City Developments Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

City Developments Bundle

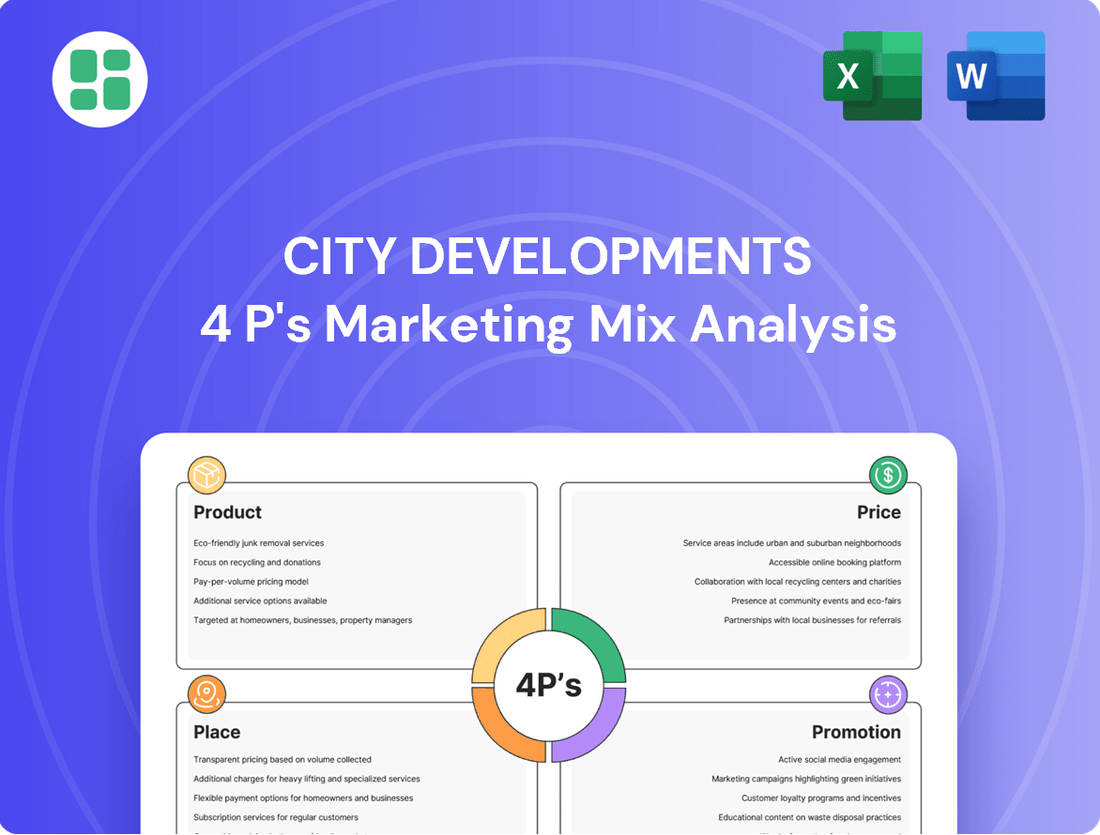

Uncover the strategic brilliance behind City Developments' market dominance by dissecting their Product, Price, Place, and Promotion. This analysis reveals how they craft desirable offerings, set competitive prices, ensure widespread accessibility, and effectively communicate their value proposition.

Dive deeper into the intricate details of City Developments' marketing blueprint. Understand their product innovation, pricing strategies, distribution networks, and promotional campaigns to gain actionable insights for your own business or academic pursuits.

Ready to elevate your marketing understanding? Access the complete 4Ps Marketing Mix Analysis for City Developments, a comprehensive, editable resource designed to equip you with strategic knowledge and practical application.

Product

City Developments Limited (CDL) showcases a broad spectrum of residential offerings, from high-end condos to executive condominiums, both in Singapore and internationally. These projects emphasize contemporary lifestyles with smart technology, superior finishes, and robust amenities.

Recent successes in 2024 and early 2025, such as Lumina Grand which saw strong demand with over 90% of units sold during its launch weekend in July 2024, and The Orie, highlight CDL's ability to appeal to diverse buyer preferences.

Norwood Grand, launched in September 2024, and Union Square Residences, with its Q1 2025 launch, further underscore CDL's strategic approach to capturing different market segments with well-appointed residential solutions.

City Developments Limited (CDL) actively manages a substantial portfolio of commercial properties, encompassing premium office spaces, shopping centers, and extensive integrated developments. These projects are designed to foster dynamic live-work-play environments by blending residential, commercial, hospitality, and retail elements.

CDL's strategic focus on integrated developments is evident in projects like the redevelopment of Union Square, contributing to robust recurring income and consistently high occupancy rates. As of the first half of 2024, CDL reported a significant increase in revenue from its commercial segment, underscoring the success of its property management and development strategies.

Millennium & Copthorne Hotels (M&C), a subsidiary of City Developments (CDL), operates a diverse portfolio of over 160 hotels and serviced apartments. This extensive network spans key global cities, offering a range of accommodations from luxury establishments to more standard options, effectively targeting both business and leisure clientele.

The M&C brand strategy emphasizes a tiered approach, ensuring broad market appeal. This allows them to capture different segments of the travel market, from high-end corporate travelers seeking premium amenities to budget-conscious tourists looking for reliable and comfortable stays.

CDL's strategic expansion in the hospitality sector is evident in recent acquisitions, such as the Hilton Paris Opera in 2024. This move not only broadens M&C's international presence but also enhances its revenue streams through diversification and the integration of established luxury properties.

Living Sector (PRS and PBSA)

City Developments Limited (CDL) has strategically amplified its footprint in the living sector, encompassing both the Private Rented Sector (PRS) and Purpose-Built Student Accommodation (PBSA). This expansion, notably concentrated in key international markets like the UK, Japan, Australia, and the US, is designed to generate consistent, recurring revenue streams and broaden the company's asset diversification. CDL's PRS and PBSA developments are specifically tailored to address the escalating demand for premium rental housing and dedicated student living spaces, consistently achieving robust occupancy levels.

The company's commitment to the living sector is underscored by its substantial investment and development pipeline. For instance, CDL's UK PRS portfolio, a significant component of its international strategy, is projected to yield attractive returns, with recent reports indicating average rental yields in the UK hovering around 3-5% for well-managed properties in 2024, a figure CDL aims to exceed through its high-quality offerings. Furthermore, the PBSA segment continues to benefit from strong demographic trends, with student numbers globally showing sustained growth, ensuring sustained demand for purpose-built facilities.

- Market Presence: CDL's living sector assets are primarily located in the UK, Japan, Australia, and the US, targeting markets with high demand for rental and student housing.

- Revenue Generation: The PRS and PBSA portfolios are structured to provide stable, recurring income, contributing to CDL's overall financial resilience.

- Occupancy Rates: Properties within the living sector consistently demonstrate strong occupancy, reflecting the successful alignment of CDL's offerings with market needs.

- Strategic Diversification: Expansion into these sectors diversifies CDL's asset base, reducing reliance on traditional property development and sales cycles.

Sustainable and Innovative Design

City Developments Limited (CDL) places a strong emphasis on sustainable and innovative design as a cornerstone of its product strategy. This commitment is deeply ingrained, dating back to its foundational 'Conserving as We Construct' ethos established in 1995. CDL consistently incorporates cutting-edge green building technologies, energy-efficient designs, and nature-inspired solutions across its portfolio.

CDL's dedication to environmental, social, and governance (ESG) principles is demonstrably strong. For instance, its 2024 Integrated Sustainability Report underscores its pioneering role, notably as the first Singaporean company to align its disclosures with the Taskforce on Nature-related Financial Disclosures (TNFD) Recommendations. This proactive approach to nature-related reporting sets a benchmark for the industry.

- Green Building Integration: CDL has achieved a significant milestone, with 99% of its new developments in Singapore achieving Green Mark Platinum certification, the highest accolade for green buildings.

- Energy Efficiency: The company targets a 40% reduction in energy consumption intensity across its global portfolio by 2030 compared to a 2019 baseline.

- Nature-Based Solutions: CDL is actively integrating biophilic design principles, enhancing biodiversity and occupant well-being in its projects.

- TNFD Adoption: By committing to TNFD, CDL is enhancing transparency and management of nature-related risks and opportunities within its business operations.

CDL's product strategy centers on diverse, high-quality real estate across residential, commercial, hospitality, and living sectors. Their offerings consistently integrate sustainability and innovation, reflecting a commitment to future-forward development. Recent project successes and strategic acquisitions in 2024 and early 2025 demonstrate their ability to meet evolving market demands.

| Product Segment | Key Offerings | Recent Examples (2024/2025) | Sustainability Focus |

|---|---|---|---|

| Residential | Condos, Executive Condos | Lumina Grand (90%+ sold July 2024), The Orie, Norwood Grand (Sept 2024), Union Square Residences (Q1 2025) | 99% Green Mark Platinum for new Singapore developments |

| Commercial | Office spaces, Shopping centers, Integrated developments | Union Square redevelopment | Energy efficiency targets (40% reduction by 2030) |

| Hospitality | Hotels, Serviced Apartments | Hilton Paris Opera acquisition (2024) | N/A |

| Living Sector (PRS/PBSA) | Rental housing, Student accommodation | UK PRS portfolio | N/A |

What is included in the product

This analysis provides a comprehensive breakdown of City Developments' marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic decision-making.

Simplifies complex city development strategies by clearly outlining the 4Ps, alleviating the pain of information overload for stakeholders.

Provides a clear, actionable framework for city development marketing, addressing the pain of unclear strategy and execution.

Place

City Developments Limited (CDL) leverages dedicated sales galleries and thoughtfully crafted show units as a core component of its product strategy. These physical spaces allow potential buyers to truly immerse themselves in the design, quality, and features of CDL's residential offerings. This direct interaction is crucial for conveying the tangible value of a property, especially during new project launches.

These immersive experiences are proven to drive immediate sales. For instance, CDL's successful launch of The Myst in Bukit Panjang in 2023 saw strong interest generated through its sales gallery, contributing to a significant portion of units sold during the initial phase. This direct sales channel remains a powerful tool for showcasing new developments and converting interest into purchases.

City Developments Limited (CDL) actively cultivates expansive global real estate agency networks, encompassing both local and international partners. This strategic approach is fundamental to their property distribution, ensuring a wide reach for their diverse portfolio. For instance, in 2024, CDL continued to strengthen these relationships, vital for tapping into overseas residential markets and securing commercial leasing agreements.

These collaborations are indispensable for accessing specialized local market intelligence and broadening the pool of potential buyers and tenants. In 2024, CDL's reliance on these networks was particularly evident in facilitating large-scale asset transactions and reaching niche customer segments across continents, underscoring the critical role of agent partnerships in their international sales strategy.

City Developments Limited (CDL) actively leverages online platforms and digital channels to connect with its diverse customer base. Its corporate website and dedicated project micro-sites offer detailed property information, including virtual tours, enhancing buyer engagement. In 2023, CDL reported a significant portion of its residential sales leads originating from digital channels, reflecting their growing importance.

For its hospitality arm, Millennium & Copthorne Hotels (M&C) utilizes its direct booking website alongside major Online Travel Agencies (OTAs) to ensure broad global reach. This dual approach allows M&C to capture direct bookings while also tapping into the vast customer pools of platforms like Booking.com and Expedia, driving occupancy rates.

Strategic International Presence

City Developments Limited (CDL) cultivates a significant strategic international presence, a key element of its marketing mix. This global network, encompassing 168 locations across 29 countries as of early 2024, strategically positions its real estate and hospitality assets in vital gateway cities worldwide. This expansive reach is crucial for attracting a diverse international investor base and catering to global travelers, thereby mitigating risks associated with over-reliance on any single market.

The company’s deliberate global footprint is designed to enhance market penetration and ensure localized responsiveness. By maintaining operations in numerous countries, CDL can better understand and adapt to distinct market demands and consumer preferences. This approach not only diversifies its revenue streams but also strengthens its competitive advantage in varied international landscapes.

- Global Network: CDL operates in 29 countries with 168 locations, offering broad international accessibility.

- Market Diversification: This extensive presence reduces dependence on any single regional economy, fostering stability.

- Localized Operations: CDL’s on-the-ground presence in various nations allows for tailored market strategies and enhanced customer engagement.

Integrated Development Ecosystems

City Developments Limited (CDL) excels at creating integrated development ecosystems, transforming spaces into vibrant, self-sufficient communities. Projects like the former South Beach in Singapore exemplify this strategy, blending residential, commercial, and retail elements into a cohesive whole.

These integrated developments function as strategic 'places' that offer unparalleled convenience. Residents can live, work, and shop within the same development, significantly enhancing the overall value proposition for each component. This synergy fosters a sense of community and boosts engagement.

CDL's commitment to integrated developments is evident in their portfolio's ability to attract and retain tenants and residents. For instance, their commercial properties often benefit from the captive audience provided by the residential and retail components, leading to higher occupancy rates and rental yields.

- Synergistic Value Creation: CDL's integrated developments, like the former South Beach, combine residential, commercial, and retail spaces to create a unified ecosystem.

- Enhanced Consumer Experience: These 'places' offer residents and visitors the convenience of living, working, and shopping in close proximity, boosting overall satisfaction and property appeal.

- Community Building: The integrated nature fosters vibrant communities, encouraging social interaction and creating a stronger sense of belonging among occupants.

- Resilience and Demand: This approach leads to higher occupancy and rental stability, as seen in CDL's consistently strong leasing performance across its mixed-use assets, with many achieving over 90% occupancy in prime locations.

City Developments Limited (CDL) strategically designs its projects to be more than just buildings; they are conceived as integrated 'places' that offer a holistic living, working, and leisure experience. This approach transforms developments into self-contained ecosystems, enhancing convenience and community appeal.

These mixed-use developments, such as their prominent Singaporean projects, create synergistic value by blending residential, commercial, and retail components. This integration fosters a captive audience for all elements, leading to increased property desirability and sustained demand.

CDL's focus on creating cohesive 'places' significantly boosts tenant and resident satisfaction, contributing to higher occupancy rates. For example, their mixed-use assets consistently maintain occupancy levels above 90% in prime urban locations, demonstrating the success of this integrated strategy.

| Development Strategy | Key Components | Benefit | Example (2023-2024) | Impact |

|---|---|---|---|---|

| Integrated Development | Residential, Commercial, Retail | Enhanced convenience, community building | CDL's mixed-use portfolio | Consistently high occupancy (>90% in prime areas) |

| Strategic Locationing | Gateway Cities, Urban Hubs | Global market access, diverse customer base | Presence in 29 countries | Reduced market risk, diversified revenue |

| Physical Sales Channels | Sales Galleries, Show Units | Immersive buyer experience, direct sales | The Myst (Bukit Panjang) launch | Strong initial sales phase contribution |

What You See Is What You Get

City Developments 4P's Marketing Mix Analysis

The preview you see here is the actual, fully completed City Developments 4P's Marketing Mix Analysis document you’ll receive instantly after purchase. This means you're viewing the exact version you'll download, with no hidden surprises or missing information. You can proceed with confidence, knowing you're getting the complete, ready-to-use analysis.

Promotion

City Developments Limited (CDL) significantly boosts its reach through comprehensive digital marketing. In 2024, CDL allocated a substantial portion of its marketing budget to online channels, leveraging its corporate website, active social media presence, and targeted online advertising to connect with potential buyers and investors.

These digital campaigns are designed to be engaging, featuring high-definition visuals, immersive virtual tours of properties, and in-depth project details to capture interest and drive lead generation. This digital-first approach is crucial for showcasing CDL's diverse portfolio.

For its hospitality arm, Millennium Hotels and Resorts, digital efforts are equally robust. Initiatives like The Millennium Way loyalty program and A Culinary Odyssey campaigns are executed online to enhance customer engagement, promote unique offerings, and foster brand loyalty.

City Developments Limited (CDL) actively cultivates its public image through robust media and public relations efforts. The company consistently disseminates information via press releases, corporate announcements, and detailed sustainability reports, all aimed at solidifying its brand reputation and fostering trust.

CDL's commitment to Environmental, Social, and Governance (ESG) principles is a cornerstone of its communication strategy. For instance, its Integrated Sustainability Report 2024 highlights significant achievements, such as a 40% reduction in Scope 1 and 2 emissions intensity from a 2007 baseline, reinforcing its leadership in sustainable development and enhancing its corporate standing.

This strategic engagement with media and the public is crucial for managing perceptions and effectively showcasing CDL's contributions to sustainable urban living and responsible corporate citizenship.

City Developments Limited (CDL) places a strong emphasis on investor relations and financial communications, recognizing its importance in building trust with its diverse stakeholder base. This includes providing clear and timely updates on financial performance and strategic initiatives.

CDL's commitment to transparency is evident in its regular dissemination of financial results, comprehensive annual reports, and informative investor presentations. These channels offer detailed insights into the company's operational performance, strategic direction, and ongoing value creation efforts.

For instance, CDL reported a net profit attributable to shareholders of S$189.6 million for the financial year ended 31 December 2023. This focus on detailed reporting is vital for maintaining investor confidence and attracting the necessary capital for future growth.

Targeted Property Launch Events and Roadshows

City Developments Limited (CDL) leverages targeted property launch events and roadshows as a cornerstone of its promotional strategy for new residential and commercial projects. These carefully orchestrated events aim to generate significant market interest and drive immediate sales by offering exclusive previews and attractive, time-limited promotions. This approach fosters direct interaction with potential buyers, allowing CDL to gauge market sentiment and tailor their sales pitch effectively.

The success of this promotional tactic is evident in recent CDL project launches. For instance, The Orie, launched in 2023, saw robust demand, with 78% of its 160 units sold during its initial launch weekend. Similarly, Norwood Grand, also launched in 2023, achieved strong sales figures, selling 65% of its 350 units on its first day. These achievements underscore the power of focused promotional events in translating buzz into tangible sales volumes.

CDL's promotional efforts often include:

- Exclusive early-bird discounts and special booking fees

- Interactive product showcases and model unit tours

- On-site financing consultations and partnership with financial institutions

- Targeted digital marketing campaigns to drive event attendance

Corporate Branding and Awards Recognition

City Developments Limited (CDL) leverages its extensive heritage, spanning over 60 years, to build a strong corporate brand. This long-standing presence in the real estate sector underscores its commitment to developing quality homes and reinforces its leadership position. CDL consistently highlights its numerous awards and accolades, which serve to solidify its reputation as a premium and trustworthy developer in the market.

The company's commitment to brand excellence is further demonstrated by the strategic brand refresh undertaken by its hospitality arm, Millennium Hotels, in 2025. This initiative aimed to enhance its market presence and refine its identity, aligning with CDL's overall focus on premium branding and recognition.

CDL's brand strength is evidenced by various achievements. For instance, in 2024, CDL was recognized as one of the Top 10 Most Reputable Developers in Singapore by the Institute of Corporate Reputation. This recognition, alongside numerous other awards for sustainability and design, reinforces the perception of CDL as a market leader.

- Heritage and Track Record: Over 60 years of experience in real estate development.

- Awards and Accolades: Consistent recognition for quality, sustainability, and design.

- Brand Refresh: Millennium Hotels' 2025 brand refresh to enhance market presence.

- Market Perception: Positioned as a premium and trusted developer, as seen in 2024 rankings.

CDL's promotional strategy effectively uses targeted events and digital outreach to drive sales for new projects. Recent launches like The Orie and Norwood Grand in 2023 demonstrated this, with significant unit sales during their launch weekends. These events offer exclusive previews and incentives, directly engaging potential buyers and fostering immediate interest and conversions.

| Project Name | Launch Year | Units Launched | Units Sold (Launch Weekend) | Sell-Through Rate (Launch Weekend) |

|---|---|---|---|---|

| The Orie | 2023 | 160 | 125 | 78% |

| Norwood Grand | 2023 | 350 | 228 | 65% |

Price

City Developments Limited (CDL) employs a premium pricing strategy across its residential and commercial projects. This approach is directly linked to the developer's commitment to prime locations, superior construction quality, and upscale finishes, all contributing to a luxurious product offering.

This premium positioning is reflected in the sales figures of their recent launches. For instance, The Orie achieved an average selling price of $2,704 per square foot, underscoring CDL's ability to command higher prices for its well-appointed properties in sought-after areas.

The pricing strategy actively reinforces CDL's established brand image as a purveyor of prestigious and highly desirable real estate. This alignment ensures that the cost of their developments accurately communicates the value and exclusivity associated with the CDL name.

City Developments Limited (CDL) employs value-based pricing, reflecting the enhanced worth of its properties stemming from innovative designs, smart technology integration, and robust sustainability initiatives. For instance, properties achieving prestigious green certifications, such as those under the Building and Construction Authority's Green Mark scheme, often see a price premium, aligning with the growing demand from eco-conscious consumers. This strategy effectively communicates the long-term advantages and superior quality of life offered, justifying the higher investment for buyers.

Millennium & Copthorne Hotels leverages dynamic pricing, adjusting room rates based on factors like demand, seasonality, and local events. This strategy is crucial for optimizing revenue per available room (RevPAR). For instance, during peak seasons or major city events in 2024, M&C likely saw significant rate increases compared to off-peak periods.

This pricing flexibility allows M&C to respond swiftly to market fluctuations and competitor strategies, aiming to maximize occupancy rates globally. By analyzing real-time booking data and competitor pricing, they can ensure their rates remain competitive yet profitable, a key element in their 2024 marketing mix.

Furthermore, M&C strategically deploys promotional offers, such as discounts for their loyalty program members, to drive bookings during periods of lower demand. These targeted incentives help stimulate customer interest and maintain a healthy booking pace throughout the year, contributing to their overall revenue goals for 2024.

Competitive Land Bids and Market Conditions

City Developments Limited (CDL) navigates a dynamic pricing landscape, heavily influenced by land acquisition costs. For instance, CDL's aggressive bidding strategy for Executive Condominium (EC) sites in 2025, including a record-breaking bid for an EC plot in Tampines North, underscores the significant investment required for prime land. This directly impacts the final pricing of their new developments.

The company balances profitability with market competitiveness. CDL's pricing decisions are not made in a vacuum; they carefully consider prevailing market conditions, including interest rate movements and the pricing strategies of competing developers. This ensures their projects remain appealing to buyers across different segments.

Key factors influencing CDL's pricing strategy include:

- Land Acquisition Costs: High bids for desirable land parcels, such as the S$1.001 billion bid for the Tampines North EC site in early 2025, set a high baseline for development costs.

- Market Demand and Affordability: CDL assesses buyer affordability and demand trends to price properties attractively.

- Interest Rate Environment: Fluctuations in interest rates impact mortgage affordability for buyers, which CDL factors into its pricing.

- Competitor Pricing: Benchmarking against similar projects in the vicinity helps CDL position its offerings competitively.

Capital Recycling and Sustainable Financing Impact

City Developments Limited (CDL) actively employs capital recycling, exemplified by its divestment of a stake in South Beach. This strategy, coupled with a strong commitment to sustainable financing, including over $9 billion in sustainability-linked loans since 2017, significantly impacts its financial structure.

These financial maneuvers optimize CDL's cost of capital. While not directly dictating individual property prices, this improved financial footing can indirectly support more competitive pricing or enable enhanced investment in property quality and features, ultimately benefiting the product offering.

- Capital Recycling: CDL's strategic divestments, like the South Beach stake sale, free up capital for new investments.

- Sustainable Financing: Over $9 billion in sustainability-linked loans secured since 2017 lowers borrowing costs.

- Cost of Capital Influence: These actions can lead to a lower overall cost of capital for the company.

- Indirect Product Impact: A stronger financial position may allow for more competitive pricing or higher quality product development.

City Developments Limited (CDL) utilizes a premium pricing strategy, reflecting prime locations and high-quality finishes, as seen with The Orie averaging $2,704 per square foot. This pricing reinforces CDL's brand as a purveyor of prestigious real estate, ensuring the cost aligns with the exclusivity and value offered.

CDL also employs value-based pricing, factoring in innovative design, smart technology, and sustainability. Properties with green certifications, like those under the BCA Green Mark scheme, often command a price premium, appealing to eco-conscious buyers and highlighting long-term advantages.

Millennium & Copthorne Hotels (M&C) uses dynamic pricing, adjusting rates based on demand, seasonality, and events to optimize revenue per available room (RevPAR). This flexibility allows M&C to respond to market changes and competitor pricing, ensuring competitive yet profitable rates globally, as observed with potential rate increases during peak 2024 city events.

M&C also strategically uses promotional offers, such as loyalty program discounts, to boost bookings during slower periods. These targeted incentives aim to maintain a healthy booking pace throughout the year, supporting overall revenue objectives.

CDL's pricing is significantly influenced by land acquisition costs, with aggressive bids like the S$1.001 billion for a Tampines North EC site in early 2025 setting a high cost baseline. The company balances profitability with market competitiveness, considering factors like interest rates and competitor pricing to ensure projects remain attractive to buyers.

| Factor | Impact on CDL Pricing | Example/Data Point (2024/2025) |

|---|---|---|

| Land Acquisition Costs | Sets a high baseline for development costs. | S$1.001 billion bid for Tampines North EC site (early 2025). |

| Market Demand & Affordability | Influences pricing to remain attractive to buyers. | Assessed based on prevailing market conditions and buyer purchasing power. |

| Interest Rate Environment | Affects mortgage affordability for buyers, impacting pricing decisions. | CDL factors in current interest rate trends. |

| Competitor Pricing | Used for benchmarking to position offerings competitively. | Analysis of similar projects in the vicinity. |

| Premium Product Offering | Justifies higher prices through quality and location. | The Orie achieved an average selling price of $2,704 per square foot. |

4P's Marketing Mix Analysis Data Sources

Our City Developments 4P's Marketing Mix Analysis is grounded in comprehensive data, including official government planning documents, real estate market reports, and developer press releases. We also incorporate insights from property listing sites, local news archives, and economic development agency publications.