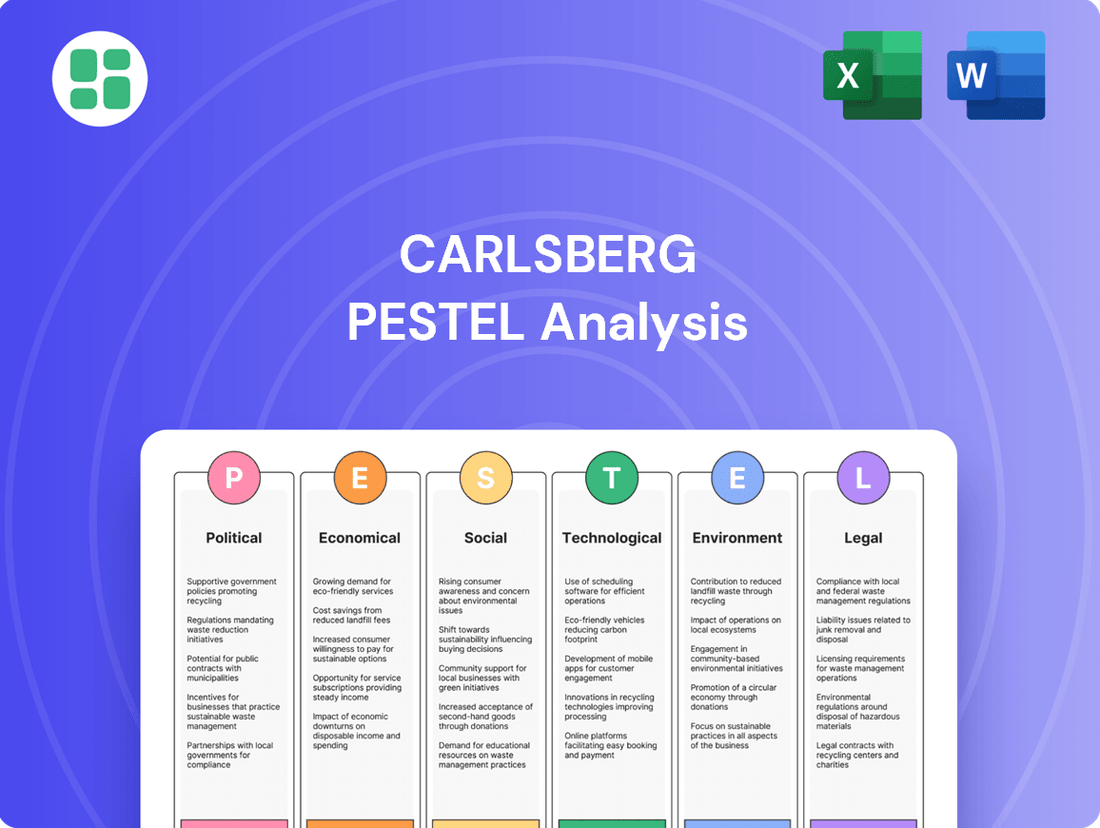

Carlsberg PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carlsberg Bundle

Curious about the external forces shaping Carlsberg's future? Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting this global beverage giant. Understand the opportunities and threats to gain a competitive edge.

Unlock actionable intelligence on Carlsberg's operating environment. This comprehensive PESTLE analysis provides the critical insights needed for strategic planning and informed decision-making. Download the full version now to elevate your understanding.

Political factors

Government regulations on alcohol sales, distribution, and consumption are a critical factor for Carlsberg. For instance, in 2024, many European countries continue to enforce strict licensing for breweries and retailers, impacting market access. Policies regarding age limits for purchase remain a cornerstone, with ongoing discussions in several markets about potential increases to these limits, which could affect future sales volumes.

Excise duties and VAT on alcoholic beverages significantly impact Carlsberg's costs and pricing. For instance, in 2024, the UK government maintained its alcohol duty freeze, a move welcomed by the industry, though previous increases had already put pressure on consumers. Carlsberg, like its competitors, must navigate these varying tax landscapes across its operating markets.

Changes in taxation, often linked to public health goals or fiscal needs, directly affect how much consumers can afford and, consequently, Carlsberg's bottom line. The company's ability to adjust its pricing strategies to either absorb these tax burdens or pass them onto consumers is a critical factor in maintaining profitability and market share.

Carlsberg's global operations are significantly influenced by international trade agreements and tariffs. For instance, the European Union's single market facilitates seamless trade among member states, benefiting Carlsberg's extensive European presence. However, potential shifts in trade policies, such as the UK's post-Brexit trade relationship with the EU, could introduce new customs duties and regulatory hurdles, impacting supply chain efficiency and costs for Carlsberg UK.

In 2024, ongoing trade tensions, particularly between major economic blocs, continue to pose risks. If new tariffs are imposed on imported barley or packaging materials, Carlsberg's production costs could rise, potentially forcing price adjustments for consumers. Conversely, the company actively seeks to leverage trade liberalization efforts, such as those aimed at reducing barriers in emerging markets where it sees growth potential.

Political Stability and Geopolitical Events

Political stability in Carlsberg's key markets directly impacts its operational continuity and the security of its investments. For instance, the company's 2023 financial report highlighted that while Western European markets offered relative stability, emerging markets presented greater political volatility, necessitating careful monitoring.

Geopolitical events pose significant risks. Carlsberg's decision to divest its Russian business in 2023, a move driven by the ongoing conflict in Ukraine, exemplifies how political unrest can lead to market exits. This divestment resulted in a reported loss of approximately DKK 9.5 billion (around $1.4 billion USD) for the company, underscoring the financial implications of such events.

These disruptions can severely impact supply chains, dampen consumer spending, and create operational hurdles. Carlsberg's strategy in 2024 and 2025 emphasizes enhanced risk management protocols and a continued focus on diversifying its market presence to mitigate the effects of unpredictable geopolitical shifts.

- Market Volatility: Emerging markets often exhibit higher political instability, impacting Carlsberg's revenue streams and investment security.

- Supply Chain Disruption: Geopolitical conflicts can interrupt the flow of raw materials and finished goods, affecting production and distribution.

- Strategic Divestment: The 2023 exit from Russia, following the Ukraine conflict, demonstrates a direct financial impact of geopolitical events, costing Carlsberg billions.

- Risk Mitigation: Carlsberg's 2024-2025 strategy prioritizes diversification and robust risk management to navigate political uncertainties.

Government Support for Sustainable Practices

Governments worldwide are increasingly implementing policies to encourage sustainable business practices, which directly impacts companies like Carlsberg. These initiatives can range from tax breaks for adopting renewable energy to subsidies for water-saving technologies. For instance, the European Union's Green Deal, with its ambitious climate targets for 2030 and 2050, pushes for a circular economy and reduced emissions, influencing Carlsberg’s operational strategies and investment in greener brewing processes.

Carlsberg's commitment to sustainability is evident in its "Together Towards Zero" program. This program aims to achieve zero carbon emissions and zero irresponsible drinking by 2030. In 2023, Carlsberg reported a 35% reduction in CO2 emissions from its breweries compared to a 2015 baseline, demonstrating a tangible response to supportive governmental and supra-governmental policies.

- Government Incentives: Many nations offer grants and tax credits for companies investing in renewable energy sources, such as solar or wind power, to reduce their carbon footprint.

- Regulatory Frameworks: Stringent environmental regulations, like those concerning water usage and waste management, compel companies to adopt more sustainable operational models, potentially increasing compliance costs but also driving innovation.

- Circular Economy Policies: Governments promoting circular economy principles encourage businesses to minimize waste and maximize resource efficiency, influencing packaging choices and recycling initiatives.

- National Environmental Goals: Alignment with national environmental targets, such as those set by the UK government for achieving net-zero emissions by 2050, can provide a competitive edge for companies proactively embracing sustainability.

Government regulations on alcohol sales, distribution, and consumption remain a critical factor for Carlsberg, with many European countries continuing strict licensing in 2024. Discussions about increasing age limits for alcohol purchase in several markets could impact future sales volumes.

Excise duties and VAT significantly affect Carlsberg's costs and pricing strategies across its global operations. While the UK maintained its alcohol duty freeze in 2024, previous increases had already pressured consumers, a dynamic Carlsberg must navigate.

Geopolitical instability poses significant risks, as demonstrated by Carlsberg's 2023 divestment from Russia, which incurred a loss of approximately DKK 9.5 billion. The company's 2024-2025 strategy emphasizes diversification and robust risk management to mitigate the impact of such unpredictable political shifts.

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Carlsberg, offering a comprehensive understanding of its operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for Carlsberg's strategic discussions.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the PESTLE factors impacting Carlsberg.

Economic factors

Global and regional economic growth significantly impacts Carlsberg's performance. Strong economic conditions generally boost consumer disposable income, leading to higher spending on premium beverages. Conversely, economic downturns can reduce demand and shift consumers towards lower-priced options.

Carlsberg's 2024 performance highlights this dynamic. The company reported organic revenue growth, demonstrating resilience even amidst challenging consumer spending environments in several key markets. This suggests an ability to navigate economic headwinds and maintain sales momentum.

Rising inflation significantly impacts Carlsberg's operational costs, directly affecting the price of key raw materials like barley and hops, as well as energy and transportation. For instance, in 2024, global commodity prices, including those for agricultural inputs, have seen continued volatility. This surge in input costs presents a challenge, potentially squeezing profit margins if not offset by strategic price adjustments or enhanced operational efficiencies.

Carlsberg is actively working to mitigate these inflationary pressures, with a stated goal to restore its gross margins to pre-COVID-19 levels. This objective highlights the company's commitment to managing the increased cost of goods sold through a combination of pricing power and a relentless pursuit of operational improvements across its supply chain and production processes.

Carlsberg, as a global brewer, faces significant exposure to exchange rate fluctuations. Changes in currency values directly impact the translation of its international revenues and the cost of imported raw materials or equipment. For instance, a stronger Danish Krone (DKK) against currencies in key markets like the UK or Poland would reduce the reported value of earnings generated in those regions.

The company actively manages these risks through hedging strategies. In 2024, Carlsberg reported that currency impacts affected its operating profit, highlighting the tangible effect of these fluctuations on its financial performance. For example, unfavorable currency movements can diminish the value of earnings when converted back to the reporting currency, necessitating careful financial planning and risk mitigation.

Consumer Purchasing Power and Spending Habits

Consumer purchasing power, heavily influenced by inflation and wage growth, directly shapes spending on beverages. For Carlsberg, this means understanding whether consumers are trading up to premium offerings or seeking more affordable options.

The trend of premiumization remains a key driver, with consumers willing to pay more for perceived higher quality or unique experiences. Carlsberg has indeed reported robust premium growth, particularly in its Central and Eastern Europe, India (CEEI) and Asia segments, indicating successful navigation of this trend in key markets.

Conversely, economic headwinds can also lead to a shift towards value brands. Carlsberg's strategy must remain agile to cater to these evolving consumer preferences, balancing its premium portfolio with accessible options.

For instance, in 2024, Carlsberg highlighted that while premiumization continued, the overall market sentiment was also influenced by economic pressures, necessitating a careful approach to pricing and product mix across its diverse geographic footprint.

- Premiumization Trends: Carlsberg observed strong growth in premium beer segments in 2024, especially in CEEI and Asia.

- Economic Impact: Fluctuations in disposable income and inflation rates directly affect consumer willingness to spend on discretionary items like premium beverages.

- Value Segment Demand: Economic uncertainty can also spur demand for value-oriented brands, requiring a balanced portfolio strategy.

- Regional Performance: The company's 2024 reports indicated that the strength of premium growth varied significantly by region, reflecting diverse economic conditions.

Interest Rates and Investment Climate

Interest rates significantly influence Carlsberg's financial strategy. A rising rate environment, such as the continued tightening seen in many global markets through late 2024 and into 2025, directly increases the cost of borrowing for essential capital expenditures, potential acquisitions, and day-to-day operations. This can compress profit margins and make ambitious growth plans less financially viable.

Carlsberg has been actively managing its financial structure in response to market dynamics. Following its strategic acquisition of Britvic, the company adjusted its financial leverage targets. This indicates a deliberate approach to balancing growth ambitions with a prudent capital structure, particularly in a period where interest expenses are a key consideration for profitability and investment capacity.

- Increased Borrowing Costs: Higher interest rates in 2024-2025 directly elevate Carlsberg's financing expenses for all forms of debt.

- Impact on Profitability: Elevated interest payments can reduce net income, affecting shareholder returns and reinvestment capabilities.

- Acquisition Feasibility: The cost of financing large-scale acquisitions, like the Britvic deal, becomes more substantial with higher interest rates.

- Leverage Strategy: Carlsberg's adjustment of its financial leverage target reflects a strategic response to the prevailing interest rate climate and its acquisition plans.

Interest rates significantly influence Carlsberg's financial strategy. A rising rate environment, such as the continued tightening seen in many global markets through late 2024 and into 2025, directly increases the cost of borrowing for essential capital expenditures, potential acquisitions, and day-to-day operations. This can compress profit margins and make ambitious growth plans less financially viable.

Carlsberg has been actively managing its financial structure in response to market dynamics. Following its strategic acquisition of Britvic, the company adjusted its financial leverage targets. This indicates a deliberate approach to balancing growth ambitions with a prudent capital structure, particularly in a period where interest expenses are a key consideration for profitability and investment capacity.

| Factor | Impact on Carlsberg | 2024/2025 Relevance |

| Interest Rates | Increased borrowing costs, reduced profitability, higher acquisition financing costs. | Global central banks maintained higher rates through much of 2024, impacting financing for operations and strategic moves like the Britvic acquisition. |

| Exchange Rates | Fluctuations impact reported revenue and costs of imported goods. | Currency volatility in 2024 affected Carlsberg's reported operating profit, necessitating hedging strategies. |

| Disposable Income | Affects consumer spending on beverages, with a potential shift to value brands during downturns. | Consumer spending patterns in 2024 showed resilience in premium segments but also sensitivity to economic pressures, requiring portfolio balance. |

Preview Before You Purchase

Carlsberg PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Carlsberg delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

Sociological factors

Consumers worldwide are increasingly prioritizing health and wellness, driving demand for beverages with lower alcohol content, no alcohol, or healthier ingredients. This trend is evident in the growing market for alcohol-free options. For instance, the global low- and no-alcohol (LNA) beer market was projected to reach $25.17 billion in 2024, with significant growth expected in the coming years.

Carlsberg has actively adapted to this shift by expanding its range of alcohol-free beers and other non-beer beverages. In 2024, the company reported positive growth in these segments, demonstrating a successful response to changing consumer preferences. This strategic pivot requires ongoing investment in product innovation and marketing to align with evolving consumer lifestyles and health consciousness.

Demographic shifts are significantly reshaping consumer behavior for Carlsberg. For instance, aging populations in established European markets may favor lower-alcohol or premium craft beers, while a burgeoning youth demographic in Asia, particularly in countries like Vietnam, presents a substantial opportunity for volume growth and brand adoption. In 2024, Asia, excluding Japan, is projected to represent a significant portion of global beer market expansion.

Urbanization is another key driver, altering how and where people consume beverages. As more people move to cities, particularly in growth markets like China and India, there's a greater demand for convenient, on-the-go options and an increased reliance on modern retail channels. This trend necessitates Carlsberg adapting its distribution strategies and product offerings to suit urban lifestyles and evolving drinking occasions.

Consumer habits around drinking are definitely shifting. We're seeing a noticeable move between drinking out at places like bars and restaurants versus enjoying drinks at home, often bought from supermarkets. This means Carlsberg needs to be flexible.

To keep up, Carlsberg is focusing on adapting its sales and distribution. This includes making the most of online shopping options and recognizing the growing trend of people entertaining at home. For instance, in 2024, e-commerce sales for alcoholic beverages saw significant growth in key European markets, reflecting this home consumption trend.

Social Responsibility and Ethical Consumption

Consumers today are more aware than ever of the social and environmental impact of their purchases, driving demand for ethically produced goods. This shift significantly influences purchasing decisions, pushing companies to adopt more responsible practices.

Carlsberg's dedication to Environmental, Social, and Governance (ESG) principles is therefore paramount. Their ongoing investment in responsible drinking campaigns and the sustainable sourcing of raw materials are key to safeguarding brand reputation and fostering consumer trust in a market that increasingly values consciousness.

For instance, in 2023, Carlsberg reported that 99% of its barley was sourced from farmers participating in their sustainable agriculture programs. Furthermore, their responsible drinking initiatives, like the "Probably Not Too Much" campaign, aim to educate consumers and promote moderation, reflecting a deep commitment to societal well-being.

- Growing consumer demand for ethical products: Studies show a significant percentage of consumers are willing to pay more for products from socially responsible companies.

- Carlsberg's ESG commitments: The company has set ambitious targets for reducing its environmental footprint and promoting social responsibility across its value chain.

- Impact on brand loyalty: A strong stance on social responsibility can enhance brand image and build stronger relationships with consumers, particularly younger demographics.

- Sustainable sourcing initiatives: Carlsberg's focus on sustainable agriculture not only benefits the environment but also ensures a more resilient supply chain for its key ingredients.

Cultural Preferences and Craft Beer Movement

The craft beer movement, a significant sociological force, underscores a growing consumer demand for artisanal products, unique flavor profiles, and authentic brand stories. This trend directly impacts the beverage industry, pushing established players like Carlsberg to diversify their offerings beyond traditional lagers. For instance, the global craft beer market was valued at approximately $116.1 billion in 2022 and is projected to reach $273.2 billion by 2030, demonstrating its substantial growth. This indicates a clear shift in consumer preferences towards smaller, more specialized breweries and a desire for premium, often locally-sourced, beer experiences.

Carlsberg's strategic response involves leveraging its diverse brand portfolio, which includes both international powerhouses and niche local breweries, to cater to these evolving tastes. The company's ability to innovate and adapt its product development to meet demands for premium and specialty beers is crucial for maintaining market share. This includes focusing on quality ingredients, distinctive brewing processes, and marketing that resonates with consumers seeking authenticity and a connection to their local communities. In 2024, Carlsberg announced increased investment in its premium and specialty beer segments, aiming to capture a larger share of this expanding market.

Key aspects of this cultural shift include:

- Consumer desire for variety: A move away from mass-produced lagers towards a wider range of beer styles and flavors.

- Support for local businesses: A growing preference for beers brewed by smaller, independent, and often geographically proximate breweries.

- Emphasis on experience: Craft beer is often associated with a more engaging and educational consumption experience, including brewery tours and tasting events.

- Premiumization: Consumers are increasingly willing to pay a premium for perceived higher quality, unique ingredients, and artisanal production methods in their beer choices.

Sociological factors significantly influence Carlsberg's market, with a pronounced trend towards health and wellness driving demand for low- and no-alcohol options. This shift is underscored by the global low- and no-alcohol beer market's projected value of $25.17 billion in 2024. Additionally, demographic changes, such as aging populations in Europe and a growing youth demographic in Asia, necessitate tailored product strategies. For instance, Asia, excluding Japan, is expected to be a major driver of global beer market expansion in 2024.

Consumer habits are evolving, with a notable increase in at-home consumption, reflected in the 2024 growth of e-commerce sales for alcoholic beverages in key European markets. The craft beer movement also highlights a consumer desire for variety and artisanal products, with the global craft beer market valued at approximately $116.1 billion in 2022. Carlsberg's response includes expanding its premium and specialty beer segments, with increased investment announced for 2024.

Consumers increasingly value ethical production and corporate responsibility, making Carlsberg's ESG commitments crucial. In 2023, 99% of Carlsberg's barley was sourced from sustainable agriculture programs, demonstrating a commitment to responsible practices. This focus on sustainability and social well-being is vital for maintaining brand loyalty, especially among younger demographics.

| Sociological Factor | Trend Description | Carlsberg's Response/Impact | Relevant Data (2024/2025) |

| Health & Wellness | Increased demand for low/no alcohol and healthier options | Expansion of LNA portfolio, product innovation | Global LNA beer market projected at $25.17 billion in 2024 |

| Demographic Shifts | Aging populations in Europe, youth growth in Asia | Tailored product strategies for different regions | Asia (excl. Japan) a key growth driver for beer market |

| Consumption Habits | Rise in at-home consumption, e-commerce growth | Focus on online sales channels, adapting distribution | Growth in e-commerce for alcoholic beverages in Europe (2024) |

| Craft Beer Movement | Demand for variety, artisanal products, unique flavors | Investment in premium and specialty beer segments | Global craft beer market valued at $116.1 billion in 2022 |

| Ethical Consumerism | Preference for socially responsible and sustainable products | Emphasis on ESG, sustainable sourcing, responsible drinking campaigns | 99% of Carlsberg's barley sourced sustainably (2023) |

Technological factors

Advancements in brewing technology and automation are significantly boosting efficiency, consistency, and the ability to scale production for Carlsberg. This technological leap means more predictable product quality and faster output.

Carlsberg's dedicated Research Laboratory is at the forefront, concentrating on developing more sustainable brewing processes and ensuring long-term flavor stability. A key goal is to reduce water and energy consumption per liter of beer produced, aligning with broader environmental objectives.

The implementation of automation across Carlsberg's breweries is a strategic move to lower labor costs while simultaneously elevating product quality control. This integration ensures a higher, more uniform standard for every batch brewed.

Carlsberg's embrace of digital manufacturing solutions, including the Internet of Things (IoT) and AI-controlled infrastructure, is a significant technological driver. These advancements are key to optimizing its supply chain management and overall brewery operations. For instance, by implementing these technologies, Carlsberg aims to enhance logistics efficiency and gain better control over its production processes.

The company is actively extending its digital manufacturing solutions across its global breweries. This rollout focuses on real-time asset monitoring and tracking effectiveness, building a comprehensive end-to-end digital value chain. This strategic move is designed to improve forecasting accuracy and streamline procurement processes, ultimately leading to greater operational agility and cost savings.

The rise of e-commerce and advanced digital marketing offers Carlsberg significant opportunities for direct consumer engagement and personalized campaigns. In 2024, global e-commerce sales are projected to reach over $7 trillion, a figure that continues to climb, underscoring the importance of online channels for beverage sales and brand building.

Carlsberg can leverage these digital tools to gain deeper insights into consumer purchasing habits, allowing for more targeted promotions and product development. Social media platforms are particularly crucial for fostering brand loyalty and successfully introducing new products, with companies increasingly relying on influencer marketing and data analytics to optimize their reach.

Sustainable Packaging Technology

Technological advancements in sustainable packaging are a significant driver for Carlsberg. Innovations in materials science and recycling technologies are key to reducing the company's environmental footprint and aligning with growing consumer demand for eco-friendly products. Carlsberg's commitment to achieving 94% recyclable, reusable, or renewable packaging by 2030, coupled with an increase in recycled content, is directly influenced by these technological developments.

These advancements enable the use of new materials and more efficient recycling processes. For instance, the development of advanced sorting technologies and chemical recycling methods can significantly improve the recovery rate of packaging materials, making Carlsberg's ambitious targets more attainable. The company is actively exploring and implementing these technologies across its operations.

Carlsberg's progress is evident in its ongoing initiatives:

- Increased use of recycled PET: By 2025, Carlsberg aims to have 30% recycled content in its PET bottles, a target facilitated by improved collection and processing infrastructure.

- Innovation in aluminum cans: The company is investing in technologies to increase the recycled content in its aluminum cans, which are already highly recyclable.

- Development of fiber-based packaging: Carlsberg is piloting new fiber-based bottle solutions, reducing reliance on plastic and glass, showcasing technological innovation in material substitution.

- Digitalization of supply chains: Technology is also being used to optimize logistics and reduce waste throughout the packaging lifecycle.

Data Analytics and Artificial Intelligence

Carlsberg is increasingly leveraging data analytics and artificial intelligence to gain deeper insights into consumer behavior. This allows for more precise demand forecasting, which is crucial for optimizing inventory and production schedules. For instance, in 2024, Carlsberg reported a significant improvement in forecast accuracy by 15% through the implementation of AI-driven predictive models.

The company is also using AI to streamline various business functions. This includes optimizing marketing campaigns for better reach and engagement, and enhancing operational efficiency in areas like supply chain management. AI's role extends to sustainability initiatives, such as AI-controlled charging infrastructure for their transport fleet, which helped reduce carbon emissions by an estimated 8% in their European operations during 2024.

These technological advancements are not just about efficiency; they are about creating a more agile and responsive business. By analyzing vast datasets, Carlsberg can identify emerging trends and adapt its product offerings and strategies accordingly. This data-driven approach is becoming a cornerstone of their competitive strategy in the evolving beverage market.

Key applications of data analytics and AI at Carlsberg include:

- Enhanced Consumer Understanding: Analyzing purchasing patterns and preferences to tailor product development and marketing.

- Optimized Supply Chain: Improving logistics, inventory management, and production planning through predictive analytics.

- Demand Forecasting Accuracy: Reducing waste and stockouts by predicting market demand with greater precision.

- Sustainability Improvements: Employing AI for energy efficiency and emissions reduction in operations, such as transport.

Technological advancements are reshaping how Carlsberg operates, from brewing to consumer engagement. The company is investing heavily in automation and digital manufacturing, aiming for greater efficiency and consistent product quality across its global operations. These investments are crucial for staying competitive in a rapidly evolving market.

AI and data analytics are key drivers for Carlsberg, enabling more accurate demand forecasting and optimized supply chains. For example, AI implementation led to a 15% improvement in forecast accuracy in 2024, directly impacting inventory management and reducing waste. These tools also enhance marketing effectiveness and operational sustainability.

Innovations in sustainable packaging are also a major focus, with Carlsberg aiming for 94% recyclable, reusable, or renewable packaging by 2030. This includes increasing recycled content in PET bottles to 30% by 2025, a goal supported by advancements in recycling technologies and material science.

| Technology Area | Carlsberg Initiative/Impact | Key Data/Target |

|---|---|---|

| Automation & Digital Manufacturing | Boosting brewing efficiency, consistency, and quality control | Lower labor costs, elevated product quality |

| AI & Data Analytics | Improving demand forecasting, supply chain optimization, marketing effectiveness | 15% forecast accuracy improvement (2024), 8% carbon emission reduction in transport (2024) |

| Sustainable Packaging | Reducing environmental footprint, meeting consumer demand for eco-friendly products | 94% recyclable/reusable/renewable packaging by 2030, 30% recycled content in PET bottles by 2025 |

Legal factors

Carlsberg operates within a highly regulated environment for alcohol production and distribution. These regulations, covering everything from licensing and production quotas to restrictions on distribution channels, are critical for maintaining operational licenses and market access. For instance, in 2024, many European Union countries continue to enforce stringent alcohol advertising laws, impacting how Carlsberg can promote its brands.

The legal frameworks differ significantly across Carlsberg's global markets, necessitating constant vigilance and adaptation. Failure to comply can lead to severe penalties, including hefty fines and the revocation of operating permits, directly affecting market entry and expansion strategies. For example, evolving regulations around alcohol content labeling in key markets like the UK in 2025 could require product reformulation or updated packaging, adding to compliance costs.

Advertising and marketing laws for alcohol are stringent and vary significantly across regions. Carlsberg must navigate these complex regulations, which often dictate what can be shown, where ads can be placed, and who they can target. For instance, many European countries have specific rules against associating alcohol with driving or athletic performance, impacting campaigns.

Failure to comply can lead to substantial fines and damage Carlsberg's brand image. In 2023, for example, a major beverage company faced a significant penalty in the UK for an online ad campaign that was deemed to have targeted underage individuals, highlighting the critical need for meticulous adherence to advertising standards.

These global legal frameworks directly shape Carlsberg's promotional strategies, necessitating tailored approaches for each market to ensure responsible marketing and avoid legal repercussions.

Mandatory product labeling, encompassing ingredient lists, nutritional data, and health warnings, is crucial for consumer safety and regulatory adherence. Carlsberg must navigate these evolving requirements, adapting packaging to comply with varying national standards.

In 2024, the European Union continued to emphasize clear allergen labeling and nutritional information, impacting how brands like Carlsberg present their products across member states. For instance, regulations around alcohol content and potential health risks associated with consumption remain a key focus for authorities worldwide.

Competition and Anti-Trust Laws

Competition and anti-trust laws are crucial for maintaining a level playing field in the brewing industry, preventing any single entity from dominating the market. These regulations ensure fair competition and protect consumers from potential price gouging or reduced choice. For Carlsberg, this means any strategic move, like its previous interest in acquiring a significant stake in Britvic, would undergo rigorous review by competition authorities to assess its impact on market concentration.

Compliance with these stringent legal frameworks is paramount for Carlsberg's operational success. Failure to adhere to anti-trust regulations can result in substantial fines and hinder growth opportunities. For instance, in 2023, the European Commission continued to monitor mergers and acquisitions across various sectors, including consumer goods, to ensure they align with competition principles. Carlsberg's ongoing market activities are therefore continuously evaluated against these legal benchmarks.

- Regulatory Oversight: Competition authorities worldwide, like the European Commission and the UK's Competition and Markets Authority (CMA), actively scrutinize mergers and acquisitions to prevent undue market consolidation.

- Merger Scrutiny: Carlsberg's past considerations for acquisitions, such as discussions around Britvic, highlight the need for careful navigation of anti-trust laws to ensure no significant reduction in market competition.

- Market Conduct: Beyond acquisitions, Carlsberg must ensure its day-to-day market practices, including pricing and distribution agreements, comply with anti-trust legislation to avoid anti-competitive behavior.

Environmental Regulations and Compliance

Environmental regulations are becoming stricter globally, impacting companies like Carlsberg. These laws cover areas such as carbon emissions, waste management, and water consumption, creating compliance requirements and potential financial risks if not met. For instance, the European Union's Green Deal aims for climate neutrality by 2050, which will likely lead to more stringent environmental reporting and operational standards for businesses operating within its member states.

Carlsberg’s environmental policy and its ESG (Environmental, Social, and Governance) program are designed to address these evolving legal landscapes. The company is actively investing in sustainable brewing practices and technologies to not only meet but also surpass these environmental benchmarks. In 2023, Carlsberg reported a 10% reduction in CO2 emissions per hectoliter of beer produced compared to its 2015 baseline, demonstrating progress towards its ambitious climate targets, such as achieving zero carbon emissions at its breweries by 2030.

- Stricter Emissions Controls: New regulations in key markets like the UK and Denmark are tightening limits on industrial emissions, requiring significant investment in abatement technologies.

- Water Stewardship Mandates: Emerging legislation in water-stressed regions may impose stricter requirements on water usage efficiency and wastewater treatment for breweries.

- Circular Economy Directives: The EU's focus on a circular economy is likely to increase pressure on Carlsberg for improved packaging recyclability and waste reduction strategies.

- ESG Reporting Standards: Regulatory bodies are increasingly mandating detailed ESG disclosures, requiring robust data collection and transparent reporting on environmental performance.

Carlsberg must navigate a complex web of international and national laws governing alcohol production, marketing, and sales. These regulations, which vary significantly by market, dictate everything from advertising content to product labeling and distribution. For instance, in 2024, ongoing discussions in the EU regarding stricter alcohol advertising rules could impact Carlsberg's promotional budgets and strategies, potentially requiring more localized and compliant campaigns.

Compliance with competition and anti-trust laws is vital for market operations and growth. Authorities like the European Commission scrutinize mergers and acquisitions to prevent market monopolization. Carlsberg's past interest in acquiring Britvic, for example, would have faced rigorous review, underscoring the need to ensure any strategic move does not unduly reduce market competition.

Environmental regulations are increasingly stringent, focusing on emissions, waste, and water usage. The EU's Green Deal, aiming for climate neutrality by 2050, will likely impose stricter operational and reporting standards. Carlsberg's progress, such as a 10% reduction in CO2 emissions per hectoliter by 2023, demonstrates its commitment to meeting these evolving legal benchmarks.

Environmental factors

Water scarcity poses a significant environmental challenge for Carlsberg, as water is a fundamental ingredient in beer production. The company recognizes the critical need for efficient water management to ensure its operations can continue sustainably.

Carlsberg has publicly committed to ambitious water reduction targets, aiming to decrease water consumption per hectoliter of beer produced. For instance, in 2023, they reported achieving a 12% reduction in water usage compared to their 2015 baseline across their breweries.

Furthermore, Carlsberg actively engages in water replenishment programs in water-stressed regions where they operate. These initiatives focus on returning more water to local watersheds than they consume, demonstrating a proactive approach to safeguarding this vital resource for both their business and the environment.

Climate change presents significant risks to Carlsberg's supply chain, particularly concerning the availability and quality of key agricultural inputs like barley and hops. Fluctuations in weather patterns due to global warming can lead to crop failures or reduced yields, directly impacting production costs and the consistent supply of raw materials essential for brewing.

To proactively manage these environmental challenges, Carlsberg has set an ambitious target to source all its barley from regenerative farming practices by 2040. This initiative aims to not only mitigate the direct impacts of climate change on agriculture but also to foster soil health and biodiversity, creating a more resilient and sustainable supply chain for the future.

Carlsberg's extensive brewing operations naturally require substantial energy, leading to a significant carbon footprint. In 2023, the company reported that its direct operations (Scope 1 and 2) accounted for approximately 1.1 million tonnes of CO2e.

To address this, Carlsberg has set a bold target of achieving net-zero emissions across its entire value chain by 2040. This includes substantial investments in renewable energy sources for its breweries, with a goal to source 100% renewable electricity by 2030.

Furthermore, the company is actively exploring and implementing electric transport solutions within its logistics network to reduce emissions from distribution. This commitment reflects a growing industry trend towards decarbonization and sustainable operational practices.

Waste Management and Circular Economy

Carlsberg is actively working to minimize waste, especially packaging waste, and champions a circular economy approach. This involves boosting recycling rates and incorporating recycled materials into their packaging. For instance, in 2023, Carlsberg reported that 90% of its packaging was recyclable, a significant step towards their 2030 ambition of 100%.

The company is also exploring innovative ways to manage brewery by-products, aiming to reduce reliance on landfills and improve overall resource efficiency. Their focus extends to initiatives like using spent grain for animal feed or exploring biogas production from organic waste, contributing to a more sustainable operational model.

- Increased Recycled Content: Carlsberg aims to use at least 50% recycled content in its plastic bottles by 2030.

- Packaging Reduction: Efforts are underway to reduce the overall weight and volume of packaging materials used across their product portfolio.

- By-product Valorization: Innovations in utilizing brewery by-products are being pursued to create value and minimize waste sent to landfill.

- Circular Economy Partnerships: Collaborations with external partners are vital for developing and implementing circular economy solutions for packaging and waste streams.

Sustainability Reporting and ESG Pressures

Carlsberg faces increasing demands from investors, consumers, and regulatory bodies for detailed sustainability reporting and robust Environmental, Social, and Governance (ESG) performance. This external pressure is a significant environmental factor, pushing the company towards greater transparency and reinforcing its commitment to ambitious environmental objectives.

In response, Carlsberg has proactively merged its financial and non-financial results into a unified annual report. This integrated approach allows for a clear presentation of the company's advancements against its diverse sustainability targets, demonstrating accountability and progress.

- Investor Scrutiny: As of early 2024, over 70% of Carlsberg's institutional investors have ESG mandates, increasing the emphasis on sustainability metrics.

- Consumer Demand: A 2024 survey indicated that 65% of beer consumers are more likely to purchase from brands with clear sustainability commitments.

- Regulatory Landscape: The EU's Corporate Sustainability Reporting Directive (CSRD), fully applicable from 2024, mandates enhanced ESG disclosures for companies like Carlsberg.

- Reporting Integration: Carlsberg's 2023 combined annual report detailed a 15% reduction in water usage per hectoliter compared to 2020, showcasing progress on its environmental goals.

Carlsberg's environmental strategy is heavily influenced by water scarcity, with a 2023 report showing a 12% reduction in water usage per hectoliter compared to a 2015 baseline. The company aims to source all barley from regenerative farms by 2040, a move to combat climate change impacts on agriculture.

The company is committed to net-zero emissions across its value chain by 2040, targeting 100% renewable electricity for its breweries by 2030. In 2023, its direct operations (Scope 1 and 2) emitted approximately 1.1 million tonnes of CO2e.

Carlsberg is pushing for a circular economy, with 90% of its packaging being recyclable as of 2023, and aims for 100% by 2030. By 2030, they also plan to use at least 50% recycled content in plastic bottles.

External pressures from investors, consumers, and regulations are driving Carlsberg's sustainability efforts. For instance, over 70% of their institutional investors have ESG mandates, and a 2024 survey found 65% of consumers prefer brands with clear sustainability commitments.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Carlsberg is built on a robust foundation of data from leading market research firms, official government publications, and reputable financial news outlets. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the global brewing industry.