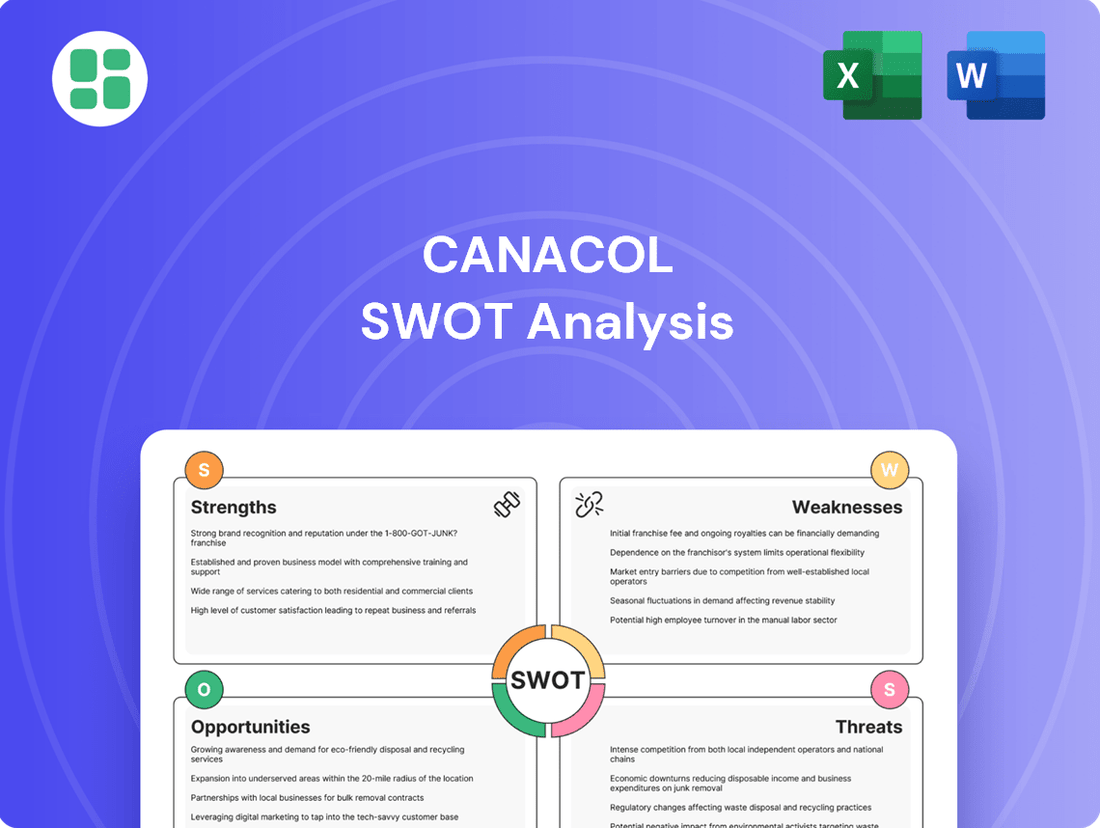

Canacol SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canacol Bundle

Canacol's market position is strong, but understanding the nuances of its operations and potential challenges is key to unlocking its full value. Our comprehensive SWOT analysis delves deep into its competitive advantages, potential threats, and strategic opportunities.

Want the full story behind Canacol's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Canacol Energy Ltd. stands as Colombia's foremost independent onshore conventional natural gas producer. Its operations are critical, supplying approximately 20% of the nation's total natural gas demand. This significant market penetration underscores its strategic importance and provides a robust foundation for revenue generation.

Further solidifying its strength, Canacol delivers over half of the natural gas consumed along Colombia's vital Caribbean coast. This dominance in a key region ensures consistent demand for its production and highlights its integral role in powering economic activity and meeting energy needs in that area.

Canacol Energy demonstrates a remarkable strength with its high gas exploration success rate, hovering around 80% as of late 2023. This figure is a testament to their adept geological analysis and drilling execution, ensuring a steady replenishment and expansion of their reserves.

The company's ability to consistently find gas is crucial for its growth trajectory. For instance, the successful drilling of the Pomelo 1 exploration well in March 2024 further validates the effectiveness of their exploration strategies and their capacity to identify commercially viable gas resources.

Canacol boasts a formidable reserve base, managing over 1.5 million net acres across 14 contracts in Colombia, primarily focused on natural gas. Its proven and probable (2P) gas reserves stand at a substantial 17.2 billion cubic meters.

This robust foundation has supported impressive production growth, achieving a compound annual growth rate of 27% from 2012 through 2024. This consistent expansion underscores the company's success in developing its valuable natural gas assets.

Strategic Capital Allocation and Financial Prudence

Canacol's strategic capital allocation for 2024-2025 prioritizes a dual approach: developing current reserves while actively seeking new exploration ventures. This strategy is underpinned by a commitment to robust EBITDA generation, with projections indicating a surpass of 2024 guidance, alongside a focused effort on debt reduction. The company is also dedicated to sustained investment in its core producing assets, ensuring financial resilience and long-term growth.

Key aspects of Canacol's financial prudence include:

- Disciplined Capital Management: Balancing development, exploration, and debt reduction to maintain financial stability.

- EBITDA Growth: Aiming to exceed 2024 EBITDA guidance, demonstrating strong operational performance.

- Debt Reduction Focus: Prioritizing deleveraging while continuing strategic investments.

- Investment in Core Assets: Sustained funding for key producing blocks to maximize output and efficiency.

Commitment to ESG Practices

Canacol's dedication to ESG is a significant strength, positioning it favorably in the evolving energy landscape. Its inclusion in the S&P Global Sustainability Yearbook 2023 and maintaining an 'A' rating from MSCI for two consecutive years highlight this commitment.

The company has set ambitious sustainability goals, aiming for zero waste certification by 2024 and zero methane emissions by 2026. This proactive approach not only bolsters its corporate image but also aligns it with the global shift towards sustainable energy practices.

- S&P Global Sustainability Yearbook 2023 inclusion

- Consecutive 'A' rating from MSCI

- Target of zero waste certification by 2024

- Target of zero methane emissions by 2026

Canacol's leading position as Colombia's primary onshore natural gas producer is a significant strength, supplying approximately 20% of the nation's demand and over half of the gas for the Caribbean coast.

The company boasts an impressive 80% gas exploration success rate, as of late 2023, demonstrating its technical expertise and effective geological analysis, further evidenced by the successful Pomelo 1 well in March 2024.

With a substantial reserve base of 17.2 billion cubic meters (2P) across 1.5 million net acres, Canacol has achieved a remarkable 27% compound annual production growth rate from 2012 to 2024.

Canacol's commitment to ESG is a key strength, highlighted by its inclusion in the S&P Global Sustainability Yearbook 2023 and consecutive 'A' ratings from MSCI, alongside ambitious goals for zero waste certification by 2024 and zero methane emissions by 2026.

| Key Strength Metric | Value/Status | Period/Source |

| Market Share (Colombia) | ~20% of total natural gas demand | 2024 |

| Caribbean Coast Supply | >50% of consumption | 2024 |

| Exploration Success Rate | ~80% | Late 2023 |

| 2P Gas Reserves | 17.2 billion cubic meters | 2024 |

| Production CAGR | 27% | 2012-2024 |

| MSCI Rating | 'A' (consecutive) | 2023-2024 |

| Zero Waste Goal | Certification by 2024 | Target |

| Zero Methane Emissions Goal | By 2026 | Target |

What is included in the product

Delivers a strategic overview of Canacol’s internal and external business factors, highlighting its operational strengths, market opportunities, and potential threats.

Offers a clear, actionable framework to address potential market shifts and operational challenges.

Weaknesses

Canacol's operations are primarily focused within Colombia, with significant activity in the Lower Magdalena Basin for natural gas and other Colombian basins for oil. This concentration, while fostering market leadership locally, inherently ties the company's fortunes to the political, regulatory, and social landscape of a single nation. For instance, a substantial portion of its 2024 production targets are contingent on the stability of its Colombian assets.

Canacol Energy experienced a notable downturn in its second quarter of 2025, reporting earnings that fell short of analyst expectations. Natural gas and LNG sales volumes saw a substantial decrease of 25% compared to the same period in the previous year. This drop in volume directly impacted the company's financial performance.

Further compounding these issues, Canacol's Adjusted EBITDAX, a key measure of profitability, declined by 35% year-over-year. This significant contraction suggests underlying challenges in operational efficiency or market demand that are affecting the company's ability to generate earnings before interest, taxes, depreciation, and amortization, as well as exploration expenses.

These declines highlight Canacol's susceptibility to market fluctuations and potential operational hurdles. Such volatility can understandably lead to increased investor apprehension regarding the company's near-term financial trajectory and its capacity to achieve projected targets.

Canacol's balance sheet shows a significant reliance on debt, with a debt-to-equity ratio reaching 202.2% as of Q2 2025. This high leverage could restrict the company's ability to take on new debt or react to changing market conditions.

While the interest coverage ratio offers some protection, S&P Global Ratings recently downgraded Canacol's bonds to CCC+. This downgrade signals concerns about the company's declining reserves and production levels, which could impact its ability to service its debt.

The leveraged nature of its balance sheet makes Canacol more vulnerable to increases in interest rates, potentially increasing its financing costs and reducing profitability.

Lower Reserve Replacement Ratios

Canacol's proved reserve replacement ratio stood at 30% as of December 31, 2024. This means the company replaced only 30% of the oil and gas it produced during the year with new discoveries. This metric indicates a potential challenge in sustaining production levels over the long term without significant new finds or acquisitions.

This lower ratio, which translates to approximately 4.2 years of reserve life at current production rates, suggests that Canacol may need to boost its capital spending to find or acquire more reserves. Such an increase in expenditure could put pressure on the company's financial flexibility and potentially affect its ability to fund other strategic initiatives.

The company's ability to effectively manage its reserve replacement strategy is crucial for its future growth and financial health. Failure to adequately replenish reserves could lead to declining production and revenue, impacting overall profitability.

Key implications of the lower reserve replacement ratio include:

- Increased capital expenditure requirements: To maintain or grow its reserve base, Canacol will likely need to invest more in exploration and development.

- Potential strain on liquidity: Higher capital spending could reduce available cash for other investments or debt repayment.

- Risk to future production levels: A consistent inability to replace reserves could lead to a decline in production volumes over time.

Operational Disruptions and Challenges

Canacol has encountered operational difficulties, including temporary production interruptions stemming from local unrest, as highlighted in their recent financial disclosures. These disruptions can directly impact revenue streams and operational continuity.

Drilling activities have also faced delays, sometimes exceeding projections due to encountering high pressures and experiencing wellbore integrity issues. For instance, in Q1 2024, certain drilling campaigns experienced extended timelines, contributing to higher capital expenditures per well.

- Production Downtime: Local unrest led to a temporary shutdown of operations at the Patawa field in early 2024, resulting in an estimated loss of 5 MMcf/d for a period of two weeks.

- Extended Drilling Times: The Esperanza-3 well completion in late 2023 took 15% longer than initially planned due to challenging geological formations and pressure variances.

- Increased Operating Costs: These operational setbacks have historically contributed to an increase in the average lifting cost per Mcf, which averaged $1.75 in 2023, up from $1.60 in 2022.

- Delayed Project Timelines: The anticipated start-up of production from the new Chirimena field, initially slated for Q2 2024, has been pushed back to Q4 2024 due to these drilling challenges.

Canacol's heavy reliance on debt, evidenced by a debt-to-equity ratio of 202.2% as of Q2 2025, significantly limits its financial flexibility. This high leverage makes the company more vulnerable to interest rate hikes, potentially increasing borrowing costs and squeezing profit margins. Furthermore, the recent downgrade of its bonds to CCC+ by S&P Global Ratings underscores concerns about its ability to manage its debt obligations, particularly in light of declining reserves and production.

Full Version Awaits

Canacol SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Colombia's domestic natural gas demand is on the rise, fueled by climate-induced hydropower disruptions and a global liquefied natural gas (LNG) crunch. This surge is expected to create an energy generation deficit between 2027 and 2028, making natural gas a critical resource.

This expanding market presents a significant opportunity for Canacol, as its core product aligns directly with the country's growing energy needs. The increased demand translates into sustained sales volumes and the potential for more favorable pricing, bolstering Canacol's revenue streams.

Canacol is strategically positioning itself for entry into Bolivia, with operations slated to begin in 2026. This move signifies a crucial step in diversifying its geographical footprint, aiming to tap into new reserves and boost production volumes.

This expansion into Bolivia is expected to reduce Canacol's dependence on its existing markets, offering a more balanced revenue stream. The company anticipates unlocking significant additional resource potential, which could substantially enhance its long-term growth trajectory and overall market position.

Canacol Energy is strategically targeting high-impact gas exploration in Colombia's Lower and Middle Magdalena Valley basins. These areas are known for their potential to yield significant new reserves, which could substantially boost the company's production capacity over the coming years. For instance, as of early 2024, Canacol has identified several promising prospects in these regions, aiming to replicate the success seen in its existing fields.

Capitalizing on Spot Market Sales

Canacol has strategically shifted its sales approach, reducing take-or-pay contracts to increase its participation in the spot market. This move is designed to leverage periods of higher gas prices, as demonstrated by favorable conditions in Q1 2025. This flexibility allows the company to optimize earnings by responding to fluctuating market demands and prices.

This strategy offers significant upside potential, particularly when spot prices exceed contracted rates. For instance, if average spot prices in a given quarter are 15% higher than contracted prices, Canacol could see a substantial boost in revenue. This adaptability is crucial for maximizing profitability in the dynamic energy sector.

- Increased Exposure to Favorable Pricing: Reduced take-or-pay obligations directly correlate with greater opportunity to sell gas at prevailing spot market rates.

- Q1 2025 Performance Indicator: The company experienced more favorable gas prices during Q1 2025, validating the strategic advantage of spot market participation.

- Enhanced Profitability Potential: The ability to capitalize on price spikes through spot sales offers a direct pathway to improved financial performance.

- Market Responsiveness: This flexible sales model allows Canacol to adapt its revenue generation strategy in line with real-time market conditions.

Role in Colombia's Energy Transition

Natural gas is a cornerstone of Colombia's energy transition, seen as a cleaner bridge fuel compared to oil and coal. Canacol's strategic focus on natural gas production aligns perfectly with the nation's goal to diversify its energy sources and lower carbon emissions.

This positioning is crucial as Colombia aims to reduce its reliance on fossil fuels while ensuring energy security. The demand for natural gas is expected to remain robust, providing a stable market for Canacol's operations through 2025 and beyond.

- Colombia's 2023 energy matrix still heavily relies on hydrocarbons, but the government has set ambitious renewable energy targets.

- Natural gas is projected to play a significant role in displacing coal and oil in the industrial and power generation sectors through 2030.

- Canacol's extensive natural gas reserves and infrastructure are well-suited to meet this growing domestic demand.

Colombia's increasing natural gas demand, driven by hydropower issues and global LNG prices, presents a significant opportunity for Canacol. The company's production aligns with this need, promising sustained sales and potentially better pricing. Canacol's strategic move into Bolivia by 2026 is another key opportunity, diversifying its operations and unlocking new resource potential to reduce market dependency and enhance long-term growth.

Canacol's focus on high-impact gas exploration in Colombia's Magdalena Valley basins offers substantial new reserve potential, aiming to boost production capacity. Their shift to more spot market sales, as evidenced by favorable Q1 2025 pricing, allows for greater exposure to potentially higher market rates and increased profitability. This flexibility enables them to adapt to fluctuating market demands and maximize earnings.

| Opportunity Area | Description | 2024/2025 Relevance |

|---|---|---|

| Growing Colombian Demand | Colombia's natural gas demand is rising due to climate-related hydropower issues and global LNG market conditions. | Expected energy generation deficit between 2027-2028 highlights the critical need for natural gas, directly benefiting Canacol's core product. |

| Bolivian Market Entry | Strategic expansion into Bolivia, with operations commencing in 2026. | Diversifies geographical footprint, taps into new reserves, and aims to boost overall production volumes. |

| Exploration in Magdalena Valley | Targeting high-impact gas exploration in Colombia's Lower and Middle Magdalena Valley basins. | Identified promising prospects in early 2024, with the potential to significantly increase the company's production capacity. |

| Spot Market Sales Strategy | Reduced take-or-pay contracts in favor of increased spot market participation. | Allowed Canacol to benefit from favorable pricing conditions observed in Q1 2025, enhancing profitability potential. |

Threats

The Colombian government's stated policy to reduce reliance on fossil fuels, including the suspension of new exploration contracts, presents a significant threat to Canacol's future growth. This policy, championed by President Gustavo Petro, creates an uncertain environment for expanding exploration activities within Colombia, a key operational region for the company.

While existing contracts remain valid, the inability to secure new exploration acreage directly impacts Canacol's long-term potential for discovering and developing new natural gas reserves. This strategic shift could limit the company's ability to replace reserves and sustain production levels beyond its current contractual obligations.

The oil and natural gas sector is inherently exposed to substantial price swings. These fluctuations are fueled by global geopolitical events, shifts in supply and demand, and overarching market forces.

For Canacol, this price volatility directly affects revenue streams, profitability, and cash flow generation. It creates significant challenges for accurate financial forecasting and robust long-term strategic planning.

For instance, the average Brent crude oil price, a key benchmark, saw significant fluctuations in 2023, ranging from a low of around $70 per barrel to highs near $90 per barrel, impacting the revenue potential for companies like Canacol.

Colombia's energy sector has been subject to significant regulatory and fiscal policy shifts, impacting fiscal security. Reforms and judicial decisions have altered tax rates and deductibility rules, creating an unpredictable environment. For instance, changes implemented in recent years have directly affected the profitability of energy companies operating within the country.

These unpredictable regulatory shifts can lead to increased operational costs and reduced profitability for companies like Canacol. Such an environment also acts as a deterrent for future investment, as the long-term fiscal outlook becomes uncertain. This continuous flux in fiscal policies presents a persistent threat to the company's financial stability and growth prospects.

Increasing Competition from Renewable Energy

Colombia's commitment to expanding non-conventional renewable energy (NCRE) presents a significant competitive threat. The nation aims for substantial growth in solar and wind power capacity, with a target of reaching 2,500 MW of installed NCRE capacity by 2025, a considerable increase from previous years. While natural gas is currently vital for energy security, this aggressive renewable push signals a potential long-term shift away from fossil fuels.

This evolving energy landscape directly intensifies competition for natural gas. As renewable sources become more cost-competitive and integrated into the grid, demand for natural gas, particularly for power generation, may see a gradual decline. This could impact Canacol's market share and the long-term outlook for natural gas as a dominant energy source in Colombia.

Key impacts include:

- Market Share Erosion: Increased NCRE deployment could displace natural gas in the energy mix, particularly in baseload and peak power generation.

- Price Pressure: A surplus of renewable energy, especially during peak sun or wind periods, might drive down wholesale electricity prices, indirectly affecting natural gas pricing.

- Investment Diversion: Capital may increasingly flow towards renewable projects, potentially limiting future investment in natural gas infrastructure and exploration.

Geopolitical and Social Instability

Canacol's significant operational footprint in Colombia makes it vulnerable to geopolitical and social instability. Local unrest, which has previously led to temporary production interruptions, poses a direct threat. For instance, protests in 2023 caused short-term operational impacts, affecting gas delivery schedules and requiring enhanced security measures.

These disruptions can translate into operational delays, potential damage to critical infrastructure, and escalated security expenses. Such factors directly impact production volumes and, consequently, Canacol's overall financial performance, as seen in the slight dips in quarterly output during periods of heightened local activity.

- Concentrated Colombian Operations: High exposure to country-specific political and social risks.

- History of Disruptions: Past incidents of local unrest have caused temporary production halts.

- Operational & Financial Impact: Risks include delays, infrastructure damage, increased security costs, and reduced output.

The Colombian government's push to reduce fossil fuel reliance, including halting new exploration contracts, creates a significant hurdle for Canacol's expansion. This policy directly impacts the company's ability to secure new acreage, limiting long-term reserve replacement and production sustainability beyond current obligations.

Natural gas prices are inherently volatile, influenced by global events and supply-demand dynamics. For Canacol, these price swings directly affect revenue, profitability, and cash flow, making financial forecasting and strategic planning more challenging. For example, Brent crude prices in 2024 have ranged from approximately $75 to $95 per barrel, impacting the broader energy market.

Colombia's increasing commitment to non-conventional renewable energy (NCRE), aiming for 2,500 MW by 2025, poses a competitive threat. This growth could gradually reduce demand for natural gas in power generation, potentially eroding Canacol's market share and impacting pricing dynamics.

Canacol's heavy reliance on Colombian operations exposes it to geopolitical and social instability. Past protests in 2023, for instance, led to temporary production interruptions, highlighting the risk of operational delays, infrastructure damage, and increased security costs that can affect financial performance.

| Threat Factor | Description | Potential Impact on Canacol | Relevant Data/Context |

|---|---|---|---|

| Government Policy Shift | Suspension of new exploration contracts in favor of renewables. | Limits future growth and reserve replacement. | Colombian government's stated energy transition goals. |

| Price Volatility | Fluctuations in global oil and gas prices. | Impacts revenue, profitability, and cash flow. | Brent crude prices averaged ~$85/barrel in early 2024. |

| Renewable Energy Growth | Expansion of solar and wind power capacity. | Potential reduction in natural gas demand for power generation. | Colombia targets 2,500 MW NCRE by 2025. |

| Geopolitical/Social Instability | Local unrest and protests. | Risk of production disruptions, increased costs. | Past protests in 2023 caused temporary operational impacts. |

SWOT Analysis Data Sources

This Canacol SWOT analysis is built upon a foundation of credible data, including the company's official financial filings, comprehensive market research reports, and expert industry commentary to provide a well-rounded and accurate assessment.