City Developments Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

City Developments Bundle

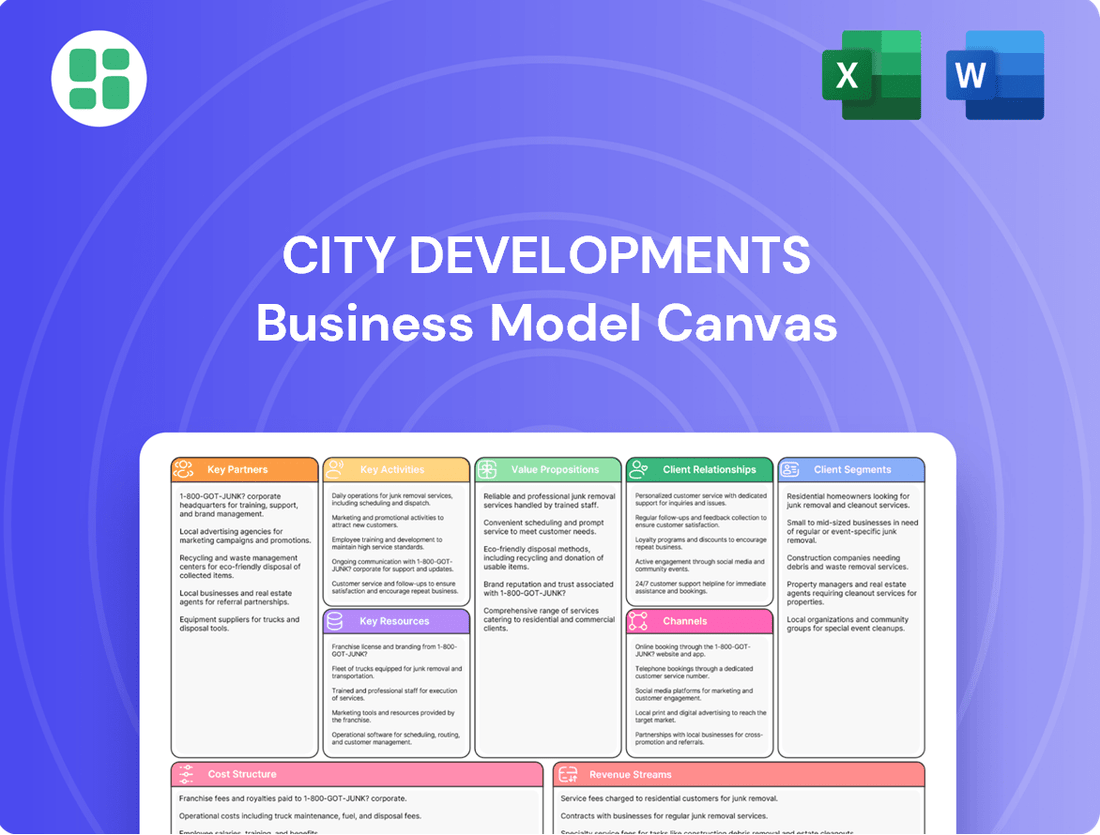

Curious about City Developments's success? Our Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their strategic advantage.

Partnerships

City Developments Limited (CDL) actively engages in joint ventures with other developers to manage the substantial risks and capital requirements inherent in large-scale property developments. This collaborative approach allows CDL to share expertise and broaden its project portfolio.

A prime example of this strategy is CDL's partnership with Mitsui Fudosan (Asia) Pte. Ltd. for a significant Government Land Sales (GLS) site on Zion Road, secured in April 2024. This collaboration is geared towards developing a mixed-use integrated project.

These joint ventures are crucial for CDL's growth, enabling the company to pursue ambitious developments and effectively replenish its land bank for future projects, thereby maintaining a robust pipeline of opportunities.

City Developments Limited (CDL) maintains vital strategic relationships with government and regulatory bodies, such as the Urban Redevelopment Authority (URA). These partnerships are fundamental for CDL's operations, especially concerning land acquisition through bids, securing necessary planning approvals, and engaging in urban development incentive programs.

A prime example of this collaboration is CDL's March 2024 receipt of Written Approval from the URA for the redevelopment of the Union Square site. This approval, granted under the URA's Strategic Development Incentive Scheme, is expected to significantly enhance the gross floor area of the project, demonstrating the tangible benefits of these government collaborations.

These collaborations enable CDL to undertake and execute large-scale, integrated developments that are instrumental in shaping the urban fabric and future landscape of cities.

City Developments Limited (CDL) collaborates closely with a variety of financial institutions, including major banks and investment firms, to fuel its ambitious development pipeline and investment strategies. These partnerships are crucial for securing the necessary project financing, obtaining loans, and raising capital for its diverse portfolio.

In 2024, CDL continued to leverage these relationships, notably by refinancing existing loans into sustainability-linked loans. This strategic move underscores the company's commitment to environmental, social, and governance (ESG) principles and highlights the supportive role of its financial partners in these endeavors. Such refinancing efforts are key to managing capital efficiently and supporting ongoing and future acquisitions.

Construction Contractors and Suppliers

City Developments Limited (CDL) relies heavily on a network of trusted construction contractors and suppliers to bring its diverse property portfolio to life. These relationships are fundamental to ensuring projects, from residential estates to commercial hubs and hotels, are completed on time and within budget, meeting CDL's exacting quality standards.

In 2024, CDL continued to emphasize strategic alliances within the construction sector. For instance, their commitment to sustainability often means partnering with suppliers offering green building materials, a trend that gained significant traction throughout the year as environmental regulations tightened and consumer demand for eco-friendly properties grew.

- Timely Project Delivery: CDL's partnerships with reliable contractors are crucial for meeting development schedules, a key factor in maintaining investor confidence and market competitiveness.

- Quality Assurance: Collaborating with reputable suppliers ensures the use of high-grade materials, directly impacting the longevity and appeal of CDL's properties.

- Supply Chain Efficiency: A well-managed network of suppliers enables CDL to navigate potential material shortages and price fluctuations, ensuring cost-effectiveness in construction.

- Innovation in Construction: CDL often partners with contractors and suppliers who are at the forefront of construction technology and sustainable practices, driving innovation in its developments.

Hospitality Sector Partners

Beyond its wholly-owned Millennium & Copthorne Hotels (M&C), City Developments Limited (CDL) actively cultivates partnerships within the hospitality sector. These collaborations are crucial for management services, brand alignment, and expanding distribution networks. For instance, CDL partners for hotel refurbishments and new openings, exemplified by the reflagging of Millennium Hotel London Knightsbridge to M Social Knightsbridge, enhancing its brand appeal and operational efficiency.

These strategic alliances bolster CDL's global presence and operational effectiveness across its diverse hospitality assets. By leveraging external expertise and shared resources, CDL can more effectively manage its portfolio, drive innovation, and adapt to evolving market demands. In 2024, CDL continued to explore these synergistic relationships to optimize its hospitality segment performance.

- Management Agreements: CDL partners with other entities for the day-to-day management of certain hotel properties, ensuring high operational standards.

- Branding Collaborations: Partnerships are formed to leverage established hotel brands or introduce new concepts, like the M Social brand expansion.

- Distribution Network Expansion: Collaborating with travel agencies and online travel platforms broadens the reach of CDL's hotel offerings.

- Refurbishment and Development Projects: Joint ventures or service agreements facilitate the upgrading and launch of new hotel facilities.

City Developments Limited (CDL) strategically partners with other developers for joint ventures, sharing capital and expertise on large projects. This is evident in their April 2024 collaboration with Mitsui Fudosan (Asia) Pte. Ltd. for a mixed-use development on a Zion Road GLS site, crucial for expanding their land bank and maintaining a robust project pipeline.

CDL also maintains vital relationships with government bodies like the URA, securing approvals and participating in incentive schemes. Their March 2024 receipt of Written Approval from the URA for the Union Square site redevelopment under the Strategic Development Incentive Scheme highlights the benefits of these collaborations for urban shaping.

Financial institutions are key partners, providing project financing and capital. In 2024, CDL’s refinancing of loans into sustainability-linked loans showcases the support from these partners for ESG initiatives and efficient capital management.

CDL relies on trusted construction contractors and suppliers to ensure timely, quality project delivery. In 2024, this included partnerships with suppliers of green building materials, reflecting growing environmental regulations and consumer demand.

In the hospitality sector, CDL partners for management services, brand alignment, and distribution, as seen with the reflagging of Millennium Hotel London Knightsbridge to M Social Knightsbridge in 2024, enhancing brand appeal and operational efficiency.

| Partnership Type | Key Partner Example | Year of Activity/Reference | Purpose/Benefit |

|---|---|---|---|

| Joint Ventures (Developers) | Mitsui Fudosan (Asia) Pte. Ltd. | April 2024 | Share capital/risk, expand project portfolio, replenish land bank |

| Government/Regulatory Bodies | Urban Redevelopment Authority (URA) | March 2024 | Land acquisition, planning approvals, urban development incentives |

| Financial Institutions | Various Banks & Investment Firms | 2024 | Project financing, loans, capital raising, sustainability-linked refinancing |

| Construction Sector | Suppliers of Green Building Materials | 2024 | Timely delivery, quality assurance, supply chain efficiency, innovation |

| Hospitality Sector | Millennium & Copthorne Hotels (M&C) | 2024 | Management services, brand alignment, distribution network expansion |

What is included in the product

The City Developments Business Model Canvas provides a structured framework for understanding the core components of a real estate development business, from identifying target customer segments and defining value propositions to outlining key resources and revenue streams.

It serves as a strategic tool for visualizing and analyzing the entire business, facilitating informed decision-making for growth and investment.

The City Developments Business Model Canvas acts as a pain point reliever by offering a structured, visual approach to untangle complex urban development challenges.

It helps stakeholders quickly pinpoint and address critical issues within city projects, fostering clarity and actionable solutions.

Activities

City Developments Limited (CDL) actively engages in the complete real estate development lifecycle. This encompasses everything from identifying and acquiring suitable land, through the intricate design and construction phases, to the final marketing and sale or leasing of completed properties. This core activity is central to their business model, driving revenue and portfolio growth.

In 2024, CDL showcased a dynamic development pipeline with the launch of several significant residential projects in Singapore. These included The Orie, Lumina Grand, Kassia, Norwood Grand, and Union Square Residences. These launches underscore their commitment to delivering new housing supply and maintaining a strong presence in the residential market.

Looking ahead, CDL continued to strategically expand its land bank in 2024, securing new parcels designated for future mixed-use developments. This forward-thinking approach ensures a steady stream of projects for the coming years, supporting sustained business activity and long-term value creation.

City Developments Limited (CDL) actively manages a global property portfolio, focusing on residential, commercial, and hospitality assets to drive long-term growth and generate consistent rental income.

In 2024, CDL demonstrated strategic portfolio optimization through significant capital recycling, divesting assets valued at over $600 million. This included the sale of strata units and portions of mixed-use developments.

City Developments Ltd. (CDL) actively manages its vast property portfolio, encompassing office buildings, shopping centers, and residential rental units. This hands-on approach ensures each asset performs optimally and that tenants are well-served. In 2024, CDL's commitment to robust property and asset management is a cornerstone of its strategy to maintain and enhance property values.

Their management activities directly contribute to stable rental income streams, a vital component of CDL's financial health. This focus on operational excellence is key to maximizing the return on investment for their diverse real estate holdings.

Hotel Operations and Management

City Developments Limited (CDL), through its subsidiary Millennium & Copthorne Hotels (M&C), actively manages and operates a diverse portfolio of hotels and serviced apartments worldwide. This includes strategic oversight of property performance, ensuring exceptional guest experiences, and undertaking vital refurbishments, such as those at the Millennium Hotel London Knightsbridge. M&C's commitment to growth is evident in its expansion efforts, including the launch of new brands like M Social Resort Penang and M Social Hotel New York Downtown, with a clear objective to increase its global hotel footprint.

M&C's operational focus in 2024 and into 2025 centers on enhancing brand value and driving occupancy. For instance, the M Social brand continues its global expansion, with new properties planned in key urban centers. This strategic brand development aims to capture a wider demographic of travelers seeking unique and contemporary experiences. M&C's ongoing investment in property upgrades and digital guest services underpins its strategy to maintain competitiveness in the hospitality sector.

- Global Hotel Operations: M&C manages a portfolio of hotels and serviced apartments across various international markets.

- Brand Development and Expansion: Launching and growing brands like M Social to attract diverse guest segments.

- Property Refurbishment and Upgrades: Investing in existing properties to enhance guest experience and operational efficiency, exemplified by projects like the Millennium Hotel London Knightsbridge.

- Strategic Growth Initiatives: Aiming to increase the total number of managed hotels globally through targeted expansion plans.

Capital Management and Fundraising

Securing adequate financing is a cornerstone of City Developments Limited's (CDL) strategy, enabling the company to pursue new development projects and strategic investments. This involves actively managing existing debt and proactively raising capital to fuel its growth ambitions.

In 2024, CDL Hospitality Trusts took a significant step by refinancing a substantial portion of its maturing loans. Notably, these were refinanced as sustainability-linked loans, underscoring CDL's dedication to incorporating green finance principles into its capital structure.

This disciplined approach to capital management is vital for maintaining financial robustness. It ensures CDL has the necessary resources to undertake large-scale developments and seize market opportunities.

- Financing New Projects: CDL's ability to secure funding for new developments is a critical activity.

- Debt Management: Effectively managing existing debt and refinancing obligations, as seen with CDL Hospitality Trusts in 2024, is key.

- Capital Raising: Proactively raising capital through various instruments supports CDL's expansion and investment plans.

- Sustainability-Linked Loans: The 2024 refinancing of maturing loans with sustainability-linked instruments highlights a strategic shift towards green finance.

CDL's key activities revolve around its extensive real estate development and investment operations. This includes acquiring land, designing and constructing properties, and managing a diverse global portfolio of residential, commercial, and hospitality assets. In 2024, CDL continued to actively manage its portfolio, divesting assets valued at over $600 million as part of its capital recycling strategy.

Furthermore, CDL, through its subsidiary Millennium & Copthorne Hotels (M&C), operates and expands its hotel portfolio. This involves property refurbishment, brand development, and strategic growth initiatives to increase its global footprint. For instance, the M Social brand saw expansion in 2024 with new properties planned in key urban centers.

Securing financing and managing capital are also crucial activities. In 2024, CDL Hospitality Trusts refinanced maturing loans with sustainability-linked instruments, demonstrating a commitment to green finance.

| Key Activity | Description | 2024 Highlights |

|---|---|---|

| Real Estate Development | Land acquisition, design, construction, marketing, and sales/leasing of properties. | Launched significant residential projects like The Orie and Lumina Grand in Singapore. Expanded land bank for future mixed-use developments. |

| Property & Asset Management | Managing a global portfolio of residential, commercial, and hospitality assets to generate rental income and enhance value. | Divested assets exceeding $600 million as part of capital recycling. Maintained focus on operational excellence for diverse real estate holdings. |

| Hotel Operations & Expansion | Managing and operating hotels and serviced apartments worldwide, focusing on brand development and property upgrades. | Continued expansion of M Social brand with new properties planned. Refurbishment projects undertaken, such as at Millennium Hotel London Knightsbridge. |

| Financing & Capital Management | Securing financing for projects, managing debt, and raising capital for growth. | CDL Hospitality Trusts refinanced maturing loans with sustainability-linked loans. |

Preview Before You Purchase

Business Model Canvas

The City Developments Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means you're seeing a direct representation of the content, structure, and formatting that will be yours to use immediately. We provide this transparent preview so you know exactly what you're getting—a fully realized business model canvas ready for your city development projects.

Resources

City Developments Limited (CDL) boasts an extensive land bank, providing a crucial foundation for its future development pipeline. This strategic asset ensures a consistent supply of projects, allowing the company to capitalize on market opportunities and maintain growth momentum.

CDL's property portfolio is remarkably diverse, encompassing residential, office, hotel, serviced apartment, student accommodation, and retail assets. This diversification across sectors and geographies, spanning 168 locations in 29 countries, contributes significantly to income stability and resilience against market fluctuations.

As of December 2024, CDL's global property holdings amounted to approximately 23 million square feet of gross floor area. This substantial physical footprint underscores the scale of its operations and its capacity to generate recurring income streams from a wide array of established assets.

City Developments Limited (CDL) possesses significant financial capital, including substantial equity and readily available credit lines. This financial strength is a cornerstone of its ability to undertake large-scale development projects and maintain robust operations.

In 2024 alone, CDL strategically deployed $2.2 billion to bolster its development pipeline and expand its global living sector portfolio. This investment underscores the company's commitment to growth and its capacity to fund ambitious ventures.

Furthermore, CDL actively utilizes sustainability-linked financing. This approach not only supports its ongoing operations but also fuels its various green initiatives, aligning financial strategy with environmental responsibility.

City Developments Ltd. (CDL) leverages the deep expertise of its human capital across real estate development, investment, project management, and hospitality. This seasoned workforce, honed over six decades, is crucial for successfully navigating complex, large-scale projects and efficiently managing its extensive international property holdings.

The company's management boasts significant experience, contributing to CDL's ability to execute its strategic vision effectively. For instance, in 2023, CDL reported a net profit attributable to shareholders of S$1.2 billion, a substantial increase from S$77.7 million in 2022, underscoring the impact of strong leadership and operational execution.

Strong Brand Reputation and Sustainability Leadership

CDL’s strong brand reputation is a cornerstone of its business model, fostering trust and loyalty among customers and stakeholders. This global recognition for quality and sustainability is a significant asset.

In 2025, CDL’s commitment to sustainability was validated by its inclusion in the Global 100 Most Sustainable Corporations in the World index, a testament to its leadership in environmental, social, and governance practices. Being the sole Singapore-headquartered company on this prestigious list highlights its unique position.

- Brand Trust: A globally recognized brand for quality developments builds immediate customer confidence.

- Sustainability Leadership: Recognition as a top sustainable corporation enhances corporate image and attracts ethically-minded investors and partners.

- Competitive Advantage: CDL’s reputation differentiates it in a crowded market, allowing for premium pricing and preferred partnerships.

- Talent Attraction: A strong, ethical brand reputation also aids in attracting and retaining top talent in the competitive real estate sector.

Technological Infrastructure and Innovation

City Developments Limited (CDL) utilizes robust technological infrastructure to streamline its property management, sales processes, and customer interactions. This digital backbone is crucial for maintaining operational efficiency across its diverse portfolio.

Within its hospitality segment, Millennium Hotels and Resorts is actively investing in digital innovation. For instance, the company has been rolling out AI-powered guest service assistants, aiming to provide more personalized and efficient support. Revitalized loyalty programs are also a key focus, leveraging technology to enhance guest engagement and retention.

CDL's commitment to technology is evident in its pursuit of enhanced operational efficiency and superior guest experiences. This strategic adoption of digital tools and platforms underpins its business model by improving service delivery and fostering stronger customer relationships.

- Property Management Efficiency: Technology enables streamlined operations for CDL's extensive property portfolio.

- Digital Hospitality: Millennium Hotels and Resorts deploys AI assistants and enhanced loyalty programs.

- Customer Relationship Management: Digital tools are used to manage and improve customer interactions.

- Operational Enhancement: The focus is on leveraging technology to boost overall business performance.

CDL's key resources include its extensive land bank, a diverse property portfolio across 29 countries, significant financial capital, and a highly experienced workforce. These assets are complemented by a strong brand reputation for quality and sustainability, and robust technological infrastructure supporting efficient operations and customer engagement.

| Key Resource | Description | 2024/2025 Relevance |

|---|---|---|

| Land Bank | Foundation for future development pipeline. | Ensures consistent project supply and growth. |

| Property Portfolio | 23 million sq ft GFA across 168 locations. | Diversified income streams and global presence. |

| Financial Capital | Equity and credit lines; $2.2 billion deployed in 2024. | Enables large-scale projects and expansion. |

| Human Capital | Expertise in development, investment, management. | Navigates complex projects and international operations. |

| Brand Reputation | Globally recognized for quality and sustainability. | Builds trust, attracts talent, and offers competitive advantage. |

| Technology Infrastructure | Streamlines operations, enhances customer interaction. | Supports efficiency in property management and hospitality. |

Value Propositions

City Developments Limited (CDL) distinguishes itself by focusing on high-quality, sustainable developments across residential, commercial, and hospitality sectors. Their commitment to premium design and environmental responsibility is a cornerstone of their value proposition.

CDL is a recognized leader in green building, evidenced by its numerous Building and Construction Authority (BCA) Green Mark certifications. This dedication to energy efficiency and climate resilience ensures their properties are not only attractive but also environmentally conscious.

For instance, in 2023, CDL achieved a significant milestone with 137 projects in Singapore receiving BCA Green Mark certifications, including 103 Green Mark Platinum awards, underscoring their consistent focus on sustainability.

For investors, City Developments Limited (CDL) presents a compelling array of diversified investment opportunities. Their portfolio spans residential, commercial, and hospitality sectors across multiple geographies, allowing investors to tap into varied market dynamics and mitigate sector-specific risks. This broad exposure is a key element in their strategy to offer potentially stable returns.

CDL's commitment to capital recycling, a strategy where they divest mature assets to reinvest in new growth opportunities, further enhances the appeal of their investment offerings. This proactive approach ensures the portfolio remains dynamic and aligned with market trends. For instance, in 2024, CDL actively managed its portfolio, completing strategic divestments and acquisitions to optimize its asset base and unlock value for shareholders.

City Developments (CDL) offers a complete suite of real estate services, covering everything from initial development and investment to property management and operations. This integrated model ensures a seamless experience across the entire property lifecycle.

CDL's commitment to integrated solutions is evident in large-scale projects such as Union Square, a prime example of their capability to blend residential, office, retail, and co-living components. This approach fosters dynamic, self-sufficient communities.

By managing the full spectrum of real estate activities, CDL effectively maximizes the value of its assets. This holistic strategy allows for greater control and optimization of each development's potential.

Reliable and Professional Asset Management

City Developments (CDL) offers reliable and professional asset management, ensuring properties are efficiently run to boost value for everyone involved. This commitment extends to consistent upkeep, fostering positive tenant relationships, and implementing strategic upgrades to stay competitive and improve user satisfaction.

CDL's expertise in property management is backed by a significant track record. For instance, as of the first half of 2024, CDL managed a diverse portfolio, demonstrating their capability in maintaining and enhancing asset value across various property types.

- Maximizing Value: CDL's professional management aims to optimize returns for property owners through effective operations and strategic enhancements.

- Tenant & Guest Experience: Ongoing maintenance and responsive tenant relations are prioritized to ensure a positive user experience.

- Strategic Enhancement: Proactive initiatives are undertaken to maintain property competitiveness and adapt to market demands, contributing to long-term asset appreciation.

- Proven Track Record: CDL's extensive history in property management signifies its reliability and deep understanding of the sector.

Global Hospitality Experience and Brand Trust

City Developments Limited (CDL) leverages its Millennium & Copthorne Hotels brand to deliver a robust global hospitality experience, encompassing over 160 hotels strategically located across the world. This extensive network allows CDL to cater to a diverse international clientele.

The company prioritizes enhancing the guest journey through continuous investment in hotel refurbishments, the integration of digital innovations for seamless service, and the cultivation of strong guest loyalty via dedicated programs. These initiatives are central to maintaining a competitive edge in the hospitality sector.

Millennium Hotels and Resorts solidified its market position by being named Singapore's most valuable hotel brand for the second year running in 2025. This repeated recognition underscores the deep brand trust CDL has cultivated and its consistent delivery of high-quality service standards.

- Global Reach: Over 160 hotels worldwide under the Millennium & Copthorne brand.

- Guest Experience Focus: Investments in refurbishments, digital innovation, and loyalty programs.

- Brand Recognition: Awarded Singapore's most valuable hotel brand for the second consecutive year in 2025.

City Developments Limited (CDL) offers a diversified portfolio of real estate investments, spanning residential, commercial, and hospitality sectors across various global markets. This broad exposure allows investors to tap into different economic cycles and mitigate risks, aiming for stable, long-term returns. CDL's strategic capital recycling, involving the divestment of mature assets to fund new growth, ensures their portfolio remains dynamic and responsive to market shifts.

CDL's integrated real estate services provide a seamless experience from development through to property management. This end-to-end approach maximizes asset value by ensuring efficient operations, proactive maintenance, and strategic upgrades. Their commitment to managing the entire property lifecycle allows for greater control and optimization of each development's potential, enhancing overall profitability.

The company's professional asset management services focus on optimizing property performance and tenant satisfaction. By prioritizing consistent upkeep, fostering strong tenant relationships, and implementing strategic enhancements, CDL ensures its managed properties remain competitive and attractive. This dedication to operational excellence is reflected in their extensive track record and ability to maintain and grow asset value.

CDL's global hospitality arm, Millennium & Copthorne Hotels, offers a wide-ranging guest experience with over 160 hotels worldwide. The brand's success is driven by continuous investment in property upgrades, digital innovation, and guest loyalty programs. This focus on enhancing the guest journey has led to significant brand recognition, including being named Singapore's most valuable hotel brand for the second consecutive year in 2025.

| Value Proposition | Description | Supporting Data/Fact |

|---|---|---|

| Diversified Investment Opportunities | Access to a broad range of real estate sectors and geographies for risk mitigation and stable returns. | Portfolio spans residential, commercial, and hospitality sectors globally. |

| Integrated Real Estate Solutions | End-to-end services covering development, investment, management, and operations for maximized asset value. | Manages the full spectrum of real estate activities, ensuring control and optimization. |

| Professional Asset Management | Efficient property operations, proactive maintenance, and strategic upgrades to enhance value and user satisfaction. | Managed a diverse portfolio as of H1 2024, demonstrating capability in maintaining asset value. |

| Global Hospitality Excellence | Extensive network of over 160 hotels offering enhanced guest experiences through investment and innovation. | Millennium Hotels and Resorts named Singapore's most valuable hotel brand for the second year running in 2025. |

Customer Relationships

City Developments Limited (CDL) cultivates strong customer connections through its specialized in-house sales and leasing teams. These teams provide personalized guidance to potential buyers and renters, ensuring a deep understanding of CDL's residential and commercial offerings. This direct interaction is further enhanced by physical sales galleries and showflats, offering tangible experiences of the properties.

CDL's approach emphasizes showcasing the distinct advantages of each property, facilitating informed decisions for their clientele. The robust performance of recently launched projects underscores the efficacy of these direct engagement strategies in building and maintaining customer relationships.

City Developments Limited (CDL) actively cultivates strong customer relationships through its comprehensive ongoing property management and tenant services. This includes essential maintenance, facility upkeep, and prompt support for both residential and commercial occupants. For instance, CDL's commitment to service excellence aims to foster high tenant satisfaction and encourage long-term tenancy, a crucial element in their business model.

City Developments Limited (CDL) fosters transparent investor relations by providing timely financial updates and engaging directly with shareholders. This includes accessible annual reports, financial results, and dedicated investor presentations, ensuring all stakeholders have clear visibility into the company's performance and strategy.

CDL's investor relations portal serves as a central hub for crucial information, offering easy access to annual reports, sustainability reports, and financial results. This commitment to transparency is vital for building and maintaining trust within the investment community.

In 2023, CDL reported a net profit attributable to shareholders of S$254.5 million, demonstrating its financial stability. The company actively engages with institutional investors and shareholders through regular meetings and comprehensive reporting, reinforcing its dedication to open communication.

Hospitality Loyalty Programs and Guest Services

City Developments Limited (CDL) cultivates strong customer relationships within its hospitality sector by focusing on loyalty and enhanced guest experiences. A prime example is their MyMillennium loyalty program, which rewards frequent hotel guests and offers tailored services to encourage repeat business. This program is central to their strategy for fostering guest retention and building brand affinity.

Furthering this commitment to guest satisfaction, CDL has integrated AI-powered assistants. These technological advancements aim to streamline guest interactions, offering immediate support and personalized recommendations. The goal is to ensure a seamless and memorable stay, thereby increasing the likelihood of future bookings.

- MyMillennium Loyalty Program: Offers points, exclusive benefits, and personalized offers to members.

- AI-Powered Guest Services: Enhances communication and service delivery through intelligent virtual assistants.

- Focus on Memorable Experiences: Initiatives designed to create positive lasting impressions and drive repeat visits.

Digital and Online Engagement

City Developments Limited (CDL) actively engages customers through its corporate website and various online property portals, facilitating inquiries, collecting feedback, and disseminating project updates. This digital presence ensures broad reach and enables instant communication.

The company's strategic adoption of digital tools, including AI, within its hospitality operations is enhancing customer interactions, making them more efficient and accessible. For instance, in 2024, CDL Hotels reported a significant increase in digital bookings, driven by personalized online experiences.

- Website and Portals: CDL leverages its corporate website and popular online property platforms for customer engagement, inquiries, and feedback.

- Digital Transformation: The integration of digital tools and AI in hospitality operations streamlines customer interactions and improves accessibility.

- Broad Reach: Online channels provide CDL with the ability to connect with a wide audience and communicate updates instantly.

- 2024 Impact: CDL Hotels saw a notable rise in digital bookings in 2024, attributed to enhanced online customer experiences.

CDL nurtures customer relationships through dedicated in-house sales and leasing teams, offering personalized property guidance. Their commitment extends to ongoing property management and tenant services, ensuring high satisfaction and encouraging long-term tenancy. Furthermore, CDL maintains transparent investor relations through timely financial updates and direct engagement, fostering trust and visibility.

| Customer Segment | Relationship Type | Key Engagement Channels | 2023/2024 Data Points |

|---|---|---|---|

| Property Buyers/Renters | Personalized Guidance, Tangible Experience | In-house Sales/Leasing Teams, Sales Galleries, Showflats | Efficacy underscored by robust performance of recent launches. |

| Tenants (Residential/Commercial) | Ongoing Management, Support Services | Property Management, Facility Upkeep, Prompt Support | Focus on service excellence to foster high tenant satisfaction. |

| Investors/Shareholders | Transparency, Direct Engagement | Annual Reports, Financial Results, Investor Presentations, Investor Portal | 2023 Net Profit: S$254.5 million; Active engagement with institutional investors. |

| Hotel Guests | Loyalty Programs, Enhanced Experiences | MyMillennium Loyalty Program, AI-Powered Assistants, Digital Booking Platforms | 2024: Significant increase in digital bookings for CDL Hotels due to personalized online experiences. |

Channels

City Developments Limited (CDL) leverages physical sales galleries and showflats as a cornerstone of its customer engagement strategy, offering potential buyers an tangible connection to their future homes. These meticulously designed spaces facilitate direct interaction with CDL's sales professionals, enabling comprehensive property presentations and immersive walkthroughs that are vital for high-value real estate decisions.

In 2024, CDL continued to invest in these physical touchpoints, recognizing their enduring importance in the property market. While digital channels are increasingly prevalent, the ability for buyers to physically experience the quality of construction, layout, and ambiance of a residential unit remains a critical factor. This approach directly supports CDL's customer value proposition by providing transparency and building trust.

City Developments Limited (CDL) heavily relies on its digital presence through its official website and popular online property portals. These platforms are crucial for reaching a wide customer base, offering detailed property listings, virtual tours, and essential information. In 2024, CDL continued to enhance its online offerings, ensuring potential buyers can easily access property details and initiate contact remotely.

These digital channels facilitate customer engagement by allowing them to research properties, explore floor plans, and submit initial inquiries without physical visits. This digital-first approach is vital for capturing leads and nurturing customer interest in CDL's diverse portfolio, reflecting the increasing trend of online property discovery.

City Developments Limited (CDL) actively collaborates with a network of external real estate agencies and brokers. This strategic approach allows CDL to significantly broaden its market presence and efficiently manage the sales and leasing processes for its diverse property portfolio.

These partnerships are crucial for tapping into the extensive networks and specialized knowledge that agents possess. By leveraging these relationships, CDL effectively connects with a larger and more diverse group of prospective buyers and tenants, thereby enhancing property transaction volumes.

This indirect channel serves as a vital complement to CDL's direct sales initiatives. In 2024, CDL reported a robust performance across its Singapore portfolio, with significant contributions from its various sales channels, including these agency partnerships, underscoring their importance in driving revenue and market penetration.

Corporate Sales and Leasing Teams

City Developments Limited (CDL) leverages specialized corporate sales and leasing teams to manage its commercial and significant residential property portfolios. These teams are instrumental in forging direct relationships with a key B2B clientele, including corporations seeking office space, institutional investors, and businesses looking for retail locations. They also facilitate bulk transactions for residential units.

These dedicated teams are crucial for securing long-term leases and high-value sales. For instance, CDL's focus on corporate clients for office leasing directly contributes to stable recurring revenue streams. In 2024, CDL continued to emphasize its commercial leasing efforts, aiming to fill its office spaces with reputable tenants, thereby bolstering its rental income.

The effectiveness of these teams is reflected in their ability to secure large-scale deals. They engage in proactive outreach and negotiation, ensuring that CDL's properties are occupied by strong corporate tenants. This B2B channel is vital for maximizing occupancy rates and rental yields across CDL's diverse commercial and residential assets.

Key aspects of these teams' operations include:

- Direct engagement with corporate clients for office and retail leasing.

- Facilitation of bulk residential unit sales to institutional buyers and investors.

- Focus on building and maintaining B2B relationships for sustained revenue.

- Negotiation of terms for significant commercial and residential property transactions.

Global Hotel Booking Platforms and Travel Agencies

Millennium & Copthorne Hotels utilizes a multi-channel distribution strategy, heavily relying on global hotel booking platforms and online travel agencies (OTAs) to connect with a vast international customer base. This approach ensures broad market penetration for its diverse hotel properties, catering to both leisure and corporate travelers seeking convenient booking options.

These digital channels are critical for driving occupancy rates and revenue. For instance, in 2023, OTAs accounted for a significant portion of bookings across the hospitality industry, with some reports indicating that platforms like Booking.com and Expedia generated over 60% of online travel bookings for many hotel groups. This underscores the importance of maintaining strong partnerships and optimized listings on these key platforms.

- Global Reach: Access to millions of travelers actively searching for accommodation worldwide.

- Visibility: Enhanced brand exposure through prominent placement on popular booking websites.

- Booking Convenience: Streamlined reservation process for customers, increasing conversion rates.

- Market Insights: Data analytics from these platforms can inform pricing strategies and promotional efforts.

CDL's channels encompass direct sales via physical showrooms, digital platforms like its website and property portals, and indirect sales through real estate agencies. Additionally, dedicated corporate sales teams handle B2B transactions for commercial properties and bulk residential sales.

Millennium & Copthorne Hotels, a subsidiary of CDL, heavily utilizes global hotel booking platforms and online travel agencies (OTAs) for broad customer reach. In 2023, OTAs represented a substantial share of online travel bookings, highlighting their crucial role in driving hotel occupancy and revenue.

| Channel Type | Description | Key Benefit | 2024 Focus/Data Point |

|---|---|---|---|

| Physical Sales Galleries | Tangible property experience, direct sales interaction. | Builds trust, facilitates high-value decisions. | Continued investment in immersive showflats. |

| Digital Platforms (Website, Portals) | Online listings, virtual tours, lead generation. | Wide reach, accessible information, remote engagement. | Enhanced online offerings for property discovery. |

| Real Estate Agencies | Leveraging external networks and expertise. | Broadened market presence, efficient transaction management. | Significant contribution to Singapore portfolio performance. |

| Corporate Sales Teams | Direct B2B relationships for commercial and bulk sales. | Secures long-term leases, high-value transactions. | Emphasis on commercial leasing to bolster rental income. |

| Global Hotel Booking Platforms/OTAs (M&C) | Connecting with international leisure and corporate travelers. | Maximizes occupancy, broad market penetration. | Critical for driving hotel bookings and revenue. |

Customer Segments

Individual Homebuyers, a core customer segment for City Developments (CDL), encompasses affluent and middle-to-high income individuals and families. These buyers are primarily looking for residential properties for either personal use or as investment opportunities. CDL's strategy targets this diverse group with a portfolio of condominium and executive condominium projects situated in various prime locations.

CDL's offerings like Union Square Residences, The Orie, and Norwood Grand are specifically designed to meet the aspirations of these discerning homebuyers. For instance, in 2024, the Singapore private residential market saw continued demand, with new launch sales remaining robust, indicating a healthy appetite among these buyer profiles for well-located and quality developments.

Corporate and institutional investors, including investment funds, REITs, and other companies, represent a key customer segment for City Developments (CDL). These entities are primarily interested in CDL's commercial, hospitality, and residential-for-lease properties as avenues for stable returns and strategic diversification. For instance, in 2023, CDL's divestment of a portfolio of logistics assets for S$137 million demonstrates their commitment to capital recycling, a strategy that directly appeals to institutional investors seeking yield-enhancing opportunities.

City Developments Limited (CDL) serves a broad range of commercial and retail tenants, encompassing everything from large multinational corporations to smaller local businesses. This diverse tenant base seeks high-quality, well-managed spaces for their operations.

CDL's portfolio includes prime office buildings such as Republic Plaza, a Grade A office tower in Singapore's central business district, and various retail spaces within its shopping centers. These properties are designed to attract and retain tenants by offering premium amenities and strategic locations.

For instance, in 2024, CDL's commitment to tenant satisfaction is reflected in its ongoing asset enhancement initiatives across its commercial properties, aiming to maintain high occupancy rates and rental yields. Their strategy focuses on providing environments that foster business growth and operational efficiency for all their commercial clients.

Hotel Guests and Tourists

Hotel guests and tourists are a core customer segment for City Developments Limited (CDL), primarily through its hospitality arm, Millennium & Copthorne Hotels. This group encompasses a wide spectrum, from business travelers requiring efficient services and connectivity to leisure tourists seeking memorable experiences and event attendees needing convenient accommodation. CDL caters to diverse preferences, offering everything from high-end luxury stays to more budget-friendly, comfortable options across major global cities.

In 2024, CDL's hospitality segment, Millennium & Copthorne Hotels, continued to focus on attracting and retaining these diverse guests. For instance, the group operates over 130 hotels globally, providing a substantial footprint to serve this broad customer base. Their strategy often involves tailored offerings and loyalty programs designed to encourage repeat business and cater to the specific needs of each traveler type.

Key aspects of this customer segment include:

- Business Travelers: Seeking reliable Wi-Fi, meeting facilities, and convenient locations for corporate engagements.

- Leisure Tourists: Looking for unique experiences, comfortable amenities, and access to local attractions.

- Event Attendees: Requiring proximity to convention centers or event venues, often booking in larger groups.

- Loyalty Program Members: Valuing rewards, exclusive offers, and personalized service for their continued patronage.

Government and Public Sector Entities

Government and public sector entities are crucial partners for City Developments Limited (CDL). While they may not directly purchase properties, their role in urban planning and development approvals is paramount. For instance, CDL's participation in Singapore's Jurong Lake District transformation involves close collaboration with government agencies like the Urban Redevelopment Authority (URA) for land parcels and planning guidelines.

These entities can also be significant tenants, particularly for large commercial spaces CDL develops. Furthermore, public-private partnerships are a key avenue for CDL, enabling large-scale urban regeneration projects. CDL's involvement in projects like the mixed-use development at Central Boulevard in Singapore, which includes office space potentially leased to government-linked corporations, exemplifies this dynamic.

- Urban Planning & Land Sales: Authorities like Singapore's URA are integral to CDL's land acquisition and project feasibility.

- Regulatory Approvals: Government bodies provide necessary permits for development, influencing project timelines and scope.

- Potential Tenants: Public sector organizations can occupy significant commercial office space within CDL's portfolio.

- Public-Private Partnerships: Collaborations on infrastructure and urban renewal projects leverage government support and expertise.

CDL also engages with government and public sector entities, not as direct property purchasers but as crucial collaborators in urban planning and development. These relationships are vital for securing land and navigating regulatory approvals, influencing project feasibility and timelines.

These government bodies can also become significant tenants, occupying substantial commercial spaces within CDL's developments, and are key partners in public-private initiatives for urban regeneration.

For example, CDL's participation in Singapore's Jurong Lake District transformation highlights close collaboration with agencies like the Urban Redevelopment Authority (URA) for land parcels and planning guidelines.

In 2023, CDL secured a prime residential site in Tampines, Singapore, through a government land sale tender, demonstrating the ongoing importance of these public sector channels for land acquisition.

Cost Structure

Land acquisition represents a substantial upfront capital expenditure for City Developments Limited (CDL) as they secure sites for future projects. These acquisitions are often a result of intense competition in government land sales or through private negotiations.

A prime example of this significant investment occurred in April 2024, when CDL, in partnership with another entity, successfully bid for a Government Land Sales (GLS) site on Zion Road. This parcel, spanning 164,451 square feet, was acquired for a considerable sum exceeding $1.1 billion, highlighting the scale of these initial outlays.

Construction and development expenses are a significant component of City Developments (CDL) cost structure, covering everything from building materials and labor to sub-contractor fees and essential project management. These costs are directly tied to the creation of CDL's diverse portfolio, which includes residential, commercial, and hospitality properties.

CDL's commitment to high-quality and sustainable developments means these costs reflect a deliberate investment in premium materials and cutting-edge construction techniques. For instance, in 2024, CDL continued to emphasize green building certifications, which can sometimes lead to higher upfront material costs but are expected to yield long-term operational savings and enhanced property value.

City Developments Limited (CDL) faces significant financing and interest costs due to the capital-intensive nature of real estate development. These costs primarily stem from interest payments on loans secured to fund land acquisitions and ongoing development projects, impacting overall project profitability.

In 2024, CDL Hospitality Trusts actively pursued refinancing initiatives, notably transitioning existing loans into sustainability-linked loans. This strategic move not only reflects a commitment to ESG principles but also aims to optimize borrowing costs and enhance financial flexibility in a dynamic market environment.

Operating and Maintenance Costs for Properties and Hotels

City Developments Limited (CDL) manages significant operating and maintenance costs across its diverse property and hotel portfolio. These ongoing expenses cover essential services like property management, utilities, routine repairs, and administrative overheads for its vast array of residential, commercial, and hospitality assets.

The company's extensive hotel operations, particularly through Millennium & Copthorne Hotels, contribute substantially to these costs. In 2024, CDL continued to invest in refurbishments aimed at elevating the guest experience and maintaining the competitiveness of its over 160 hotels worldwide.

- Property Management Fees: Costs associated with third-party or in-house management of residential and commercial properties.

- Utilities: Expenses for electricity, water, gas, and other services essential for property operation.

- Repairs and Maintenance: Funds allocated for upkeep, minor repairs, and preventative maintenance to ensure asset quality.

- Hotel Operational Costs: Includes staffing, supplies, marketing, and ongoing refurbishments for the hospitality segment.

Sales, Marketing, and Administrative Expenses

Sales, marketing, and administrative expenses are crucial for City Developments' business model. These costs cover everything from advertising new properties and managing sales teams to running global corporate operations. For instance, in 2024, the company likely allocated significant resources to digital marketing campaigns and maintaining a robust international sales force to drive property transactions and secure tenants.

These expenditures are directly tied to generating revenue and ensuring the smooth functioning of the organization. Effective marketing attracts buyers and renters, while efficient administration supports the entire business. In 2023, for example, many real estate firms saw increased marketing spend to counter market uncertainties, a trend likely continuing into 2024.

- Property Promotion: Costs for advertising, public relations, and event marketing.

- Sales Force: Salaries, commissions, and training for sales personnel.

- Marketing Campaigns: Digital advertising, content creation, and market research.

- General Administration: Corporate overhead, legal, and IT support.

The cost structure of City Developments Limited (CDL) is heavily influenced by significant upfront investments in land acquisition, followed by substantial construction and development expenditures. These are compounded by ongoing financing costs, particularly interest on loans, and the operational expenses tied to managing a vast portfolio of properties and hotels.

Furthermore, CDL incurs considerable costs in sales, marketing, and administration to drive transactions and maintain its global presence. These elements collectively form the backbone of CDL's financial outlays, directly impacting its profitability and strategic decision-making.

| Cost Category | Description | 2024 Relevance/Example |

|---|---|---|

| Land Acquisition | Upfront capital for securing development sites. | Zion Road GLS site acquisition (over $1.1 billion in April 2024). |

| Construction & Development | Materials, labor, sub-contractors, project management. | Investment in green building certifications and premium materials. |

| Financing & Interest Costs | Interest on loans for land and development. | CDL Hospitality Trusts' refinancing into sustainability-linked loans. |

| Operating & Maintenance | Property management, utilities, repairs, hotel operations. | Refurbishments for over 160 global hotels under Millennium & Copthorne. |

| Sales, Marketing & Admin | Advertising, sales force, corporate overhead. | Likely increased digital marketing spend to counter market uncertainties. |

Revenue Streams

City Developments Limited (CDL) primarily generates revenue through the sale of properties it develops. This includes both residential homes and commercial spaces.

In the first quarter of 2025, CDL saw a significant boost in sales revenue, reaching $1.9 billion. This represents a substantial 155% increase from the same period in the prior year, highlighting strong market demand for their offerings.

This impressive growth was fueled by successful new project launches, such as The Orie, and sustained sales momentum from their existing portfolio of developments.

City Developments Limited (CDL) secures consistent revenue through rental income generated from its diverse global portfolio of investment properties. This encompasses office spaces, retail outlets, and industrial facilities.

The company benefits from a stable income stream thanks to a strong committed occupancy rate. As of March 2024, CDL reported an impressive 89.5% committed occupancy across its property portfolio, demonstrating robust demand for its leased spaces.

Revenue from Millennium & Copthorne Hotels (M&C) stems from various sources, including room reservations, dining and beverage sales, and ancillary services provided at its global hotel and serviced apartment properties.

CDL Hospitality Trusts, a key entity within this segment, recorded SGD 56.59 million in sales for the first half of 2024, highlighting the financial performance of these hospitality operations.

Asset Divestments and Investment Gains

City Developments Limited (CDL) actively manages its property portfolio by divesting non-core or mature assets. This strategic approach not only unlocks value but also generates significant investment gains, contributing to the company's financial flexibility. In 2024, CDL successfully divested assets exceeding $600 million, a move that included properties located in key markets like London and Singapore, as part of its ongoing capital recycling strategy.

These divestments are crucial for optimizing CDL's overall portfolio, allowing the company to reallocate capital towards more promising growth opportunities. The proceeds from these sales enhance financial resilience and provide the necessary resources for future investments and strategic initiatives.

- Capital Recycling: CDL strategically divests assets to free up capital.

- Investment Gains: Divestments generate significant profits, boosting financial performance.

- 2024 Performance: Over $600 million in assets divested, including London and Singapore properties.

- Portfolio Optimization: Enhances financial flexibility and strategic asset allocation.

Fund Management Fees

City Developments Limited (CDL) is strategically developing its fund management capabilities, aiming to generate revenue through management fees. While not a primary current income source, this represents a significant growth avenue. CDL's ambition is to leverage its extensive property portfolio and expertise to manage assets for external investors, thereby earning fees for its services.

This fund management growth strategy is designed to capitalize on CDL's established track record and market presence. By offering its property management skills to third parties, CDL can create a recurring revenue stream. For instance, in 2024, CDL announced its intention to launch new real estate funds, signaling a proactive move towards this revenue stream.

- Fund Management Fees: CDL is actively building its fund management business to generate income from managing assets for third-party investors.

- Growth Strategy: This represents a key strategic initiative for CDL to diversify and expand its revenue base.

- Leveraging Strengths: The strategy aims to utilize CDL's existing property expertise and portfolio to attract and manage external capital.

City Developments Limited (CDL) garners revenue from property sales, rental income, hospitality operations, and strategic asset divestments. The company is also cultivating fund management fees as a future income stream.

| Revenue Stream | Primary Source | Key Data Point (2024/2025) | Notes |

|---|---|---|---|

| Property Sales | Development and sale of residential and commercial properties | Q1 2025 revenue of $1.9 billion, a 155% increase year-on-year | Driven by new launches and existing portfolio sales |

| Rental Income | Leasing of investment properties (office, retail, industrial) | 89.5% committed occupancy as of March 2024 | Provides stable, recurring income |

| Hospitality Operations | Room reservations, F&B, and ancillary services from hotels and serviced apartments | CDL Hospitality Trusts recorded SGD 56.59 million in sales (H1 2024) | Operated through Millennium & Copthorne Hotels (M&C) |

| Investment Gains | Profits from strategic divestment of non-core or mature assets | Over $600 million in assets divested in 2024 | Enhances financial flexibility and capital recycling |

| Fund Management Fees | Fees earned from managing assets for external investors | CDL announced intentions to launch new real estate funds in 2024 | Emerging revenue stream leveraging CDL's expertise |

Business Model Canvas Data Sources

The City Developments Business Model Canvas is built using demographic data, urban planning reports, and economic forecasts. These sources ensure each canvas block is filled with accurate, up-to-date information relevant to urban growth and development.