Cardlytics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cardlytics Bundle

Uncover the intricate web of external forces shaping Cardlytics's trajectory. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for the company. Gain a strategic advantage by understanding these critical influences.

Ready to make informed decisions about Cardlytics? Our comprehensive PESTLE analysis provides actionable intelligence on everything from evolving consumer behavior to emerging data privacy regulations. Download the full report now to unlock deeper insights and refine your market strategy.

Political factors

Governments worldwide are intensifying their focus on data privacy and how companies use consumer information, leading to a surge in stricter regulations. For Cardlytics, a company that leverages anonymized purchase data to deliver targeted advertising, this evolving landscape demands constant adaptation to new data protection laws. For instance, the General Data Protection Regulation (GDPR) in Europe, implemented in 2018, set a precedent for robust data rights, and similar frameworks continue to emerge in other major markets.

Non-compliance with these increasingly stringent data protection laws can carry severe consequences for Cardlytics, including substantial financial penalties and significant reputational damage. In 2023, for example, regulatory bodies continued to issue significant fines for data breaches and privacy violations across various industries, underscoring the financial risks involved. This necessitates that Cardlytics maintains robust internal data governance policies and engages external legal counsel to ensure ongoing adherence to global data privacy standards.

Financial institutions, Cardlytics' key partners, operate under strict advertising rules set by agencies like the FTC and FDIC. New regulations effective in 2025 mandate that banks update their physical and digital advertising to clearly display FDIC insurance status and detailed product terms. Cardlytics must ensure its promotional offers comply with these changing standards to preserve valuable bank relationships.

Global political instability, including ongoing conflicts and trade tensions, can significantly impact consumer spending and marketing budgets. For instance, the ongoing geopolitical shifts in 2024 continue to create economic uncertainty, potentially leading businesses to reduce discretionary spending, including advertising.

While Cardlytics' core markets are the US and UK, broader economic uncertainty influenced by geopolitical events can indirectly affect advertiser confidence and their investment in advertising platforms. For example, a slowdown in international trade or increased energy costs due to global events can dampen overall economic sentiment, impacting marketing spend.

This external volatility necessitates that Cardlytics remains agile in its market strategies, adapting to potential shifts in consumer behavior and advertiser priorities driven by geopolitical developments. The company's ability to navigate these unpredictable external factors will be crucial for sustained growth.

Government Support for FinTech Innovation

Governments worldwide are increasingly recognizing the potential of financial technology (FinTech) to drive economic growth and improve financial inclusion. This often translates into supportive policies and incentives. For instance, the UK's Financial Conduct Authority (FCA) has been a pioneer with its regulatory sandbox, allowing firms to test innovative products in a live market with regulatory oversight. This environment can indirectly benefit companies like Cardlytics by fostering a more receptive market for data-driven financial solutions.

Such government backing can manifest in various forms, directly impacting the FinTech landscape. These include:

- Direct Grants and Funding: Many nations offer grants or seed funding for startups and established companies developing innovative financial technologies, particularly those focused on secure data utilization and consumer benefits.

- Regulatory Sandboxes: As seen in the UK, Singapore, and Australia, these controlled environments allow companies to test new products and services with reduced regulatory burden, accelerating development and market entry.

- Tax Incentives: Some governments provide tax breaks or credits for research and development in FinTech, encouraging investment in advanced analytics and data-driven platforms.

- Policy Support for Data Sharing: Initiatives promoting open banking or secure data aggregation can create a more favorable ecosystem for companies like Cardlytics that leverage consumer transaction data.

The impact of these initiatives, however, is geographically diverse. While some regions actively promote FinTech innovation through substantial government support, others may have more restrictive or nascent regulatory frameworks, influencing the pace of adoption and the potential for companies like Cardlytics to expand their offerings.

Antitrust and Competition Concerns

As digital advertising platforms amass significant influence, governments worldwide are intensifying their scrutiny of market dominance and fair competition. This trend directly impacts companies like Cardlytics, a commerce media platform, which may face regulatory examination if its market share or data aggregation strategies are perceived as hindering competition.

Cardlytics' business model, which leverages transaction data for targeted advertising, could attract attention from antitrust regulators concerned about potential monopolistic practices or unfair advantages gained through data access. For instance, the U.S. Department of Justice and the Federal Trade Commission have been actively investigating major tech companies for antitrust violations, setting a precedent for increased oversight across the digital advertising landscape.

- Regulatory Scrutiny: Increased governmental focus on market concentration in digital advertising.

- Competition Impact: Potential examination of Cardlytics' market share and data practices affecting competitors.

- Navigational Needs: Cardlytics must carefully manage market growth and its competitive positioning to comply with evolving regulations.

Governments globally are enhancing data privacy regulations, impacting how companies like Cardlytics utilize consumer information. The ongoing evolution of these laws, exemplified by the GDPR's precedent, necessitates continuous adaptation to ensure compliance and avoid penalties. For instance, in 2024, several countries introduced new data protection frameworks, mirroring the stringent requirements already in place in established markets.

What is included in the product

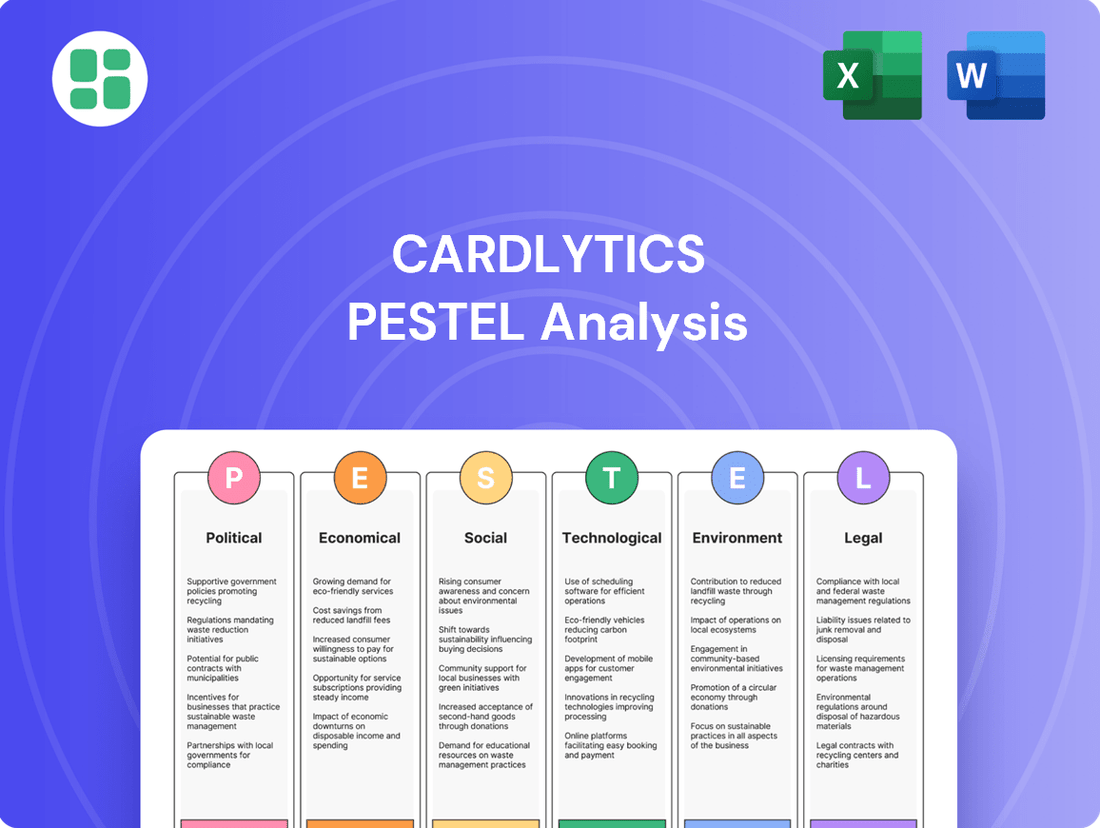

This PESTLE analysis examines the external macro-environmental forces impacting Cardlytics across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying opportunities and threats within Cardlytics's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, highlighting how Cardlytics can leverage political stability and economic growth while mitigating technological shifts and regulatory changes.

Economic factors

Inflationary pressures and broader economic conditions are significantly impacting consumer spending habits and, consequently, advertiser budgets. As the cost of goods rises, consumers tend to reduce discretionary spending, which directly affects the transaction volumes that Cardlytics relies on. This economic climate also leads marketers to scrutinize their advertising expenditures, potentially cutting back on campaigns.

Cardlytics' revenue model is intrinsically linked to both consumer transaction activity and the marketing spend of businesses. When consumers tighten their belts, fewer transactions occur, and when advertisers reduce their budgets, Cardlytics sees a direct impact on its top line. This makes the company particularly sensitive to economic downturns.

Recent financial reports underscore this sensitivity. For instance, Cardlytics reported a net loss of $20.7 million in the first quarter of 2024, compared to a net loss of $15.6 million in the same period of 2023, indicating ongoing challenges in navigating these economic headwinds and their effect on revenue generation.

Advertiser budget fluctuations significantly impact Cardlytics. Marketers' spending on advertising is closely tied to overall economic health and their company's own financial standing. When economic conditions are uncertain, businesses tend to tighten their belts, and advertising budgets are often among the first to be reduced.

Cardlytics relies on advertisers' willingness to invest in personalized offers delivered through its platform. During economic downturns or periods of heightened uncertainty, this willingness can diminish, directly affecting Cardlytics' revenue streams. For instance, the company's Q2 2025 financial results highlighted challenges, including declining billings and revenue, which were partly attributed to these shifts in advertiser spending patterns.

Interest rate fluctuations directly impact Cardlytics' financial obligations, notably its convertible senior notes. As of early 2024, the Federal Reserve maintained a hawkish stance, with benchmark rates holding steady in the 5.25%-5.50% range, a significant increase from previous years. This environment makes servicing existing debt more costly and could influence the attractiveness of new debt financing for Cardlytics.

Higher interest rates can also dampen investor sentiment towards growth-oriented technology companies like Cardlytics, potentially affecting its stock valuation and ability to raise capital through equity. The cost of capital rises, making future investments and acquisitions more expensive, a crucial consideration for the company’s capital structure and expansion plans in the evolving financial market.

Digital Advertising Market Growth

The digital advertising market demonstrates resilience, projected to reach $1.1 trillion globally by 2024, with continued expansion anticipated through 2025. This growth is fueled by advancements in AI for targeting, the increasing demand for personalized consumer experiences, and the rise of retail media networks, which offer brands direct access to shopper data and intent. Cardlytics, by focusing on the commerce media space, is well-positioned to benefit from this ongoing shift in marketing spend towards measurable, data-driven digital channels.

Key drivers of this market expansion include:

- AI-powered personalization: Enhancing ad relevance and effectiveness.

- Retail Media Networks: Growing rapidly as retailers leverage their first-party data.

- Shift to Measurable Channels: Marketers prioritizing ROI and demonstrable campaign success.

Financial Performance of Partner Banks

Cardlytics' reliance on financial institution partners means their performance is crucial. For instance, in Q1 2024, Bank of America reported a net income of $8.1 billion, while JPMorgan Chase posted $13.4 billion. These figures indicate the substantial scale of Cardlytics' potential reach through these major players.

The financial health of these banks directly influences the volume of transactions processed through Cardlytics' platform. A downturn in bank profitability could lead to reduced marketing budgets or a scaling back of digital initiatives, impacting Cardlytics' revenue streams.

- Bank Performance Impact: Strong financial results from partner banks like Wells Fargo (which reported a Q1 2024 net income of $4.7 billion) suggest a robust environment for Cardlytics' services.

- Market Consolidation Risk: Mergers or acquisitions among major banks could alter Cardlytics' partnership landscape, potentially creating integration challenges or reducing the number of key relationships.

- Digital Investment Trends: Banks' continued investment in digital transformation and customer engagement platforms, often supported by healthy profits, directly benefits Cardlytics' platform adoption and effectiveness.

Economic factors significantly shape Cardlytics' operational landscape. Persistent inflation, as seen with the US CPI remaining elevated throughout 2024, directly pressures consumer discretionary spending, reducing transaction volumes. Concurrently, advertisers, facing their own economic uncertainties, often pare back marketing budgets, impacting Cardlytics' core revenue streams. This dual pressure was evident in Cardlytics' Q1 2024 results, which showed a widening net loss to $20.7 million, highlighting the sensitivity to these macroeconomic shifts.

Interest rate policies also play a critical role. The Federal Reserve's sustained higher interest rate environment in 2024, with the federal funds rate holding at 5.25%-5.50%, increases the cost of capital for companies like Cardlytics, affecting debt servicing and potential future financing. This can also make growth-oriented tech stocks less attractive to investors, potentially impacting valuation and capital raising efforts.

The digital advertising market, however, offers a counterbalancing opportunity. Projected to reach $1.1 trillion globally in 2024 and continue growing through 2025, this expansion is driven by AI personalization and the rise of retail media networks. Cardlytics' focus on the commerce media space positions it to capture a share of this growing market, provided it can effectively navigate the economic headwinds.

The financial health of Cardlytics' banking partners is also a key economic indicator. Major banks like JPMorgan Chase reported robust net income, such as $13.4 billion in Q1 2024, indicating a strong environment for digital engagement and marketing spend. However, any significant downturn in bank profitability could translate to reduced marketing investment on their platforms, affecting Cardlytics.

Preview the Actual Deliverable

Cardlytics PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. It details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Cardlytics. This comprehensive PESTLE analysis provides valuable insights for strategic decision-making.

Sociological factors

Consumers today have a strong preference for personalized interactions, with studies indicating that a substantial portion of shoppers favor tailored advertisements over broadly distributed ones. For instance, a 2024 survey revealed that over 70% of consumers find personalized offers more appealing than generic promotions, directly supporting Cardlytics' business model.

Cardlytics' ability to deliver customized cashback offers directly taps into this consumer desire, fostering greater engagement and encouraging spending. This alignment with evolving consumer expectations is a key driver of their platform's success in the current market landscape.

However, there's a growing awareness among consumers regarding data privacy and the intrusiveness of certain personalization tactics. While they appreciate relevance, a significant segment is becoming more discerning about the extent and nature of the personalization they are willing to accept, creating a need for careful data handling and transparent communication from companies like Cardlytics.

Cardlytics' business model hinges on consumer trust in financial institutions, as it utilizes anonymized purchase data shared by these partners. A recent survey in early 2024 indicated that while a majority of consumers still trust their primary bank, a significant portion express concerns about how their financial data is used by third parties, with 35% reporting increased anxiety about data privacy in the past year.

Any breach of this trust, whether by Cardlytics' financial partners or the broader FinTech ecosystem, could directly impact consumer engagement with card-linked offers. For instance, high-profile cybersecurity failures at other financial technology firms in late 2023 led to a measurable dip in consumer participation in loyalty programs, highlighting the sensitivity of data sharing to public perception.

The increasing embrace of digital banking by consumers is a cornerstone for Cardlytics' success. As of early 2024, a significant majority of banking customers, often exceeding 70% in developed markets, regularly utilize mobile banking apps for transactions and account management. This trend directly enhances Cardlytics' ability to embed its offers within these familiar digital touchpoints.

This widespread adoption means Cardlytics' platform can reach a larger audience as more individuals manage their finances digitally. For instance, in the US, mobile banking transactions have seen consistent year-over-year growth, with projections indicating continued expansion through 2025. This expanding digital footprint translates to a greater addressable market for Cardlytics' data-driven marketing solutions.

Shifting Consumer Values Towards Sustainability

Consumers are increasingly prioritizing brands that showcase eco-friendly operations and transparency, a significant shift impacting marketing strategies. While Cardlytics itself is a data platform, its banking and advertising partners face mounting pressure to integrate sustainability into their campaigns. This growing consciousness could shape advertiser platform choices and how consumers engage with promotions, with studies in 2024 indicating over 60% of consumers are willing to pay more for sustainable products.

This evolving consumer sentiment directly influences the advertising landscape. Brands are actively seeking platforms that align with or can effectively communicate their sustainability efforts. For Cardlytics, this means its partners may increasingly favor advertising channels that demonstrate a commitment to environmental, social, and governance (ESG) principles. For instance, a bank highlighting its green lending initiatives might seek advertising placements with publishers or platforms that resonate with environmentally conscious audiences.

- Consumer Demand: Over 60% of consumers are willing to pay a premium for sustainable goods, highlighting a strong market preference.

- Partner Pressure: Banks and advertisers must demonstrate ESG alignment to meet consumer expectations and maintain brand reputation.

- Platform Influence: Advertisers may select platforms like Cardlytics based on their partners' ability to support and amplify sustainability messaging.

- Perception Impact: Consumer perception of offers is increasingly tied to the perceived sustainability of the brand and its marketing channels.

Financial Literacy and Engagement

FinTech solutions are increasingly embedding tools designed to boost financial literacy and aid consumers in managing their money more effectively. Cardlytics' approach, offering personalized incentives and spending insights, directly supports a user's financial health, reflecting a growing societal emphasis on informed financial decision-making.

This trend is evidenced by the significant adoption of financial management apps. For instance, in 2024, over 75% of US adults reported using at least one budgeting or personal finance app, indicating a strong consumer appetite for tools that simplify financial oversight.

- Growing Demand for Financial Education: Societal trends show an increasing desire for accessible financial education, with online resources and apps seeing a surge in usage.

- Cardlytics' Value Proposition: The company's platform offers tangible benefits through targeted offers, indirectly educating users on spending patterns and potential savings.

- Impact on Consumer Behavior: By providing data-driven insights, Cardlytics can empower consumers to make more conscious spending choices, contributing to their overall financial well-being.

- FinTech Integration: The broader FinTech landscape is prioritizing features that enhance financial literacy, a movement Cardlytics actively participates in.

Consumer trust in financial institutions is paramount, as Cardlytics relies on anonymized data shared by these partners. While many consumers trust their banks, a notable percentage, around 35% in early 2024 surveys, expressed increased anxiety about data privacy, directly impacting willingness to share information.

The increasing digital adoption in banking, with over 70% of users in developed markets actively using mobile banking apps by early 2024, provides a robust channel for Cardlytics' embedded offers. This digital shift expands the platform's reach and engagement opportunities.

Consumers are increasingly prioritizing brands demonstrating sustainability, with over 60% willing to pay more for eco-friendly products as of 2024. This trend pressures Cardlytics' partners to align their marketing with ESG principles, potentially influencing platform choices.

Societal emphasis on financial literacy is growing, with over 75% of US adults using personal finance apps in 2024. Cardlytics' personalized offers and spending insights align with this, indirectly aiding users in managing their finances more effectively.

Technological factors

Cardlytics' core business thrives on sophisticated AI and data analytics to make sense of anonymized consumer spending. These technologies are crucial for identifying patterns and delivering targeted offers to shoppers, a process that directly impacts campaign effectiveness and customer engagement.

Continuous innovation in AI and data analytics promises to sharpen Cardlytics' targeting capabilities and boost the relevance of its promotions. For instance, advancements in machine learning algorithms can lead to more accurate predictions of consumer behavior, thereby increasing the return on investment for brands advertising through the platform.

The rise of generative AI in digital advertising opens new avenues for Cardlytics. This technology can streamline the creation of personalized ad content and optimize campaign delivery, potentially leading to greater efficiency and improved campaign outcomes for its clients in 2024 and beyond.

Cardlytics' reliance on sensitive purchase data makes robust cybersecurity paramount. The FinTech industry, in particular, is a prime target for increasingly sophisticated cyber threats. In 2024, the financial services sector experienced a significant rise in ransomware attacks, with some reports indicating a 70% increase compared to the previous year, highlighting the urgent need for advanced defenses.

To safeguard its operations and maintain the trust of financial institutions and consumers, Cardlytics must continually invest in cutting-edge security protocols. This includes implementing advanced encryption techniques and exploring biometric authentication methods. The global cybersecurity market is projected to reach over $300 billion by 2025, underscoring the significant resources dedicated to combating these evolving threats.

Cardlytics' success hinges on its ability to integrate smoothly with the ever-changing digital banking infrastructure. As financial institutions upgrade their systems, Cardlytics must adapt to ensure its loyalty program and rewards platform remain compatible. This means keeping pace with advancements like real-time payment processing, which saw significant growth in 2024, with many countries reporting a substantial increase in real-time transaction volumes.

The rise of open banking, driven by regulations and consumer demand for greater data control, presents a key opportunity. By leveraging open banking APIs, Cardlytics can potentially access richer customer data, enabling more personalized offers and a deeper understanding of consumer spending habits. Furthermore, the ongoing migration of financial services to cloud computing platforms offers scalability and flexibility, allowing Cardlytics to expand its service offerings and reach more users within partner banks.

Identity Resolution and Fraud Detection Technologies

Cardlytics leverages sophisticated identity resolution, exemplified by its Bridg platform, to transform anonymous consumer data into actionable customer profiles, enhancing marketing precision. This capability is vital as the digital advertising landscape increasingly demands granular targeting and measurable results.

Continuous advancements in identity resolution and fraud detection are paramount for Cardlytics to maintain and improve its value proposition to advertisers. In 2024, the financial sector saw a significant uptick in AI-driven fraud prevention, with some reports indicating that AI can reduce false positives in fraud detection by up to 50%.

The integration of artificial intelligence into fraud detection is a transformative trend. For instance, by late 2024, many leading financial institutions reported using AI to analyze transaction patterns in real-time, leading to a substantial reduction in fraudulent activities and a more secure environment for both consumers and advertisers.

- Identity Resolution: Cardlytics' Bridg platform converts anonymous shopper data into identifiable customer profiles, enabling targeted advertising.

- Fraud Detection Advancements: Continuous innovation in fraud detection is critical for mitigating risks and ensuring the integrity of advertising campaigns.

- AI in Fraud Prevention: AI-powered fraud detection is a key technological trend, with capabilities to significantly reduce false positives in financial transactions.

- Market Impact: Enhanced identity resolution and fraud detection directly contribute to improved advertiser effectiveness and a safer transaction ecosystem.

Scalability and Platform Modernization

Cardlytics' ability to scale its technology platform is crucial for managing increasing user numbers and transaction volumes. In 2024, the company continued to prioritize investments in modernizing its infrastructure and enhancing its product and technical capabilities. This focus is directly tied to maintaining operational efficiency and securing a competitive edge in the digital advertising space.

The ongoing platform modernization efforts are designed to support efficient operations, which is vital for attracting and retaining both new partners and advertisers. Cardlytics' strategic roadmap for 2025 heavily emphasizes these technological advancements as a core driver for growth and market leadership.

- Scalability Investments: Cardlytics' commitment to platform modernization is a strategic imperative to handle anticipated growth in user acquisition and transaction throughput.

- Competitive Advantage: Enhancing tech capabilities directly translates to a stronger competitive position, enabling the company to offer more sophisticated solutions to partners and advertisers.

- Partner and Advertiser Attraction: A robust and modern platform is key to drawing in new business relationships and retaining existing ones through superior performance and features.

Cardlytics' core technology relies on advanced AI and data analytics to process anonymized spending data, enabling precise targeting for marketing campaigns. Continuous innovation in machine learning algorithms is projected to enhance predictive capabilities for consumer behavior, thereby boosting advertiser ROI.

The company's strategic focus on platform modernization in 2024 and 2025 aims to ensure scalability and operational efficiency, critical for managing growth and maintaining a competitive edge. These investments are vital for attracting and retaining both financial institution partners and advertisers.

Generative AI presents a significant opportunity for Cardlytics in 2024, offering streamlined content creation and optimized ad delivery for improved campaign outcomes. Cybersecurity remains paramount, especially with the financial sector facing a notable increase in cyber threats, highlighting the need for robust defenses.

Cardlytics’ ability to integrate with evolving digital banking infrastructure, including real-time payments and open banking APIs, is crucial for its platform's compatibility and expansion. By leveraging these technological advancements, Cardlytics can unlock richer customer data and offer more personalized experiences.

| Technology Area | Key Advancement/Focus | Impact on Cardlytics | 2024/2025 Relevance |

|---|---|---|---|

| AI & Data Analytics | Machine Learning for Predictive Behavior | Enhanced targeting, increased ROI for advertisers | Sharpened targeting, improved campaign relevance |

| Generative AI | Personalized Ad Content Creation | Streamlined content, optimized delivery | Efficiency gains, better campaign outcomes |

| Cybersecurity | Advanced Encryption & Biometrics | Mitigating sophisticated threats, maintaining trust | Essential for protecting sensitive data, combating rising threats |

| Digital Banking Integration | Real-time Payments & Open Banking | Platform compatibility, richer data access | Adaptation to infrastructure upgrades, expanded data insights |

Legal factors

Cardlytics navigates a challenging landscape of data privacy regulations, including the UK's GDPR and numerous US state laws such as CCPA, Virginia's CDPA, Colorado's CPA, and others in Tennessee, Maryland, and Delaware. These laws dictate how personal data can be collected, processed, and stored, and they grant consumers specific rights regarding their information, necessitating ongoing compliance investments from Cardlytics.

Failure to adhere to these stringent data privacy mandates can result in substantial financial penalties. Cardlytics' commitment to compliance is evident in its updated privacy policy from May 2025, which incorporates the latest state-specific privacy legislation, demonstrating proactive adaptation to the evolving legal environment.

Advertising in financial services is a minefield of regulations, with agencies like the FTC, FINRA, and SEC setting strict standards. Cardlytics must meticulously vet all offers on its platform to avoid misleading claims, ensure comprehensive disclosures are readily available, and comply with specific rules around testimonials and performance representations. This scrutiny is crucial to maintain trust and avoid penalties.

The evolving landscape of digital banking advertising, including recent FDIC rule updates, adds another layer of complexity. Cardlytics' bank partners are directly impacted, necessitating that any co-branded promotions or financial product advertisements align with these new digital-specific compliance requirements. Staying ahead of these regulatory shifts is paramount for Cardlytics' operational integrity and the success of its partnerships.

The Consumer Financial Protection Bureau (CFPB) actively scrutinizes Unfair, Deceptive, or Abusive Acts and Practices (UDAAP) within financial services marketing. In 2023, the CFPB continued its focus on ensuring fair treatment of consumers, with enforcement actions often targeting misleading advertising and hidden fees across various financial products.

Cardlytics and its financial institution partners must maintain absolute transparency in their offers, ensuring all terms and conditions are clearly communicated. Avoiding any hidden charges or misrepresentations of product benefits is crucial to sidestep regulatory penalties and maintain consumer trust.

Contractual Agreements with Financial Institutions

Cardlytics' core operations are built upon intricate contractual agreements with a network of financial institutions. These partnerships are crucial for accessing the transaction data that fuels their advertising platform. The terms of these contracts dictate data access, privacy compliance, and the revenue-sharing models that form the backbone of Cardlytics' financial performance.

The legal landscape surrounding these agreements presents significant risks. Potential breaches of contract by either party, unfavorable renegotiations of partnership terms, or even the outright termination of key relationships could severely disrupt Cardlytics' business. For instance, a major bank deciding not to renew its data-sharing agreement could directly impact the volume of transactions available for analysis and monetization.

- Contractual Dependence: Cardlytics' business model is intrinsically linked to its contractual relationships with financial institutions for data access and platform integration.

- Revenue Sharing Implications: The terms of these contracts directly influence Cardlytics' revenue streams through established revenue-sharing percentages.

- Risk of Partnership Disruption: Legal disputes, renegotiations, or terminations of these agreements pose a substantial threat to operational continuity and financial projections.

- Regulatory Compliance: Adherence to data privacy regulations within these contracts is paramount, with non-compliance leading to severe legal and financial penalties.

Intellectual Property Protection

Intellectual property protection is a cornerstone for Cardlytics, safeguarding its innovative technology, proprietary algorithms, and platform architecture. This is primarily achieved through a robust strategy involving patents, trademarks, and trade secrets, which are vital for maintaining its competitive advantage in the data analytics and digital advertising space.

Legal battles concerning intellectual property infringement, whether defending its own rights or facing accusations, represent a significant risk. Such disputes can lead to substantial legal expenditures and divert management focus away from strategic growth initiatives. For instance, the increasing complexity of data privacy regulations and the evolving landscape of digital advertising necessitate continuous vigilance and adaptation of IP strategies.

- Patents: Securing patents for novel algorithms and data processing techniques is essential to prevent competitors from replicating Cardlytics' core technology.

- Trademarks: Protecting brand names and logos through trademarks ensures brand recognition and prevents market confusion.

- Trade Secrets: Confidential information, such as specific customer data handling processes and internal operational methodologies, are guarded as trade secrets to maintain a unique operational advantage.

- Legal Costs: In 2023, companies in the tech sector, including those in data analytics, often allocate a notable portion of their budget to legal counsel for IP matters, with potential costs for litigation running into millions of dollars.

Cardlytics operates within a complex web of legal frameworks governing data privacy and advertising practices. The company must adhere to stringent regulations like GDPR and various US state privacy laws, such as the California Consumer Privacy Act (CCPA), to ensure responsible data handling and avoid significant penalties. For instance, in 2024, enforcement actions related to data privacy violations continued to be a major concern for technology companies, with fines potentially reaching millions of dollars.

Furthermore, advertising on financial platforms is heavily regulated by bodies like the FTC and FINRA, requiring Cardlytics to ensure all offers are transparent and free from misleading claims. The evolving digital banking regulations, including recent FDIC guidance, also necessitate careful alignment with partner requirements. The Consumer Financial Protection Bureau's ongoing focus on Unfair, Deceptive, or Abusive Acts and Practices (UDAAP) underscores the need for absolute transparency in all consumer-facing communications.

Environmental factors

The digital advertising industry, including platforms like Cardlytics, relies heavily on data centers, which consume substantial energy. This consumption contributes to a significant digital carbon footprint, a growing concern in today's environmentally conscious world.

As environmental awareness intensifies, companies are facing increased scrutiny regarding their energy usage. Cardlytics, like its peers, is expected to address the energy demands of its data centers and explore more efficient data delivery strategies to mitigate its environmental impact.

In 2024, the global IT industry's carbon footprint was estimated to be around 2-4% of total global greenhouse gas emissions, a figure that includes data center operations. This highlights the scale of the challenge and the imperative for companies to innovate in energy efficiency.

Consumers and investors are increasingly scrutinizing companies for their environmental, social, and governance (ESG) performance. This means Cardlytics, despite its digital nature, faces expectations to promote sustainability within its network. For instance, by 2024, over 90% of S&P 500 companies were expected to report on ESG metrics, highlighting the widespread demand for environmental accountability.

Brands partnering with Cardlytics are themselves under pressure to align with sustainable practices, influencing their choice of marketing platforms. A 2024 survey revealed that 70% of consumers consider sustainability when making purchasing decisions, pushing brands to seek partners that reflect these values. Cardlytics can leverage this by highlighting how its data-driven insights can help brands reach environmentally conscious consumers.

Consumers and regulators are increasingly demanding advertising that's kinder to the planet, focusing on campaigns that use less energy and media with a smaller carbon footprint. This means Cardlytics might see a push to offer or highlight greener advertising options on its platform.

Brands are recognizing that aligning with eco-conscious values is no longer optional but a requirement for success in today's market. For instance, a 2024 report indicated that 60% of consumers are more likely to purchase from brands with strong environmental commitments.

Regulatory Pressure for Environmental Reporting

While Cardlytics' core business isn't directly tied to heavy manufacturing, the increasing global push for environmental, social, and governance (ESG) reporting could eventually necessitate disclosures on its operational footprint. This trend is accelerating, with many jurisdictions exploring or implementing mandatory ESG reporting frameworks for publicly traded companies.

For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD) is already expanding the scope of ESG disclosures for a significant number of companies, and similar initiatives are gaining traction in North America. If these trends evolve to include data-centric businesses like Cardlytics, the company might need to report on metrics such as:

- Energy consumption of data centers and office spaces.

- Waste generation and recycling rates from operations.

- Carbon emissions associated with its digital infrastructure.

Adapting to and complying with these evolving regulatory pressures for environmental reporting will be crucial for maintaining investor confidence and market access in the coming years.

Supply Chain Sustainability (Indirect Impact)

While Cardlytics operates as a software and data platform, its success is intertwined with a broader ecosystem of technology vendors and financial institutions. These partners often have their own environmental policies and sustainability mandates that can indirectly shape Cardlytics' operational decisions and partnership agreements. For instance, a major financial partner might require Cardlytics to demonstrate a commitment to reducing its own carbon footprint or to ensure its data centers meet certain energy efficiency standards.

The digital sector as a whole is facing increased scrutiny regarding its environmental impact, from energy consumption of servers to the lifecycle of electronic hardware. As regulations around environmental, social, and governance (ESG) factors become more stringent, companies like Cardlytics will likely see greater pressure to ensure their supply chains, even for indirect components like cloud services or hardware, align with sustainability goals. This could manifest in audits, reporting requirements, or preferences for vendors with verifiable green credentials.

Consider the growing trend in cloud computing sustainability. Major providers are investing heavily in renewable energy to power their data centers. For example, in 2023, Microsoft announced plans to be carbon negative by 2030, and Google Cloud aims to operate on 24/7 carbon-free energy by 2030. Cardlytics, as a user of these services, benefits from these initiatives but may also be asked to contribute or demonstrate its own alignment with these environmental objectives.

- Ecosystem Interdependence: Cardlytics' indirect environmental impact stems from its reliance on technology and financial partners with their own sustainability commitments.

- Digital Sector Scrutiny: The broader tech industry's environmental footprint is under increasing examination, influencing operational standards for data-driven companies.

- ESG Compliance Pressure: Evolving ESG regulations can compel companies like Cardlytics to ensure their indirect supply chains adhere to environmental standards.

- Cloud Provider Initiatives: Major cloud providers' investments in renewable energy (e.g., Microsoft's 2030 carbon negative goal) indirectly support Cardlytics' sustainability efforts but may also lead to partnership alignment requirements.

Environmental factors significantly influence Cardlytics' operations and market perception. The company's reliance on data centers means energy consumption and carbon footprint are key considerations, with the IT sector's emissions being a growing global concern. By 2024, the IT industry's carbon footprint was estimated at 2-4% of total global greenhouse gas emissions.

Increasing consumer and investor demand for Environmental, Social, and Governance (ESG) performance means Cardlytics faces pressure to promote sustainability. Brands partnering with Cardlytics are also prioritizing eco-conscious partners, with around 70% of consumers considering sustainability in purchasing decisions as of 2024.

Evolving ESG regulations, such as the EU's CSRD, are expanding reporting requirements. This trend may eventually necessitate disclosures from data-centric businesses like Cardlytics concerning energy usage and carbon emissions from their digital infrastructure.

Cardlytics' ecosystem partners, including cloud providers, are also investing in sustainability. For instance, major cloud providers aim for carbon-free energy by 2030, indirectly supporting Cardlytics' environmental efforts while potentially leading to partnership alignment requirements.

| Factor | Impact on Cardlytics | 2024/2025 Data/Trend |

|---|---|---|

| Energy Consumption | Data center energy use contributes to carbon footprint. | IT sector's carbon footprint: 2-4% of global emissions. |

| Consumer Demand | Brands seek sustainable marketing partners. | 70% of consumers consider sustainability in purchases. |

| Regulatory Pressure | Increasing ESG reporting requirements. | Expansion of ESG disclosure mandates globally. |

| Ecosystem Sustainability | Cloud providers' green initiatives affect partners. | Major cloud providers targeting carbon-free energy by 2030. |

PESTLE Analysis Data Sources

Our PESTLE analysis is built on a robust foundation of data from leading financial institutions, government agencies, and reputable market research firms. We incorporate economic indicators, legislative updates, and technological advancements to provide a comprehensive view.