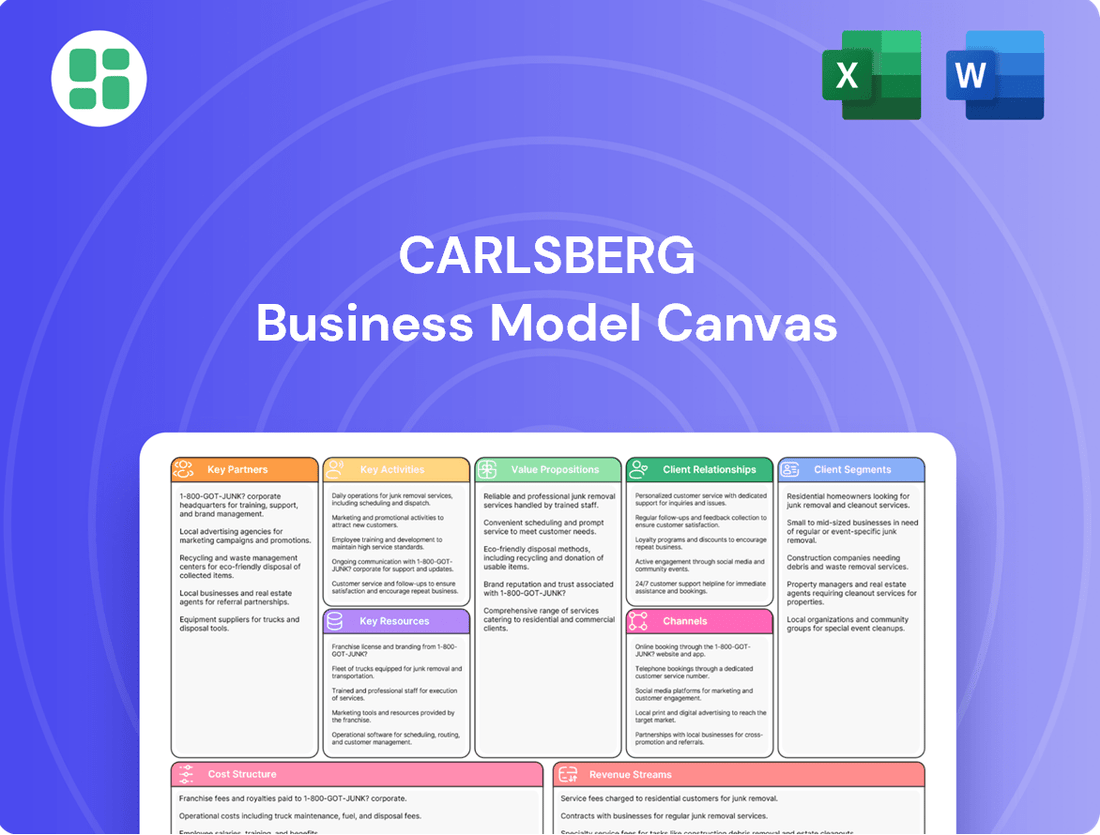

Carlsberg Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carlsberg Bundle

Unlock the strategic genius behind Carlsberg's enduring success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Ideal for anyone looking to replicate or adapt proven business strategies.

Partnerships

Carlsberg actively cultivates strategic distribution alliances with numerous third-party distributors and logistics firms worldwide. These collaborations are vital for achieving efficient market penetration and ensuring broad product availability across diverse geographical landscapes, particularly in regions where direct distribution channels are impractical or economically unviable.

A significant aspect of Carlsberg's partnership strategy involves expanding its global collaboration with PepsiCo, notably through bottling franchises in emerging markets. This move is designed to leverage PepsiCo's established distribution networks and local market expertise, thereby accelerating Carlsberg's reach and sales in these key growth areas.

Carlsberg's success hinges on its key partnerships with raw material suppliers, who provide essential brewing ingredients like malt, hops, yeast, and water. These relationships are crucial for ensuring consistent quality and a stable supply chain. For example, Carlsberg is actively securing barley grown using regenerative farming practices, with these sustainable ingredients slated for use starting in 2025, demonstrating a commitment to both quality and environmental responsibility.

Carlsberg collaborates with a wide spectrum of retail partners, encompassing supermarkets, convenience stores, and specialized liquor outlets. These partnerships are crucial for reaching consumers directly and driving sales of their extensive beer and beverage range.

The company also maintains strong ties with on-trade partners, including bars, restaurants, and hotels, which serve as vital points of consumer experience and consumption. In 2024, Carlsberg continued to emphasize building deeper engagement and loyalty with both customers and end-consumers across these diverse channels.

Licensing and Joint Venture Partners

Carlsberg actively pursues licensing and joint venture agreements with local entities to expand its global reach. These partnerships are crucial for navigating diverse regulatory landscapes and consumer preferences in new territories. For example, in 2023, Carlsberg continued to optimize its portfolio through strategic moves, such as the full acquisition of its Indian and Nepalese joint ventures, demonstrating a commitment to consolidating operations and increasing control in key growth markets.

These collaborations allow Carlsberg to leverage established local distribution networks and brand recognition, significantly reducing market entry barriers. By partnering, Carlsberg can efficiently produce and distribute its international brands alongside locally relevant offerings. This approach proved effective in markets where local expertise is paramount for success.

Key aspects of these partnerships include:

- Leveraging Local Expertise: Gaining insights into consumer behavior and market dynamics through local partners.

- Distribution Network Access: Utilizing existing infrastructure for efficient product delivery.

- Brand Portfolio Expansion: Offering a mix of global and local brands tailored to specific markets.

- Risk Sharing: Mitigating financial and operational risks through collaborative ventures.

Technology and Innovation Collaborators

Carlsberg actively partners with technology providers and leading research institutions to spearhead innovation across its operations. These collaborations are crucial for advancing brewing techniques, developing cutting-edge packaging, and implementing robust sustainability strategies. For instance, in 2024, Carlsberg continued its focus on digital transformation, leveraging partnerships to enhance supply chain visibility and optimize production processes.

These strategic alliances enable Carlsberg to boost operational efficiency and introduce novel products tailored to shifting consumer preferences. A key area of focus in 2024 has been the integration of advanced analytics and AI to refine product development cycles and personalize consumer engagement.

- Technology Providers: Collaborations with companies specializing in automation, data analytics, and IoT solutions to improve brewing efficiency and quality control.

- Research Institutions: Partnerships with universities and scientific bodies to explore new fermentation techniques, sustainable ingredient sourcing, and advanced packaging materials.

- Sustainability Focus: Joint projects aimed at reducing water consumption, lowering carbon emissions, and developing circular economy solutions for packaging.

- Digital Transformation: Alliances to implement AI, machine learning, and blockchain for supply chain optimization, consumer insights, and enhanced operational management.

Carlsberg's key partnerships are foundational to its global operations, enabling market access, innovation, and supply chain resilience. These collaborations span distribution, raw material sourcing, retail and on-trade engagement, and technology development. By leveraging these alliances, Carlsberg effectively navigates diverse markets and enhances its product offerings.

In 2024, Carlsberg continued to strengthen its ties with raw material suppliers, with a particular emphasis on sustainable sourcing. For instance, the company is increasing its use of barley grown using regenerative farming practices, with these ingredients scheduled for wider use from 2025 onwards. This commitment underscores a dual focus on ingredient quality and environmental stewardship.

The company's strategic alliances with technology providers and research institutions are critical for driving innovation. These partnerships focus on improving brewing techniques, developing advanced packaging solutions, and implementing robust sustainability strategies. In 2024, Carlsberg's digital transformation efforts included leveraging these collaborations to enhance supply chain visibility and optimize production processes.

| Partner Type | Example/Focus Area | 2024/2025 Relevance |

|---|---|---|

| Distributors & Logistics | Third-party firms worldwide | Ensuring efficient market penetration and product availability. |

| Bottling Franchises | PepsiCo in emerging markets | Leveraging established networks for accelerated market reach. |

| Raw Material Suppliers | Malt, hops, yeast, water providers | Securing quality ingredients; increased use of regenerative barley from 2025. |

| Retail & On-Trade Partners | Supermarkets, bars, restaurants | Driving sales and consumer engagement across diverse channels. |

| Technology & Research | AI, automation, universities | Enhancing brewing, sustainability, and digital transformation. |

What is included in the product

A strategic overview of Carlsberg's business model, detailing its key customer segments, value propositions, and revenue streams.

This model outlines Carlsberg's operational structure, key resources, and cost drivers, reflecting its global brewing and beverage operations.

Provides a structured framework to identify and address inefficiencies in Carlsberg's operations, streamlining strategic planning.

Simplifies complex strategic elements into a clear, actionable format, reducing confusion and facilitating focused decision-making.

Activities

Carlsberg's core activity revolves around the large-scale brewing, fermentation, and packaging of a diverse portfolio of beer, cider, and soft drink products. This intricate process demands rigorous quality control at every stage, from sourcing raw materials to the final packaged goods. The company operates a vast network of 70 breweries across the globe as of late 2024, underscoring the immense scale of its production operations.

Carlsberg's brand management and marketing efforts are central to its strategy, focusing on building strong connections with consumers. In 2024, the company continued to invest in its diverse portfolio, which includes well-known international names like Carlsberg and Tuborg, alongside a growing number of local craft and specialty beers. This dual approach allows them to cater to a wide range of tastes and preferences across different markets.

The company's marketing campaigns are designed to enhance brand equity and cultivate lasting consumer loyalty. This includes significant investments in sponsorships, particularly in the sports arena, which proved effective in 2024. For instance, new football sponsorships helped increase visibility and engagement, driving both brand awareness and sales volume. Digital engagement also plays a crucial role, with targeted online promotions and social media interactions designed to resonate with younger demographics.

Carlsberg's distribution and logistics involve the crucial task of getting their beverages from breweries to customers efficiently. This means managing warehouses, transportation, and inventory to ensure products arrive fresh and on time. In 2024, Carlsberg continued to optimize its global supply chain, a complex operation for a company with breweries and markets spanning numerous countries.

The company leverages its extensive network to maintain product quality and availability. This includes strategic warehousing and transportation solutions designed to minimize lead times and costs. For instance, their focus on supply chain efficiencies aims to reduce waste and improve delivery speed, a key factor in the competitive beverage market.

Research and Development

Carlsberg's commitment to Research and Development is central to its strategy, driving continuous innovation across its product portfolio and operational processes. This focus ensures the company remains competitive by exploring novel ingredients, refining brewing techniques, and pioneering advancements in sustainable practices. A significant portion of their R&D efforts in 2024 and leading up to July 2025 is directed towards premium and alcohol-free product segments, reflecting evolving consumer preferences.

The company actively invests in developing environmentally friendly production methods and packaging solutions. This includes research into reducing water consumption, optimizing energy efficiency in breweries, and exploring sustainable materials for packaging to minimize environmental impact. For instance, Carlsberg has been a leader in trialing and implementing innovations like the Snap Pack and paper bottle prototypes, aiming to significantly reduce plastic waste.

- Product Innovation: Development of new beer varieties, including craft and specialty brews, alongside a strong emphasis on expanding their alcohol-free and low-alcohol offerings to cater to health-conscious consumers.

- Brewing Technology: Research into advanced fermentation processes, yeast strains, and ingredient sourcing to enhance flavor profiles, improve consistency, and optimize production efficiency.

- Sustainability Initiatives: Focus on reducing carbon footprint, water usage, and waste generation throughout the value chain, including packaging material innovation and circular economy principles.

- Digitalization in R&D: Leveraging data analytics and AI to accelerate product development cycles, predict consumer trends, and optimize brewing parameters for quality and efficiency.

Sales and Customer Relationship Management

Carlsberg's sales and customer relationship management are heavily focused on cultivating robust partnerships with retailers, distributors, and on-trade establishments. This involves actively engaging these crucial B2B clients to secure product listings, negotiate favorable terms, and deliver consistent support. The company's strategy hinges on ensuring widespread product availability and prominent market visibility, a goal bolstered by significant investments in its sales and marketing infrastructure.

In 2023, Carlsberg reported that its commercial activities, including sales and marketing, were a key driver of its performance. For instance, the company's focus on premiumization and innovation in markets like Germany and France contributed to volume growth in those regions, demonstrating the direct impact of strong customer relationships and targeted sales efforts.

- Retailer Engagement: Direct interaction with retail chains to ensure optimal shelf placement and promotional activities.

- Distributor Partnerships: Collaborating with distributors to manage inventory, logistics, and market penetration effectively.

- On-Trade Support: Providing resources and marketing assistance to pubs, bars, and restaurants to drive sales of Carlsberg brands.

- Sales Force Effectiveness: Investing in training and tools for the sales team to enhance customer interactions and achieve sales targets.

Carlsberg's key activities are centered on its extensive brewing operations, encompassing the entire production cycle from sourcing raw materials to final packaging. This is supported by robust brand management and marketing, aimed at fostering consumer loyalty through diverse product portfolios and strategic sponsorships. Furthermore, efficient distribution and logistics are critical for ensuring product availability, while continuous investment in R&D drives innovation in both products and sustainable practices.

Full Version Awaits

Business Model Canvas

The Carlsberg Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered to you, ensuring no surprises. Once your order is complete, you'll gain full access to this comprehensive analysis, ready for your strategic planning.

Resources

Carlsberg's brand portfolio is a critical asset, featuring global powerhouses like Carlsberg and Tuborg, alongside a robust collection of strong local brands. This diversity is a significant driver of consumer loyalty and market penetration worldwide.

The company's strategic focus on premium and alcohol-free offerings is yielding positive results. For instance, in 2023, Carlsberg reported that its premium brands experienced a notable increase in sales, contributing to overall revenue growth.

This extensive intellectual property translates directly into market value and competitive advantage. The recognition and trust associated with these brands allow Carlsberg to command premium pricing and maintain market share even in competitive segments.

Carlsberg's extensive brewing facilities and infrastructure are its operational core, encompassing a global network of 70 breweries, production plants, and distribution centers. This vast physical asset base is fundamental to efficiently manufacturing and delivering its diverse portfolio of beverages to consumers worldwide.

Carlsberg's human capital is a cornerstone of its business, with over 30,000 employees globally. This workforce includes highly skilled master brewers, innovative marketing specialists, efficient supply chain experts, and dedicated sales teams. Their collective knowledge and expertise are critical for driving innovation in product development and ensuring operational excellence across the company.

The company actively focuses on engaging and motivating its workforce, recognizing that human capital is a key driver of competitive advantage. In 2023, Carlsberg reported a strong commitment to employee development and well-being, which directly translates into enhanced market execution and customer engagement. This investment in people underpins their ability to adapt to evolving market demands and maintain high standards of quality.

Distribution Networks and Logistics Systems

Carlsberg relies on a robust global and local distribution network, encompassing warehouses, its own transport fleet, and advanced IT systems to guarantee efficient product delivery. This logistical prowess is fundamental to its market penetration and customer satisfaction, with continuous investments aimed at enhancing supply chain efficiency.

In 2023, Carlsberg reported that its supply chain operations were a significant focus, with efforts to optimize inventory management and transportation routes. The company’s investment in technology plays a crucial role in tracking products from production to the point of sale, ensuring freshness and availability.

- Global Reach: Carlsberg’s distribution network spans over 150 markets worldwide, ensuring its products are accessible to a broad consumer base.

- Logistical Efficiency: Investments in advanced IT systems and fleet management in 2023 aimed to reduce delivery times and transportation costs.

- Warehouse Infrastructure: The company maintains a network of strategically located warehouses to support efficient inventory management and timely order fulfillment.

- Sustainability Focus: Carlsberg is increasingly integrating sustainable practices into its logistics, exploring lower-emission transport options and optimizing packaging for reduced environmental impact.

Financial Capital and Market Access

Carlsberg requires substantial financial capital to fuel its operations and growth. This includes significant investments in upgrading and expanding its production facilities, a crucial aspect of maintaining efficiency and capacity. In 2023, Carlsberg reported capital expenditures of DKK 5.3 billion, primarily directed towards these areas, demonstrating a commitment to modernizing its infrastructure.

Access to capital markets is vital for Carlsberg to execute its strategic objectives. This allows the company to secure funding for large-scale projects, including potential acquisitions that could enhance its market presence or product portfolio. The company's consistent focus on capital allocation principles, such as share buy-back programs, highlights its strategy to return value to shareholders while also reinvesting in the business.

Carlsberg's financial strategy is designed to support sustained growth and competitive advantage. By effectively managing its financial resources and accessing capital when needed, the company can pursue innovation in research and development and strengthen its global marketing efforts. This financial flexibility is key to navigating the dynamic beverage industry and achieving long-term success.

- Capital Expenditures: DKK 5.3 billion in 2023, focused on production facilities.

- Strategic Funding: Access to capital markets for growth initiatives and acquisitions.

- Shareholder Value: Utilization of share buy-back programs as part of capital allocation.

- Financial Flexibility: Essential for R&D investment and marketing expansion.

Carlsberg's intellectual property is a significant asset, encompassing a vast array of patents, trademarks, and proprietary brewing techniques. This intellectual capital underpins the quality and distinctiveness of its products, providing a strong competitive edge in the global market.

The company actively protects and leverages its intellectual property through strategic brand management and ongoing innovation. This focus ensures that its brands remain recognizable and trusted by consumers, contributing to sustained market leadership and premium positioning.

Carlsberg's commitment to innovation is evident in its continuous investment in research and development. This dedication allows the company to introduce new products, improve existing ones, and explore novel brewing processes, thereby maintaining its relevance and appeal in a dynamic industry.

Value Propositions

Carlsberg’s diverse portfolio of quality beverages is a cornerstone of its business model, offering consumers a broad spectrum of choices. This includes everything from globally recognized premium lagers and popular local brews to innovative craft beers and a growing selection of non-alcoholic options.

This variety directly addresses a wide array of consumer preferences and occasions, ensuring broad market appeal. Notably, in 2023, Carlsberg saw strong performance in its alcohol-free brews, with sales increasing by 15%, and premium beers also experienced a robust 10% growth, highlighting the success of this strategic offering.

Carlsberg's strong brand heritage, dating back to 1847, fosters deep consumer trust and loyalty. This long-standing reputation for brewing excellence and consistent quality, exemplified by brands like Carlsberg Pilsner and Tuborg, sets it apart in a crowded beverage market. In 2023, Carlsberg continued to leverage this heritage, with its premium brands contributing significantly to its overall sales performance.

Carlsberg's global availability is a cornerstone of its business model, ensuring its diverse portfolio of beverages reaches consumers across numerous markets. This extensive reach is facilitated by a robust distribution network and strategic partnerships, making it easy for customers to find their favorite Carlsberg brands, from the flagship Carlsberg Pilsner to local specialties.

In 2024, Carlsberg's commitment to accessibility was evident in its presence in over 140 markets globally. This broad market penetration is supported by strong relationships with distributors and retailers, allowing for efficient product placement and consumer access, a key factor in maintaining market share and driving sales volume.

Commitment to Sustainability

Carlsberg's commitment to sustainability, particularly through its 'Together Towards ZERO and Beyond' program, resonates strongly with consumers and business partners who prioritize environmental responsibility. This dedication translates into tangible value by fostering a positive brand image and demonstrating concrete progress toward global sustainability objectives.

The company's focus on sustainable brewing practices isn't just about environmental stewardship; it's a strategic advantage. For instance, by 2022, Carlsberg had achieved a 54% reduction in CO2 emissions from its breweries compared to a 2015 baseline, showcasing a significant step towards their ambitious targets. This commitment also extends to water replenishment efforts, aiming to replenish 100% of water used in their breweries by 2030.

- Reduced Carbon Footprint: Carlsberg's breweries achieved a 54% reduction in CO2 emissions by 2022, a key metric for environmentally conscious stakeholders.

- Water Stewardship: The company aims to replenish 100% of water used in its breweries by 2030, addressing water scarcity concerns.

- Brand Reputation Enhancement: Sustainable practices bolster brand loyalty and attract partners aligned with environmental, social, and governance (ESG) principles.

- Alignment with Global Goals: Carlsberg's initiatives directly contribute to achieving UN Sustainable Development Goals, enhancing its societal license to operate.

Innovation in Product and Experience

Carlsberg consistently drives innovation, launching new flavors and packaging to align with shifting consumer preferences. This commitment ensures brand relevance and provides consumers with fresh beverage options, exemplified by their digital transformation initiatives and recent product introductions.

The company’s dedication to innovation is evident in its approach to enhancing the consumer experience. By exploring new formats and digital touchpoints, Carlsberg aims to offer novel and engaging choices, keeping pace with evolving market demands.

- Product Innovation: Introduction of new beer varieties and limited editions catering to diverse tastes.

- Packaging Innovation: Development of sustainable and convenient packaging solutions.

- Experiential Innovation: Leveraging digital platforms to enhance consumer engagement and brand interaction.

- Market Responsiveness: Adapting product portfolios based on emerging consumer trends and market feedback.

Carlsberg's value proposition centers on delivering a diverse and high-quality beverage portfolio, catering to a wide range of consumer tastes and occasions. This includes globally recognized premium lagers, popular local brews, and a growing selection of alcohol-free options, ensuring broad market appeal. In 2023, the company saw significant growth in its alcohol-free segment, with sales up 15%, and premium beers also performed strongly with 10% growth.

The company leverages its strong brand heritage, dating back to 1847, to build deep consumer trust and loyalty, exemplified by brands like Carlsberg Pilsner and Tuborg. This long-standing reputation for brewing excellence and consistent quality sets it apart in the competitive beverage market. Carlsberg's global presence, reaching over 140 markets in 2024, is supported by a robust distribution network, ensuring accessibility for consumers worldwide.

Furthermore, Carlsberg's commitment to sustainability, particularly through its 'Together Towards ZERO and Beyond' program, enhances its brand image and attracts environmentally conscious consumers and partners. By 2022, Carlsberg achieved a 54% reduction in CO2 emissions from its breweries, demonstrating tangible progress in its environmental stewardship and alignment with global sustainability goals.

Innovation is another key pillar, with Carlsberg consistently launching new flavors and packaging to meet evolving consumer preferences and enhance the overall consumer experience. This includes exploring new formats and digital touchpoints to keep pace with market demands.

| Value Proposition | Description | Supporting Data (2023/2024) |

|---|---|---|

| Diverse & Quality Beverage Portfolio | Offering a wide range of premium lagers, local brews, and alcohol-free options. | 15% sales growth in alcohol-free brews; 10% growth in premium beers. |

| Strong Brand Heritage & Trust | Leveraging a long-standing reputation for brewing excellence and consistent quality. | Brands like Carlsberg Pilsner and Tuborg continue to drive sales performance. |

| Global Accessibility | Ensuring broad market reach through an extensive distribution network. | Presence in over 140 markets globally in 2024. |

| Commitment to Sustainability | Driving environmental responsibility through programs like 'Together Towards ZERO and Beyond'. | 54% reduction in CO2 emissions by 2022; Aim to replenish 100% of water used by 2030. |

| Continuous Innovation | Launching new flavors, packaging, and digital experiences to meet consumer trends. | Ongoing development of new product varieties and sustainable packaging solutions. |

Customer Relationships

Carlsberg cultivates strong customer relationships by building brand communities through engaging campaigns and active social media presence. For instance, in 2024, their "Probably the Best Beer in the World" tagline continued to be a cornerstone of their marketing, fostering a sense of shared experience among consumers.

Events and strategic sports sponsorships, like their long-standing partnership with the UEFA European Championship, create shared moments and deepen emotional connections. This direct engagement aims to transform customers into loyal brand advocates, moving beyond transactional relationships.

For its B2B partners, including retailers, wholesalers, and on-trade establishments, Carlsberg implements a strategy of dedicated key account management. These specialized teams are tasked with providing personalized support, streamlining order processes, and offering expert merchandising guidance.

This focused approach aims to cultivate robust business relationships and ensure efficient execution of market strategies. For instance, in 2024, Carlsberg reported significant growth in its B2B segment, partly attributed to enhanced account management services that helped partners optimize their beverage offerings and promotions.

Carlsberg prioritizes responsive customer service through various channels, ensuring prompt handling of inquiries, feedback, and issue resolution for consumers and business partners alike. This commitment to efficient support directly contributes to fostering strong, lasting relationships and enhancing overall stakeholder value.

Partnerships for Growth with Distributors

Carlsberg cultivates robust partnerships with its distributors, viewing them as crucial allies for expanding market reach. These collaborations involve tailored incentive programs, comprehensive marketing support, and joint strategic planning sessions aimed at boosting sales and brand presence.

These strategic alliances are fundamental to Carlsberg's growth objectives, enabling efficient product distribution and deeper penetration into diverse markets. For instance, in 2024, Carlsberg continued to invest in distributor training and digital tools to enhance their operational capabilities and market responsiveness.

- Distributor Incentives: Programs designed to reward high performance and volume sales, fostering a competitive spirit among partners.

- Marketing Support: Provision of co-branded marketing materials, digital advertising campaigns, and local event sponsorships to drive consumer demand.

- Strategic Planning: Collaborative development of regional sales targets, promotional calendars, and inventory management strategies to optimize supply chain efficiency.

- Market Penetration: Focus on expanding distribution networks in emerging markets and strengthening presence in established territories through joint efforts.

Digital Engagement and Personalization

Carlsberg is actively enhancing its customer relationships through digital engagement and personalization. By leveraging digital platforms and sophisticated data analytics, the company strives to deliver marketing messages and offers that resonate deeply with individual consumers.

This strategy is designed to significantly boost relevance and engagement by tailoring experiences to specific preferences, thereby advancing Carlsberg's overall digital transformation efforts.

- Digital Platforms: Carlsberg utilizes its own digital channels and partnerships to connect with consumers.

- Data Analytics: Advanced analytics are employed to understand consumer behavior and preferences.

- Personalized Offers: Marketing messages and promotions are customized based on individual data insights.

- Enhanced Engagement: This approach aims to create more meaningful interactions and build stronger brand loyalty.

Carlsberg fosters deep customer connections through community building and personalized digital experiences. In 2024, their continued investment in social media engagement and targeted digital campaigns aimed to create a sense of belonging among consumers, reinforcing brand loyalty.

Their strategy extends to B2B partners, with dedicated key account management providing tailored support and merchandising advice, crucial for optimizing retail presence. This focus on partner success was reflected in 2024’s B2B segment growth, underscoring the effectiveness of these relationships.

Carlsberg also strengthens relationships with distributors through collaborative planning and incentive programs. In 2024, the company enhanced distributor training and digital tools to improve market responsiveness and sales execution.

| Relationship Type | Key Activities | 2024 Impact/Focus |

| Consumers | Brand communities, social media, events, digital personalization | Enhanced engagement, loyalty programs |

| B2B Partners (Retailers, Wholesalers) | Key account management, merchandising support, streamlined orders | B2B segment growth, optimized offerings |

| Distributors | Incentives, marketing support, joint planning, training | Market penetration, operational efficiency |

Channels

Retail supermarkets and hypermarkets are a cornerstone of Carlsberg's distribution strategy, ensuring its extensive product range, from core beers like Carlsberg Pilsner to specialty brews and soft drinks, reaches a broad consumer base. This channel is vital for driving high-volume sales and maintaining strong brand presence across numerous markets.

In 2024, the grocery retail sector continued its dynamic evolution, with major supermarket chains playing a crucial role in consumer purchasing habits. For Carlsberg, these partnerships are essential for visibility and accessibility, directly impacting sales figures for its flagship brands and newer product innovations, contributing significantly to overall revenue generation.

Carlsberg's extensive network within the on-trade sector, encompassing bars, restaurants, cafes, and hotels, forms a cornerstone of its distribution strategy. This channel is vital for driving organic volume growth, particularly for premium brands, as it facilitates consumption in social environments and directly influences consumer perception.

In 2024, the on-trade segment continued to be a significant contributor to Carlsberg's revenue, reflecting the ongoing recovery and resilience of the hospitality industry post-pandemic. For instance, in Q1 2024, Carlsberg reported a 6% increase in total sales volume, with a notable portion of this growth attributed to the strong performance in European markets where on-trade channels are particularly robust.

Convenience stores and local shops are vital for Carlsberg, offering immediate access to their beverages for on-the-go consumers. These smaller outlets are crucial for broad market penetration, particularly in densely populated urban areas and local neighborhoods, acting as a complementary channel to larger supermarkets and hypermarkets.

In 2024, the convenience store sector continued to be a significant sales driver for alcoholic beverages. For instance, in the UK, convenience stores accounted for a substantial portion of off-trade beer sales, with reports indicating growth in this segment. This accessibility ensures Carlsberg's products are readily available for impulse buys and immediate consumption, boosting sales volume.

E-commerce Platforms and Direct-to-Consumer (DTC) Initiatives

Carlsberg is actively expanding its presence on e-commerce platforms, both through its proprietary sites and partnerships with established online retailers, to directly connect with consumers. This strategic move enhances accessibility and convenience for customers, simultaneously creating new revenue streams and fostering direct interaction, a key component of their ongoing digital transformation. In 2023, Carlsberg reported a significant increase in online sales, contributing to a broader shift in consumer purchasing habits towards digital channels.

These direct-to-consumer (DTC) initiatives allow Carlsberg to gather valuable customer data, enabling more personalized marketing efforts and a deeper understanding of consumer preferences. This direct engagement is crucial for building brand loyalty and refining product offerings in a competitive market. For instance, their investment in digital infrastructure has seen a notable uptick in customer acquisition through online channels.

Carlsberg's e-commerce strategy is multifaceted, encompassing:

- Direct Sales via Brand Websites: Offering a curated selection of products and exclusive bundles directly to consumers.

- Partnerships with Online Retailers: Leveraging the reach of major e-commerce players to broaden market access.

- Subscription Services: Exploring recurring delivery models for loyal customers, enhancing customer lifetime value.

- Digital Marketing Integration: Utilizing online advertising and social media to drive traffic and conversions on e-commerce platforms.

Wholesalers and Independent Distributors

Carlsberg leverages a robust network of wholesalers and independent distributors to penetrate diverse and often fragmented markets, particularly reaching smaller retail outlets and on-trade establishments. These partnerships are crucial for expanding Carlsberg's market presence beyond what its direct sales force can manage, especially across its extensive international operations.

This distribution strategy is essential for ensuring product availability and visibility in numerous local markets. For instance, in 2023, Carlsberg’s total revenue reached DKK 73.5 billion, a significant portion of which is attributable to sales facilitated through these indirect channels, highlighting their commercial importance.

- Market Reach: Wholesalers and independent distributors are key to accessing a vast number of smaller, independent customers.

- Logistical Support: They often handle local warehousing and delivery, reducing Carlsberg's direct logistical burden.

- Market Intelligence: These partners provide valuable on-the-ground insights into local consumer preferences and competitive dynamics.

- Sales Volume: In 2023, Carlsberg reported a 5.1% volume growth in Western Europe, driven in part by effective distribution through these partners.

Carlsberg's e-commerce channels are increasingly important for direct consumer engagement and sales. This includes their own brand websites and partnerships with online retailers, aiming to capture a growing segment of digitally-native consumers and facilitate convenient purchasing. These digital avenues are crucial for data collection and personalized marketing efforts.

In 2023, Carlsberg saw a substantial uplift in online sales, reflecting a broader consumer shift towards digital purchasing. This trend is expected to continue in 2024, with e-commerce becoming a more significant contributor to overall revenue and brand interaction, especially for specialty products and direct-to-consumer offerings.

Customer Segments

Carlsberg's mass market consumers are adults of legal drinking age who enjoy beer and other beverages for social gatherings, relaxation, and celebrations. This is their largest customer base, reached through extensive distribution networks and broad marketing campaigns that highlight value and accessibility.

In 2024, the global beer market was valued at over $700 billion, with Western Europe, a key market for Carlsberg, representing a significant portion of this. Carlsberg's strategy focuses on catering to diverse tastes within this segment, offering a wide array of alcoholic and non-alcoholic options to capture a substantial share of this vast market.

Premium and craft beer enthusiasts represent a significant growth area for Carlsberg. This segment actively seeks out higher-quality, distinctive, and specialty brews, demonstrating a willingness to invest more for a superior taste experience.

Carlsberg effectively addresses this demand through its robust portfolio of premium international brands and its increasing investment in craft beer offerings. The company has noted strong organic growth within its craft beer segment, indicating successful penetration and appeal to these discerning consumers.

HoReCa businesses, including hotels, restaurants, and cafes, are key partners for Carlsberg, representing a significant channel for on-premise beverage consumption. These establishments rely on a consistent and reliable supply of Carlsberg's diverse product portfolio, often requiring tailored product ranges to suit their specific customer base and brand identity.

Carlsberg's engagement with the HoReCa sector is vital for building brand presence and driving sales, particularly in social environments where consumers experience beverages firsthand. In 2024, the European HoReCa sector continued its recovery, with many markets seeing pre-pandemic sales levels return, underscoring the importance of these partners for beverage companies.

Beyond product supply, Carlsberg often provides marketing support and collaborative initiatives to these businesses, aiming to enhance the overall customer experience and drive foot traffic. This partnership model is crucial for maintaining brand visibility and loyalty within the competitive on-trade market.

Retailers (Supermarkets, Convenience Stores)

Retailers, such as supermarkets and convenience stores, are key business customers for Carlsberg. They buy Carlsberg products with the intention of selling them to everyday consumers. These partners are vital for reaching the end market.

Carlsberg focuses on ensuring a consistent and dependable supply chain for these retailers. They also work to offer competitive pricing to help these businesses remain profitable. Furthermore, Carlsberg provides merchandising support to help showcase their products effectively in stores.

- Distribution Channel: Retailers are a primary channel for Carlsberg's products to reach consumers.

- Customer Needs: They require reliable product availability, attractive pricing, and in-store promotional assistance.

- Market Share Impact: In 2024, Carlsberg maintained a significant presence in key European markets, with its brands featuring prominently on supermarket shelves, contributing to its overall revenue.

- Sales Volume: The volume of sales through these retail partners is a critical indicator of Carlsberg's market penetration and consumer demand.

International Licensees and Joint Venture Partners

International licensees and joint venture partners are crucial B2B customers for Carlsberg, allowing for localized brand production and distribution across diverse geographies. These strategic alliances are fundamental to the company's global growth strategy, enabling market penetration through established local expertise and infrastructure. For instance, Carlsberg's partnerships in Asia, a key growth region, leverage local market knowledge to navigate regulatory environments and consumer preferences effectively. In 2023, Carlsberg's international operations, heavily reliant on such partnerships, contributed significantly to its overall revenue, with emerging markets showing particularly strong performance.

These collaborations are not merely about brand extension; they represent a shared commitment to market development and operational efficiency. By engaging with companies that possess deep understanding of their respective markets, Carlsberg can optimize its supply chains and marketing efforts. This approach is exemplified by the success of bottling franchise expansions, similar to PepsiCo's model, where local partners manage production and distribution, ensuring product availability and quality. Such ventures allow Carlsberg to tap into new customer segments and increase its market share without the full capital expenditure of establishing wholly-owned subsidiaries in every region.

- Strategic B2B Customers: Companies in specific geographies that license Carlsberg's brands or partner in joint ventures.

- Global Expansion Driver: Vital for market penetration and increasing global brand presence.

- Local Expertise Leverage: Partners provide essential knowledge of local regulations, consumer preferences, and distribution networks.

- Revenue Contribution: International operations, including those through partnerships, are a significant part of Carlsberg's overall financial performance, with emerging markets showing robust growth in recent years.

Carlsberg serves a broad spectrum of customers, from everyday beer drinkers to sophisticated craft enthusiasts and crucial business partners. This diverse customer base necessitates a multi-faceted approach to product development, marketing, and distribution, ensuring relevance and appeal across different segments.

The company's strategy acknowledges the varying needs and preferences within each segment, aiming to capture market share by offering value, quality, and unique experiences. In 2024, the global beverage market continued to show resilience, with beer remaining a dominant category, underscoring the importance of effectively engaging these distinct customer groups.

| Customer Segment | Description | 2024 Market Context/Carlsberg's Strategy |

|---|---|---|

| Mass Market Consumers | Adults of legal drinking age seeking accessible and enjoyable beverages for social occasions. | Largest segment; Carlsberg focuses on broad distribution and value-driven marketing. Global beer market exceeded $700 billion in 2024. |

| Premium & Craft Beer Enthusiasts | Consumers seeking higher quality, distinctive, and specialty brews, willing to pay a premium. | Growth area; Carlsberg invests in premium international brands and craft offerings, noting strong organic growth. |

| HoReCa (Hotels, Restaurants, Cafes) | Businesses providing on-premise consumption, requiring reliable supply and tailored product ranges. | Key channel for brand presence; European HoReCa sector recovery in 2024 boosted on-premise sales. |

| Retailers (Supermarkets, Convenience Stores) | Businesses purchasing for resale to end consumers, requiring consistent supply and promotional support. | Vital for reaching consumers; Carlsberg ensures dependable supply and offers merchandising support. Significant shelf presence in European retail in 2024. |

| International Licensees & JV Partners | B2B partners enabling localized production and distribution in diverse global markets. | Crucial for global expansion and market penetration, leveraging local expertise. Emerging markets showed robust growth in 2023/2024. |

Cost Structure

Carlsberg's cost structure is heavily influenced by raw material and production expenses. Key ingredients such as malt, hops, and water represent significant outlays, fluctuating with market prices and availability. For instance, global barley prices, a primary component of malt, saw volatility in 2024 due to weather patterns impacting harvests in major producing regions.

Beyond raw materials, the energy required for brewing, packaging, and distribution forms a substantial part of production costs. Labor expenses for skilled brewery workers and maintenance staff are also critical. In 2024, Carlsberg continued its focus on optimizing these variable costs through supply chain efficiencies and investments in energy-saving technologies across its breweries to mitigate rising energy prices.

Carlsberg dedicates significant resources to marketing and sales, encompassing advertising campaigns, promotional events, and strategic sponsorships to bolster brand recognition and stimulate demand. These expenditures are vital for preserving market position and competitive edge, with a notable increase in commercial investments anticipated as part of their Accelerate SAIL strategy.

Distribution and logistics represent a significant portion of Carlsberg's expenses. These costs encompass warehousing, the transportation of goods via various shipping methods, fuel, and the upkeep of their delivery fleets. In 2024, Carlsberg, like many in the beverage industry, continued to focus on optimizing these operations to mitigate rising fuel prices and supply chain complexities.

Personnel and Administrative Costs

Personnel and administrative costs are a major component of Carlsberg's fixed expenses. These include salaries, benefits, and the overhead associated with managing a global workforce. In 2023, Carlsberg reported €2,439 million in selling, general, and administrative expenses, which encompasses these personnel and administrative outlays. This significant expenditure underpins the company's operational capacity and strategic execution across all its functions, from human resources and finance to legal and research and development.

These costs are crucial for maintaining the company's global presence and operational efficiency. They directly influence the overall operating profit by representing a substantial, ongoing financial commitment. For example, the administrative overhead supports vital functions that ensure compliance, manage finances, and drive innovation, all of which are essential for long-term business success.

- Salaries and Benefits: Covering a diverse global workforce across all operational and support departments.

- Administrative Overheads: Including office space, utilities, IT infrastructure, and support services for functions like HR, Finance, and Legal.

- Impact on Profitability: These fixed costs directly affect the company's operating profit margin, requiring careful management and efficiency gains.

- Strategic Support: Costs associated with R&D and strategic planning teams are vital for future growth and market positioning.

Research, Development, and Innovation Costs

Carlsberg's commitment to innovation is reflected in its substantial investment in Research, Development, and Innovation (R&D&I) costs. These expenditures are crucial for developing new beverages, enhancing existing product lines, and optimizing production processes. For instance, in 2023, Carlsberg reported R&D expenses of DKK 1.2 billion, a significant portion of which was allocated to exploring new brewing technologies and sustainable packaging solutions.

These R&D&I costs are a vital component of Carlsberg's cost structure, directly impacting its ability to stay competitive and drive long-term growth. The company actively invests in technology upgrades, such as implementing advanced automation in its breweries and upgrading canning lines to improve efficiency and reduce waste. These investments are essential for maintaining a leading position in the dynamic beverage market.

- Product Development: Significant investment in creating new beer varieties and non-alcoholic options to cater to evolving consumer preferences.

- Process Improvement: Funding for optimizing brewing processes, water usage, and energy efficiency across all production facilities.

- Sustainability Initiatives: Allocating resources to research and implement eco-friendly packaging materials and carbon reduction technologies.

- Technology Upgrades: Capital expenditure on modernizing brewery equipment, including new canning and bottling lines, to enhance operational performance.

Carlsberg's cost structure is a complex interplay of raw materials, production, marketing, and administrative expenses. Raw materials like malt and hops are significant variable costs, subject to market fluctuations; for example, global barley prices experienced volatility in 2024 due to weather impacts. Energy for brewing and packaging, labor, and distribution are also major cost drivers, with the company actively seeking efficiencies to counter rising energy and fuel prices in 2024.

Marketing and sales, including advertising and sponsorships, are crucial for brand strength, with increased commercial investments planned under their Accelerate SAIL strategy. Personnel and administrative costs, comprising salaries, benefits, and overheads, represent substantial fixed expenses. In 2023, Carlsberg reported €2,439 million in selling, general, and administrative expenses, underscoring the significant investment in operational capacity and strategic execution.

Research, Development, and Innovation (R&D&I) costs are vital for competitiveness, with DKK 1.2 billion spent in 2023 on new product development and process optimization, including sustainable packaging and brewing technologies. These investments are essential for maintaining market leadership and driving future growth through technological upgrades and efficiency improvements.

| Cost Category | Key Components | 2023 Data (if available) | 2024 Focus/Trends |

| Raw Materials | Malt (barley), hops, water | Subject to market price volatility | Managing volatility in barley prices |

| Production & Energy | Energy for brewing, packaging, labor | Energy efficiency investments, mitigating rising energy prices | |

| Marketing & Sales | Advertising, promotions, sponsorships | Increased commercial investments, brand building | |

| Distribution & Logistics | Warehousing, transportation, fuel | Optimizing operations, mitigating fuel price increases | |

| Personnel & Admin | Salaries, benefits, overheads | €2,439 million (SG&A 2023) | Maintaining operational capacity, strategic execution |

| R&D&I | New product development, process optimization | DKK 1.2 billion (2023) | Innovation in brewing tech, sustainable packaging |

Revenue Streams

Carlsberg's main income source is selling its wide range of beer products. This includes popular international brands like Carlsberg and Tuborg, as well as local favorites and newer craft beers. In 2024, the company reported that its beer sales were the backbone of its financial performance, driving organic revenue growth across its key markets.

Carlsberg's revenue streams extend beyond its core beer products to include a variety of other alcoholic beverages. This diversification is evident in their sales of ciders and ready-to-drink (RTD) cocktails, which cater to evolving consumer preferences and expand their market reach.

The company actively pursues growth within this 'Beyond Beer' segment, recognizing its potential to contribute significantly to overall revenue. For instance, in the first half of 2024, Carlsberg reported a 7.4% volume growth in its Western European markets, partly driven by the strong performance of its cider and RTD portfolio.

Carlsberg generates revenue not only from traditional alcoholic beverages but also from the sale of soft drinks and a growing portfolio of non-alcoholic beers. This diversification taps into a wider consumer demographic and addresses the increasing consumer preference for healthier and alcohol-free alternatives.

The company's strategic acquisition of Britvic in 2024 significantly bolstered its presence in the soft drinks market, adding a substantial revenue stream and expanding its reach in this category. This move positions Carlsberg to capitalize on the robust growth observed in the non-alcoholic beverage sector.

In 2024, the non-alcoholic beer segment showed particularly strong growth, with sales increasing by 15% year-over-year. This performance highlights the successful strategy of offering a diverse range of low- and no-alcohol options to meet evolving consumer demands.

Licensing Fees and Royalties

Carlsberg generates revenue through licensing fees and royalties from agreements where other companies gain rights to produce and distribute its brands in designated regions. This strategy facilitates market expansion without requiring substantial direct capital investment from Carlsberg itself. For instance, the company's expanded bottling franchise with PepsiCo exemplifies this approach, allowing for broader market reach and sales.

These licensing deals are crucial for global market penetration, enabling Carlsberg to leverage local expertise and infrastructure. In 2023, licensing and royalty income contributed to the overall financial performance, although specific figures for this segment are often embedded within broader reporting categories. This model is particularly effective in markets where establishing wholly-owned operations would be complex or less efficient.

- Licensing Agreements: Carlsberg earns income by granting other companies the right to use its brand names and brewing technologies in specific geographical areas.

- Royalty Payments: These agreements typically involve royalty payments based on a percentage of sales generated by the licensed products.

- Market Penetration: Licensing allows Carlsberg to enter new markets or strengthen its presence in existing ones by partnering with local entities, reducing operational risk and investment.

- Examples: The PepsiCo bottling franchise is a prime example of how Carlsberg utilizes licensing to broaden its beverage portfolio and distribution network.

Brewing Expertise and Consulting Services

Carlsberg leverages its deep brewing heritage by offering specialized consulting services. This revenue stream taps into their decades of experience in brewery operations, recipe development, and quality assurance, providing valuable expertise to external partners or emerging breweries.

This segment allows Carlsberg to monetize its intellectual property and technical know-how. For example, in 2023, the global beer market saw continued innovation, with craft and specialty beers driving growth, creating opportunities for experienced players like Carlsberg to share their insights.

- Consulting on Brewery Operations: Offering guidance on efficiency, process optimization, and sustainability in brewing facilities.

- Quality Control Expertise: Sharing best practices and methodologies for ensuring consistent beer quality and safety.

- Recipe Development Support: Assisting partners in creating new beer styles or refining existing ones.

- Technical Training Programs: Providing specialized training for brewing professionals.

Carlsberg's revenue is primarily driven by the sale of beer, encompassing its flagship brands and a diverse portfolio of local and international offerings. In 2024, the company highlighted that beer sales remained the core of its financial performance, contributing significantly to organic revenue growth across its operating regions.

Beyond beer, Carlsberg has expanded its revenue streams to include a growing range of ciders and ready-to-drink (RTD) beverages. This strategic move into the 'Beyond Beer' category has been successful, with Carlsberg reporting a 7.4% volume growth in Western Europe during the first half of 2024, partly attributed to these alternative alcoholic drinks.

The company also generates income from soft drinks and a robust selection of non-alcoholic beers, catering to health-conscious consumers and those seeking alcohol-free options. The acquisition of Britvic in 2024 significantly amplified this segment, adding a substantial revenue stream and strengthening Carlsberg's position in the non-alcoholic beverage market, which saw a 15% year-over-year sales increase in its non-alcoholic beer offerings in 2024.

Licensing agreements and royalty payments form another key revenue source, allowing Carlsberg to extend its brand reach globally by partnering with local producers. This strategy, exemplified by its bottling franchise with PepsiCo, reduces operational risk and investment while facilitating market penetration. While specific figures for licensing income are often integrated into broader financial reporting, this model remains vital for international expansion.

| Revenue Stream | Description | 2024 Relevance/Growth |

|---|---|---|

| Beer Sales | Core product sales of international and local beer brands. | Backbone of financial performance; driving organic revenue growth. |

| Beyond Beer (Ciders, RTDs) | Sales of alternative alcoholic beverages. | Contributed to 7.4% volume growth in Western Europe (H1 2024). |

| Soft Drinks & Non-Alcoholic Beers | Sales of non-alcoholic beverages and low/no-alcohol beer variants. | Non-alcoholic beer sales grew 15% YoY in 2024; Britvic acquisition bolstered soft drink revenue. |

| Licensing & Royalties | Income from granting brand and technology usage rights. | Facilitates global market penetration and brand expansion. |

Business Model Canvas Data Sources

The Carlsberg Business Model Canvas is built using a blend of internal financial data, extensive market research on consumer preferences and competitive landscapes, and strategic insights derived from industry analysis. These diverse data sources ensure each component of the canvas is grounded in verifiable information and current market realities.