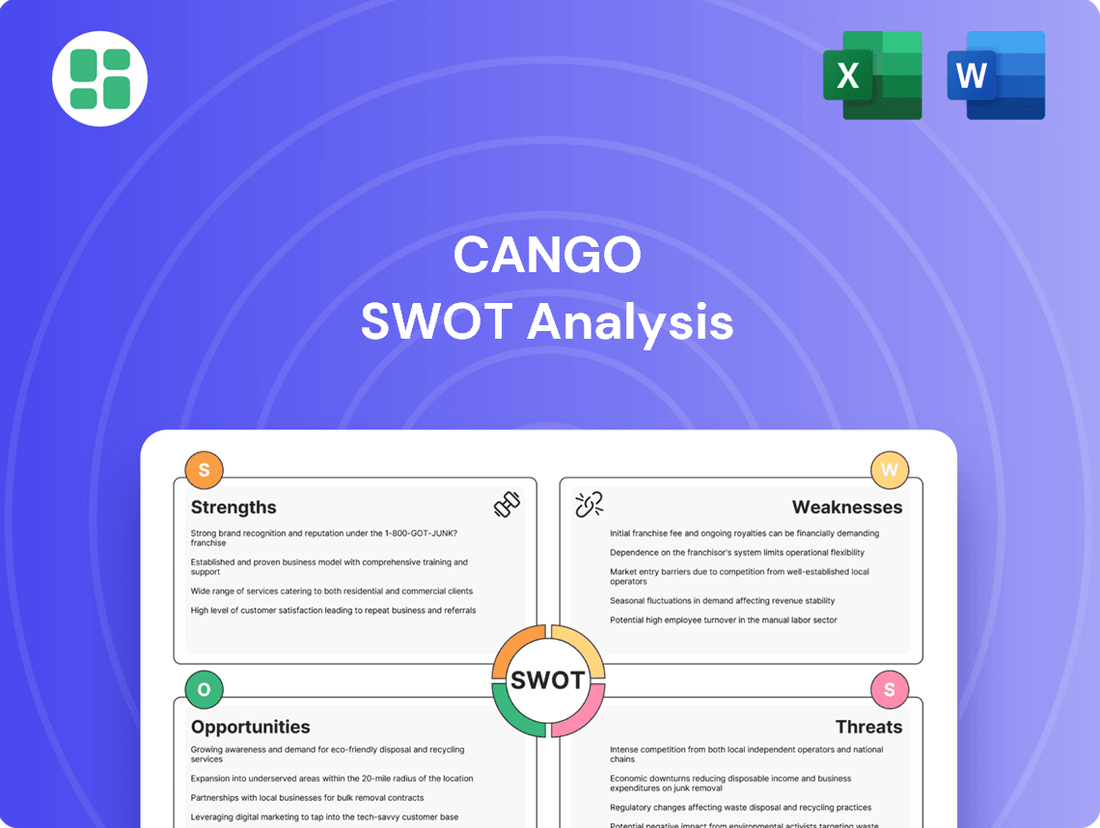

Cango SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cango Bundle

You've seen a glimpse of Cango's strategic landscape, but the full picture holds the keys to unlocking its true potential. Our comprehensive SWOT analysis dives deep into its unique strengths, potential weaknesses, exciting opportunities, and critical threats.

Want the full story behind Cango's market position and future trajectory? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning, investment decisions, and competitive analysis.

Strengths

Cango Inc. has strategically pivoted to global Bitcoin mining, a significant shift that commenced in November 2024. This swift transition has enabled the company to rapidly secure a notable position within the cryptocurrency mining industry.

The company's demonstrated agility in reshaping its business model highlights a robust capacity for strategic redirection and effective implementation. This pivot is a testament to Cango's ability to adapt to evolving market opportunities.

By July 2025, Cango boasts a formidable Bitcoin mining capacity of 50 Exahashes per second (EH/s), placing it among the top publicly traded mining companies worldwide. This significant operational scale is a key strength, enabling substantial participation in the Bitcoin network.

Cango's mining infrastructure is strategically distributed across North America, the Middle East, South America, and East Africa. This global footprint not only diversifies operational risks associated with specific regions but also enhances the company's ability to maintain consistent production levels and adapt to varying energy costs and regulatory environments.

Cango's substantial Bitcoin treasury is a significant strength, with the company holding over 4,000 Bitcoins as of July 2025. This demonstrates a strategic, long-term accumulation and holding approach to digital assets. This robust asset base not only provides considerable financial backing but also offers potential for substantial upside as Bitcoin's value appreciates. The company's confidence in the long-term viability of digital assets is clearly reflected in this accumulation strategy.

Experienced New Leadership

Cango's recent appointment of a new Board of Directors and senior management team signifies a strategic pivot. This influx of talent brings significant expertise in digital-asset infrastructure, finance, and energy investments, areas critical for success in the evolving Bitcoin mining landscape.

The new leadership's specialized knowledge is expected to be a key driver for Cango. For instance, the company's strategic focus now includes leveraging advancements in energy efficiency for mining operations, a sector where the new team possesses considerable experience. This expertise is vital as the Bitcoin mining industry increasingly prioritizes sustainable and cost-effective energy solutions.

- Digital Asset Infrastructure Expertise: The new leadership team has a proven track record in developing and managing digital asset infrastructure, crucial for scaling Bitcoin mining operations efficiently.

- Financial Acumen in Energy Investments: Deep understanding of financial markets and energy sector investments allows for strategic capital allocation and risk management in a volatile industry.

- Navigating Industry Complexities: The combined experience equips Cango to effectively address regulatory challenges, technological advancements, and market fluctuations inherent in Bitcoin mining.

Retained Used Car Export Business

Cango maintains an online international used car export business via AutoCango.com, a segment that, while smaller, offers a diversified, asset-light revenue stream. This operation capitalizes on Cango's established automotive industry knowledge.

The company's dual business model, encompassing both cryptocurrency and used car exports, provides a degree of resilience against the inherent fluctuations in the cryptocurrency market. For instance, in the first quarter of 2024, Cango reported that its used car export business contributed to its overall revenue, demonstrating its ongoing operational capacity.

- Diversified Revenue: The used car export business provides an alternative income source, reducing reliance on any single market.

- Asset-Light Model: This segment requires less capital investment compared to traditional manufacturing or extensive physical infrastructure.

- Leverages Expertise: Cango utilizes its existing understanding of the automotive sector to support its export operations.

- Market Resilience: The international used car market offers a different economic cycle, potentially buffering against crypto market downturns.

Cango's strategic pivot to Bitcoin mining, effective November 2024, has rapidly established it as a significant player. By July 2025, the company achieved an impressive 50 EH/s mining capacity, positioning it among the top global mining firms. This operational scale is a core strength, allowing substantial participation in the Bitcoin network. The company's global infrastructure, spanning North America, the Middle East, South America, and East Africa, diversifies risk and enhances production consistency.

Cango's substantial Bitcoin treasury, exceeding 4,000 BTC as of July 2025, represents a strong long-term asset base. This accumulation strategy underscores confidence in digital assets and provides considerable financial backing. The recent appointment of a new, experienced board and management team, with deep expertise in digital asset infrastructure, finance, and energy, is a critical strength. This new leadership is expected to drive efficiency, particularly in energy-conscious mining operations.

The company's continued operation of its online international used car export business via AutoCango.com offers a diversified, asset-light revenue stream. This segment leverages Cango's automotive industry knowledge and provides market resilience, acting as a potential buffer against cryptocurrency market volatility. The dual business model enhances overall financial stability.

| Metric | Value (as of July 2025) | Significance |

|---|---|---|

| Bitcoin Mining Capacity | 50 EH/s | Top-tier global operational scale |

| Bitcoin Treasury | > 4,000 BTC | Significant financial backing and long-term asset accumulation |

| Geographic Mining Footprint | North America, Middle East, South America, East Africa | Diversified operational risk and enhanced stability |

| Used Car Export Business | Ongoing revenue stream | Diversification and market resilience |

What is included in the product

Analyzes Cango’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing strategic weaknesses and threats.

Weaknesses

Cango faces a significant weakness due to its extreme revenue concentration. In the first quarter of 2025, approximately 99% of its total revenue stemmed from Bitcoin mining. This heavy reliance on a single, highly volatile market creates substantial business risk.

Any adverse movement in Bitcoin prices or a decline in mining profitability could disproportionately impact Cango's financial health. This singular focus makes the company exceptionally vulnerable to market fluctuations and regulatory changes affecting cryptocurrency mining.

Cango's financial performance is significantly impacted by the unpredictable nature of the cryptocurrency market. Fluctuations in Bitcoin prices directly influence the company's profitability, as seen in its operating loss during Q1 2025, which was partly attributed to a decline in Bitcoin's fair value. This dependency creates considerable uncertainty regarding future earnings, making them inherently unstable.

Bitcoin mining operations, a significant part of Cango's business, come with hefty electricity bills and hosting charges. These are key drivers of their cost of revenue, directly impacting how much they make on each transaction.

Cango's reliance on a hosted operation model means they absorb considerable energy expenses. This can put a squeeze on their profit margins, making cost management a critical factor for their long-term financial health.

Evolving Regulatory Landscape for Crypto

The global regulatory environment for cryptocurrency mining is a significant weakness for companies like Cango, as it remains in flux and subject to frequent changes. This evolving landscape means new rules, limitations, or even prohibitions can emerge in different regions, potentially disrupting Cango's operations, hindering expansion, and affecting its long-term business prospects. Successfully navigating this unpredictable regulatory terrain is a constant hurdle.

The uncertainty surrounding crypto regulations directly impacts operational stability and strategic planning. For instance, in 2024, several countries continued to debate and implement stricter controls on digital asset activities, with some jurisdictions introducing new reporting requirements or energy consumption standards for mining operations. This creates a challenging operational environment where Cango must remain agile and adaptable to comply with diverse and often shifting legal frameworks across its potential or existing operational bases.

- Regulatory Uncertainty: The global crypto mining sector faces an evolving and unpredictable regulatory environment, posing a significant risk to business operations.

- Impact on Operations: New regulations, restrictions, or bans in key jurisdictions can directly impede Cango's mining activities and expansion strategies.

- Compliance Challenges: Navigating the complex and frequently changing legal requirements across different countries presents an ongoing operational and strategic challenge for Cango.

- Market Volatility: Regulatory shifts can contribute to market volatility, indirectly affecting the profitability and valuation of crypto assets Cango might hold or mine.

Limited Track Record in New Core Business

While Cango has made significant strides in expanding its Bitcoin mining operations, its long-term viability and consistent performance in this new venture are still in the early stages. The company's recent and substantial shift in its core business model introduces an element of uncertainty for investors, who will be looking for a proven history of success over time. Establishing a robust and reliable track record in the volatile cryptocurrency mining sector will be crucial for Cango's sustained growth and investor confidence.

Cango's heavy reliance on Bitcoin mining, which comprised approximately 99% of its revenue in Q1 2025, presents a significant weakness due to the inherent volatility of the cryptocurrency market. This concentration makes the company highly susceptible to price fluctuations and regulatory changes impacting Bitcoin mining profitability, as evidenced by an operating loss in Q1 2025 partly due to Bitcoin's fair value decline.

High operating costs, particularly electricity and hosting charges, directly impact Cango's profit margins. The company's hosted operation model means it absorbs substantial energy expenses, making cost management a critical factor for its financial health.

The global regulatory landscape for cryptocurrency mining is a substantial weakness. Evolving rules, potential limitations, or outright bans in various jurisdictions can disrupt operations and hinder expansion, demanding constant agility to comply with diverse and shifting legal frameworks.

Cango's recent substantial shift to Bitcoin mining introduces uncertainty regarding its long-term viability and consistent performance in this nascent sector, requiring a proven track record to build investor confidence.

| Metric | Q1 2025 | Trend/Impact |

|---|---|---|

| Revenue Concentration (Bitcoin Mining) | ~99% | High dependency, significant risk |

| Operating Loss | Yes | Attributed partly to Bitcoin fair value decline |

| Key Cost Drivers | Electricity, Hosting Charges | Impacts profit margins |

| Regulatory Environment | Evolving & Uncertain | Operational disruption risk |

What You See Is What You Get

Cango SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase. This ensures transparency and guarantees you get the complete, professionally crafted report without any hidden surprises.

Opportunities

Cango's strategic initiative to boost its Bitcoin mining capacity offers a substantial growth avenue. The company aims to reach roughly 50 EH/s by the close of July 2025, a significant leap that directly translates to enhanced revenue potential and a stronger foothold in the competitive global Bitcoin mining landscape. This expansion underscores a commitment to scaling operations and solidifying its market position.

Cango is exploring upstream integration into energy resources, focusing on green energy, to power its high-performance computing needs. This strategic move aims to secure more affordable and dependable energy, which could directly boost profitability and bolster environmental credentials.

By controlling its energy supply, Cango could achieve significant cost savings, potentially leading to a competitive edge in an increasingly energy-intensive market. For instance, the increasing global demand for renewable energy, projected to grow substantially through 2030, highlights the strategic timing of such an investment.

Cango is actively seeking strategic mergers and acquisitions to bolster its Bitcoin mining capabilities. By integrating with existing mining operations or acquiring new facilities, Cango aims to swiftly expand its hashrate and improve overall efficiency. This approach is crucial for accelerating growth and achieving greater economies of scale in the highly competitive cryptocurrency mining sector.

Increasing Global Adoption of Digital Assets

The increasing global acceptance of digital assets, including Bitcoin, presents a significant opportunity. In 2024, we've seen continued institutional interest, with major financial players exploring or actively investing in cryptocurrencies, potentially driving more stable demand and prices.

This trend could translate into a more mature and less volatile market for digital assets. As Cango operates within this evolving financial landscape, its services could see increased utilization as digital assets become more integrated into mainstream financial systems.

- Growing Institutional Investment: Major financial institutions are increasingly allocating capital to digital assets, signaling growing confidence and market maturity.

- Potential for Price Stability: Broader adoption and institutional backing could lead to reduced volatility in digital asset prices, benefiting Cango's business model.

- Enhanced Market Integration: As digital assets become more embedded in the global financial infrastructure, Cango can leverage this trend for expanded service offerings and customer reach.

Expanding International Used Car Export Business

Cango's AutoCango.com platform presents a significant opportunity to expand its international used car export business, capitalizing on China's substantial vehicle inventory. This strategic move can establish a robust secondary revenue stream, enhancing income diversification and reducing reliance on more volatile markets.

This expansion into an asset-light export model is particularly promising. For instance, China's used car exports have seen substantial growth, with figures indicating a significant increase in outbound shipments in recent years. In 2023, China's auto exports, including used vehicles, reached record highs, demonstrating a strong global demand.

- Leveraging China's Vast Inventory: Access to a wide selection of quality used vehicles for export.

- Secondary Revenue Stream: Diversifies income beyond existing business lines, mitigating risk.

- Asset-Light Model: Focuses on platform and logistics rather than heavy asset ownership, improving capital efficiency.

- New Market Potential: Opens doors to international markets eager for affordable, reliable used cars.

Cango's strategic expansion into Bitcoin mining, targeting approximately 50 EH/s by July 2025, presents a significant revenue growth opportunity. Furthermore, its exploration of upstream integration into green energy sources for mining operations could lead to substantial cost savings and a competitive advantage, especially as global renewable energy demand is set to rise considerably through 2030.

Threats

The most significant external threat Cango faces is the extreme volatility of Bitcoin prices, which directly impacts its financial health. For instance, during periods of sharp downturns, such as the significant price drops seen throughout 2022 and early 2023, Cango's revenue streams tied to Bitcoin transactions or holdings could be severely curtailed.

This market risk can translate into substantial reductions in revenue, potential operational losses, and even impairment of asset values if the company holds significant Bitcoin reserves. The unpredictable nature of these price swings makes financial forecasting and stability a considerable challenge for Cango.

As more miners join the Bitcoin network and technology improves, the difficulty of mining increases. This means Cango needs more computing power to mine the same amount of Bitcoin, potentially lowering its efficiency and profit per unit of hashrate. For instance, as of early 2024, the Bitcoin network difficulty has seen significant upward trends, impacting mining profitability for all participants.

Governments globally are increasingly scrutinizing cryptocurrency operations. For instance, in 2024, several nations intensified discussions around imposing stricter energy consumption standards for mining, potentially impacting Cango's operational costs and geographic flexibility. These evolving regulatory landscapes, including potential tax increases or even outright bans, represent a significant external threat that could force costly operational shifts or disruptions to Cango's core business model.

Rising Global Energy Costs

The profitability of Cango's operations, particularly its burgeoning Bitcoin mining ventures, is intrinsically linked to the cost of electricity. As of early 2025, global energy prices have seen significant volatility, with benchmarks like Brent crude oil trading around $80 per barrel and natural gas futures hovering near $3.00 per MMBtu, reflecting ongoing geopolitical tensions and supply chain adjustments. These fluctuations can directly translate into higher operational expenses for energy-intensive activities like cryptocurrency mining.

Sustained increases in global energy costs, driven by factors such as heightened demand from developing economies, potential supply disruptions, or the transition to renewable energy sources which can initially involve higher infrastructure costs, pose a direct threat to Cango's profit margins. For instance, if electricity rates were to increase by 15-20% across its mining facilities in 2025, it would significantly impact the cost per Bitcoin mined.

The direct impact of rising energy costs on Cango would be a reduction in its profitability and operational efficiency. This could necessitate adjustments to mining strategies, such as relocating facilities to regions with lower energy prices or investing in more energy-efficient mining hardware, which requires substantial capital outlay. The company's ability to pass these increased costs onto its customers or absorb them will be a critical factor in maintaining its financial health.

- Bitcoin mining's profitability is highly sensitive to electricity costs, which represent a major operational expenditure for Cango.

- Global energy market volatility, influenced by geopolitical events and demand shifts, directly impacts electricity rates.

- Sustained energy cost increases could erode Cango's profit margins and hinder operational efficiency, potentially impacting its competitive standing in the mining sector.

Technological Obsolescence of Mining Hardware

The mining industry, including companies like Cango, is constantly battling the threat of technological obsolescence in its hardware. Innovation moves at a breakneck pace, meaning the advanced equipment purchased today can be significantly less efficient than newer models available in just a few years. This rapid evolution necessitates substantial and ongoing capital expenditure to keep the mining fleet competitive.

For Cango, this translates into a continuous challenge of needing to invest heavily to upgrade its machinery. Failing to do so risks a decline in operational efficiency, directly impacting profitability as older machines struggle to keep up with the output and cost-effectiveness of newer technology. This cycle demands careful financial planning to balance the cost of upgrades against the potential for diminishing returns from outdated equipment.

- Hardware Depreciation: Mining equipment, especially advanced drilling and processing machinery, can see its value plummet as newer, more efficient models emerge.

- Efficiency Gap: Older machines may consume more energy or process materials at a slower rate, creating a significant cost disadvantage compared to state-of-the-art alternatives. For instance, a 2020-era electric mining truck might have a 15% lower energy efficiency than a 2024 model.

- Capital Investment Burden: Companies like Cango must allocate considerable capital to regular fleet upgrades, impacting cash flow and potentially delaying other strategic investments.

The increasing difficulty of Bitcoin mining presents a significant operational challenge for Cango. As more miners join the network and technology advances, the computational power required to mine a block increases, directly impacting profitability. For example, as of early 2024, Bitcoin network difficulty saw substantial increases, meaning Cango needs more energy and processing power to achieve the same mining output.

The company also faces considerable regulatory uncertainty. Governments worldwide are intensifying scrutiny of cryptocurrency operations, with discussions around stricter energy consumption standards for mining becoming more prevalent in 2024. Such evolving regulations, including potential tax hikes or outright bans, could force costly operational changes or disruptions to Cango's business model.

Technological obsolescence of mining hardware is another substantial threat. The rapid pace of innovation means that mining equipment can quickly become outdated and less efficient. This necessitates continuous, significant capital investment to maintain a competitive mining fleet, impacting Cango's cash flow and potentially hindering its ability to invest in other strategic areas.

SWOT Analysis Data Sources

This Cango SWOT analysis is built upon a robust foundation of data, drawing from Cango's official financial reports, comprehensive market research, and expert industry analyses to provide a clear and actionable strategic overview.