City Developments PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

City Developments Bundle

City Developments operates within a dynamic external environment, shaped by political stability, economic fluctuations, and evolving social trends. Understanding these forces is crucial for strategic planning and mitigating risks. Our PESTLE analysis dives deep into these factors, offering actionable intelligence to inform your decisions. Download the full version now to gain a competitive edge.

Political factors

Government housing policies are a major driver for city developments, especially in Singapore. Measures like Additional Buyer's Stamp Duty (ABSD) and Loan-to-Value (LTV) limits directly affect demand and affordability in the property market. These policies are designed to promote market stability and prevent excessive speculation.

For companies like City Developments Limited (CDL), these policies can significantly influence residential sales volumes and pricing. For example, the Singapore government has been actively managing the property market to ensure affordability. In 2024, the government continued to monitor the market closely, with analysts predicting a moderated growth of 3-5% for the private property market in 2025, partly due to the persistence of these cooling measures.

City Developments Limited (CDL) navigates a complex web of foreign investment regulations across its key markets. In the UK, for instance, while generally open, specific planning permissions and capital controls can impact large-scale acquisitions. Australia's Foreign Investment Review Board (FIRB) scrutinizes foreign property purchases, with recent tightening of rules potentially affecting CDL's development pipeline and sales to overseas investors. For example, in 2023, FIRB approvals for residential real estate transactions saw a notable increase in value, but the underlying sentiment towards foreign ownership remains a key consideration.

China's capital outflow restrictions and evolving property market policies present ongoing challenges for CDL's operations there. Similarly, Japan's historically welcoming stance on foreign investment in real estate can be influenced by broader economic policies and national security concerns, although it remains a significant market for CDL. Geopolitical shifts, such as the ongoing trade tensions between major economies, can indirectly impact investor confidence and the ease with which capital flows into and out of these real estate markets, creating both headwinds and tailwinds for CDL's global strategy.

Singapore's Urban Redevelopment Authority (URA) continuously shapes the nation's future through its Master Plan, a dynamic framework updated every five years to guide land use and development. This strategic planning ensures that urban growth aligns with national objectives, fostering efficient resource allocation and sustainable city living.

CDL's developments, like Union Square, actively leverage government initiatives such as the Strategic Development Incentive Scheme. This scheme, for instance, can grant substantial Gross Floor Area (GFA) uplifts, a crucial factor for developers aiming to maximize project value and contribute to the government's vision of creating vibrant, integrated urban environments.

Political Stability and Geopolitical Risks

The political stability within the countries where City Developments Limited (CDL) operates is a critical determinant of investor sentiment and the viability of its development projects. Instability can directly translate into increased project risk and a dampening of investor appetite.

Geopolitical tensions and ongoing trade conflicts introduce significant uncertainty into the global economic landscape. These factors can adversely affect economic growth, suppress tourism numbers, and consequently reduce demand for real estate, impacting CDL's diverse portfolio, especially its international hospitality and investment property segments.

- Global Political Climate: As of early 2024, regions with heightened geopolitical risks, such as parts of Eastern Europe and the Middle East, continue to present challenges for international investment and travel, potentially affecting CDL's global operations.

- Trade Relations: Ongoing trade discussions and potential tariff changes between major economies, including the US and China, can influence supply chain costs and overall market demand for real estate developments.

- Regulatory Environment: Changes in government policies related to foreign investment, property ownership, and development regulations in key markets where CDL operates can significantly impact project timelines and profitability.

Taxation Policies on Property

Changes in property taxation, including stamp duties, property gains taxes, and corporate tax rates, directly influence City Developments Limited's (CDL) profitability and the returns on its investments. For instance, an increase in stamp duty could deter potential buyers, impacting sales volumes and CDL's revenue streams. Similarly, shifts in property gains tax can affect the net profit realized from property disposals.

These fiscal policies also shape the attractiveness of specific markets and asset classes for CDL's development and acquisition strategies. For example, a more favorable tax environment in a particular region might encourage CDL to allocate more capital there, while higher taxes could lead to divestment or a pause in new projects. This was evident when Singapore's Additional Buyer's Stamp Duty (ABSD) rates were adjusted in 2023, impacting demand for residential properties.

- Impact on Profitability: Higher property taxes directly reduce net profits from sales and rental income.

- Investment Attractiveness: Tax policies influence CDL's decisions on where and in what types of property to invest.

- Hospitality Sector: For example, tax adjustments can affect the profitability of hospitality trusts managed by CDL, influencing their dividend payouts and overall valuation.

Government housing policies significantly shape city development, impacting demand and affordability. For City Developments Limited (CDL), measures like Singapore's Additional Buyer's Stamp Duty (ABSD) and Loan-to-Value (LTV) limits directly influence sales and pricing, with the market predicted to see moderated growth of 3-5% in 2025 due to these cooling measures.

Foreign investment regulations in countries like the UK and Australia, scrutinized by bodies such as the FIRB, can affect CDL's development pipeline and sales to overseas investors, with FIRB approvals for residential real estate transactions seeing a value increase in 2023.

China's capital outflow restrictions and Japan's evolving economic policies, alongside geopolitical shifts and trade tensions, create an uncertain global landscape that can impact investor confidence and capital flow into real estate markets, presenting both challenges and opportunities for CDL's international strategies.

What is included in the product

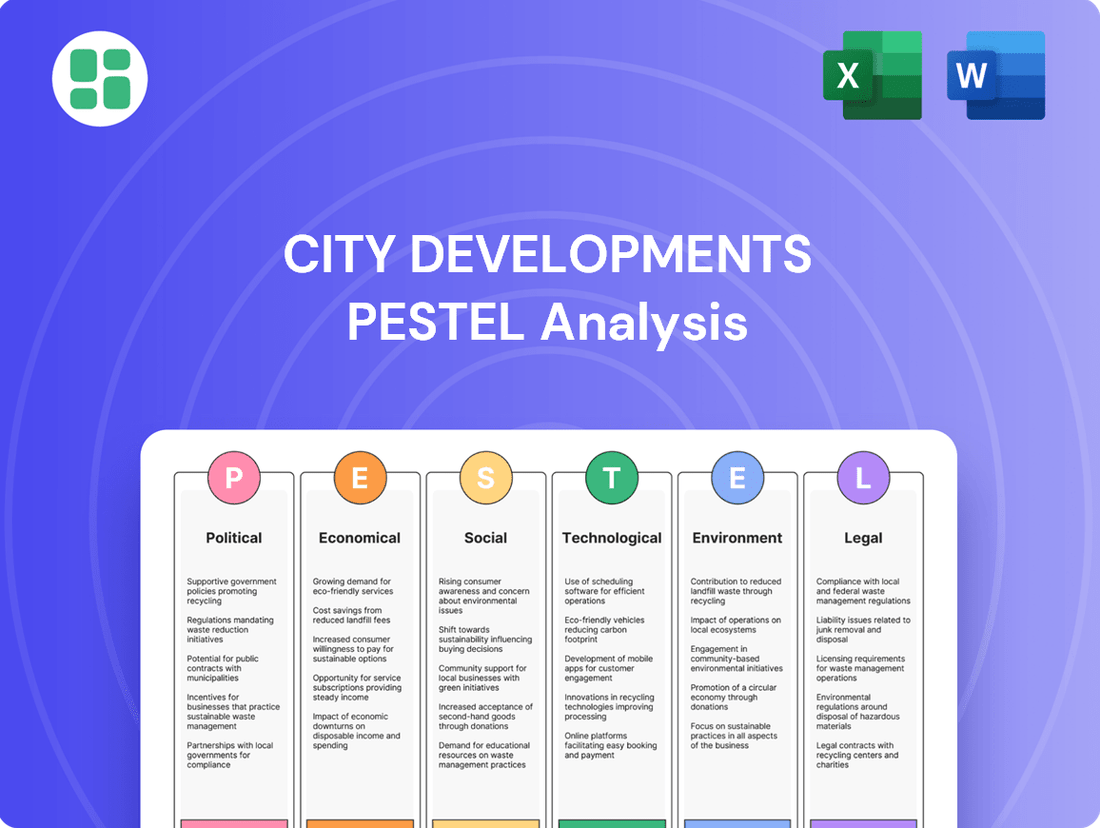

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting City Developments, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers forward-looking insights and actionable strategies to navigate market dynamics and capitalize on emerging opportunities.

A PESTLE analysis for city developments offers a structured way to identify and mitigate potential external risks, transforming uncertainty into actionable insights for strategic planning.

Economic factors

Fluctuations in global and local interest rates directly impact City Developments Limited (CDL) by affecting their financing costs for new projects and property purchases. Higher rates mean more expensive borrowing, while lower rates can make it cheaper to fund expansion. For instance, if the US Federal Reserve cuts rates in late 2024, as many economists predict, this could lead to lower borrowing costs for CDL and potentially for their customers.

These interest rate shifts also significantly influence the affordability of homes for potential buyers. When interest rates are low, mortgages become cheaper, encouraging more people to buy property, which can boost demand for CDL's residential developments. Conversely, rising rates can dampen buyer enthusiasm and slow down the property market.

Rising inflation in 2024 and 2025 has a direct impact on City Developments Limited (CDL) by increasing construction costs. This escalation can squeeze project profit margins and potentially lead to timelines being extended for CDL's ongoing and future developments.

While land prices in Singapore have shown relative stability, the persistent high costs associated with construction materials and labor mean that the prices for new homes are expected to remain firm. This suggests that CDL will likely continue to see robust pricing for its new residential offerings, reflecting the elevated input expenses.

The overall economic health of key markets significantly influences property demand. In Singapore, a projected GDP growth of 2.5% for 2025 is expected to bolster demand across residential, commercial, and hospitality sectors, reflecting strong market fundamentals.

Similarly, Australia's economic outlook, with GDP growth anticipated at 2.3% in 2025, supports a positive environment for property investment and development. The UK's GDP is forecast to grow by 1.8% in 2025, indicating a steady, albeit more moderate, expansion that will still contribute to property market activity.

Consumer Confidence and Disposable Income

Consumer confidence and disposable income are key drivers for City Developments' performance. Higher confidence means people are more likely to spend on housing and services, boosting demand for the company's residential projects and its retail and hospitality offerings. For instance, in early 2024, consumer confidence indices in many developed economies showed signs of recovery, suggesting a potential uptick in discretionary spending.

A robust labor market and increasing wages directly translate to greater disposable income, which is crucial for sustaining demand in the housing market. This also fuels spending in retail and hospitality sectors, areas where City Developments has significant interests. As of mid-2024, unemployment rates remained low in several key markets, supporting wage growth and consumer spending power.

- Consumer confidence: A sustained rise in consumer confidence indicates a willingness to make larger purchases, including property.

- Disposable income: Higher disposable income directly supports demand for residential units and spending in retail and hospitality.

- Labor market: A strong labor market with low unemployment underpins rising incomes and consumer spending.

- Purchasing power: Increased purchasing power stemming from confidence and income growth benefits City Developments across its business segments.

Property Market Cycles

Understanding and navigating property market cycles is fundamental for City Developments Limited (CDL) to refine its investment and development strategies. These cycles are driven by shifts in supply and demand, influencing price trends and rental yields.

Singapore's private property market is anticipated to find its footing in 2025, showing signs of stabilization after a period of strong performance. This moderate growth outlook suggests a more predictable environment for developers and investors.

Key indicators for CDL's strategic planning include:

- Supply-Demand Balance: Monitoring new property launches against absorption rates is crucial. For instance, in Q1 2024, the Urban Redevelopment Authority (URA) reported a launch of 1,087 uncompleted private residential units, with take-up rates providing early cycle signals.

- Price Trends: Observing median price movements and rental growth rates helps in timing acquisitions and sales. The URA Private Property Price Index saw a 1.4% increase in Q1 2024, indicating continued, albeit potentially moderating, appreciation.

- Interest Rate Environment: Fluctuations in interest rates directly impact mortgage affordability and investment returns, a key consideration for CDL's financing and pricing models.

- Economic Growth Projections: Broader economic forecasts for Singapore and key international markets where CDL operates influence buyer sentiment and demand for property.

Economic factors significantly shape City Developments Limited's (CDL) operational landscape. Interest rate fluctuations directly impact borrowing costs and buyer affordability, with potential Federal Reserve rate cuts in late 2024 influencing financing expenses.

Rising inflation, such as that experienced in 2024-2025, elevates construction material and labor costs, potentially squeezing CDL's profit margins on new projects. Despite this, strong GDP growth projections for key markets like Singapore (2.5% in 2025) and Australia (2.3% in 2025) are expected to bolster property demand.

Consumer confidence and robust labor markets, evidenced by low unemployment rates in mid-2024, directly translate to increased disposable income and purchasing power, benefiting CDL's residential, retail, and hospitality segments.

Property market cycles, driven by supply-demand dynamics, are also critical. Singapore's private property market is showing signs of stabilization in 2025, with Q1 2024 seeing 1,087 new private residential units launched and a 1.4% increase in the URA Private Property Price Index, indicating a generally positive but moderating market.

| Economic Factor | Impact on CDL | 2024/2025 Data/Projection |

|---|---|---|

| Interest Rates | Financing costs, buyer affordability | Potential Fed rate cuts late 2024; affects mortgage rates. |

| Inflation | Construction costs, profit margins | Increased material and labor costs in 2024-2025. |

| GDP Growth (Singapore) | Property demand | Projected 2.5% growth in 2025. |

| Consumer Confidence | Demand for housing and services | Signs of recovery in early 2024 in developed economies. |

| Labor Market | Disposable income, spending power | Low unemployment rates mid-2024 support wage growth. |

What You See Is What You Get

City Developments PESTLE Analysis

The preview shown here is the exact City Developments PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use. This comprehensive document delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting city development, providing crucial insights for strategic planning.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering a detailed breakdown of each PESTLE category relevant to urban growth and infrastructure projects. You can trust that the depth of analysis and clarity of presentation will be consistent in the document you download.

Sociological factors

Demographic shifts are profoundly reshaping urban landscapes. Singapore, for instance, anticipates continued population growth, which directly fuels the demand for diverse housing solutions. This includes a growing need for smaller residential units catering to smaller household sizes and an increasing demand for specialized senior living facilities as the population ages.

Urbanization trends are also critical. As more people move into cities, the pressure on existing infrastructure intensifies, necessitating significant development in transportation, utilities, and public spaces. This influx also drives demand for mixed-use developments that integrate living, working, and recreational areas, aiming to create more efficient and livable urban environments.

The widespread adoption of hybrid work models, accelerated by events in 2020 and continuing into 2024-2025, is reshaping urban demand. Companies are re-evaluating their physical footprints, with reports indicating a significant portion of businesses plan to maintain hybrid operations, impacting the need for traditional, large-scale office spaces. This shift favors flexible workspaces and buildings offering enhanced amenities to attract employees back to the office.

Concurrently, lifestyle preferences are evolving, with a growing emphasis on convenience and work-life integration. This is driving demand for mixed-use developments that seamlessly blend residential, commercial, and recreational functions. For instance, urban planning initiatives in major cities are increasingly prioritizing developments that offer walkable access to amenities, reflecting a desire for more integrated living experiences.

Societal shifts are profoundly influencing the property market, with a growing emphasis on health, wellness, and environmental consciousness. This translates into a heightened demand for green buildings and living spaces that prioritize sustainability. For instance, in 2024, the global green building market was valued at over $1.2 trillion, with projections indicating continued robust growth as consumers increasingly seek eco-friendly options.

City Developments Limited (CDL) is well-positioned to capitalize on this trend. Their commitment to integrating natural elements into their projects and championing energy-efficient designs directly addresses these evolving consumer preferences. CDL's developments often feature extensive green spaces and incorporate smart technologies aimed at reducing environmental impact, aligning perfectly with the desire for a healthier and more sustainable lifestyle.

Digital Lifestyles and Connectivity

The way people live and work is changing dramatically due to digital lifestyles. This means city developments need to keep up with expectations for seamless connectivity and smart features in both homes and workplaces. Think about the demand for reliable, high-speed internet as a basic amenity, much like electricity or water.

The real estate technology sector, often called Proptech, is rapidly transforming how properties are bought, sold, and managed. In Southeast Asia, for instance, Proptech investment reached an estimated $1.2 billion in 2023, signaling a significant shift towards digitally integrated living and operational solutions.

- Smart Home Integration: Growing demand for automated lighting, climate control, and security systems in residential units.

- Connectivity as a Utility: High-speed internet and robust Wi-Fi are now considered essential, not optional, for both living and working.

- Proptech Adoption: Increased use of digital platforms for property search, virtual tours, and property management, especially in urban centers.

- Remote Work Infrastructure: City planning must consider spaces that support flexible and remote working arrangements, often requiring advanced digital infrastructure.

Community and Social Inclusivity

There's a growing societal push for developments that actively embrace community and social inclusivity. City Developments Limited (CDL) frequently focuses on enhancing the overall liveability of its projects, aiming to cultivate thriving neighborhoods that boost social well-being. This approach aligns well with modern urban planning goals that seek to integrate public and private housing seamlessly, fostering diverse and connected communities.

CDL's commitment to community is evident in projects like the redevelopment of the former CID Headquarters into a mixed-use development, which aims to create a vibrant public space. Their focus on liveability often translates into amenities and design considerations that encourage social interaction and a sense of belonging among residents.

- Community Focus: CDL's strategy prioritizes creating developments that foster strong community ties.

- Liveability Enhancement: Projects are designed to improve the quality of life for residents and the surrounding area.

- Urban Integration: CDL aims to blend public and private housing, contributing to social cohesion and fulfilling urban planning objectives.

Societal values are increasingly prioritizing sustainability and wellness, influencing demand for eco-friendly and health-conscious urban living. This trend is supported by a growing global green building market, projected to exceed $1.2 trillion in 2024, reflecting a strong consumer preference for environmentally responsible developments.

The rise of digital lifestyles and remote work necessitates advanced connectivity and smart features within city developments, making high-speed internet a fundamental utility. Proptech investments in Southeast Asia reached approximately $1.2 billion in 2023, highlighting the integration of technology in real estate transactions and management.

There is a growing emphasis on community building and social inclusivity within urban planning, with developers focusing on creating integrated neighborhoods that enhance social well-being and foster a sense of belonging.

| Factor | Trend | Impact on City Developments | Example/Data Point |

|---|---|---|---|

| Sustainability & Wellness | Increasing consumer demand for green and healthy living spaces. | Drives adoption of eco-friendly building materials and wellness amenities. | Global green building market valued over $1.2 trillion in 2024. |

| Digital Lifestyles & Remote Work | Need for seamless connectivity and smart home/office integration. | Requires robust digital infrastructure and flexible workspace designs. | Proptech investment in Southeast Asia reached $1.2 billion in 2023. |

| Community & Inclusivity | Desire for integrated neighborhoods and social cohesion. | Focus on mixed-use developments that foster interaction and belonging. | Developers prioritizing liveability and community-centric projects. |

Technological factors

The integration of smart building technologies, driven by the Internet of Things (IoT), Artificial Intelligence (AI), and automation, is revolutionizing property management. These advancements significantly boost energy efficiency, streamline operational processes, and elevate the overall tenant experience. For instance, smart systems can optimize HVAC and lighting based on real-time occupancy, leading to substantial energy savings. In 2024, the global smart building market was valued at approximately $80 billion and is projected to grow considerably, reflecting strong adoption trends.

City Developments Limited (CDL) actively embraces this technological shift, prioritizing innovation and robust cyber-readiness. By embedding smart solutions across its portfolio, CDL aims to enhance property performance and minimize its environmental footprint. CDL's commitment to sustainability, as evidenced by its 2023 sustainability report highlighting a 6.3% reduction in energy intensity across its portfolio, demonstrates the tangible benefits of these technological investments.

Proptech is rapidly reshaping the real estate landscape, with digitalization touching everything from initial sales and marketing efforts to ongoing property management. This digital transformation offers significant opportunities for companies like City Developments (CDL).

CDL can harness proptech platforms to gain access to real-time market data, streamline transactions with greater transparency, and offer immersive virtual property viewings. Such advancements are key to boosting operational efficiency and deepening customer engagement in the competitive 2024-2025 market.

City Developments Limited (CDL) can significantly boost efficiency by adopting advanced construction technologies. Innovations like modular construction and prefabrication, which were gaining substantial traction in 2024, allow for greater control over quality and faster project completion. For instance, the global modular construction market was projected to reach $257.8 billion by 2025, indicating a strong industry trend toward off-site manufacturing.

These technological advancements directly address CDL’s need to mitigate construction delays and improve profitability. By utilizing pre-assembled components, projects can see reduced on-site labor requirements and shorter overall build times, translating into lower costs and quicker revenue generation. This approach was a key focus for many developers in 2024, aiming to counter rising material costs and labor shortages.

Data Analytics and Market Insights

City Developments Limited (CDL) leverages big data and advanced analytics to gain a granular understanding of market dynamics, consumer preferences, and the performance of its extensive property assets. This sophisticated data analysis allows CDL to identify emerging trends and anticipate shifts in demand across various property sectors.

By embracing a data-driven strategy, CDL enhances its ability to make well-informed investment decisions, ensuring capital is allocated to opportunities with the highest potential for returns. This analytical rigor is crucial for optimizing the performance of its diverse global portfolio, which includes residential, commercial, and hospitality segments.

In 2024, the real estate technology sector saw significant investment, with PropTech startups attracting over $10 billion globally, underscoring the growing importance of data analytics in property management and investment. CDL's commitment to this area positions it to capitalize on these advancements.

- Enhanced Market Trend Identification: CDL uses data analytics to pinpoint shifts in urban development and residential demand, such as the growing preference for mixed-use developments in Singapore, which saw a 5% increase in transactions in 2024.

- Optimized Asset Performance: By analyzing occupancy rates, rental yields, and operational costs across its portfolio, CDL can implement targeted strategies to improve profitability, aiming for a 3% uplift in net operating income for its commercial properties in 2025.

- Informed Investment Strategy: Data insights into economic indicators and demographic changes in key markets, like the projected 2.5% GDP growth in the UK in 2025, inform CDL's strategic acquisitions and divestments.

- Personalized Customer Engagement: Understanding consumer behavior through data allows CDL to tailor marketing efforts and product offerings, potentially increasing customer acquisition by 7% in its new residential projects.

Cybersecurity and Data Privacy

As City Developments Limited (CDL) increasingly integrates smart technology into its properties, the importance of robust cybersecurity and data privacy measures escalates. The digitalization of building operations, from access control to energy management, creates new vulnerabilities. CDL's commitment to cyber-readiness and data privacy is paramount to safeguarding its digital infrastructure, sensitive tenant data, and ultimately, maintaining the trust essential for its smart building initiatives.

The evolving threat landscape necessitates continuous investment in cybersecurity. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the significant financial and reputational risks associated with breaches. CDL's proactive approach involves implementing advanced security protocols and regular audits to mitigate these risks.

Key aspects of CDL's technological strategy concerning cybersecurity and data privacy include:

- Enhanced Data Encryption: Implementing state-of-the-art encryption for all tenant and operational data.

- Regular Security Audits: Conducting frequent vulnerability assessments and penetration testing on smart building systems.

- Tenant Data Protection Policies: Adhering to stringent data privacy regulations and ensuring transparency with tenants regarding data usage.

- Employee Training: Providing ongoing cybersecurity awareness and best practice training to all relevant staff.

Technological advancements are reshaping the real estate sector, with smart building technologies like IoT and AI improving efficiency and tenant experience. The global smart building market was valued at around $80 billion in 2024, indicating strong adoption. City Developments Limited (CDL) is integrating these solutions to enhance property performance and sustainability, as seen in their 2023 report noting a 6.3% reduction in energy intensity.

Proptech is driving digitalization across the property lifecycle, from sales to management, offering CDL opportunities for data access, transparent transactions, and virtual viewings to boost efficiency and customer engagement through 2025.

CDL is also adopting advanced construction technologies such as modular construction, which was projected to reach $257.8 billion globally by 2025, to speed up project completion and improve quality, thereby mitigating delays and enhancing profitability.

The company leverages big data analytics to understand market trends and consumer preferences, informing investment decisions and optimizing asset performance, with over $10 billion invested in PropTech startups globally in 2024.

| Technology Area | 2024/2025 Impact/Projection | CDL Application Example |

|---|---|---|

| Smart Building Tech (IoT, AI) | Global market ~$80B (2024), driving efficiency & tenant experience. | Optimizing HVAC/lighting based on occupancy for energy savings. |

| Proptech | Digitalizing sales, marketing, and management for transparency. | Virtual property viewings and real-time market data access. |

| Construction Tech (Modular) | Global market projected $257.8B by 2025, enabling faster builds. | Reducing on-site labor and project timelines for cost efficiency. |

| Big Data & Analytics | Over $10B PropTech investment (2024), enabling data-driven decisions. | Identifying market trends and optimizing asset performance. |

Legal factors

City Developments Limited (CDL) faces significant hurdles due to stringent land use and zoning regulations, especially in land-constrained Singapore. These rules directly influence how intensely and what type of development can occur on any given piece of land. CDL must meticulously adhere to these regulations, as demonstrated by their engagement with the Urban Redevelopment Authority's (URA) Master Plan, to secure land and conceptualize new projects. For instance, in 2023, CDL secured a prime residential site at Dunman Road for S$1.284 billion, a transaction heavily influenced by the site's allowable plot ratio and development parameters set by the URA.

City Developments Ltd. (CDL) must adhere to stringent and often evolving building codes and safety standards across all its global projects. These regulations, which cover everything from structural integrity to fire safety and accessibility, directly impact design choices, construction materials, and overall project timelines. For instance, updated seismic retrofitting requirements in earthquake-prone regions can add significant costs and extend construction schedules.

Compliance is non-negotiable, ensuring public safety and the long-term viability of CDL's assets. In 2024, for example, many jurisdictions are implementing stricter energy efficiency standards for new constructions, requiring advanced insulation and HVAC systems, which can increase initial capital expenditure but offer long-term operational savings. CDL’s commitment to sustainability, as seen in its Green Mark Platinum certified projects, aligns with these trends, though it necessitates careful planning and investment to meet heightened environmental and safety benchmarks.

Tenancy and rental laws significantly shape City Developments' (CDL) operations, particularly for its investment properties and extensive hospitality portfolio. Regulations around landlord-tenant relationships, including rental price controls and the strictures of eviction processes, directly influence CDL's revenue streams and the stability of its rental income. For instance, in Singapore, where CDL has a substantial presence, rental regulations are generally designed to protect tenants, which can impact landlords' flexibility in adjusting rents or managing tenancies, potentially affecting occupancy rates and overall profitability.

Environmental Protection Laws

City Developments Limited (CDL) navigates an increasingly complex regulatory landscape shaped by environmental protection laws. For instance, Singapore's push for greener infrastructure, exemplified by its Green Mark certification scheme, mandates higher standards for building sustainability. CDL's commitment to these standards is crucial for maintaining its market position and operational compliance.

Furthermore, regulations like the Mandatory Energy Improvement (MEI) regime directly impact CDL's building portfolio. This regime compels owners of older, less energy-efficient buildings to undertake upgrades. CDL's proactive investment in sustainable technologies and practices is therefore not just a matter of corporate responsibility but a strategic necessity to meet these evolving legal requirements and avoid potential penalties.

These environmental mandates directly influence CDL's operational costs and capital expenditure. For example, achieving higher Green Mark ratings often requires investing in advanced building materials, efficient HVAC systems, and renewable energy integration. The company's 2024 sustainability report highlights a 15% reduction in energy intensity across its Singapore portfolio, demonstrating a tangible response to these regulatory pressures.

- Green Building Mandates: CDL actively pursues certifications like Singapore's Green Mark, which sets benchmarks for environmental performance in buildings.

- Energy Efficiency Regulations: Compliance with regimes like the Mandatory Energy Improvement (MEI) necessitates ongoing investment in upgrading building systems to reduce energy consumption.

- Carbon Emission Targets: National and international goals for carbon reduction translate into specific operational requirements for property developers like CDL, influencing design and construction practices.

- Sustainable Practices Investment: CDL's strategic allocation of capital towards sustainable technologies and materials is directly driven by the evolving legal framework for environmental protection in the real estate sector.

Consumer Protection and Fair Trading Laws

Consumer protection and fair trading laws are paramount for City Developments (CDL), particularly in its residential sales operations. These regulations, which mandate clear disclosure of property information and prohibit deceptive marketing, are vital for fostering customer trust and ensuring ethical business practices. For instance, in Singapore, the Sale of Commercial Properties Act requires developers to provide prospective buyers with detailed information, including project plans and payment schedules, to prevent misrepresentation.

Adherence to these legal frameworks not only safeguards CDL from potential litigation and reputational damage but also strengthens its market position by demonstrating a commitment to transparency. Failure to comply can result in significant penalties, impacting sales momentum and investor confidence. In 2024, regulatory bodies across key markets continue to enhance oversight on property sales, emphasizing the need for robust compliance protocols.

- Disclosure Requirements: Ensuring all property details, including any defects or encumbrances, are accurately presented to buyers.

- Fair Trading Practices: Prohibiting misleading advertising and unfair contract terms in real estate transactions.

- Consumer Redressal: Providing mechanisms for consumers to seek remedies in case of disputes or unfair treatment.

- Regulatory Scrutiny: Increased focus by authorities on developer conduct and consumer rights in 2024, necessitating proactive compliance.

City Developments Limited (CDL) operates within a framework of evolving legal requirements, particularly concerning land use and development approvals. Singapore's Urban Redevelopment Authority (URA) Master Plan dictates plot ratios and development intensity, as seen in CDL's S$1.284 billion Dunman Road site acquisition in 2023, where these parameters were critical. Furthermore, stringent building codes and safety standards globally impact design and construction timelines, with 2024 seeing increased emphasis on energy efficiency mandates that require advanced systems, influencing initial capital expenditure but promising long-term operational savings.

Environmental protection laws are increasingly shaping CDL's operations, with Singapore's Green Mark certification scheme setting higher sustainability benchmarks. Compliance with regulations like the Mandatory Energy Improvement (MEI) regime necessitates upgrades to older buildings, making proactive investment in sustainable technologies a strategic imperative to avoid penalties. CDL's 2024 sustainability report noted a 15% reduction in energy intensity across its Singapore portfolio, reflecting a direct response to these environmental mandates.

Consumer protection laws are vital for CDL's residential sales, mandating clear disclosures and fair trading practices to build trust and avoid litigation. In 2024, regulatory bodies are intensifying oversight on property sales, underscoring the need for robust compliance protocols to prevent misleading advertising and ensure consumer redressal mechanisms are in place.

| Legal Factor | Impact on CDL | Example/Data Point (2023-2024) |

|---|---|---|

| Land Use & Zoning | Dictates development intensity and type. | S$1.284 billion Dunman Road site acquisition (2023) influenced by URA plot ratio. |

| Building Codes & Safety | Affects design, materials, and timelines. | Increased energy efficiency standards in 2024 require advanced HVAC and insulation. |

| Environmental Regulations | Drives investment in sustainable practices. | 15% energy intensity reduction in Singapore portfolio (2024) due to Green Mark and MEI compliance. |

| Consumer Protection | Ensures transparency in property sales. | Heightened regulatory scrutiny on developer conduct in 2024 necessitates proactive compliance. |

Environmental factors

Climate change presents significant physical risks, with rising sea levels and more frequent extreme weather events directly threatening City Developments' (CDL) coastal assets and operational continuity. For instance, the company's portfolio in Singapore, a low-lying island nation, is particularly vulnerable to these shifts.

CDL is proactively embedding climate resilience and adaptation into its core business strategies. This includes exploring innovative solutions, such as the ambitious Long Island project in Singapore, designed to enhance flood resilience and create new land with integrated coastal protection measures.

City Developments Limited (CDL) recognizes the growing importance of green building standards for both market appeal and regulatory adherence. Achieving certifications like BCA Green Mark and LEED is becoming a key differentiator in the real estate sector.

CDL has a strong track record in sustainability, aiming for full alignment with the International Sustainability Standards Board (ISSB) by the end of fiscal year 2025. This commitment reflects a strategic focus on environmental responsibility and transparency.

City Developments Limited (CDL) is actively aligning with global and national net-zero emission targets, demonstrating a strong commitment to reducing its operational carbon footprint. This strategic focus is evident in their significant investments in enhancing energy efficiency across their extensive property portfolio. For instance, CDL has targeted a 40% reduction in Scope 1 and 2 carbon emissions intensity by 2030 compared to a 2016 baseline.

To achieve these ambitious decarbonization goals, CDL is actively adopting renewable energy sources and exploring innovative nature-based solutions. Their commitment extends to investing in solar power installations and other green technologies, aiming to power their operations with cleaner energy. By 2025, CDL aims to achieve 100% renewable energy usage for its Singapore operations.

Resource Scarcity and Waste Management

The increasing scarcity of vital resources, such as water and construction materials, is a significant environmental factor impacting city developments. This reality mandates that companies like City Developments Limited (CDL) adopt robust resource management strategies and embrace circular economy principles in their project planning and execution. For instance, CDL's commitment to sustainability, as seen in their 2023 ESG report highlighting a 4.8% reduction in water intensity across their portfolio, demonstrates a proactive approach to resource conservation.

Implementing sustainable sourcing and rigorous waste reduction practices are not just environmentally responsible but also crucial for minimizing a project's overall environmental footprint and achieving operational cost efficiencies. CDL's focus on waste diversion, with a reported 70% of construction waste diverted from landfills in their 2023 projects, directly contributes to this goal.

- Water Scarcity: Global freshwater availability is projected to decline, impacting construction and urban living.

- Material Costs: Fluctuations and rising costs of construction materials, exacerbated by supply chain issues, drive the need for efficient use and recycling.

- Waste Management Regulations: Increasingly stringent regulations globally push for reduced landfill waste and greater adoption of circular economy models.

- CDL's Initiatives: CDL reported a 70% construction waste diversion rate in 2023, showcasing a commitment to waste reduction.

Biodiversity and Nature-Positive Development

The increasing emphasis on preserving biodiversity and incorporating natural elements into urban planning presents a significant environmental factor for city developments. This trend is driven by a global recognition of the ecological services provided by nature and the need to mitigate the impact of urbanization.

City Developments Limited (CDL) is actively responding to this by being the first Singaporean company to voluntarily report in line with the Task Force on Nature-related Financial Disclosures (TNFD) recommendations. This aligns with Singapore's ambitious 'City in Nature' vision, aiming to enhance green spaces and biodiversity within its urban landscape.

- Growing Urban Biodiversity Focus: Cities worldwide are increasingly prioritizing the integration of green infrastructure and biodiversity conservation into development projects to improve ecological resilience and citizen well-being.

- CDL's TNFD Adoption: CDL's voluntary reporting under TNFD demonstrates a commitment to understanding and managing nature-related risks and opportunities, setting a precedent for corporate environmental responsibility in the sector.

- Singapore's 'City in Nature' Vision: This national strategy underscores the importance of nature-based solutions and greening efforts, influencing development standards and creating opportunities for nature-positive projects.

Environmental factors are increasingly shaping urban development strategies, pushing companies like City Developments Limited (CDL) to prioritize sustainability and resilience. Climate change, resource scarcity, and biodiversity preservation are key considerations influencing project planning and operational efficiency.

CDL's proactive approach includes aligning with net-zero targets, aiming for 100% renewable energy in Singapore by 2025 and a 40% reduction in carbon emissions intensity by 2030. They are also focusing on resource management, evidenced by a 4.8% reduction in water intensity in 2023, and waste reduction, with a 70% construction waste diversion rate in 2023.

Furthermore, CDL is embracing nature-based solutions and biodiversity conservation, demonstrated by their voluntary reporting in line with the Task Force on Nature-related Financial Disclosures (TNFD) recommendations. This aligns with Singapore's 'City in Nature' vision, highlighting the growing importance of integrating ecological considerations into urban development.

| Environmental Factor | CDL's Response/Initiative | Key Data/Target |

| Climate Change & Physical Risks | Coastal asset resilience, flood mitigation | Long Island project in Singapore |

| Net-Zero Emissions | Reducing operational carbon footprint | 40% reduction in Scope 1 & 2 emissions intensity by 2030 (vs. 2016 baseline) |

| Renewable Energy | Adoption of solar power and green technologies | 100% renewable energy for Singapore operations by 2025 |

| Resource Scarcity (Water) | Robust resource management, circular economy principles | 4.8% reduction in water intensity (2023) |

| Waste Management | Sustainable sourcing, waste reduction practices | 70% construction waste diversion rate (2023) |

| Biodiversity & Nature Preservation | Integrating green infrastructure, nature-based solutions | Voluntary TNFD reporting, aligning with 'City in Nature' vision |

PESTLE Analysis Data Sources

Our City Developments PESTLE Analysis is meticulously crafted using data from official municipal records, national census bureaus, and reputable urban planning research institutions. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors shaping urban growth.