Carlsberg Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carlsberg Bundle

Curious about Carlsberg's strategic positioning? This glimpse into their BCG Matrix reveals the potential of their product portfolio, highlighting which brands are driving growth and which might need a closer look. Don't miss out on the full picture.

Unlock a comprehensive understanding of Carlsberg's market share and growth potential across all its brands. Purchase the full BCG Matrix report to gain actionable insights and make informed decisions about resource allocation and future investments, ensuring Carlsberg continues to lead the market.

Stars

Carlsberg's premium beer portfolio, featuring brands like Carlsberg, Tuborg, 1664 Blanc, and Brooklyn, is a strong performer in Asia and Central & Eastern Europe (CEE). These markets are experiencing rapid growth, and Carlsberg's premium offerings have captured significant market share.

In fiscal year 2024, premium Carlsberg volumes saw a robust increase of 19%, while overall Carlsberg volumes grew by 9%. Further demonstrating this positive trend, Brooklyn volumes experienced a 10% rise in the first quarter of 2025, underscoring the strength of these brands in high-growth regions.

This impressive performance in key markets like China, Vietnam, and India, alongside CEE, firmly places these premium beers in the Stars category. Continued strategic investment is crucial to sustain their market leadership and capitalize on ongoing expansion opportunities.

Carlsberg's alcohol-free brews (AFBs) are a clear star in their portfolio. The segment saw impressive organic volume growth of 6% in 2024, and that momentum accelerated to a strong 15% in the first quarter of 2025. This surge is driven by consumers increasingly seeking healthier beverage choices.

While precise market share figures for specific AFB products aren't publicly broken down, the category itself is booming. Double-digit growth in key markets like Western Europe and Central & Eastern Europe, alongside strategic new product introductions such as 'Electric Beer' in Sweden, strongly suggests a leading position within this rapidly expanding market.

Carlsberg's Beyond Beer portfolio, including brands like Somersby cider and Garage hard seltzers, is a significant growth driver. In 2024, this segment achieved 5% organic volume growth, and continued this momentum with 6% growth in the first quarter of 2025. This performance highlights the increasing consumer demand for alternatives to traditional beer.

These products are well-positioned to capture evolving consumer tastes, tapping into the expanding market for ciders and hard seltzers. While precise market share figures are dynamic, the robust growth trajectory indicates a strong and expanding presence for Carlsberg in these key beverage categories, effectively diversifying its overall product offering.

Carlsberg Brand (Premium Segment in Growth Markets)

The premium variants of the Carlsberg brand are truly shining in rapidly expanding markets. Think about places like China, Vietnam, India, Ukraine, and Kazakhstan. In these key growth areas, the volume for premium Carlsberg jumped by an impressive 19% in fiscal year 2024. This shows the brand is really connecting with consumers looking for quality in these emerging economies.

This strong performance in specific, high-growth regions, combined with Carlsberg's established global reputation and its deliberate push towards premium offerings, suggests it holds a significant market share within these particular growth segments. It's a clear indicator of its 'Star' status in the BCG matrix.

- Premium Carlsberg volumes grew by 19% in FY2024 in key growth markets.

- Key markets include China, Vietnam, India, Ukraine, and Kazakhstan.

- Strong regional penetration and global brand recognition contribute to high market share in premium segments.

- Continued investment in these growth markets is crucial for maintaining its Star position.

Tuborg Brand (Premium Segment in Growth Markets)

Tuborg, a key international brand for Carlsberg, is performing exceptionally well in emerging markets. In fiscal year 2024, its total volumes saw a healthy increase of 5%. This growth is particularly noticeable in dynamic regions like Vietnam, India, Turkey, Ukraine, and Italy, highlighting Tuborg's strong appeal in these expanding economies.

The brand's success is driven by its strategic focus on premium offerings, which resonates well with consumers in these growth markets. Tuborg's ability to secure a significant market presence and achieve volume growth in these high-potential segments firmly places it in the Star category of the BCG matrix. This indicates a strong market share in a rapidly expanding industry, suggesting it will continue to be a significant contributor to Carlsberg's portfolio.

- Tuborg's FY2024 volume growth: 5% increase in total volumes.

- Key growth markets: Vietnam, India, Turkey, Ukraine, and Italy.

- Strategic focus: Emphasis on premium segment offerings.

- BCG Matrix Classification: Star, due to high market share in growing segments.

Carlsberg's premium offerings, including its namesake brand and Tuborg, are firmly positioned as Stars. These brands are experiencing robust growth in key emerging markets. For instance, premium Carlsberg volumes surged by 19% in fiscal year 2024 in markets like China and Vietnam. Similarly, Tuborg saw a 5% total volume increase in 2024, driven by strong performance in Vietnam and India. This indicates a high market share in rapidly expanding segments.

| Brand | FY2024 Volume Growth | Key Growth Markets | BCG Category |

| Premium Carlsberg | 19% | China, Vietnam, India, Ukraine, Kazakhstan | Star |

| Tuborg | 5% (Total Volumes) | Vietnam, India, Turkey, Ukraine, Italy | Star |

What is included in the product

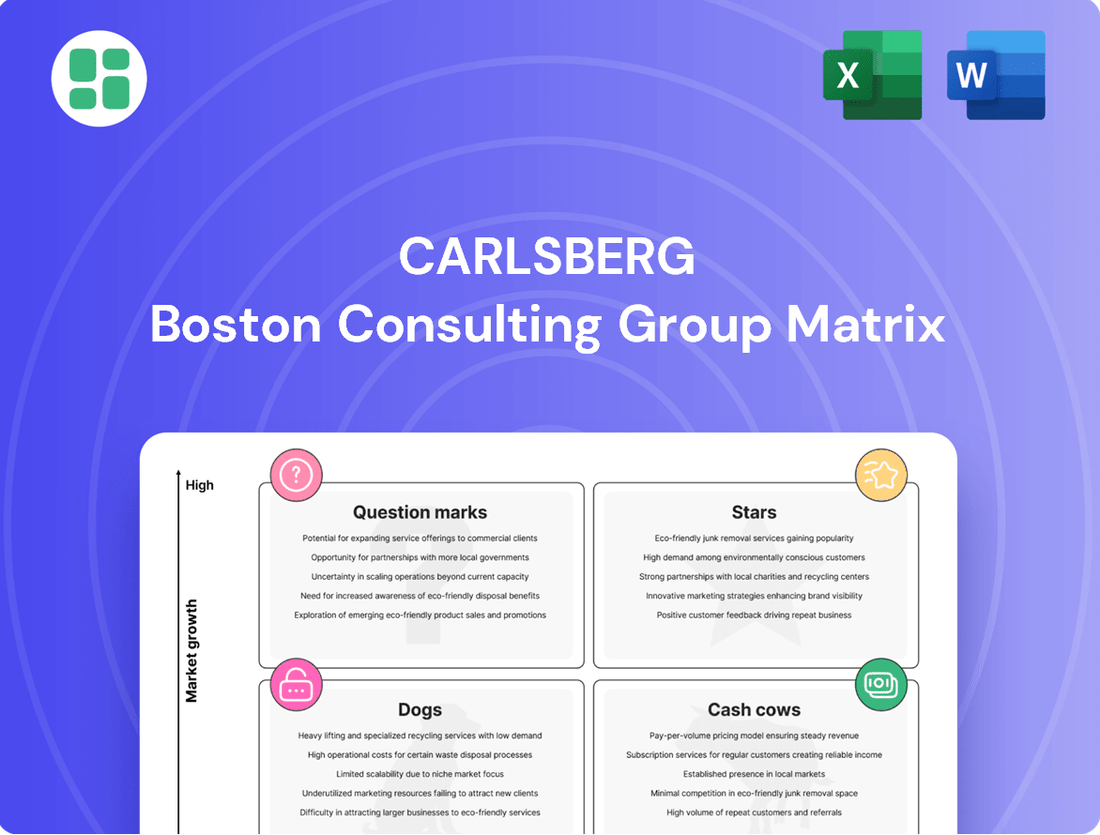

The Carlsberg BCG Matrix analyzes its product portfolio, categorizing brands into Stars, Cash Cows, Question Marks, and Dogs to guide strategic resource allocation.

The Carlsberg BCG Matrix offers a clear, actionable overview of their portfolio, alleviating the pain of unclear strategic direction.

Cash Cows

The core Carlsberg lager in Western Europe is a classic Cash Cow. It holds a significant market share in a mature, slow-growth region.

Despite a modest volume decline of -1.1% in FY2024 for Western Europe overall, the Carlsberg brand's strong market position means it requires less spending on marketing and promotions. This translates into robust and reliable cash generation for the company.

Kronenbourg 1664, in its established markets, is a prime example of a cash cow within Carlsberg's portfolio. It commands a significant share in the mature premium beer segment, consistently delivering strong revenue.

Despite a minor volume dip of -2% for 1664 Blanc in Q1 2025, the brand's enduring heritage and dedicated following guarantee a stable income. This reliability, coupled with high profit margins, makes it a dependable cash generator that needs less marketing investment than emerging brands.

Carlsberg's portfolio features established local brands like Feldschlösschen in Switzerland. These brands hold significant market share within their mature, slow-growth domestic markets, demonstrating strong consumer loyalty and established distribution. In 2024, such brands are crucial for generating consistent, predictable revenue streams.

These mature brands, often referred to as Cash Cows, require minimal capital expenditure for growth, allowing them to generate substantial free cash flow. This financial stability is vital for funding other parts of Carlsberg's business, such as Stars or Question Marks, and supporting overall corporate objectives.

Overall Western European Operations (excluding new acquisitions)

Carlsberg's Western European operations, excluding recent acquisitions, are a robust cash cow for the company. Despite a slight volume decline of 1.1% in fiscal year 2024, the region demonstrated resilience with a 0.8% increase in volume in the first quarter of 2025, excluding the San Miguel business. This stability underscores Carlsberg's strong market presence and mature operations.

The ability to generate organic revenue growth, even amidst minor volume pressures, points to significant pricing power and deeply entrenched brand equity. This translates into consistently high profit margins and a steady stream of cash for the Carlsberg Group. The established nature of these markets allows for efficient operations and reliable cash generation.

- Mature Market Strength: Western Europe's maturity provides a stable, predictable revenue base.

- Pricing Power: Carlsberg effectively leverages its brand equity to command premium pricing.

- Consistent Cash Flow: High profit margins ensure reliable cash generation for the group.

- Operational Efficiency: Established infrastructure supports cost-effective operations.

Brewing Expertise and Licensing

Carlsberg's brewing expertise and brand licensing are classic cash cows. This means they operate in a mature, slow-growing market but hold a significant share. Think of it like a well-established, popular restaurant in a quiet town; it consistently brings in steady business.

This segment is a powerhouse for generating reliable, high-margin income. Because Carlsberg already has the know-how and the brand recognition, they don't need to spend a lot of extra money to keep these operations running smoothly. It's about milking the established value.

For instance, Carlsberg's licensing agreements allow partners to brew and distribute its brands in specific regions. This strategy taps into local market knowledge and distribution networks without requiring massive capital expenditure from Carlsberg itself. In 2023, Carlsberg reported that its international premium brands, which often benefit from licensing, continued to perform well, contributing to overall revenue stability.

- Leveraging Legacy: Carlsberg's deep brewing knowledge and established brands are its core assets in this category.

- Low Investment, High Return: Licensing models minimize new capital outlays, maximizing profitability from existing intellectual property.

- Predictable Revenue: These operations provide a consistent and dependable stream of income, crucial for funding other business ventures.

- Market Dominance: The high market share in mature segments ensures sustained cash flow, even with limited market expansion.

Carlsberg's established Western European beer portfolio, particularly its core lagers and premium brands like Kronenbourg 1664, function as significant cash cows. These products dominate mature markets with slow growth but boast high market shares, requiring minimal investment for maintenance and expansion. For example, in FY2024, while Western Europe saw a slight volume decline of -1.1%, Carlsberg's strong brand equity allowed for effective pricing strategies, ensuring consistent revenue generation. This stability is crucial for funding growth initiatives in other segments of the business.

| Brand/Segment | Market Maturity | Market Share | Growth Rate (Est.) | Cash Generation Potential |

|---|---|---|---|---|

| Carlsberg Core Lager (Western Europe) | Mature | High | Low (slight volume decline in FY2024) | Very High |

| Kronenbourg 1664 (Premium Segment) | Mature | Significant | Low (minor volume dip in Q1 2025) | High |

| Local Heritage Brands (e.g., Feldschlösschen) | Mature | Dominant (Domestic) | Low | High |

Delivered as Shown

Carlsberg BCG Matrix

The BCG Matrix report you're previewing is the complete, unwatermarked document you will receive immediately after your purchase. This comprehensive analysis of Carlsberg's product portfolio, categorized by market share and growth rate, is ready for immediate integration into your strategic planning. You'll gain access to the exact same actionable insights and professional formatting as shown here, ensuring no surprises and full usability for your business decisions.

Dogs

Prior to the Britvic acquisition, certain legacy soft drink brands within Carlsberg, those with a small footprint in mature or shrinking markets, would likely fall into the Dogs category of the BCG Matrix. These brands typically generate low profits and consume resources that could be better allocated elsewhere.

The broader soft drinks segment experienced a 4% organic volume decline in Q1 2025. This overall trend highlights the challenges faced by many brands, particularly those in less dynamic markets.

Brands operating in regions like Laos and Cambodia, which have seen specific market pressures, are prime examples of potential Dogs. Their low market share and the declining overall segment performance suggest they are candidates for divestment or a strategic overhaul to improve their viability.

Somersby, within Carlsberg's portfolio, faces challenges in specific underperforming regional segments. Despite the broader 'Beyond Beer' category's growth, Somersby experienced a -2% volume decline in fiscal year 2024. Its performance in Western Europe during the first half of 2024 was particularly difficult.

These struggling regional segments or older Somersby variants can be considered Dogs in the BCG Matrix. They operate in low-growth markets and are losing market share, indicating they may not warrant substantial investment for a turnaround.

Huda beer, a prominent mainstream brand in Vietnam, saw a slight dip in performance in 2024, particularly during the final quarter which faced market headwinds. Despite Carlsberg's overall solid position as Vietnam's fourth-largest brewer, a weakening mainstream brand like Huda, even within a growing market, can be categorized as a Dog. This classification arises if its market share continues to shrink without clear signs of recovery, indicating it might be demanding more investment than it generates in returns.

Carlsberg's legacy brands in declining Eastern European markets

Certain legacy mainstream brands within Carlsberg's portfolio, especially those situated in Eastern European markets experiencing overall decline or facing fierce competition, are likely candidates for the Dogs quadrant in the BCG Matrix. For instance, Kazakhstan's beer market saw a contraction, directly impacting Carlsberg's operations there. These brands often operate at break-even, consuming valuable resources without offering substantial growth potential.

These "Dogs" require careful management. While they might not be immediate divestment candidates, their low growth and low market share necessitate a strategic approach to minimize resource drain. Carlsberg's focus in these regions might shift towards optimizing operations for cash generation rather than expansion.

- Legacy Brands in Declining Markets: Brands in Eastern Europe, such as those in Kazakhstan, where the overall beer market declined, exemplify this category.

- Low Growth, Low Share: These brands typically exhibit minimal growth prospects and hold a small share of their respective markets.

- Resource Allocation Challenge: They tie up capital and management attention, diverting resources from more promising ventures.

- Potential for Rationalization: Carlsberg may explore options to streamline these operations, potentially leading to consolidation or divestment if profitability cannot be improved.

San Miguel License (UK)

The loss of the San Miguel brand license in the UK at the end of 2024 marks a significant shift for Carlsberg, effectively reclassifying this previously distributed brand as a 'Dog' within its portfolio. This means the brand no longer contributes to Carlsberg's revenue or market share in the UK. For instance, in 2023, San Miguel held a notable share in the imported lager market, and its departure necessitates strategic adjustments for Carlsberg to compensate for the lost volume and revenue.

While San Miguel was not an internally developed product, its absence represents a divested component of Carlsberg's business operations in the UK. This situation highlights the dynamic nature of distribution agreements and the impact they can have on a company's product portfolio. Carlsberg's challenge now is to identify and promote alternative brands or products to fill the void left by San Miguel's departure, ensuring continued growth and market presence.

- Brand License Loss: San Miguel license in the UK expired end of 2024.

- BCG Matrix Classification: Reclassified as a 'Dog' for Carlsberg UK.

- Impact: Loss of distributed volume and revenue for Carlsberg.

- Strategic Implication: Need to replace lost market share and revenue streams.

Dogs in Carlsberg's portfolio are brands with low market share in low-growth markets. These often include legacy brands in declining regions like parts of Eastern Europe, where market contraction impacts performance. For instance, Kazakhstan's beer market contraction directly affected Carlsberg's operations there, placing its brands in that region into the Dog category.

These brands typically operate near break-even, consuming resources without significant return potential. The expiration of the San Miguel brand license in the UK at the end of 2024 also effectively moved this distributed brand into the 'Dog' classification for Carlsberg UK, representing a loss of volume and revenue.

Managing these Dogs involves optimizing operations for cash generation rather than expansion, potentially leading to consolidation or divestment if profitability cannot be improved.

Carlsberg's soft drinks segment saw a 4% organic volume decline in Q1 2025, a trend that disproportionately affects brands in less dynamic markets, further solidifying their 'Dog' status.

| Brand/Category Example | Market Characteristic | BCG Quadrant | Strategic Consideration |

|---|---|---|---|

| Legacy Brands (e.g., Kazakhstan) | Declining Market, Low Share | Dog | Optimize for cash, potential divestment |

| Somersby (Underperforming Regions) | Low Growth, Declining Volume (-2% FY24) | Dog | Streamline operations, reassess regional focus |

| San Miguel (UK Distribution) | Lost Distribution Agreement | Dog | Replace lost revenue, focus on owned brands |

| Soft Drinks Segment (Overall) | Mature/Shrinking Markets | Potential Dogs | Resource reallocation, portfolio review |

Question Marks

The acquisition of Britvic plc in January 2025 dramatically reshaped Carlsberg's soft drinks segment, boosting its share from 16% to almost 30% of total volumes. This move targets a high-growth area, especially in the UK and Western Europe, indicating a strategic pivot towards beverages beyond beer.

While Britvic's established brands like Robinsons and J2O offer immediate market presence, their individual market share within the newly combined Carlsberg portfolio is still being assessed and developed. This makes the expanded soft drinks category a Question Mark, requiring substantial investment to nurture growth and achieve synergies, but holding considerable future potential.

Carlsberg's Fonio beer, launched in August 2024, exemplifies a new product innovation targeting the high-growth segment of sustainable brewing and novel ingredients. This limited-edition offering reflects a strategic move into niche markets with significant future potential.

Currently, Fonio beer occupies a very small market share, characteristic of a question mark in the BCG matrix. Its success hinges on substantial investment in research and development, alongside targeted marketing and distribution efforts to build consumer awareness and acceptance.

The company is investing heavily to nurture these innovations, aiming to capture a larger share of the evolving beverage market. If these new products gain traction and demonstrate sustained growth, they could transition from question marks to stars in Carlsberg's portfolio.

Carlsberg's acquisition of the Pepsi bottling license in Kazakhstan and Kyrgyzstan, effective Q1 2026, marks a strategic pivot into the soft drinks sector. This move positions these new operations as question marks within the BCG matrix, requiring significant investment to build market share and brand recognition in potentially lucrative markets.

While these Central Asian markets show promise for soft drink consumption growth, Carlsberg's current market penetration in these specific bottling ventures is minimal. The company's investment will be crucial for establishing a competitive foothold against existing players and realizing the full potential of these new territories, which are expected to see a rise in beverage demand.

New City Expansions in China

Carlsberg's expansion into new Chinese cities represents a strategic play for future growth, fitting the profile of Question Marks in the BCG Matrix. The company is investing heavily to establish a foothold in these promising, yet undeveloped, urban markets. This focus is crucial as China's middle class continues to expand, creating demand for premium beverages. For instance, by the end of 2024, China's per capita disposable income was projected to reach approximately $5,500, signaling increased consumer spending power.

These new city initiatives require substantial capital for building distribution networks and enhancing brand visibility. Carlsberg aims to convert these initial low-market-share ventures into high-growth Stars. The Chinese beer market itself is immense, with total sales volume exceeding 40 million kiloliters annually in recent years. Successfully penetrating these new urban centers is key to capturing a larger share of this dynamic market.

- Strategic Focus: Carlsberg targets new Chinese cities for value and volume growth.

- Market Position: Initial market share in these new urban areas is expected to be low.

- Investment Required: Significant investment in distribution and brand building is necessary.

- Growth Potential: These markets represent high-growth opportunities to become future Stars.

Accelerated Investments in India and Nepal

Carlsberg's strategic move to gain full control of its Indian and Nepalese operations in November 2024 signals a significant shift towards accelerated investment in these markets. This action positions India and Nepal as potential Stars or Question Marks within the BCG Matrix, given their high growth potential and the company's stated intention to increase market share.

The accelerated investment strategy suggests that while Carlsberg recognizes the long-term growth prospects, its current market share in India and Nepal might be relatively lower compared to established competitors. For instance, the Indian beer market, projected to grow at a CAGR of over 8% from 2023 to 2028, presents a substantial opportunity for market share gains through increased capital allocation.

- Market Position: India and Nepal are being targeted for accelerated investment, indicating a strategic focus on increasing Carlsberg's presence in high-growth, potentially underpenetrated markets.

- Investment Rationale: The company aims to leverage the appealing long-term growth opportunities in these regions by injecting substantial capital to capture a larger market share.

- BCG Matrix Implication: This strategy suggests that India and Nepal are likely classified as Question Marks or early-stage Stars, requiring significant investment to achieve their full potential and move towards a dominant market position.

Carlsberg's strategic ventures into new markets or product categories, such as the Fonio beer launched in August 2024 or the Pepsi bottling licenses secured in Kazakhstan and Kyrgyzstan for Q1 2026, are prime examples of Question Marks.

These initiatives, characterized by low current market share but high growth potential, necessitate significant investment in marketing, distribution, and brand building to gain traction and achieve profitability.

The success of these ventures hinges on Carlsberg's ability to effectively nurture them, aiming to transition them into Stars by capturing a substantial portion of their respective growing markets.

| Initiative | Market Potential | Current Share | Investment Need | BCG Classification |

|---|---|---|---|---|

| Fonio Beer (Launched Aug 2024) | High (Sustainable Brewing) | Very Low | High (R&D, Marketing) | Question Mark |

| Kazakhstan/Kyrgyzstan Pepsi Bottling (Q1 2026) | High (Growing Soft Drink Market) | Minimal | High (Market Penetration) | Question Mark |

| New Chinese Cities Expansion | High (Expanding Middle Class) | Low | High (Distribution, Brand Visibility) | Question Mark |

| India & Nepal Operations (Full Control Nov 2024) | High (Projected 8%+ CAGR for India) | Moderate/Low (vs. Competitors) | Accelerated/High | Question Mark / Early Star |

BCG Matrix Data Sources

Our Carlsberg BCG Matrix is built on robust market data, encompassing financial reports, sales figures, and consumer trend analysis to accurately position each business unit.