Canacol Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canacol Bundle

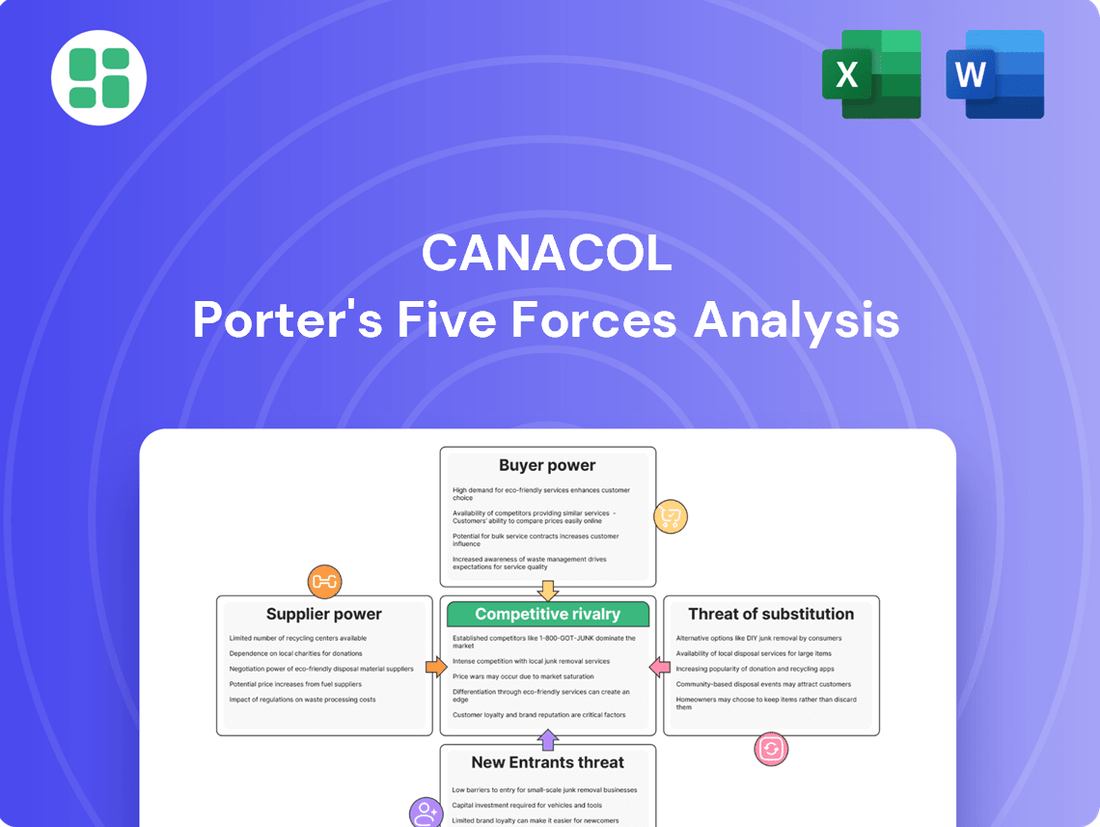

Canacol's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the ever-present threat of new entrants. Understanding these dynamics is crucial for navigating its operational environment.

The complete report reveals the real forces shaping Canacol’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of highly specialized drilling equipment, advanced seismic technology, and expert technical services wield considerable bargaining power. This is due to the niche nature and substantial cost of these critical inputs within the oil and gas exploration and production industry. For instance, the cost of a single advanced seismic survey can run into millions of dollars, and specialized drilling rigs can cost upwards of $500,000 per day to operate.

Canacol Energy, like other E&P companies, depends on these few, highly capable providers for the efficiency and safety of its operations. A limited pool of suppliers for complex deep drilling and advanced reservoir management technologies means Canacol may face higher prices or less advantageous contract terms, directly impacting operational expenditures.

The bargaining power of suppliers, particularly concerning skilled labor and technical expertise, is a significant consideration for Canacol. The availability of experienced engineers, geologists, and field technicians with specific knowledge of Colombian geological formations and its regulatory landscape directly impacts operational efficiency and cost. A scarcity of these specialized professionals, or the presence of strong labor unions, can lead to increased wage demands and, consequently, higher operational expenses for the company.

In 2024, the energy sector globally, including in regions like Colombia, has seen a tightening labor market for specialized technical roles. This trend is driven by increased exploration and production activities coupled with an aging workforce in some areas. For Canacol, this means that retaining and developing its talent pool is not just beneficial but essential for mitigating the upward pressure on labor costs and ensuring continuity of operations. Investing in training and competitive compensation packages becomes a strategic imperative.

Government and regulatory bodies function as critical suppliers for Canacol, providing essential exploration and production licenses, environmental permits, and land access rights. Their decisions on new oil and gas exploration contracts or adjustments to tax structures directly influence Canacol's operational capacity and financial performance.

The Colombian government's recent decision to suspend new exploration licensing rounds in 2024 significantly amplifies the bargaining power of these entities. This move directly impacts Canacol by limiting future growth opportunities and increasing reliance on existing concessions, effectively making the government a more powerful gatekeeper for the industry.

Landowners and Local Communities

The bargaining power of landowners and local communities is a significant factor for energy companies like Canacol. Accessing land for exploration, drilling, and building infrastructure necessitates negotiations with these groups, including private landowners and indigenous communities. Their ability to influence project timelines and costs is substantial.

These stakeholders can wield considerable power. They might engage in protests or blockades, or they could demand increased compensation and more substantial social investments. Such actions have the potential to cause significant delays or even completely halt development projects. In Colombia, where Canacol operates, socio-environmental opposition and escalating levels of violence have been identified as key obstacles for energy operators.

- Land Access Negotiations: Companies must negotiate with private landowners and local communities, including indigenous groups, for crucial land access.

- Community Influence: Protests, blockades, and demands for higher compensation or social investments can significantly impact project timelines and viability.

- Operational Challenges in Colombia: Socio-environmental opposition and rising violence are noted as specific hurdles for operators in the Colombian context.

Infrastructure Providers (Pipelines, Processing)

Canacol's reliance on third-party infrastructure providers, like pipeline and processing companies, grants these entities significant bargaining power. This is particularly true when alternative transportation routes are scarce or when these providers control essential choke points in the supply chain, impacting Canacol's ability to deliver its natural gas and oil efficiently.

The bargaining power of infrastructure providers can lead to higher transportation costs and potentially limit market access if terms are unfavorable. For instance, if a single pipeline is the primary route to a key market, its owner can dictate terms, affecting Canacol's profitability and operational flexibility.

To mitigate this, Canacol has strategically invested in developing its own infrastructure. The Jobo-Medellín natural gas pipeline project is a prime example, designed to directly connect Canacol's production to the vital Medellín market. This vertical integration reduces dependence on external midstream operators and strengthens Canacol's market position.

- Infrastructure Dependence: Canacol's operations are tethered to existing pipelines and processing facilities, giving owners leverage.

- Market Bottlenecks: Control over critical transportation points amplifies the bargaining power of infrastructure providers.

- Strategic Mitigation: Canacol's investment in its own pipeline network, like the Jobo-Medellín line, aims to reduce reliance and enhance market access.

Suppliers of specialized equipment, technical services, and skilled labor hold significant sway over Canacol Energy. The limited availability of highly specialized drilling technology, advanced seismic equipment, and experienced personnel in niche areas means these suppliers can command higher prices and dictate terms. For example, the daily operating cost for advanced drilling rigs can easily exceed $500,000, highlighting the substantial investment required and the suppliers' leverage.

Canacol's operational efficiency and cost structure are directly influenced by these suppliers, especially given the high costs associated with essential inputs like seismic surveys, which can run into millions of dollars. The scarcity of specialized expertise, particularly for deep drilling and reservoir management, further concentrates power in the hands of a few providers.

The Colombian government, by controlling exploration licenses and permits, acts as a powerful supplier. In 2024, the government's decision to halt new exploration licensing rounds significantly boosted its bargaining power, limiting Canacol's future growth avenues and increasing its reliance on existing concessions.

Landowners and local communities also possess considerable bargaining power, influencing project timelines and costs through negotiations for land access. In Colombia, socio-environmental opposition and security concerns, as noted in 2024, can lead to project delays or even halts, amplifying the leverage of these stakeholders.

Third-party infrastructure providers, such as pipeline and processing companies, exert influence, particularly when they control essential transportation routes. Canacol's strategic investment in its own infrastructure, like the Jobo-Medellín pipeline, aims to reduce this dependence and strengthen its market position.

| Supplier Type | Bargaining Power Factor | Impact on Canacol | Example Cost/Data (Approximate) |

|---|---|---|---|

| Specialized Equipment Providers | Niche technology, high capital cost | Higher equipment rental/purchase costs | Drilling Rig: $500,000+/day |

| Technical Service Providers | Scarcity of specialized expertise | Increased service fees, potential delays | Advanced Seismic Survey: Millions of dollars |

| Skilled Labor | Tight labor market, specific knowledge requirements | Higher wage demands, retention challenges | Tightening energy labor market in 2024 |

| Government/Regulators | Control over licenses and permits | Limited exploration opportunities, regulatory compliance costs | Suspension of new licensing rounds in 2024 |

| Landowners/Local Communities | Land access rights, socio-environmental concerns | Project delays, increased compensation demands | Socio-environmental opposition and violence in Colombia |

| Infrastructure Providers | Control of critical transportation routes | Higher transportation fees, limited market access | Dependence on single pipeline routes |

What is included in the product

This analysis dissects the competitive forces impacting Canacol, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the energy sector.

Easily identify and address competitive threats with a visual breakdown of Canacol's market landscape, simplifying complex strategic analysis.

Customers Bargaining Power

Canacol's main clients for natural gas are major industrial businesses and power plants in Colombia. While these sectors represent significant demand, their bargaining power can be considerable, especially if they have access to alternative energy sources or if natural gas is readily available.

However, Colombia is anticipating a natural gas shortage by 2025. This projected deficit is likely to shift the balance, potentially enhancing Canacol's ability to influence pricing and terms with its customers.

Canacol benefits from long-term 'take-or-pay' contracts in the natural gas sector, which offer a degree of sales volume and price certainty. However, the specific clauses within these agreements, such as price adjustments and volume flexibility, significantly influence customer leverage over the contract's duration.

The current scenario of a constrained natural gas supply in Colombia, driving up both gas and electricity costs, generally strengthens the negotiating position of suppliers like Canacol. For instance, in 2023, average natural gas prices in Colombia saw an upward trend, reflecting this tighter market dynamic.

Major energy distributors and the national grid act as crucial intermediaries, buying natural gas from producers like Canacol to supply homes and businesses. This concentrated buying power, coupled with regulatory oversight, can significantly impact the prices Canacol can secure at the wellhead.

While the Colombian energy minister has expressed confidence in avoiding natural gas shortages for 2025, any increased reliance on Liquefied Natural Gas (LNG) imports could push up costs for the ultimate consumers, indirectly affecting negotiations with producers.

Customer Concentration

Customer concentration is a key factor in assessing bargaining power. If Canacol relies heavily on a few large customers, those clients gain significant leverage. The loss of a single major contract could disproportionately affect Canacol's financial performance, as seen in industries where a handful of buyers dominate. For example, if 30% of Canacol's 2024 revenue came from its top five industrial clients, each of those clients would hold considerable sway in price negotiations.

To counter this, a diversified customer base is essential. Securing numerous off-take agreements across various sectors reduces dependence on any single buyer. Canacol's stated mission to supply Colombia's energy needs implies a broad market reach, but it's vital to understand the distribution of this demand. While the overall market may be large, specific large industrial consumers, such as major manufacturing plants or utility providers, could still wield substantial bargaining power if they represent a significant portion of Canacol's sales volume.

- Customer Concentration Risk: High reliance on a few major clients amplifies their bargaining power.

- Revenue Impact: Losing even one significant customer can severely impact Canacol's revenue streams.

- Mitigation Strategy: Diversifying the customer base through multiple off-take agreements is crucial.

- Market Dynamics: While serving Colombia's broad energy demand, specific large industrial clients may hold disproportionate influence.

Substitution Threat for Customers

The availability and cost-effectiveness of substitute energy sources significantly empower customers to switch away from Canacol's natural gas. Hydropower, renewables, and imported Liquefied Natural Gas (LNG) all present viable alternatives. For instance, Colombia's energy matrix showed a substantial contribution from hydropower in 2023, accounting for over 60% of electricity generation, providing a readily available alternative for power users.

While natural gas is considered a cleaner fuel compared to oil, the accelerating growth of renewable energy in Colombia presents a notable long-term threat to demand. Solar and wind power installations have seen considerable expansion. By the end of 2023, Colombia's installed renewable energy capacity, excluding large hydro, had reached over 2,000 MW, a figure expected to grow substantially in the coming years, potentially diverting demand from natural gas.

- Substitution Threat: Customers can switch to alternative energy sources like hydropower, renewables, or imported LNG.

- Cost-Effectiveness: The price competitiveness of these substitutes directly impacts customer loyalty to natural gas.

- Renewable Growth: Colombia's increasing investment in solar and wind power offers a cleaner, long-term alternative to natural gas.

- Market Dynamics: The expanding renewable sector in Colombia, with over 2,000 MW of non-hydro capacity by end-2023, signifies a shift in energy preferences.

Canacol's customers, primarily large industrial users and power plants, possess significant bargaining power, especially when alternative energy sources are readily available and cost-effective. Colombia's projected natural gas shortage by 2025, however, is expected to bolster Canacol's pricing leverage, as evidenced by the upward trend in natural gas prices observed in 2023.

Customer concentration poses a risk; if a few major clients account for a substantial portion of Canacol's 2024 revenue, their negotiating power increases. For instance, if the top five industrial clients represented 30% of revenue, they would wield considerable influence.

The availability of substitutes like hydropower, which supplied over 60% of Colombia's electricity in 2023, and the rapid growth of renewables (over 2,000 MW non-hydro capacity by end-2023) empower customers to switch, potentially impacting demand for natural gas.

| Factor | Impact on Customer Bargaining Power | Canacol's Position |

|---|---|---|

| Alternative Energy Availability | High (e.g., Hydropower >60% of 2023 generation) | Weakens leverage, but gas is often preferred for industrial processes. |

| Projected Gas Shortage (2025) | Lowers leverage for customers, increases for suppliers. | Strengthens Canacol's pricing power. |

| Customer Concentration | High for large clients (e.g., if top 5 clients are 30% of 2024 revenue) | Risk of significant impact from losing a major client. |

| Renewable Energy Growth | Increases long-term substitution threat (e.g., >2,000 MW non-hydro by end-2023) | Requires strategic adaptation to evolving energy landscape. |

Full Version Awaits

Canacol Porter's Five Forces Analysis

This preview showcases the complete Canacol Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the company's operating environment. The document you see here is precisely what you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning. You are looking at the actual, professionally formatted analysis, providing immediate value and actionable insights upon completion of your transaction.

Rivalry Among Competitors

The Colombian oil and gas sector is a crowded field, featuring state-owned giants like Ecopetrol alongside international oil companies and numerous independent exploration and production firms. This broad spectrum of players creates a dynamic and often intense competitive environment.

Canacol, a key player in Colombia's natural gas market, faces significant rivalry. For instance, Ecopetrol, the national oil company, remains a dominant force. In 2023, Ecopetrol reported a net income of approximately COP 17.9 trillion (around $4.5 billion USD), highlighting its substantial market presence and resources.

Beyond Ecopetrol, other companies are actively growing their footprint. NG Energy, for example, has been focused on expanding its natural gas production in Colombia, aiming to capture a larger share of the domestic market. This ongoing expansion by various independent producers further intensifies the competition for reserves and market access.

Competition for exploration blocks and proven reserves is intense, particularly given the Colombian government's temporary halt on new licensing rounds. This scarcity elevates the importance and competition for existing concessions, forcing companies like Canacol to actively bid and develop current assets to sustain or expand their reserve base.

The National Hydrocarbons Agency (ANH) is strategically reassigning lower-producing assets to smaller and medium-sized companies. This move is poised to introduce new competitive dynamics into the market, as these entities seek to capitalize on these opportunities and grow their portfolios.

Competition over pricing for natural gas and oil can be intense, particularly when supply outstrips demand or global commodity prices are depressed. Canacol's success in maintaining strong operating netbacks hinges on its cost management and securing advantageous contract terms in this competitive landscape.

Recent data from Colombia's energy sector in 2024 highlights a tightening of the natural gas supply, leading to increased prices. This shift could significantly benefit Canacol by potentially alleviating some of the pricing pressure it faces, allowing for more favorable revenue generation.

Technological Advancements and Efficiency

Companies that invest in advanced drilling techniques, enhanced oil recovery (EOR), and operational efficiencies gain a significant competitive edge in the energy sector. These technological investments directly translate to lower production costs and higher output volumes, making them formidable rivals.

Rivals adopting new technologies to reduce costs or increase output can put considerable pressure on Canacol to innovate and maintain its competitive position. This necessitates continuous evaluation and adoption of cutting-edge solutions to avoid falling behind.

Canacol has actively pursued drilling efficiencies and cost-reduction initiatives. For instance, in its 2024 financial reporting, the company highlighted improvements in its drilling cycle times and a focus on optimizing operational expenditures across its asset base.

- Technological Investment: Companies adopting advanced drilling and EOR methods gain a cost and output advantage.

- Competitive Pressure: Rivals leveraging new tech to lower costs or boost production challenge Canacol's market standing.

- Canacol's Initiatives: Canacol reported drilling efficiencies and cost-reduction efforts in its 2024 financials.

Regulatory and Political Landscape

The competitive rivalry within Colombia's energy sector is intensely influenced by the regulatory and political landscape. The Colombian government's energy policies, particularly its stance on fossil fuels versus renewables and evolving tax regulations, directly shape how companies compete. For instance, the current administration's decision to halt new oil and gas exploration licenses, announced in late 2023 and continuing into 2024, introduces significant uncertainty and forces a redefinition of competitive strategies for all sector participants.

This shift towards an energy transition, with a stated emphasis on renewables, alters the playing field. Companies heavily invested in traditional oil and gas may face increased operational challenges and a need to diversify. Conversely, those agile enough to adapt to renewable energy mandates and the associated regulatory frameworks could find new avenues for growth. The government's approach to taxation on existing operations versus incentives for new green energy projects is a critical factor influencing investment decisions and, consequently, competitive intensity.

- Government Stance on Fossil Fuels: Colombia's policy to halt new oil and gas exploration licenses impacts established players and new entrants.

- Energy Transition Focus: Increased government support and regulatory frameworks for renewable energy sources are reshaping competitive dynamics.

- Taxation Policies: Changes in tax regulations for both fossil fuel extraction and renewable energy projects directly influence profitability and competitive advantage.

- Regulatory Uncertainty: The evolving political climate and policy shifts create an environment where strategic adaptation is paramount for survival and success.

Competitive rivalry in Colombia's energy sector is marked by the presence of large state-owned entities like Ecopetrol, alongside numerous international and independent producers. This diverse group intensifies competition for resources and market share.

Canacol faces direct competition from players like Ecopetrol, which reported substantial net income in 2023, and expanding independent producers such as NG Energy. The temporary halt on new licensing rounds by the government in 2023-2024 further heightens competition for existing concessions and reserves.

The market is also influenced by the government's strategy to reassign lower-producing assets, potentially introducing new competitive dynamics from smaller and medium-sized companies. Intense pricing competition, especially during periods of oversupply, requires Canacol to focus on cost management and favorable contract terms.

Technological advancements in drilling and production efficiency offer significant competitive advantages, pushing companies like Canacol to continuously innovate. In 2024, Canacol reported improvements in drilling cycle times and operational cost optimization, demonstrating its efforts to maintain a competitive edge.

| Competitor Type | Key Players | 2023 Financial Highlight (Example) | Competitive Factor |

|---|---|---|---|

| State-Owned | Ecopetrol | Net Income: COP 17.9 trillion (approx. $4.5 billion USD) | Market Dominance, Resource Access |

| International/Independent | NG Energy | Focus on production expansion | Market Share Growth, Reserve Acquisition |

| Emerging/Reassigned Assets | Various smaller/medium firms | N/A (Emerging) | New Market Dynamics, Niche Opportunities |

SSubstitutes Threaten

The most significant threat of substitutes for natural gas, particularly in electricity generation, comes from non-conventional renewable energy (NCRE) sources such as solar and wind power. Colombia has been actively promoting NCRE, with substantial installed capacity additions expected in 2024. This trend is projected to continue, with further growth anticipated through 2025 and beyond, directly impacting the demand for natural gas in the power sector.

Colombia's electricity grid heavily relies on hydropower, which historically accounts for the majority of its power generation. In 2024, hydropower continued to be the primary source, though its dominance faces potential challenges from other energy sources. This reliance means that fluctuations in rainfall significantly impact energy availability.

While natural gas serves as a critical buffer during periods of low hydropower output, such as dry seasons, any expansion of hydropower capacity or improved rainfall patterns could diminish the need for gas-fired power plants. Although the pace of new hydropower projects has slowed, these facilities remain essential for providing flexible power during peak demand periods.

For industrial and power generation, coal is a substitute for natural gas, though it's often less desirable due to higher emissions. In 2023, global coal consumption for power generation was around 8,000 TWh, a significant amount, highlighting its persistent role.

However, government initiatives to phase out hydrocarbons and reduce fossil fuel reliance aim to diminish coal's threat. Despite this, coal's established infrastructure and availability mean it remains a viable, albeit environmentally less favorable, substitute for natural gas.

Energy Efficiency and Conservation

Improvements in energy efficiency across industrial, commercial, and residential sectors can reduce overall demand for natural gas, acting as a significant substitute. For instance, advancements in building insulation and more efficient appliances directly lower the need for gas heating. In 2024, many countries continued to push for greater energy efficiency, with targets for reducing energy consumption in new constructions and retrofits, impacting the total addressable market for natural gas.

Government policies promoting energy conservation and efficiency could impact Canacol's long-term sales volumes. These policies often include incentives for adopting renewable energy sources or mandating stricter energy performance standards. This aligns with broader energy transition goals in Colombia, where the government has expressed a commitment to diversifying its energy mix and reducing reliance on fossil fuels, potentially affecting future demand for natural gas.

- Reduced Demand: Enhanced energy efficiency directly curtails the need for natural gas in heating and industrial processes.

- Policy Influence: Government mandates and incentives for conservation can accelerate the adoption of alternatives.

- Energy Transition Alignment: Colombia's focus on a broader energy transition creates a favorable environment for substitutes to gain traction.

- Market Impact: Increased efficiency can lead to a softer, yet persistent, erosion of market share for natural gas providers like Canacol.

Liquefied Petroleum Gas (LPG) and Biofuels

Liquefied Petroleum Gas (LPG) and biofuels present a threat of substitutes for natural gas, particularly in residential, commercial, and transportation sectors. While their adoption for large-scale industrial applications or power generation is less prevalent, their availability offers customers alternative energy sources, especially in regions lacking natural gas infrastructure. For example, in 2024, Colombia's increasing reliance on imported gas, including Liquefied Natural Gas (LNG), could influence pricing dynamics and the competitive environment, potentially making these substitutes more attractive in specific market segments.

The threat of substitutes is amplified by the growing availability and improving efficiency of LPG and biofuels. These alternatives can directly compete with natural gas for heating, cooking, and vehicle fuel. In 2024, the global push towards energy diversification and reduced carbon emissions further supports the development and adoption of these substitute fuels, creating a more competitive landscape for natural gas providers.

- LPG and Biofuels as Alternatives: These fuels can replace natural gas in residential, commercial, and transportation uses.

- Limited Industrial Use: While not dominant in large-scale industrial or power generation, they offer customer choice.

- Colombian Market Context: Colombia's growing dependence on gas imports, including LNG, in 2024 impacts pricing and competition.

- Energy Diversification Trends: Global efforts to diversify energy sources and lower carbon footprints bolster the viability of substitutes.

The most significant threat of substitutes for natural gas, particularly in electricity generation, comes from non-conventional renewable energy (NCRE) sources such as solar and wind power. Colombia has been actively promoting NCRE, with substantial installed capacity additions expected in 2024. This trend is projected to continue, with further growth anticipated through 2025 and beyond, directly impacting the demand for natural gas in the power sector.

Improvements in energy efficiency across industrial, commercial, and residential sectors can reduce overall demand for natural gas, acting as a significant substitute. For instance, advancements in building insulation and more efficient appliances directly lower the need for gas heating. In 2024, many countries continued to push for greater energy efficiency, with targets for reducing energy consumption in new constructions and retrofits, impacting the total addressable market for natural gas.

Liquefied Petroleum Gas (LPG) and biofuels present a threat of substitutes for natural gas, particularly in residential, commercial, and transportation sectors. While their adoption for large-scale industrial applications or power generation is less prevalent, their availability offers customers alternative energy sources, especially in regions lacking natural gas infrastructure. In 2024, Colombia's increasing reliance on imported gas, including Liquefied Natural Gas (LNG), could influence pricing dynamics and the competitive environment, potentially making these substitutes more attractive in specific market segments.

Entrants Threaten

Entering the oil and natural gas exploration and production sector, like the one Canacol operates in, demands substantial upfront capital. This includes massive investments for exploration activities, drilling operations, and the construction of essential infrastructure and production facilities. These significant financial requirements act as a substantial deterrent for potential new entrants, particularly for large-scale projects that are typical in this industry.

The sheer scale of investment needed creates a formidable barrier. For instance, crude oil and natural gas investments in Colombia are anticipated to reach $4.68 billion in 2025, underscoring the immense capital commitment required to even begin operations. This high capital threshold effectively limits the number of new companies that can realistically challenge established players like Canacol.

The oil and gas sector faces significant regulatory complexity, demanding extensive permits, licenses, and environmental clearances. These processes are notoriously time-consuming and susceptible to shifts in government policy, creating a substantial barrier for any new companies looking to enter the market.

Colombia's recent decision to pause new oil and gas exploration licensing directly amplifies this threat. This governmental action effectively closes the door for new entrants seeking to establish a foothold, particularly in exploration activities, thereby protecting existing players like Canacol.

The energy sector, particularly exploration and production (E&P), presents a significant barrier to entry due to the immense need for specialized technical expertise. Companies require deep knowledge in geology, geophysics, drilling, and reservoir engineering. For instance, in 2024, the global oil and gas industry continued to face a shortage of skilled professionals, with many experienced engineers nearing retirement, making it harder for newcomers to acquire necessary talent.

Beyond human capital, substantial investment in infrastructure is critical. New entrants must either build or secure access to extensive pipeline networks and processing facilities, a capital-intensive undertaking. Canacol Energy, operating in Colombia's Lower Magdalena Basin, benefits from its established infrastructure, which includes a significant natural gas pipeline network, facilitating efficient delivery of its production and posing a challenge for any potential new competitor looking to replicate this advantage.

Access to Existing Distribution Networks and Market Relationships

New entrants into the natural gas market face a significant hurdle in gaining access to established distribution networks and vital market relationships. Existing infrastructure, such as natural gas pipelines, is often controlled by incumbent companies or government-backed entities, making it difficult for newcomers to secure the necessary capacity. Canacol Energy, for instance, has strategically focused on securing and developing its own pipeline infrastructure, as evidenced by its ongoing projects to enhance market access and transportation capabilities. This proactive approach mitigates the threat of new entrants by consolidating control over essential distribution channels.

The challenge extends beyond physical infrastructure; building relationships with major industrial consumers and power generation facilities requires substantial time, capital, and a proven track record. These customers often prioritize reliability and established supply chains, which new entrants may struggle to demonstrate initially. Canacol's existing customer base and long-term contracts provide a competitive advantage, making it harder for new players to displace them.

- Established Pipeline Infrastructure: New entrants must overcome the significant capital expenditure and regulatory hurdles associated with building new pipeline infrastructure or securing capacity on existing networks, which are often dominated by established players.

- Customer Relationships: Developing strong, long-term relationships with major industrial and power generation customers is crucial and time-consuming, as these clients value reliability and proven supply chains.

- Canacol's Strategic Advantage: Canacol's ongoing investment in new pipeline construction and its existing customer contracts serve to fortify its market position, thereby increasing the barriers to entry for potential competitors.

Geopolitical and Social Risks

The threat of new entrants in Colombia's energy sector, particularly for companies like Canacol, is significantly influenced by geopolitical and social risks. New players must contend with the inherent complexities of operating in a region marked by security concerns and potential political instability, factors that can directly impact project timelines and profitability. For instance, reports from 2024 highlighted ongoing security challenges in certain operational areas, which can deter investment and increase the cost of doing business for any new participant.

Incumbent firms such as Canacol have cultivated deep-rooted relationships with local communities and government bodies over time, providing a critical buffer against socio-environmental opposition and potential disruptions. New entrants often lack this established trust and operational experience, making them more vulnerable to community grievances or protests that have, in some instances, led to project delays or increased operating expenses for energy companies in the region. The evolving social landscape and reported increases in localized violence in 2024 underscore the significant barriers to entry that require substantial local knowledge and robust risk mitigation strategies.

- Geopolitical Volatility: Operating in Colombia presents inherent risks due to its complex political climate, which can affect regulatory stability and operational security.

- Community Relations: Building and maintaining positive relationships with local communities is crucial, as opposition can lead to significant project delays and increased costs.

- Security Challenges: Rising levels of violence in certain regions pose a direct threat to personnel and infrastructure, demanding substantial investment in security measures.

- Regulatory Uncertainty: Changes in government policy or regulatory frameworks can impact the profitability and feasibility of new energy projects.

The threat of new entrants into Colombia's natural gas sector remains moderate due to substantial capital requirements and regulatory hurdles. While the market offers attractive opportunities, the immense upfront investment needed for exploration, infrastructure development, and securing permits acts as a significant deterrent. For instance, the projected $4.68 billion investment in Colombian oil and gas for 2025 highlights the scale of capital involved.

Furthermore, the sector demands specialized technical expertise, a resource that new companies may struggle to acquire quickly, especially given the 2024 global shortage of skilled oil and gas professionals. Canacol's established infrastructure, including its extensive pipeline network, and its strong customer relationships with industrial users and power generators create additional barriers, making it difficult for newcomers to compete effectively on cost and reliability.

| Barrier Type | Description | Impact on New Entrants | Canacol's Advantage |

|---|---|---|---|

| Capital Requirements | High upfront investment for exploration, drilling, and infrastructure. | Significant deterrent for smaller or less-funded entities. | Established financial backing and operational scale. |

| Technical Expertise | Need for specialized geological, engineering, and operational knowledge. | Difficulty in acquiring and retaining skilled personnel. | Experienced workforce and proven operational track record. |

| Infrastructure Access | Securing access to or building pipeline and processing facilities. | Costly and time-consuming to establish necessary logistics. | Existing, extensive pipeline network in key basins. |

| Customer Relationships | Building trust and long-term contracts with major consumers. | New entrants lack proven reliability and established supply chains. | Strong existing customer base and long-term agreements. |

Porter's Five Forces Analysis Data Sources

Our Canacol Porter's Five Forces analysis leverages data from the company's annual reports and investor presentations, alongside industry-specific publications and energy market intelligence reports.