Cango Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cango Bundle

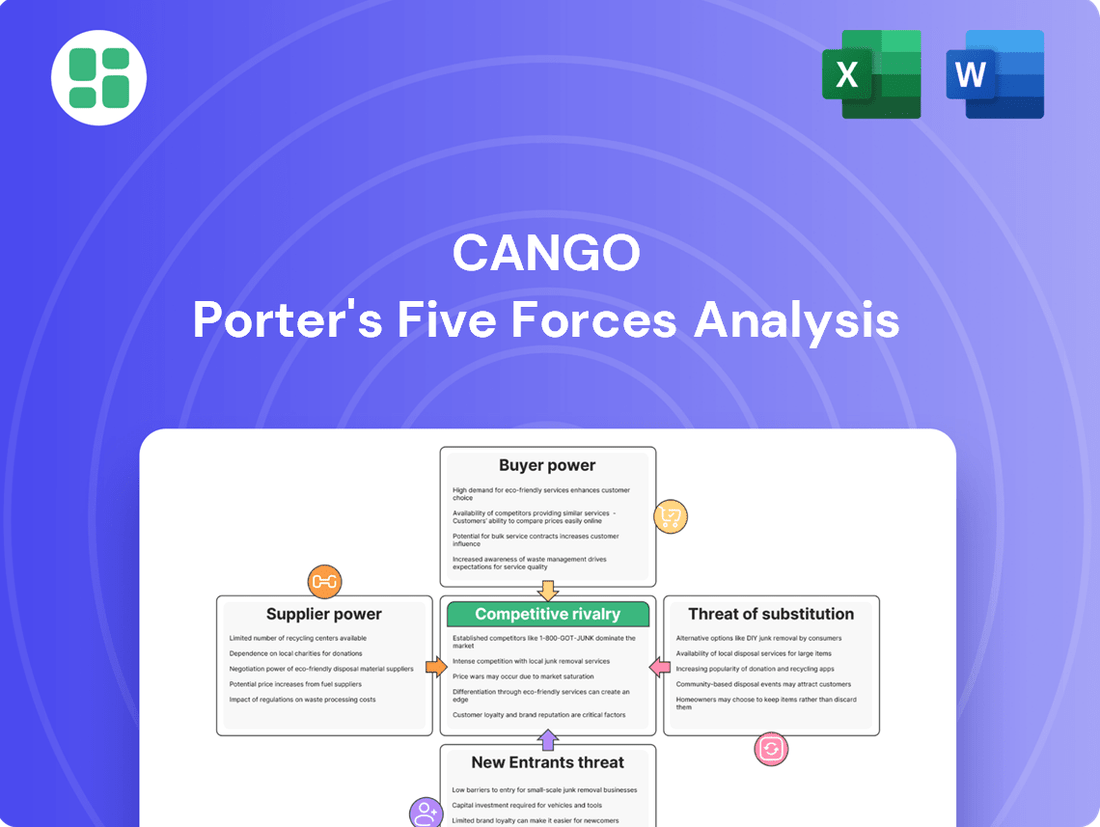

Our Porter's Five Forces Analysis of Cango reveals critical insights into the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants, and the intensity of rivalry. Understanding these forces is crucial for navigating Cango's market effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Cango’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of financial institutions supplying capital for auto financing to Cango Inc. is a significant factor, generally considered moderate to high. Cango depends on these institutions to provide the necessary financing options for its customers, directly impacting the platform's competitiveness and profitability. For instance, in 2024, the automotive financing sector saw continued consolidation, with larger banks and specialized lenders holding substantial market share.

Major financial players, due to their scale, established regulatory compliance, and deep pockets, often have the leverage to dictate terms. This can translate to higher interest rates or stricter collateral requirements for Cango. However, Cango's extensive network of dealerships and its substantial customer transaction volume can serve as a counter-leveraging point, offering these financial institutions access to a large and active market. The ability of Cango to attract and retain a broad base of car buyers and sellers provides a valuable pipeline of business for lenders.

Automotive dealers, especially those with high sales volumes or specialized inventory, wield a degree of bargaining power over Cango. They are essential for Cango's platform, acting as the conduit to both car buyers and the vehicles themselves. Cango's success hinges on its ability to cultivate and maintain a robust network of these dealers, as they are the gatekeepers to its financing and transaction services.

While dealers are critical, their power is tempered by the competitive landscape. The sheer number of dealers vying for business, coupled with the benefits Cango's platform offers—like simplified financing processes and access to a wider customer base—can reduce individual dealer leverage. For instance, in 2023, Cango reported facilitating transactions for a significant number of vehicles, demonstrating its value proposition to dealers seeking to expand their reach and streamline sales.

Suppliers of technology infrastructure, software, and big data analytics tools for Cango generally possess moderate bargaining power. Cango's operations, risk management, and user experience heavily depend on these advanced technologies and data insights.

Specialized providers, particularly those offering proprietary AI-driven analytics or critical cloud infrastructure, can exert greater influence. For instance, a significant portion of the global cloud computing market, estimated to reach over $1 trillion by 2024, is dominated by a few key players, giving them leverage.

Marketing and Advertising Platforms

Online automotive advertising platforms and other marketing channels that Cango utilizes to reach users and dealers possess a degree of bargaining power. The cost and efficacy of these platforms are crucial to Cango's approach to acquiring new customers.

Dominant digital marketing channels in China, such as Tencent's WeChat and Alibaba's platforms, can significantly influence pricing and terms. This directly impacts Cango's sales and marketing expenditures, as seen in the competitive landscape for user and dealer acquisition.

- Increased Marketing Costs: In 2023, digital advertising spending in China continued to rise, with automotive sectors often facing higher customer acquisition costs due to intense competition.

- Platform Dependency: Cango's reliance on a few major platforms means these providers can exert pressure on pricing and service terms.

- Effectiveness Measurement: The ability of these platforms to deliver measurable results for Cango influences their negotiation leverage; if a platform is less effective, Cango has more power.

Regulatory Bodies (Indirect Supplier)

Government and regulatory bodies in China function as significant indirect suppliers for Cango, shaping the operational landscape. Their directives on auto finance, data privacy, and market access directly impact Cango's strategic decisions and cost structures. For instance, in 2023, China's cybersecurity review measures, including those for network data security, imposed stricter compliance burdens on companies handling user data, potentially increasing operational expenses for Cango.

These entities wield substantial bargaining power by setting the rules of engagement. Cango's ability to operate and grow is contingent on adhering to these regulations. Failure to comply can result in penalties or restrictions, underscoring the indirect suppliers' influence. The evolving regulatory environment means Cango must remain agile, investing in compliance to mitigate risks and maintain its license to operate.

- Regulatory Framework: Chinese government bodies establish the legal and operational guidelines for the automotive finance sector.

- Data Security Mandates: Regulations concerning network data security, such as those enforced in 2023, necessitate significant investment in compliance for companies like Cango.

- Market Access and Operations: Policies on market entry and operational conduct directly influence Cango's business model and risk exposure.

- Compliance Costs: Adherence to evolving regulations represents a mandatory and often substantial cost for Cango.

Suppliers of technology and data analytics tools generally hold moderate bargaining power over Cango. Cango's reliance on specialized software and cloud services means these providers can influence pricing. For instance, the dominance of a few major cloud providers in 2024 gives them leverage, potentially increasing Cango's infrastructure costs.

Online advertising platforms, crucial for customer acquisition, also exhibit bargaining power. Dominant Chinese digital marketing channels can dictate terms, impacting Cango's marketing expenditures. In 2023, rising digital ad costs in China meant higher customer acquisition expenses for automotive firms.

Government and regulatory bodies act as indirect suppliers, wielding significant power through setting operational rules. Cango's compliance with directives on data privacy and auto finance, like those tightened in 2023, incurs costs and shapes its strategy.

| Supplier Type | Bargaining Power Level | Key Factors Influencing Power | Impact on Cango |

|---|---|---|---|

| Financial Institutions | Moderate to High | Market share, scale, Cango's transaction volume | Terms of financing, interest rates |

| Automotive Dealers | Moderate | Sales volume, Cango's network value, dealer competition | Platform adoption, service level agreements |

| Technology & Data Providers | Moderate | Proprietary technology, market concentration (e.g., cloud) | Software costs, data service fees |

| Advertising Platforms | Moderate to High | Market dominance (e.g., WeChat, Alibaba), ad cost trends | Customer acquisition costs |

| Government/Regulators | High (Indirect) | Regulatory framework, data security mandates | Compliance costs, operational restrictions |

What is included in the product

Analyzes the competitive forces impacting Cango, including buyer and supplier power, threat of new entrants and substitutes, and existing rivalry, to understand its market position and profitability.

Instantly identify and mitigate competitive threats with a dynamic, visual representation of all five forces, enabling proactive strategy adjustments.

Customers Bargaining Power

Car buyers in China wield considerable bargaining power, a key factor for Cango. The Chinese auto market is incredibly competitive, offering buyers many choices for both vehicles and financing. In 2024, with the ongoing expansion of the new energy vehicle (NEV) market, buyers are further empowered by a wide array of financing options, including those from traditional banks, online platforms, and direct manufacturer financing arms.

Buyers can easily compare deals across different providers, putting pressure on companies like Cango to offer competitive rates and terms. This accessibility to multiple financing solutions, coupled with government incentives for NEVs and trade-in programs, allows consumers to negotiate for the most favorable conditions, directly impacting Cango's service margins and customer acquisition costs.

Automotive dealers, especially smaller independent ones, possess moderate bargaining power with Cango. They can opt for alternative transaction service providers or establish their own in-house financing, limiting Cango's leverage. The ease with which dealers can switch platforms and the tangible value Cango provides in sales and customer acquisition directly influence their negotiating strength.

Financial institutions partnering with Cango to originate loans wield significant bargaining power. They are both suppliers, providing the capital for loans, and customers, utilizing Cango's platform to connect with car buyers. In 2024, the competitive landscape for auto financing means these institutions can negotiate terms, impacting Cango's fee structure and profitability.

These institutions can leverage alternative channels to originate auto loans, reducing their reliance on Cango. This gives them leverage to push for more favorable interest rates and risk-sharing agreements, directly affecting Cango's revenue streams from its financing facilitation services.

Used Car Exporters/International Buyers

Used car exporters and international buyers wield significant bargaining power when dealing with platforms like Cango. Their ability to negotiate stems from their need for a complete export solution, encompassing vehicle inspection, complex logistics, and customs procedures. These buyers can easily switch between different export facilitators, making Cango's value proposition crucial.

The effectiveness of Cango's platform in managing cross-border transactions directly influences these buyers' willingness to engage. Factors like service transparency, operational efficiency, and overall cost-competitiveness are paramount. For instance, in 2023, the global used car market saw continued growth, with export markets playing an increasingly vital role, underscoring the importance of competitive pricing and streamlined processes for international buyers.

- Demand for Comprehensive Services: International buyers require end-to-end solutions, including quality inspections, shipping arrangements, and customs brokerage.

- Availability of Alternatives: The presence of numerous other export facilitators means buyers can readily compare and select the most advantageous option.

- Price Sensitivity: Cross-border transactions are often cost-sensitive, making competitive pricing a key determinant for these buyers.

- Transparency and Efficiency: Buyers prioritize clear communication and efficient processing to minimize delays and unexpected costs in international trade.

Evolving Consumer Preferences

The rapid shift in consumer preferences towards New Energy Vehicles (NEVs) and smart vehicle features in China significantly bolsters buyer leverage. For instance, in 2023, NEV sales in China surpassed 9 million units, representing a substantial portion of the total automotive market and indicating a strong consumer demand for these technologies.

This evolving landscape necessitates that Cango, as a platform, must proactively adapt its service offerings and forge strategic partnerships. This includes developing specialized NEV financing solutions and ensuring seamless integration with advanced in-car technology to meet these growing demands.

Failure to cater to these evolving consumer preferences could result in a considerable loss of Cango's customer base, as buyers increasingly seek out platforms that align with the latest automotive trends and technological advancements.

- NEV sales in China: Over 9 million units in 2023.

- Consumer demand: Growing preference for NEVs and smart vehicle features.

- Cango's adaptation: Need for specialized NEV financing and tech integration.

- Risk of non-compliance: Potential loss of customer base.

Car buyers in China, especially those interested in New Energy Vehicles (NEVs), possess significant bargaining power due to the highly competitive market and diverse financing options available in 2024. This allows them to easily compare offers and negotiate favorable terms, directly impacting Cango's profitability.

The growing demand for NEVs, with over 9 million units sold in China in 2023, further empowers consumers. Cango must adapt by offering specialized NEV financing and integrating smart vehicle technologies to retain its customer base.

Automotive dealers and financial institutions also exert considerable bargaining power, as they can utilize alternative platforms or in-house solutions, forcing Cango to offer competitive fee structures and risk-sharing agreements.

| Customer Segment | Bargaining Power Factors | Impact on Cango |

|---|---|---|

| General Car Buyers | Numerous vehicle choices, competitive financing rates, government incentives (e.g., NEV subsidies) | Pressure on service margins, increased customer acquisition costs |

| NEV Buyers | Rapid NEV market growth (9M+ units in 2023), advanced technology features, diverse financing for NEVs | Need for specialized financing solutions, risk of losing customers to tech-aligned platforms |

| Automotive Dealers | Ability to switch providers, establish in-house financing, reliance on Cango for sales support | Negotiation leverage on fees, potential for reduced platform usage |

| Financial Institutions | Alternative origination channels, ability to negotiate rates and risk-sharing | Direct impact on Cango's revenue from financing facilitation |

| Used Car Exporters/International Buyers | Need for end-to-end export solutions, price sensitivity, availability of alternative facilitators | Emphasis on competitive pricing, operational efficiency, and transparent processes |

What You See Is What You Get

Cango Porter's Five Forces Analysis

This preview showcases the complete Cango Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the automotive industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate usability for your strategic planning needs.

Rivalry Among Competitors

The Chinese auto financing and transaction services sector is a battlefield. Cango Inc. operates in a market teeming with competitors, from established banks to burgeoning online platforms and the captive finance arms of car manufacturers themselves. This crowded landscape means constant pressure on pricing and a relentless drive to offer better, more innovative services to attract and retain customers.

Original Equipment Manufacturers (OEMs) are increasingly building their own captive finance arms and online platforms. This trend means they need fewer third-party services like Cango. For example, in 2024, many major automakers expanded their digital offerings, aiming to control the entire customer journey from car purchase to financing.

Furthermore, big tech firms and nimble fintech startups are making significant inroads into auto finance. These companies often possess massive customer bases and advanced technology, allowing them to offer competitive and user-friendly financing solutions. This influx of new players intensifies the competitive landscape for established facilitators.

The Chinese automotive market, particularly for New Energy Vehicles (NEVs), has been a hotbed of intense price competition. This aggressive pricing strategy directly impacts financing providers like Cango, forcing them to offer more attractive rates to retain dealers and end-buyers. For example, reports from 2024 indicated that average NEV prices saw a noticeable decline due to these competitive pressures.

This constant need to provide competitive financing solutions inevitably squeezes profit margins for platforms operating within this space. Cango, like its rivals, must therefore prioritize operational efficiency and explore innovative service offerings to maintain profitability amidst these market dynamics. The pressure to keep financing costs low for consumers directly translates to narrower margins for the company.

Technological Innovation as a Differentiator

Competitive rivalry in the automotive transaction services sector is intensely fueled by rapid technological innovation. Companies are pouring resources into big data analytics, artificial intelligence (AI), and cloud-based platforms. These investments aim to elevate user experience, bolster risk management capabilities, and optimize operational efficiency. For instance, in 2024, many platforms focused on enhancing their AI-driven credit assessment tools to speed up loan approvals, a critical factor for customer satisfaction.

Platforms that successfully deploy superior digital tools, offer expedited approval workflows, and deliver highly personalized services are carving out significant competitive advantages. This technological edge allows them to attract and retain customers in a crowded market. The ability to leverage data for predictive analytics, such as anticipating customer needs or identifying potential fraud, becomes a key differentiator.

- Technological Investment: Companies are heavily investing in AI, big data, and cloud solutions to improve services and operations.

- Key Differentiators: Superior digital tools, faster approvals, and personalized services are crucial for gaining market share.

- Impact on Rivalry: Innovation directly intensifies competition, as firms strive to offer the most advanced and user-friendly platforms.

- User Experience Focus: Enhancing the digital journey for consumers is a primary driver of technological development and competitive strategy.

Market Consolidation and Strategic Pivots

The competitive landscape for companies like Cango is intensifying due to market consolidation, especially within the New Energy Vehicle (NEV) sector. This trend forces players to continually adapt and seek new avenues for growth.

Cango itself has executed significant strategic pivots, venturing into areas like Bitcoin mining and international used car exports. These moves highlight how competitors are actively reshaping their business models to overcome existing challenges and tap into emerging markets, adding considerable complexity to the rivalry.

- Market Consolidation: The NEV market, a key area for many automotive-related businesses, has seen significant consolidation. For instance, by early 2024, several smaller NEV manufacturers had either ceased operations or been acquired, streamlining the competitive set but also concentrating market power among larger entities.

- Strategic Pivots: Cango's diversification into Bitcoin mining and international used car exports exemplifies a broader trend. In 2023, the company announced plans to expand its used car export business, aiming to leverage global demand. This strategic repositioning is a direct response to the evolving automotive market and a method to mitigate risks associated with its traditional business lines.

- Reshaping Business Models: Competitors are not static; they are actively reinventing themselves. This could involve investing in charging infrastructure, developing advanced driver-assistance systems, or exploring subscription-based vehicle models. Such dynamic shifts mean that rivalry is not just about current market share but also about future adaptability and innovation.

The competitive rivalry in China's auto financing sector is exceptionally fierce. Cango faces intense pressure from a diverse range of players, including banks, OEM captive finance arms, and increasingly, tech-savvy fintech startups. This dynamic environment necessitates continuous innovation and aggressive pricing to capture market share.

The trend of Original Equipment Manufacturers (OEMs) strengthening their captive finance operations and digital platforms directly challenges third-party service providers like Cango. For example, in 2024, many major automotive brands enhanced their direct-to-consumer online sales channels, integrating financing options seamlessly.

The influx of big tech and agile fintech companies, armed with advanced technology and vast customer bases, further intensifies competition. These new entrants often offer streamlined, user-friendly financing solutions that appeal to modern consumers. This competitive pressure is evident as many platforms in 2024 focused on improving their AI-driven credit assessment tools to expedite loan approvals.

The aggressive pricing strategies within China's automotive market, particularly for New Energy Vehicles (NEVs), directly impact financing providers. Reports from 2024 indicated a notable decline in average NEV prices due to intense competition, forcing financing companies to offer more attractive rates to dealers and buyers, thereby squeezing profit margins.

| Competitor Type | Key Characteristics | Impact on Cango |

|---|---|---|

| OEM Captive Finance | Integrated financing, brand loyalty, digital platforms | Reduces reliance on third-party providers |

| Banks | Established customer base, broad financial services | Strong competition on interest rates and loan terms |

| Fintech Startups | Agile, tech-driven, user-friendly interfaces | Innovate rapidly, potentially offer lower costs |

| Big Tech Firms | Large user bases, data analytics capabilities | Can leverage existing ecosystems for financing |

SSubstitutes Threaten

The threat of direct car purchases without financing is a notable concern for Cango. This is particularly true for individuals with higher incomes or those who can leverage substantial personal savings. In 2023, a significant portion of new vehicle sales in China were still financed, but the segment of cash buyers, while smaller, represents a direct bypass of Cango's core services, thereby shrinking its addressable market.

Consumers and dealers have a wide array of alternative financing channels available, bypassing Cango’s platform. These options include direct loans from traditional banks, emerging peer-to-peer lending networks, and specialized micro-finance institutions. Furthermore, many car manufacturers offer their own direct financing programs, often with attractive incentives.

The accessibility and competitive interest rates offered by these substitutes present a significant threat. For instance, in 2024, the automotive finance market saw continued growth in direct manufacturer financing, with many brands actively promoting low APR deals to drive sales, directly competing with third-party financiers like Cango.

In major Chinese urban centers, the availability of extensive public transportation systems, including subways and buses, coupled with the widespread adoption of ride-sharing platforms like Didi Chuxing, presents a significant threat of substitutes for personal car ownership. These alternatives directly address the need for mobility, thereby diminishing the perceived necessity for individuals to purchase and finance their own vehicles.

This shift in consumer preference away from personal car ownership indirectly affects Cango, a platform focused on auto financing. For instance, Didi Chuxing reported over 10 billion completed trips in 2023, highlighting the massive scale of its operations and its role in providing convenient transportation alternatives. This substantial usage indicates a reduced reliance on private vehicles, which can translate to lower demand for auto loans.

Longer Car Ownership Cycles

Longer car ownership cycles directly threaten Cango’s business by decreasing the demand for new vehicle financing. As cars become more durable and consumers face economic pressures, they tend to hold onto their vehicles for extended periods. This trend means fewer people are in the market for a new car, directly reducing the volume of transactions Cango can facilitate.

For instance, in 2024, the average age of vehicles on U.S. roads reached an all-time high of approximately 12.5 years, a figure that has been steadily increasing. This extended lifespan means fewer opportunities for Cango to engage customers in new financing arrangements. The economic climate also plays a role, with many consumers opting to repair existing vehicles rather than purchase new ones, further dampening demand for new car financing services.

- Extended Vehicle Lifespans: Modern vehicles are built to last longer, reducing the perceived need for frequent replacements.

- Economic Factors: Inflation and interest rate concerns in 2024 encourage consumers to delay new car purchases and opt for repairs on existing vehicles.

- Reduced Transaction Volume: Fewer new car sales directly translate to fewer financing opportunities for companies like Cango.

- Impact on Financing Demand: A shrinking pool of new car buyers means a smaller customer base for Cango's core financing services.

Leasing and Subscription Models

The increasing adoption of car leasing and subscription services, especially for New Energy Vehicles (NEVs), poses a significant threat of substitution to traditional car ownership and financing. These flexible models offer alternatives that bypass the conventional purchase and loan processes. For instance, in 2024, the NEV subscription market saw substantial growth, with companies reporting a 30% year-over-year increase in subscriber numbers, indicating a shift in consumer preference away from outright ownership.

These alternative models often come with distinct payment structures and comprehensive service packages that differ from Cango's core financing facilitation business. This divergence means that potential customers might opt for these all-inclusive subscriptions rather than seeking traditional financing through Cango. The convenience and predictable monthly costs associated with subscriptions can be particularly appealing, potentially diverting a portion of the market that would have previously relied on financing.

- Growing NEV Subscription Market: Reports indicate a 30% year-over-year rise in NEV subscription users in 2024.

- Alternative Payment Structures: Subscription models offer bundled services and predictable monthly fees, contrasting with traditional financing.

- Consumer Preference Shift: Convenience and flexibility of subscriptions are attracting consumers who might otherwise finance vehicle purchases.

The threat of substitutes for Cango is multifaceted, encompassing direct cash purchases, alternative financing channels, and evolving mobility solutions. These substitutes directly impact Cango's core business by offering consumers and dealers ways to bypass its services.

Direct cash purchases, while a smaller segment, represent a complete bypass of Cango's financing model. Alternative financing from banks, P2P lenders, and manufacturer-specific programs offer competitive rates, especially with manufacturer incentives seen in 2024. Furthermore, the rise of car leasing and subscription services, particularly for NEVs, provides flexible alternatives that sidestep traditional financing.

The increasing durability of vehicles, leading to longer ownership cycles, also acts as a substitute by reducing the overall demand for new vehicle financing. For example, the average vehicle age on U.S. roads reached approximately 12.5 years in 2024, a trend that dampens the need for frequent new car purchases and associated financing.

| Threat of Substitutes | Description | Impact on Cango | 2024 Data/Trend |

| Direct Cash Purchases | Consumers buying vehicles outright without financing. | Reduces addressable market for financing services. | Continues to be a segment, though often smaller than financed purchases. |

| Alternative Financing Channels | Loans from traditional banks, P2P lending, manufacturer financing. | Offers competitive rates and incentives, diverting customers. | Manufacturer direct financing saw increased promotion of low APR deals. |

| Evolving Mobility Solutions | Ride-sharing services, public transportation, car leasing/subscriptions. | Reduces the perceived need for personal car ownership and financing. | NEV subscription market grew by 30% year-over-year in 2024; Didi Chuxing completed over 10 billion trips in 2023. |

| Extended Vehicle Lifespans | Consumers holding onto cars longer due to durability and economic factors. | Decreases demand for new vehicle financing as fewer replacements occur. | Average vehicle age on U.S. roads reached ~12.5 years in 2024. |

Entrants Threaten

The digital nature of automotive transaction services presents a challenge with relatively low barriers to entry for new, tech-savvy companies. A well-designed digital platform, coupled with smart algorithms and impactful marketing, can rapidly draw in customers, particularly if the new entrant offers novel solutions or caters to specific market segments.

While digital platforms can lower entry barriers, the actual facilitation of auto financing demands considerable capital. New players must secure substantial funding or forge strong alliances with banks to manage credit risks and handle significant loan volumes, creating a notable deterrent.

For instance, in 2024, the average auto loan amount in the U.S. remained robust, requiring entrants to have deep pockets to underwrite even a modest market share. Companies like Cango Inc., operating in this space, demonstrate the need for significant financial backing to manage the scale of operations and associated credit exposures.

The Chinese regulatory environment presents substantial barriers for new entrants in the financial services sector, particularly concerning data security. Obtaining the requisite licenses and adhering to stringent, evolving data protection laws demands significant investment and expertise.

These compliance costs, estimated to be substantial for new businesses, heavily favor established companies like Cango, which already possess robust compliance frameworks and a deep understanding of the regulatory landscape. For instance, in 2024, the cost of obtaining financial licenses in China can range from hundreds of thousands to millions of dollars, depending on the specific service offered.

Established Dealer Networks and Financial Partnerships

Established players like Cango, before its strategic shift, had cultivated deep-rooted networks of dealerships and forged enduring alliances with major financial institutions throughout China. Replicating these crucial relationships, which are vital for customer acquisition and securing financing, presents a significant hurdle for any new entrant aiming to compete effectively in the automotive retail and financing sector.

These entrenched dealer networks provide new entrants with substantial barriers:

- Exclusive Agreements: Incumbents often secure exclusive or preferential agreements with dealerships, limiting access for newcomers.

- Financing Access: Long-standing partnerships with banks and financial service providers grant incumbents favorable financing terms and broader customer credit options.

- Brand Trust and Loyalty: Years of operation have built trust and loyalty among both dealers and consumers, making it difficult for new entrants to gain traction.

Technological Advancements and Data Expertise

New entrants, especially those with strong technological foundations, represent a significant threat. These companies can leverage advanced AI and big data analytics to offer more efficient and personalized services, potentially disrupting established players. For instance, in 2024, the automotive technology sector saw significant investment in AI-driven predictive maintenance, a capability that could be integrated into new mobility service platforms.

Their agility allows for rapid innovation, enabling them to quickly adapt to market changes and enhance user experience. This can lead to a swift capture of market share from incumbents who may be slower to adopt new technologies. Consider the rise of new fintech solutions in 2024 that streamlined payment processes, attracting a large user base due to their ease of use.

The integration of blockchain technology by new entrants can also offer enhanced security and transparency, appealing to a growing segment of consumers concerned about data privacy. This technological edge allows them to differentiate their offerings and attract customers seeking more robust and trustworthy platforms.

- Technological Disruption: New entrants can introduce disruptive technologies like AI-powered customer service or blockchain-based transaction systems.

- Data Analytics Advantage: Companies adept at big data analytics can offer highly personalized services and optimize operations, outperforming less data-savvy competitors.

- Agility and Innovation: Tech-focused startups often possess greater agility, allowing for faster product development and market adaptation.

- Enhanced User Experience: Innovations in user interface and service delivery can quickly attract and retain customers.

While the digital nature of automotive transaction services might suggest low barriers, significant capital is needed for auto financing, a key deterrent for new entrants. In 2024, the substantial average auto loan amounts in the U.S. underscore the need for deep pockets to manage credit risks and loan volumes, as demonstrated by companies like Cango. Furthermore, stringent Chinese regulations, particularly around data security and licensing, impose considerable compliance costs, estimated in the hundreds of thousands to millions of dollars for new financial service businesses in 2024, favoring established players with existing frameworks.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Cango leverages data from publicly available financial statements, investor relations reports, and industry-specific market research. We also incorporate insights from automotive industry publications and regulatory filings to provide a comprehensive view of the competitive landscape.