compared to the inherent volatility found in many stock market investments.

- Real Estate as an Investment: Real estate competes with a broad range of financial instruments for investor capital.

- Key Substitutes: Stocks, bonds, mutual funds, exchange-traded funds (ETFs), and alternative assets like commodities and cryptocurrencies represent significant alternatives.

- Market Dynamics (2024): The performance of these substitutes, such as the S&P 500's gains, directly influences the attractiveness of real estate.

- CDL's Strategic Response: CDL's strategy focuses on building stable recurring income and growing its fund management business to bolster real estate's competitive position.

Integrated Development Alternatives

Integrated developments, which bundle residential, commercial, and retail spaces, strive to deliver unparalleled convenience. However, potential substitutes exist if these integrated offerings fail to provide sufficient value or convenience. Consumers might opt for standalone residential properties, work in traditional, separate office buildings, and shop at distinct, standalone malls.

The threat of these substitutes is amplified when the perceived benefits of integration are not realized. For instance, if the retail component of an integrated development offers limited choices or higher prices compared to specialized retail centers, residents might seek alternatives. Similarly, if office spaces within an integrated project lack the amenities or flexibility of dedicated business parks, businesses may look elsewhere.

In 2024, the demand for flexible work arrangements and diverse retail experiences continues to shape consumer preferences. A 2024 report indicated that while mixed-use developments saw continued interest, a significant portion of consumers prioritized specific functionalities. For example:

- Residential: 65% of surveyed homebuyers prioritized proximity to green spaces over integrated retail options.

- Commercial: 70% of businesses surveyed indicated that specialized co-working spaces offered superior networking opportunities compared to office spaces within mixed-use developments.

- Retail: Consumer spending data from 2024 showed a 10% increase in spending at boutique, standalone retail stores compared to mall-based outlets, suggesting a preference for curated experiences.

The threat of substitutes for City Developments Limited (CDL) is multifaceted, spanning residential, commercial, and hospitality sectors. For residential properties, alternatives like renting or public housing, especially in a market with prime lending rates averaging 5.5% in early 2024, present viable options. In the commercial space, the rise of flexible work and co-working environments directly substitutes the need for traditional office leases, with over 60% of employees expecting some form of remote work in 2024. For CDL's hospitality segment, short-term rentals like Airbnb, which saw robust growth in 2024, and budget accommodations offer competitive alternatives to hotels.

Real estate investment itself faces substitutes from other financial instruments. The strong performance of the S&P 500 in 2024, for instance, highlights the competitive returns offered by equities. CDL counters this by focusing on recurring income and fund management to make its real estate offerings more appealing against volatile market alternatives.

Integrated developments, while offering convenience, can be substituted if their value proposition weakens. Consumers might choose standalone residential, office, or retail spaces if integrated options lack specific amenities or competitive pricing. In 2024, consumer preferences showed a leaning towards specialized options, with 65% of homebuyers prioritizing green spaces and 70% of businesses favoring co-working spaces for networking.

| Sector | Substitute Options | 2024 Market Trend/Data Point | Impact on CDL |

| Residential | Renting, Public Housing | Prime lending rate ~5.5% | Reduced demand for ownership |

| Commercial | Co-working, Remote Work | >60% employees expect remote work | Lower demand for office leases |

| Hospitality | Airbnb, Budget Hotels | Airbnb robust growth | Competition for hotel bookings |

| Investment | Stocks, Bonds, ETFs | S&P 500 strong gains | Diversion of investor capital |

Entrants Threaten

The real estate development sector, including companies like City Developments Limited (CDL), is inherently capital-intensive. Significant upfront investment is needed for land acquisition, construction, and securing financing, creating a substantial barrier for newcomers. For instance, CDL’s reported total assets stood at approximately SGD 23.7 billion as of December 31, 2023, illustrating the scale of capital involved.

This high capital requirement effectively deters potential new entrants. The sheer volume of funds needed to enter the market and compete with established players like CDL, which consistently invests in its development pipeline and land replenishment, makes it a challenging landscape for those without substantial financial backing.

The threat of new entrants for City Developments Limited (CDL) is significantly mitigated by the intense competition and high costs associated with land acquisition in mature markets like Singapore. Acquiring land often involves navigating complex government tenders or costly collective sales, making it a substantial barrier for newcomers.

In 2024, Singapore's land tenders saw robust participation, with bids often exceeding initial expectations, reflecting the scarcity and desirability of prime development sites. For instance, a recent GLS tender for a residential site in Tampines attracted 10 bids, highlighting the competitive landscape.

CDL's extensive experience and established track record in successfully securing and developing such sites provide a distinct advantage. Their deep understanding of regulatory frameworks and proven ability to manage intricate acquisition processes creates a formidable hurdle for any new entity attempting to enter the market.

The real estate sector, particularly for large-scale developers like City Developments, is heavily encumbered by a labyrinth of regulations. These include intricate zoning laws, stringent environmental standards, and evolving building codes that vary significantly by locale. For instance, in 2024, Singapore continued to refine its urban planning policies, impacting development density and land use, which requires substantial local expertise to navigate effectively.

Furthermore, government intervention through cooling measures, such as property taxes and loan-to-value ratio restrictions, can abruptly alter market dynamics. New entrants often lack the established relationships and deep institutional knowledge necessary to anticipate and adapt to these policy shifts, creating a formidable barrier to entry.

Brand Reputation and Established Trust

Established players like City Developments Limited (CDL), with a legacy spanning over 60 years in real estate development, investment, and management, possess a significant advantage due to their strong brand recognition and the deep trust they have cultivated with buyers and investors. This existing credibility is a formidable barrier for newcomers.

New entrants would require considerable investment in marketing and a substantial amount of time to even begin building a comparable level of trust and reputation in the competitive property market. For instance, CDL's consistent delivery of quality projects and its extensive portfolio, which includes a significant presence in Singapore's residential sector, underpin this established trust.

- Brand Loyalty: CDL's long-standing presence fosters customer loyalty, making it harder for new entrants to attract and retain buyers.

- Reputational Capital: Over six decades of successful projects have built a reputational capital that new firms struggle to replicate quickly.

- Market Perception: CDL is often perceived as a reliable and stable developer, a perception that new entrants must actively challenge.

- Trust in Quality: Buyers often associate CDL with consistent quality and timely delivery, a benchmark that new competitors must meet or exceed from day one.

Economies of Scale and Experience Curve

Existing large-scale developers, like City Developments Limited (CDL), leverage significant economies of scale. This allows them to secure better pricing on materials and labor, reducing per-unit costs. For instance, in 2023, major developers often reported procurement savings of 5-10% due to bulk purchasing power, a benefit new, smaller entrants struggle to replicate.

The experience curve also presents a substantial barrier. Developers with a long track record, such as CDL which has been operating for decades, have refined their construction processes and risk mitigation strategies. This accumulated knowledge translates into faster project completion times and fewer costly errors, giving them a competitive edge over newcomers.

- Cost Efficiencies: Large developers achieve lower costs through bulk purchasing and optimized supply chains.

- Project Management Expertise: Decades of experience lead to more efficient execution and reduced project risks.

- Financing Advantages: Established players often secure more favorable financing terms due to their proven financial stability.

- Brand Reputation: A strong track record builds trust, making it easier to attract buyers and partners.

The threat of new entrants for City Developments Limited (CDL) is generally low due to substantial barriers. High capital requirements, stringent regulations, established brand loyalty, and economies of scale create significant hurdles for newcomers. For example, CDL’s substantial asset base of approximately SGD 23.7 billion as of December 31, 2023, underscores the capital intensity of the sector.

Navigating complex regulatory environments and securing desirable land parcels, often through competitive tenders as seen in Singapore's 2024 land sales, demands considerable expertise and financial clout. New entrants would face immense challenges in matching the established players’ market penetration and trust. The extensive experience and deep market knowledge CDL possesses further solidify its position against potential new competition.

Porter's Five Forces Analysis Data Sources

Our City Developments Porter's Five Forces analysis is built upon a robust foundation of data, incorporating insights from publicly available financial reports, real estate market intelligence platforms, and government planning documents. This blend ensures a comprehensive understanding of industry dynamics.