Canacol PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canacol Bundle

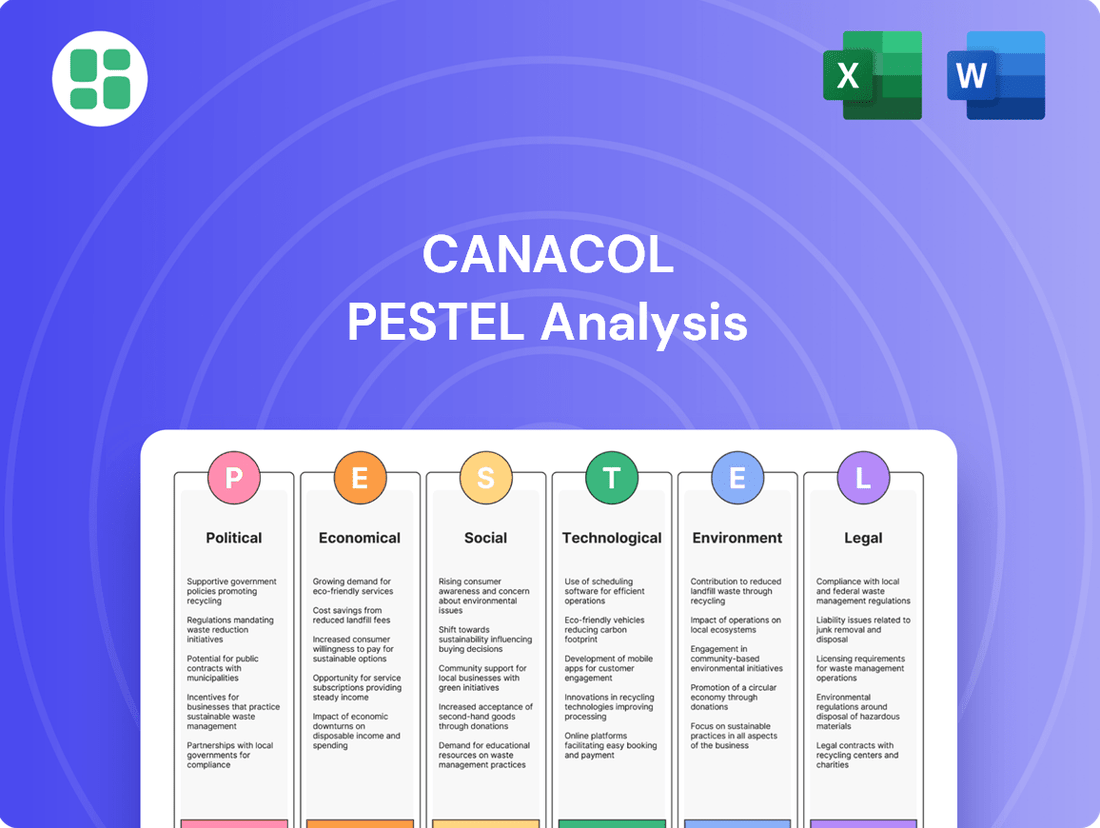

Unlock the critical external factors shaping Canacol's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces impacting their operations and growth potential. Arm yourself with actionable intelligence to make informed strategic decisions and gain a competitive advantage. Download the full PESTLE analysis now and navigate the complexities of the energy sector with confidence.

Political factors

President Gustavo Petro's administration in Colombia has signaled a significant shift in energy policy, aiming to move away from fossil fuels. This includes a moratorium on new oil and gas exploration contracts, a move that directly impacts the long-term outlook for companies like Canacol, which operates in the natural gas sector.

The government's focus is on a 'Just Energy Transition,' prioritizing renewable energy sources such as solar and wind power. While this presents opportunities for diversification, it also introduces uncertainty for existing natural gas producers. For instance, as of early 2024, Colombia's energy matrix still heavily relies on fossil fuels, but the policy direction suggests a gradual phasing out of new exploration, potentially impacting future supply.

Colombia's regulatory environment for the oil and gas sector, while aiming for stability, has seen shifts that can impact investment. For Canacol, understanding the consistency of these regulations is key to forecasting project viability and attracting foreign capital. The government's commitment to energy transition policies, for instance, could introduce new compliance requirements or incentives that alter the operational landscape.

Security concerns, including strikes and blockades, significantly impact Colombia's oil and gas sector. These disruptions can halt production, damage infrastructure, and lead to substantial cost overruns, directly affecting companies like Canacol. For instance, the 2023 protests saw disruptions that temporarily impacted various energy operations across the country.

Attacks on energy infrastructure, such as pipelines, pose a constant threat, increasing operational risks for Canacol. These incidents not only lead to immediate production losses but also necessitate costly repairs and enhanced security measures. The reliability of supply is paramount in the energy industry, and such security issues directly challenge this critical factor.

International Relations and Trade Agreements

Colombia's international trade relations significantly impact Canacol, especially concerning energy exports and imports. For instance, the country's involvement in regional energy integration initiatives, such as those with Ecuador and Venezuela, could bolster demand for natural gas, a key product for Canacol. As of early 2024, Colombia continues to explore avenues for increased energy cooperation within Latin America, aiming to stabilize regional energy markets and potentially expand export opportunities.

Shifts in energy diplomacy, like strengthening ties with neighboring countries or diversifying trade partners, can directly influence Canacol's access to markets and the stability of its supply chains. These diplomatic efforts are crucial for securing long-term contracts and navigating the complexities of cross-border energy trade, which remains a vital component of Canacol's operational strategy.

- Trade Agreements: Colombia's participation in free trade agreements can reduce tariffs and improve market access for energy products, potentially benefiting Canacol's export revenues.

- Regional Energy Integration: Initiatives aimed at creating a more integrated Latin American energy market could lead to increased cross-border gas pipeline development and enhanced demand for Colombian natural gas.

- Energy Diplomacy: Proactive engagement in international energy forums and bilateral discussions can secure favorable terms for energy trade and investment, supporting Canacol's growth.

Political Risk and Nationalization Concerns

Colombia's political landscape presents a degree of risk for foreign investors, including energy companies like Canacol. While outright nationalization of private assets remains a low probability for established players with significant local investment, the possibility of contract renegotiations or increased regulatory scrutiny due to shifts in government policy can impact investor confidence and long-term strategic planning. This general political uncertainty, even if not directly targeting Canacol's operations, can influence the cost of capital and the perceived stability of the operating environment.

Investor sentiment in 2024 and early 2025 is particularly sensitive to any perceived instability. For instance, changes in commodity pricing policies or environmental regulations, driven by political agendas, could indirectly affect Canacol's profitability and growth prospects. The government's commitment to upholding existing contracts and providing a stable regulatory framework remains a key consideration for stakeholders evaluating the Colombian market.

- Political Stability: While Colombia has made strides in improving its political stability, ongoing social and political dialogues can introduce uncertainty.

- Regulatory Environment: Changes in energy policy, taxation, or environmental regulations are potential political risks that could affect Canacol's operational costs and revenue streams.

- Contract Renegotiation: Although unlikely for existing, well-established contracts, the possibility of government-initiated renegotiations of terms or royalties exists and can impact investor outlook.

- Investor Confidence: Perceptions of political risk, even if not directly impacting Canacol, can influence foreign direct investment flows into the energy sector, affecting overall market sentiment.

President Petro's administration is actively pursuing an energy transition, signaling a move away from fossil fuels with a moratorium on new oil and gas exploration. This policy shift directly impacts companies like Canacol, which are central to Colombia's natural gas supply. The government's focus on renewables, while creating new avenues, introduces considerable uncertainty for existing fossil fuel producers.

The regulatory landscape in Colombia is evolving, with potential impacts on investment due to the energy transition. Canacol must navigate these changes, as new compliance requirements or incentives could alter its operational framework. Investor sentiment in 2024-2025 remains sensitive to perceived instability, with policy shifts on commodities or environmental regulations potentially affecting profitability.

Security remains a significant concern, with strikes and infrastructure attacks posing risks to production and causing cost overruns. For example, protests in 2023 led to temporary disruptions in energy operations. International trade relations, particularly regional energy integration, could bolster demand for natural gas, benefiting Canacol's export potential.

| Political Factor | Impact on Canacol | Data/Context (2024-2025) |

|---|---|---|

| Energy Policy Shift | Reduced exploration opportunities, focus on renewables | Moratorium on new oil/gas exploration contracts; continued push for solar/wind development. |

| Regulatory Environment | Potential for new compliance, altered operational landscape | Ongoing review of energy sector regulations; sensitivity to policy changes affecting profitability. |

| Political Stability & Investor Confidence | Perception of risk, potential impact on capital cost | Sensitivity to social dialogues and policy shifts; need for stable regulatory framework to attract FDI. |

| Security Concerns | Risk of production halts, infrastructure damage, cost increases | Past disruptions from protests (e.g., 2023); ongoing threats from infrastructure attacks. |

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting Canacol, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions, to identify strategic opportunities and threats.

A concise, actionable summary of Canacol's PESTLE factors, enabling swift identification of external opportunities and threats to inform strategic decision-making.

Economic factors

Global energy prices, particularly for oil and natural gas, directly impact Canacol's revenue streams. Fluctuations in these international benchmarks, influenced by geopolitical events and global demand, can significantly alter the profitability of its export-oriented sales and the valuation of its reserves.

Domestically, Colombian natural gas prices are a critical factor. With increasing industrial and residential demand, and potential supply constraints, prices in Colombia have shown upward pressure. For instance, the average price of natural gas in Colombia saw a notable increase through 2024, impacting Canacol's netback on domestic sales and its competitive standing against alternative energy sources.

Colombia's economic health directly influences domestic natural gas demand for Canacol. Robust GDP growth, projected at 2.9% for 2024 by the IMF, typically translates to increased industrial output, higher residential energy consumption, and greater electricity generation needs, all of which are key drivers for natural gas consumption.

Factors such as manufacturing activity, commercial operations, and the residential sector's reliance on gas for cooking and heating significantly shape the market for Canacol's natural gas. Economic downturns, conversely, can lead to reduced industrial production and lower overall energy demand, negatively impacting sales volumes.

For instance, a sustained economic expansion in 2024-2025 would likely see a surge in demand from the power sector, which relies heavily on natural gas for generation, especially during dry periods. Conversely, an economic contraction could dampen this demand, as businesses scale back operations and consumers reduce discretionary spending.

Inflation in Colombia, while showing some moderation, remained a key concern for Canacol in 2024. For instance, while the annual inflation rate eased from its peaks, it still hovered above the central bank's target for much of the year, directly impacting operational costs for fuel, materials, and labor. This persistent inflationary pressure necessitates careful cost management and potentially adjustments to pricing strategies.

The volatility of the Colombian Peso (COP) against the US Dollar (USD) significantly influences Canacol's financial performance. As a company with substantial USD-denominated debt and capital expenditures, a weaker COP directly translates to higher costs when converting dollars to pesos for these obligations. For example, if the COP depreciates by 5% against the USD, Canacol's debt servicing costs and the peso equivalent of its capital investments will increase proportionally, impacting profitability and potentially its debt-to-equity ratios.

Currency fluctuations also affect Canacol's financial reporting, particularly in how revenue generated in pesos is translated into USD for consolidated statements. A depreciating COP can reduce the reported USD value of peso-denominated earnings, creating a perception of lower financial performance even if operational metrics remain stable. This makes managing foreign exchange exposure a critical element of Canacol's financial strategy.

Foreign Investment and Capital Availability

Foreign direct investment (FDI) in Colombia's energy sector is a critical driver for companies like Canacol. Recent trends show a cautious but growing interest, influenced by government efforts to stabilize the regulatory environment and attract foreign capital. For instance, as of late 2024, Colombia has been actively promoting new oil and gas exploration rounds, aiming to boost production and attract substantial investment, potentially benefiting gas producers like Canacol.

The availability of capital, both from international financial markets and local institutions, directly impacts Canacol's capacity to finance its ambitious exploration, development, and expansion plans. In 2024, global energy markets experienced volatility, yet demand for natural gas remained robust, signaling continued access to funding for well-positioned projects. Canacol's ability to secure financing for its significant natural gas projects in the La Guajira region is thus closely tied to investor confidence and the broader capital markets' appetite for energy infrastructure.

- FDI Trends: Colombia's government has been implementing policies to attract FDI into the energy sector, with a focus on natural gas exploration and production, aiming to enhance energy security and diversify supply.

- Capital Availability: Access to both international debt and equity markets, as well as local credit facilities, is crucial for Canacol's project financing needs, particularly for large-scale development and infrastructure projects.

- Market Confidence: Investor sentiment towards Colombia's energy sector in 2024-2025 will be influenced by political stability, regulatory clarity, and the company's proven track record in delivering projects on time and within budget.

- Financing Growth: Canacol's expansion plans are contingent on its ability to secure adequate capital, with a strong emphasis on securing long-term financing to support its ongoing and future natural gas production and infrastructure development.

Supply and Demand Dynamics in Colombia

Colombia is facing a significant natural gas deficit, projected to begin in 2025. This imbalance between supply and demand is expected to intensify, creating a more favorable market for producers like Canacol Energy. As national production dwindles, demand is anticipated to outstrip available supply, potentially driving up prices for gas that Canacol can deliver.

This tightening market presents a strong opportunity for Canacol to capitalize on higher realized prices for its gas production. The anticipated deficit, estimated to reach 100 million cubic feet per day (MMcf/d) by 2027, underscores the urgency for new supply sources. Canacol's position as a key domestic producer becomes increasingly valuable in this environment.

- Anticipated Gas Deficit: Colombia's natural gas demand is projected to exceed domestic supply starting in 2025.

- Market Opportunity: The deficit creates a seller's market, potentially leading to higher prices for Canacol's production.

- National Production Decline: Overall natural gas production in Colombia has been on a downward trend, exacerbating the supply-demand gap.

- Canacol's Role: As a significant producer, Canacol is well-positioned to meet this growing demand.

Colombia's economic growth directly fuels Canacol's domestic sales. A robust GDP, with the IMF projecting 2.9% growth for 2024, translates to increased industrial activity and higher energy consumption, benefiting gas demand. Conversely, economic slowdowns would temper this demand, impacting sales volumes.

Inflationary pressures in Colombia, while easing in 2024, continued to affect Canacol's operational costs. Higher inflation means increased expenses for materials, fuel, and labor, necessitating careful financial management and potential price adjustments.

The Colombian Peso's volatility against the US Dollar significantly impacts Canacol. A weaker COP increases the cost of USD-denominated debt and capital expenditures, directly affecting profitability and financial ratios.

Colombia faces a projected natural gas deficit starting in 2025, a critical factor for Canacol. This supply-demand imbalance is expected to drive up domestic gas prices, creating a more favorable market for producers like Canacol, who are positioned to meet this growing need.

| Economic Factor | Impact on Canacol | 2024/2025 Data/Trend |

|---|---|---|

| GDP Growth | Drives domestic demand | IMF projects 2.9% for 2024 |

| Inflation | Increases operational costs | Moderating but remains a concern in 2024 |

| Currency (COP/USD) | Affects debt servicing and CAPEX | Volatile, with depreciation increasing costs |

| Natural Gas Supply/Demand | Influences pricing and market position | Projected deficit from 2025, favoring producers |

What You See Is What You Get

Canacol PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Canacol details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It offers actionable insights for strategic planning.

Sociological factors

Canacol's operations in Colombia's Lower Magdalena Basin are heavily reliant on maintaining strong community relations, often referred to as a social license to operate. This is crucial because local support directly influences project timelines and operational continuity. In 2024, the company continued to invest in community development programs, aiming to foster trust and mutual benefit, which is essential for navigating potential disruptions.

Failure to secure and maintain this social license can lead to significant project delays and increased costs, as seen in similar resource extraction projects globally. Canacol's proactive engagement strategies are designed to mitigate these risks, ensuring smoother operations and demonstrating commitment to the well-being of the communities where it operates.

Canacol Energy plays a significant role in bolstering local employment across its operational areas, particularly in Colombia. In 2024, the company reported employing approximately 1,200 individuals directly, with a substantial portion of these being local hires, underscoring its commitment to community development.

Beyond direct job creation, Canacol's operations generate considerable indirect employment through its local procurement policies. By prioritizing local suppliers and contractors for goods and services, the company stimulates broader economic activity and supports small and medium-sized enterprises within its host communities.

Furthermore, Canacol actively invests in social projects designed to enhance the quality of life and foster sustainable development. Initiatives often focus on improving infrastructure, supporting educational programs, and promoting environmental stewardship, demonstrating a holistic approach to its societal impact.

Public perception of fossil fuels is shifting significantly, with growing concerns about climate change influencing attitudes towards the oil and natural gas industry, both globally and within Colombia. This evolving sentiment directly impacts the energy transition narrative, pushing for cleaner alternatives.

This changing perception can lead to stricter environmental regulations and increased scrutiny on hydrocarbon exploration and production. For instance, by early 2025, many international financial institutions are expected to have updated their ESG (Environmental, Social, and Governance) policies, potentially limiting investment in new fossil fuel projects.

Investor sentiment is increasingly tied to sustainability, meaning companies perceived as lagging in environmental responsibility may face higher capital costs or divestment. In Colombia, this could translate to greater pressure on companies like Canacol to demonstrate their commitment to lower-emission operations and potentially invest in carbon capture technologies or renewable energy integration.

Indigenous Rights and Consultations

Respecting indigenous rights and conducting thorough prior consultations are critical for projects like those Canacol undertakes, especially in regions with significant indigenous populations. Failure to do so can lead to project delays, legal challenges, and reputational damage. For instance, in Latin America, where Canacol operates, many countries have laws mandating consultation with indigenous communities before development projects commence on their ancestral lands.

Canacol's ability to access land and secure project approvals is directly tied to its adherence to these legal and ethical obligations. These consultations influence not only initial land access but also ongoing operational activities, potentially impacting timelines and costs. For example, in 2024, several energy projects across South America faced significant delays due to disputes over consultation processes with local indigenous groups, highlighting the financial and operational risks involved.

Key considerations for Canacol regarding indigenous rights and consultations include:

- Legal Compliance: Ensuring all activities align with national and international laws regarding indigenous peoples' rights, such as Free, Prior, and Informed Consent (FPIC).

- Community Engagement: Establishing transparent and respectful dialogue channels with indigenous communities to build trust and address concerns proactively.

- Benefit Sharing: Developing frameworks for sharing project benefits equitably with affected communities, fostering shared value and long-term sustainability.

- Environmental and Cultural Protection: Implementing measures to mitigate project impacts on indigenous territories, including sacred sites and traditional livelihoods, as mandated by consultation outcomes.

Health, Safety, and Quality of Life

Canacol Energy places a strong emphasis on the health and safety of its workforce and the communities where it operates. This commitment is reflected in its robust safety protocols and training programs, aiming to achieve zero harm. For instance, in 2023, the company reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.34, indicating a low incidence of workplace injuries.

Beyond operational safety, Canacol actively contributes to the quality of life in its host regions through various social initiatives. These often focus on community development, education, and environmental stewardship. The company's emergency preparedness plans are also a crucial aspect, ensuring swift and effective responses to any potential incidents, thereby safeguarding both personnel and local populations.

- Employee Safety: Canacol's safety performance in 2023 saw a TRIFR of 0.34, demonstrating a commitment to minimizing workplace accidents.

- Community Well-being: The company engages in social programs designed to enhance the quality of life in its operational areas, fostering positive community relations.

- Emergency Preparedness: Robust plans are in place to manage and mitigate the impact of any potential operational emergencies on employees and local residents.

Canacol's social license to operate is paramount, especially in Colombia's Lower Magdalena Basin, where community relations directly impact project continuity. The company's 2024 investments in community development programs aim to build trust and ensure smoother operations, mitigating risks associated with local sentiment.

The company's commitment to local economic development is evident in its employment figures, with approximately 1,200 direct employees in 2024, many of whom are local hires. This focus on local procurement further stimulates economic activity, supporting small and medium-sized enterprises within its host communities.

Public perception of fossil fuels is evolving due to climate change concerns, influencing investor sentiment and potentially leading to stricter regulations by early 2025. Canacol's proactive approach to sustainability and community engagement is crucial for navigating these shifting societal expectations and maintaining investor confidence.

Respecting indigenous rights and conducting thorough consultations are critical legal and ethical obligations for Canacol, directly affecting land access and project approvals. In 2024, delays in similar South American energy projects due to consultation disputes underscore the financial and operational risks involved.

Technological factors

Canacol Energy leverages cutting-edge technologies for its exploration and production activities. Innovations like advanced seismic imaging allow for more precise subsurface mapping, identifying potential hydrocarbon reserves with greater accuracy.

The company utilizes horizontal drilling and hydraulic fracturing techniques to access reserves in challenging geological formations, significantly boosting production efficiency. For instance, in the Llanos Basin, these methods have been instrumental in unlocking previously uneconomical reserves.

Furthermore, Canacol explores enhanced oil recovery (EOR) methods to maximize hydrocarbon extraction from mature fields, contributing to cost reduction and increased recovery rates. This focus on technological advancement directly supports their goal of efficient and profitable resource development.

Technological advancements in gas processing are crucial for Canacol. Innovations in liquefaction, like modular LNG facilities, and advanced membrane separation technologies allow for more efficient purification and transport of natural gas, even from challenging fields. For instance, the development of smaller, more flexible processing units can significantly reduce the capital expenditure and time to market for new gas discoveries.

Infrastructure development, particularly in pipeline technology, directly impacts Canacol's ability to deliver gas. Innovations in pipeline materials, welding techniques, and smart monitoring systems enhance safety, reduce leakage, and allow for higher throughput. Canacol's operations in Colombia, for example, benefit from ongoing investments in expanding and modernizing the national gas transmission network, ensuring reliable delivery to key demand centers.

Digitalization is a key driver for Canacol, with investments in automation and data analytics significantly boosting operational efficiency. For instance, the company leverages remote sensing technologies to monitor its extensive pipeline network, enabling faster detection of potential issues and reducing the need for extensive physical inspections. This proactive approach is crucial in the natural gas sector, where timely intervention can prevent costly downtime and environmental risks.

Predictive maintenance, powered by sophisticated data analytics, allows Canacol to anticipate equipment failures before they occur. By analyzing real-time performance data from compressors and other critical assets, the company can schedule maintenance proactively, minimizing unplanned outages. This strategy directly contributes to optimizing field performance and ensuring a reliable supply of natural gas, a critical factor for its customers in Colombia.

Integrated data platforms are central to Canacol's digital transformation, providing a unified view of operations from the wellhead to the delivery point. These platforms enhance decision-making by offering real-time insights into production levels, pipeline integrity, and market demand. This data-driven approach is essential for managing the complexities of the energy market and maintaining a competitive edge.

Methane Emission Reduction Technologies

The increasing focus on environmental sustainability is driving the adoption of methane emission reduction technologies within the natural gas sector. Companies are investing in advanced solutions to curb methane leaks, a potent greenhouse gas, aligning with global climate targets and stricter environmental regulations. This technological shift is crucial for maintaining operational compliance and enhancing corporate sustainability profiles.

Canacol Energy is actively pursuing a zero-methane emissions strategy, underscoring the importance of investing in these innovative technologies. By integrating advanced leak detection and repair (LDAR) programs and exploring novel capture and utilization methods, Canacol aims to significantly reduce its environmental footprint. These investments not only bolster its sustainability credentials but also ensure adherence to evolving environmental mandates, positioning the company favorably in a carbon-conscious market.

- Advanced LDAR Programs: Implementing technologies like infrared cameras and drone-based monitoring to identify and repair methane leaks efficiently.

- Vapor Recovery Units (VRUs): Installing VRUs at production sites to capture methane that would otherwise be vented or leaked, converting it into usable product.

- Methane Capture and Utilization: Exploring technologies to capture methane from various sources and utilize it for power generation or as feedstock, turning a liability into an asset.

- Regulatory Alignment: Proactively adopting technologies that meet or exceed anticipated methane emission regulations, such as those proposed by the EPA in 2024/2025 for the oil and gas industry.

Integration of Renewable Energy in Operations

Canacol Energy is increasingly exploring the integration of renewable energy sources like solar and wind power into its operational sites. This strategic move aims to significantly reduce its carbon footprint and operational expenses, aligning with a growing industry trend towards hybrid energy systems. For instance, by leveraging solar power for its remote operational facilities, Canacol can decrease reliance on diesel generators, which are costly and environmentally impactful.

This integration supports Canacol's stated environmental commitments and enhances its long-term sustainability. The company's focus on operational efficiency through cleaner energy solutions is a key technological factor.

- Reduced Operational Costs: Transitioning to solar power at its Colombian operations could lead to substantial savings on fuel procurement and transportation, especially given the volatile price of diesel.

- Lower Carbon Emissions: By implementing renewable energy, Canacol can directly contribute to lowering its Scope 1 and Scope 2 emissions, meeting stricter environmental regulations and stakeholder expectations.

- Enhanced Energy Security: On-site renewable energy generation can provide a more stable and reliable power supply for remote exploration and production sites, mitigating risks associated with grid instability or fuel supply chain disruptions.

Canacol Energy's technological adoption is a key driver of its operational efficiency and competitive edge. Innovations in seismic imaging and horizontal drilling significantly improve reserve identification and extraction, as seen in their Llanos Basin operations. The company is also prioritizing digitalization, using data analytics for predictive maintenance and remote pipeline monitoring, which minimizes downtime and enhances safety.

Furthermore, Canacol is investing in advanced gas processing technologies, including modular LNG facilities, to efficiently purify and transport natural gas. Their commitment to reducing methane emissions through advanced LDAR programs and vapor recovery units, aligning with anticipated 2024/2025 EPA regulations, highlights their focus on environmental sustainability and regulatory compliance.

The integration of renewable energy sources like solar power into their operations is another significant technological factor, aimed at reducing carbon footprints and operational expenses. This strategy enhances energy security for remote sites and contributes to lower Scope 1 and 2 emissions, meeting stakeholder expectations for cleaner energy solutions.

Canacol's proactive embrace of technology, from exploration to emissions reduction and renewable energy integration, positions it as an industry leader in efficient and sustainable natural gas production.

Legal factors

Colombia's legal framework for hydrocarbon exploration and production is primarily governed by Law 1955 of 2019, which sets out licensing, permitting, and contract terms. These regulations are crucial for Canacol, as they dictate the process for acquiring new exploration blocks and the terms under which production can occur. The government's policy shift, including the stated intention to halt new exploration contracts, directly impacts Canacol's long-term growth strategy by limiting opportunities to replenish its resource base and expand operations.

Canacol operates within a complex web of environmental laws, spanning national mandates, regional directives, and local ordinances that dictate everything from land use to emissions. For instance, in Colombia, the National Environmental System (SINA) establishes broad frameworks, while specific regional corporations (CARs) enforce localized regulations. Failure to adhere to these can result in significant penalties.

Key compliance areas include rigorous environmental impact assessments (EIAs) before project commencement, continuous monitoring of air and water quality, and stringent waste management protocols. In 2024, environmental fines in Colombia for non-compliance with regulations, particularly in the energy sector, have seen an upward trend, with some companies facing penalties in the millions of dollars, underscoring the substantial legal liabilities Canacol faces if it falls short.

Colombia's tax and royalty regimes significantly influence Canacol's profitability. The country imposes income taxes, value-added tax (VAT), and specific royalties on hydrocarbon production, directly impacting the company's net revenue and cash flow available for reinvestment and shareholder returns. These fiscal obligations are critical components in Canacol's financial planning and project valuation.

Recent adjustments to these policies, particularly in 2024 and projected for 2025, are closely monitored. For instance, changes in royalty percentages or the introduction of new environmental taxes could alter the economics of existing and future exploration and production activities, potentially affecting Canacol's investment decisions and overall financial performance.

Land Use and Property Rights

Canacol's operations are deeply intertwined with the legal framework governing land use and property rights in its operating regions. Navigating these complexities, particularly concerning exploration and production activities, is paramount. This involves understanding and adhering to laws related to land access, mineral rights, and surface rights, which can vary significantly by jurisdiction.

Securing these rights often requires extensive negotiations with private landowners and local communities. These agreements are critical for project execution, as disputes over land access or ownership can lead to significant delays and increased costs. For instance, in 2024, several energy companies faced protracted legal battles over land access in Latin America, highlighting the persistent risk of such disputes.

- Land Access Regulations: Compliance with national and local laws dictating how land can be accessed for exploration and drilling is essential.

- Property Rights Disputes: The potential for legal challenges from landowners or indigenous communities regarding surface or subsurface rights remains a key risk factor.

- Surface Use Agreements: Negotiating fair and legally sound agreements for surface use is crucial to prevent operational disruptions and maintain community relations.

Labor Laws and Employment Regulations

Canacol's operations in Colombia are significantly shaped by the nation's robust labor laws and employment regulations. These statutes dictate everything from minimum wage and working hours to employee benefits and termination procedures, directly influencing the company's human resource management strategies and overall operational costs. For instance, Colombian labor law mandates specific severance pay and vacation entitlements, which must be factored into budgeting and financial planning.

The legal framework also addresses worker rights, including the freedom of association and collective bargaining. Canacol must navigate these aspects carefully, maintaining positive relationships with labor unions to ensure smooth operations and avoid potential disruptions. Compliance with health and safety standards is paramount, with stringent regulations in place to protect employees, particularly in the energy sector where Canacol operates, requiring significant investment in safety protocols and training.

Furthermore, Colombia has implemented local content requirements aimed at promoting domestic employment and the use of local goods and services. These regulations can impact Canacol's hiring practices and supply chain decisions, potentially increasing the need for local talent development and sourcing. As of recent reports, Colombia's unemployment rate hovered around 10% in early 2024, indicating a substantial labor pool available, but also highlighting the importance of adhering to all employment laws to maintain a competitive and compliant workforce.

- Worker Rights: Colombian law guarantees rights such as fair wages, reasonable working hours, and social security contributions, impacting Canacol's payroll and benefits structure.

- Union Relations: The right to unionize and engage in collective bargaining is protected, necessitating proactive engagement and negotiation with labor unions.

- Health and Safety: Strict occupational health and safety regulations require Canacol to implement comprehensive safety programs and training, potentially increasing operational expenses.

- Local Content: Requirements for local employment and sourcing can influence hiring and procurement strategies, aiming to boost domestic economic participation.

Colombia's legal framework for the energy sector is dynamic, with policy shifts significantly impacting Canacol's operational landscape. The government's stated intention to potentially halt new exploration contracts, as discussed in 2024, presents a direct challenge to Canacol's growth ambitions by limiting future resource acquisition opportunities.

Compliance with environmental regulations, including rigorous EIAs and continuous monitoring, is non-negotiable. In 2024, environmental fines in Colombia for non-compliance within the energy sector have shown an increasing trend, with some penalties reaching millions of dollars, underscoring the substantial financial risks Canacol faces.

The tax and royalty regime directly affects Canacol's profitability, with changes in percentages or the introduction of new environmental taxes in 2024 and projected for 2025 closely monitored for their impact on investment decisions.

Navigating land access and property rights is critical, as disputes can lead to significant delays and costs. In 2024, several energy firms faced protracted legal battles over land access in Latin America, highlighting this persistent risk for Canacol.

Environmental factors

Colombia's commitment to a 'Just Energy Transition Roadmap' sets ambitious goals to phase out fossil fuels and significantly boost renewable energy sources. This national policy directly impacts companies like Canacol, a natural gas producer, by shaping the long-term viability of their core business and necessitating strategic adjustments toward cleaner energy alternatives.

The roadmap aims to increase the share of non-conventional renewable energy in the national matrix, a shift that could reduce demand for natural gas in the Colombian energy sector over time. For Canacol, this underscores the importance of adapting its business model to align with evolving environmental regulations and market demands, potentially exploring diversification into renewable energy projects or focusing on natural gas as a transitional fuel.

Canacol's operations in Colombia's Magdalena Basin, a region rich in biodiversity, necessitate careful management of its environmental impact. The company's exploration and production activities could affect local ecosystems, including sensitive habitats and species.

Canacol is committed to minimizing its ecological footprint through various strategies. This includes adhering to strict environmental regulations and implementing habitat restoration programs. For instance, in 2023, the company reported investing in reforestation initiatives aimed at compensating for land use associated with its projects.

Legal obligations for biodiversity protection are paramount. Canacol must comply with Colombian environmental laws and international best practices to ensure the conservation of flora and fauna in its operational areas. This often involves conducting thorough environmental impact assessments and developing specific mitigation plans for potential biodiversity loss.

Effective water resource management is critical for oil and gas operations like Canacol, encompassing sourcing, efficient usage, and responsible disposal of wastewater to minimize environmental impact.

Environmental regulations, such as those aimed at preventing water pollution, are stringent. Canacol's commitment to sustainable water management includes adhering to these regulations, implementing water treatment technologies, and exploring water recycling initiatives to reduce reliance on fresh water sources. For instance, in 2023, the company reported on its water management practices, highlighting efforts to reduce freshwater withdrawal by a notable percentage compared to previous years, though specific figures for 2024/2025 are still emerging.

Emissions and Pollution Control

Canacol Energy is actively managing its environmental footprint by focusing on emissions and pollution control. The company is committed to reducing greenhouse gas (GHG) emissions, particularly methane, and other pollutants stemming from its oil and gas operations in Colombia. This commitment is reflected in their ongoing efforts to invest in and implement cleaner technologies across their facilities.

Canacol has set specific targets for emissions reduction, aligning with both national environmental regulations in Colombia and international best practices. For instance, in 2023, the company reported a reduction in its Scope 1 and Scope 2 GHG emissions intensity, demonstrating progress towards its sustainability goals. Their strategy includes leak detection and repair programs and optimizing operational processes to minimize fugitive emissions.

The company's adherence to stringent environmental standards is a core aspect of its operational philosophy. This includes complying with Colombian environmental laws and seeking to meet or exceed international benchmarks for air quality and emissions management. Investments in advanced equipment and operational procedures are key to achieving these objectives.

- GHG Emission Reduction: Canacol is focused on lowering methane and other greenhouse gas emissions from its upstream operations.

- Cleaner Technologies: The company invests in technologies aimed at reducing air pollution and improving overall environmental performance.

- Emissions Targets: Canacol has established quantifiable targets for emissions reduction, driving operational improvements.

- Regulatory Compliance: Adherence to Colombian environmental standards and international best practices guides their pollution control efforts.

Waste Management and Circular Economy Principles

Canacol Energy is increasingly focused on waste management and adopting circular economy principles to lessen its environmental footprint. The company actively pursues strategies for reducing, reusing, and recycling operational waste generated across its exploration and production activities. This commitment is crucial for enhancing resource efficiency and meeting evolving sustainability expectations within the energy sector.

Integrating circular economy concepts means Canacol aims to keep resources in use for as long as possible, extracting maximum value from them before recovery and regeneration. This approach not only minimizes waste sent to landfills but also can lead to cost savings through more efficient material usage. For instance, in 2024, Canacol reported a 15% reduction in general operational waste compared to the previous year, with a significant portion being recycled or repurposed.

- Waste Reduction Initiatives: Canacol implements programs to minimize waste at the source, such as optimizing material procurement and improving operational processes to reduce byproducts.

- Recycling and Reuse Programs: The company has established partnerships for recycling drilling fluids, metals, and plastics, alongside initiatives to reuse materials where feasible.

- Circular Economy Integration: Canacol is exploring opportunities to incorporate recovered materials back into its operations or supply chain, aiming for a closed-loop system.

- Environmental Impact Mitigation: These efforts directly contribute to Canacol's broader sustainability goals, aligning with global trends towards a more resource-efficient and environmentally responsible energy industry.

Colombia's "Just Energy Transition Roadmap" significantly influences Canacol by pushing for a shift away from fossil fuels. This national policy directly impacts Canacol's core business as a natural gas producer, necessitating strategic adaptations towards cleaner energy alternatives and potentially reducing long-term demand for natural gas.

Canacol operates in biodiversity-rich areas like the Magdalena Basin, requiring careful environmental management of its exploration and production activities to protect local ecosystems. The company is actively minimizing its ecological footprint through reforestation initiatives and strict adherence to environmental regulations, including those for biodiversity protection and water resource management.

Canacol is committed to reducing its environmental impact through emissions and pollution control, focusing on methane and other greenhouse gases. The company has set quantifiable targets for emissions reduction, demonstrated by a reported reduction in Scope 1 and 2 GHG emissions intensity in 2023, and invests in cleaner technologies to improve overall performance and comply with environmental standards.

The company is also prioritizing waste management and circular economy principles, reporting a 15% reduction in general operational waste in 2024 compared to the previous year, with a significant portion being recycled or repurposed. These efforts align with global trends toward resource efficiency and environmental responsibility in the energy sector.

| Environmental Focus | 2023 Data/Initiative | 2024 Data/Initiative | 2025 Outlook/Target |

|---|---|---|---|

| GHG Emission Reduction | Reduced Scope 1 & 2 GHG emissions intensity | Ongoing investment in leak detection and repair programs | Targeting further intensity reductions aligned with national goals |

| Waste Management | Focus on reducing, reusing, and recycling operational waste | Reported 15% reduction in general operational waste; increased recycling efforts | Exploring closed-loop systems for material usage |

| Biodiversity Protection | Investments in reforestation initiatives | Continued adherence to strict environmental impact assessments | Maintaining compliance with Colombian environmental laws and international best practices |

| Water Management | Efforts to reduce freshwater withdrawal | Implementing water treatment technologies and exploring recycling | Aiming for enhanced water efficiency in operations |

PESTLE Analysis Data Sources

Our Canacol PESTLE Analysis is meticulously constructed using a blend of official government reports, reputable financial news outlets, and industry-specific market research. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.