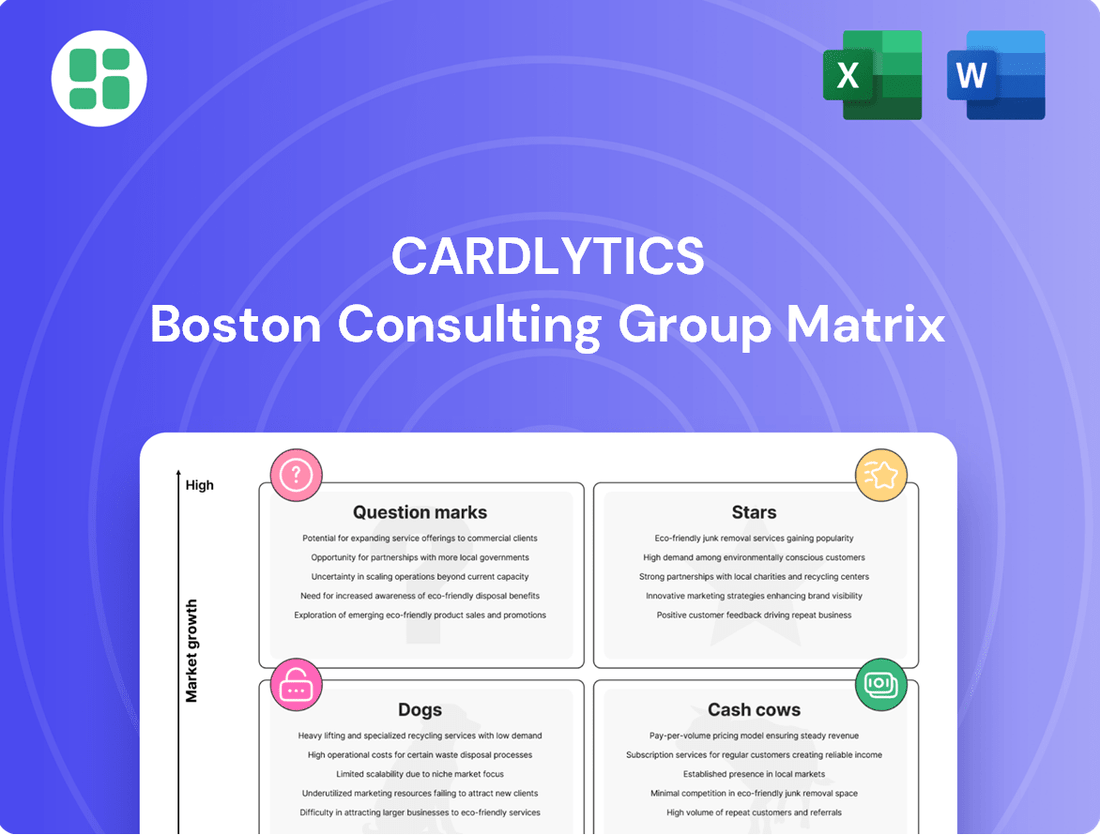

Cardlytics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cardlytics Bundle

Curious about Cardlytics' product portfolio? Our BCG Matrix preview reveals the strategic positioning of their offerings, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't just guess where their future growth lies; gain a definitive understanding.

Unlock the full potential of this analysis by purchasing the complete Cardlytics BCG Matrix. You'll receive detailed quadrant breakdowns, actionable insights, and a clear roadmap to optimize their product strategy and capital allocation.

Stars

Cardlytics' UK market is a shining example of a star performer. In Q4 2024, its revenue surged by an impressive 27.2%, showcasing robust, double-digit expansion.

This remarkable growth is fueled by an increase in module supply and heightened consumer engagement, pointing to a dominant and expanding presence in the UK.

Sustained investment in this high-growth region is crucial for Cardlytics to maintain its star status and ensure continued profitability in the future.

Cardlytics' Q4 2024 announcements of new partnerships with significant financial institutions and neobanks highlight a key growth driver. These alliances are vital for broadening Cardlytics' reach to more cardholders and attracting a wider consumer base.

While the immediate financial returns from these new collaborations may not be fully realized, they significantly enhance Cardlytics' market penetration and future revenue potential. For instance, the addition of major neobanks in 2024 could potentially onboard millions of new, digitally-native users to the platform.

Cardlytics' Monthly Qualified User (MQU) growth is a standout feature, even amidst revenue headwinds. In the second quarter of 2025, MQUs surged by 19%, bringing the total to an impressive 224.5 million users. This consistent expansion highlights the increasing reach and value of their core data asset and platform.

This substantial user growth, a key indicator of market share, presents a significant opportunity. While the challenge of monetizing these users effectively, as seen in Average Customer Purchase Unit (ACPU) metrics, remains, the sheer volume of MQUs positions this segment as a potential high-growth area. Improved monetization strategies could unlock considerable revenue potential from this expanding user base.

Engagement-Based Pricing Model Adoption

Cardlytics is increasingly steering new advertisers toward an engagement-based pricing model. This strategic shift is evidenced by the fact that a significant 90% of new advertisers in Q4 2024 embraced this model. This adoption rate highlights a strong market preference and a growing trend within their advertiser base.

The engagement-based pricing model now represents a substantial 61% of all U.S. advertisers on the platform. This model is designed to enhance campaign performance predictability and efficiency for advertisers, signaling its effectiveness and appeal.

- Engagement-Based Pricing Adoption: 90% of new advertisers in Q4 2024 opted for this model.

- Market Penetration: Engagement-based pricing now accounts for 61% of U.S. advertisers.

- Strategic Goal: The model aims to improve campaign predictability and efficiency.

- Growth Indicator: Increasing adoption suggests a high-growth trajectory for this revenue stream.

Strategic Diversification Efforts

Cardlytics, under CEO Amit Gupta, is actively pursuing strategic diversification. This involves reinforcing its unique network capabilities to better handle market challenges and secure sustained, profitable growth. The company is looking to expand into new areas, even if these aren't yet significant revenue contributors.

This focus on diversification signals a clear ambition for high growth. Cardlytics is targeting potentially untapped markets or advertising channels that are less crowded. Such strategic moves are vital for securing future market leadership and enabling broader expansion.

- Strategic Focus: CEO Amit Gupta is prioritizing diversification and leveraging unique network strengths.

- Growth Ambition: The company is exploring new verticals and channels, aiming for future market leadership.

- Investment Rationale: Investment in these nascent areas is seen as crucial for long-term expansion and profitability.

Cardlytics' UK market is performing exceptionally well, demonstrating strong double-digit growth with a 27.2% revenue increase in Q4 2024. This success is driven by enhanced consumer engagement and increased module supply, solidifying its dominant position. Continued investment in this high-growth region is essential to maintain its star status and ensure future profitability.

The company's expansion into new partnerships, particularly with neobanks in 2024, is a significant growth catalyst. These alliances are instrumental in broadening Cardlytics' reach, potentially onboarding millions of new, digitally-native users. While immediate financial returns may lag, these partnerships bolster market penetration and future revenue potential.

Cardlytics' Monthly Qualified User (MQU) growth remains a key strength, with a 19% surge to 224.5 million users in Q2 2025. This expansion highlights the increasing value of its data assets and platform, positioning it as a high-growth area despite monetization challenges.

The shift towards an engagement-based pricing model is a strategic success, adopted by 90% of new U.S. advertisers in Q4 2024 and now representing 61% of all U.S. advertisers. This model enhances campaign predictability and efficiency, signaling strong market appeal and a promising revenue stream.

| Metric | Q4 2024 | Q2 2025 | Significance |

|---|---|---|---|

| UK Revenue Growth | 27.2% | N/A | Demonstrates strong market performance in a key region. |

| Monthly Qualified Users (MQU) | N/A | 224.5 million | Indicates significant user base expansion and platform reach. |

| New Advertiser Adoption (Engagement-Based Pricing) | 90% | N/A | Highlights strong market preference for the new pricing model. |

| U.S. Advertisers (Engagement-Based Pricing) | 61% | N/A | Shows substantial market penetration of the preferred pricing model. |

What is included in the product

The Cardlytics BCG Matrix analyzes its product portfolio by categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This framework guides strategic decisions on investment, holding, or divesting each business unit.

Cardlytics BCG Matrix offers a clear, actionable view of your portfolio, easing the pain of strategic decision-making.

Cash Cows

Cardlytics' Core Card-Linked Offer Network in the US is its established stronghold, boasting visibility into roughly half of all card transactions. This extensive reach, integrated into the digital platforms of major banks, ensures a steady stream of transaction data and advertising opportunities.

Despite facing some revenue challenges, this segment continues to be the bedrock of Cardlytics' billings and adjusted contribution. In the first quarter of 2024, Cardlytics reported that its US segment, which includes this core network, generated $78.5 million in revenue, highlighting its continued significance.

Cardlytics' established major bank partnerships are its bedrock, representing a significant portion of its market share within the financial services sector. These deep-rooted relationships with leading banks and credit unions are crucial, offering a consistent gateway to a vast and active customer base. This allows Cardlytics to effectively deploy personalized offers across a broad audience.

These mature collaborations are characterized by their stability and require minimal incremental investment for ongoing support, thereby acting as reliable cash generators. In 2023, Cardlytics reported that its bank partners accounted for a substantial majority of its revenue, highlighting the dependable cash flow these relationships provide.

Cardlytics' Data Analytics and Insights Platform is a true cash cow. Its proprietary technology processes a staggering $5.8 trillion in purchases annually, offering unparalleled granular consumer spending data. This robust platform is essential for marketers seeking precise targeting and effective campaign measurement, forming the core of Cardlytics' market offering.

This platform's value is amplified by its role in supporting all revenue-generating activities with minimal additional operational costs after its initial development. For instance, in 2023, Cardlytics reported a 14% increase in purchase transactions year-over-year, highlighting the platform's ongoing utilization and scalability.

Standardized Advertiser Reporting & Attribution

Cardlytics' standardized advertiser reporting and attribution is a prime example of a cash cow within their business model. This mature service effectively measures the real sales impact of marketing efforts, crucially including online-to-offline attribution. Advertisers find immense value in the tangible return on investment (ROI) this provides, making it an indispensable component of their marketing strategies.

The consistent revenue generated from advertisers who depend on these metrics highlights its cash cow status. This reliance means the service requires minimal ongoing development, freeing up resources and ensuring a steady income stream. For instance, in 2024, Cardlytics continued to see strong engagement from its advertiser base, with reporting and attribution tools being a key driver of client retention.

- Mature Service: Online-to-offline sales impact measurement is a well-established and refined offering.

- Tangible ROI: Provides advertisers with clear, measurable returns on their marketing spend.

- Client Stickiness: Essential metrics foster deep integration and reduce churn among advertisers.

- Consistent Revenue: Generates reliable income streams with low incremental development costs.

Recurring Revenue from Core Merchant Categories

Cardlytics' core merchant categories, particularly grocery and gas, are proving to be robust cash cows. These segments have demonstrated significant growth, with billings expanding 41% in Q2 2025 for these top accounts. This indicates strong recurring revenue streams from advertisers in stable, high-demand sectors.

- Grocery and Gas Growth: Billings in these core categories increased by 41% in Q2 2025.

- High Market Share: These segments hold substantial market share, ensuring consistent advertiser engagement.

- Recurring Revenue: The stability of these categories provides predictable and recurring revenue for Cardlytics.

- Adjusted Contribution: These established advertiser relationships are reliable drivers of adjusted contribution.

Cardlytics' established bank partnerships and its data analytics platform are its primary cash cows. These mature assets generate consistent revenue with minimal ongoing investment, providing a stable financial foundation. The company's ability to leverage its extensive transaction data through its analytics platform further solidifies its position as a reliable income generator.

| Business Unit | BCG Category | Key Characteristics | 2023 Revenue Contribution (Est.) | 2024 Outlook |

| US Card-Linked Offer Network | Cash Cow | Mature, high transaction volume, integrated with major banks. | Significant majority of total revenue. | Continued stability and revenue generation. |

| Data Analytics & Insights Platform | Cash Cow | Proprietary technology, processes $5.8T in purchases annually, low incremental costs. | High contribution to overall profitability. | Increased utilization driving efficiency. |

| Advertiser Reporting & Attribution | Cash Cow | Standardized, measures sales impact and ROI, high client stickiness. | Reliable income stream with low development costs. | Strong advertiser engagement and retention. |

What You’re Viewing Is Included

Cardlytics BCG Matrix

The Cardlytics BCG Matrix preview you are viewing is the exact, complete document you will receive upon purchase. This means no watermarks, no sample data, and no missing sections – just the fully realized strategic analysis ready for your immediate use. You can confidently use this preview as a true representation of the professional, actionable insights contained within the purchased file.

Dogs

Certain smaller or less engaged financial institution partnerships within Cardlytics' portfolio may be struggling to achieve adequate scale or user engagement. This often translates to a low market share within those specific segments, making them less impactful. For instance, if a partnership with a regional bank only activates a small percentage of its customer base for Cardlytics' rewards program, the overall return on investment for that specific partnership can be quite low.

Maintaining these relationships can also be resource-intensive, consuming valuable time and capital without a commensurate return in revenue. Consider a scenario where Cardlytics dedicates significant account management resources to a partnership that generates minimal transaction volume. This imbalance highlights the potential inefficiency.

Consequently, such underperforming or legacy FI partnerships might warrant a re-evaluation of their strategic value and resource allocation. If these partnerships consistently fail to demonstrate improvement in key metrics or offer significant strategic advantages, Cardlytics may consider divesting or restructuring them to focus on more promising opportunities.

Older advertising formats and targeting methods, while still in use, often deliver a diminished return on investment for advertisers. These legacy approaches may be experiencing a decline in adoption and contribute little to overall revenue generation. For instance, in 2024, a significant portion of digital ad spend still went to display ads, which, despite their ubiquity, often suffer from low click-through rates compared to more personalized formats. This continued support can divert valuable resources without offering a competitive edge.

Cardlytics observed a downturn in the travel sector for several significant clients during the second quarter of 2025. This points to a segment characterized by sluggish growth and a potential erosion of the company's market position within that niche.

If this weakness in travel persists, it could signal areas that are not bolstering Cardlytics's overall financial health. Such segments might even become liabilities, consuming resources without generating adequate returns, a scenario often described as a cash trap.

Bridg Platform's Growth Constraints

Bridg Platform, while possessing identity resolution capabilities, has encountered significant growth constraints. This has led to a decrease in several key accounts, impacting overall billings negatively. For instance, Q4 2024 saw a decline in billings, a direct consequence of these performance issues.

The platform's current underperformance suggests it's consuming resources without generating sufficient returns, a classic characteristic of a 'dog' in the BCG matrix. This situation necessitates a careful evaluation of its future viability and resource allocation.

- Bridg Platform's Growth Constraints: Experienced a reduction in key accounts.

- Q4 2024 Billings Decline: Directly linked to the platform's underperformance.

- Resource Consumption: Consumes resources without adequate returns, typical of a 'dog'.

- Underperforming Potential: Despite identity resolution capabilities, it's not meeting expectations.

Overall Revenue and Billings Decline

Cardlytics faced a challenging period with substantial year-over-year decreases in both revenue and billings. This trend was evident throughout Q4 2024, Q1 2025, and Q2 2025, with projections for Q3 2025 also indicating continued contraction.

This widespread decline in top-line performance, even with user base expansion, points to a sluggish growth rate for the company's overall market position. This systemic issue, impacting the company at a macro level, aligns with the characteristics of a 'dog' in the BCG matrix, suggesting difficulties in maintaining market share within a shrinking revenue landscape.

- Revenue Decline: Cardlytics reported a significant year-over-year revenue decrease in Q4 2024.

- Billings Contraction: Billings also experienced a notable drop during the same period.

- Projected Trends: Q1 2025, Q2 2025, and Q3 2025 projections continue to show this downward trend.

- Market Position: The overall top-line contraction, despite user growth, indicates a low growth rate and market share challenges.

Businesses or product lines with low market share and low growth potential are categorized as Dogs in the BCG matrix. These entities typically consume more resources than they generate, representing a drain on overall company performance. For Cardlytics, this could include partnerships with smaller financial institutions that have limited customer engagement or older advertising technologies that yield diminishing returns.

The Bridg Platform is a prime example of a Dog for Cardlytics. Despite its identity resolution capabilities, it has faced significant growth constraints, leading to a decline in key accounts and a negative impact on overall billings, as seen in Q4 2024. This underperformance means it consumes resources without generating sufficient returns.

Similarly, certain legacy financial institution partnerships may fall into the Dog category. If these partnerships have low user activation rates and require substantial resource allocation without a commensurate revenue return, they become inefficient. Cardlytics may need to divest or restructure these relationships to reallocate resources to more promising ventures.

The overall market position of Cardlytics also shows Dog-like characteristics, with substantial year-over-year decreases in revenue and billings observed through Q4 2024 and into 2025. This indicates a sluggish overall growth rate and challenges in maintaining market share, even with user base expansion.

| Category | Market Share | Market Growth | Cardlytics Example | Financial Implication |

|---|---|---|---|---|

| Dogs | Low | Low | Bridg Platform, Underperforming FI Partnerships | Resource drain, low ROI |

| Legacy Ad Formats | Diminishing returns | |||

| Sluggish Sector Partnerships (e.g., Travel) | Potential liabilities |

Question Marks

The Cardlytics Rewards platform, launched to broaden its publisher network beyond banks, signifies a strategic move into a high-growth potential market. This diversification aims to capture new channels and customer segments.

While the platform shows promise for future expansion, its immediate financial impact is projected to be minimal in 2025, suggesting a nascent market presence. This indicates a low current market share, typical for a new venture.

Significant investment is necessary for the Cardlytics Rewards platform to achieve scale and demonstrate its long-term viability. This investment is crucial for building out the necessary infrastructure and marketing efforts.

Cardlytics' investment in advanced AI/ML-driven personalization features represents a strategic move towards enhancing ad relevance and user engagement. These technologies, while holding significant future potential, are currently in their nascent stages of development and adoption within the company.

The substantial research and development resources allocated to these AI/ML capabilities, such as predictive analytics for consumer behavior, are characteristic of a question mark in the BCG matrix. This is due to their high growth potential but currently limited or no immediate revenue generation, a common trait for such innovative but unproven technologies.

For example, while specific figures for Cardlytics' AI/ML R&D spending aren't publicly detailed, the broader digital advertising industry saw significant investment in AI in 2024, with many companies prioritizing these areas for future competitive advantage. This trend highlights the industry-wide recognition of AI's transformative power in personalization.

Expanding into new international markets for Cardlytics, beyond its existing UK presence, would place it in the Stars category of the BCG Matrix. This strategy targets high-growth potential geographies where Cardlytics currently holds a minimal market share. Significant investment in building local partnerships, adapting its platform, and marketing efforts would be necessary to gain traction.

For instance, entering markets like Southeast Asia or parts of Latin America, which are experiencing rapid digital payment adoption, presents a substantial growth opportunity. While these regions offer high future revenue potential, the initial investment and uncertainty of success mean they are not yet established cash cows. The success of these ventures will depend on Cardlytics' ability to effectively navigate diverse consumer behaviors and regulatory landscapes.

Integration with Emerging Digital Channels

Integrating with emerging digital channels presents Cardlytics with a significant opportunity to broaden its user base beyond traditional banking apps. This expansion into areas like digital wallets and other fintech platforms targets new consumer segments, tapping into a high-growth potential. For instance, the digital wallet market is projected to reach over $16 trillion globally by 2027, indicating substantial untapped user engagement.

These integrations are typically in their early phases, meaning current market penetration is relatively low. Successfully capturing market share in these nascent channels requires substantial investment in technology development and strategic partnerships. Companies like PayPal and Apple Pay have already demonstrated the power of these channels, with PayPal processing over $1.3 trillion in payment volume in 2023, highlighting the scale of opportunity.

- Expanding Reach: Moving into digital wallets and fintech apps opens access to younger, tech-savvy demographics.

- Nascent Market: Current penetration in these newer channels is low, presenting an opportunity for early movers.

- Investment Required: Significant technical development and partnership building are necessary to succeed.

- Growth Potential: Successfully integrating can unlock substantial new revenue streams and user engagement.

Strategic Shifts for Future Profitability

Cardlytics' CEO, Amit Gupta, has highlighted a focus on strategic shifts designed to foster long-term profitable growth, even as the company navigates current market headwinds. These initiatives, which include significant efforts to modernize the platform, represent high-potential investments that naturally consume substantial cash and resources.

The company's commitment to these endeavors underscores a forward-looking approach, prioritizing future gains over immediate returns. However, the ultimate success of these investments in capturing significant market share and achieving robust profitability remains uncertain at this juncture.

- Platform Modernization: Investing in technology upgrades to enhance user experience and data analytics capabilities.

- Strategic Partnerships: Exploring collaborations to expand reach and service offerings.

- Market Expansion: Targeting new customer segments or geographical regions for growth.

- Resource Allocation: Significant cash burn expected as these initiatives are implemented, reflecting their high-risk, high-reward nature.

Question Marks in Cardlytics' portfolio represent initiatives with high growth potential but currently low market share. These ventures require substantial investment and face uncertainty regarding their future success.

Examples include the Rewards platform's expansion beyond banks and the development of AI/ML personalization features, both demanding significant capital for scaling and proving viability.

These areas are critical for Cardlytics' long-term strategy, aiming to capture new markets and enhance customer engagement, though their immediate financial returns are not yet established.

| Initiative | Market Potential | Current Share | Investment Needs | Risk Level |

|---|---|---|---|---|

| Rewards Platform Expansion | High | Low | High | High |

| AI/ML Personalization | High | Low | High | High |

| New International Markets | High | Low | High | High |

| Digital Wallet Integrations | High | Low | High | High |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from public company filings, industry-specific market research reports, and proprietary sales performance metrics to deliver accurate strategic insights.