Cardlytics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cardlytics Bundle

Cardlytics operates in a dynamic landscape shaped by intense competition, the bargaining power of buyers, and the constant threat of new entrants. Understanding these forces is crucial for any strategic assessment of the company.

The complete report reveals the real forces shaping Cardlytics’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Cardlytics faces considerable supplier bargaining power due to its deep reliance on a select group of major financial institutions (FIs). These partners, such as Chase, Bank of America, and Wells Fargo, represent a concentrated source of valuable data and user access, granting them significant leverage.

The sheer volume of transactions and customer data provided by a single large FI can disproportionately influence Cardlytics' operations and revenue streams. This dependence means that key terms and pricing structures are often dictated by these powerful banking entities.

Cardlytics' reliance on proprietary purchase data and access to digital banking channels gives significant leverage to its financial institution (FI) partners. These FIs are the sole providers of this anonymized transaction information, which is the bedrock of Cardlytics' advertising platform. This exclusive control allows them to set the terms for data usage and the integration of Cardlytics' services into their banking apps.

Financial institutions possess substantial contractual leverage over Cardlytics. For example, the ability to terminate agreements with relatively short notice, as seen in Bank of America's General Services Agreement with a 90-day termination clause, grants these institutions significant power. This leverage allows them to renegotiate terms or switch providers, directly impacting Cardlytics' revenue streams and operational stability.

Internal Strategic Marketing Initiatives

Banks are increasingly focusing on developing their own internal marketing and loyalty programs. This trend directly impacts the bargaining power of suppliers like Cardlytics, as financial institutions gain more leverage. For instance, by enhancing their in-house capabilities, banks can reduce their dependence on external platforms for customer engagement and data analysis.

This strategic shift means banks might negotiate for more favorable revenue-sharing terms with third-party providers. A report from Deloitte in 2023 highlighted that 65% of banks were prioritizing digital transformation, including enhancing their customer loyalty initiatives. This investment in proprietary systems strengthens their position, potentially leading to reduced fees or increased demands on service providers.

- Increased In-House Capabilities: Banks are investing heavily in proprietary marketing technology and data analytics platforms.

- Reduced Reliance on Third Parties: As internal systems mature, banks may decrease their reliance on external marketing and loyalty program providers.

- Negotiating Power: Enhanced internal capabilities empower banks to negotiate more favorable revenue-sharing agreements and service terms.

- Customer Data Control: Banks aim to retain greater control over customer data and personalized marketing efforts.

Diversification of Cardlytics' Publisher Base

Cardlytics is actively reducing supplier power by diversifying its publisher base. Beyond traditional financial institutions, they are onboarding non-bank digital partners through initiatives like the Cardlytics Rewards Platform. This strategic move aims to lessen reliance on a few large financial institutions and broaden their network via various app-based digital properties.

This diversification is crucial for strengthening Cardlytics' position. By expanding beyond a core group of financial partners, the company can negotiate from a stronger stance, as its revenue streams become less concentrated. This approach directly counters the bargaining power of any single, dominant supplier.

As of early 2024, Cardlytics reported a significant portion of its revenue still stemmed from its top financial institution partners, highlighting the ongoing importance of this diversification effort. The company's stated goal is to onboard hundreds of new digital partners throughout 2024, aiming to shift this balance.

Key aspects of this strategy include:

- Expanding beyond FIs: Targeting digital-native companies and app developers.

- New platform initiatives: The Cardlytics Rewards Platform is a central piece for onboarding diverse partners.

- Reducing concentration risk: Minimizing dependence on any single large financial institution.

- Broader market access: Tapping into a wider range of consumer engagement channels.

Cardlytics faces significant supplier bargaining power primarily from its core financial institution (FI) partners. These FIs, acting as gatekeepers to vast transaction data, hold considerable sway due to their concentrated data supply and direct customer relationships. This leverage allows them to dictate terms, impacting Cardlytics' revenue and operational flexibility. For instance, the ability of a major bank to potentially terminate agreements, as seen with a 90-day clause in some contracts, underscores their power to renegotiate or seek alternative solutions.

As of early 2024, a substantial portion of Cardlytics' revenue still originates from its top FI partners, emphasizing the ongoing need for diversification. To counter this, Cardlytics is actively expanding its publisher base beyond traditional banks, aiming to onboard hundreds of new digital partners throughout 2024 via its Rewards Platform. This strategy seeks to reduce reliance on a few dominant suppliers and broaden market access.

| Supplier Type | Bargaining Power Driver | Impact on Cardlytics | Mitigation Strategy |

| Large Financial Institutions (e.g., Chase, Bank of America) | Concentrated Data Supply, Direct Customer Access, Contractual Leverage | Dictate Terms, Influence Pricing, Risk of Termination/Renegotiation | Diversification of Publisher Base, Onboarding Non-Bank Digital Partners |

| Emerging Digital Partners | Lower Transaction Volume (initially), Less Established Data Sets | Less Immediate Leverage, Potential for Scalable Growth | Cardlytics Rewards Platform, Broadening Network Reach |

What is included in the product

This analysis unpacks the competitive forces shaping Cardlytics' market, examining buyer and supplier power, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

Cardlytics' Porter's Five Forces analysis provides a simplified, actionable framework to quickly identify and address competitive pressures, alleviating the pain of complex market analysis.

Customers Bargaining Power

Cardlytics' customers, primarily marketers and advertisers, benefit from an abundance of alternative advertising channels. These include major platforms like Meta (Facebook/Instagram) and Google, which command significant digital ad spend. In 2024, the digital advertising market is projected to reach over $600 billion globally, highlighting the vast competitive landscape.

Marketers are increasingly demanding a clear return on investment (ROI) and measurable sales impact from their advertising budgets. This focus puts pressure on platforms like Cardlytics to prove their effectiveness.

While Cardlytics provides valuable purchase intelligence for attribution, the competitive advertising technology market means marketers will always shop around for the best results. They expect platforms to demonstrate superior, quantifiable outcomes for their spend.

In 2024, for instance, the average ROI for digital advertising across various industries continued to be a critical metric, with many campaigns aiming for a 4:1 return or higher. This persistent demand for demonstrable performance empowers customers to negotiate terms and seek out solutions that offer the most tangible sales lift.

Cardlytics is experiencing a significant shift as advertisers increasingly favor engagement-based pricing. By Q1 2025, a substantial percentage of Cardlytics' advertiser base had adopted these performance-oriented models. This trend underscores customers' desire to pay for demonstrable consumer actions and actual sales, not just ad visibility.

This customer demand places direct pressure on Cardlytics to consistently deliver measurable results and prove the direct impact of its advertising solutions on client revenue. The company must ensure its platform reliably drives tangible consumer behavior to retain and attract advertisers committed to engagement-based metrics.

Flexibility in Campaign Allocation and Cancellation

Marketers possess significant flexibility in how they allocate their advertising budgets, which directly impacts Cardlytics. This flexibility allows them to shift spending between different platforms and campaigns based on performance and market dynamics. For instance, Cardlytics reported that in Q1 2024, they experienced campaign cancellations and delays, demonstrating marketers' ability to quickly adjust or withdraw their ad spend.

This power to adjust spending quickly gives customers considerable leverage. It means Cardlytics' revenue and operational stability can be influenced by the decisions of its marketing clients. The ability for marketers to easily pivot their strategies highlights a key aspect of their bargaining power.

- Marketer Flexibility: Advertisers can readily reallocate funds across various marketing channels.

- Q1 2024 Impact: Cardlytics observed campaign cancellations and delays during this period, indicating client control.

- Revenue Influence: Customer decisions directly affect Cardlytics' financial performance and predictability.

- Operational Stability: The ease with which marketers can change plans impacts Cardlytics' operational planning.

High Expectations for Hyper-Personalization and Data Insights

Customers, particularly advertisers, are setting a high bar for hyper-personalization and deep data insights. They want marketing efforts to be incredibly precise, reaching the right people with the right message at the right time.

Cardlytics' strength lies in its first-party purchase data, which is a significant advantage. However, this isn't enough to stand still; advertisers will keep pushing for even more refined targeting, better ways to group audiences, and more actionable insights from this data. This means Cardlytics faces ongoing pressure to innovate and enhance its analytical capabilities to meet these evolving demands.

- Advertisers demand sophisticated targeting and segmentation capabilities.

- Cardlytics' first-party purchase data is a key differentiator, but innovation is crucial.

- The expectation for advanced data analytics drives continuous platform improvement.

Cardlytics faces strong customer bargaining power due to the vast array of advertising alternatives available, including giants like Meta and Google, which dominate digital ad spend. In 2024, the global digital advertising market is expected to exceed $600 billion, underscoring the competitive intensity and offering marketers numerous choices.

Advertisers are increasingly focused on measurable ROI and tangible sales impact, pushing platforms like Cardlytics to prove their effectiveness. The demand for demonstrable outcomes, with many campaigns targeting a 4:1 return or higher in 2024, empowers customers to negotiate terms and seek the best performance for their investment.

Cardlytics is seeing a trend towards engagement-based pricing, with a significant portion of its advertiser base adopting these models by Q1 2025. This shift reflects customers' desire to pay for actual consumer actions and sales, not just ad exposure, directly pressuring Cardlytics to consistently deliver quantifiable results.

Marketers' flexibility in reallocating ad budgets significantly impacts Cardlytics, as demonstrated by campaign cancellations and delays observed in Q1 2024. This ability to quickly adjust or withdraw spend gives customers considerable leverage, influencing Cardlytics' revenue and operational stability.

| Factor | Description | Impact on Cardlytics |

|---|---|---|

| Availability of Alternatives | Numerous digital advertising platforms and channels exist. | Reduces customer switching costs and increases price sensitivity. |

| Demand for Measurable ROI | Advertisers prioritize demonstrable sales impact and campaign effectiveness. | Requires Cardlytics to prove its value proposition and potentially adjust pricing. |

| Shift to Performance-Based Pricing | Customers prefer paying for engagement and sales rather than impressions. | Pressures Cardlytics to ensure its platform drives tangible consumer actions. |

| Customer Budget Flexibility | Marketers can easily shift ad spend between platforms and campaigns. | Creates leverage for customers and impacts Cardlytics' revenue predictability. |

Preview Before You Purchase

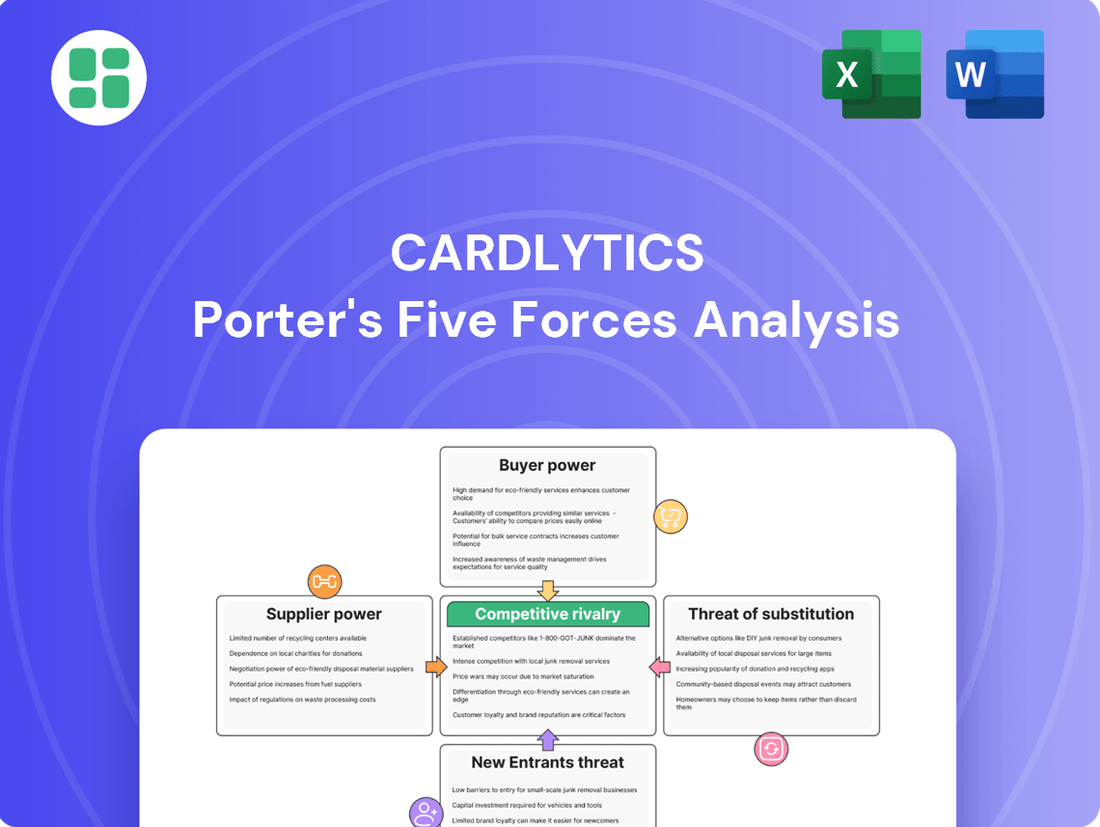

Cardlytics Porter's Five Forces Analysis

This preview showcases the exact Porter's Five Forces Analysis for Cardlytics that you will receive immediately after purchase, ensuring no surprises or placeholder content. The document you see here details the competitive landscape, including the threat of new entrants, bargaining power of buyers and suppliers, threat of substitute products, and intensity of rivalry, all formatted and ready for your immediate use. You're looking at the actual, professionally written analysis; once you complete your purchase, you’ll get instant access to this exact file, providing you with a comprehensive understanding of Cardlytics' market position.

Rivalry Among Competitors

The digital advertising arena is a battlefield, with giants like Google and Meta dominating, alongside a surge of specialized platforms and emerging technologies. Cardlytics faces this intense rivalry, where capturing marketer budgets requires constant innovation and demonstrable ROI. In 2023, global digital ad spending was projected to reach over $600 billion, highlighting the sheer scale of the market and the fierce competition for a share of that pie.

The rise of retail media networks poses a growing threat to companies like Cardlytics. These networks, leveraging retailer-specific data, allow brands to reach consumers directly at the point of sale, diverting significant advertising spend. For example, by the end of 2023, the U.S. retail media advertising market was projected to reach $52 billion, a substantial increase from previous years, illustrating the scale of this competitive shift.

Cardlytics encounters significant direct competition from other loyalty and Adtech providers. Companies specializing in loyalty programs, card-linked offers, and data-driven advertising present a constant challenge. This competitive landscape includes established loyalty program operators, nimble fintech firms venturing into Adtech, and even financial institutions exploring their own advertising solutions.

Innovation in AI and Analytics-Driven Solutions

Competitors are pouring resources into AI and analytics to sharpen targeting, personalization, and measurement. This ongoing technological race, evident in industry developments through 2024 and into 2025, compels Cardlytics to continuously enhance its platform to stay competitive.

The drive for smarter, data-driven customer engagement means companies are leveraging AI for more precise campaign execution and ROI demonstration. For instance, advancements in predictive analytics allow for more accurate forecasting of customer behavior, a key area of investment for rivals.

- AI-powered personalization: Competitors are developing AI models to deliver hyper-personalized offers, increasing engagement rates.

- Advanced analytics for measurement: Investment in analytics tools is focused on proving campaign effectiveness with granular data.

- Platform upgrades: The need to match or exceed competitor technological capabilities necessitates ongoing investment in Cardlytics' own infrastructure.

Cardlytics' Unique First-Party Data Position

Cardlytics' competitive rivalry is mitigated by its unique position in first-party data. By partnering directly with financial institutions, Cardlytics accesses secure, anonymized purchase data, covering a substantial portion of U.S. card transactions. This direct line to transactional insights provides a significant advantage over competitors relying on less direct or aggregated data sources.

This privileged access allows for highly precise targeting and robust measurement capabilities, differentiating Cardlytics in a crowded market. Competitors often struggle to achieve the same level of granularity and accuracy in their campaign analysis. For instance, in 2024, Cardlytics continued to expand its network, reporting engagement with millions of active users, underscoring the scale of its data advantage.

- First-Party Data Access: Direct partnerships with banks provide Cardlytics with unique, secure, anonymized purchase data.

- Targeting Precision: This data enables highly accurate customer segmentation and personalized offers.

- Measurement Capabilities: Cardlytics can demonstrate direct impact and ROI for marketers, a key differentiator.

- Competitive Moat: The difficulty for competitors to replicate this direct data access creates a sustainable competitive advantage.

The competitive landscape for Cardlytics is highly dynamic, characterized by intense rivalry from established tech giants, emerging retail media networks, and other Adtech and loyalty providers. This necessitates continuous innovation and a strong focus on demonstrating return on investment to capture marketer budgets. The sheer volume of digital ad spending, projected to exceed $600 billion globally in 2023, underscores the significant opportunities but also the fierce competition for market share.

Retail media networks, in particular, are a growing competitive force, leveraging retailer-specific data to offer brands direct access to consumers at the point of sale. The U.S. retail media advertising market alone was anticipated to reach $52 billion by the end of 2023, diverting substantial advertising spend. This trend highlights a significant shift in how brands engage with customers, directly challenging traditional advertising models.

Cardlytics also faces direct competition from other loyalty program operators and Adtech firms that specialize in card-linked offers and data-driven advertising. The market is further intensified by financial institutions exploring their own advertising solutions, creating a complex ecosystem of competitors. This environment demands ongoing investment in technology, particularly in AI and advanced analytics, to maintain a competitive edge in personalization and campaign measurement.

Competitors are actively investing in AI-powered personalization and advanced analytics to prove campaign effectiveness, a trend that will continue to shape the market through 2024 and 2025. This technological race requires Cardlytics to consistently enhance its platform capabilities to remain relevant and effective in delivering measurable results for advertisers.

| Competitor Type | Key Competitive Actions | Market Trend Relevance |

| Tech Giants (e.g., Google, Meta) | Dominant ad platforms, broad reach, sophisticated targeting | Setting benchmarks for digital advertising effectiveness |

| Retail Media Networks | Leveraging first-party shopper data, point-of-sale advertising | Capturing significant ad spend, direct consumer engagement |

| Adtech/Loyalty Providers | Card-linked offers, data-driven advertising solutions | Offering specialized, data-centric marketing capabilities |

| Fintech/Financial Institutions | Developing in-house advertising and loyalty solutions | Increasing competition for consumer data and advertising inventory |

SSubstitutes Threaten

Marketers have a vast array of traditional digital advertising channels they can turn to instead of platforms like Cardlytics. Think about search engine marketing (SEM) where brands bid on keywords, or social media advertising on platforms like Meta and TikTok, which offer targeted reach. These established channels provide broad audience access for brand building and customer acquisition, even if they don't directly leverage purchase data in the same way.

The sheer scale and maturity of these substitute channels present a significant competitive force. For instance, in 2024, global digital ad spending was projected to exceed $700 billion, with a substantial portion going to search and social media. This massive investment in alternative digital advertising ecosystems means marketers have readily available and well-understood options for reaching consumers.

Brands increasingly leverage direct-to-consumer (DTC) marketing, bypassing third-party platforms. This includes robust email, SMS, and loyalty programs managed via their own websites and apps. For instance, a significant portion of consumer spending, estimated to be in the hundreds of billions annually across various sectors, now flows directly through these brand-owned channels, reducing reliance on intermediaries.

Financial institutions, a key supplier for Cardlytics, possess the potential to develop or enhance their own in-house marketing and loyalty programs. This would allow them to deliver personalized offers directly to their customer base, bypassing Cardlytics' platform entirely.

Such an internal solution represents a significant threat of substitution, as it directly replicates the core value proposition Cardlytics offers to its clients. For instance, in 2024, many banks are investing heavily in customer data analytics to deepen relationships, potentially reducing reliance on third-party loyalty platforms.

Alternative Loyalty and Rewards Programs

Consumers are increasingly participating in a multitude of loyalty and rewards programs offered by airlines, retailers, and competing credit card issuers. These programs actively vie for consumer spending and attention, presenting alternative ways for individuals to derive value. This can divert engagement from Cardlytics' cashback offers, as consumers may prioritize accumulating points or miles with other providers.

For instance, in 2024, the U.S. credit card market saw continued robust growth in rewards spending, with estimated annual spending on rewards programs exceeding $100 billion. Many of these programs offer tiered benefits and personalized incentives that directly compete with Cardlytics' value proposition.

- Increased Consumer Engagement: A significant portion of consumers actively participate in at least one loyalty program, with many belonging to multiple programs across different sectors.

- Value Diversion: Alternative rewards, such as travel miles or exclusive retail discounts, can be perceived as more valuable by certain consumer segments, drawing spending away from Cardlytics' cashback incentives.

- Competitive Landscape: The sheer volume of loyalty programs creates a crowded marketplace where Cardlytics must continually differentiate its offerings to maintain consumer interest and spending.

- Partnership Dependence: Cardlytics' success is tied to its bank partnerships, and if these banks offer their own enhanced or competing rewards directly, it can diminish the appeal of Cardlytics' platform.

Emerging Privacy-Centric Ad Technologies

The rise of privacy-centric ad technologies presents a significant threat of substitutes for Cardlytics. As data privacy concerns grow and regulations like GDPR and CCPA tighten, advertisers are actively seeking alternatives to traditional data-driven targeting. For instance, the deprecation of third-party cookies by major browsers, a trend that accelerated in 2024, forces a rethink of digital advertising strategies. This shift encourages the development of new ad tech solutions that rely less on individual user tracking.

These emerging technologies could offer advertisers new ways to reach consumers without needing direct access to the kind of granular, transaction-level data that Cardlytics leverages. Think about contextual advertising that targets based on the content of a webpage, or on-device processing that analyzes user behavior locally without sending it to a third party. Such innovations could provide comparable or even superior targeting capabilities, potentially at a lower cost or with greater consumer trust, directly impacting Cardlytics' value proposition.

Consider the growth in contextual advertising solutions. In 2024, the global contextual advertising market was projected to reach approximately $300 billion, demonstrating a clear demand for privacy-friendly alternatives. New platforms are emerging that allow for sophisticated audience segmentation based on anonymized data or aggregated trends, bypassing the need for partnerships with companies like Cardlytics that rely on direct consumer data sharing.

- Evolving Privacy Landscape: Increased regulatory scrutiny and consumer demand for privacy are driving innovation in ad tech.

- Cookie Deprecation: The phasing out of third-party cookies by browsers like Chrome (with significant progress in 2024) necessitates new targeting methods.

- Emergence of Alternatives: Privacy-centric technologies such as contextual advertising and on-device analytics offer substitutes for traditional data-sharing models.

- Market Growth: The contextual advertising market's substantial growth in 2024 highlights the increasing adoption of privacy-preserving ad solutions.

The threat of substitutes for Cardlytics is significant, stemming from a variety of established and emerging digital advertising channels. Marketers can opt for search engine marketing or social media advertising, which together accounted for a substantial portion of the projected over $700 billion in global digital ad spending in 2024. Additionally, brands are increasingly utilizing direct-to-consumer channels like email and SMS, bypassing intermediaries and leveraging their own customer data. These alternatives offer broad reach and established methodologies, presenting a clear substitute for Cardlytics' purchase-data-driven approach.

Entrants Threaten

New entrants find it incredibly challenging to forge partnerships with established financial institutions. These collaborations are crucial for accessing the anonymized purchase data that fuels Cardlytics' business model.

Securing these data streams and integrating with digital banking platforms involves navigating complex compliance regulations and enduring protracted sales processes. For instance, in 2024, the average time for a fintech to secure a data-sharing agreement with a top-tier bank often stretched beyond 18 months, highlighting the significant hurdle.

This high barrier of entry, built on trust, regulatory adherence, and substantial integration efforts, effectively limits the number of new competitors capable of quickly scaling and challenging incumbents like Cardlytics.

The threat of new entrants into the purchase intelligence space, particularly as it relates to competing with companies like Cardlytics, is significantly mitigated by the sheer scale of data required. New players would need to either build or acquire similarly vast, secure, and granular datasets of consumer purchase behavior, a monumental undertaking. For instance, Cardlytics leverages data from billions of transactions annually, providing a competitive moat that is difficult for newcomers to replicate quickly or cost-effectively.

Beyond data acquisition, the development of sophisticated analytics capabilities to derive meaningful insights from such massive datasets presents another substantial hurdle. This requires significant investment in advanced technology, specialized talent in data science and AI, and robust cybersecurity infrastructure. The complexity and cost associated with building these capabilities mean that only well-funded and technologically adept organizations could realistically challenge established players in this niche.

Stringent regulatory and privacy compliance significantly deters new entrants in the financial data analytics sector. Operating with sensitive financial data requires adherence to a complex web of evolving laws like GDPR and CCPA, alongside specific financial industry regulations. For instance, in 2024, the estimated cost of compliance for financial institutions globally continued to rise, with significant investments required in data protection and cybersecurity infrastructure.

Significant Capital Investment Needs

Establishing a platform that can truly compete with Cardlytics necessitates significant capital outlay. This includes the hefty costs associated with developing and maintaining sophisticated technology, building out robust data infrastructure, and securing crucial partnerships with financial institutions and merchants.

Furthermore, the investment required to build out effective sales and marketing teams to acquire both customers and partners is substantial. These high upfront expenditures and the extended timelines for achieving profitability act as a considerable deterrent for many potential new entrants looking to challenge Cardlytics' position in the market.

- Technology Development: Building a competitive platform requires substantial investment in AI, data analytics, and secure transaction processing capabilities.

- Partnership Acquisition: Securing agreements with banks and merchants involves significant outreach, integration costs, and potentially revenue-sharing models.

- Sales & Marketing: Acquiring a critical mass of users and merchant partners demands considerable spending on customer acquisition and brand building.

Strong Network Effects and Incumbent Advantages

Cardlytics benefits from powerful network effects, making it difficult for new entrants. As more financial institutions partner with Cardlytics, the platform attracts more marketers seeking to reach those customers. This leads to a greater variety of offers, which in turn makes the platform more attractive to consumers and, consequently, to more financial institutions. This self-reinforcing cycle creates a significant competitive advantage.

In 2024, Cardlytics continued to leverage these network effects. The company reported a significant increase in its active customer base, driven by deeper engagement with existing financial institution partners and the onboarding of new ones. This growth in user participation directly strengthens the value proposition for advertisers, creating a formidable barrier to entry for any potential competitor looking to replicate the scale and reach of Cardlytics' ecosystem.

The incumbent advantage for Cardlytics is substantial. Breaking into this established network requires not only substantial capital investment but also the ability to simultaneously attract a critical mass of both financial institutions and consumers. Without this, new entrants would struggle to offer the same level of targeted marketing opportunities that Cardlytics provides, a challenge that was evident in the limited market penetration of emerging players throughout 2024.

- Network Effect Cycle: Financial Institutions → Marketers → Consumer Offers → Financial Institutions

- 2024 Growth: Increased active customer base and deepened partnerships with FIs.

- Barrier to Entry: High capital and user acquisition costs for new entrants.

The threat of new entrants in the purchase intelligence sector, particularly for companies like Cardlytics, is significantly dampened by the immense data requirements and the complexity of establishing necessary partnerships. Newcomers face substantial hurdles in acquiring comparable datasets of consumer purchase behavior, a feat that demands massive investment and time.

Securing partnerships with financial institutions is a protracted and complex process, often involving extensive compliance checks and integration efforts. For instance, in 2024, the average time for a fintech to establish a data-sharing agreement with a major bank frequently exceeded 18 months, illustrating the formidable entry barrier.

The high capital expenditure needed for technology development, data infrastructure, and market acquisition, coupled with the strength of network effects, creates a robust defense for incumbents like Cardlytics. These factors collectively limit the feasibility and scalability of new competitors entering the market.

Porter's Five Forces Analysis Data Sources

Our Cardlytics Porter's Five Forces analysis is built on a foundation of robust data, including proprietary transaction data, public company filings, and industry-specific market research reports.

We leverage insights from investor relations materials, competitor press releases, and economic indicator databases to comprehensively assess the competitive landscape.