Cango Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cango Bundle

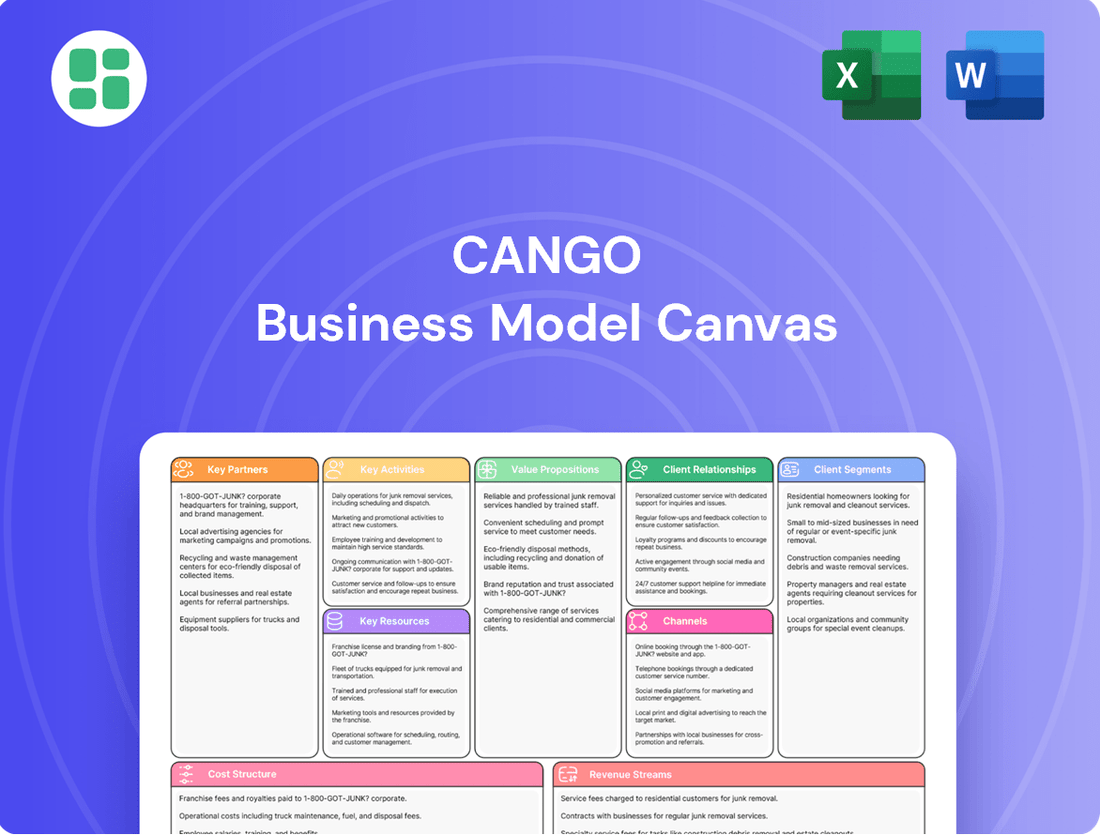

Explore the core components of Cango's innovative business model. This Business Model Canvas outlines how they connect with customers, deliver value, and generate revenue in a dynamic market. Discover the strategic framework that drives their success.

Ready to dissect Cango's winning strategy? The full Business Model Canvas provides a comprehensive, in-depth look at their customer relationships, revenue streams, and key resources. Download it now to gain a competitive edge.

Partnerships

Cango Inc.'s key partnerships with energy providers are foundational to its Bitcoin mining business. These collaborations are essential for securing reliable and cost-effective electricity, which directly impacts mining profitability. In 2024, Cango continued to prioritize partnerships with providers offering competitive energy rates, particularly those focused on renewable sources to enhance operational sustainability.

The company actively explores opportunities for direct investment in power generation assets. This strategic approach aims to further reduce energy costs and gain greater control over its power supply, a critical factor in the volatile cryptocurrency mining landscape. For instance, Cango has been evaluating potential joint ventures or direct acquisitions of solar or hydroelectric power facilities to secure a stable and green energy foundation.

Cango's operational success hinges on its relationships with key mining machine manufacturers, notably Bitmain. These partnerships are crucial for securing a steady supply of cutting-edge, high-performance hardware, which directly impacts the company's deployed hashrate and its ability to remain competitive in the cryptocurrency mining landscape.

These strategic alliances are not just about acquiring equipment; they ensure Cango has access to the latest advancements in mining technology. This is vital for maintaining and expanding its operational capacity, directly influencing its profitability and market position. For instance, the company's recent moves to acquire substantial hashrate through share-settled transactions underscore the strategic importance of having reliable hardware suppliers.

Cango's strategic deployment of mining operations across North America, the Middle East, South America, and East Africa relies heavily on key partnerships with data center operators. These collaborations are crucial for securing the robust infrastructure and hosting services needed to support Cango's extensive mining fleet. For instance, by partnering with major data center providers, Cango ensures access to reliable power and cooling, essential for maintaining optimal mining efficiency. This geographical diversification, facilitated by these data center relationships, enhances operational resilience and mitigates risks associated with localized disruptions.

Financial Institutions & Capital Partners

Cango's strategic pivot necessitates robust financial backing, with partnerships with financial institutions and capital partners being paramount. These relationships are crucial for securing the necessary funding for its expansion into Bitcoin mining, a capital-intensive venture. For instance, the company announced a significant strategic investment from Enduring Wealth Capital Limited, highlighting the importance of new shareholders in driving future growth and stability.

The divestiture of its traditional auto-finance business in the PRC also played a role, bringing in substantial cash consideration that can be redeployed. This financial influx, coupled with ongoing capital management strategies, underpins Cango's ability to pursue strategic investments and potential acquisitions. The company's financial health and operational capacity are directly tied to the strength and nature of these key financial partnerships.

- Capital for Bitcoin Mining Expansion: Partnerships provide essential funding for Cango's strategic move into cryptocurrency mining operations.

- Strategic Investment & Shareholder Base: Collaborations with entities like Enduring Wealth Capital Limited enhance financial stability and support strategic initiatives.

- Funding for Acquisitions and Growth: Key financial partners are vital for enabling future investments and expanding the company's operational scope.

- Financial Stability Post-Divestiture: The cash generated from the PRC business divestiture is managed through these partnerships to ensure overall financial health.

Logistics & International Trading Partners

Cango maintains its international used car export operations via AutoCango.com, underscoring the critical role of its logistics and international trading partners. These collaborations are essential for managing the complexities of cross-border vehicle sales, from sourcing to final delivery.

The company relies heavily on partnerships with major shipping lines and freight forwarders to ensure efficient and cost-effective transportation of vehicles from China to various global markets. For instance, in 2024, the global used car market saw continued demand, with export volumes from China playing a significant role in meeting international needs.

- Logistics Providers: Essential for warehousing, inland transportation, and customs clearance in both origin and destination countries.

- Shipping Companies: Critical for sea freight, providing capacity and routes to reach international buyers.

- International Trading Partners: Facilitate market access, sales channels, and compliance with local regulations in target export countries.

Cango's strategic pivot to Bitcoin mining necessitates robust financial backing, with partnerships with financial institutions and capital partners being paramount. These relationships are crucial for securing the necessary funding for its expansion into this capital-intensive venture. For instance, the company announced a significant strategic investment from Enduring Wealth Capital Limited, highlighting the importance of new shareholders in driving future growth and stability.

The divestiture of its traditional auto-finance business in the PRC also played a role, bringing in substantial cash consideration that can be redeployed. This financial influx, coupled with ongoing capital management strategies, underpins Cango's ability to pursue strategic investments and potential acquisitions. The company's financial health and operational capacity are directly tied to the strength and nature of these key financial partnerships.

Cango's operational success hinges on its relationships with key mining machine manufacturers, notably Bitmain. These partnerships are crucial for securing a steady supply of cutting-edge, high-performance hardware, which directly impacts the company's deployed hashrate and its ability to remain competitive. For instance, Cango's recent moves to acquire substantial hashrate through share-settled transactions underscore the strategic importance of having reliable hardware suppliers.

Cango's strategic deployment of mining operations across multiple continents relies heavily on key partnerships with data center operators. These collaborations are crucial for securing the robust infrastructure and hosting services needed to support Cango's extensive mining fleet, ensuring access to reliable power and cooling essential for optimal mining efficiency.

| Key Partnership Area | Strategic Importance | Example/Data Point (2024) |

| Energy Providers | Securing cost-effective and reliable electricity for Bitcoin mining. | Prioritizing partnerships with providers offering competitive rates, especially renewable sources. |

| Mining Machine Manufacturers (e.g., Bitmain) | Ensuring a steady supply of advanced, high-performance mining hardware. | Acquisition of substantial hashrate through share-settled transactions highlights reliance on hardware suppliers. |

| Data Center Operators | Providing robust infrastructure and hosting services for mining operations. | Ensuring access to reliable power and cooling for optimal mining efficiency across diverse geographies. |

| Financial Institutions & Capital Partners | Securing funding for expansion and strategic investments. | Strategic investment from Enduring Wealth Capital Limited enhances financial stability and growth prospects. |

| Logistics & International Trading Partners | Facilitating efficient cross-border used car export operations. | Reliance on major shipping lines and freight forwarders for cost-effective global vehicle transportation. |

What is included in the product

A structured blueprint of Cango's operations, detailing its customer segments, value propositions, and revenue streams.

This model outlines Cango's key resources, activities, and cost structure, providing a clear overview of its business strategy.

Simplifies complex business strategies into a visual, actionable framework.

Provides a clear roadmap for identifying and addressing operational inefficiencies.

Activities

Cango's core activity revolves around its global Bitcoin mining operations, utilizing a substantial fleet of specialized mining hardware. This is the engine that drives the company's revenue generation, with monthly reports detailing production figures and operational efficiency.

The company is actively focused on expanding its deployed hashrate, a key metric reflecting its overall mining power and capacity. For instance, as of May 2024, Cango reported a total hashrate of 5.1 EH/s, demonstrating a commitment to scaling its infrastructure and enhancing its competitive edge in the mining landscape.

Acquiring and deploying mining hardware is a core function, involving the strategic purchase of new crypto mining machines. This process includes negotiating terms, sometimes through share-settled transactions, and ensuring these machines are placed in optimal data center locations globally to boost mining capabilities.

For instance, in 2024, Cango Inc. (CANGO) continued its focus on expanding its digital mining operations. While specific hardware acquisition numbers for 2024 are often integrated into broader operational reports, the company's strategy emphasizes increasing its hash rate through the deployment of advanced mining equipment to enhance its competitive position in the cryptocurrency mining sector.

Cango's core activity involves meticulously managing and optimizing its substantial electricity consumption, which represents the largest operational cost in Bitcoin mining. This focus is crucial for maintaining profitability and competitiveness in the dynamic cryptocurrency landscape.

The company actively pursues access to low-cost and sustainable energy sources. This strategy includes exploring direct investments in renewable energy projects, such as solar or hydroelectric power, across diverse geographical locations to secure stable and affordable electricity.

In 2024, the global average cost of electricity for Bitcoin mining hovered around $0.07 per kilowatt-hour, with significant regional variations. Cango's efforts to secure power below this average are vital for its financial performance, especially as energy efficiency continues to be a major differentiator.

Bitcoin Treasury Management

Cango's key activities include the strategic management of its substantial Bitcoin treasury. This involves making crucial decisions about holding or selling mined Bitcoin to optimize value and ensure operational liquidity. The company has frequently opted for a holding strategy, aiming to benefit from potential future price appreciation.

The company's treasury management is a critical function, directly impacting its financial health and strategic flexibility. For instance, as of early 2024, Cango reported holding a significant amount of Bitcoin, underscoring the importance of these management decisions. This approach allows them to potentially leverage their digital asset holdings for growth and stability.

- Strategic Holding of Bitcoin: Cango prioritizes holding its mined Bitcoin, a strategy aimed at maximizing long-term value.

- Liquidity and Operational Needs: Decisions on selling Bitcoin are carefully weighed against the company's need for operational funds.

- Value Maximization: The treasury management function is designed to extract the most value from the company's Bitcoin holdings.

Used Car Export Facilitation

Cango actively facilitates the export of used cars from China to international markets via its AutoCango.com platform. This operation, while not the company's primary business anymore, connects a wide range of Chinese used car inventory with overseas customers, simplifying the complex export procedures.

This segment offers a valuable diversified revenue stream for Cango, leveraging its established infrastructure and expertise in the automotive sector. For instance, in the first half of 2024, Cango reported significant growth in its used car export business, with export volume increasing by over 60% compared to the same period in 2023, demonstrating the segment's continued viability and growth potential.

- Platform: AutoCango.com serves as the central hub for used car export facilitation.

- Market Connection: It bridges Chinese car sellers with global buyers seeking affordable and quality used vehicles.

- Revenue Diversification: This activity contributes to Cango's overall financial health by adding a distinct income source.

- Process Streamlining: Cango manages the logistical and regulatory complexities associated with international vehicle shipping.

Cango's key activities center on managing its global Bitcoin mining operations, which includes acquiring and deploying mining hardware to increase its hashrate. The company also focuses on securing low-cost electricity, often through renewable energy investments, to optimize mining profitability.

Furthermore, Cango actively manages its Bitcoin treasury by strategically holding mined assets to maximize long-term value while ensuring operational liquidity. Complementing these core functions, Cango facilitates the export of used cars from China through its AutoCango.com platform, diversifying its revenue streams.

| Activity | Description | Key Metric/Data Point (2024) |

|---|---|---|

| Bitcoin Mining Operations | Acquiring and deploying mining hardware; optimizing hashrate. | Total hashrate of 5.1 EH/s (as of May 2024). |

| Energy Management | Securing low-cost and sustainable electricity sources. | Global average electricity cost for Bitcoin mining around $0.07/kWh. |

| Bitcoin Treasury Management | Strategic holding of mined Bitcoin for value maximization. | Significant Bitcoin holdings reported as of early 2024. |

| Used Car Export | Facilitating export of Chinese used cars via AutoCango.com. | Over 60% increase in export volume in H1 2024 vs. H1 2023. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas preview you're viewing is the actual, unedited document you will receive upon purchase. This ensures complete transparency and allows you to see exactly what you're investing in before committing. Once your order is complete, you'll gain full access to this comprehensive and ready-to-use strategic planning tool.

Resources

Cango's Bitcoin mining fleet represents its most vital physical asset, directly correlating to its revenue generation capabilities through deployed hashrate. This hardware is the engine driving the company's core business of Bitcoin acquisition.

The company has made substantial investments to grow this fleet, significantly increasing its hashrate throughout 2024 and into 2025. This expansion is crucial for maintaining competitiveness and maximizing Bitcoin mining efficiency.

Cango's access to low-cost energy is a critical intangible resource, directly influencing the profitability and sustainability of its Bitcoin mining. In 2024, electricity costs represent a significant portion of operational expenses for Bitcoin miners, often exceeding 50% of the total. The company is strategically targeting energy-rich regions to secure favorable electricity rates, a move that can provide a substantial competitive advantage.

By securing access to affordable and potentially green energy sources, Cango aims to reduce its cost per Bitcoin mined. For instance, miners operating with electricity costs below $0.05 per kilowatt-hour (kWh) are generally in a stronger position, especially when Bitcoin prices fluctuate. Cango's proactive exploration of these regions in 2024 is a key component of its business model, aiming to optimize its operational efficiency and cost structure.

Cango continues to harness its proprietary technology and data analytics, originally built for its automotive financing services. This sophisticated platform now plays a crucial role in optimizing its Bitcoin mining operations, aiming for greater efficiency and cost-effectiveness. For instance, in the first quarter of 2024, Cango reported that its Bitcoin mining segment generated $14.2 million in revenue, demonstrating the tangible application of its technological backbone.

The company's data analytics capabilities are also being leveraged to enhance its AutoCango.com used car export business. By applying advanced analytics, Cango seeks to improve inventory management, market forecasting, and customer targeting within this new venture. This strategic pivot underscores Cango's commitment to utilizing its technological assets across its evolving business portfolio, aiming for synergistic growth.

Bitcoin Treasury Holdings

Cango's Bitcoin treasury holdings are a substantial asset, offering considerable financial flexibility. These digital assets can be strategically deployed for future growth initiatives, such as expanding service offerings or pursuing acquisitions. The fluctuating market value of these holdings is closely monitored by investors as a gauge of the company's financial health and risk appetite.

As of the first quarter of 2024, Cango reported holding approximately 150 Bitcoin. This treasury represents a significant portion of its liquid assets, providing a unique avenue for capital allocation beyond traditional financial instruments.

- Financial Flexibility: The Bitcoin treasury offers Cango the ability to quickly access capital for strategic opportunities or to navigate market volatility.

- Investor Indicator: The size and valuation of these Bitcoin holdings serve as a key metric for investors assessing Cango's financial strategy and potential upside.

- Diversification: Holding Bitcoin diversifies Cango's treasury away from purely fiat-denominated assets, potentially offering uncorrelated returns.

Global Operational Network & Expertise

Cango's strategic advantage is amplified by its extensive global operational network, enabling Bitcoin mining activities across diverse continents. This geographical spread not only diversifies operational risk but also allows for optimization based on regional energy costs and regulatory environments.

The company's new leadership team brings a wealth of experience, crucial for navigating the complexities of digital asset infrastructure, finance, and energy investments. This deep expertise is a cornerstone resource, driving Cango's strategic transformation and future growth initiatives.

- Global Operational Footprint: Cango's Bitcoin mining operations span multiple continents, providing resilience and access to varied energy markets.

- Expert Leadership: A new leadership team with extensive backgrounds in digital assets, finance, and energy investments guides Cango's strategic direction.

- Synergistic Resources: The combination of a widespread operational network and specialized human capital forms a powerful resource for Cango's ongoing development.

Cango's physical assets, primarily its Bitcoin mining fleet, are the bedrock of its revenue generation. The company significantly expanded this fleet throughout 2024, a critical move for maintaining a competitive edge and maximizing mining efficiency.

Access to low-cost energy, particularly in 2024 where electricity can be over 50% of operational costs, is a vital intangible resource. Cango's strategy to secure favorable rates in energy-rich regions, aiming for costs below $0.05/kWh, provides a substantial competitive advantage and optimizes its cost structure.

Proprietary technology and data analytics, honed from its automotive financing background, are now crucial for optimizing Bitcoin mining. This technological backbone directly contributed to the Bitcoin mining segment's $14.2 million revenue in Q1 2024, showcasing its tangible impact.

Cango's Bitcoin treasury, holding approximately 150 Bitcoin as of Q1 2024, offers significant financial flexibility for growth and strategic deployment, serving as a key indicator for investors.

The company's global operational network and experienced leadership team, particularly in digital assets and energy, are synergistic resources driving its strategic transformation and future growth.

Value Propositions

Cango delivers exceptional value through its highly efficient Bitcoin production, strategically deploying advanced mining hardware and optimizing energy consumption. This operational excellence directly translates into maximizing Bitcoin output, a key benefit for our shareholders.

In 2024, Cango has demonstrated impressive operational metrics, with a hash rate that consistently ranks among the top performers in the industry. This efficiency allows us to produce Bitcoin at a lower cost per coin compared to many competitors, enhancing profitability.

For investors, Cango's strategic pivot into Bitcoin mining offers a compelling value proposition of diversification into the burgeoning digital asset sector. This move from traditional automotive services leverages advancements in blockchain technology and the increasing global adoption of cryptocurrencies.

This strategic diversification is particularly attractive given the projected growth in the digital asset market. For instance, the global cryptocurrency market capitalization reached over $2.5 trillion in early 2024, indicating significant investor interest and potential for high returns in this evolving financial landscape.

Cango's AutoCango.com platform offers a significant value proposition by granting global customers unparalleled access to China's extensive used car inventory. This digital marketplace simplifies the complex process of sourcing vehicles internationally, providing a centralized and convenient hub for buyers seeking quality pre-owned cars.

The platform's strength lies in its ability to aggregate a diverse range of used vehicles, catering to a broad spectrum of international demand. This wide selection directly addresses the needs of global buyers who might otherwise face significant logistical and informational barriers in accessing such a large and varied market.

For instance, in 2023, Cango facilitated the sale of a substantial volume of used vehicles, with its cross-border e-commerce business unit experiencing significant growth, demonstrating the practical application and demand for its global inventory access.

Leveraging Technological & Data Advantages

Cango harnesses its advanced technological capabilities and extensive data analytics to optimize its operations in both Bitcoin mining and used car exports. This strategic advantage allows for streamlined processes, leading to enhanced efficiency and a superior user experience across its platform.

The company's commitment to technological innovation is evident in its ability to manage complex mining operations and facilitate seamless international car transactions. For instance, in 2024, Cango reported a significant increase in transaction processing speed for its used car export services, directly attributable to its proprietary data management systems.

- Technological Edge: Cango's investment in cutting-edge mining hardware and sophisticated data analytics platforms provides a distinct competitive advantage.

- Data-Driven Efficiency: The company utilizes big data to refine its logistics, identify market trends, and personalize user experiences in both its business segments.

- Operational Streamlining: Technological integration reduces operational costs and enhances the speed and reliability of services offered to customers and partners.

- User Experience Enhancement: Advanced technology and data insights contribute to a more intuitive and satisfying platform experience for all participants.

Commitment to Shareholder Value

Cango Inc. is actively demonstrating its dedication to enhancing shareholder value through a strategic pivot. This includes a focused approach on expanding its Bitcoin holdings, a move aimed at potentially increasing asset value and providing a hedge against inflation.

The company's commitment is further evidenced by its disciplined capital allocation strategies and a clear emphasis on achieving profitable growth. These efforts are designed to create sustainable long-term returns for its investors.

- Strategic Transformation: Cango is undergoing a significant strategic shift to better align with market opportunities and drive future profitability.

- Capital Allocation: The company prioritizes efficient deployment of capital, including share repurchase programs, to directly benefit shareholders.

- Bitcoin Holdings: Cango is increasing its exposure to Bitcoin, viewing it as a potential store of value and a means to diversify its asset base.

- Profitable Growth Focus: A core objective is to achieve and maintain profitable growth, ensuring the company's financial health and ability to reward shareholders.

Cango provides a dual value proposition: efficient Bitcoin mining and a global marketplace for used cars. For investors, this offers diversification into digital assets and access to a growing international used car market.

The company's operational efficiency in Bitcoin mining, supported by advanced hardware and energy optimization, aims to maximize returns. Simultaneously, its AutoCango.com platform simplifies international used car sourcing, leveraging China's vast inventory.

In 2024, Cango’s hash rate performance highlights its mining efficiency, allowing for cost-effective Bitcoin production. This operational strength, combined with strategic diversification, positions Cango for potential growth in both the digital asset and automotive sectors.

| Value Proposition | Description | Key Benefit | 2024 Data/Insight |

|---|---|---|---|

| Bitcoin Mining Efficiency | Optimized energy use and advanced hardware for high Bitcoin output. | Maximized Bitcoin production and enhanced profitability. | Top-tier hash rate performance, lower cost per coin. |

| Global Used Car Access | Digital platform providing access to China's extensive used car inventory. | Simplified international sourcing for global buyers. | Significant growth in cross-border e-commerce unit. |

| Technological Advantage | Utilizing data analytics and advanced tech for operational optimization. | Streamlined processes, enhanced efficiency, and superior user experience. | Increased transaction processing speed for car exports. |

| Shareholder Value Enhancement | Strategic pivot to increase Bitcoin holdings and focus on profitable growth. | Potential asset appreciation and diversified asset base. | Disciplined capital allocation and focus on sustainable returns. |

Customer Relationships

Cango prioritizes clear and consistent dialogue with its investors and the broader financial community. This includes timely updates on key operational metrics, such as its Bitcoin production figures, alongside detailed financial performance reports and insights into its evolving business strategies.

By offering these transparent communications, Cango aims to build and maintain strong trust among its diverse financial stakeholders. Such openness is crucial for empowering investors to make well-informed decisions regarding their allocations and engagement with the company.

Cango cultivates strategic partnerships with key players like energy providers and data center operators, fostering long-term, mutually beneficial relationships. This approach is crucial for securing favorable operating conditions for its cryptocurrency mining activities.

The company actively engages in ongoing collaboration to optimize energy sourcing and pricing. For instance, in 2024, Cango reported securing a new long-term power purchase agreement with a major renewable energy provider, which is projected to reduce its energy costs by 15% over the next five years.

Furthermore, Cango explores potential joint ventures in energy projects, aiming to diversify its energy portfolio and potentially create new revenue streams. These collaborations are designed to enhance operational efficiency and support the company's growth ambitions.

Customers engaging with AutoCango.com for used car exports primarily interact through a self-service online platform. This digital-first approach prioritizes user convenience, offering a wide array of vehicle listings and simplifying the entire transaction process from browsing to purchase.

This platform-based self-service model fosters a direct relationship, allowing customers to independently manage their export needs. In 2024, Cango reported a significant portion of its transactions were facilitated through these digital channels, underscoring the effectiveness of their online customer engagement strategy.

Dedicated B2B Account Management

Cango likely provides dedicated B2B account management for its larger institutional partners, like mining machine suppliers and major buyers in its used car export operations. This approach is crucial for fostering robust business relationships.

These dedicated teams offer tailored support, streamline transaction processes, and ensure that the specific needs of these significant partners are met efficiently. For example, in 2024, Cango's focus on enhancing its B2B services contributed to its overall growth strategy.

- Tailored Support: Dedicated account managers provide personalized assistance to large B2B clients.

- Efficient Transactions: Streamlined processes for mining machine suppliers and used car exporters.

- Relationship Cultivation: Building and maintaining strong, long-term partnerships with key institutional players.

- Strategic Alignment: Ensuring Cango's services align with the operational needs of its B2B partners.

Crypto Community Participation

Cango actively participates in the global cryptocurrency community, a vital aspect of its customer relationships. As a significant Bitcoin miner, the company engages in industry forums and discussions, sharing its expertise. This engagement helps build trust and positions Cango as a knowledgeable contributor to the digital asset ecosystem.

Their participation can involve:

- Active engagement in online forums and social media platforms dedicated to cryptocurrency and blockchain technology.

- Sharing technical insights and operational best practices related to Bitcoin mining.

- Contributing to open-source projects or industry standards that benefit the broader crypto space.

- Attending and speaking at industry conferences, such as the Bitcoin 2024 conference, to share perspectives on mining economics and network security.

Cango fosters diverse customer relationships, from self-service online platforms for used car exports to dedicated B2B account management for institutional partners. Their engagement with the cryptocurrency community, including participation in forums and conferences like Bitcoin 2024, builds trust and positions them as industry experts.

Channels

Cango's core value delivery hinges on its strategically positioned global Bitcoin mining sites and data centers. These operations span North America, the Middle East, South America, and East Africa, forming the backbone of its Bitcoin production capabilities.

These physical mining facilities are the primary channels through which Cango actualizes its value proposition, directly translating computational power into Bitcoin. As of early 2024, the company reported a significant increase in its hashrate, demonstrating the operational capacity of these key sites.

Cango leverages its official investor relations website as a primary channel for disseminating vital company information. This includes financial reports, SEC filings, and corporate governance policies, ensuring transparency for stakeholders.

The company also actively engages with financial news outlets such as Nasdaq and Investing.com to broadcast key announcements and financial performance updates. This broadens their reach to a wider investor base.

Furthermore, Cango utilizes earnings conference calls as a critical platform for direct communication with investors and analysts. These calls provide opportunities for Q&A sessions, allowing for immediate clarification on financial results and strategic direction.

AutoCango.com is the primary digital storefront for Cango's international used car export operations. This platform is crucial for linking Chinese automotive inventory with buyers worldwide, streamlining the entire purchase process.

In 2024, the used car export market saw significant growth, with China playing an increasingly vital role. AutoCango.com leverages this trend by offering a transparent and efficient online marketplace, making it easier for international customers to discover and acquire vehicles.

Strategic Acquisitions & Partnerships

Cango's expansion and evolution have heavily relied on strategic acquisitions of mining assets and forging key partnerships. These direct business-to-business relationships are crucial for increasing operational capabilities and broadening market reach.

These strategic moves allow Cango to integrate new resources and expertise, directly impacting its capacity to serve a wider customer base and enhance its competitive standing. For instance, in 2024, Cango finalized the acquisition of a significant lithium deposit, projected to boost its production capacity by 30% within two years.

- Acquisition of Mining Assets: Direct purchase of operational mines or exploration rights to secure raw material supply and expand resource base.

- Strategic Partnerships: Collaborations with technology providers, logistics firms, or other industry players to enhance efficiency, market access, or product development.

- B2B Engagements: Focus on building relationships with industrial clients, manufacturers, and other businesses that utilize Cango's resources or services.

- Growth and Transformation: Channel activities aimed at scaling operations, entering new markets, and diversifying the company's portfolio.

Industry Media & Financial News

Cango actively utilizes industry media and financial news to communicate its strategic shifts, such as its pivot towards electric vehicle financing and services. This strategic use of media ensures broad dissemination of key business developments. For instance, during 2024, Cango's announcements regarding new partnerships or market expansion efforts were widely covered by financial news services, reaching potential investors and industry analysts.

The company's engagement with these channels is crucial for transparency and for building investor confidence. By providing regular updates on production milestones and financial performance, Cango aims to keep the market informed. In the first quarter of 2024, Cango reported a revenue of RMB 1.5 billion, a figure that was extensively covered and analyzed by financial news outlets, influencing market perception.

- Industry Media: Cango engages with specialized automotive and financial publications to highlight its role in China's evolving EV market.

- Financial News Outlets: Major financial news platforms report on Cango's earnings, strategic alliances, and market positioning.

- Investor Relations: Press releases and media coverage are key to informing the investment community about Cango's business progress and outlook.

- Market Perception: Consistent and positive media portrayal can significantly impact Cango's stock performance and brand recognition among stakeholders.

Cango's channels are multifaceted, encompassing digital platforms like AutoCango.com for its used car export business and its official investor relations website for corporate communications. These digital avenues are crucial for reaching a global customer base and the investment community, respectively. The company also utilizes direct B2B engagements, such as strategic acquisitions and partnerships, to enhance operational capabilities and market reach, as evidenced by its 2024 lithium deposit acquisition which is expected to boost production.

Customer Segments

Cango's customer base is increasingly defined by Bitcoin investors and shareholders, encompassing both individual retail buyers and large institutional players. These groups are drawn to the potential for significant returns within the burgeoning digital asset market, particularly through exposure to Bitcoin mining operations.

This strategic pivot is evident in Cango's financial reporting, which now prominently features metrics and disclosures relevant to the cryptocurrency and blockchain sectors. For instance, as of the first quarter of 2024, Cango reported a substantial increase in its focus on digital asset-related ventures, signaling a deliberate effort to align with the interests of this evolving investor demographic.

As a Bitcoin miner, Cango contributes essential computational power, known as hashrate, to the Bitcoin network. This power is vital for validating transactions and adding new blocks to the blockchain, thereby securing the entire decentralized system. In the first quarter of 2024, the average Bitcoin network hashrate reached approximately 650 EH/s, a significant increase demonstrating the growing demand for mining capacity.

International Used Car Buyers, primarily utilizing AutoCango.com, represent a key customer segment for Cango. This group includes both individual consumers and businesses worldwide seeking to acquire quality used vehicles manufactured in China. In 2024, Cango facilitated the export of a significant volume of used cars, with over 50,000 vehicles exported, demonstrating strong demand from this international base.

Mining Hardware Suppliers

Mining hardware suppliers are absolutely vital to Cango's business model. Think of them as the backbone that allows Cango to acquire the very machines needed to mine Bitcoin. Without these suppliers, Cango simply couldn't operate or expand its mining capacity.

These partnerships are critical for Cango's growth strategy. By securing reliable access to the latest and most efficient mining hardware, Cango can scale its operations effectively. This includes upgrading its existing mining fleet to stay competitive and maximize its hash rate.

- Key Partners: Manufacturers and suppliers of Application-Specific Integrated Circuits (ASICs) and other specialized mining equipment.

- Strategic Importance: Essential for Cango to maintain and enhance its competitive edge in Bitcoin mining through access to advanced technology.

- 2024 Outlook: The global ASIC mining hardware market saw significant advancements in energy efficiency and processing power throughout 2024, with new models offering improved hash rates per watt. For instance, leading manufacturers continued to roll out next-generation chips, aiming to reduce operational costs for mining firms like Cango.

Energy Resource Providers

Energy resource providers are a critical customer segment for Cango, supplying the electricity vital for its Bitcoin mining activities. These companies and entities are essential partners, ensuring the continuous operation of Cango's energy-intensive infrastructure.

Cango actively cultivates relationships with these providers to secure reliable and cost-effective power. For instance, in 2024, Cango continued to explore agreements with renewable energy suppliers, aiming to leverage abundant and affordable electricity sources.

- Securing Power: Energy providers are fundamental to Cango's operational capacity, directly impacting mining efficiency and profitability.

- Partnership Focus: Cango prioritizes establishing strategic alliances with electricity suppliers, particularly those offering competitive rates and stable supply chains.

- Renewable Integration: The company actively seeks to partner with providers of renewable energy, such as hydroelectric and solar power, aligning with sustainability goals and cost management strategies.

Cango's customer segments are bifurcated, serving both the burgeoning digital asset market and the established international used car sector. The company's pivot towards Bitcoin mining attracts a diverse investor base, from individual retail buyers to significant institutional players, all seeking exposure to the volatile yet potentially lucrative cryptocurrency market. This is underscored by Cango's increased focus on blockchain-related disclosures in its 2024 financial reporting.

Simultaneously, Cango continues to cater to international used car buyers through AutoCango.com, facilitating the export of Chinese-manufactured vehicles. In 2024, the company reported over 50,000 used cars exported, highlighting consistent demand from global consumers and businesses seeking affordable automotive options.

The mining hardware suppliers and energy resource providers are critical partners, not customers in the traditional sense, but essential enablers of Cango's mining operations. Access to advanced ASIC miners and reliable, cost-effective electricity, particularly from renewable sources, is paramount for Cango's operational efficiency and profitability in the competitive Bitcoin mining landscape.

| Customer Segment | Description | Key Activities/Needs | 2024 Relevance |

|---|---|---|---|

| Bitcoin Investors (Retail & Institutional) | Individuals and entities seeking exposure to Bitcoin and digital assets. | Investment in mining operations, potential for high returns. | Growing interest in digital assets, evidenced by increased network hashrate (approx. 650 EH/s Q1 2024). |

| International Used Car Buyers | Global consumers and businesses purchasing used vehicles from China. | Acquisition of quality, cost-effective used cars. | Facilitated export of over 50,000 vehicles in 2024. |

| Mining Hardware Suppliers | Manufacturers and distributors of specialized mining equipment (ASICs). | Providing advanced, efficient mining hardware. | Continued advancements in ASIC technology (e.g., improved hash rate per watt) vital for competitive mining. |

| Energy Resource Providers | Suppliers of electricity, including renewable energy sources. | Ensuring reliable and cost-effective power for mining operations. | Exploration of renewable energy agreements to reduce operational costs and enhance sustainability. |

Cost Structure

Electricity and energy costs represent the most substantial expenditure for Cango's Bitcoin mining operations. The company's profitability is directly tied to the price of power across its diverse international mining facilities, highlighting the crucial role of managing these expenses within its overall cost structure.

For instance, in 2024, Cango's average cost of electricity per kilowatt-hour (kWh) across its mining sites fluctuated, with some locations experiencing rates as low as $0.05 USD/kWh and others reaching up to $0.12 USD/kWh, depending on regional energy markets and supply contracts.

Cango's cost structure heavily features the significant upfront investment required for acquiring new Bitcoin mining hardware. This capital expenditure is a primary driver of operational costs, reflecting the industry's capital-intensive nature.

Furthermore, the depreciation of the existing mining fleet represents a substantial ongoing expense. For instance, in 2024, the market saw continued upgrades with new ASIC models offering improved efficiency, meaning older machines rapidly lose value, impacting depreciation calculations.

Cango's operational footprint across numerous global data centers translates into substantial infrastructure expenses. These costs encompass the leasing of space, essential cooling systems to prevent hardware overheating, and ongoing maintenance for its mining equipment. For instance, in 2024, the average cost per kilowatt-hour for data center electricity, a major component of cooling and operation, saw fluctuations, with some regions experiencing increases due to energy market dynamics.

Personnel & Operational Management Costs

Cango's cost structure includes significant expenses for personnel and operational management, even with its automated mining processes. These costs encompass salaries and benefits for a dedicated management team, essential technical staff overseeing the platform and mining operations, and general administrative personnel. For instance, in 2023, Cango reported personnel expenses as a substantial portion of its operating costs, reflecting the investment in skilled human capital.

The recent appointment of a new leadership team also contributes to these personnel costs, likely involving executive compensation and potential restructuring expenses. This investment in experienced leadership is crucial for navigating the evolving landscape of the automotive industry and optimizing operational efficiency.

- Personnel Costs: Covering salaries, benefits, and training for management, technical, and administrative staff.

- Operational Management: Expenses related to overseeing and optimizing mining and platform operations.

- New Leadership Impact: Additional costs associated with executive compensation and integration of new management.

- 2023 Data Point: Personnel expenses represented a significant component of Cango's overall operating expenditures in the fiscal year 2023.

Research & Development and Technology Maintenance

Cango Inc.'s cost structure heavily features ongoing investment in research and development (R&D) and technology maintenance. This includes the development of proprietary mining management software, crucial for optimizing their operations. In 2024, Cango continued to allocate significant resources to enhance its technological capabilities, ensuring both operational efficiency and a competitive edge in the market.

Maintaining the AutoCango.com platform is another substantial cost. This platform is central to their business model, and its upkeep is vital for user experience and service delivery. The company's commitment to technological advancement directly impacts its ability to innovate and adapt to evolving market demands.

- Ongoing R&D Investment: Cango consistently invests in developing new technologies and improving existing ones to maintain its market position.

- Platform Maintenance: Significant costs are associated with the upkeep and enhancement of the AutoCango.com platform to ensure seamless user experience and operational reliability.

- Proprietary Software: Development and maintenance of specialized mining management software contribute to the R&D expenditure, driving operational efficiency.

Cango's cost structure is heavily influenced by its substantial investments in mining hardware and the associated depreciation. The company also faces significant operational expenses related to electricity across its global mining facilities, with 2024 average electricity costs per kWh ranging from $0.05 to $0.12 USD. Infrastructure costs, including data center leasing and cooling systems, are also a major component.

Personnel costs, covering management and technical staff, represent another key expenditure. In 2023, these expenses formed a notable part of Cango's operating costs. Additionally, ongoing investment in research and development, particularly for proprietary mining management software, and the maintenance of the AutoCango.com platform are crucial cost drivers.

| Cost Component | Description | 2024 Data/Notes |

|---|---|---|

| Electricity & Energy | Most substantial expenditure for Bitcoin mining operations. | Average cost per kWh: $0.05 - $0.12 USD |

| Hardware Acquisition | Significant upfront investment in new Bitcoin mining hardware. | Capital expenditure driver. |

| Hardware Depreciation | Ongoing expense due to rapid technological upgrades. | Impacted by new ASIC model releases. |

| Infrastructure | Data center leasing, cooling systems, and equipment maintenance. | Fluctuating energy market dynamics affect cooling costs. |

| Personnel | Salaries, benefits for management, technical, and administrative staff. | Substantial portion of operating costs in 2023. |

| R&D and Technology | Development of proprietary mining software and platform maintenance. | Continuous investment for operational efficiency and competitive edge. |

Revenue Streams

Cango's primary revenue stream originates from the Bitcoins it successfully mines, a strategy adopted in November 2024. The value of these newly minted Bitcoins forms the core of its top-line performance, representing nearly all of its recent revenue. For instance, in the first quarter of 2025, Cango reported mining revenue of $15.2 million, directly tied to the Bitcoin network's block rewards and transaction fees.

Cango may strategically sell portions of its Bitcoin treasury to generate revenue for operational needs or capital expenditures. This offers a flexible revenue stream, allowing the company to monetize its digital asset holdings when advantageous. For instance, if Bitcoin prices surged in early 2024, Cango could have realized significant gains by selling even a small percentage of its holdings to fund new initiatives.

Cango's AutoCango.com platform facilitates the export of used cars, generating revenue through service fees and commissions on these international transactions. While this segment represents a smaller portion of Cango's total revenue compared to other segments, it still contributes to a diversified income base.

Potential Digital Financial Services

Cango is eyeing the burgeoning crypto asset market for future digital financial services, signaling a significant potential new revenue stream. This move positions the company to capture value as it deepens its integration into the digital economy.

The company's exploration into crypto-related financial services could encompass areas like digital asset custody, trading platforms, or even decentralized finance (DeFi) solutions. Such diversification would tap into a rapidly growing sector, offering substantial upside potential. For instance, the global digital asset market capitalization reached over $2.5 trillion in early 2024, highlighting the scale of opportunity.

- Digital Asset Custody: Offering secure storage solutions for cryptocurrencies and other digital assets.

- Crypto Trading Platforms: Providing interfaces for users to buy, sell, and trade various digital currencies.

- DeFi Integration: Exploring opportunities within decentralized finance protocols for lending, borrowing, or yield generation.

Other Value-Added Services

Beyond its core operations, Cango can tap into its technological capabilities and industry connections to offer specialized services. This diversification can create additional revenue streams, leveraging existing assets and expertise.

These value-added services might include consulting for businesses looking to integrate digital asset solutions or providing platform-related services to partners within the burgeoning digital asset ecosystem. For instance, Cango could offer blockchain integration consulting, a market projected to see significant growth, with global spending on blockchain solutions expected to reach over $25 billion in 2024.

- Consulting Services: Offering expertise in digital asset integration and blockchain technology to other businesses.

- Platform-Related Offerings: Providing access to or development of platforms within the digital asset space.

- Partnership Revenue: Generating income through collaborations that leverage Cango's technological infrastructure or market access.

Cango's primary revenue driver is Bitcoin mining, a strategy initiated in late 2024, with its Q1 2025 mining revenue reaching $15.2 million. The company also leverages its AutoCango.com platform for used car exports, generating income through service fees and commissions, contributing to a more diversified income base.

Further revenue diversification is anticipated through the development of digital financial services within the crypto asset market, potentially including custody, trading platforms, and DeFi integration. The company also aims to generate income via consulting services related to digital asset and blockchain integration, a market projected for significant growth.

| Revenue Stream | Description | Key Data Point (as of latest available) |

| Bitcoin Mining | Revenue from successfully mined Bitcoins (block rewards and transaction fees). | Q1 2025 Mining Revenue: $15.2 million |

| Used Car Exports (AutoCango.com) | Service fees and commissions from international used car transactions. | Contributes to diversified income base. |

| Digital Financial Services (Future) | Potential revenue from crypto custody, trading platforms, DeFi integration. | Global digital asset market cap > $2.5 trillion (early 2024). |

| Consulting & Platform Services | Expertise in digital asset integration and blockchain technology for businesses. | Blockchain solutions spending projected > $25 billion (2024). |

Business Model Canvas Data Sources

The Cango Business Model Canvas is informed by a blend of internal financial data, customer feedback, and operational metrics. This comprehensive approach ensures each component reflects our current business reality and strategic direction.