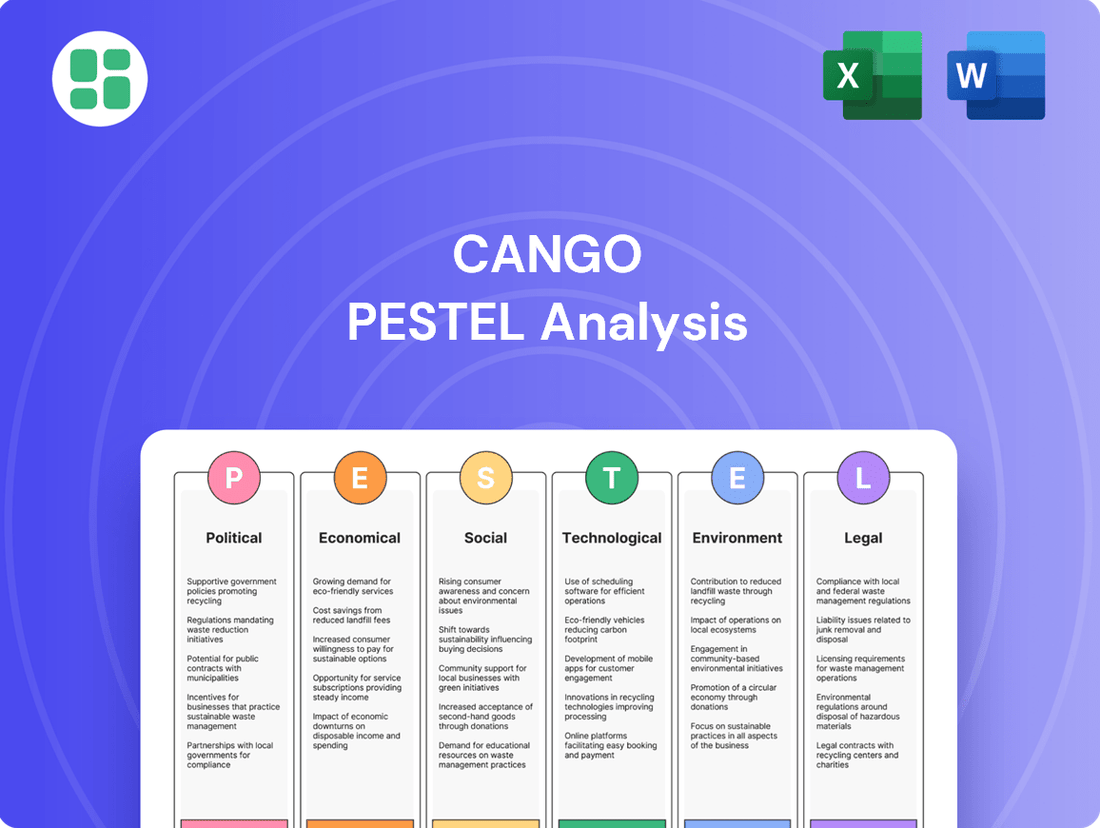

Cango PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cango Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting Cango's trajectory. This meticulously researched PESTLE analysis offers a strategic roadmap, highlighting both opportunities and potential pitfalls. Equip yourself with actionable intelligence to navigate Cango's evolving landscape and make informed decisions. Download the full version now for an unparalleled understanding.

Political factors

The Chinese government's strategic directives are a major force shaping the automotive landscape, dictating production quotas, sales objectives, and offering preferential treatment for specific vehicle categories. These governmental actions directly influence Cango's capacity to support car transactions, particularly if policies lean towards new energy vehicles (NEVs) over traditional gasoline-powered cars. For instance, in 2023, China's NEV sales surged by 37.9% year-on-year, reaching 9.495 million units, demonstrating the impact of supportive policies on market dynamics that Cango must navigate.

China's financial regulatory environment significantly shapes Cango's operations. Stricter rules on consumer lending, for instance, could limit the volume of auto loans facilitated. In 2023, China's central bank, the People's Bank of China (PBOC), continued to emphasize financial stability, which often translates to tighter oversight of lending practices.

Changes in interest rate policies directly impact Cango's cost of capital and the attractiveness of its financing products. While specific rate adjustments fluctuate, the PBOC's monetary policy stance, aiming for controlled inflation and economic growth, influences these decisions. For example, a rise in benchmark lending rates could increase Cango's funding costs.

Furthermore, evolving regulations concerning financial technology (fintech) and digital lending platforms present both challenges and opportunities. Policies that promote innovation in digital finance could streamline Cango's processes and expand its reach, whereas increased scrutiny on data privacy or cybersecurity could necessitate costly compliance measures.

Broader geopolitical tensions, particularly those between China and major economies like the United States, can indirectly ripple through Cango's business. These tensions can disrupt global supply chains for automotive components, potentially affecting vehicle availability and pricing within China. For instance, trade disputes in 2023 led to increased tariffs on certain goods, which could raise costs for manufacturers relying on imported parts, thereby impacting Cango's transaction volumes.

Shifts in economic alliances and trade policies can also influence consumer confidence in China's automotive market. Uncertainty surrounding international trade relations might make consumers more hesitant to make large purchases like vehicles, leading to a slowdown in demand. This cautious consumer sentiment, fueled by geopolitical instability, could directly translate to fewer transactions processed through Cango's platform.

Furthermore, these geopolitical uncertainties can impact investor sentiment towards companies operating in China, including Cango. A perception of increased risk due to trade wars or political friction can lead to lower valuations and make it harder for Cango to attract investment or maintain its stock price, as seen in market reactions to escalating trade rhetoric.

Support for New Energy Vehicles (NEVs)

The Chinese government's unwavering commitment to New Energy Vehicles (NEVs) is a significant political factor. This support manifests through substantial subsidies, streamlined licensing processes, and aggressive investment in charging infrastructure. For instance, by the end of 2023, China had over 8.9 million charging facilities, a substantial increase from previous years, directly supporting NEV adoption.

This governmental push directly impacts Cango, as it operates within the automotive transaction ecosystem. The accelerating consumer preference for NEVs, fueled by these incentives, demands that Cango evolve its service offerings. This adaptation involves a deeper understanding of NEV-specific financing structures and the unique market dynamics governing these vehicles to maintain its competitive edge.

- Government Subsidies: Continued financial incentives encourage NEV purchases, boosting demand for related services.

- Infrastructure Development: Expanding charging networks makes NEVs more practical for consumers, increasing their appeal.

- Policy Alignment: Cango's ability to integrate NEV financing and services reflects its responsiveness to national energy and transportation policies.

Data Security and Privacy Regulations

China's tightening grip on data security and privacy, exemplified by the Cybersecurity Law (CSL) and the Personal Information Protection Law (PIPL), significantly shapes Cango's operations. These regulations mandate strict protocols for data collection, storage, and cross-border transfer, directly affecting how Cango manages its customer information. Failure to comply can result in substantial fines and reputational damage.

For Cango, adherence to these evolving legal frameworks is not just a matter of avoiding penalties; it's fundamental to maintaining customer trust. As of early 2024, the enforcement of PIPL continues to mature, requiring businesses like Cango to invest heavily in data governance and security infrastructure. This includes implementing clear consent mechanisms and robust anonymization techniques.

- CSL and PIPL Compliance: Cango must meticulously adhere to China's Cybersecurity Law and Personal Information Protection Law.

- Data Governance Investment: Significant investment in data governance and security infrastructure is necessary to meet regulatory demands.

- Customer Trust: Robust data protection measures are crucial for maintaining and building customer confidence in Cango's platform.

- Penalties for Non-Compliance: Non-compliance can lead to substantial fines, potentially impacting Cango's financial performance and market standing.

Governmental support for New Energy Vehicles (NEVs) remains a cornerstone of China's automotive policy, directly influencing Cango's business model. With NEV sales in China reaching approximately 9.5 million units in 2023, up from 6.887 million in 2022, the trend underscores the effectiveness of these policies. Cango must continue to adapt its financing solutions to cater to this rapidly growing segment, ensuring its services align with national objectives for green transportation.

China's regulatory landscape, particularly concerning financial technology and data privacy, presents ongoing challenges and opportunities for Cango. The implementation of laws like the Personal Information Protection Law (PIPL) necessitates robust data governance. As of early 2024, PIPL enforcement requires significant investment in security infrastructure, impacting operational costs but also building customer trust.

Geopolitical tensions, such as ongoing trade dialogues between China and the US, can indirectly affect Cango through supply chain disruptions and consumer confidence. While direct impacts are hard to quantify for 2024, historical trade disputes have shown the potential for increased costs and market volatility, which Cango must monitor.

What is included in the product

This Cango PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to empower strategic decision-making and identify potential opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Cango's performance is intrinsically linked to China's economic trajectory and consumer spending power. A robust economy generally fuels consumer confidence, encouraging purchases of significant items such as automobiles, which directly benefits Cango's transaction services. For instance, China's GDP grew by 5.2% in 2023, indicating a recovering economy that supports higher consumer spending.

Conversely, any economic deceleration in China could dampen car sales and tighten credit availability, thereby negatively affecting Cango's revenue streams. The automotive sector, a key market for Cango, saw retail sales of passenger vehicles reach 21.7 million units in 2023, a 5.6% year-on-year increase, demonstrating the market's sensitivity to economic conditions.

The People's Bank of China's benchmark lending rates significantly impact Cango's business. For instance, a key one-year loan prime rate stood at 3.45% as of early 2024, affecting both consumer affordability and the cost of capital for Cango's financing partners.

Fluctuations in these rates directly influence consumer demand for financed vehicles. When rates rise, car loans become more expensive, potentially slowing down sales and impacting Cango's transaction volumes. Conversely, lower rates can boost demand.

Credit availability is equally crucial. In 2023, China's financial sector saw efforts to maintain liquidity, which generally supported credit access. Cango needs to stay attuned to these dynamics to ensure its partner institutions can effectively provide financing to customers.

Inflationary pressures in China have been a significant concern, with consumer price index (CPI) growth fluctuating. For instance, while CPI growth was moderate in early 2024, the potential for higher inflation in late 2024 and into 2025 could directly impact Cango's customer base. Higher inflation erodes purchasing power, making vehicle acquisition, particularly with financing, a less attractive proposition for many Chinese consumers.

This dynamic directly affects Cango's transaction volumes. As the cost of living rises, consumers may postpone or opt for less expensive vehicle models, shifting demand away from the types of vehicles Cango typically facilitates. Understanding these shifts in consumer behavior and the resulting affordability challenges for financing solutions is crucial for Cango's strategic planning.

Automotive Market Trends and Sales Volume

The Chinese automotive market's overall health is a primary driver for Cango. In 2023, China's auto sales reached a record 30.09 million units, a 12% increase year-on-year, signaling robust demand. This growth trajectory, particularly in new energy vehicles (NEVs) which saw a 37.9% surge to 9.495 million units in 2023, directly impacts Cango's transaction volumes and service offerings.

Market saturation and evolving consumer preferences are critical considerations. While new car sales are strong, the used car market also presents significant opportunities for Cango's platform. For instance, the China Automobile Dealers Association reported that the used car market transaction volume in 2023 exceeded 16 million units. Shifts towards SUVs and the continued dominance of NEVs influence the types of vehicles Cango facilitates transactions for, requiring adaptability in its service model.

- Record Sales: China's automotive market saw 30.09 million units sold in 2023, up 12% from the previous year.

- NEV Boom: New energy vehicle sales in China reached 9.495 million units in 2023, a 37.9% increase.

- Used Car Activity: Over 16 million used cars were transacted in China during 2023.

- Consumer Shifts: Growing preference for SUVs and NEVs shapes demand for Cango's services.

Availability of Capital and Funding Costs

Cango's business model hinges on its partnerships with financial institutions, making the availability and cost of capital for these lenders a critical factor. When capital is readily available and funding costs are low, lenders are more inclined to offer competitive auto loan terms through Cango's platform, boosting transaction volumes.

Conversely, a contraction in liquidity within the financial markets, a scenario that can be influenced by central bank policies or broader economic uncertainty, directly impacts Cango. This tightening can lead to reduced lending capacity and higher borrowing costs for consumers, potentially slowing down vehicle sales facilitated by Cango.

For instance, in early 2024, many financial institutions faced increased funding costs due to persistent inflation and higher interest rates set by central banks globally. This environment could have made it more challenging for Cango's partner lenders to provide the same volume of affordable financing as in previous periods, directly affecting Cango's transaction facilitation capabilities.

- Impact of Interest Rates: Rising benchmark interest rates, such as the Federal Reserve's federal funds rate, directly increase the cost of borrowing for financial institutions, which in turn can lead to higher interest rates on auto loans offered through Cango.

- Liquidity Crunch Concerns: Periods of financial market stress, like those seen during the 2023 regional banking issues, can reduce the overall availability of capital for lending, potentially limiting the number of auto loans Cango can help originate.

- Lender Profitability: The spread between a lender's cost of funds and the interest rate they charge consumers is crucial for profitability. If this spread narrows due to high funding costs, lenders may become more cautious in their lending practices on platforms like Cango.

China's economic growth directly fuels consumer spending on vehicles, a key driver for Cango's business. With GDP growth at 5.2% in 2023 and automotive retail sales increasing by 5.6% year-on-year to 21.7 million units, the market shows resilience. However, economic slowdowns or increased inflation, which saw fluctuating CPI growth in 2023 and early 2024, can erode purchasing power and reduce demand for financed vehicles, impacting Cango's transaction volumes.

Interest rates set by the People's Bank of China, such as the one-year loan prime rate at 3.45% in early 2024, significantly influence affordability. Higher rates make auto loans more expensive, potentially dampening sales and affecting Cango's transaction facilitation. Conversely, lower rates can stimulate demand, benefiting the company.

The availability and cost of capital for Cango's financial partners are critical. In 2023, efforts to maintain liquidity generally supported credit access, but global financial market conditions and rising funding costs for institutions, as seen in early 2024, can lead to more cautious lending practices and impact Cango's ability to originate transactions.

| Economic Factor | 2023 Data Point | Early 2024 Trend/Data | Impact on Cango |

| GDP Growth (China) | 5.2% | Continued recovery expected | Supports consumer spending and vehicle purchases |

| Passenger Vehicle Retail Sales | 21.7 million units (5.6% YoY increase) | Ongoing market activity | Directly correlates with Cango's transaction volumes |

| One-Year Loan Prime Rate | N/A (historical data) | 3.45% (early 2024) | Higher rates increase financing costs for consumers |

| Consumer Price Index (CPI) Growth | Fluctuating | Moderate early 2024, potential for increase | Higher inflation reduces purchasing power for financed vehicles |

Preview Before You Purchase

Cango PESTLE Analysis

The preview you see here is the exact Cango PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at Cango's external environment.

The content and structure shown in the preview is the same Cango PESTLE Analysis document you’ll download after payment, offering actionable insights.

Sociological factors

Consumer attitudes toward car ownership are evolving, with a noticeable shift towards alternative mobility solutions and a growing preference for electric and smart vehicles. This trend directly impacts Cango, as it needs to align its platform and financing options with these changing demands. For instance, in 2024, the used car market continued to show resilience, with average prices for used vehicles remaining elevated compared to pre-pandemic levels, though showing signs of stabilization.

Furthermore, the demand for SUVs and crossovers persists, while interest in sedans has seen a relative decline. Cango's ability to offer financing for a diverse range of vehicle types, including the increasingly popular electric vehicles (EVs), is crucial for its continued market relevance. Reports from early 2025 indicate that EV sales, while still a smaller portion of the overall market, are projected to grow by over 20% year-over-year in key markets, presenting both an opportunity and a challenge for financing providers.

China's ongoing urbanization is a significant driver for personal mobility. As more people move to cities, the demand for convenient transportation options grows. For instance, by the end of 2023, China's urbanization rate reached 66.16%, indicating a substantial shift towards urban living and a corresponding need for mobility solutions.

However, mobility preferences vary greatly by region. In megacities like Shanghai or Beijing, traffic congestion often encourages a greater reliance on ride-sharing services and public transport. Conversely, in emerging smaller cities and rural areas, the desire for personal car ownership remains strong, potentially boosting demand for Cango's car sales and rental services in these locales.

Understanding these nuanced regional differences is crucial for Cango. By segmenting its services based on demographic and geographic characteristics, Cango can better meet the diverse mobility needs across China's evolving urban landscape, ensuring its offerings are relevant and competitive.

The growing digital savviness of Chinese consumers, with a significant portion comfortable with online transactions, directly benefits Cango's platform. This trend means more potential customers are willing to explore, compare vehicles, and even start financing applications through digital channels.

In 2024, China's e-commerce penetration rate continued to climb, with a substantial percentage of the population actively engaging in online purchases, including big-ticket items like vehicles. This widespread digital adoption creates a fertile ground for Cango's online-centric approach.

To fully leverage these evolving consumer habits, Cango needs to consistently refine its digital user experience, ensuring it's intuitive and seamless for car buyers and sellers alike. This includes optimizing mobile interfaces and streamlining online application processes.

Influence of Social Media and Online Reviews

Social media and online reviews are increasingly shaping consumer choices in the automotive sector, impacting decisions on vehicle purchases and financing solutions. Cango must actively manage its digital footprint and utilize these platforms for effective marketing and customer interaction.

A strong online reputation is crucial for building trust and drawing more users to Cango's platform. For instance, by mid-2024, over 70% of consumers reported that online reviews significantly influenced their car buying decisions, with platforms like Xiaohongshu and Douyin being key influencers in China's automotive market.

- Digital Influence: Consumers increasingly rely on social media and online reviews for automotive purchase decisions.

- Reputation Management: Cango's online presence directly impacts trust and user acquisition.

- Platform Leverage: Digital channels are vital for Cango's marketing and customer engagement strategies.

- Market Trends: Over 70% of consumers in 2024 stated online reviews influenced their car buying, highlighting a key sociological shift.

Demographic Shifts and Generational Buying Patterns

China's demographic landscape is evolving, presenting unique challenges and opportunities for Cango. The aging population, a significant trend, means a growing segment of potential customers may have different financing priorities, perhaps leaning towards more conservative or accessible options. Conversely, the ascendancy of Gen Z and younger millennials entering the workforce and the car market brings a new set of expectations. This younger demographic is often digitally native, comfortable with online transactions, and may prioritize electric vehicles (EVs) or shared mobility solutions, influencing their financing needs and preferences.

These generational differences directly impact buying patterns and financial service utilization. For instance, while older generations might prefer traditional dealership financing, younger consumers are increasingly open to digital platforms and innovative financing models. Cango needs to acknowledge these shifts; for example, by understanding that in 2024, China's youth are a key demographic for EV adoption, a sector where flexible and digital financing solutions are paramount. Tailoring product offerings to suit varying financial literacy levels and risk appetites across these age groups is crucial for Cango's market penetration.

- Aging Population: China's population aged 65 and above is projected to reach over 300 million by 2025, impacting demand for certain vehicle types and financing structures.

- Gen Z and Millennials: These cohorts, representing a significant portion of new car buyers, often exhibit a preference for tech-integrated vehicles and digital financial services.

- Digital Finance Adoption: Surveys indicate a high comfort level among younger Chinese consumers with online loan applications and digital payment systems for vehicle purchases.

- EV Market Growth: The increasing demand for electric vehicles, particularly among younger demographics, necessitates financing options that align with the lifecycle and charging infrastructure needs of EVs.

Consumer attitudes towards car ownership are shifting, with a growing interest in electric vehicles and alternative mobility. This trend is reflected in the market, where by early 2025, EV sales were projected to increase by over 20% year-over-year in key regions, presenting both opportunities and challenges for financing providers like Cango.

Urbanization continues to drive demand for transportation solutions, with China's urbanization rate reaching 66.16% by the end of 2023. However, mobility preferences vary, with megacities favoring ride-sharing and public transport, while smaller cities show a stronger inclination towards personal car ownership, benefiting Cango's sales and rental services.

The increasing digital savviness of Chinese consumers, with a significant portion comfortable with online transactions, directly benefits Cango's platform. In 2024, China's e-commerce penetration continued to rise, with a substantial percentage of the population engaging in online purchases, including vehicles, creating a fertile ground for Cango's online-centric approach.

Social media and online reviews significantly influence consumer choices, with over 70% of consumers in 2024 reporting that online reviews impacted their car buying decisions. Cango must actively manage its digital footprint to build trust and attract users.

| Sociological Factor | Description | Impact on Cango | Relevant Data (2024/2025) |

|---|---|---|---|

| Shifting Mobility Preferences | Growing interest in EVs and alternative transport. | Need to adapt financing to new vehicle types and usage models. | Projected EV sales growth >20% YoY (early 2025). |

| Urbanization Trends | Increased demand for transportation in cities. | Opportunity in urban areas, but competition from ride-sharing exists. | China's urbanization rate reached 66.16% (end of 2023). |

| Digital Consumer Behavior | High comfort with online transactions and reviews. | Leverage digital platform for sales and financing; manage online reputation. | >70% of consumers influenced by online reviews (2024); rising e-commerce penetration. |

| Demographic Changes | Aging population and rise of Gen Z/Millennials. | Tailor financing to diverse age-related needs and preferences (digital vs. traditional). | China's 65+ population to exceed 300 million by 2025; younger demographics driving EV adoption. |

Technological factors

The automotive industry's move towards digital sales and financing is a major technological shift. Cango is at the forefront, offering online showrooms and digital contracting, making car buying more accessible. This digital transformation extends to financing, with remote application processes becoming standard.

In 2024, it's estimated that over 70% of car buyers conduct significant research online before visiting a dealership, highlighting the critical role of digital platforms. Cango's strategy to integrate these advanced digital tools directly impacts its ability to provide a seamless experience for both customers and its network of dealers.

Big data analytics and AI are revolutionizing credit assessment for companies like Cango, enabling more precise risk evaluation. By analyzing vast datasets, these technologies allow for quicker, more accurate creditworthiness assessments, which is vital for Cango's financing facilitation services.

The adoption of AI-driven credit scoring is projected to significantly reduce default rates. For instance, studies in 2024 indicate that AI models can improve prediction accuracy by up to 20% compared to traditional methods, directly benefiting Cango's risk management and profitability.

Continuous innovation in AI and big data analytics is key to Cango's competitive edge. Companies investing in these areas in 2025 are expected to see enhanced operational efficiency, leading to faster loan processing and improved customer satisfaction in the evolving automotive financing landscape.

Fintech innovations, particularly blockchain, offer Cango significant opportunities to bolster its platform's security and transparency. For instance, blockchain can streamline transaction records, reducing the potential for fraud and fostering greater trust among dealers, financial institutions, and consumers. As of early 2024, the global fintech market was projected to reach over $300 billion, highlighting the rapid growth and adoption of these technologies.

Advanced payment solutions, another key fintech development, can also enhance Cango's operational efficiency. By integrating cutting-edge payment technologies, Cango can potentially lower transaction costs and speed up processing times. The digital payments market alone was estimated to be worth trillions globally in 2024, indicating a substantial user base receptive to such advancements.

Staying ahead of these technological shifts is crucial for Cango's continued success. The company's ability to adapt and integrate emerging fintech solutions will directly impact its competitive edge and its capacity to serve its diverse customer base effectively in the evolving automotive finance landscape.

Cybersecurity and Data Protection Technologies

As a digital platform facilitating financial transactions and managing sensitive customer data, Cango's technological environment heavily relies on robust cybersecurity and data protection. The increasing sophistication of cyber threats necessitates continuous investment in advanced technologies. For instance, Cango likely employs end-to-end encryption and multi-factor authentication to secure user information and financial activities.

Maintaining a strong security posture is not just about preventing breaches; it's also crucial for regulatory compliance. In 2024, global spending on cybersecurity solutions was projected to reach over $200 billion, highlighting the industry's focus on this area. Cango's commitment to protecting user data directly impacts its ability to operate within various financial regulations and maintain customer trust.

- Advanced Encryption: Implementing sophisticated encryption protocols to protect data both in transit and at rest.

- Threat Detection Systems: Utilizing AI-powered tools to identify and neutralize potential cyber threats in real-time.

- Data Loss Prevention (DLP): Employing technologies to prevent sensitive information from leaving the company's network without authorization.

- Regular Security Audits: Conducting frequent vulnerability assessments and penetration testing to identify and address weaknesses.

Integration with Automotive Ecosystem Technologies

Cango's strategic integration with the evolving automotive ecosystem, particularly in areas like telematics and connected car services, presents significant opportunities. By leveraging telematics data, Cango can develop innovative insurance products or offer personalized financing solutions based on driving behavior, enhancing customer value. For instance, with the projected growth in connected car services, which saw a significant uptick in adoption rates in 2024, Cango can tap into this data stream to refine its risk assessments and customer segmentation.

Collaborating with original equipment manufacturers (OEMs) and other technology providers is crucial for Cango to move beyond its core transaction facilitation role. These partnerships can lead to integrated offerings, such as embedded financing options within vehicle purchase journeys or bundled telematics and insurance packages. This expansion of services could solidify Cango's position as a comprehensive platform within the automotive value chain, potentially increasing its market share and revenue streams. The automotive industry's continued push towards digitalization and connected experiences, with global spending on automotive software and services expected to reach hundreds of billions by 2025, underscores the importance of such integrations.

- Telematics Data Utilization: Cango can leverage telematics data for dynamic insurance pricing and personalized loan assessments, potentially reducing risk and improving customer acquisition.

- Connected Car Services Integration: Opportunities exist to bundle financing with connected car features, offering a more holistic customer experience and creating new revenue streams.

- OEM and Technology Partnerships: Collaborations with automotive manufacturers and tech firms can embed Cango's services directly into the vehicle purchase and ownership lifecycle.

- Market Growth in Connected Vehicles: The increasing adoption of connected car technologies globally provides a fertile ground for Cango to expand its service offerings and data-driven insights.

Technological advancements are reshaping automotive finance, with digital platforms like Cango leading the charge. By 2024, over 70% of car buyers research online, underscoring the necessity of Cango's digital showrooms and financing processes. AI and big data analytics are crucial for Cango, improving credit assessments with projected accuracy increases of up to 20% by 2025 compared to traditional methods.

Legal factors

Cango operates in China's heavily regulated automotive sector, necessitating compliance with numerous licenses and permits for vehicle sales, distribution, and related services. For instance, in 2023, the China Automobile Dealers Association reported that regulatory changes continued to shape dealership operations, impacting areas like after-sales service standards and environmental compliance.

Navigating these often intricate and evolving regulations is paramount for Cango's sustained business and growth. Failure to comply can result in significant penalties, potentially affecting financial performance and market standing.

China's stringent consumer protection laws, especially for financial services, directly shape Cango's business model. The company is obligated to provide clear, transparent financing terms and engage in fair lending, ensuring customers fully understand their agreements.

Cango must maintain robust mechanisms for addressing customer complaints and resolving disputes effectively to comply with these regulations. For instance, in 2023, China's Consumer Council reported a 15% increase in financial service-related complaints, highlighting the critical need for companies like Cango to prioritize consumer rights.

Adhering to these legal frameworks is crucial for building and sustaining consumer trust, which is essential for Cango's long-term success and avoiding costly legal battles or damage to its brand reputation in the competitive Chinese market.

China's Personal Information Protection Law (PIPL) and Cybersecurity Law (CSL) create a complex legal landscape for companies like Cango. These laws mandate strict rules around how personal and sensitive data is collected, stored, and moved, especially across borders. Failure to comply can result in significant penalties, potentially impacting Cango's operational and financial stability. For instance, PIPL can levy fines up to 5% of annual turnover or 50 million yuan for serious violations.

Anti-Monopoly and Competition Laws

Cango, as a major player in China's automotive transaction services, is subject to strict anti-monopoly and competition laws. These regulations are designed to prevent unfair business practices, the abuse of market dominance, and the formation of monopolies, ensuring a level playing field for all market participants. For instance, China's Anti-Monopoly Law (AML) prohibits companies from leveraging their market position to stifle competition.

Cango must meticulously align its business operations, strategic alliances, and market expansion plans with these legal frameworks. This includes ensuring that any agreements with dealerships, financial institutions, or technology providers do not violate competition rules. Failure to comply can result in significant penalties, including substantial fines and operational restrictions.

- Regulatory Scrutiny: Cango faces ongoing scrutiny from China's State Administration for Market Regulation (SAMR) regarding its market practices.

- Compliance Measures: The company has implemented internal compliance programs to ensure adherence to anti-monopoly regulations.

- Market Dynamics: China's evolving competition landscape, particularly in the digital and automotive sectors, necessitates continuous adaptation of Cango's strategies.

- Fair Competition Advocacy: Adherence to these laws is crucial for fostering trust and maintaining a healthy competitive environment within the automotive financial services industry.

Financial Services Licensing and Compliance

Cango's operations, particularly in facilitating financing solutions, necessitate strict adherence to financial services licensing and compliance regulations within China. Authorities such as the China Banking and Insurance Regulatory Commission (CBIRC) and the People's Bank of China (PBOC) actively oversee these activities. Maintaining compliance is crucial for Cango's legitimacy and its ability to operate its platform and partner with financial institutions.

Ensuring that all financial partners integrated into Cango's ecosystem are properly licensed is a critical legal requirement. Furthermore, Cango itself must ensure its platform meets all evolving financial compliance standards to avoid penalties and maintain trust. For instance, in 2023, China continued to strengthen its regulatory framework for online financial services, impacting platforms like Cango.

- Regulatory Oversight: Cango operates under the purview of Chinese financial regulators like the CBIRC and PBOC.

- Partner Due Diligence: Ensuring all financing partners possess valid licenses is a non-negotiable compliance step.

- Platform Adherence: Cango's platform must consistently meet stringent financial compliance standards.

- Evolving Landscape: China's regulatory environment for financial technology is dynamic, requiring continuous adaptation.

Cango must navigate China's stringent consumer protection laws, ensuring transparency in financing terms and fair lending practices, a critical aspect highlighted by a 15% rise in financial service complaints reported by China's Consumer Council in 2023.

Compliance with data privacy laws like PIPL and CSL is paramount, with potential fines reaching up to 5% of annual turnover for violations, underscoring the need for robust data handling protocols.

The company is also subject to anti-monopoly regulations, requiring careful alignment of business practices and partnerships to avoid penalties and maintain market fairness, as enforced by China's Anti-Monopoly Law.

Environmental factors

China's unwavering commitment to New Energy Vehicles (NEVs) is a powerful environmental driver, with the government actively encouraging adoption through substantial subsidies and tax incentives. For instance, in 2023, the central government continued to phase out direct purchase subsidies but maintained other supportive policies, while local governments often offered additional incentives. This policy landscape is directly reshaping consumer preferences, steering them towards electric and plug-in hybrid models.

This strong governmental push means Cango, a facilitator of automotive financing, must strategically align its services with the burgeoning NEV market. By adapting its financing solutions to cater to the growing demand for electric vehicles, Cango can capitalize on this significant environmental shift. This proactive adaptation is crucial for maintaining relevance and capturing market share in China's rapidly evolving automotive sector.

China's commitment to reducing pollution is leading to increasingly stringent emission standards for traditional gasoline and diesel vehicles. For instance, the national emission standards have progressively tightened, with the latest iterations pushing manufacturers towards cleaner technologies.

These evolving regulations directly affect the automotive market by influencing which vehicle models are produced and sold. As less efficient vehicles face potential phase-outs, the inventory available to dealerships, and therefore the types of vehicles Cango finances, will shift.

Cango's ability to adapt its financing offerings to support the sale of compliant and newer-generation vehicles is crucial. The company must stay abreast of manufacturing regulations, which are also being updated to encourage the adoption of greener automotive technologies.

Chinese consumers are increasingly prioritizing environmentally friendly transportation, with a notable surge in demand for new energy vehicles (NEVs), encompassing both electric and hybrid models. This growing consciousness is a significant environmental factor shaping the automotive market.

By 2024, the penetration rate of NEVs in China's passenger vehicle market had surpassed 35%, a testament to this evolving consumer preference. This trend presents a clear opportunity for Cango to align its services with this burgeoning market segment.

Specializing in financing and facilitating transactions for NEVs allows Cango to tap into this environmentally motivated demand, potentially strengthening its market standing and brand perception among a growing eco-conscious consumer base.

Development of EV Charging Infrastructure

The expansion of electric vehicle (EV) charging infrastructure in China is a critical environmental factor influencing the NEV market. By the end of 2023, China had over 8.5 million charging facilities, a significant increase that directly supports the growing NEV sector. This robust infrastructure development is essential for building consumer confidence in NEVs, a key segment Cango operates within.

Cango's business, which facilitates NEV purchases, is directly impacted by the convenience and accessibility of charging solutions. As more charging stations become available, the perceived range anxiety associated with EVs diminishes, encouraging more consumers to consider NEV purchases through Cango's platform. This trend is expected to continue, with projections indicating further substantial growth in charging point installations through 2025.

- Charging Infrastructure Growth: China's charging network surpassed 8.5 million units by the end of 2023, a testament to rapid expansion.

- Consumer Confidence: Improved charging accessibility directly bolsters consumer willingness to adopt NEVs, benefiting Cango's core business.

- Potential Partnerships: Cango could explore strategic alliances with charging network operators to offer integrated solutions, enhancing its service offering.

Sustainability in Automotive Supply Chain

The automotive industry is experiencing a significant shift towards sustainability, impacting every facet of the supply chain, from raw material sourcing to end-of-life vehicle management. This heightened environmental consciousness directly influences Cango's partners, including dealerships and Original Equipment Manufacturers (OEMs), as they increasingly prioritize eco-friendly practices. For instance, by 2024, many OEMs are setting ambitious targets for reducing carbon emissions in their manufacturing processes, with some aiming for carbon neutrality by 2030.

While Cango itself doesn't engage in direct manufacturing, its strategic alliances with environmentally responsible partners can significantly bolster its corporate image and market appeal. Consumers and investors alike are showing a greater preference for companies demonstrating a commitment to sustainability. A 2024 survey indicated that over 60% of car buyers consider a brand's environmental record when making a purchase decision.

Understanding these evolving supply chain trends is crucial for Cango's long-term strategic alignment and competitive positioning. This includes:

- Increased demand for electric vehicle (EV) components and charging infrastructure.

- Growing regulatory pressure on emissions standards and waste management.

- Emphasis on circular economy principles, such as material reuse and recycling.

- Supplier requirements for sustainability certifications and transparent reporting.

China's aggressive push for New Energy Vehicles (NEVs) is a cornerstone environmental policy, with government incentives actively driving consumer adoption. By 2024, NEVs represented over 35% of China's passenger vehicle market, a clear indicator of this trend's momentum.

Stricter emission standards for traditional vehicles are also reshaping the market, favoring cleaner technologies and influencing the types of vehicles available for financing. Cango must align its offerings with these evolving regulatory landscapes to remain competitive.

The rapid expansion of EV charging infrastructure, exceeding 8.5 million units by the end of 2023, directly supports NEV adoption and consumer confidence. This growth is crucial for Cango's business, as it reduces range anxiety for potential NEV buyers.

Growing consumer and industry focus on sustainability is driving demand for eco-friendly vehicles and practices throughout the automotive supply chain. Over 60% of car buyers in 2024 considered a brand's environmental record, highlighting the importance of green credentials.

| Environmental Factor | Description | Impact on Cango | Data Point (2023/2024) |

| NEV Policy Support | Government incentives and mandates promoting electric and hybrid vehicles. | Increases demand for NEVs, Cango's financing focus. | NEV penetration >35% of China's passenger vehicle market (2024). |

| Emission Standards | Stricter regulations on traditional internal combustion engine vehicles. | Shifts vehicle production towards cleaner models, influencing Cango's portfolio. | Progressive tightening of national emission standards. |

| Charging Infrastructure | Development of a widespread network for EV charging. | Boosts consumer confidence in NEVs, facilitating Cango's financing. | Over 8.5 million charging facilities in China (end of 2023). |

| Sustainability Focus | Growing consumer and industry preference for environmentally conscious practices. | Enhances brand appeal for Cango if partners are eco-friendly. | >60% of car buyers consider environmental record (2024 survey). |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on comprehensive data from reputable sources including government publications, international organizations, and leading market research firms. We ensure each factor is informed by current economic indicators, technological advancements, and regulatory updates.