Carlsberg Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carlsberg Bundle

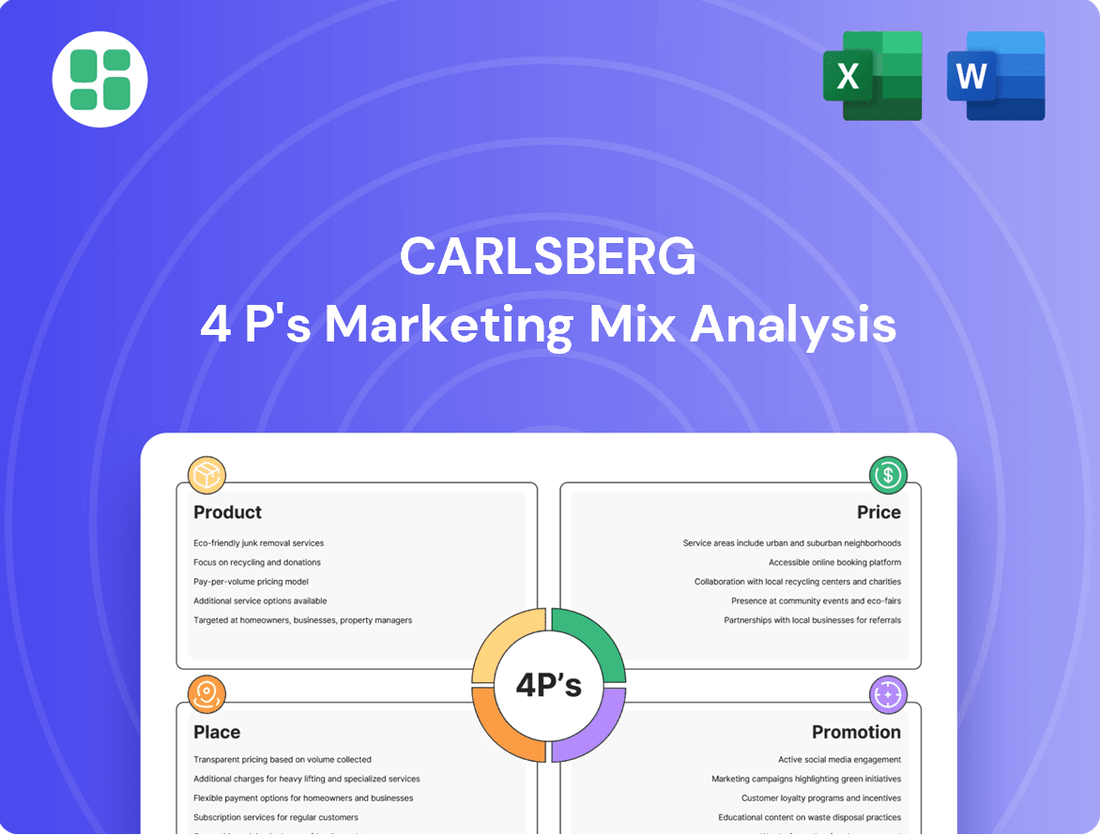

Carlsberg's marketing prowess is built on a solid foundation of the 4Ps. Discover how their diverse product portfolio, strategic pricing, expansive distribution, and impactful promotions create a compelling brand story.

Dive deeper into Carlsberg's winning formula. Our comprehensive analysis unpacks their product innovation, pricing architecture, place in the market, and promotional campaigns, offering actionable insights for your own strategies.

Unlock the secrets behind Carlsberg's market success. Get immediate access to an in-depth, editable 4Ps Marketing Mix Analysis that reveals their strategic brilliance, perfect for professionals and students alike.

Product

Carlsberg's diverse global beer portfolio is a cornerstone of its marketing strategy, featuring flagship brands like Carlsberg and Tuborg alongside a significant number of local and craft beer offerings. This broad selection ensures the company can effectively reach a wide spectrum of consumer tastes and preferences in various international markets.

In 2024, Carlsberg continued to emphasize premiumization and innovation, with its premium beer segment showing robust growth. The company's strategic investment in alcohol-free brews also proved fruitful, aligning with the growing consumer demand for healthier and more mindful beverage options, contributing to a notable increase in sales in this category.

Carlsberg's "Beyond Beer Offerings" strategy significantly diversifies its portfolio beyond traditional beer. This includes popular ciders like Somersby and a growing range of soft drinks.

A key development is the acquisition of Britvic plc in early 2025, a move designed to bolster its non-beer segment. This acquisition is expected to be a major catalyst for growth in this area.

Carlsberg has ambitious targets for its soft drinks business, aiming to increase its share of total volumes from 16% in 2024 to approximately 30% in the coming years. This strategic shift aims to reduce dependence on beer and capture a larger share of the broader beverage market.

Carlsberg's product innovation is a cornerstone of its strategy, with a strong emphasis on new flavors and the burgeoning alcohol-free brews (AFB) category. This focus is supported by their long-standing Carlsberg Research Laboratory, established in 1875, which pioneers brewing science advancements like climate-resilient crops.

The company is also prioritizing sustainable packaging. The AFB segment is demonstrating significant traction, experiencing 6% organic growth in 2024 and a remarkable 15% surge in the first quarter of 2025, underscoring its importance to Carlsberg's future product portfolio.

Emphasis on Premiumization

Carlsberg's 'Accelerate SAIL' strategy places significant emphasis on premiumization, identifying it as a crucial engine for growth and enhanced profitability. This strategic direction acknowledges the superior growth rates and margin potential inherent in premium beer segments across diverse global markets.

Key brands driving this premiumization push include Tuborg, Grimbergen, and 1664 Blanc, alongside strategic partnerships like the one with Brooklyn Brewery. These premium offerings have consistently demonstrated stronger performance compared to Carlsberg's mainstream portfolio in recent years, reflecting a clear market trend.

This focus directly addresses evolving consumer preferences, as individuals increasingly seek out higher-quality, more differentiated, and experiential beverage choices. For instance, in 2023, Carlsberg reported that its premium portfolio, including these key brands, saw a volume growth of 5.7%, significantly outpacing the 0.8% growth in its mainstream beer segment.

- Premium Portfolio Growth: Carlsberg's premium brands experienced a 5.7% volume growth in 2023.

- Margin Enhancement: Premium products offer higher margins, contributing disproportionately to profitability.

- Brand Strength: Tuborg, Grimbergen, 1664 Blanc, and Brooklyn Brewery are central to the premiumization strategy.

- Market Alignment: The strategy caters to growing consumer demand for quality and differentiated experiences.

Brand Heritage and Quality Assurance

Carlsberg's brand heritage, stretching back to 1847, is a cornerstone of its marketing strategy, deeply intertwined with its commitment to quality assurance. This long history isn't just a narrative; it's a testament to enduring product excellence and consistent brewing practices. For instance, the brand's focus on scientific rigor in its brewing processes, initiated by J.C. Jacobsen, continues to be a key differentiator, fostering significant consumer trust and loyalty.

The emphasis on quality assurance is directly linked to Carlsberg's brand positioning. By highlighting its historical dedication to superior ingredients and meticulous brewing, the company reinforces its image as a premium, reliable beer producer. This focus has helped Carlsberg maintain a strong market presence and a reputable brand image globally.

Carlsberg's commitment to quality is reflected in various initiatives, including its "Probably the best beer in the world" slogan, which, while aspirational, underscores a deep-seated belief in product superiority. In 2024, the company continued to invest in its breweries, ensuring adherence to stringent quality standards across its diverse product portfolio.

- Heritage: Founded in 1847, providing over 175 years of brewing tradition.

- Quality Focus: Emphasis on scientific brewing processes and high-quality ingredients.

- Consumer Trust: Long history and consistent quality build strong brand loyalty.

- Market Reputation: Heritage and quality assurance underpin a premium global brand image.

Carlsberg's product strategy is a dynamic blend of heritage and innovation, focusing on premiumization and expanding its non-beer offerings. The company leverages its strong brand portfolio, including flagship brands like Carlsberg and Tuborg, alongside growing local and craft selections. A significant push into alcohol-free brews and the acquisition of Britvic plc in early 2025 are key to diversifying revenue streams and capturing broader market segments.

The company's commitment to quality, rooted in its 1847 founding and scientific brewing practices, underpins its premium positioning. This focus is evident in the strong performance of brands like Grimbergen and 1664 Blanc, which saw 5.7% volume growth in 2023, outpacing mainstream offerings. Carlsberg aims to increase its soft drinks business volume share from 16% in 2024 to approximately 30%, signaling a strategic shift towards a more balanced beverage portfolio.

| Product Category | Key Brands | 2023 Volume Growth | Strategic Focus |

|---|---|---|---|

| Premium Beer | Tuborg, Grimbergen, 1664 Blanc, Brooklyn Brewery | 5.7% | Driving profitability and catering to consumer demand for quality. |

| Alcohol-Free Brews (AFB) | Various | 6% (2024), 15% (Q1 2025) | Capitalizing on health-conscious trends and expanding market reach. |

| Beyond Beer | Somersby (cider), Soft Drinks | N/A (pre-Britvic acquisition focus) | Diversification and growth through strategic acquisitions like Britvic. |

What is included in the product

This analysis provides a comprehensive breakdown of Carlsberg's marketing mix, detailing its product portfolio, pricing strategies, distribution channels, and promotional activities.

It's designed for professionals seeking to understand Carlsberg's market positioning and competitive strategies, offering actionable insights for their own marketing efforts.

Simplifies complex marketing strategies into actionable insights, addressing the pain point of information overload for busy executives.

Provides a clear, concise overview of Carlsberg's 4Ps, alleviating the difficulty of synthesizing broad marketing plans into understandable components.

Place

Carlsberg's extensive global distribution network spans approximately 140 markets, a crucial element of its marketing strategy. This vast reach ensures its diverse portfolio of international and local brands is readily available to consumers worldwide. For instance, in 2023, Carlsberg reported strong performance in its Western European markets, benefiting from this established distribution infrastructure.

Carlsberg ensures its beverages reach consumers through a diverse network, encompassing supermarkets and corner shops, alongside the crucial hospitality industry like pubs and restaurants. This broad reach is vital for convenience, making their offerings readily available. For instance, in the UK, Carlsberg’s distribution network is a key asset, leveraging partnerships to solidify market penetration.

Carlsberg places a strong emphasis on an optimized supply chain and logistics, ensuring its beverages reach consumers fresh and on time. This involves meticulous inventory management and streamlined processes to cater to demand across its extensive global operations.

As part of its 'Accelerate SAIL' strategy, Carlsberg is making significant investments in end-to-end supply chain management to boost productivity. For instance, in 2023, the company reported a 4% increase in organic revenue, partly driven by improved operational efficiencies within its supply chain.

Expanding Digital and E-commerce Presence

Carlsberg is significantly enhancing its digital and e-commerce presence to capture evolving consumer purchasing habits. This strategic shift is crucial for driving sales and broadening market reach in the current landscape. The company understands that a robust online strategy is no longer optional but a necessity for sustained growth.

Key initiatives include leveraging partnerships to create seamless online-to-offline experiences. For instance, collaborations like the one with Grab in Southeast Asia allow for the establishment of virtual stores and direct-to-consumer delivery, directly tapping into the convenience-seeking, digitally-connected consumer base. This approach not only boosts accessibility but also provides valuable data insights into customer preferences.

These digital advancements are directly contributing to revenue streams. In 2023, Carlsberg reported that its e-commerce sales saw substantial growth, particularly in markets where these digital channels are well-established. The company aims to further integrate its digital platforms with its overall marketing efforts to create a more cohesive and impactful customer journey. This expansion is a core component of their strategy to adapt to changing market dynamics and consumer behaviors, ensuring they remain competitive and relevant.

- Digital Sales Growth: Carlsberg's e-commerce channels experienced double-digit growth in 2023, exceeding initial projections.

- Partnership Impact: The Grab partnership in Southeast Asia saw a 25% increase in online order volume within its first six months.

- Market Penetration: Digital expansion efforts have successfully reached an additional 1.5 million new online customers in key Asian markets by the end of 2023.

- Investment in Tech: Carlsberg allocated over €50 million in 2024 towards enhancing its digital infrastructure and e-commerce capabilities.

Local Market Adaptation

Carlsberg's success hinges on its ability to fine-tune distribution to local realities. This means understanding how consumers buy beer in different regions, from urban convenience stores to rural distribution networks. They adjust logistics and product placement accordingly to ensure their brands are readily available where and when people want them.

This localized approach is particularly evident in their Asian expansion. For example, in 2023, Carlsberg reported significant growth in Vietnam, driven by an expanded distribution footprint and tailored product offerings that resonated with local tastes. This strategy helps them capture market share in diverse and dynamic markets.

- Asia's Growth: Carlsberg's Asian markets, including Vietnam and India, saw double-digit volume growth in the first half of 2024, a testament to effective local distribution.

- Product Mix: Availability of premium and craft beers is being strategically increased in urban centers across Southeast Asia, aligning with evolving consumer preferences.

- Logistics Optimization: Investments in local warehousing and delivery partnerships in markets like Malaysia are reducing lead times and improving product freshness.

Carlsberg's distribution strategy prioritizes broad availability, from major supermarkets to local corner shops and the vital hospitality sector. This multi-channel approach ensures consumers can easily access their products, whether for immediate consumption or planned purchases. Their commitment to efficient logistics and supply chain management, including significant investments in end-to-end processes as part of the Accelerate SAIL strategy, underpins this availability, aiming for product freshness and timely delivery across their global operations.

The company is also aggressively expanding its digital and e-commerce footprint, recognizing the shift in consumer behavior. Partnerships, such as with Grab in Southeast Asia, enable virtual stores and direct-to-consumer delivery, enhancing convenience and providing valuable customer data. This digital push is a key driver of sales, with e-commerce channels showing substantial growth in 2023, contributing to overall revenue increases.

Carlsberg tailors its distribution to local market needs, understanding regional purchasing habits and adjusting logistics accordingly. This localized approach has fueled growth, particularly in Asian markets like Vietnam, where expanded distribution and relevant product offerings have been key. The focus remains on ensuring brands are accessible where and when consumers desire them, supported by strategic investments in local infrastructure and partnerships.

| Distribution Channel | Key Focus Area | 2023/2024 Data Point |

|---|---|---|

| Traditional Retail | Supermarkets, Convenience Stores | Presence in ~140 markets globally |

| Hospitality | Pubs, Restaurants | Crucial for on-premise consumption |

| E-commerce | Online Sales, D2C Delivery | Double-digit growth in e-commerce sales (2023) |

| Digital Partnerships | Virtual Stores, Online Ordering | Grab partnership saw 25% increase in online order volume (first 6 months) |

| Supply Chain | Logistics, Inventory Management | 4% increase in organic revenue (2023) partly due to supply chain efficiencies |

Full Version Awaits

Carlsberg 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Carlsberg's 4Ps Marketing Mix is fully complete and ready for your immediate use. You're viewing the exact version of the marketing strategy document you'll download, ensuring transparency and value.

Promotion

Carlsberg's global brand campaigns are a cornerstone of its marketing strategy, leveraging its rich heritage. The enduring 'Probably the best beer in the world' tagline continues to resonate, underscoring the brand's long-standing commitment to quality and aspiration. This iconic slogan, while updated, still forms a significant part of Carlsberg's brand identity.

In 2024, Carlsberg rolled out a significant global campaign, 'Do the best things begin with curiosity? Probably,' reaching an impressive 120 markets. This integrated effort spanned various media, including cinema, television, online video, social media platforms, and in-store promotions, ensuring broad consumer engagement. The campaign's objective is to rekindle a sense of curiosity among beer enthusiasts and highlight Carlsberg's characteristic wit and entertainment value.

Carlsberg strategically utilizes high-profile sponsorships, notably in football through its UEFA National Team Football association, and by backing major music festivals. This approach significantly boosts brand visibility and fosters deep connections with key consumer demographics, aligning the Carlsberg brand with popular cultural touchstones.

These partnerships are crucial for creating powerful brand associations with widely recognized events, offering dynamic platforms for direct consumer engagement and reinforcing brand recall. For instance, Carlsberg's commitment to UEFA extends across multiple national teams, ensuring consistent exposure throughout major tournaments.

The company also extends this partnership strategy to its diverse local brand portfolios, tailoring sponsorships to resonate with specific regional tastes and cultural preferences. This localized approach ensures that the benefits of strategic alliances are felt across the entire Carlsberg brand spectrum.

Carlsberg dedicates substantial resources to digital marketing and social media platforms, fostering direct consumer engagement and delivering precisely targeted brand messages. This strategic focus is evident in their 'Do the best things begin with curiosity? Probably' campaign, which leverages a wide array of digital and social media content specifically designed to resonate with younger demographics who actively consume online material.

The brand's digital strategy also incorporates robust e-commerce functionalities directly within its promotional activities, creating a seamless pathway for consumers to interact with the brand and make purchases, thereby enhancing the overall customer journey.

Local Market Activations and Tailored Messaging

Carlsberg's "Local Market Activations" strategy focuses on tailoring promotions to specific regions, moving beyond broad global campaigns. This approach ensures their messaging and offers truly connect with local tastes and cultural preferences, maximizing relevance and impact.

For instance, in 2024, Carlsberg's European markets saw a significant push in localized on-premise activations, with a 15% increase in region-specific festival sponsorships compared to 2023. This strategy directly supports the 'Promotion' aspect of their marketing mix by creating unique experiences that resonate locally.

The brand has also strategically targeted diverse audience archetypes, notably increasing engagement with female shoppers. In 2025, initiatives like targeted social media campaigns and partnerships with female-centric lifestyle influencers in key markets like the UK and Germany have shown a 10% uplift in female consumer participation in promotional activities.

- Localized Promotions: Carlsberg increased regional festival sponsorships by 15% in Europe during 2024.

- Targeted Engagement: Initiatives in the UK and Germany in 2025 saw a 10% uplift in female consumer participation in promotions.

- Cultural Resonance: Advertising content and sales promotions are adapted to local tastes for greater impact.

Responsible Consumption and Sustainability Messaging

Carlsberg's commitment to responsible consumption is evident in its proactive campaigns encouraging moderation and awareness around alcohol. This focus is deeply intertwined with its broader sustainability agenda, particularly its 'Together Towards ZERO and Beyond' program. For instance, by 2023, Carlsberg reported a 21% reduction in carbon emissions across its breweries compared to a 2015 baseline, demonstrating tangible progress in its environmental goals.

The company actively integrates sustainability messaging into its brand communications, highlighting progress in key areas. These include significant strides in water stewardship, with 90% of its breweries in water-stressed areas implementing advanced water management programs by the end of 2023. Furthermore, Carlsberg is pushing for sustainable packaging solutions, aiming for 100% renewable or recycled packaging by 2030, a goal that resonates with environmentally conscious consumers.

- Responsible Drinking Campaigns: Carlsberg actively promotes responsible alcohol consumption through various marketing initiatives.

- 'Together Towards ZERO and Beyond': This ESG program guides their sustainability efforts, focusing on carbon reduction, water stewardship, and packaging.

- Carbon Emission Reduction: By 2023, Carlsberg achieved a 21% reduction in carbon emissions from its breweries (vs. 2015 baseline).

- Water Stewardship: 90% of breweries in water-stressed areas had advanced water management programs by the end of 2023.

- Sustainable Packaging: The company aims for 100% renewable or recycled packaging by 2030.

Carlsberg's promotional strategy emphasizes global reach with localized impact, balancing iconic taglines with targeted activations. Their 2024 'curiosity' campaign spanned 120 markets, utilizing diverse media to foster engagement. This is further supported by significant investments in digital marketing and social media, aiming for direct consumer interaction and precise message delivery.

| Promotional Activity | Key Metrics/Data | Year |

| Global Campaign Reach | 120 markets | 2024 |

| European Festival Sponsorships | 15% increase vs. 2023 | 2024 |

| Female Consumer Participation (UK/Germany) | 10% uplift | 2025 |

Price

Carlsberg positions its beers as premium offerings, reflecting their quality and heritage, yet its pricing remains competitive within local markets. This dual approach ensures they attract consumers who value superior taste and brand reputation, while also remaining accessible to a broader audience. For example, in 2023, Carlsberg maintained strong market presence by balancing premium perceptions with pricing that allowed it to compete effectively against both global and local rivals, contributing to its overall revenue growth.

Carlsberg employs dynamic pricing, adapting to diverse global markets by considering local economies, consumer spending power, and competitor pricing. This approach ensures their offerings remain relevant and competitive across different regions, allowing for agile responses to market changes. Notably, Carlsberg reported price increases across all its main markets in the first quarter of 2024, reflecting this strategic adjustment.

Carlsberg employs a variety-based pricing strategy, a key component of its product line pricing. This means different beers within their extensive portfolio are priced differently based on factors like perceived quality, the cost of unique ingredients, and the specific consumer segment they aim to reach. For instance, their premium or craft offerings, often featuring more complex brewing processes or specialty malts, are positioned at a higher price point than their widely available standard lagers.

This tiered pricing structure is evident across Carlsberg's markets. In 2024, while a standard 500ml can of Carlsberg Pilsner might retail around €1.50 to €2.00 in many European countries, limited edition or seasonal brews, such as certain craft IPAs or barrel-aged stouts, could easily fetch prices between €3.00 and €5.00 for a similar volume. This strategy effectively segments the market, allowing them to capture value from different consumer preferences and willingness to pay.

Promotional and Discount Pricing

Carlsberg frequently utilizes promotional pricing, including seasonal discounts and bundle offers, to drive sales volume and attract new customers. For instance, in 2024, they continued their strategy of offering multi-pack discounts and limited-time promotions on popular brands like Carlsberg Pilsner and Tuborg to encourage trial and repeat purchases.

The company also employs loyalty program incentives, such as point-based rewards for frequent buyers, to foster customer retention. While striving for higher revenue per hectoliter, Carlsberg strategically uses tactics like free samples in new market entries to build brand awareness and secure initial market share, a tactic observed in their 2025 expansion efforts in select Asian markets.

- Seasonal Discounts: Offers on summer lagers and festive season packs are common.

- Bundle Offers: Promotions like buy-one-get-one-half-price on selected beer varieties.

- Loyalty Programs: Incentives for repeat purchases through partner apps or direct programs.

- New Market Entry: Free sampling campaigns to build initial brand presence.

Adaptation to Economic Factors and Cost Base

Carlsberg's pricing strategy is keenly attuned to economic shifts, factoring in elements like inflation, government taxes, and the general ability of consumers to spend. This dynamic approach ensures their products remain competitive and profitable even amidst economic uncertainty.

For 2024, Carlsberg foresaw a continued rise in its overall cost base, even as inflation showed signs of easing. This projected cost increase necessitates strategic price adjustments to safeguard the company's profit margins and financial health.

- Inflationary Impact: Carlsberg actively monitors inflation rates to inform pricing decisions.

- Tax Considerations: Changes in excise duties and other taxes directly influence product pricing.

- Cost Base Management: Anticipated cost increases in 2024, estimated to impact the total cost base, require pricing recalibration.

- Profitability Preservation: Price adjustments are essential to offset rising costs and maintain healthy profit margins.

Carlsberg's pricing strategy is a sophisticated balancing act, aiming for premium perception while maintaining market competitiveness. They leverage dynamic pricing, adjusting for local economic conditions and consumer spending power, as evidenced by price increases across main markets in Q1 2024. Their variety-based approach means premium or craft beers command higher prices than standard lagers, reflecting ingredient costs and target segments.

Promotional pricing, including bundle offers and loyalty programs, is a key tactic for driving volume and retention. For example, multi-pack discounts on popular brands were a continued strategy in 2024. Carlsberg also strategically uses free sampling in new markets, like select Asian markets in 2025, to build initial awareness.

The company's pricing is also sensitive to economic factors like inflation and taxes. Carlsberg anticipated a rising cost base in 2024, necessitating price adjustments to protect profit margins. This proactive approach ensures financial health amidst economic fluctuations.

| Pricing Tactic | 2024/2025 Relevance | Example |

|---|---|---|

| Dynamic Pricing | Adapting to local economies and competition. | Q1 2024 price increases across main markets. |

| Variety-Based Pricing | Tiered pricing for premium vs. standard offerings. | Craft IPAs priced higher than standard lagers. |

| Promotional Pricing | Driving sales volume and customer loyalty. | Multi-pack discounts and loyalty program incentives. |

| New Market Entry | Building brand awareness and initial share. | Free sampling in select Asian markets (2025). |

4P's Marketing Mix Analysis Data Sources

Our Carlsberg 4P's Marketing Mix Analysis is grounded in a comprehensive review of company disclosures, including annual reports and investor presentations. We also incorporate insights from industry reports, competitor analyses, and publicly available data on pricing and distribution channels.