City Developments Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

City Developments Bundle

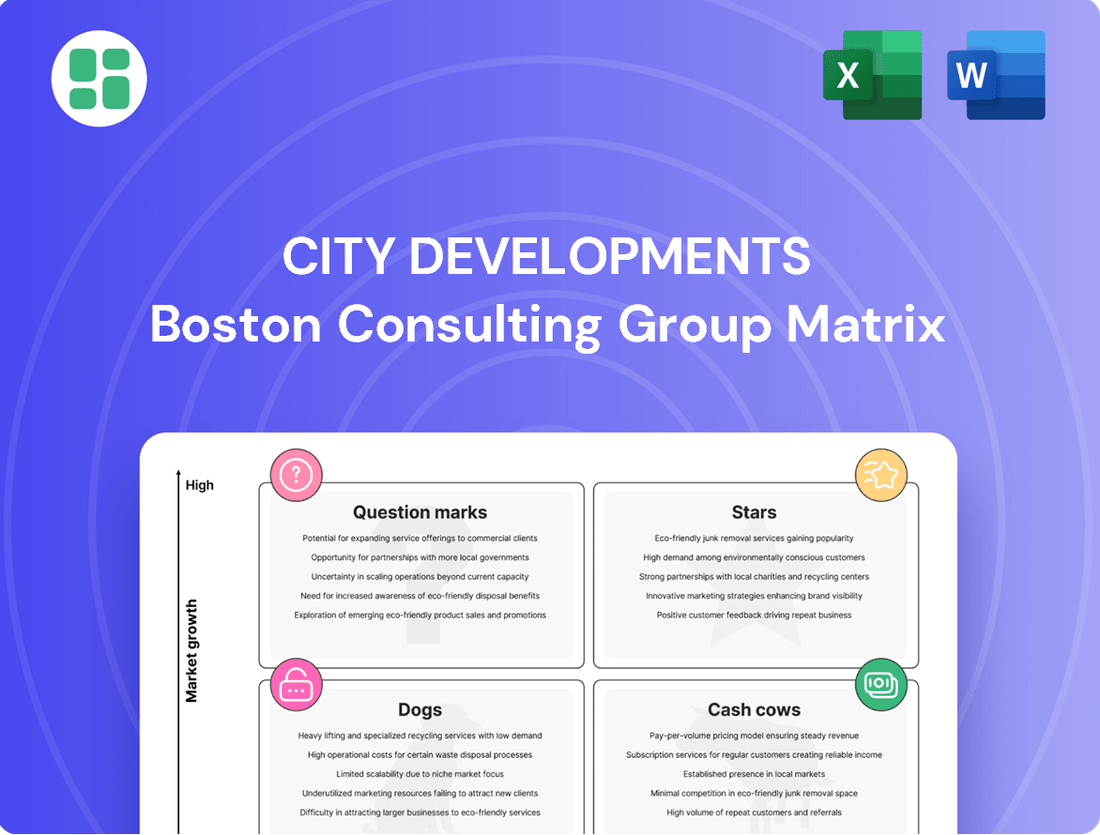

Unlock the strategic potential of city development with our comprehensive BCG Matrix. Understand which urban projects are thriving Stars, which are stable Cash Cows, which are underperforming Dogs, and which emerging initiatives are promising Question Marks. This analysis provides a crucial framework for resource allocation and future planning.

Don't just guess where your city's development efforts should focus; know for sure. Purchase the full BCG Matrix to gain detailed quadrant placements, data-backed recommendations, and a clear roadmap for smart investment and project prioritization that drives growth and sustainability.

Stars

CDL's recent residential launches, like The Orie in Toa Payoh, are performing exceptionally well. In Q1 2025, The Orie saw a significant portion of its units sold very quickly after its launch, showcasing robust buyer interest.

This strong sales momentum suggests high demand within a key segment of Singapore's property market. Factors like positive buyer sentiment and potentially more favorable mortgage rates are likely contributing to this success.

These successful launches position CDL's residential projects as market leaders, poised to contribute substantially to the company's revenue streams.

City Developments' (CDL) Purpose-Built Student Accommodation (PBSA) in the UK represents a promising Star in their BCG Matrix. This segment is experiencing robust demand, with CDL reporting strong occupancy rates for the 2024/2025 academic year, highlighting its current success and growth potential.

The UK's living sector, particularly PBSA, is a key growth area for CDL. This is driven by persistent trends of increasing rental demand and a highly mobile workforce, creating a favorable environment for continued expansion and investment. CDL's strategic focus on scaling its PBSA portfolio is effectively building a more stable and predictable recurring income stream.

City Developments Limited (CDL) is actively bolstering its hospitality portfolio through strategic acquisitions in prime global locations. A prime example is the acquisition of the Hilton Paris Opéra in May 2024, a move that significantly strengthens its presence in a major European gateway city and taps into robust tourism demand.

The global hospitality sector is on an upward trajectory, with strong recovery signs and optimistic growth projections. This trend is fueled by a resurgence in travel, leading to increased occupancy rates and a rise in Revenue Per Available Room (RevPAR). For instance, the global hotel RevPAR is anticipated to grow by 5.8% in 2024, according to industry forecasts.

These calculated investments allow CDL to capture a larger share of the market, particularly in segments that demonstrate high performance and resilience. By securing assets in key gateway cities, CDL is strategically positioning itself to benefit from sustained travel demand and capitalize on the ongoing recovery and expansion of the hospitality industry.

Redevelopment of Large-Scale Mixed-Use Developments (e.g., Union Square)

Redevelopment of large-scale mixed-use projects, exemplified by Union Square at Havelock Road, are positioned as stars within the City Developments BCG Matrix. These ventures benefit from substantial Gross Floor Area (GFA) increases and prime urban locations, aligning with city-wide transformation efforts.

These developments integrate residential, retail, and serviced apartment components, attracting a broad range of buyers and tenants. This diversification fuels strong potential for capital appreciation. Notably, Union Square Residences has achieved a sales milestone, with one-third of its units already sold, indicating robust market demand.

- High Growth Potential: Urban redevelopment projects offer significant growth prospects due to strategic locations and GFA enhancements.

- Market Appeal: Integration of residential, retail, and serviced apartments caters to diverse market segments.

- Sales Performance: Union Square Residences demonstrates strong market reception with one-third of units sold.

- Strategic Alignment: These projects leverage urban transformation initiatives, positioning them for future value creation.

Executive Condominiums (ECs) in Singapore

Executive Condominiums (ECs) represent a strong "Star" for City Developments Limited (CDL) within Singapore's property market. CDL's recent successes with Lumina Grand and Copen Grand, both nearly or fully sold out, underscore their significant market share in this sought-after segment.

The demand for ECs remains high, fueled by a consistent flow of upgraders from Housing & Development Board (HDB) flats. CDL's proactive approach is evident in their top bids for new EC sites, signaling a clear strategy to solidify and expand their leadership in this lucrative niche.

- Market Dominance: CDL's Lumina Grand achieved an impressive 80% take-up within its launch weekend in August 2024, with Copen Grand nearing full sell-out.

- Strong Demand Drivers: The EC segment benefits from a substantial pool of HDB upgraders, a demographic with proven purchasing power.

- Strategic Acquisitions: CDL secured a prime EC site in Tampines North in October 2024 for S$576 million, demonstrating their commitment to future growth in this sector.

CDL's Purpose-Built Student Accommodation (PBSA) in the UK is a clear Star. The segment is experiencing robust demand, with CDL reporting strong occupancy rates for the 2024/2025 academic year. This success is driven by increasing rental demand and a mobile workforce, creating a favorable environment for CDL's expansion and a stable recurring income stream.

The company's hospitality portfolio, bolstered by strategic acquisitions like the Hilton Paris Opéra in May 2024, also shines. The global hospitality sector is recovering strongly, with forecasts predicting a 5.8% growth in global hotel RevPAR for 2024. These investments position CDL to capitalize on sustained travel demand and industry expansion.

Large-scale mixed-use redevelopments, such as Union Square at Havelock Road, are Stars due to their prime urban locations and GFA enhancements. The integration of residential, retail, and serviced apartments appeals to diverse market segments, fueling capital appreciation potential. Union Square Residences has already seen one-third of its units sold, indicating strong market reception.

Executive Condominiums (ECs) in Singapore are another Star for CDL. Lumina Grand achieved an 80% take-up during its August 2024 launch weekend, and Copen Grand is nearing a full sell-out. This segment benefits from a substantial pool of HDB upgraders, and CDL's strategic acquisition of a prime EC site in Tampines North for S$576 million in October 2024 reinforces its leadership.

What is included in the product

The City Developments BCG Matrix analyzes its real estate portfolio by categorizing properties into Stars, Cash Cows, Question Marks, and Dogs.

This framework guides strategic decisions on investment, divestment, and resource allocation for each property type.

The City Developments BCG Matrix offers a clear, one-page overview, relieving the pain of complex portfolio analysis.

Cash Cows

CDL's Singapore office portfolio, featuring prime assets like Republic Plaza and City House, demonstrates robust performance with high committed occupancy rates that consistently surpass the island-wide average. For instance, as of the first half of 2024, CDL's Singapore office portfolio maintained a committed occupancy rate of approximately 95%, a notable figure compared to the island-wide average which hovered around 90% during the same period.

These strategically located properties operate within a mature market, yet they are a dependable source of substantial recurring income. This stability is underpinned by their prime locations and a strong, loyal tenant base, ensuring consistent rental revenue streams.

The mature nature of these assets means they require minimal promotional investment to maintain their occupancy. This efficiency allows them to function as reliable cash cows, generating steady profits that can be reinvested in other strategic areas of CDL's business.

Established retail malls like City Square Mall and Claymore Connect represent mature assets within City Developments Limited's (CDL) portfolio, functioning as cash cows. These properties are located in developed markets, consistently generating stable rental income for the company.

Despite potentially moderate growth prospects in the retail mall sector, these established locations boast high occupancy rates, contributing significantly to CDL's net property income. For instance, in 2023, CDL's retail segment reported a strong performance, with occupancy rates for its Singapore malls remaining robust, underscoring the dependable cash flow these assets provide.

Long-standing hotel assets in stable markets, exemplified by the Grand Copthorne Waterfront Hotel Singapore, are the bedrock of a strong hotel portfolio. These properties consistently deliver robust revenue per available room (RevPAR), a key performance indicator in the hospitality industry, and secure a significant market share within their respective segments.

While the hospitality sector can experience volatility, these established hotels leverage strong brand equity and a reliable influx of both corporate and leisure guests. Their mature nature means they demand less capital expenditure for upkeep, allowing for sustained profitability and predictable cash flow.

In 2024, Singapore’s hotel sector saw a significant rebound. For instance, the average RevPAR for upscale hotels in Singapore reached approximately S$250-S$300, with established properties like the Grand Copthorne Waterfront often performing at the higher end of this spectrum due to their prime locations and established reputation.

Residential Developments with High Sales Rates (e.g., Lumina Grand, Tembusu Grand)

Residential projects nearing completion and largely sold out, like Lumina Grand and Tembusu Grand, are prime examples of cash cows. Lumina Grand, for instance, reported a 98% sales rate, while Tembusu Grand achieved 93% sold as of early 2024. These high sales figures signify secured revenue streams with significantly reduced ongoing marketing and sales expenditures.

The substantial cash flow generated from these completed or near-completion residential developments is crucial. This capital can be strategically redeployed into new ventures, such as acquiring land for future projects or investing in innovative urban regeneration initiatives. This reinvestment fuels the company's growth pipeline.

- Secured Revenue: Projects like Lumina Grand (98% sold) and Tembusu Grand (93% sold) represent substantial, predictable income.

- Reduced Costs: With high sales rates, marketing and sales expenses are minimal, maximizing profit margins.

- Capital Reallocation: Funds generated can be strategically reinvested into new development projects or other growth areas.

- Market Validation: High sell-through rates indicate strong market demand and successful product positioning.

Income-Stable Diversified Portfolio (Overall)

City Developments Ltd (CDL) leverages its extensive and geographically varied portfolio of stable income-generating assets, encompassing residential leases, commercial spaces, and hospitality ventures, to create a consistent and reliable cash flow. This diversification across established markets is a key strength.

This stable income base allows CDL to effectively fund new growth initiatives and manage its operational expenses. For instance, in 2023, CDL reported a significant contribution from its rental income streams, which bolstered its overall financial performance, providing a solid foundation for strategic investments.

- Diversified Income Streams: CDL's portfolio includes a mix of residences for lease, commercial properties, and hospitality assets, ensuring a broad base of recurring revenue.

- Geographic Spread: Operations in mature markets globally mitigate risk and provide consistent cash generation.

- Funding Growth: The stable cash flow from these assets is crucial for financing CDL's expansion into new markets and development projects.

- Focus on Sustainability: CDL prioritizes strengthening these recurring income streams to ensure long-term value creation and financial resilience.

CDL's established residential projects nearing completion, such as Lumina Grand and Tembusu Grand, are prime examples of cash cows. These developments have achieved high sales rates, with Lumina Grand at 98% and Tembusu Grand at 93% sold as of early 2024, signifying secured revenue streams and reduced ongoing marketing costs.

The substantial cash flow generated from these near-completion residential assets is vital, allowing for strategic reinvestment into new ventures and urban regeneration initiatives, thereby fueling the company's growth pipeline.

These completed or nearly completed residential developments, characterized by high sales figures, represent predictable income with significantly lower marketing and sales expenditures, maximizing profit margins.

The capital generated from these successful residential sales can be strategically reallocated to fund new land acquisitions or invest in innovative urban regeneration projects, ensuring CDL's future development pipeline remains robust.

| Asset Type | Example | Sales Rate (Early 2024) | Cash Flow Impact |

|---|---|---|---|

| Residential (Near Completion) | Lumina Grand | 98% | Secured revenue, reduced marketing costs |

| Residential (Near Completion) | Tembusu Grand | 93% | Significant capital for reinvestment |

Preview = Final Product

City Developments BCG Matrix

The City Developments BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This ensures you know exactly what you're getting—a professional, analysis-ready report without any watermarks or demo content, ready for your strategic planning.

Dogs

Certain older industrial buildings or strata retail units, like those at Cideco Industrial Complex and strata units within Citilink Warehouse Complex or Fortune Centre, can be categorized as Dogs in the BCG Matrix. These properties often struggle with low market share in mature or even declining sub-markets, resulting in minimal returns and inefficient capital utilization.

CDL's strategic divestment of such non-core assets underscores their low profitability and limited prospects for future growth. For instance, in 2024, the real estate market continued to see a bifurcation, with older, less adaptable retail and industrial spaces facing significant headwinds compared to modern, well-located, or specialized properties.

In Q1 2025, certain hotels in markets like downtown Chicago and parts of London saw RevPAR (Revenue Per Available Room) dip by approximately 5% and 7% respectively. This decline is largely attributed to a combination of reduced occupancy, down 3% year-over-year in Chicago, and a softening of average daily rates (ADR) by 2% in London's core tourist areas.

These specific properties, struggling with sustained RevPAR declines, might be classified as 'Dogs' within a City Developments BCG Matrix. For instance, a historic hotel in a secondary US market undergoing significant, prolonged renovations could be a prime example, showing negative growth prospects and consuming capital without yielding adequate returns.

City Developments Limited (CDL) is strategically divesting non-core assets as part of its capital recycling efforts, even if these assets aren't underperforming. This move treats them as 'dogs' in the BCG matrix context, meaning they don't align with CDL's future high-growth objectives.

For 2024, CDL has set a target to divest approximately $1 billion in assets. This initiative is designed to unlock value from assets that, while potentially stable, offer limited growth potential or are no longer central to the company's long-term strategic vision.

Completed Projects with Stagnant Sales (if any)

Completed projects with stagnant sales, while not explicitly detailed for City Developments (CDL) in recent public reports, would represent a significant challenge in their BCG Matrix. These are properties that, after their initial marketing push, are not selling as expected. Imagine a residential development that launched with great fanfare but then saw sales slow to a crawl, or an office building struggling to find tenants. This scenario indicates a potential misjudgment of market demand or an inability to compete effectively.

Such underperforming assets tie up substantial capital, meaning that money could have been invested in more promising ventures. Holding costs, like property taxes and maintenance, continue to accrue, further eroding profitability. For instance, if CDL had a completed commercial project in a secondary market that only achieved 40% occupancy after a year, it would fit this description, representing a "Cash Cow" that has turned into a "Dog" due to market realities.

- Definition: Completed projects failing to achieve anticipated market absorption post-launch.

- Market Position: Low market share in mature or competitive segments.

- Financial Impact: Ties up capital, incurs holding costs, and generates minimal new revenue.

- Strategic Implication: Represents a failure to convert potential into realized gains, requiring a strategic review or divestment.

Legacy Assets Requiring Significant Capital Outlay for Minimal Return

Older, legacy properties within City Developments (CDL) portfolio that demand significant capital for upkeep or modernization, yet yield only minor gains in market share or profit, would be classified as Dogs in a BCG Matrix analysis. These assets often reside in stagnant market segments, and even with injected capital, struggle to bolster their competitive standing or cash flow generation when weighed against the expenditure. For instance, a 2024 report indicated that certain older retail spaces, requiring substantial renovation to meet modern standards, were only projected to see a 2-3% increase in rental yield post-investment, a return insufficient to justify the capital outlay.

CDL's strategic emphasis on capital recycling points towards a deliberate divestment or repositioning away from these capital-intensive, low-return assets. This approach allows the company to reallocate resources towards more promising growth areas. In 2024, CDL announced the divestment of several non-core, older industrial properties, freeing up capital that was subsequently channeled into their burgeoning data center and build-to-rent segments.

- Legacy Assets: Properties requiring substantial capital for maintenance or upgrades.

- Low Return: Offer only marginal increases in market share or profitability.

- Market Position: Often in low-growth segments with limited competitive improvement.

- Strategic Shift: CDL's focus on capital recycling indicates a move away from these assets.

Dogs in City Developments' BCG Matrix represent properties with low market share in mature or declining sectors, offering minimal returns and inefficient capital use. These are often older, legacy assets requiring significant investment for upkeep without substantial growth prospects. CDL's strategy involves divesting these non-core properties to reallocate capital to higher-growth areas.

For example, CDL aimed to divest approximately $1 billion in assets in 2024, including older industrial properties, to fund expansion in data centers and build-to-rent segments. This aligns with treating underperforming or stagnant assets as Dogs, freeing up capital for more promising ventures.

In Q1 2025, certain hotels in markets like downtown Chicago and London experienced RevPAR declines of around 5% and 7% respectively, with occupancy down 3% in Chicago and average daily rates softening by 2% in London. Such hotels, struggling with sustained declines and consuming capital without adequate returns, exemplify 'Dogs' in a City Developments BCG Matrix context.

| Asset Type | Market Segment | BCG Category | 2024/2025 Data Point | Strategic Action |

| Older Industrial Buildings | Mature/Declining | Dog | Targeted for divestment in 2024 ($1B total) | Capital Recycling |

| Legacy Retail Units | Mature/Declining | Dog | Low rental yield increase (2-3%) post-renovation | Divestment/Repositioning |

| Struggling Hotels | Mature/Declining | Dog | RevPAR decline (e.g., ~5% in Chicago Q1 2025) | Capital Intensive, Low Return |

| Completed Projects with Stagnant Sales | Mature/Competitive | Dog | Low occupancy (e.g., 40% after one year) | Potential Misjudgment, Requires Review |

Question Marks

Upcoming mixed-use integrated developments, like the Zion Road (Parcel A) joint venture, are classic question marks in the BCG Matrix. These projects are situated in areas with high growth potential, signaling significant future revenue streams, but currently hold zero market share as they are still in their nascent stages, either not yet launched or in very early sales phases.

These developments necessitate considerable upfront investment in infrastructure, marketing, and sales efforts to capture market attention and establish a foothold. For instance, the Zion Road (Parcel A) project, a collaboration between City Developments Limited (CDL) and MCL Land, is expected to yield approximately 740 residential units and commercial space, representing a substantial commitment to future market presence.

City Developments Limited (CDL) is actively exploring new residential ventures in emerging overseas markets, moving beyond its strong foothold in the UK living sector. These new developments, such as potential projects in Southeast Asia or other developing economies, represent CDL's strategic expansion into territories with high growth potential but also inherent uncertainties.

These emerging markets often present a scenario where CDL, while a major player in established markets, might hold a relatively low initial market share. This necessitates substantial investment in marketing, local partnerships, and tailored product offerings to gain traction and build a competitive presence. For instance, CDL's recent expansion into markets like Japan, where they acquired residential assets, signals this strategic shift, though the long-term market share in these new territories remains to be seen.

The success of these ventures is still very much in question, making them prime candidates for the question mark category in a BCG matrix. Factors such as local economic stability, regulatory environments, and consumer acceptance of CDL's brand and development style will heavily influence their trajectory. The outcome hinges on effective execution and the ability to adapt to diverse market dynamics, with early performance indicators being closely watched.

Investments in innovative property technologies, like advanced smart building solutions, or highly niche real estate segments, such as specialized co-living spaces, would fall into the question mark category for City Developments Limited (CDL). These emerging areas offer significant growth potential, but CDL would likely start with a low market share, demanding substantial investment in research and development and aggressive market penetration tactics to achieve scale.

Early-Stage Build-to-Rent (BTR) Projects in Developing Markets

Early-stage Build-to-Rent (BTR) projects in developing markets represent City Developments Limited's (CDL) question marks within the BCG Matrix. While the BTR sector itself is experiencing robust growth, CDL's presence in these nascent rental markets is still establishing its footing. These ventures demand significant capital infusion to build scale and achieve a competitive market share, with the potential for future high returns if successful.

These projects are characterized by their high investment needs and uncertain future returns. CDL's strategy here involves nurturing these early-stage assets to eventually transition them into stars or cash cows. For instance, in markets where regulatory frameworks for BTR are still evolving, CDL might be investing heavily in infrastructure and tenant acquisition, aiming to capture a substantial portion of future rental demand. As of early 2024, the global BTR market is projected to grow substantially, with new developments in emerging economies being a key driver, though specific CDL market share data in these developing segments is still being consolidated.

- High Investment Requirement: Early-stage BTR projects in developing markets necessitate substantial upfront capital for land acquisition, construction, and operational setup.

- Market Share Uncertainty: CDL's market share in these less mature rental markets is likely low, requiring focused efforts to build scale and brand recognition.

- Growth Potential: Despite the current uncertainties, these projects are positioned in a sector with significant long-term growth prospects as rental markets mature.

- Strategic Importance: These question marks are critical for CDL's long-term diversification and revenue stream expansion, aiming to become future stars.

Future Land Replenishment and Strategic Landbank

City Developments Limited (CDL) actively pursues strategic land replenishment, aiming to secure parcels with high future growth potential. These acquisitions are crucial for sustaining its pipeline of new projects beyond those currently launched. As of early 2024, CDL's landbank strategy focuses on identifying sites in well-connected urban areas with strong rental demand and capital appreciation prospects, a key component of its long-term value creation.

These land parcels are essentially CDL's question marks in the BCG matrix. While acquired with the expectation of significant future returns, their ultimate market share and profitability are uncertain. Success hinges on navigating evolving market conditions and executing development plans effectively. For instance, CDL's ongoing efforts to expand its presence in key international markets like the UK and Australia reflect this forward-looking approach, though the profitability of these nascent developments remains to be seen.

The capital outlay for acquiring and holding these undeveloped land parcels represents an investment that consumes resources before any revenue is generated. This capital commitment is a defining characteristic of question mark assets, requiring careful management and a clear vision for future development to convert potential into realized value. CDL's financial reports often highlight the significant investment in its landbank as a key driver of future growth.

- Strategic Landbank Growth: CDL's land replenishment efforts are geared towards securing future development opportunities in growth corridors.

- Uncertainty of Returns: The ultimate market share and profitability of these new land parcels are contingent on future market dynamics and development execution.

- Capital Consumption: Significant capital is allocated to land acquisition and holding costs before projects commence generating revenue.

- International Expansion Focus: CDL's strategy includes acquiring land in key international markets to diversify its future project pipeline.

Upcoming mixed-use integrated developments, like the Zion Road (Parcel A) joint venture, are classic question marks in the BCG Matrix. These projects are situated in areas with high growth potential, signaling significant future revenue streams, but currently hold zero market share as they are still in their nascent stages, either not yet launched or in very early sales phases.

These developments necessitate considerable upfront investment in infrastructure, marketing, and sales efforts to capture market attention and establish a foothold. For instance, the Zion Road (Parcel A) project, a collaboration between City Developments Limited (CDL) and MCL Land, is expected to yield approximately 740 residential units and commercial space, representing a substantial commitment to future market presence.

City Developments Limited (CDL) is actively exploring new residential ventures in emerging overseas markets, moving beyond its strong foothold in the UK living sector. These new developments, such as potential projects in Southeast Asia or other developing economies, represent CDL's strategic expansion into territories with high growth potential but also inherent uncertainties.

These emerging markets often present a scenario where CDL, while a major player in established markets, might hold a relatively low initial market share. This necessitates substantial investment in marketing, local partnerships, and tailored product offerings to gain traction and build a competitive presence. For instance, CDL's recent expansion into markets like Japan, where they acquired residential assets, signals this strategic shift, though the long-term market share in these new territories remains to be seen.

The success of these ventures is still very much in question, making them prime candidates for the question mark category in a BCG matrix. Factors such as local economic stability, regulatory environments, and consumer acceptance of CDL's brand and development style will heavily influence their trajectory. The outcome hinges on effective execution and the ability to adapt to diverse market dynamics, with early performance indicators being closely watched.

Investments in innovative property technologies, like advanced smart building solutions, or highly niche real estate segments, such as specialized co-living spaces, would fall into the question mark category for City Developments Limited (CDL). These emerging areas offer significant growth potential, but CDL would likely start with a low market share, demanding substantial investment in research and development and aggressive market penetration tactics to achieve scale.

Early-stage Build-to-Rent (BTR) projects in developing markets represent City Developments Limited's (CDL) question marks within the BCG Matrix. While the BTR sector itself is experiencing robust growth, CDL's presence in these nascent rental markets is still establishing its footing. These ventures demand significant capital infusion to build scale and achieve a competitive market share, with the potential for future high returns if successful.

These projects are characterized by their high investment needs and uncertain future returns. CDL's strategy here involves nurturing these early-stage assets to eventually transition them into stars or cash cows. For instance, in markets where regulatory frameworks for BTR are still evolving, CDL might be investing heavily in infrastructure and tenant acquisition, aiming to capture a substantial portion of future rental demand. As of early 2024, the global BTR market is projected to grow substantially, with new developments in emerging economies being a key driver, though specific CDL market share data in these developing segments is still being consolidated.

- High Investment Requirement: Early-stage BTR projects in developing markets necessitate substantial upfront capital for land acquisition, construction, and operational setup.

- Market Share Uncertainty: CDL's market share in these less mature rental markets is likely low, requiring focused efforts to build scale and brand recognition.

- Growth Potential: Despite the current uncertainties, these projects are positioned in a sector with significant long-term growth prospects as rental markets mature.

- Strategic Importance: These question marks are critical for CDL's long-term diversification and revenue stream expansion, aiming to become future stars.

City Developments Limited (CDL) actively pursues strategic land replenishment, aiming to secure parcels with high future growth potential. These acquisitions are crucial for sustaining its pipeline of new projects beyond those currently launched. As of early 2024, CDL's landbank strategy focuses on identifying sites in well-connected urban areas with strong rental demand and capital appreciation prospects, a key component of its long-term value creation.

These land parcels are essentially CDL's question marks in the BCG matrix. While acquired with the expectation of significant future returns, their ultimate market share and profitability are uncertain. Success hinges on navigating evolving market conditions and executing development plans effectively. For instance, CDL's ongoing efforts to expand its presence in key international markets like the UK and Australia reflect this forward-looking approach, though the profitability of these nascent developments remains to be seen.

The capital outlay for acquiring and holding these undeveloped land parcels represents an investment that consumes resources before any revenue is generated. This capital commitment is a defining characteristic of question mark assets, requiring careful management and a clear vision for future development to convert potential into realized value. CDL's financial reports often highlight the significant investment in its landbank as a key driver of future growth.

- Strategic Landbank Growth: CDL's land replenishment efforts are geared towards securing future development opportunities in growth corridors.

- Uncertainty of Returns: The ultimate market share and profitability of these new land parcels are contingent on future market dynamics and development execution.

- Capital Consumption: Significant capital is allocated to land acquisition and holding costs before projects commence generating revenue.

- International Expansion Focus: CDL's strategy includes acquiring land in key international markets to diversify its future project pipeline.

BCG Matrix Data Sources

Our City Developments BCG Matrix is built on comprehensive data, including municipal planning documents, real estate market reports, economic growth indicators, and demographic trends.