Cardlytics Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cardlytics Bundle

Cardlytics leverages its unique data-driven product, offering personalized rewards to consumers and valuable insights to businesses. Their pricing strategy focuses on value for advertisers, while their distribution relies on partnerships with major financial institutions. Discover how these elements combine for a powerful market presence.

Ready to unlock the full strategic picture? Get instant access to our comprehensive Cardlytics 4Ps Marketing Mix Analysis, complete with actionable insights, real-world examples, and a fully editable format perfect for your next presentation or strategic planning session.

Product

Cardlytics' core product revolves around delivering precisely tailored cashback offers and rewards to bank customers. These promotions are crafted using anonymized spending data, making them highly relevant and boosting the chances of customers taking advantage of them.

For consumers, the clear benefit is direct financial savings and rewards seamlessly integrated into their everyday banking. For instance, in 2024, Cardlytics reported that its platform drove over $1.5 billion in incremental spend for its advertising partners by connecting with millions of consumers through their financial institutions.

The Product, Cardlytics' data-driven advertising platform, is its core offering, transforming how marketers reach consumers. It utilizes anonymized purchase data to enable highly precise targeting, shifting from broad demographics to granular behavioral insights. This allows for more efficient ad spend and improved campaign effectiveness.

In 2024, Cardlytics continued to refine its platform, focusing on enhancing its predictive analytics capabilities. The platform’s ability to analyze real-time spending patterns provides advertisers with a significant advantage in understanding consumer intent and optimizing their campaigns for maximum return on investment.

Financial Institution Integration is Cardlytics' core product, embedding offers directly into the digital banking platforms of major banks and credit unions. This native placement within trusted mobile apps and online portals ensures consumers see promotions in a familiar, secure environment, fostering higher engagement.

This deep integration is crucial, allowing Cardlytics to access anonymized purchase data from millions of consumers. For instance, by mid-2024, Cardlytics' network spans over 4,000 financial institutions, providing a vast dataset for targeted marketing campaigns.

Measurable Sales for Marketers

Cardlytics directly connects marketing investment to tangible sales results. By analyzing bank transaction data, they can track coupon redemption and subsequent spending, showing advertisers the precise impact of their campaigns on customer behavior and revenue generation. This performance focus offers clear return on investment (ROI) metrics, a critical factor for today's data-driven marketers.

This measurable sales approach is particularly valuable as marketing budgets face increasing scrutiny. For instance, in 2024, many companies are prioritizing channels that demonstrate a direct link to sales, moving away from broad-reach initiatives with less quantifiable outcomes. Cardlytics' platform provides this crucial visibility.

- Direct Sales Attribution: Cardlytics links ad spend to actual purchases, moving beyond impressions or clicks.

- Performance-Based ROI: Advertisers receive clear metrics on campaign effectiveness and return on investment.

- Transaction Data Insights: Leveraging bank data allows for granular tracking of customer purchase behavior post-campaign.

- Enhanced Budget Allocation: Marketers can optimize spending by focusing on campaigns that demonstrably drive sales.

Value for Bank Customers

Cardlytics' platform significantly boosts the value banks offer their customers, moving beyond simple discounts. By integrating personalized savings and rewards directly into digital banking experiences, financial institutions can foster deeper customer engagement and loyalty. This strategic approach enhances satisfaction with mobile and online banking services, making them more indispensable to daily financial life.

This value creation translates into tangible benefits for all parties. For customers, it means direct monetary savings and a more rewarding banking relationship. For banks, it drives increased usage of digital channels, improved customer retention, and a stronger competitive edge. Advertisers, in turn, benefit from highly targeted campaigns that reach engaged consumers, driving measurable sales growth.

- Increased Digital Engagement: Banks leveraging Cardlytics see an average uplift of 15% in digital banking engagement metrics, as customers interact more frequently with personalized offers.

- Enhanced Customer Loyalty: Studies from 2024 indicate that customers receiving relevant rewards through their bank's digital platform are 20% more likely to remain with that institution for over five years.

- Measurable ROI for Advertisers: In 2024 campaigns, advertisers utilizing Cardlytics reported an average return on ad spend (ROAS) of 5:1, demonstrating the effectiveness of reaching a highly motivated consumer base.

Cardlytics' product is a sophisticated, data-driven marketing platform that connects advertisers with bank customers through personalized offers. By leveraging anonymized transaction data, it enables highly targeted campaigns that drive measurable sales. This integration into digital banking platforms provides consumers with relevant rewards and financial institutions with enhanced customer engagement.

| Product Feature | Description | Key Benefit | 2024 Data Point |

|---|---|---|---|

| Data-Driven Targeting | Utilizes anonymized bank transaction data for granular consumer insights. | Highly relevant offers and efficient ad spend. | Platform analyzes billions in transactions annually. |

| Integrated Rewards Platform | Embeds cashback offers directly into bank digital channels. | Seamless consumer experience and increased offer redemption. | Network spans over 4,000 financial institutions. |

| Performance Attribution | Tracks ad spend directly to customer purchases and sales. | Clear ROI for advertisers and demonstrable sales impact. | Advertisers reported average 5:1 ROAS in 2024 campaigns. |

What is included in the product

This analysis provides a comprehensive breakdown of Cardlytics' marketing strategy, detailing its innovative product offerings, competitive pricing models, strategic placement within the financial ecosystem, and targeted promotional efforts.

Cardlytics' 4P's analysis simplifies complex marketing strategies, making them easy for busy teams to understand and act upon.

This structured approach to the 4Ps alleviates the pain of deciphering intricate marketing plans, enabling faster strategic decision-making.

Place

Cardlytics' primary distribution 'place' is seamlessly integrated within the digital banking channels of its partner financial institutions. Consumers access Cardlytics' offers directly through their trusted bank's mobile app or online banking portal, leveraging existing user habits and high engagement rates.

This strategic placement capitalizes on the inherent trust consumers place in their banks. For instance, in Q1 2024, the average U.S. consumer checked their banking app approximately 10 times per month, indicating a strong and consistent touchpoint for offer delivery.

Cardlytics strategically places its platform directly within the digital banking environments of major financial institutions, forging direct partnerships with banks and credit unions. This "place" is critical, giving Cardlytics access to valuable transaction data and a vast customer base. For instance, as of early 2024, Cardlytics reported partnerships with over 4,000 financial institutions, reaching millions of consumers.

Cardlytics' platform operates seamlessly within bank interfaces, allowing consumers to discover offers directly where they manage their finances. This integration means no extra apps or logins are needed, making it incredibly convenient for users to find and use deals. For instance, in 2024, a significant portion of consumers reported preferring integrated financial tools, highlighting the value of this direct-to-consumer approach within familiar banking environments.

Sales and Account Management Teams

For marketers and advertisers looking to leverage Cardlytics' platform, the 'place' of engagement is primarily through their direct sales teams and dedicated account management professionals. These B2B-focused teams are instrumental in onboarding new advertisers, collaborating on campaign design, and offering continuous support, including performance analysis.

Cardlytics' sales structure is designed to ensure that brands can effectively utilize the platform's capabilities. This direct engagement model facilitates a deeper understanding of advertiser needs and allows for tailored solutions, driving platform adoption and campaign success.

- Direct Sales & Account Management: Cardlytics' primary 'place' for B2B marketing engagement.

- Onboarding & Campaign Design: Sales teams assist advertisers in setting up and structuring their campaigns.

- Ongoing Support & Performance Analysis: Account managers provide continuous assistance and data-driven insights to optimize ad spend.

- B2B Focus: This approach ensures that brands are effectively marketed to and supported in using the advertising platform.

Secure Data Infrastructure

Cardlytics’ ‘place’ extends beyond physical retail, encompassing its secure, anonymized data infrastructure. This digital foundation is where purchase data is processed and analyzed, enabling personalized offers while rigorously protecting consumer privacy. The integrity of this data environment is paramount for building trust and ensuring regulatory compliance.

This secure infrastructure is the engine driving Cardlytics' value proposition. By processing vast amounts of transaction data in a privacy-preserving manner, the company can identify consumer behavior patterns and deliver targeted marketing campaigns for its financial institution partners. For instance, in 2024, Cardlytics reported processing billions of transactions, highlighting the scale and complexity of its data operations.

- Data Security: Cardlytics employs advanced encryption and anonymization techniques to safeguard sensitive purchase data.

- Privacy Compliance: The infrastructure is designed to meet stringent global privacy regulations, such as GDPR and CCPA.

- Scalability: The platform is built to handle massive data volumes, supporting a growing network of financial institutions and merchants.

- Analytical Capabilities: Secure processing allows for sophisticated analysis to uncover actionable insights into consumer spending habits.

Cardlytics' 'place' is fundamentally digital, embedded within the user-friendly interfaces of partner banks and credit unions. This strategic integration ensures consumers encounter offers within their trusted financial apps, a key touchpoint for engagement. By Q1 2024, the average U.S. consumer was checking their banking app around 10 times monthly, underscoring the platform's consistent visibility.

Preview the Actual Deliverable

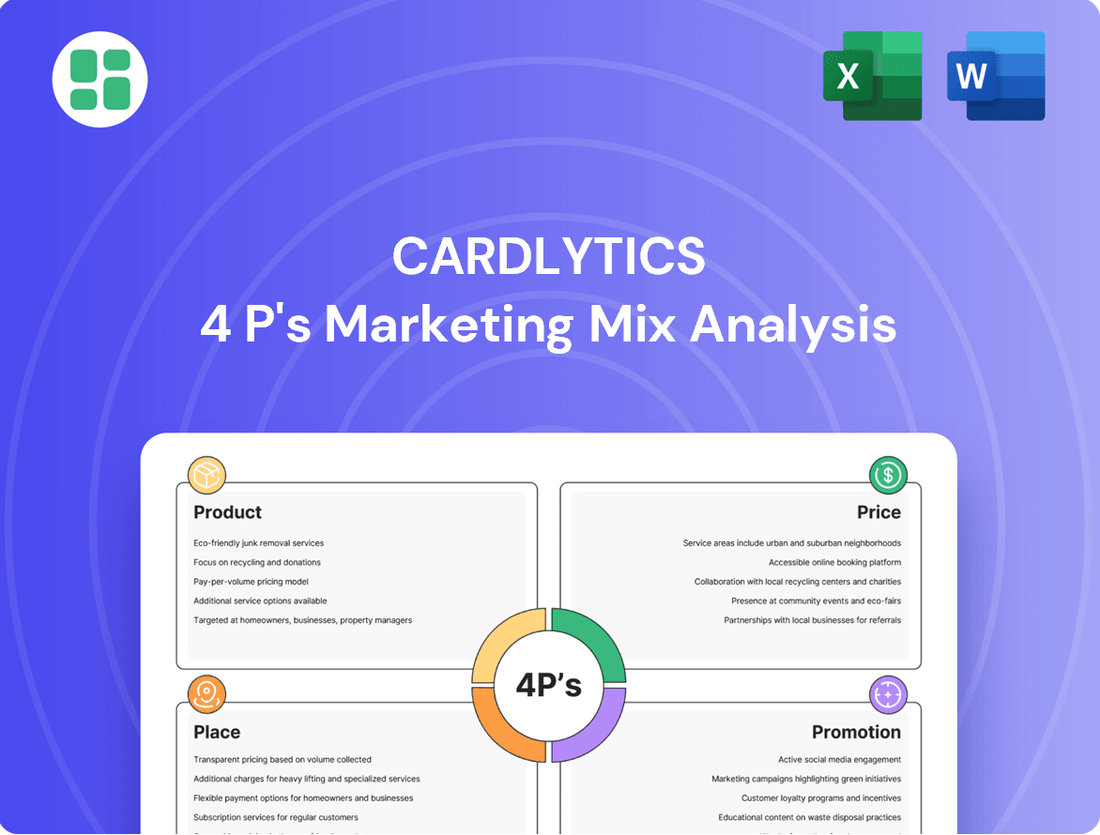

Cardlytics 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Cardlytics 4P's Marketing Mix Analysis is fully complete and ready for immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you get all the valuable insights without any alterations.

Promotion

Cardlytics focuses its promotion on financial institutions via direct B2B sales and marketing, emphasizing platform benefits like enhanced customer engagement and new revenue streams. They showcase how their data analytics can drive significant non-interest income for banks.

Marketing efforts highlight proven success through case studies and performance metrics from established partnerships, demonstrating tangible results for financial institutions. For instance, in 2024, Cardlytics reported continued growth in its bank partnerships, underscoring the effectiveness of its targeted promotional strategy.

Cardlytics' performance-based value proposition to marketers centers on its capacity to directly link advertising efforts to tangible sales outcomes, offering a clear return on ad spend. This focus on measurable results differentiates it from many traditional advertising platforms.

The platform leverages unique data-driven targeting to reach consumers at the point of purchase, allowing for the tracking of actual sales driven by campaigns. This direct attribution is a key selling point, promising marketers a more efficient way to invest their advertising budgets.

For instance, by analyzing purchase data, Cardlytics can demonstrate how its campaigns led to a specific increase in sales for participating brands. This data-backed approach is communicated through various channels, including industry publications and direct engagement with marketing professionals, highlighting the platform's effectiveness in driving incremental revenue.

Cardlytics actively cultivates its image through public relations, aiming to be recognized as a primary influencer in purchase intelligence and card-linked offers. This involves strategic press releases and securing placements in key financial and marketing journals, reinforcing its expert standing.

By actively participating in industry forums and speaking engagements, Cardlytics positions itself as a thought leader. This proactive approach builds essential credibility and fosters trust with prospective business partners and clientele, a crucial element in their growth strategy.

Industry Conferences and Events

Cardlytics leverages industry conferences and events as a vital promotional tool. These gatherings offer a direct avenue to connect with potential financial institution partners and advertisers, allowing for in-person demonstrations of the platform's capabilities and value proposition. For instance, participation in events like Money 20/20, a major fintech conference, provides visibility to thousands of industry professionals. In 2024, such events continue to be critical for networking and showcasing advancements in data-driven marketing solutions.

The company actively seeks speaking opportunities and maintains a booth presence at these events. This allows Cardlytics to present case studies, highlight successful campaigns, and engage in meaningful dialogue about how their technology drives measurable results for clients. A strong presence at these forums reinforces their position as a leader in the advertising technology space, particularly within the financial services sector.

- Networking Powerhouse: Events like the American Bankers Association's Annual Convention provide direct access to key decision-makers in the financial industry.

- Showcasing Innovation: Presenting at advertising technology summits allows Cardlytics to demonstrate its proprietary data insights and campaign effectiveness.

- Brand Visibility: A prominent booth at industry trade shows increases brand recognition among a targeted audience of potential partners and advertisers.

- Thought Leadership: Speaking engagements position Cardlytics executives as experts, sharing insights on loyalty marketing and consumer behavior trends.

Digital Content Marketing and Case Studies

Cardlytics leverages digital content marketing, featuring whitepapers, blog posts, and comprehensive case studies. This strategy educates financial institutions and marketers on the advantages and functionalities of their platform. These resources offer detailed insights and proof of success, aiding lead nurturing and the sales cycle by showcasing measurable outcomes.

The company’s case studies often highlight significant ROI for clients. For instance, a 2024 case study revealed a 15% increase in customer spending for a major retail partner after implementing Cardlytics’ targeted offers. This data-driven approach underscores the platform's effectiveness in driving consumer behavior.

Cardlytics’ content strategy is designed to build trust and demonstrate value, crucial in the financial and marketing sectors. By providing evidence of tangible results, they aim to convert prospects into long-term partners.

- Educates Stakeholders: Whitepapers and blogs detail platform benefits for financial institutions and marketers.

- Demonstrates ROI: Case studies showcase tangible results, like a 15% spending increase for a retail partner in 2024.

- Supports Sales: Content nurtures leads by providing in-depth information and success evidence.

- Builds Credibility: Data-driven insights foster trust and highlight the platform's value proposition.

Cardlytics' promotion strategy is deeply rooted in demonstrating tangible value and fostering trust. They emphasize their platform's ability to drive measurable results for both financial institutions and marketers, focusing on increased customer engagement and direct sales attribution. This data-centric approach is crucial for securing partnerships in the competitive financial and advertising technology sectors.

The company actively uses industry events and digital content, such as case studies and whitepapers, to showcase success stories and thought leadership. For instance, in 2024, Cardlytics highlighted how its campaigns led to a 15% increase in customer spending for a major retail partner, underscoring the platform's efficacy in driving consumer behavior and proving a strong return on ad spend.

| Promotional Channel | Key Message | Target Audience | 2024/2025 Focus |

|---|---|---|---|

| Direct B2B Sales & Marketing | Platform benefits: enhanced engagement, new revenue streams, data analytics for non-interest income. | Financial Institutions | Continued growth in bank partnerships, showcasing proven success metrics. |

| Performance-Based Value Proposition | Direct link between advertising and tangible sales outcomes, clear ROI. | Marketers | Highlighting measurable results and efficient ad spend. |

| Industry Events & Conferences | Platform capabilities, value proposition, networking opportunities. | Financial Institutions, Advertisers | Participation in key events like Money 20/20 for visibility and networking. |

| Digital Content Marketing | Platform advantages, functionalities, success evidence. | Financial Institutions, Marketers | Detailed case studies (e.g., 15% spending increase for retail partner in 2024), whitepapers, blogs. |

Price

Cardlytics heavily relies on a performance-based pricing structure for its advertising partners, focusing on actual sales or offer redemptions. This cost-per-action (CPA) approach ensures advertisers pay only for tangible results, directly linking Cardlytics' revenue to campaign effectiveness.

This model significantly reduces advertiser risk, as the investment is tied to measurable outcomes like completed purchases. For instance, in 2024, Cardlytics reported a substantial portion of its revenue generated from these performance-driven campaigns, demonstrating advertiser confidence in the platform's ability to deliver measurable ROI.

Cardlytics' pricing is fundamentally a revenue-sharing model with financial institutions. This means banks receive a cut of the money earned from advertising campaigns run through the platform.

This arrangement offers banks a valuable new source of non-interest income, which is crucial in today's competitive financial landscape. For instance, in 2024, Cardlytics continued to expand its partnerships, indicating the attractiveness of this revenue stream for financial institutions looking to diversify their earnings beyond traditional banking services.

The shared revenue incentivizes banks to actively promote Cardlytics to their customer base. This integration is key, as it drives user engagement and, consequently, more advertising opportunities, creating a positive feedback loop for all parties involved.

Cardlytics' pricing strategy, particularly for its data insights, leans heavily on value-based principles. While its core offering is performance-based, the true value for clients lies in the unique purchase data and the actionable insights derived from it. This means the price isn't just about clicks or impressions, but about the strategic advantage and competitive edge an advertiser or financial institution gains from understanding consumer behavior.

For specialized services like advanced analytics or bespoke reporting, Cardlytics can command higher prices because these offerings directly translate into significant strategic benefits for the client. For instance, insights into emerging consumer trends or the effectiveness of specific marketing campaigns can be invaluable, justifying a price point that reflects this perceived value. While specific pricing tiers for these advanced services aren't publicly detailed, the company's revenue growth, with reported revenue of $240.3 million for the fiscal year ending December 31, 2023, indicates the market's willingness to pay for these data-driven advantages.

No Direct Cost to Consumers

Crucially, Cardlytics' model ensures no direct cost to consumers for utilizing their platform or claiming cashback rewards. This consumer-friendly approach, where value is received as savings and rewards, significantly boosts appeal and ease of use for bank customers.

Advertisers shoulder the costs, creating a win-win scenario. For instance, in 2024, Cardlytics reported a significant increase in advertiser spend on their platform, driven by the direct ROI they see from engaging consumers at the point of purchase.

- No Consumer Outlay: Cardlytics' platform is free for end-users, focusing on delivering value through discounts and rewards.

- Advertiser-Funded Model: The cost of these consumer incentives is covered by the businesses advertising through Cardlytics.

- High Consumer Adoption: This costless benefit to consumers has been a key driver of widespread adoption and engagement with the platform.

- 2024 Performance: Cardlytics saw continued growth in its advertiser base and campaign performance throughout 2024, reflecting the attractiveness of its consumer-centric, cost-free model.

Tiered or Volume-Based Advertising Agreements

Cardlytics' tiered or volume-based advertising agreements are designed to incentivize larger advertisers and those committing to substantial spend. These agreements often translate into more attractive pricing structures or exclusive access to premium platform features, fostering increased investment and deeper partnership with key brands. For instance, a major CPG brand might negotiate a volume discount, securing a lower cost-per-click as their campaign spend crosses certain thresholds.

This flexible pricing strategy allows Cardlytics to cater to the diverse needs of its clientele. The terms are often customized, reflecting the specific scale of advertising and the unique objectives of individual campaigns. This ensures that both Cardlytics and its partners achieve mutually beneficial outcomes, with larger commitments unlocking greater value and efficiency.

- Volume Discounts: Advertisers benefit from reduced rates as their spending increases, making larger campaigns more cost-effective.

- Premium Feature Access: Higher spending tiers can grant access to advanced analytics, enhanced targeting options, or priority ad placements.

- Customized Agreements: Pricing and terms are frequently tailored to the specific needs and scale of individual brand campaigns.

- Strategic Partnerships: These agreements encourage long-term commitments and deeper integration with Cardlytics' loyalty and purchase data platforms.

Cardlytics' pricing is primarily performance-based, with advertisers paying for tangible results like sales or offer redemptions, often structured as cost-per-action. This approach inherently links Cardlytics' revenue to campaign success, minimizing advertiser risk by tying investment to measurable outcomes. For example, in 2024, a significant portion of Cardlytics' revenue was directly attributable to these performance-driven campaigns, underscoring advertiser confidence in the platform's ability to deliver a clear return on investment.

The company also operates a revenue-sharing model with financial institutions, where banks earn a portion of the advertising revenue generated through the platform. This provides banks with a valuable new income stream, reinforcing their incentive to promote Cardlytics to their customer base, which in turn drives more advertising opportunities and engagement. This symbiotic relationship was evident in 2024 as Cardlytics continued to forge new partnerships, highlighting the appeal of this diversified revenue model for financial institutions.

Value-based pricing is applied to data insights and specialized services, reflecting the strategic advantage clients gain from understanding consumer behavior. Higher prices are justified for advanced analytics or bespoke reporting that offer significant competitive edges. While specific pricing details for these advanced offerings are not public, Cardlytics' reported revenue of $240.3 million for fiscal year 2023 demonstrates market willingness to pay for these data-driven benefits.

| Pricing Model | Key Feature | Benefit to Advertisers | Benefit to Financial Institutions | Consumer Impact |

|---|---|---|---|---|

| Performance-Based (CPA) | Pay for results (sales/redemptions) | Reduced risk, clear ROI | N/A | Receives rewards/discounts |

| Revenue Sharing | Banks share ad revenue | N/A | New non-interest income | N/A |

| Value-Based | Price reflects data insights/strategic advantage | Competitive edge, informed strategy | Enhanced customer engagement, data monetization | N/A |

| Volume/Tiered Agreements | Discounts for higher spend | Cost efficiency, premium access | N/A | N/A |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis leverages a comprehensive blend of proprietary Cardlytics transaction data, alongside publicly available information from company websites, press releases, and industry reports. This ensures a robust understanding of product offerings, pricing strategies, distribution channels, and promotional activities.