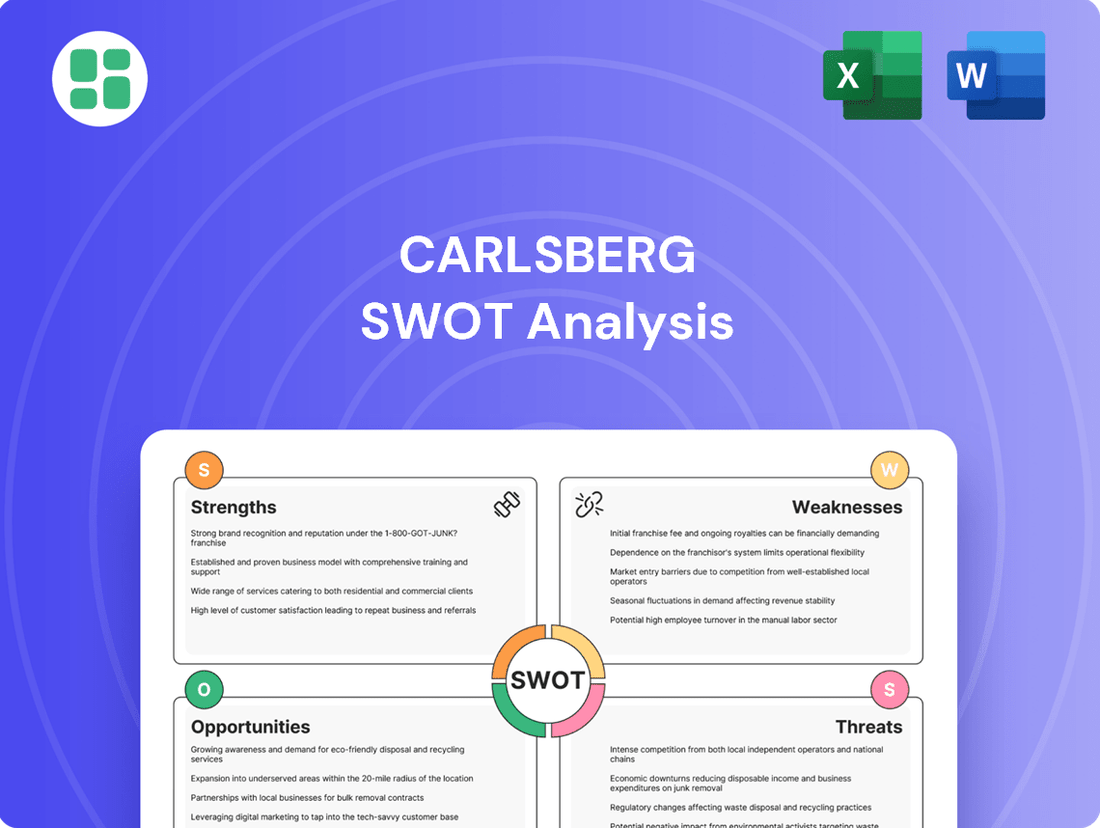

Carlsberg SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carlsberg Bundle

Carlsberg's strong brand recognition and global distribution network are significant strengths, but they also face intense competition and evolving consumer preferences. Our comprehensive SWOT analysis delves into these dynamics, revealing critical opportunities for market expansion and potential threats to their market share.

Want the full story behind Carlsberg's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research, offering actionable strategies to navigate the competitive brewing landscape.

Strengths

Carlsberg’s strength lies in its robust global brand portfolio, featuring well-established international names like Carlsberg and Tuborg, alongside a significant collection of local and craft beer brands. This extensive range solidifies its worldwide presence and allows it to effectively tap into diverse consumer preferences across various markets.

The company’s flagship brands demonstrated impressive performance in 2024, with Carlsberg achieving 9% organic volume growth and Tuborg seeing a 5% increase. This growth underscores the enduring appeal and market penetration of its key international offerings.

Carlsberg's strategic focus on premium and 'Beyond Beer' categories is a key strength, as highlighted by its 'Accelerate SAIL' strategy unveiled in February 2024. This plan prioritizes growth in higher-margin segments, aiming to diversify revenue beyond traditional beer.

The acquisition of Britvic plc in January 2025 exemplifies this strength, significantly boosting Carlsberg's presence in the soft drinks market. This move is projected to increase soft drinks' contribution to total volumes to approximately 30%, demonstrating a concrete step towards revenue diversification and capitalizing on growing consumer preferences.

Carlsberg's dedication to sustainability is a significant strength, clearly outlined in its 'Together Towards ZERO and Beyond' program. This commitment is not just aspirational; it's backed by tangible progress. By 2024, the company achieved a remarkable 58% reduction in carbon emissions at its breweries compared to 2015 levels, showcasing a substantial environmental impact.

Further demonstrating this commitment, Carlsberg reported a 76% collection and recycling rate for bottles and cans in 2024. The company is also actively exploring innovative solutions, such as piloting regenerative agriculture practices, which not only support environmental health but also contribute to a more resilient supply chain.

Strong Financial Performance and Growth Ambitions

Carlsberg demonstrated robust financial performance in 2024, achieving a 2.4% increase in organic revenue and a 6.0% rise in organic operating profit, even amidst a demanding market environment. This resilience underscores the company's operational strength and strategic execution.

Looking ahead, Carlsberg has ambitiously increased its long-term organic revenue growth target to a compound annual growth rate (CAGR) of 4-6%. This upward revision signals strong confidence in the company's ability to capitalize on future market opportunities and drive sustained expansion.

- Solid 2024 Financials: Organic revenue up 2.4%, organic operating profit up 6.0%.

- Raised Growth Ambition: Long-term organic revenue growth target increased to 4-6% CAGR.

- Market Resilience: Achieved growth despite challenging market conditions.

Brewing Expertise and Licensing Capabilities

Carlsberg's extensive brewing expertise is a significant asset, allowing it to license its brands and share technical knowledge globally. This strategy enhances market penetration and solidifies its reputation for quality and innovation. For instance, in Q1 2026, Carlsberg is set to acquire the Pepsi license in Kazakhstan and Kyrgyzstan, demonstrating its capability to leverage these partnerships effectively.

The company's licensing model allows for market expansion with reduced capital outlay. This approach is further exemplified by its existing licensing agreements across various regions, contributing to a diversified revenue stream. Carlsberg's commitment to sharing brewing know-how also fosters stronger relationships with its partners, ensuring consistent product quality across different markets.

- Global Brand Licensing: Carlsberg extends its reach through licensing agreements, allowing partners to produce and sell its brands.

- Brewing Knowledge Transfer: The company shares its deep brewing expertise, ensuring quality and consistency for licensed products.

- Strategic Partnerships: Acquisitions like the Pepsi license in Kazakhstan and Kyrgyzstan (Q1 2026) showcase the strategic use of licensing capabilities.

- Market Expansion Efficiency: Licensing enables market entry and growth with lower direct investment compared to organic expansion.

Carlsberg's brand strength is evident in its portfolio, with flagship brands like Carlsberg and Tuborg showing robust growth. Carlsberg achieved 9% organic volume growth in 2024, while Tuborg saw a 5% increase, highlighting their enduring market appeal.

The company's strategic pivot towards premium and 'Beyond Beer' segments, as outlined in its February 2024 'Accelerate SAIL' strategy, is a key differentiator. This focus aims to boost higher-margin revenue streams.

Acquiring Britvic plc in January 2025 significantly bolsters Carlsberg's soft drinks segment, projecting it to represent roughly 30% of total volumes and enhancing revenue diversification.

Carlsberg's commitment to sustainability is a notable strength, with a 58% reduction in brewery carbon emissions by 2024 (vs. 2015) and a 76% bottle/can recycling rate in 2024.

Financially, Carlsberg demonstrated resilience in 2024 with a 2.4% organic revenue increase and a 6.0% rise in organic operating profit, exceeding expectations in a challenging market.

| Metric | 2024 Performance | Year-over-Year Change |

|---|---|---|

| Organic Revenue | Increased | 2.4% |

| Organic Operating Profit | Increased | 6.0% |

| Carlsberg Brand Volume Growth | Strong | 9.0% |

| Tuborg Brand Volume Growth | Strong | 5.0% |

What is included in the product

Analyzes Carlsberg’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Carlsberg's strategic vulnerabilities, transforming potential threats into manageable challenges.

Weaknesses

Carlsberg's reliance on mature Western European markets presents a notable weakness. In 2024, organic volume in these established regions saw a slight dip of 1.1%, indicating slower growth or even contraction. This concentration means Carlsberg's overall expansion could be capped as these markets mature and beer consumption trends shift.

The company struggles to maintain volume in its traditional home markets. This is a direct consequence of its deep roots in these developed economies, where competition is fierce and consumer preferences are evolving. Consequently, Carlsberg faces an uphill battle in retaining its market share in these core segments.

Carlsberg's international presence means its financial results can be significantly swayed by currency exchange rate changes. For instance, in 2024, these fluctuations had a notable impact on its reported operating profit, highlighting a key vulnerability.

Furthermore, the company faces considerable risk from the volatile pricing of essential raw materials like barley and aluminum. Coupled with increasing energy costs, this volatility directly pressures Carlsberg's profit margins, making consistent profitability a challenge.

Carlsberg operates in a fiercely competitive global beer market, a landscape dotted with both established giants and a proliferation of smaller, agile players. This intense rivalry, particularly from larger international brewers and a dynamic craft beer scene, presents a significant hurdle for maintaining and growing market share across diverse geographies. For instance, in 2023, the global beer market was valued at approximately $764.6 billion, with significant regional variations in competitive intensity.

The rise of craft breweries, while offering consumer choice, also fragments the market further, demanding constant innovation and strategic agility from Carlsberg. These smaller breweries often cater to niche tastes and can quickly capture local market segments. Despite the maturation of the craft segment, new entrants continue to emerge, adapting to evolving consumer preferences for unique and artisanal beverages, thereby intensifying pressure on established brands.

Impact of Geopolitical Events and Market Exits

Carlsberg's exposure to geopolitical instability poses a significant weakness. The company's divestment of its Russian business in December 2024, a move driven by the ongoing geopolitical climate, resulted in a substantial financial impact. This exit, while strategically necessary, led to a write-off of approximately DKK 2.5 billion (around $360 million USD) in the fourth quarter of 2024, directly affecting profitability and market presence in a key region.

The disposal of its Russian operations meant Carlsberg forfeited a significant market share and the associated revenue streams. This strategic retreat not only impacts current financial performance but also necessitates a redirection of resources and strategic focus towards other markets, potentially slowing growth in the short to medium term.

- Geopolitical Risk: Operations are vulnerable to international political tensions and conflicts.

- Market Exit Costs: Divestments, like the Russian exit in December 2024, incur significant financial write-offs (approx. DKK 2.5 billion).

- Loss of Market Position: Exiting key markets leads to a forfeiture of established market share and brand presence.

- Strategic Diversion: Resources must be reallocated, potentially delaying expansion or innovation in other areas.

Challenges in Specific Key Markets

Carlsberg grapples with a subdued consumer environment in key territories. For instance, while gaining market share, China's beer market remained flat in 2024, hindering overall volume expansion. Similarly, Western Europe experienced declining beer volumes, a trend that persisted into early 2025, impacting Carlsberg's top-line performance in these mature markets.

Consumer sentiment in both China and several European nations continues to be a significant headwind. This cautious consumer behavior directly affects Carlsberg's volume and revenue growth projections for these crucial regions, requiring strategic adjustments to navigate the economic landscape.

- Flat Beer Market in China: Despite market share gains, China's beer market showed no growth in 2024, impacting Carlsberg's volume potential.

- Declining Volumes in Western Europe: The company faced volume contractions in Western Europe throughout 2024 and into early 2025.

- Subdued Consumer Sentiment: Weak consumer confidence in China and parts of Europe dampens demand for alcoholic beverages.

- Impact on Growth Expectations: These market challenges necessitate recalibrating volume and revenue growth forecasts for affected regions.

Carlsberg faces significant pressure from intense competition within the global beer market. The presence of major international brewers and a growing craft beer segment, which is valued for its niche appeal and artisanal qualities, challenges Carlsberg's ability to maintain and expand its market share. In 2023, the global beer market was valued at approximately $764.6 billion, underscoring the scale of competition.

The company's reliance on mature Western European markets is a notable weakness, with organic volume in these regions experiencing a slight dip of 1.1% in 2024. This concentration limits overall expansion potential as these markets mature and beer consumption trends evolve, making it difficult to retain market share in core segments.

Carlsberg's financial performance is susceptible to currency exchange rate fluctuations, which notably impacted its reported operating profit in 2024. Additionally, the volatile pricing of essential raw materials like barley and aluminum, combined with rising energy costs, directly squeezes profit margins, posing a consistent challenge to profitability.

The company's exposure to geopolitical instability presents a considerable risk. Carlsberg's divestment of its Russian business in December 2024, driven by geopolitical tensions, resulted in a DKK 2.5 billion (approximately $360 million USD) write-off in Q4 2024, impacting profitability and market presence.

| Weakness | Description | Impact | Supporting Data (2024/2025) |

| Intense Competition | Rivalry from global brewers and craft segment | Market share erosion, pressure on pricing | Global beer market valued at $764.6 billion (2023) |

| Mature Market Dependence | Concentration in Western Europe | Limited growth potential, declining volumes | 1.1% organic volume dip in Western Europe (2024) |

| Cost Volatility | Fluctuating raw material and energy prices | Squeezed profit margins | Impact on reported operating profit due to currency fluctuations (2024) |

| Geopolitical Risk | Exposure to international political tensions | Financial write-offs, loss of market position | DKK 2.5 billion write-off from Russian exit (Dec 2024) |

Preview the Actual Deliverable

Carlsberg SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The global market for non-alcoholic and low-alcohol beverages is expanding rapidly, fueled by a growing consumer focus on health and evolving tastes, especially among younger generations. Carlsberg is well-positioned to capitalize on this trend, with its alcohol-free options showing significant traction.

In 2024, Carlsberg's alcohol-free brews saw a healthy 6% growth. The company has set a strategic goal to boost the proportion of no- and low-alcohol products within its overall global sales, indicating a significant opportunity for future revenue generation and market share expansion in this dynamic segment.

Emerging markets, especially in Asia, represent a significant avenue for growth for Carlsberg. These economies are experiencing rising demand for beverages driven by evolving lifestyles, rapid urbanization, and a growing middle class with increasing disposable income. For instance, disposable income in many Asian countries has seen consistent annual growth, fueling consumer spending on products like beer.

Carlsberg has strategically prioritized Asia for expansion, with a clear focus on key markets like China, Vietnam, and India. The company plans to bolster its commercial investments in these regions, aiming to capitalize on the burgeoning consumer base and market opportunities. This strategic focus is crucial as these markets are projected to contribute a substantial portion to global beer consumption growth in the coming years.

Consumers are increasingly seeking out premium and craft beers, drawn to their unique ingredients and distinctive flavor profiles. Carlsberg is strategically capitalizing on this by investing in its premium portfolio and developing new craft beer offerings. This focus allows the company to tap into a growing market segment and achieve higher profit margins, as evidenced by the 2% growth in premium beer volumes observed in 2024.

Digitalization and E-commerce Expansion

The burgeoning e-commerce landscape offers Carlsberg a prime avenue to broaden its consumer base and enhance customer interaction. This digital shift is not just about selling beer online; it's about creating seamless, engaging experiences that resonate with today's digitally-native consumers.

Carlsberg's strategic focus on digital innovation and the development of eB2B platforms is central to its 'Accelerate SAIL' strategy. These digital tools are designed to streamline operations, improve the efficiency of sales processes, and ultimately drive revenue growth by meeting customers where they are – online.

- E-commerce Growth: Global e-commerce sales are projected to reach $8.1 trillion by 2024, a testament to the increasing consumer preference for online shopping.

- Digital Channels: Carlsberg is actively investing in its digital capabilities, recognizing the need to adapt to evolving consumer purchasing habits.

- B2B Platforms: The company's eB2B initiatives aim to simplify the ordering and delivery process for trade partners, fostering stronger business relationships.

- Revenue Impact: Successful digital expansion is expected to contribute significantly to Carlsberg's top-line growth in the coming years.

Strategic Acquisitions and Partnerships for Portfolio Diversification

Carlsberg can leverage strategic acquisitions and partnerships to broaden its product offerings, moving beyond its core beer business. A prime example of this strategy is the acquisition of Britvic plc, which significantly increased Carlsberg's presence in the lucrative soft drinks market. This move not only diversifies revenue streams but also taps into growing consumer demand for non-alcoholic beverages.

This diversification strategy allows Carlsberg to enter new, high-growth categories and geographical markets, thereby strengthening its competitive positioning. By actively seeking and integrating complementary businesses, Carlsberg can achieve greater resilience against market fluctuations and unlock new avenues for long-term expansion and profitability.

- Acquisition of Britvic plc: Completed in 2024, this acquisition significantly bolstered Carlsberg's soft drinks portfolio, adding brands like Robinsons and Tango.

- Market Entry: This move provides access to new consumer segments and geographic markets where Britvic has a strong foothold.

- Revenue Diversification: Expanding into soft drinks reduces reliance on the beer market, offering a more balanced revenue profile.

- Enhanced Growth Prospects: The soft drinks sector is experiencing robust growth, presenting an opportunity for Carlsberg to capture additional market share and drive overall company performance.

The ongoing global shift towards healthier lifestyles presents a significant opportunity for Carlsberg to expand its portfolio of alcohol-free and low-alcohol beverages. This trend is particularly strong among younger consumers, a demographic Carlsberg is actively targeting.

Carlsberg's strategic focus on expanding its presence in high-growth emerging markets, especially in Asia, offers substantial potential for increased sales and market share. The company's planned investments in these regions are designed to capitalize on rising disposable incomes and evolving consumer preferences.

The increasing consumer demand for premium and craft beer varieties provides Carlsberg with an avenue to enhance profitability and brand perception. By investing in its premium offerings and developing new craft products, the company can capture a larger share of this value-driven market segment.

Leveraging e-commerce and digital platforms presents a key opportunity for Carlsberg to reach a wider customer base and improve engagement. The company's investment in eB2B platforms aims to streamline sales processes and foster stronger relationships with trade partners.

| Opportunity Area | 2024/2025 Data/Trend | Carlsberg's Strategic Focus |

|---|---|---|

| No/Low Alcohol Beverages | Global market growth projected at 7% annually through 2025. Carlsberg's AF/Low Alcohol volume grew 6% in 2024. | Expanding product range and marketing efforts. |

| Emerging Markets (Asia) | Asia expected to account for 60% of global beer volume growth by 2025. | Increased commercial investment and market penetration. |

| Premium & Craft Beer | Premium segment growth outpacing mainstream beer by 3-4% in key markets. Carlsberg's premium volumes grew 2% in 2024. | Portfolio enhancement and new product development. |

| Digital & E-commerce | Global e-commerce sales expected to reach $8.1 trillion in 2024. | Development of eB2B platforms and digital consumer engagement. |

Threats

A major threat for Carlsberg is the growing consumer shift towards healthier living, which often translates to less alcohol consumption. This trend is fueling a rise in demand for beverages like kombucha and other functional drinks, directly impacting traditional beer sales.

To counter this, Carlsberg must invest heavily in developing and marketing a robust portfolio of low- and no-alcohol (NoLo) beer options. For example, the global NoLo beer market was valued at approximately $11.5 billion in 2023 and is projected to reach over $25 billion by 2030, highlighting the significant market opportunity and the competitive pressure to adapt.

Furthermore, emphasizing responsible drinking messages is crucial to maintain brand reputation and consumer trust amidst this evolving landscape. Carlsberg's commitment to sustainability and health initiatives, as seen in their 2023 reports, will be key to navigating these changing consumer preferences.

Carlsberg, like many in the brewing sector, faces the significant threat of escalating excise duties. For instance, in some European markets, governments have been increasing these taxes to boost revenue and discourage alcohol consumption. This directly impacts profitability by raising the cost of goods sold and can force price increases, potentially dampening consumer demand for Carlsberg's products.

Beyond taxes, a tightening regulatory landscape presents further challenges. Stricter rules on advertising, product formulation, and even packaging can necessitate costly adjustments to operations and marketing strategies. For example, new health-related labeling requirements or limitations on promotional activities, which have been observed in various regions throughout 2024, can restrict Carlsberg's ability to reach and engage its target audience, thereby hindering market growth and potentially increasing compliance costs.

Global supply chain snags and escalating raw material costs, like barley and hops, continue to pressure Carlsberg's production expenses and profit margins. While certain commodity prices have shown stability, ongoing volatility in others necessitates persistent cost management and operational efficiency improvements.

For instance, the price of barley, a key ingredient, saw significant fluctuations in 2023, impacting brewing costs. Carlsberg's 2023 annual report highlighted that energy prices, though easing from peaks, remained a considerable factor in operational expenditures.

Intensifying Competition and Market Saturation in Key Regions

The global beer market is a battleground, with giants like AB InBev and Heineken dominating, while a surge of craft breweries adds further pressure. This intense rivalry is particularly acute in mature markets where beer consumption is plateauing or declining, forcing companies to fight harder for every customer.

Market saturation in key regions, such as Western Europe and North America, means that growth often comes at the expense of competitors. This can trigger aggressive pricing strategies and promotional activities, which directly impact profitability and Carlsberg's market share. For instance, European beer volumes saw a slight contraction in 2023, intensifying the competitive landscape.

- Intensified Competition: Major global players and a growing number of craft breweries vie for market share.

- Market Saturation: Mature markets like Western Europe and North America face declining or stagnant beer volumes.

- Margin Pressure: Increased competition can lead to price wars and reduced profitability for established brands.

- Growth Challenges: Companies must innovate and differentiate to gain ground in saturated markets.

Economic Downturns and Subdued Consumer Spending

Economic uncertainties and subdued consumer sentiment, particularly in key markets like China and parts of Europe, can directly impact discretionary spending on beverages like beer. This can lead to lower volumes and revenue growth, challenging the company's financial targets.

For instance, a slowdown in consumer spending, exacerbated by inflation and geopolitical instability, could significantly affect Carlsberg's sales performance. In 2024, many analysts are projecting a more cautious consumer approach to non-essential purchases, which directly impacts the beer market.

- Impact on Discretionary Spending: Consumers may reduce spending on premium or imported beers, opting for more budget-friendly alternatives.

- Volume and Revenue Pressure: A sustained downturn could lead to lower sales volumes and consequently, reduced revenue for Carlsberg.

- Market-Specific Challenges: Key markets such as China, which has shown volatility in consumer confidence, and certain European regions facing economic headwinds, present particular risks.

- Financial Target Attainment: Subdued spending directly challenges the company's ability to meet its projected financial growth and profitability targets for the 2024-2025 period.

Intensified competition from global rivals and a growing craft beer segment poses a significant threat, particularly in mature markets like Western Europe where beer volumes saw a slight contraction in 2023. This competitive pressure often leads to price wars, impacting Carlsberg's profitability and market share. Furthermore, the company faces challenges from escalating excise duties and a tightening regulatory environment, with new health-related labeling and advertising restrictions observed in various regions throughout 2024, potentially increasing compliance costs.

Economic uncertainties and subdued consumer sentiment, especially in key markets like China and parts of Europe, could dampen discretionary spending on beverages. This trend directly affects sales volumes and revenue growth, challenging Carlsberg's financial targets for 2024-2025, as consumers may opt for more budget-friendly alternatives amid inflation and geopolitical instability.

| Threat Category | Description | Impact | 2023/2024 Data Point |

|---|---|---|---|

| Competition | Intense rivalry from global players and craft breweries | Margin pressure, market share erosion | European beer volumes contracted slightly in 2023 |

| Regulatory & Taxation | Rising excise duties, stricter advertising and labeling rules | Increased costs, reduced market reach | New health labeling requirements observed in 2024 |

| Economic Conditions | Subdued consumer sentiment, inflation | Reduced discretionary spending, lower volumes | Projected cautious consumer spending in 2024 |

| Consumer Trends | Shift towards healthier living, lower alcohol consumption | Decreased demand for traditional beer | Global NoLo beer market projected to exceed $25 billion by 2030 |

SWOT Analysis Data Sources

This Carlsberg SWOT analysis is built upon a foundation of comprehensive data, including the company's official financial reports, detailed market research from leading industry analysts, and insights from expert commentary on the global beverage sector.