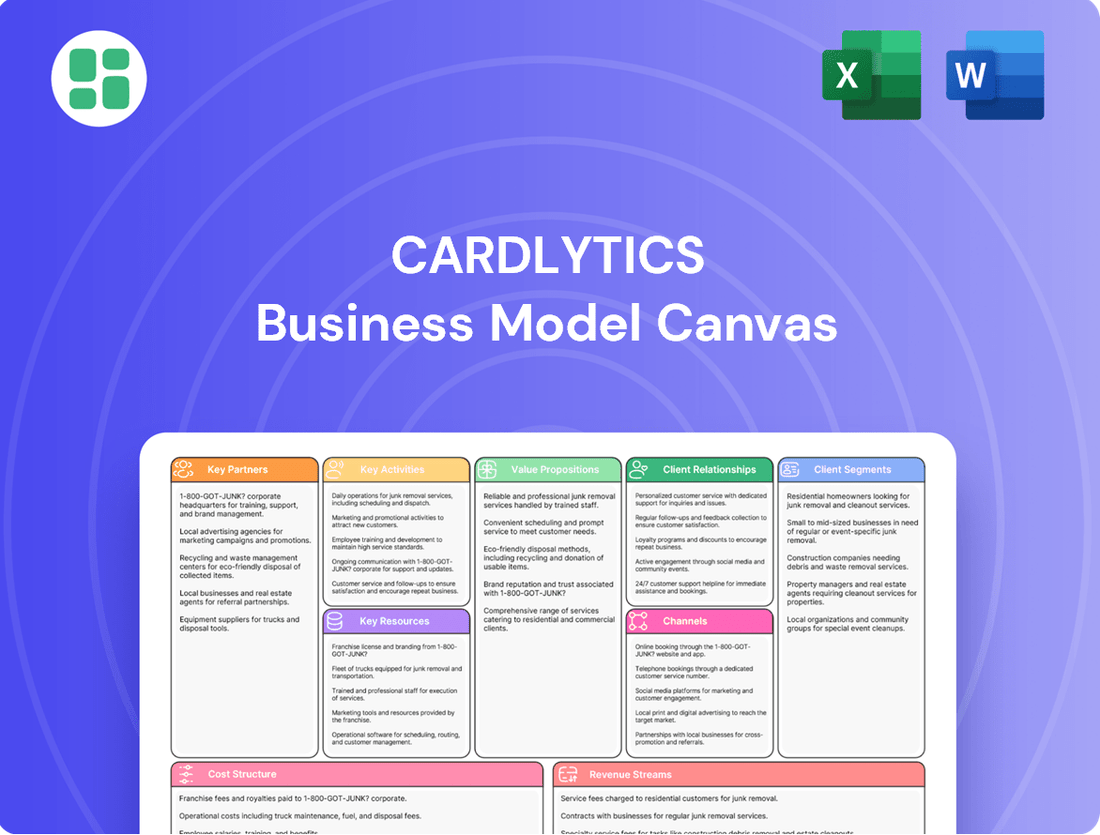

Cardlytics Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cardlytics Bundle

Curious how Cardlytics leverages its unique data to drive customer loyalty and revenue? This Business Model Canvas breaks down their customer relationships, key resources, and revenue streams. Download the full version to understand the strategic architecture behind their success.

Partnerships

Cardlytics' key partnerships with financial institutions, including major banks and credit unions, are the bedrock of its business model. These collaborations allow Cardlytics to integrate its advertising platform into the digital banking experiences of millions of consumers. This provides Cardlytics with invaluable access to anonymized customer purchase data, which is crucial for its advertising operations.

As of the fourth quarter of 2023, Cardlytics had established partnerships with over 2,300 financial institutions. This extensive network includes prominent US banks, smaller regional banks, and credit unions, underscoring the widespread adoption and trust placed in Cardlytics' technology by the financial sector.

Cardlytics' core strength lies in its extensive network of merchants and advertisers. These partners, ranging from major national brands to smaller local establishments, leverage Cardlytics to reach consumers precisely when and where they are most likely to purchase, based on their actual spending behavior.

These collaborations are the engine of Cardlytics' business model, directly driving revenue through advertising placements and funding the attractive cashback rewards offered to cardholders. In the fourth quarter of 2023, Cardlytics highlighted a robust ecosystem, boasting over 1,500 retail merchant partners and more than 250 e-commerce platforms.

Cardlytics enhances its platform by partnering with key data analytics and technology providers. These collaborations are crucial for maintaining a robust, secure, and innovative data-driven marketing ecosystem.

For instance, Cardlytics utilizes Amazon Web Services (AWS) for its cloud infrastructure, ensuring scalability and reliability. Additionally, partnerships with firms like Snowflake for advanced data analytics empower Cardlytics to process and derive insights from vast datasets more effectively.

Payment Processors and Credit Card Networks

While Cardlytics directly partners with banks, its ecosystem relies heavily on underlying relationships with major payment processors and credit card networks like Visa, Mastercard, and American Express. These networks are crucial for the secure and efficient movement of transaction data that Cardlytics leverages for its insights. In 2024, these networks continued to be the backbone of the card-linked offer space, processing trillions of dollars in transactions globally.

These partnerships are fundamental to enabling the card-linked offer model. They ensure that transaction data, anonymized and aggregated, can flow seamlessly from the point of sale through the network to Cardlytics for analysis and subsequent offer delivery. Without these foundational relationships, the entire value proposition of Cardlytics would be impossible to realize.

- Visa: Processed over $14.4 trillion in payment volume globally in fiscal year 2023, a key facilitator for card-linked offers.

- Mastercard: Reported over $3.5 trillion in gross dollar volume in 2023, underscoring its role in enabling transaction data flow.

- American Express: Continues to be a significant player, with its proprietary network essential for many card-linked programs.

Retail Media Networks and Publishers (Non-FI)

Cardlytics is strategically broadening its reach by forging partnerships with entities beyond traditional banks. The May 2025 launch of the Cardlytics Rewards Platform (CRP) signifies a major step in this direction, enabling a wider array of publishers, including major retailers and popular digital sports platforms, to leverage card-linked offers. This expansion diversifies Cardlytics' advertising inventory and significantly increases its consumer touchpoints.

These new alliances are crucial for Cardlytics’ growth strategy, allowing them to tap into new customer bases and offer more targeted promotions. By integrating with non-financial publishers, Cardlytics can access a richer dataset and provide advertisers with more granular insights into consumer behavior across various sectors.

- Retailer Integration: Cardlytics partners with retailers to embed loyalty programs and personalized offers directly into their digital platforms, enhancing customer engagement and driving sales.

- Publisher Ecosystem Expansion: The company is actively onboarding digital sports platforms and other media publishers to integrate card-linked offers, creating new channels for advertising and data acquisition.

- Diversified Supply Chain: This move diversifies Cardlytics' supply of advertising inventory, reducing reliance on financial institutions and opening up new revenue streams through broader market access.

Cardlytics' key partnerships are the foundation of its business model, connecting financial institutions, merchants, and technology providers. These collaborations enable the delivery of personalized, card-linked offers to consumers directly through their banking apps. In 2024, Cardlytics continued to strengthen its relationships with over 2,300 financial institutions, including major banks and credit unions, providing access to millions of consumers.

The company also boasts a robust network of over 1,500 retail merchant partners and more than 250 e-commerce platforms, who leverage Cardlytics for targeted advertising based on actual purchase data. Furthermore, strategic alliances with technology providers like AWS and Snowflake enhance data processing and platform capabilities. Crucially, partnerships with payment networks such as Visa, Mastercard, and American Express are essential for the seamless flow of anonymized transaction data, processing trillions of dollars in 2023 and 2024 transactions globally.

Cardlytics is expanding its reach through new partnerships with publishers, including major retailers and digital sports platforms, as seen with the May 2025 launch of its Rewards Platform. This diversification broadens advertising inventory and consumer touchpoints, driving revenue and providing advertisers with richer consumer insights across various sectors.

| Partner Type | Key Players | 2023/2024 Data Points | Impact on Cardlytics |

|---|---|---|---|

| Financial Institutions | Major Banks, Credit Unions | Over 2,300 partners (Q4 2023) | Access to millions of consumers, transaction data |

| Merchants & Advertisers | National Brands, Local Businesses, E-commerce | 1,500+ retail, 250+ e-commerce (Q4 2023) | Advertising revenue, targeted offer delivery |

| Payment Networks | Visa, Mastercard, American Express | Visa: $14.4T+ payment volume (FY23) Mastercard: $3.5T+ gross dollar volume (2023) |

Enables transaction data flow, core to CLO model |

| Technology Providers | AWS, Snowflake | Cloud infrastructure, advanced data analytics | Scalability, reliability, enhanced data insights |

| New Publishers | Retailers, Digital Sports Platforms | Expanding ecosystem with CRP (May 2025) | Diversified inventory, new revenue streams |

What is included in the product

A robust business model outlining Cardlytics' strategy for connecting advertisers with consumers through bank transaction data, emphasizing its unique data-driven approach to loyalty and marketing.

Cardlytics' Business Model Canvas provides a clear, one-page snapshot of how they leverage transaction data to deliver targeted advertising, solving the pain point of ineffective marketing spend for brands.

This structured approach allows Cardlytics to quickly identify and articulate their value proposition, addressing the pain point of disconnected customer insights and marketing efforts.

Activities

Cardlytics’ core operations revolve around the meticulous anonymization and analysis of extensive purchase data. This process transforms raw transaction information into actionable insights about consumer spending habits.

In 2024, the sheer volume of data processed was immense, with the Cardlytics platform analyzing approximately $5.8 trillion in purchases. This massive scale underscores the depth of their analytical capabilities and the foundational nature of this activity.

By securely handling and interpreting this data, Cardlytics uncovers granular patterns in consumer behavior, which is essential for delivering their unique value proposition to financial institutions and advertisers.

Cardlytics' core function revolves around creating and tailoring cashback offers and rewards. They meticulously analyze customer purchase data to ensure these offers resonate deeply with individual bank customers, making them relevant and valuable. This targeted approach is crucial for boosting engagement and encouraging customers to actually use the offers.

The company's ongoing efforts are focused on refining the methods through which they connect with and influence potential buyers. By understanding purchase patterns, Cardlytics aims to present the right offers at the opportune moments. For instance, in 2024, their platform facilitated billions of transactions, with a significant portion of these leading to personalized offer redemptions, demonstrating the effectiveness of their curation strategy.

Cardlytics' core operations revolve around the continuous development and upkeep of its advanced technology platforms, such as Cardlytics Direct and Bridg. This ensures the platform remains robust, secure, and capable of delivering sophisticated data analytics.

Significant investment fuels these efforts, with Cardlytics dedicating $12.3 million to platform technology development in the fourth quarter of 2023 alone. This focus enhances data processing, user experience for banks and merchants, and overall system performance.

Sales and Campaign Management for Advertisers

Cardlytics actively engages with marketers and advertisers, guiding them through the entire lifecycle of their advertising campaigns. This crucial activity involves understanding advertiser goals, developing targeted strategies, and ensuring seamless campaign execution. The company focuses on helping businesses connect with their most receptive audiences.

A core function is the meticulous management of these advertising campaigns, optimizing them for maximum impact and reach. This includes the strategic placement of offers and promotions to influence purchasing decisions at the point of sale. Cardlytics provides advertisers with the tools and expertise to drive measurable results.

Providing comprehensive performance reporting is essential, allowing advertisers to understand the true sales impact of their initiatives. This data-driven approach enables continuous improvement and demonstrates the return on investment for campaign spend. In 2024, Cardlytics successfully managed over 1,900 advertising campaigns, showcasing their operational capacity.

- Engaging Marketers: Building relationships and understanding advertiser needs.

- Campaign Management: Strategizing, executing, and optimizing ad placements.

- Performance Reporting: Measuring sales impact and providing actionable insights.

- 2024 Data: Managed over 1,900 advertising campaigns.

Financial Institution Integration and Support

Cardlytics actively integrates its platform with new financial institution partners, a crucial activity for expanding its reach. This onboarding process ensures that the offer delivery system functions smoothly within the digital banking environments of these partners.

Ongoing technical and operational support for existing financial institution partners is paramount. This support maintains the seamless delivery of offers and reinforces strong relationships with these key data providers.

The success of these integration efforts is evident in recent performance metrics. For instance, monthly qualified users saw a significant increase of 19% in Q2 2025, directly attributed to the onboarding of new bank and non-bank partners onto the Cardlytics platform.

- Platform Integration: Continuously onboarding new financial institutions to broaden network reach and offer delivery capabilities.

- Ongoing Support: Providing essential technical and operational assistance to existing partners to ensure platform efficacy.

- Partner Relationships: Maintaining robust connections with financial institutions, who are vital data providers for offer targeting.

- User Growth: Achieved a 19% increase in monthly qualified users in Q2 2025, driven by successful new partner integrations.

Cardlytics’ key activities center on the sophisticated analysis of anonymized purchase data to generate consumer insights. This foundational step enables the creation of highly personalized cashback offers and rewards, driving engagement for bank customers.

The company actively manages and optimizes advertising campaigns for marketers, focusing on connecting businesses with receptive audiences through strategic offer placement. This includes delivering comprehensive performance reports to demonstrate campaign ROI.

Furthermore, Cardlytics prioritizes the integration of new financial institution partners and provides ongoing support to existing ones, ensuring the seamless delivery of offers and expanding its network reach.

| Key Activity | Description | 2024/2025 Data Point |

| Data Analysis & Insight Generation | Processing anonymized purchase data to understand consumer spending habits. | Analyzed approximately $5.8 trillion in purchases in 2024. |

| Offer & Reward Creation | Developing personalized cashback offers and rewards based on purchase data. | Facilitated billions of transactions with personalized offer redemptions. |

| Advertising Campaign Management | Strategizing, executing, and optimizing ad campaigns for advertisers. | Managed over 1,900 advertising campaigns in 2024. |

| Platform Integration & Support | Onboarding new financial institutions and supporting existing partners. | Achieved a 19% increase in monthly qualified users in Q2 2025 from new integrations. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the comprehensive analysis you will gain access to. Upon completing your order, you will download this identical file, ready for your strategic planning needs.

Resources

Cardlytics' proprietary technology platform is its absolute core. It's the engine that powers everything, from crunching massive amounts of transaction data to getting the right offers into consumers' hands. This sophisticated system handles data analytics, delivers personalized marketing offers, and securely connects with banks.

In 2023 alone, this powerful platform processed a staggering $1.87 billion in total purchase transactions. This demonstrates the scale and effectiveness of their technology in facilitating real-world spending and providing valuable insights.

Anonymized purchase data is Cardlytics' core asset, offering unparalleled insights into consumer spending. This massive dataset, derived from millions of bank customers, enables highly precise audience segmentation and campaign measurement.

Cardlytics' access to roughly half of all U.S. card transactions and a quarter of U.K. transactions provides a significant competitive advantage. This extensive reach allows for robust analysis of spending trends and consumer behavior across diverse demographics.

Cardlytics' intellectual property, particularly its patents and proprietary algorithms, forms the bedrock of its business. These sophisticated tools are designed for behavioral targeting, offer optimization, and sales attribution, allowing for highly effective and measurable advertising campaigns.

In 2024, Cardlytics continued to invest heavily in research and development, aiming to further refine its data models and enhance its product capabilities. This ongoing innovation ensures the company remains at the forefront of data-driven advertising solutions.

Relationships with Financial Institutions

Cardlytics’ deep-rooted connections with major financial institutions, including Chase, Bank of America, and Wells Fargo, are a cornerstone of its business model. These long-standing relationships are vital for accessing crucial customer transaction data and for effectively distributing targeted offers to consumers. This reliance underscores the importance of maintaining strong partnerships.

These partnerships are not easily replicated, offering Cardlytics a substantial competitive moat. The ability to tap into the vast customer bases of these large banks and credit unions provides a significant advantage in the digital advertising and rewards space. For instance, in 2023, Cardlytics reported that its platform reached over 200 million active users, largely due to these exclusive financial institution integrations.

- Data Access: Partnerships grant Cardlytics access to anonymized transaction data, enabling personalized offers.

- Distribution Channels: Financial institutions serve as primary channels for delivering Cardlytics’ marketing campaigns.

- Competitive Advantage: The exclusivity and scale of these relationships are difficult for competitors to match.

- Revenue Generation: These relationships are fundamental to Cardlytics’ ability to generate revenue through advertising and loyalty programs.

Skilled Talent (Data Scientists, Engineers, Sales)

Cardlytics relies heavily on a highly skilled workforce, especially data scientists, software engineers, and sales professionals. These individuals are critical for building and running the company's platform, dissecting valuable data, and forging crucial partnerships with businesses.

The company has made significant investments in developing its talent pool, recognizing it as a key driver for future expansion. This focus on human capital is a strategic priority to ensure continued innovation and market leadership.

For instance, in 2023, Cardlytics continued to invest in its engineering and data science teams to enhance its AI-driven insights and personalized marketing capabilities. This investment is directly tied to the company's ability to deliver measurable results for its clients, a core component of its value proposition.

- Data Scientists: Crucial for analyzing vast datasets to uncover consumer behavior patterns and provide actionable insights to advertisers.

- Software Engineers: Essential for developing, maintaining, and scaling the technology platform that powers Cardlytics' services.

- Sales Professionals: Key to acquiring and retaining merchant and advertiser partnerships, driving revenue growth.

- Talent Investment: A stated priority for Cardlytics, reflecting the understanding that skilled personnel are fundamental to its business model and competitive advantage.

Cardlytics' key resources are its proprietary technology platform, its extensive anonymized purchase data, and its exclusive partnerships with major financial institutions. These elements collectively form a powerful ecosystem for targeted advertising and loyalty programs. The company's intellectual property, including patents and algorithms, further strengthens its competitive position by enabling sophisticated behavioral targeting and campaign measurement.

In 2023, Cardlytics' platform processed $1.87 billion in transactions, highlighting the scale of its data operations. The company's access to approximately half of U.S. card transactions and a quarter of U.K. transactions provides a significant data advantage. Furthermore, by the end of 2023, Cardlytics reported reaching over 200 million active users, a testament to the strength of its financial institution integrations.

Cardlytics' skilled workforce, particularly its data scientists and software engineers, is instrumental in developing and leveraging its technology and data assets. The company's ongoing investment in talent, as seen in its 2023 focus on enhancing AI-driven insights, underscores its commitment to innovation and maintaining a competitive edge in the data analytics and advertising sectors.

Value Propositions

Cardlytics offers marketers a powerful way to reach consumers by leveraging actual purchase data, ensuring campaigns are highly relevant and drive measurable results. This precision allows for a clear understanding of the impact on sales and the return on advertising investment.

In 2024, Cardlytics' sophisticated targeting capabilities directly contributed to over $3.8 billion in incremental sales for its advertising partners, showcasing the tangible impact of its data-driven approach.

Cardlytics empowers financial institutions to foster deeper customer connections by facilitating the delivery of tailored cashback offers and rewards directly through their digital banking platforms. This approach significantly boosts customer loyalty and engagement, transforming the banking experience into a more valuable proposition.

By partnering with financial institutions, Cardlytics actively manages and optimizes their customer rewards programs, a key driver for building lasting loyalty. In 2024, financial institutions leveraging Cardlytics saw an average uplift in customer transaction volume of 7% for targeted campaigns, demonstrating the direct impact on engagement.

Consumers gain tangible value through cashback and rewards specifically curated to match their spending patterns and preferences. These personalized offers provide real savings, making everyday purchases more rewarding.

These tailored incentives are conveniently presented within familiar banking apps, eliminating the need for separate loyalty programs and making it easy to track benefits. This seamless integration enhances the user experience.

Card-linked offers are a significant draw, with a substantial 72% of consumers favoring brands that provide these types of rewards, demonstrating their effectiveness in driving engagement and loyalty.

For Merchants: Access to a Large, Engaged Bank Customer Base

Merchants gain direct access to a substantial and actively engaged customer base through a trusted banking channel. This unique marketing avenue allows businesses to effectively drive measurable sales and attract new clientele by leveraging valuable first-party data for precise targeting.

Cardlytics' platform offers a powerful way for merchants to connect with consumers. As of the first quarter of 2025, the company reported an impressive 214.9 million monthly qualified users, underscoring the significant reach available to participating businesses.

- Access to a large, engaged bank customer base.

- Drives measurable sales and customer acquisition.

- Leverages first-party data for effective reach.

- Connects merchants with consumers through a trusted channel.

For All Parties: Secure and Private Data Utilization

Cardlytics prioritizes the secure and private utilization of data, a cornerstone for all participants. The platform analyzes anonymized purchase data, safeguarding consumer privacy and ensuring robust data security, which in turn fosters trust across financial institutions, consumers, and advertisers. This dedication to privacy is critical in a landscape where data protection is paramount.

This secure approach allows Cardlytics to offer a unique insight into consumer spending habits. In fact, Cardlytics provides a secure view into approximately one out of every two card-based transactions in the U.S. This extensive reach, combined with strict privacy protocols, makes their data offering highly valuable and trustworthy.

- Privacy-First Data Analysis: Cardlytics processes anonymized purchase data, ensuring consumer privacy is maintained throughout the analysis.

- Trust Building: The platform's commitment to data security and privacy cultivates confidence among financial institutions, consumers, and advertisers.

- Extensive Transaction Visibility: Cardlytics offers a secure window into roughly 50% of all card-based transactions in the United States.

- Secure Targeting Capabilities: Despite anonymization, the data enables effective and secure targeting for marketing campaigns.

Cardlytics provides marketers with unparalleled access to actual purchase data, enabling highly relevant campaigns that demonstrably boost sales. This precision allows for a clear understanding of the impact on sales and the return on advertising investment, with partners seeing over $3.8 billion in incremental sales in 2024.

By integrating with financial institutions, Cardlytics enhances customer loyalty through personalized cashback and rewards delivered via digital banking platforms. This strategy significantly boosts engagement, as seen in a 7% average uplift in transaction volume for targeted campaigns by partner institutions in 2024.

Consumers benefit from rewards that align with their spending habits, offering real savings and convenience through familiar banking apps. This seamless integration is highly valued, with 72% of consumers preferring brands that offer card-linked rewards.

Merchants gain access to a large, engaged customer base through a trusted banking channel, driving measurable sales and customer acquisition. As of Q1 2025, Cardlytics reached 214.9 million monthly qualified users, offering significant reach.

Customer Relationships

Cardlytics cultivates enduring partnerships with financial institutions by providing dedicated account management and strategic support. This ensures seamless platform integration and efficient data exchange, vital for maximizing value for bank customers.

These deep relationships are foundational to Cardlytics' strategy, enabling them to expand their partner network and solidify their competitive advantage in the market.

Cardlytics offers robust sales and campaign support to its advertisers. This includes personalized sales consultations to understand specific marketing goals, expert assistance with campaign setup, and continuous optimization throughout the campaign lifecycle. In 2023, Cardlytics reported that advertisers using their platform saw an average uplift in purchase frequency of 10%.

The company is committed to enhancing its product and technological capabilities to further empower advertisers. This focus aims to ensure clients can effectively leverage Cardlytics' data-driven insights to achieve measurable marketing objectives and maximize their return on investment.

Cardlytics' customer relationship with consumers is built on automated, personalized offer delivery. These offers appear directly within users' digital banking apps, making them convenient and relevant. This digital-first approach, while lacking direct human contact, aims to build loyalty through the perceived value and tailored nature of the promotions.

The effectiveness of this relationship is amplified by Cardlytics' collaboration with bank partners. These partnerships are crucial for optimizing how users interact with the offers, ensuring maximum engagement and benefit for both the consumer and the participating brands. In 2024, Cardlytics continued to refine its algorithms to enhance offer relevance, contributing to a positive user experience.

Self-Service Platform for Smaller Advertisers

Cardlytics offers a self-service platform designed to empower smaller advertisers. This allows them to independently create, manage, and monitor their targeted advertising campaigns, providing a flexible and efficient solution. For instance, in 2024, the company continued to refine its digital tools to ensure ease of use for businesses of varying sizes.

This direct campaign control grants clients greater autonomy over their marketing spend and strategy. The platform aims to democratize access to sophisticated advertising tools, making them accessible even to those with smaller budgets or less dedicated marketing teams. Cardlytics' commitment to user-friendly interfaces is a key aspect of this customer relationship.

- Self-Service Control: Advertisers can manage campaigns without direct intervention from Cardlytics.

- Efficiency for Smaller Businesses: Streamlined processes cater to the needs of smaller advertisers.

- Flexibility: Adaptable tools allow for tailored campaign management based on advertiser scale and objectives.

Performance Reporting and Data Insights Sharing

Cardlytics prioritizes building trust and showcasing value by sharing transparent performance reports and data insights with its financial institution and advertiser partners. This open communication allows partners to clearly see campaign effectiveness and understand consumer behavior patterns, fostering stronger collaborations.

These detailed reports are a cornerstone of Cardlytics' customer relationships, enabling partners to gauge the direct impact of their marketing efforts. For instance, in 2024, Cardlytics continued to provide financial institutions with data demonstrating how its platform drives incremental spending for their cardholders.

- Demonstrating ROI: Cardlytics shares reports that highlight the return on investment for advertisers, showing increased sales and customer acquisition driven by targeted offers.

- Consumer Behavior Insights: Partners receive data on spending trends, popular merchant categories, and offer redemption rates, providing valuable market intelligence.

- Strengthening Partnerships: Regular sharing of performance data reinforces the value proposition for financial institutions and advertisers, solidifying long-term relationships.

- Campaign Optimization: Insights derived from these reports enable both parties to refine future campaigns for maximum impact and efficiency.

Cardlytics fosters strong relationships with consumers through personalized, automated offers delivered directly within digital banking apps. This convenience and relevance build loyalty, with ongoing algorithm refinement in 2024 enhancing offer accuracy. The company also supports advertisers with dedicated sales and campaign assistance, aiming to maximize their return on investment, as evidenced by a reported 10% average uplift in purchase frequency for advertisers in 2023.

For financial institutions, Cardlytics provides dedicated account management and strategic support, ensuring smooth integration and data exchange. This deepens partnerships, allowing Cardlytics to expand its network and competitive edge. Transparency is key, with performance reports shared in 2024 demonstrating how the platform drives incremental spending for bank cardholders.

| Partner Type | Relationship Focus | Key Value Proposition | 2023/2024 Data Point |

|---|---|---|---|

| Financial Institutions | Dedicated Account Management, Strategic Support, Data Sharing | Seamless integration, enhanced customer value, driving incremental spending | Continued refinement of algorithms for offer relevance in 2024 |

| Advertisers | Sales Support, Campaign Optimization, Self-Service Platform | Maximized ROI, increased purchase frequency, flexible campaign control | 10% average uplift in purchase frequency observed in 2023 |

| Consumers | Personalized Offer Delivery, Convenience | Relevant promotions within banking apps, building loyalty through perceived value | Focus on user-friendly digital tools for businesses of all sizes in 2024 |

Channels

Financial institutions' digital banking platforms, encompassing both online portals and mobile apps, serve as the primary conduit for delivering value to consumers. This integration ensures offers are presented within familiar environments where users actively manage their financial lives.

Cardlytics Direct, the company's core technology, utilizes proprietary systems to embed advertisements directly into the secure digital banking interfaces. This strategic placement capitalizes on the trust and engagement users have with their financial institutions' platforms.

By mid-2024, a significant portion of consumer banking activity, estimated to be over 75% for many institutions, occurs through digital channels. This high engagement rate underscores the effectiveness of leveraging these platforms for targeted advertising and value delivery.

Cardlytics employs a dedicated direct sales force to cultivate and manage relationships with key financial institutions and significant merchants. This approach emphasizes personalized engagement, crafting bespoke solutions, and navigating intricate contract negotiations to secure mutually beneficial partnerships.

The company's strategic focus remains on expanding its network of both financial institution partners and merchant clients. For instance, in 2024, Cardlytics continued to onboard new major banks and large retailers, aiming to broaden its reach and data acquisition capabilities.

API integrations and dedicated partner portals are crucial channels for Cardlytics, facilitating seamless data exchange and platform management. These technical conduits enable financial institutions and advertisers to interact with Cardlytics' ecosystem, ensuring efficient operations and scalability.

In 2024, Cardlytics continued to enhance these integrations, aiming to streamline the onboarding process for new partners. The company's strategy includes expanding its reach through the Cardlytics Rewards Platform, which broadens its publisher network beyond traditional financial institutions.

Email and Real-Time Notifications (via FIs)

Cardlytics leverages financial institutions' existing communication channels, extending its reach beyond the primary banking app. This includes utilizing email notifications and real-time alerts, directly integrating into the customer's daily financial interactions.

These supplementary channels are crucial for engaging consumers. For instance, in 2024, financial institutions continued to see high engagement rates with personalized offers delivered via email, with some reporting open rates upwards of 25% for targeted campaigns.

- Email Notifications: Cardlytics can embed targeted offers and insights within routine customer emails sent by banks, such as monthly statements or transaction alerts.

- Real-Time Alerts: Push notifications for transactions or account activity can also serve as a conduit for Cardlytics' personalized marketing messages, capturing consumer attention at the moment of financial activity.

- Cross-Channel Integration: The strategy emphasizes a seamless experience, ensuring offers are consistent whether viewed within the banking app, an email, or a real-time notification.

Marketing and Industry Events

Cardlytics leverages industry events and marketing initiatives as key channels to connect with potential partners and clients. By actively participating in conferences, hosting webinars, and publishing thought leadership content, the company builds brand awareness and generates valuable leads. These engagements are crucial for showcasing the capabilities of its advertising platform.

The company's strategic focus on modernizing its platform is directly supported by these outreach efforts. For instance, in 2024, Cardlytics continued to invest in enhancing its data analytics and targeting technologies, which are often highlighted at these industry gatherings. This modernization aims to solidify its competitive position in the digital advertising space.

- Industry Conferences: Cardlytics actively participates in major advertising and retail technology conferences, providing opportunities for direct engagement with potential clients and partners.

- Webinars and Thought Leadership: The company hosts webinars and produces content that demonstrates its expertise in data-driven advertising, attracting a wider audience and establishing credibility.

- Platform Modernization Showcase: Marketing efforts highlight ongoing platform upgrades, such as enhanced AI capabilities and real-time data processing, to attract businesses seeking advanced advertising solutions.

- Partnership Development: These channels are instrumental in forging new partnerships with financial institutions and retailers, expanding the reach and effectiveness of the Cardlytics network.

Cardlytics utilizes financial institutions' digital banking platforms, including mobile apps and online portals, as its primary channel to deliver value. This strategic placement ensures offers are integrated into familiar environments where users actively manage their finances, with over 75% of banking activity occurring digitally by mid-2024.

Beyond the core banking interface, Cardlytics extends its reach through supplementary channels like email notifications and real-time transaction alerts. In 2024, these channels continued to show strong engagement, with targeted email offers from financial institutions reporting open rates exceeding 25%.

API integrations and partner portals are vital for seamless data exchange and platform management, facilitating efficient operations and scalability for both financial institutions and advertisers. Cardlytics also leverages industry events and thought leadership content to build brand awareness and generate leads.

Customer Segments

Financial Institutions, encompassing major banks, regional banks, and credit unions, are core partners for Cardlytics. They leverage Cardlytics to bolster their digital banking platforms, cultivate deeper customer loyalty, and explore new avenues for revenue generation.

These institutions are crucial as they provide Cardlytics with access to anonymized transaction data and a broad consumer base. This partnership is vital for Cardlytics' growth, as evidenced by the increase in monthly qualified users to 224.5 million in Q2 2025, a rise significantly driven by onboarding new bank and non-bank partners.

National and regional advertisers, including major players in retail, grocery, and travel, are key customers. These businesses, regardless of size, are looking for advertising tools that leverage data to attract new customers and boost sales. They specifically seek solutions that demonstrate a clear return on investment.

Cardlytics has a proven track record with these advertisers, particularly within the retail sector. For instance, in the second quarter of 2025, the company reported a $2.8 million year-over-year increase in billings from its largest retail advertiser, highlighting the effectiveness of its platform for driving incremental revenue.

E-commerce businesses are a key customer segment for Cardlytics, with online retailers increasingly utilizing purchase intelligence to reach consumers. These businesses are keen to understand how their digital advertising influences not just online transactions but also in-store purchases, a capability Cardlytics provides. In 2024, the global e-commerce market is projected to reach over $6.3 trillion, highlighting the significant advertising spend available.

Cardlytics' platform offers these online merchants the ability to analyze purchase data across all categories and locations, both digital and physical. This holistic view allows e-commerce players to refine targeting and accurately measure the return on investment for campaigns aimed at driving both online and offline engagement. For instance, a clothing e-tailer could use Cardlytics to identify customers who frequently buy similar items in brick-and-mortar stores and then target them with online promotions.

Bank Customers (Consumers)

Bank customers are not directly paying Cardlytics, but they are absolutely essential. They are the ones who receive the personalized offers, and their actions ultimately drive the transaction volume that advertisers and banks value. Cardlytics reported a significant reach with 224.5 million monthly qualified users in Q2 2025, highlighting the broad engagement potential within this segment.

The engagement of these bank customers with the loyalty and rewards programs is what makes the entire system work. Without their participation in viewing and acting on offers, the value proposition for both advertisers and the financial institutions partnering with Cardlytics would diminish. This user base is the engine of the platform.

- Crucial for Transaction Volume: Bank customers' engagement directly fuels the transactions that advertisers seek to influence.

- Recipients of Value: They are the end-users who benefit from personalized offers and rewards.

- Platform Drivers: Their active participation is key to the success of the Cardlytics model.

- Massive Reach: Cardlytics' Q2 2025 data shows 224.5 million monthly qualified users, underscoring the scale of this customer segment.

Non-Financial Institution Publishers/Partners

Cardlytics is broadening its appeal by welcoming non-financial institution publishers, such as digital sports platforms and various retail media networks, to its ecosystem. This strategic move, particularly with the anticipated launch of the Cardlytics Rewards Platform (CRP) in May 2025, significantly expands the network for advertisers and consumers alike.

This expansion allows for more diverse data sources and engagement opportunities. For instance, by integrating with platforms that have high consumer traffic, Cardlytics can offer advertisers access to a wider, more engaged audience. This is crucial as the digital advertising market continues its upward trajectory, with global ad spending projected to reach approximately $1 trillion by the end of 2025.

- Expanded Reach: Access to non-FI publishers like digital sports platforms and retail media networks.

- Enhanced Ecosystem: Broader opportunities for advertisers to connect with consumers.

- Strategic Integration: Leverages the upcoming Cardlytics Rewards Platform (CRP) launching May 2025.

- Market Growth: Aligns with the robust growth in the digital advertising sector, expected to surpass $1 trillion globally by 2025.

Cardlytics serves a diverse clientele, primarily financial institutions and national/regional advertisers. Financial institutions use Cardlytics to enhance their digital offerings and customer loyalty, benefiting from anonymized transaction data. Advertisers, from retail giants to e-commerce players, seek data-driven solutions to boost sales and acquire new customers, valuing measurable ROI.

The platform's success hinges on bank customers who engage with personalized offers, driving transaction volume. Cardlytics reported 224.5 million monthly qualified users in Q2 2025, showcasing significant consumer reach. Furthermore, the expansion into non-financial institution publishers, such as sports platforms and retail media networks, is broadening the ecosystem for advertisers, aligning with a global digital ad market projected to exceed $1 trillion by 2025.

| Customer Segment | Key Value Proposition | 2025 Data/Projections |

|---|---|---|

| Financial Institutions | Enhanced digital banking, customer loyalty, new revenue streams | 224.5 million monthly qualified users (Q2 2025) |

| National & Regional Advertisers | Data-driven customer acquisition, sales uplift, measurable ROI | $2.8 million YoY increase in billings from largest retail advertiser (Q2 2025) |

| E-commerce Businesses | Purchase intelligence, cross-channel campaign measurement | Global e-commerce market projected over $6.3 trillion (2024) |

| Bank Customers | Personalized offers, rewards, enhanced loyalty programs | 224.5 million monthly qualified users (Q2 2025) |

| Non-FI Publishers | Expanded reach, diverse data sources, new engagement opportunities | Global digital ad spending projected ~ $1 trillion (end of 2025) |

Cost Structure

Cardlytics faces substantial expenses related to the creation and upkeep of its core Cardlytics and Bridg technology platforms. These costs encompass software engineering, maintaining the necessary digital infrastructure, and ensuring robust data security measures are in place.

For instance, in the fourth quarter of 2023, the company allocated $12.3 million specifically towards advancing its platform technology, highlighting the significant investment required to stay competitive and innovative in the digital advertising space.

Cardlytics incurs significant costs for its data processing and analytics infrastructure. Operating a platform that handles trillions of dollars in purchase data necessitates substantial investment in robust data centers, cloud computing services, and advanced analytics tools to manage the sheer volume and complexity of information. For instance, in 2023, cloud infrastructure spending by companies like Cardlytics continued to be a major operational expense, with the global cloud market reaching an estimated $600 billion.

These infrastructure costs are critical for the platform's ability to process and analyze massive datasets efficiently. Cardlytics' ongoing efforts to modernize its platform further underscore the continuous need for capital expenditure in this area. Companies in this sector often allocate a substantial portion of their budget, sometimes upwards of 30-40%, towards maintaining and upgrading their data processing capabilities to stay competitive.

Cardlytics' sales and marketing expenses are a major component of its cost structure, driven by the need to onboard both financial institutions and advertisers. This includes the salaries and commissions for its sales force, alongside significant investment in marketing campaigns and business development to grow its network. For instance, in the first quarter of 2024, Cardlytics reported sales and marketing expenses of $35.8 million, reflecting ongoing efforts to expand its reach and secure new partnerships.

Personnel Costs (Salaries & Benefits)

Personnel costs are a significant driver of Cardlytics' operational expenses. This includes salaries, benefits, and stock-based compensation for a substantial team encompassing engineers, data scientists, sales, account management, and administrative functions.

In the first quarter of 2025, Cardlytics reported that total adjusted operating expenses, excluding stock-based compensation, remained stable at $36.8 million compared to the prior year. This figure highlights the ongoing investment in human capital necessary to support the company's technology platform and customer relationships.

- Salaries and Benefits: Compensation for a diverse workforce of technical and client-facing professionals.

- Stock-Based Compensation: Equity awards to retain and incentivize key personnel.

- Q1 2025 Adjusted Operating Expenses: $36.8 million, demonstrating cost management in personnel.

Partner Share and Consumer Incentives

Cardlytics allocates a significant portion of its revenue to its financial institution partners, a crucial element of its cost structure. This partnership model drives platform adoption and data access.

Furthermore, a portion of the costs is dedicated to consumer incentives, including cashback rewards. These incentives are directly linked to user engagement and the overall performance of the Cardlytics platform. For instance, in 2024, Cardlytics reported a decrease in Average Revenue Per User (ARPU) attributed to a $21.3 million increase in Consumer Incentives, highlighting the direct impact of these programs on profitability.

- Partner Revenue Share: A substantial cost category involving revenue sharing with financial institutions.

- Consumer Incentives: Funds allocated for cashback and other rewards to drive consumer engagement.

- Impact on ARPU: Increased consumer incentives directly reduced Cardlytics' ARPU in 2024 by $21.3 million.

Cardlytics' cost structure is heavily influenced by its technology investments and partner relationships. The company spends considerably on platform development, data infrastructure, and sales and marketing efforts to acquire both financial institutions and advertisers.

Consumer incentives, such as cashback offers, also represent a significant expense, directly impacting user engagement and the company's average revenue per user.

Personnel costs, including salaries and benefits for its engineering, data science, and sales teams, form another substantial part of its operational expenses.

| Cost Category | Q1 2024 Expense (Millions) | Key Driver |

|---|---|---|

| Platform Technology | $12.3 (Q4 2023) | Software engineering, infrastructure, data security |

| Sales & Marketing | $35.8 | Onboarding financial institutions and advertisers |

| Personnel Costs (Adjusted OpEx) | $36.8 (Q1 2025) | Salaries, benefits, stock-based compensation |

| Consumer Incentives | $21.3 (2024 Increase) | Cashback rewards, user engagement |

Revenue Streams

Cardlytics primarily earns revenue through performance-based advertising fees from merchants. These fees are typically structured as a commission on the transaction value or a percentage of the sales directly driven by their platform, directly linking their success to advertiser outcomes.

This performance-driven model ensures that Cardlytics is incentivized to deliver tangible results for its advertising partners. In 2023, approximately 80% of Cardlytics' revenue was generated from the U.S. market, highlighting the significant concentration of its advertising business within this region.

Cardlytics' revenue model heavily relies on sharing advertising spend with its financial institution partners. This partnership is crucial, as financial institutions provide access to anonymized consumer data and their digital banking platforms, forming a core part of the value proposition.

For instance, in 2023, Cardlytics reported that approximately 60% of its revenue was paid out to financial institution partners as incentives and revenue share. This significant payout underscores the collaborative nature of the business, where FIs are compensated for enabling targeted advertising opportunities.

It's important to note that Cardlytics recognizes its GAAP revenue net of consumer incentives but gross of the partner share. This accounting treatment reflects the direct costs associated with rewarding consumers for engagement and the subsequent distribution of revenue to financial partners.

While performance-based fees are a primary revenue driver, Cardlytics diversifies its income through platform access and service fees. Advertisers may pay subscription or licensing fees to utilize the Cardlytics platform, gaining access to its advanced targeting and analytics capabilities.

This model provides a more stable revenue stream, mitigating the inherent performance risk associated with purely results-driven compensation. For instance, in 2023, Cardlytics reported a significant portion of its revenue coming from these types of fees, alongside its performance-based earnings, demonstrating a balanced approach to revenue generation.

Data Insights and Analytics Services (Bridg Platform)

Cardlytics generates revenue through its Bridg platform by providing sophisticated data insights and analytics services. This platform excels at identity resolution, connecting disparate data points to create a clearer picture of consumer behavior. It then leverages this enriched data, particularly point-of-sale information, to enable targeted loyalty marketing campaigns for businesses.

The financial impact of these services is becoming increasingly significant. For instance, the Bridg platform alone contributed $5.21 million to Cardlytics' consolidated revenue in the second quarter of 2025. This highlights the growing demand for granular consumer insights and the effectiveness of Cardlytics' data-driven approach.

- Identity Resolution: Bridg's core capability to accurately identify and unify consumer data across various touchpoints.

- POS Data Leverage: Utilizing transaction-level data from point-of-sale systems for deep analytical insights.

- Targeted Loyalty Marketing: Enabling businesses to create highly specific and effective loyalty programs based on analyzed consumer behavior.

- Revenue Contribution: Demonstrating the financial success of these services, with Bridg reporting $5.21 million in Q2 2025 revenue.

Expansion into New Publisher Verticals (Cardlytics Rewards Platform)

The May 2025 launch of the Cardlytics Rewards Platform (CRP) introduces a significant new revenue stream by allowing non-financial institution (FI) publishers to integrate card-linked rewards. This expansion broadens Cardlytics' ecosystem, attracting a wider range of advertisers and diversifying the sources of advertising spend. By enabling these new publishers, Cardlytics effectively increases its supply of consumer engagement opportunities.

- Diversified Publisher Base: CRP allows retailers and other non-FI entities to leverage card-linked offers, moving beyond traditional bank partnerships.

- Expanded Advertising Inventory: This strategic move increases the volume and variety of advertising placements available on the Cardlytics network.

- Increased Demand Potential: A larger, more diverse publisher base is expected to attract a greater number of advertisers seeking targeted consumer reach.

- New Revenue Opportunities: Monetization of these new publisher relationships creates additional income streams for Cardlytics.

Cardlytics' revenue is primarily driven by performance-based advertising fees from merchants, often structured as a commission on sales generated through their platform. In 2023, the U.S. market accounted for roughly 80% of this revenue. Additionally, platform access and service fees provide a more stable income, complementing the performance-driven model and offering advanced targeting capabilities.

| Revenue Source | Primary Mechanism | 2023 Data Point |

| Performance-Based Advertising Fees | Commission on sales driven by platform | ~80% of revenue from U.S. |

| Platform Access & Service Fees | Subscription/licensing for platform use | Significant portion alongside performance fees |

| Bridg Platform Services | Data insights and analytics | $5.21 million in Q2 2025 revenue |

| Cardlytics Rewards Platform (CRP) | Monetizing non-FI publisher partnerships | New revenue stream initiated May 2025 |

Business Model Canvas Data Sources

The Cardlytics Business Model Canvas is informed by a blend of proprietary transaction data, partner insights, and market research. This multifaceted approach ensures a data-driven understanding of customer behavior and market opportunities.