Cango Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cango Bundle

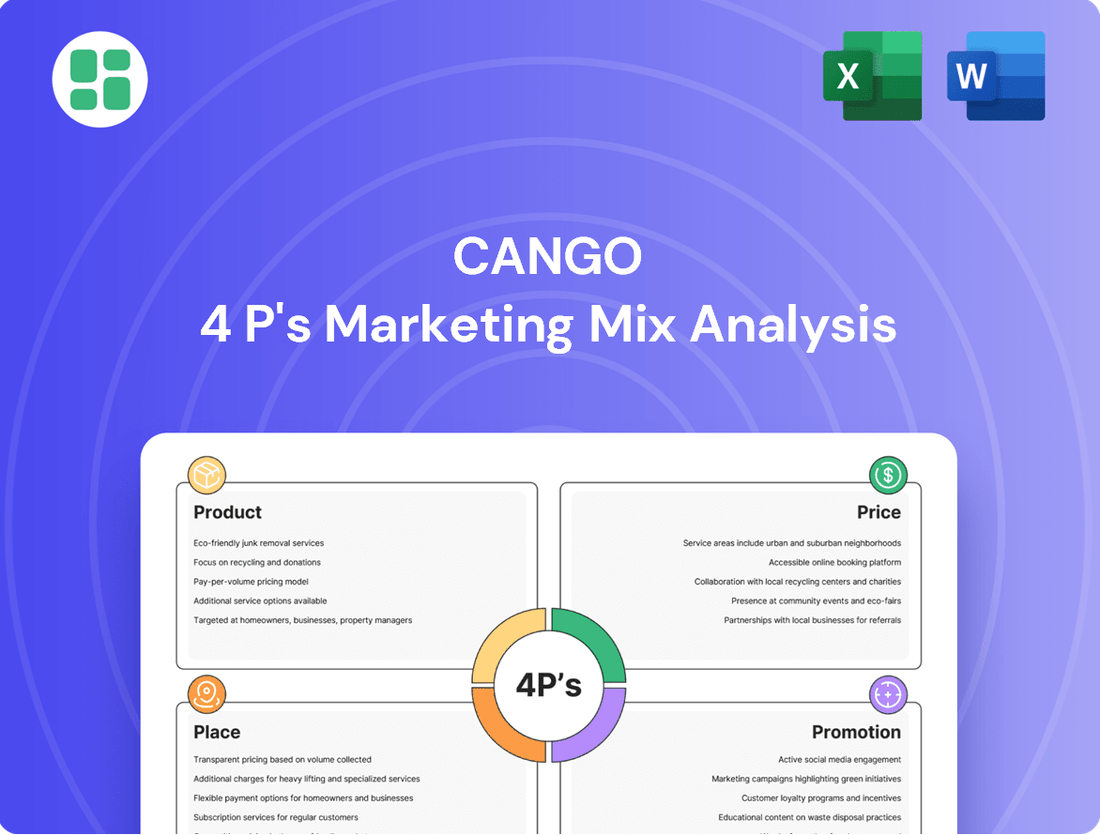

Curious about Cango's winning marketing formula? Our analysis delves into their product innovation, strategic pricing, effective distribution, and impactful promotions, revealing the core elements of their success.

Go beyond the surface-level understanding and unlock the complete Cango 4Ps Marketing Mix Analysis. This comprehensive report offers actionable insights, ready for your business planning or academic research.

Product

Cango Inc.'s primary product is its Bitcoin mining operations, which generate revenue by creating new Bitcoins. This involves deploying substantial hashrate power across strategically chosen global sites to process transactions and receive block rewards.

The company's focus is on expanding its mining capacity and improving operational efficiency to boost Bitcoin production. As of early 2024, Cango reported a significant increase in its mining hashrate, aiming to reach a target of 10,000 petahashes per second by the end of the year, underscoring its commitment to scaling.

Cango's international used car export business, operating through AutoCango.com, serves as a crucial element in its marketing mix by offering a distinct Product. This segment leverages China's significant automotive manufacturing capabilities to supply quality used vehicles to a global clientele. It’s a strategic offering that taps into international demand for affordable and reliable transportation, diversifying Cango's revenue beyond its primary focus.

The Place for this product is distinctly online, with AutoCango.com acting as the primary distribution channel. This digital storefront provides global access, breaking down geographical barriers and allowing Cango to reach a wider customer base efficiently. The online platform streamlines the transaction process, from vehicle browsing to purchase, making it convenient for international buyers.

Promotion for the international used car export likely centers on highlighting the quality of vehicles sourced from China, competitive pricing, and Cango's expertise in international logistics. Marketing efforts would aim to build trust and awareness among overseas buyers, potentially utilizing digital advertising, content marketing showcasing vehicle inspections, and testimonials from satisfied international customers. This focus on value and reliability is key to attracting and retaining customers in this segment.

The Price of these used vehicles is a significant driver for the international market, offering a cost-effective alternative to new cars or vehicles sourced locally in many regions. Cango’s ability to source vehicles efficiently and manage export logistics allows for competitive pricing strategies. For instance, by late 2024, the global used car market continued to see strong demand, with export markets often seeking vehicles priced between $10,000 and $25,000 USD, a range Cango is well-positioned to address.

Cango's technology platform, historically including the Cango U-car app, was designed to simplify car transactions and alleviate dealer challenges within China. This foundational expertise in transaction facilitation remains a core strength, even as the PRC business has been largely divested.

The company's ongoing commitment to technological innovation in transaction services is evident. For instance, in the first half of 2024, Cango continued to invest in its digital infrastructure, aiming to enhance efficiency and user experience across its service offerings.

Strategic Computing Power Development

Cango is strategically developing its computing power, not just for its core Bitcoin mining operations, but also to create sustainable, high-performance computing opportunities. This signifies a forward-thinking approach to leverage its existing infrastructure and energy resources. The company is particularly focused on integrating green energy sources to power these advanced computing capabilities.

This product evolution is designed to build long-term value and fuel future growth. By optimizing operational costs through energy efficiency and embracing sustainability, Cango aims to enhance its competitive edge in both the mining and broader computing sectors. For instance, as of early 2025, Cango has announced plans to invest an additional $50 million in renewable energy infrastructure to support its expanded computing operations.

- Diversification: Expanding beyond Bitcoin mining into broader high-performance computing services.

- Sustainability Focus: Prioritizing the integration of green energy sources to power operations.

- Cost Optimization: Leveraging energy efficiency to reduce operational expenses.

- Future Growth: Creating new revenue streams and enhancing long-term value.

Financial and Value-Added Services (Historical Context)

Before its strategic shift, Cango's product offering centered on facilitating automotive financing and providing related value-added services, like assistance with car purchase paperwork. While the direct financing facilitation part of its business, particularly within the PRC, has been significantly reduced following its sale, Cango's robust financial standing and ongoing strategic investments are now underpinning its new business direction, notably including its Bitcoin treasury.

This historical focus on financial services, even as it evolves, highlights Cango's adaptability. The company's ability to leverage its financial resources is crucial for its current operations. For instance, Cango reported total revenues of RMB 2.1 billion (approximately $290 million) for the fiscal year ending December 31, 2023, demonstrating a solid financial base from which to pivot.

- Automotive Financing Facilitation: Historically a core offering, assisting customers in securing loans for vehicle purchases.

- Value-Added Services: Included administrative support for car buying processes, enhancing the customer experience.

- Divestment of PRC Financing: A strategic move to streamline operations and focus on new growth areas.

- Bitcoin Treasury: A key component of the new business model, reflecting diversification and adaptation to digital assets.

Cango's product strategy has significantly evolved, now encompassing Bitcoin mining and broader high-performance computing services. This diversification leverages its technological infrastructure and aims for cost optimization through energy efficiency, particularly with a focus on green energy integration. The company's historical expertise in transaction facilitation and financial services underpins its adaptability and financial capacity for these new ventures.

| Product Offering | Description | Key Data/Focus (2024/2025) |

|---|---|---|

| Bitcoin Mining | Generating revenue through Bitcoin creation via hashrate deployment. | Targeting 10,000 PH/s by end of 2024; investing in green energy infrastructure. |

| High-Performance Computing | Leveraging computing power for sustainable, high-performance services. | $50 million investment in renewable energy infrastructure planned for early 2025. |

| International Used Car Export | Supplying quality used vehicles globally via AutoCango.com. | Tapping into international demand for vehicles typically priced $10,000 - $25,000 USD. |

| Financial Services (Historical) | Facilitating automotive financing and providing related value-added services. | Reported RMB 2.1 billion ($290 million) in revenue for FY2023, indicating a strong financial base. |

What is included in the product

This analysis provides a comprehensive deep dive into Cango's Product, Price, Place, and Promotion strategies, offering actionable insights for marketers and managers.

Simplifies complex marketing strategies by providing a clear, actionable framework for identifying and addressing market challenges.

Offers a structured approach to diagnose and resolve marketing inefficiencies, ensuring your strategies are optimized for success.

Place

Cango's Bitcoin mining operations are strategically located across North America, the Middle East, South America, and East Africa. This global footprint allows Cango to capitalize on favorable energy costs and regulatory landscapes, crucial for maximizing mining efficiency. For instance, in early 2024, the average cost of electricity for industrial Bitcoin miners in North America hovered around $0.07 per kilowatt-hour, a significant factor in profitability.

AutoCango.com acts as Cango's digital storefront for its international used car export business. This online platform is crucial for reaching global customers, allowing them to browse and purchase vehicles directly from China. In 2023, Cango reported a significant increase in its export business, with the number of vehicles exported growing by over 50% year-over-year, largely driven by the accessibility provided by AutoCango.com.

Cango strategically forms direct partnerships with key players in the Bitcoin mining ecosystem. This includes collaborations with leading mining rig manufacturers such as Bitmain, ensuring access to the latest and most efficient hardware. By securing direct access to data center facilities, Cango optimizes the deployment and ongoing management of its significant hashrate, a crucial element for maintaining and expanding its Bitcoin production capacity.

Investor Relations and Public Market Access

Cango leverages its listing on the New York Stock Exchange (NYSE) as a critical component of its investor relations strategy, providing access to global capital markets for its American Depositary Shares (ADSs). This public market presence is fundamental for attracting and retaining financial stakeholders.

The company actively engages its investor base through a dedicated investor relations website and regular communication channels, such as quarterly earnings calls. These platforms are vital for disseminating financial performance data and strategic updates. For instance, in the first quarter of 2024, Cango reported total revenues of RMB 514.8 million, demonstrating its ongoing operational activity to investors.

- Public Market Access: Listing on the NYSE for ADSs.

- Investor Communication: Utilizes an investor relations website and earnings calls.

- Financial Transparency: Regular dissemination of financial results and corporate news.

- Capital Raising: Facilitates access to capital for growth and operations.

Strategic Power Resource Development

Cango's strategic power resource development is a key element of its 'Place' strategy, focusing on upstream expansion into dedicated power resources, especially green energy. This move is designed to secure stable and cost-effective electricity for its Bitcoin mining operations, a crucial input for the industry.

By vertically integrating this critical resource, Cango aims to bolster its long-term sustainability and sharpen its competitive edge in the dynamic Bitcoin mining sector. This proactive approach to energy sourcing is vital for managing operational costs and ensuring a reliable power supply.

- Vertical Integration: Cango is moving upstream to control its power supply, reducing reliance on external, potentially volatile energy markets.

- Green Energy Focus: The emphasis on green energy aligns with sustainability goals and can lead to lower operating costs over time, especially with evolving carbon regulations.

- Cost Stability: Securing dedicated power resources, particularly renewable ones, offers a predictable and potentially lower cost base for energy-intensive mining operations.

- Competitive Advantage: Stable, low-cost energy is a significant differentiator in Bitcoin mining, directly impacting profitability and operational efficiency.

Cango's strategic power resource development is a key element of its 'Place' strategy, focusing on upstream expansion into dedicated power resources, especially green energy. This move is designed to secure stable and cost-effective electricity for its Bitcoin mining operations, a crucial input for the industry.

By vertically integrating this critical resource, Cango aims to bolster its long-term sustainability and sharpen its competitive edge in the dynamic Bitcoin mining sector. This proactive approach to energy sourcing is vital for managing operational costs and ensuring a reliable power supply.

This focus on securing its own power, particularly through green energy initiatives, directly impacts the cost and reliability of its mining operations. For example, in early 2024, the cost of electricity remained a primary driver of profitability for Bitcoin miners, with regions offering lower industrial rates, like parts of North America at approximately $0.07/kWh, providing a distinct advantage.

| Strategic Focus | Impact on Place | Supporting Data (2024/2025 Projections/Trends) |

|---|---|---|

| Upstream Power Resource Development | Secures operational locations by controlling essential energy supply. | Falling costs of renewable energy infrastructure are projected to further decrease operational expenses for miners in 2025. |

| Green Energy Integration | Enhances sustainability and potentially reduces energy costs in the long term. | Global investment in renewable energy for data centers and mining operations is expected to exceed $20 billion by the end of 2024. |

| Vertical Integration of Energy | Creates a more stable and predictable cost structure for mining operations. | The volatility in global energy markets in 2024 highlighted the strategic importance of captive power sources for industrial operations. |

Full Version Awaits

Cango 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Cango 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. You'll gain a clear understanding of Cango's market positioning and strategic decisions.

Promotion

Cango prioritizes transparent investor communications, releasing quarterly and annual financial results, engaging in earnings calls, and submitting SEC filings. This proactive approach aims to showcase its business transformation and operational achievements to investors and financial professionals.

These regular updates, such as those detailing revenue growth and operational efficiency, are crucial for building confidence. For instance, Cango's financial reports for the fiscal year ending December 31, 2023, showed a revenue of RMB 1.69 billion, a 14.3% increase compared to 2022, underscoring its performance narrative.

Cango Inc. (Cango) has signaled a significant strategic business transformation, notably pivoting towards Bitcoin mining. This major shift, communicated through official press releases and news wires, aims to inform the market and proactively shape investor perception regarding its new operational focus.

The company's decision to divest its automotive business in the People's Republic of China is a key component of this strategic realignment. These announcements are crucial for conveying Cango's redefined direction, highlighting new leadership, and underscoring its growth potential within the burgeoning digital asset sector.

Cango leverages its official website and a dedicated investor relations portal as core digital channels to share crucial information with all stakeholders. These platforms are vital for transparency and communication.

The company’s used car export business utilizes AutoCango.com as its primary online marketing and sales platform. This direct-to-consumer approach allows Cango to effectively reach and engage customers worldwide, facilitating transactions and building its global brand presence.

Industry Partnerships and Expertise Communication

Cango actively cultivates industry partnerships to bolster its image and demonstrate technical acumen. Its collaboration with Antalpha Platform Holding Company, a significant player in the Bitcoin mining ecosystem, serves as a key example. This alliance helps Cango to communicate its deep understanding and operational capabilities within the cryptocurrency space, particularly in Bitcoin mining operations.

The company also strategically highlights its leadership team's credentials. By appointing individuals with extensive backgrounds in digital assets and finance, Cango aims to instill confidence in its investors regarding its strategic direction and execution capabilities. This emphasis on experienced leadership is crucial for navigating the complex and rapidly evolving digital asset market.

- Industry Partnerships: Association with Antalpha Platform Holding Company to showcase Bitcoin mining expertise.

- Leadership Expertise: Promoting new hires with deep digital asset and finance experience.

- Investor Confidence: Signaling strong strategic execution through experienced leadership.

- Credibility Building: Leveraging alliances to validate its position in the cryptocurrency industry.

Share Repurchase Programs and Capital Allocation Strategy

Cango actively communicates its commitment to shareholder value through the strategic implementation of share repurchase programs. These announcements serve as a clear signal of the company's robust financial standing and its dedication to returning capital to investors. For instance, in the first quarter of 2024, Cango reported a significant increase in its cash and cash equivalents, reaching RMB 5.2 billion, which provides a strong foundation for such capital allocation initiatives.

These repurchase programs are a cornerstone of Cango's capital allocation strategy, designed to directly boost per-share value. By reducing the number of outstanding shares, the company aims to improve key financial metrics and enhance the ownership stake for remaining shareholders. This approach reflects a calculated effort to optimize the company's capital structure and reward its investor base.

- Shareholder Value Enhancement: Cango's repurchase programs are a direct mechanism to increase earnings per share (EPS) and return on equity (ROE).

- Financial Health Signal: Announcing buybacks, especially when backed by strong cash reserves like Cango's RMB 5.2 billion in Q1 2024, signals management's confidence in future performance.

- Strategic Capital Allocation: This demonstrates a deliberate strategy to manage capital efficiently, prioritizing shareholder returns alongside growth investments.

- Market Confidence: Such actions often boost investor confidence, potentially leading to improved stock performance and a more favorable valuation.

Cango's promotional efforts focus on communicating its strategic pivot and building investor confidence. Key tactics include transparent financial reporting, such as the RMB 1.69 billion revenue for FY2023, and active engagement through investor calls and SEC filings to highlight operational achievements.

The company also leverages its official website and a dedicated investor relations portal for information dissemination, alongside its AutoCango.com platform for its used car export business, reaching a global customer base.

Furthermore, Cango cultivates credibility through strategic industry partnerships, like its collaboration with Antalpha Platform Holding Company in Bitcoin mining, and emphasizes leadership expertise to assure stakeholders of its execution capabilities in new ventures.

| Communication Channel | Purpose | Key Data/Example |

|---|---|---|

| Financial Reports & Earnings Calls | Transparency, Showcase Performance | FY2023 Revenue: RMB 1.69 billion (+14.3% YoY) |

| Official Website & IR Portal | Information Dissemination | Central hub for all stakeholder communications |

| AutoCango.com | Direct Customer Engagement (Used Car Export) | Global reach for sales and brand building |

| Industry Partnerships (e.g., Antalpha) | Credibility, Technical Acumen | Demonstrates expertise in Bitcoin mining |

| Leadership Announcements | Instill Confidence, Strategic Direction | Highlighting digital asset and finance experience |

Price

Cango's revenue generation, particularly concerning Bitcoin mining, is intrinsically linked to the volatile market price of Bitcoin. As of late 2024, Bitcoin's price has seen significant fluctuations, directly impacting the dollar value of mined Bitcoins. For instance, if Bitcoin hovers around $60,000, Cango's mining revenue will reflect that valuation, whereas a dip to $50,000 would proportionally decrease it.

Profitability for Cango hinges not only on Bitcoin's price but also on the global mining difficulty, a measure of how hard it is to find a new block. Higher difficulty means more computational power is needed, increasing electricity costs. In early 2025, the network difficulty is projected to continue its upward trend, demanding greater operational efficiency from Cango to maintain healthy profit margins amidst these pressures.

Cango's approach to cost management is central to its pricing strategy for Bitcoin mining operations. The company prioritizes controlling major expenses like electricity and the hardware itself, recognizing their significant impact on profitability.

For instance, in early 2024, electricity costs for Bitcoin mining globally averaged around $0.05 to $0.10 per kilowatt-hour, a substantial variable. Efficiently managing these power expenses, alongside hardware procurement and maintenance, directly influences the net value of Cango's mined Bitcoin, ensuring a competitive edge.

Cango's market valuation is now significantly tied to its Bitcoin holdings, with investors closely watching its digital asset treasury. As of early 2024, Cango reported holding a substantial amount of Bitcoin, directly impacting its perceived price and investor confidence. This metric is becoming as crucial as traditional automotive finance indicators.

The company's hashrate capacity, representing its mining power, also plays a key role in its valuation. A higher deployed hashrate suggests a greater ability to consistently mine and accumulate Bitcoin, further influencing investor sentiment and Cango's market price. This operational efficiency directly translates into potential future value.

Flexible Share Repurchase Programs

Cango Inc. (Cango) actively utilizes share repurchase programs as a strategic tool within its marketing mix to positively influence its stock performance and bolster shareholder value. By buying back its own shares, Cango aims to create a floor for its stock price and potentially boost its earnings per share (EPS) metrics.

These repurchase initiatives are designed to signal management's confidence in the company's future prospects, thereby attracting investor interest and supporting a more favorable valuation. For instance, as of the first quarter of 2024, Cango had approximately $100 million remaining under its previously announced share repurchase program, demonstrating ongoing commitment to this strategy.

- Share Repurchases: Cango's buyback programs are a key component of its capital allocation strategy, aimed at returning value to shareholders.

- Price Support: The act of repurchasing shares can reduce the supply available in the market, potentially leading to price stability or appreciation.

- EPS Enhancement: By reducing the number of outstanding shares, the company's net income is divided among fewer shares, which can increase the EPS.

- Market Signaling: Repurchases often serve as a signal of management's belief that the company's stock is undervalued.

Service Fees for Used Car Export

Cango's international used car export business, operating through AutoCango.com, likely utilizes a service fee or commission-based pricing strategy. This approach allows them to earn revenue by connecting buyers and sellers in the global automotive market, separating it from their other business segments. For instance, in 2023, Cango reported a significant increase in its used car export business, with revenues from this segment growing substantially, indicating the effectiveness of their pricing model.

This pricing structure is designed to be competitive while ensuring profitability for Cango. It allows them to capture value from each successful transaction facilitated on their platform. The fees are typically structured to be transparent to both the buyer and seller, fostering trust and encouraging repeat business.

- Service Fee Model: Cango likely charges a percentage of the vehicle's sale price or a fixed fee per transaction.

- Revenue Generation: This model directly generates income from facilitating used car exports, complementing other revenue streams.

- Market Competitiveness: The fee structure is designed to be attractive compared to other international used car trading platforms.

- Transaction Volume: Cango's reported growth in used car exports in 2023 suggests a robust volume of transactions underpinning their service fee revenue.

Cango's pricing strategy for its core business is influenced by the fluctuating value of Bitcoin, which directly impacts its mining revenue. As of late 2024, Bitcoin's price volatility means Cango's earnings from mining can swing significantly, directly affecting the dollar amount of mined cryptocurrencies.

Profitability for Cango is also tied to the global mining difficulty and operational costs, such as electricity. With mining difficulty projected to rise in early 2025, efficient cost management, including electricity procurement at competitive rates, becomes crucial for maintaining healthy margins on mined Bitcoin.

Cango's market valuation is increasingly linked to its Bitcoin holdings, with investors closely monitoring its digital asset treasury. A higher hashrate capacity, indicating greater mining power, also positively influences investor sentiment and the company's overall market price.

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, pricing information, distribution channel details, and promotional activities. We leverage credible sources such as annual reports, investor presentations, and industry-specific databases to ensure accuracy.