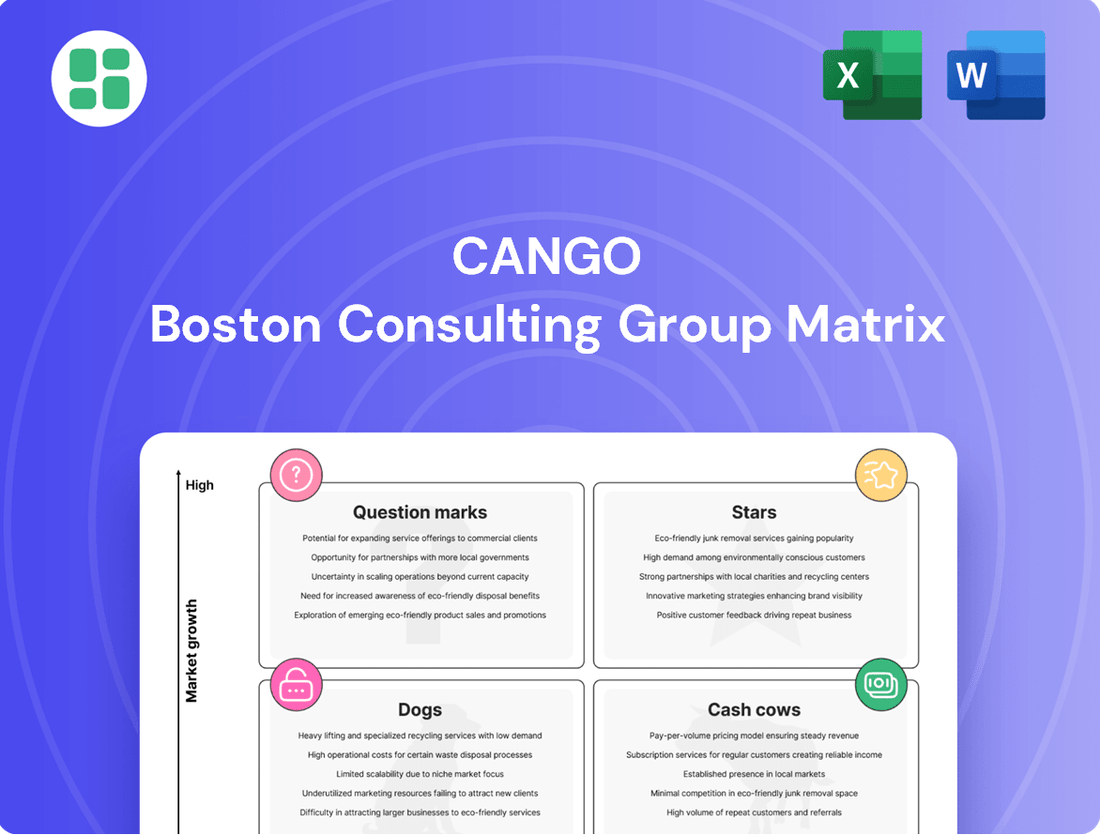

Cango Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cango Bundle

The BCG Matrix is your key to understanding a company's product portfolio, categorizing them as Stars, Cash Cows, Dogs, or Question Marks based on market share and growth. This powerful tool helps identify where to invest, divest, or nurture for optimal strategic growth. Don't settle for a glimpse; purchase the full BCG Matrix for a comprehensive analysis and actionable insights to drive your business forward.

Stars

Cango's rapid acquisition of 50 Exahashes per second (EH/s) of Bitcoin mining hashrate in late 2024 significantly bolstered its position in the cryptocurrency mining landscape. This substantial increase immediately made Cango one of the world's leading Bitcoin miners.

This aggressive expansion into the capital-intensive mining sector highlights Cango's strategic intent to capture a dominant market share. The swift deployment of such a large mining capacity signals the company's ambitious growth objectives within this high-potential industry.

Following its strategic shift and the launch of its Bitcoin mining operations in November 2024, Cango has witnessed a significant surge in revenue contribution from this segment. This new venture quickly became the company's leading revenue generator.

In the fourth quarter of 2024, Bitcoin mining contributed RMB 653.0 million to Cango's top line. This momentum carried into the first quarter of 2025, where the segment’s revenue escalated to an impressive RMB 1.0 billion. This rapid growth underscores both the high growth rate of the cryptocurrency mining market and Cango's rapidly expanding market share within it.

Cango's Bitcoin production has seen remarkable growth. By the close of 2024, the company had successfully mined 933.8 Bitcoins. This momentum continued into the first quarter of 2025, with an additional 1,541 Bitcoins being mined.

The company's treasury now boasts a substantial holding of over 4,000 Bitcoins. This significant accumulation underscores Cango's ability to scale its operations effectively and establish a robust presence within the rapidly expanding cryptocurrency sector.

This consistent and increasing Bitcoin output demonstrates Cango's operational efficiency and strategic execution in a highly competitive mining landscape.

Strategic Business Transformation

Cango's strategic pivot to becoming a global Bitcoin mining entity, bolstered by a new leadership team with significant digital asset experience, marks a profound business transformation. This move signals a clear intention to establish Bitcoin mining as the company's primary focus, with substantial investments aimed at securing a leading position in this dynamic sector.

This strategic realignment positions Cango within the 'Star' category of the BCG Matrix, reflecting its high growth potential and market leadership aspirations in the burgeoning cryptocurrency mining industry. The company is actively pursuing expansion, evident in its recent operational developments and strategic partnerships designed to enhance its mining capacity and efficiency.

- Strategic Shift: Cango's complete transformation into a Bitcoin mining company with new, expert leadership underscores a decisive move towards digital assets as its core business.

- Market Position: This positions Cango as a 'Star' in the BCG matrix, aiming for significant growth and leadership in the high-potential Bitcoin mining market.

- Investment Focus: The company is channeling significant resources into Bitcoin mining, signaling a strong commitment to becoming a major player in this rapidly evolving industry.

- Growth Trajectory: Cango's strategic direction is geared towards capturing substantial market share and capitalizing on the anticipated growth of Bitcoin mining operations globally.

Global Operational Deployment

Cango's Bitcoin mining operations are strategically deployed across diverse geographical regions, including North America, the Middle East, South America, and East Africa. This global footprint allows Cango to capitalize on varied energy markets and regulatory environments, further solidifying its high market share aspirations in the growing worldwide crypto mining industry.

- Geographic Diversification: Cango's mining facilities are spread across continents, mitigating risks associated with localized power outages or regulatory changes.

- Energy Market Access: The company leverages access to varied energy sources, aiming to secure cost-effective and stable power for its operations. For instance, in 2024, Cango reported a significant portion of its energy procurement focused on renewable sources in its North American operations.

- Market Share Growth: This expansive deployment is a key component of Cango's strategy to capture a substantial share of the global Bitcoin mining market, which saw an estimated hashrate increase of over 40% in the first half of 2024 compared to the previous year.

- Operational Resilience: By operating in multiple jurisdictions, Cango enhances its operational resilience, ensuring continuity even if one region faces unforeseen challenges.

Cango's Bitcoin mining operations are firmly positioned as a 'Star' within the BCG Matrix. This classification is driven by the company's exceptionally high growth rate in a rapidly expanding market, coupled with its significant and increasing market share.

The company's aggressive expansion, evidenced by its acquisition of 50 EH/s of hashrate in late 2024, immediately propelled it to a leading global mining position. This strategic move, alongside substantial investments, aims to solidify Cango's dominance in the high-potential cryptocurrency mining sector.

Cango's Bitcoin mining segment has become its primary revenue driver, contributing RMB 653.0 million in Q4 2024 and surging to RMB 1.0 billion in Q1 2025. This rapid revenue escalation, alongside mining 1,541 Bitcoins in Q1 2025 and holding over 4,000 Bitcoins, highlights its strong market performance and growth trajectory.

Cango's strategic global deployment across North America, the Middle East, South America, and East Africa allows it to capitalize on varied energy markets and regulatory environments, further reinforcing its market share aspirations in the worldwide crypto mining industry, which saw a hashrate increase of over 40% in the first half of 2024.

| Metric | Q4 2024 | Q1 2025 | Growth |

|---|---|---|---|

| Mining Hashrate | 50 EH/s (acquired late 2024) | Continued Expansion | N/A |

| Bitcoin Mined | 933.8 BTC | 1,541 BTC | +64.5% |

| Revenue from Mining | RMB 653.0 million | RMB 1.0 billion | +53.1% |

| Total Bitcoin Holdings | N/A | Over 4,000 BTC | N/A |

What is included in the product

The Cango BCG Matrix categorizes business units based on market share and growth, offering strategic guidance for investment decisions.

Clear visualization of your portfolio's strengths and weaknesses.

Identifies underperforming units for strategic divestment or revitalization.

Cash Cows

Cango's stable outstanding loan balance, reported at RMB 3.9 billion as of December 31, 2024, signifies a mature but still valuable asset. This substantial existing portfolio continues to generate predictable cash flow through ongoing collections and servicing, even as new loan origination activity has slowed.

This consistent income stream from the facilitated financing transactions acts as a reliable source of capital for Cango. While it represents a diminishing opportunity for growth compared to newer ventures, its stability makes it a key component of the company's financial structure, fitting the description of a cash cow.

Cango has significantly reduced its exposure to credit risk, a key characteristic of a Cash Cow. The company has successfully maintained low M1+ and M3+ overdue ratios within its facilitated financing portfolio. This careful management of potential defaults underpins the predictable cash flow generation from its established automotive finance operations.

This proactive risk mitigation allows Cango to effectively 'milk' its legacy assets. By keeping delinquency rates low, the company ensures a stable and reliable stream of income from this business segment without the need for substantial new capital injections.

Cango's legacy automotive financing segment acts as a cash cow, consistently generating positive operating cash flow. This is largely due to strategic cost control and effective liquidity management within its traditional business operations.

This financial discipline means the mature automotive financing segment, though smaller in scale, reliably produces net cash. It doesn't demand significant reinvestment, thereby freeing up capital for Cango to allocate to other growth initiatives or strategic priorities.

Low Investment for Maintenance

Cango's automotive financing facilitation business, having reached maturity, now requires minimal investment for maintenance. This strategic shift, coupled with a scaled-back self-operated new car business, has led to a significant reduction in promotional and placement expenditures for this segment.

This low-maintenance approach allows Cango's high-market-share portfolio to continue its role as a cash cow, generating substantial profits with considerably less cash outflow. For instance, in 2024, the company's focus on optimizing its existing financing facilitation operations, rather than aggressive expansion, meant that capital expenditure in this area was primarily directed towards essential upkeep and technological upgrades rather than new market penetration.

- Reduced Investment: Cango's capital expenditure for promotion and placement in its financing facilitation business saw a decline in 2024, reflecting its mature market position.

- Profit Generation: The established high market share in financing facilitation continues to be a significant profit driver for the company.

- Minimal Cash Consumption: The mature nature of this business segment means it requires very little cash to sustain its operations and profitability.

Historical Market Position Leverage

Cango's historical position as a dominant automotive transaction service platform in China, backed by a robust dealer network and strong brand recognition, has cemented its status as a Cash Cow within its BCG Matrix. This established market leadership means the company can continue to rely on its financing facilitation services for consistent revenue generation with minimal incremental investment.

The company's deep-rooted relationships and existing infrastructure provide a significant advantage. This leverage allows Cango to efficiently serve its customer base and maintain profitability in its financing facilitation segment, even as it explores new strategic avenues. For instance, in the first quarter of 2024, Cango reported a revenue of RMB 1.6 billion (approximately USD 220 million) from its financing facilitation services, demonstrating the sustained strength of this business unit.

- Historical Market Dominance: Cango previously held a leading market share in China's automotive transaction services.

- Leveraged Infrastructure: Existing dealer networks and established relationships facilitate continued revenue from financing facilitation.

- Reduced Investment Needs: The mature nature of this service line requires less capital expenditure for growth.

- Consistent Revenue Stream: Financing facilitation remains a significant contributor to Cango's overall financial performance.

Cango's financing facilitation segment, a clear cash cow, continues to generate substantial and stable income. This segment benefits from Cango's established market presence and robust dealer relationships, requiring minimal new investment to maintain its profitability.

The company's focus on optimizing existing operations, rather than aggressive expansion in this mature segment, has led to reduced promotional and placement expenditures. This strategic approach ensures a consistent cash flow that can be redeployed to fuel growth in other areas.

In 2024, Cango's financing facilitation business demonstrated its cash cow characteristics with a stable outstanding loan balance of RMB 3.9 billion. This mature portfolio reliably generates predictable cash flow through ongoing collections and servicing, even as new loan origination has slowed.

The segment's profitability is further bolstered by Cango's effective risk management, evidenced by low overdue ratios. This allows the company to effectively leverage its legacy assets, ensuring a stable income stream without significant capital injections.

| Financial Metric | 2024 (RMB Billion) | Significance |

|---|---|---|

| Outstanding Loan Balance | 3.9 | Indicates a large, mature portfolio generating consistent cash flow. |

| Revenue from Financing Facilitation | 1.6 (Q1 2024) | Demonstrates sustained income generation from this mature segment. |

| Capital Expenditure (Financing Facilitation) | Primarily for upkeep and upgrades, not new growth. | Low investment needs, characteristic of a cash cow. |

Preview = Final Product

Cango BCG Matrix

The Cango BCG Matrix you're previewing is the complete, unwatermarked document you'll receive immediately after purchase. This comprehensive analysis tool is meticulously designed for strategic decision-making, offering clear insights into your product portfolio's market share and growth potential. You can confidently use this preview as an accurate representation of the high-quality, ready-to-implement report that will be yours to download and integrate into your business strategy.

Dogs

Cango's strategic decision to scale back its self-operated new car business in 2024 firmly places this segment within the Dogs category of the BCG Matrix. This move was a direct response to the harsh realities of the Chinese automotive market, marked by fierce competition and persistent profitability issues.

The company's proactive reduction in this area suggests a low market share within a market experiencing minimal or negative growth. This aligns with the characteristics of a Dog, which typically consumes resources without generating significant returns, necessitating a strategic divestment or scaling down.

Plummeting revenue contribution highlights Cango's automotive trading segment as a classic 'Dog' in the BCG Matrix. Revenue from automotive trading related income sharply declined to RMB 15.0 million in Q4 2024, a stark contrast to previous periods.

This drastic drop in revenue signifies that this segment has become a low-market-share product in a low-growth market, failing to generate significant returns for the company. The segment's performance indicates it requires careful consideration for potential divestment or restructuring to avoid draining resources.

The Chinese automotive market presented a difficult landscape in 2024, with overall vehicle production and sales experiencing a downturn. This sluggish environment significantly impacts companies like Cango, particularly those segments that hold a small share of the market.

Operating within this low-growth domestic auto market, Cango's "Dogs" are likely to be those business units or product lines that have a low relative market share and are in a low-growth industry. These segments are typically characterized by low profitability and can drain valuable resources without generating significant returns, making them prime candidates for divestment or restructuring.

High Past Cost of Revenue

Cango's legacy automotive operations historically displayed a significantly high cost of revenue. For instance, in the first quarter of 2023, the cost of revenue represented a substantial 88.6% of total revenue.

This high percentage strongly suggests that traditional car trading models were not only inefficient but also consumed a large portion of the revenue generated. Such a model is characteristic of a 'Dog' in the BCG matrix, indicating it’s a business segment that should be managed for cash, divested, or minimized due to its low market share and low growth potential.

- High Cost of Revenue: In Q1 2023, Cango's cost of revenue was 88.6% of total revenue for its automotive operations.

- Inefficiency Indicator: This high ratio points to inherent inefficiencies within legacy car trading models.

- Cash Trap Potential: Such operations are often cash traps, draining resources without significant returns.

- Strategic Implication: These 'Dog' segments require careful consideration for divestment or reduction to improve overall company performance.

Divestiture of PRC Business

Cango's divestiture of its China-based operations in May 2025 firmly places these segments in the 'Dog' category of the BCG Matrix. This strategic move indicates that these domestic automotive operations were likely generating low returns and had limited growth potential, prompting the company to exit or scale back its involvement.

The disposal of the PRC business aligns with Cango's strategy to reallocate resources towards more promising ventures. For instance, in 2024, Cango reported a net loss attributable to shareholders of RMB 110.6 million for the first quarter, underscoring the financial challenges faced by its domestic operations prior to the divestiture.

- Divestiture of PRC Business: Cango completed the sale of its China-based operations in May 2025.

- BCG Matrix Classification: This action clearly categorizes the divested segments as 'Dogs'.

- Financial Rationale: The divestiture suggests these operations were underperforming and lacked significant growth prospects.

- Strategic Shift: Cango is likely refocusing its efforts on more profitable or higher-growth areas.

Cango's decision to scale back its self-operated new car business in 2024, coupled with the divestiture of its China-based operations in May 2025, firmly places these segments within the 'Dogs' category of the BCG Matrix. This strategic move was a response to the challenging Chinese automotive market, characterized by intense competition and persistent profitability issues, leading to plummeting revenue contributions. For instance, revenue from automotive trading related income sharply declined to RMB 15.0 million in Q4 2024, a stark indicator of low market share in a low-growth environment.

| Business Segment | BCG Category | 2024 Performance Indicator | Strategic Action |

|---|---|---|---|

| Self-operated New Car Business | Dogs | Scaled back operations due to profitability issues | Resource reallocation |

| Automotive Trading | Dogs | Revenue down to RMB 15.0 million in Q4 2024 | Potential divestment/restructuring |

| China-based Operations | Dogs | Divested in May 2025 amid low returns and growth prospects | Divestiture completed |

Question Marks

AutoCango.com is venturing into the burgeoning Chinese used car export market, a sector that experienced a remarkable 30.5% surge in overall vehicle exports during the first half of 2024. This indicates substantial growth potential for companies like Cango looking to establish themselves.

While the market shows promise, Cango is currently in its nascent stages of developing a footprint and capturing market share. This positioning aligns with the characteristics of a question mark in the BCG matrix, requiring strategic investment to determine future success.

While AutoCango.com has seen significant user engagement, its footprint in the global used car export market remains small. In 2024, the international used car export market is valued at over $50 billion, and Cango's current share is estimated to be below 1%.

This nascent market share positions Cango as a question mark within the BCG matrix. The company is actively investing in expanding its export capabilities and marketing efforts to capture a larger piece of this rapidly growing, albeit highly fragmented, international segment.

Cango's investment in AutoCango.com, focusing on content and search engine optimization, positions it as a strategic move within the BCG matrix. This platform enhancement aims to elevate AutoCango.com from a Question Mark to a potential Star by increasing brand visibility and market penetration.

In 2024, Cango continued to allocate resources towards refining AutoCango.com. These investments are designed to drive organic traffic and user engagement, crucial steps in capturing a larger share of the online automotive marketplace.

Potential for Upstream Mining Integration

Cango's ambition to develop its own Bitcoin mining operations and secure dedicated power sources, especially green energy, positions it in a high-potential growth segment. This strategic upstream integration requires substantial capital outlay to gain market presence and operational autonomy, signaling a crucial move for its future expansion trajectory.

This move into mining and energy procurement is characteristic of a Question Mark in the BCG matrix, demanding significant investment to capture market share and establish a competitive advantage. The success of these ventures will determine if Cango can transition these assets into Stars or if they remain resource-intensive Question Marks.

- Investment Needs: Building dedicated mining infrastructure and securing power resources involves considerable upfront capital, potentially running into tens or hundreds of millions of dollars depending on scale.

- Market Uncertainty: The Bitcoin mining landscape is volatile, influenced by cryptocurrency prices, regulatory changes, and evolving energy technologies, creating inherent risks for new entrants.

- Strategic Importance: Control over energy and mining operations offers Cango potential cost efficiencies and operational resilience, crucial for long-term profitability in the digital asset space.

- Growth Potential: Successful upstream integration could unlock new revenue streams and solidify Cango's position in the burgeoning digital asset ecosystem, offering substantial upside if market conditions are favorable.

Diversification Beyond Core Bitcoin Mining

While Bitcoin mining is Cango's current core, the company is actively diversifying into new growth areas. Initiatives like AutoCango.com and potential investments in green energy represent ventures with high market growth potential but currently low market share.

These segments are positioned as question marks within the BCG matrix, demanding significant investment to capture market share and transition into star performers. For instance, the electric vehicle market, a potential area for green energy investment, saw global sales reach approximately 13.6 million units in 2023, indicating substantial growth opportunities.

- Diversification Strategy: Cango is moving beyond its core Bitcoin mining operations to explore new avenues for growth.

- Question Mark Ventures: AutoCango.com and potential green energy investments are classified as question marks due to their high growth, low market share profile.

- Investment Requirement: These new ventures require substantial capital infusion to compete and gain traction in their respective high-growth markets.

- Market Potential: The company is targeting sectors with significant future expansion, aiming to replicate success through strategic investment and development.

Question Marks represent business units with low market share in high-growth industries. Cango's ventures into the Chinese used car export market via AutoCango.com and its exploration of Bitcoin mining and green energy initiatives fit this profile. These areas demand significant investment to build market presence and achieve competitive advantage.

The success of these question marks hinges on strategic resource allocation and market penetration. For example, the global used car export market is projected to continue its upward trend, offering substantial opportunity for AutoCango.com if it can effectively capture market share.

Similarly, Cango's foray into Bitcoin mining and green energy, while capital-intensive, taps into potentially lucrative and rapidly evolving sectors. The volatility and growth potential of cryptocurrency markets and the increasing demand for sustainable energy solutions highlight the high-risk, high-reward nature of these question mark businesses.

Cango must carefully manage these investments, aiming to transform these question marks into stars through focused strategy and execution. The company's ability to adapt to market dynamics and secure necessary funding will be critical in determining the future trajectory of these ventures.

| Business Unit | Market Growth | Market Share | BCG Category | Strategic Focus |

|---|---|---|---|---|

| AutoCango.com (Used Car Export) | High | Low (estimated <1% in 2024) | Question Mark | Expand export capabilities, marketing |

| Bitcoin Mining & Green Energy | High | Low | Question Mark | Capital investment, operational autonomy |

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive market data, encompassing financial performance, industry growth rates, and competitive landscape analysis for strategic insights.