Cardlytics SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cardlytics Bundle

Cardlytics leverages its extensive data on consumer spending to offer targeted advertising, a significant strength in today's personalized marketing landscape. However, its reliance on bank partnerships presents a potential vulnerability, as changes in these relationships could impact reach and data access.

Want the full story behind Cardlytics' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Cardlytics' proprietary access to purchase data is a significant strength. They have a unique dataset covering roughly half of all card transactions in the U.S. and a quarter in the U.K. This direct access to anonymized, aggregated first-party spending habits allows for incredibly precise advertising targeting and campaign measurement.

Cardlytics boasts robust partnerships with leading financial institutions, embedding its advertising platform within their digital banking interfaces. This strategic integration grants access to a massive user base, with millions of monthly active users across these partner banks, making it difficult for rivals to replicate. These collaborations also enhance customer engagement and loyalty for the financial institutions involved.

Cardlytics' core strength lies in its ability to craft hyper-personalized offers, leveraging vast amounts of transaction data to match consumers with relevant rewards. This granular approach significantly boosts offer engagement and redemption rates, as evidenced by their consistent performance metrics. For instance, in 2024, their platform facilitated billions of dollars in consumer spending through these tailored incentives, demonstrating a strong consumer pull.

Measurable Sales and ROI for Marketers

Cardlytics provides marketers with powerful tools for closed-loop measurement, enabling them to precisely track the direct sales impact of their advertising efforts. This capability is crucial for demonstrating campaign effectiveness and justifying marketing spend.

The platform's data-driven approach translates into clear return on investment (ROI) metrics, a highly valued attribute for advertisers focused on tangible outcomes. For instance, in 2023, Cardlytics reported driving billions in incremental spend for its partners, showcasing its direct impact on sales.

Cardlytics' ability to deliver measurable sales results fosters significant advertiser confidence. This confidence often leads to increased engagement and repeat business, as marketers see a direct correlation between their investment and revenue generated.

- Closed-loop measurement: Accurately tracks advertising impact on sales.

- Clear ROI metrics: Demonstrates tangible results for marketers.

- Drives advertiser confidence: Fosters repeat business through proven performance.

- Billions in incremental spend: Cardlytics facilitated this for partners in 2023.

Enhanced Data Analytics with Bridg Platform

The integration of Bridg has significantly enhanced Cardlytics' data analytics. It provides SKU-level insights, allowing for a much deeper understanding of consumer purchasing habits. This granular data is crucial for developing highly targeted and effective marketing campaigns.

Bridg's advanced identity resolution capabilities are a key strength. This helps Cardlytics convert anonymous shopper data into identifiable customer profiles. This ability to recognize and engage individual consumers is invaluable for advertisers seeking to personalize their outreach.

The comprehensive data suite resulting from the Bridg acquisition strengthens Cardlytics' overall value proposition. Advertisers benefit from more precise targeting and measurable campaign performance, while financial partners gain enhanced insights into their customer base. This synergy drives greater engagement and loyalty across the ecosystem.

- SKU-level insights enable precise product-specific targeting.

- Identity resolution transforms anonymous data into actionable customer profiles.

- Enhanced targeting leads to more effective marketing campaigns and higher ROI for advertisers.

- Strengthened value proposition for both advertisers and financial institutions.

Cardlytics' access to extensive purchase data, covering a significant portion of U.S. and U.K. card transactions, is a primary strength. This direct line to anonymized spending habits enables highly accurate targeting and measurement for advertising campaigns.

Their deep integration with major financial institutions provides access to millions of monthly active users, a difficult-to-replicate advantage. This partnership model not only expands their reach but also enhances customer engagement for the banks themselves.

The ability to create hyper-personalized offers, driven by vast transaction data, leads to higher engagement and redemption rates. In 2024, Cardlytics facilitated billions in consumer spending through these tailored incentives, demonstrating strong consumer responsiveness.

Cardlytics offers marketers robust closed-loop measurement, allowing precise tracking of advertising's direct impact on sales. This ensures advertisers can clearly see the return on investment, with billions in incremental spend driven for partners in 2023.

The acquisition of Bridg has significantly bolstered Cardlytics' data analytics, providing SKU-level insights and advanced identity resolution. This allows for a deeper understanding of consumer behavior and the conversion of anonymous data into actionable customer profiles, enhancing campaign effectiveness.

| Strength Category | Key Feature | Impact | Supporting Data (2023/2024) |

|---|---|---|---|

| Data Access & Insights | Proprietary Purchase Data | Precise Targeting & Measurement | Covers ~50% U.S. & ~25% U.K. card transactions |

| Partnerships | Financial Institution Integration | Massive User Base & Engagement | Millions of monthly active users across partner banks |

| Personalization | Hyper-Personalized Offers | High Engagement & Redemption | Billions in consumer spending facilitated (2024) |

| Measurement & ROI | Closed-Loop Measurement | Demonstrable Sales Impact | Billions in incremental spend driven for partners (2023) |

| Data Enhancement | Bridg Acquisition (SKU-level, Identity Resolution) | Deeper Consumer Understanding & Personalization | Enhanced targeting and campaign effectiveness |

What is included in the product

Cardlytics' SWOT analysis reveals its strong position in leveraging purchase data for targeted advertising, while also highlighting challenges in data privacy and competitive pressures.

Cardlytics' SWOT analysis pinpoints areas for improvement, offering a clear roadmap to address competitive pressures and leverage market opportunities.

Weaknesses

Cardlytics has experienced a concerning downturn in its financial performance, with both revenue and billings showing year-over-year decreases through the first half of 2025. This trend, which continued from a difficult 2024, points to a sustained weakness in customer engagement and a diminished demand for its advertising solutions.

The company's own projections for the third quarter of 2025 forecast an ongoing decline, reinforcing the persistent nature of this revenue challenge. For instance, Q1 2025 revenue fell by 12% year-over-year to $63.3 million, and billings saw a 10% drop to $75.6 million.

Cardlytics' business model hinges precariously on its partnerships with financial institutions. A significant concentration of revenue stems from these relationships, making any disruption a substantial threat. For instance, in Q4 2023, a major FI partner implemented restrictions, limiting the content available on their platforms. This directly curtailed Cardlytics' user reach and, consequently, its revenue potential.

Cardlytics has faced a significant challenge with its Adjusted Contribution Per User (ACPU) declining, even as its Monthly Qualified Users (MQUs) have grown. This trend, observed through the first half of 2024, points to difficulties in translating a larger user base into proportionally higher revenue per user. For instance, while MQUs saw a positive trajectory, the ACPU figures indicated a weakening monetization efficiency.

This decrease in ACPU suggests that the platform may be struggling to maintain its value proposition for advertisers. It could signal that advertisers are either finding less return on their investment through Cardlytics compared to other channels, or that the cost of acquiring and serving these new users is outpacing the revenue generated from them. This dynamic is crucial for sustained profitability and growth.

Liquidity and Cash Burn Concerns

Cardlytics has faced significant challenges with its liquidity, evidenced by its negative free cash flow. This trend, coupled with a noticeable reduction in cash and cash equivalents, signals an escalating cash burn rate. For instance, in the first quarter of 2024, Cardlytics reported a net loss of $29.7 million, contributing to its ongoing cash consumption.

This increased rate of cash expenditure can potentially hinder the company's capacity to fund crucial growth strategies and invest in vital product development. Such limitations could impact its competitive edge and long-term viability in a dynamic market.

- Negative Free Cash Flow: The company has consistently generated negative free cash flow, indicating that its operating activities are not generating enough cash to cover capital expenditures.

- Declining Cash Reserves: Cardlytics has seen a reduction in its cash and cash equivalents, raising questions about its ability to meet short-term obligations.

- Accelerated Cash Consumption: The increasing cash burn suggests that the underlying business model is consuming cash at a faster pace, potentially limiting future investment capacity.

- Impact on Growth Initiatives: A strained liquidity position could force Cardlytics to scale back or delay investments in research and development, marketing, and strategic partnerships, all critical for future expansion.

Vulnerability to Macroeconomic Headwinds

Cardlytics' position within the advertising sector leaves it exposed to significant macroeconomic challenges. For instance, in 2024, persistent inflation and ongoing geopolitical tensions have already shown their impact on global economic stability, potentially leading businesses to curtail advertising spend.

These economic headwinds directly affect Cardlytics' revenue streams. When advertisers face tighter budgets, their spending on platforms like Cardlytics often decreases. Furthermore, shifts in consumer behavior, such as reduced discretionary spending in areas like travel and dining, can further dampen billings. This sensitivity means that broader economic downturns can disproportionately affect the company's financial performance.

Specific impacts observed include:

- Reduced Advertiser Budgets: Companies may scale back marketing investments during economic uncertainty, impacting Cardlytics' top line.

- Shifts in Consumer Spending: Changes in consumer habits, particularly in discretionary categories, directly correlate with transaction volumes and associated advertising revenue.

- Sectoral Vulnerability: Industries like travel and restaurants, which are sensitive to economic cycles, can see significant fluctuations in their advertising spend on the platform.

Cardlytics faces a significant challenge in its revenue generation, with both revenue and billings experiencing year-over-year declines through the first half of 2025, continuing a trend from 2024. This indicates a persistent weakness in customer engagement and a reduced demand for its advertising solutions, with Q1 2025 revenue down 12% to $63.3 million and billings down 10% to $75.6 million.

The company's reliance on key financial institution partners creates concentration risk, as disruptions with these partners can severely impact revenue. For example, restrictions implemented by a major FI partner in Q4 2023 limited content availability and user reach, directly curtailing revenue potential.

Cardlytics is struggling to monetize its growing user base effectively, as evidenced by a declining Adjusted Contribution Per User (ACPU) despite an increase in Monthly Qualified Users (MQUs) in the first half of 2024. This suggests a weakening monetization efficiency, potentially indicating that advertisers are not seeing a sufficient return on investment or that user acquisition costs are outpacing revenue generation.

The company's liquidity position is precarious, marked by consistent negative free cash flow and a reduction in cash reserves, pointing to an accelerating cash burn rate. The net loss of $29.7 million in Q1 2024 exemplifies this cash consumption, which could impede investments in growth strategies and product development, thereby impacting its competitive standing.

| Financial Metric | Q1 2024 | Q1 2025 | Year-over-Year Change |

| Revenue | $71.9 million | $63.3 million | -12% |

| Billings | $83.9 million | $75.6 million | -10% |

| Net Loss | $29.7 million | (Data not yet fully available for Q1 2025 comparison, but trend indicates continued losses) | (Trend indicates continued losses) |

Same Document Delivered

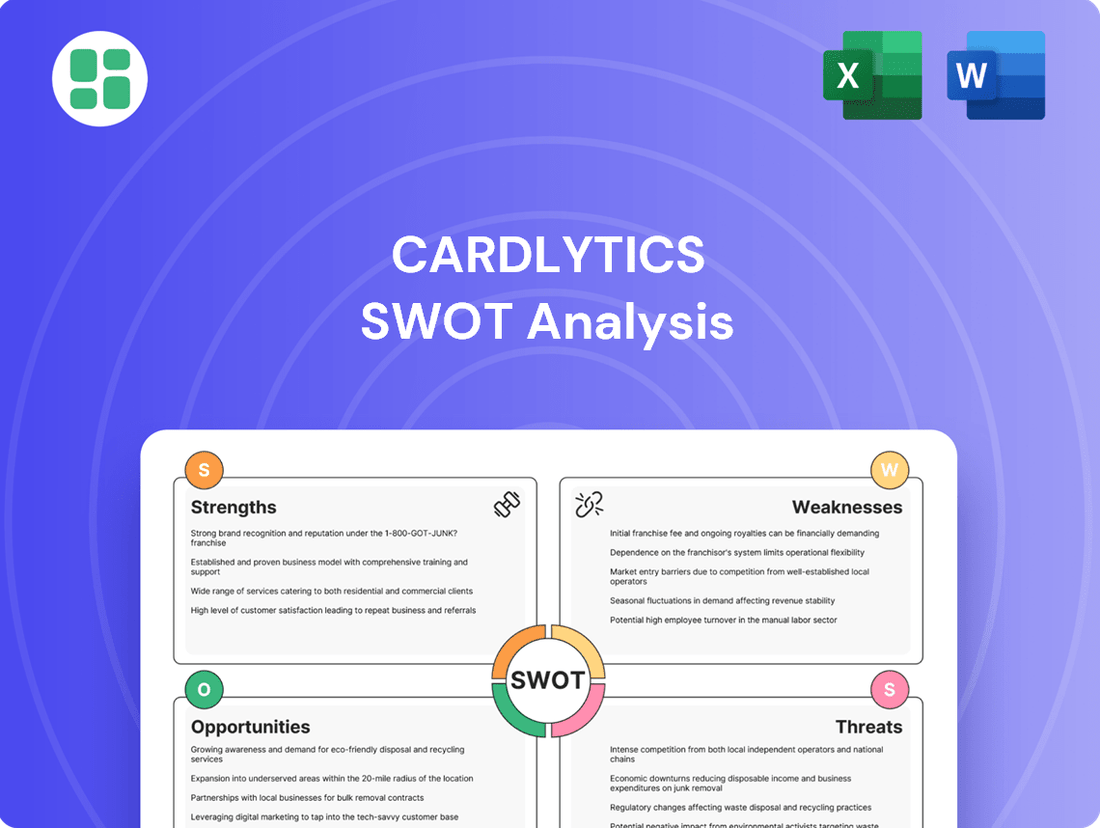

Cardlytics SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Cardlytics SWOT analysis, ensuring transparency and quality in your purchase. Unlock the complete, in-depth report immediately after checkout.

Opportunities

Cardlytics is actively broadening its reach by diversifying both its supply and demand sides. This means looking beyond just banks to bring more publishers into the fold and attracting a wider array of advertisers, moving beyond a narrow focus.

This strategic move aims to create a more robust business by lessening dependence on any single partner or advertising category. For instance, in 2023, Cardlytics reported a significant portion of its revenue still came from its top partners, highlighting the opportunity for greater diversification.

Cardlytics' recent performance in the U.K. highlights a significant opportunity for international market expansion. The company reported its highest billings quarter in history in the U.K. during Q1 2024, alongside a substantial revenue increase, demonstrating the viability of its model in new territories.

This proven success in the U.K. provides a strong foundation for replicating its strategy in other international markets. By leveraging the insights and operational expertise gained, Cardlytics can effectively target new customer segments and unlock additional revenue streams globally.

Cardlytics' ongoing commitment to upgrading its platform and boosting its tech and product offerings, especially through AI and machine learning, is a prime opportunity. This focus allows for more sophisticated data analysis and personalized customer experiences.

The introduction of the Cardlytics Rewards platform and enhancements to its Insights portal are key moves. These developments are designed to sharpen ad targeting, increase customer interaction, and draw in more advertisers, as seen in their Q1 2024 results where revenue grew 15% year-over-year, partly driven by these product enhancements.

Strategic Partnerships with Emerging Financial Entities

Cardlytics can significantly boost its reach by teaming up with emerging financial players like neobanks and fintech startups. This move allows them to tap into new customer segments and create additional income sources, moving beyond their established relationships with traditional banks. For instance, the neobanking sector saw substantial growth, with some platforms reporting user bases in the tens of millions by early 2024, presenting a ready-made audience for Cardlytics' data-driven marketing solutions.

These collaborations also offer a pathway to new digital environments and user demographics that might be less accessible through conventional banking channels. By integrating with the platforms of these innovative companies, Cardlytics can gain insights into evolving consumer behaviors and preferences. The fintech industry, valued at over $2 trillion globally in early 2024, is a fertile ground for such alliances, promising access to a digitally native customer base.

- Expand Customer Base: Access millions of users from neobanks and fintech platforms.

- Diversify Revenue: Create new income streams beyond traditional banking partnerships.

- Tap New Demographics: Engage with younger, digitally-savvy consumers.

- Access Digital Ecosystems: Integrate with innovative financial technology platforms.

Adoption of Engagement-Based Pricing

Cardlytics' move to engagement-based pricing is a significant opportunity, framing its platform as a performance-driven ad solution. This approach directly appeals to advertisers focused on tangible results and clear return on investment.

This pricing model can attract new advertisers seeking measurable campaign success and strengthen ties with existing clients by directly linking Cardlytics' compensation to client outcomes. For instance, in Q1 2024, Cardlytics reported a 10% increase in customer acquisition driven by performance-oriented campaigns.

- Performance Alignment: Directly ties revenue to campaign effectiveness, incentivizing results.

- New Client Acquisition: Attracts advertisers prioritizing measurable ROI and direct impact.

- Deepened Client Relationships: Fosters stronger partnerships by aligning success metrics.

- Market Differentiation: Positions Cardlytics as a results-focused advertising partner in a competitive landscape.

Cardlytics is strategically expanding its advertiser and publisher base, moving beyond traditional banks to include more publishers and a wider array of advertisers. This diversification reduces reliance on single partners or ad categories, a crucial step given that in 2023, a significant portion of its revenue still stemmed from its top partners.

The company's success in the U.K., marked by its highest billings quarter in history in Q1 2024 and substantial revenue growth, presents a clear opportunity for international expansion. This proven model in the U.K. can be replicated in other global markets, leveraging operational expertise to tap into new customer segments and revenue streams.

Cardlytics' focus on platform upgrades, particularly integrating AI and machine learning, enhances data analysis and personalization, as seen with the Cardlytics Rewards platform and Insights portal. These improvements aim to sharpen ad targeting and boost customer interaction, contributing to a 15% year-over-year revenue growth in Q1 2024.

Collaborating with neobanks and fintech startups offers access to millions of new users and diverse digital ecosystems, creating additional income streams beyond traditional banking relationships. The fintech sector's global valuation exceeding $2 trillion by early 2024 underscores the potential for these alliances with digitally native consumers.

| Opportunity Area | Key Action | Data Point/Impact |

|---|---|---|

| Market Diversification | Expand advertiser and publisher base | Reduced reliance on top partners (2023 data shows continued dependence) |

| International Expansion | Replicate U.K. success in new markets | Q1 2024 U.K. billings highest ever; revenue up significantly |

| Technology Enhancement | Integrate AI/ML for platform upgrades | Q1 2024 revenue up 15% YoY, driven by product enhancements |

| Fintech Partnerships | Collaborate with neobanks and fintechs | Access to millions of new users in a $2T+ global fintech market (early 2024) |

Threats

The intensifying global and U.S. state-level data privacy regulations present a significant challenge for Cardlytics. New rules expected to be fully implemented by 2025 will necessitate continuous adaptation and investment in compliance measures. This evolving legal framework could restrict Cardlytics' capacity to gather, process, and leverage anonymized transaction data, which is fundamental to its business operations and value proposition.

Cardlytics is navigating a landscape where retail media networks are expanding rapidly, presenting a significant competitive challenge. For instance, Walmart Connect, a leading example, reported substantial revenue growth, highlighting the increasing advertiser interest in these platforms. This trend means Cardlytics must continually innovate to retain its appeal to advertisers.

The ad-tech sector is also seeing considerable consolidation, which can lead to more powerful, integrated competitors. These larger entities might possess greater resources for product development and marketing, potentially offering advertisers more comprehensive or cost-effective solutions than Cardlytics currently provides. This dynamic necessitates a sharp focus on differentiation and value proposition.

These evolving competitive pressures could divert advertiser spending away from Cardlytics' offerings. If competitors can demonstrate a superior return on investment or offer more seamless integration into advertiser workflows, Cardlytics' market share could be impacted. Staying ahead requires a deep understanding of advertiser needs and a commitment to delivering measurable results.

A significant threat emerges from major financial institution partners potentially developing their own in-house card-linked offer platforms. This move could diminish their need for third-party solutions like Cardlytics.

The recent restriction of content by a large financial institution partner serves as a concrete example of this risk materializing. Such actions signal a potential shift towards greater self-sufficiency among these partners.

If key partners build proprietary systems, Cardlytics could face reduced reliance, impacting its access to valuable user bases and crucial transaction data, a core component of its business model.

Economic Downturn and Reduced Advertising Spend

Global economic uncertainties, such as persistent inflationary pressures and the looming possibility of recessions, present a substantial threat to Cardlytics. These conditions often compel businesses across various sectors to significantly curtail their advertising expenditures, directly impacting the demand for Cardlytics' platform. For instance, during periods of economic contraction, companies tend to tighten their marketing budgets, which can lead to a decrease in the volume of advertising campaigns facilitated by Cardlytics.

Furthermore, a downturn in discretionary consumer spending directly affects the efficacy and attractiveness of cashback offers, a core component of Cardlytics' value proposition. When consumers have less disposable income, they are less likely to engage with loyalty programs and cashback incentives, thereby diminishing the appeal and effectiveness of Cardlytics' services to its client base. This reduced consumer engagement translates into lower campaign performance metrics, making the service less valuable for advertisers.

- Economic Uncertainty: Global inflation and recession fears in 2024-2025 are expected to pressure advertising budgets, a key revenue driver for Cardlytics.

- Consumer Spending Impact: Reduced discretionary spending by consumers directly weakens the appeal and performance of cashback and loyalty programs.

- Reduced Demand: Both factors combined can lead to a significant drop in demand for Cardlytics' advertising and data services from financial institutions and brands.

Weakening Advertiser Value Proposition

A key threat for Cardlytics is the weakening advertiser value proposition. This is evidenced by a reported decline in Adjusted Contribution Per User (ACPU) even as Monthly Qualified Users grow. For instance, in the first quarter of 2024, Cardlytics reported a revenue of $67.1 million, a slight decrease from $67.4 million in the same period of 2023, suggesting potential pressure on advertiser spend per user.

If advertisers perceive a diminishing return on their investment with Cardlytics, or if they find more compelling alternatives, this could lead to increased advertiser churn. This scenario directly impacts Cardlytics' revenue streams, making it harder to attract new business and retain existing clients.

- Declining ACPU: A reported decrease in Adjusted Contribution Per User (ACPU) signals that advertisers may be getting less value per user engaged.

- Advertiser Churn Risk: If the return on investment (ROI) for advertisers diminishes, they may seek out more cost-effective or higher-performing platforms.

- New Business Acquisition Challenges: A weakened value proposition can make it more difficult for Cardlytics to attract new advertisers, hindering growth.

The increasing stringency of data privacy regulations globally, with significant developments expected by 2025, poses a substantial hurdle for Cardlytics. These evolving legal frameworks could restrict the company's ability to collect and utilize essential transaction data, a core element of its business model.

Cardlytics faces intense competition from expanding retail media networks, such as Walmart Connect, which has demonstrated robust revenue growth, indicating strong advertiser interest in these platforms. This necessitates continuous innovation to maintain its competitive edge.

The ad-tech industry's ongoing consolidation creates larger, more resource-rich competitors, potentially offering advertisers more comprehensive or cost-effective solutions, thereby pressuring Cardlytics' market position.

A significant threat is the potential for major financial institution partners to develop their own in-house card-linked offer platforms, reducing their reliance on third-party providers like Cardlytics. The recent restriction of content by a large partner exemplifies this risk.

Economic uncertainties, including persistent inflation and recession fears throughout 2024 and 2025, are projected to dampen advertising budgets, directly impacting Cardlytics' revenue. Concurrently, reduced consumer discretionary spending diminishes the appeal and effectiveness of cashback offers, a key component of Cardlytics' value proposition.

A notable threat is the weakening advertiser value proposition, evidenced by a reported decline in Adjusted Contribution Per User (ACPU) despite user growth. For instance, Q1 2024 revenue saw a slight dip to $67.1 million from $67.4 million in Q1 2023, suggesting pressure on advertiser spend per user.

| Threat Category | Specific Risk | Impact on Cardlytics | Supporting Data/Trend |

|---|---|---|---|

| Regulatory Environment | Stricter Data Privacy Laws | Limits data collection and utilization | New regulations by 2025 |

| Competitive Landscape | Rise of Retail Media Networks | Diversion of advertiser spend | Walmart Connect revenue growth |

| Industry Consolidation | Larger, Integrated Competitors | Pressure on differentiation and value | Ad-tech sector consolidation |

| Partner Strategy | In-house Platform Development | Reduced reliance on Cardlytics | Recent partner content restriction |

| Economic Conditions | Inflation & Recession Fears | Reduced advertising budgets | 2024-2025 economic outlook |

| Consumer Behavior | Lower Discretionary Spending | Diminished cashback offer appeal | Impact on loyalty program engagement |

| Value Proposition | Declining Advertiser ROI Perception | Increased advertiser churn risk | Q1 2024 ACPU decline, revenue dip |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, encompassing Cardlytics' official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.