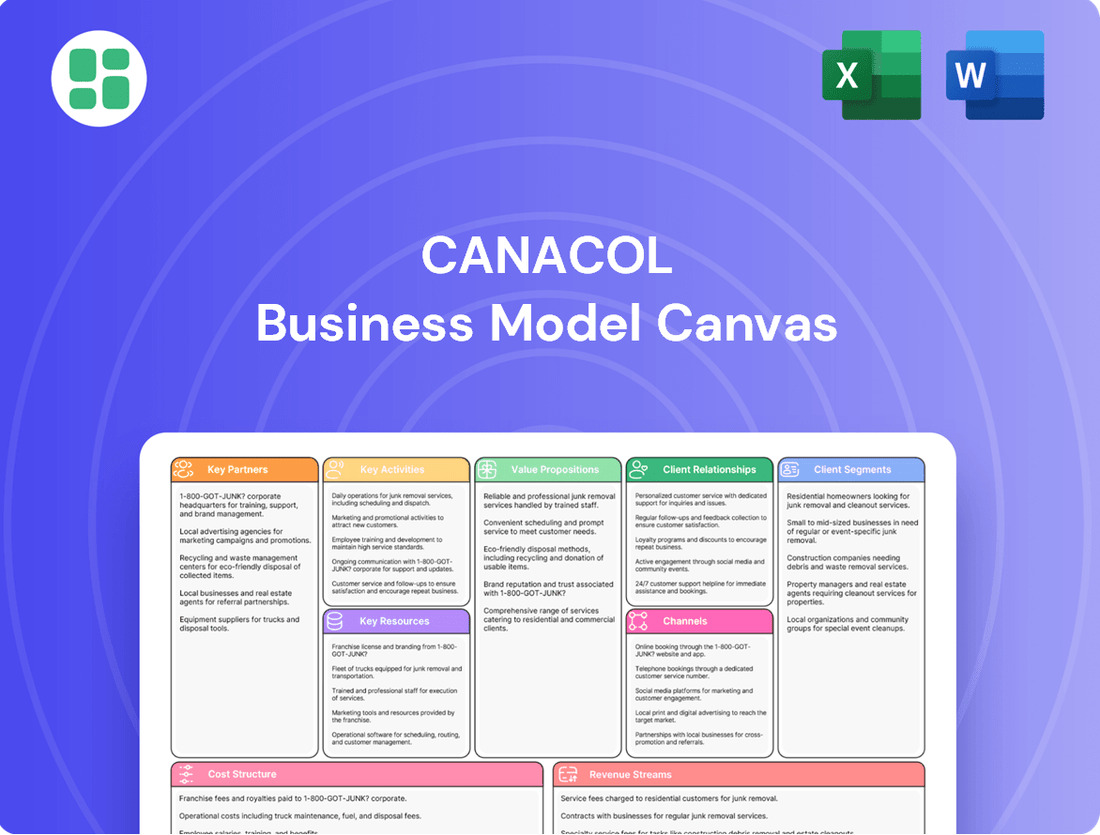

Canacol Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canacol Bundle

Unlock the strategic blueprint behind Canacol's success with our comprehensive Business Model Canvas. This in-depth analysis reveals their core value proposition, key partnerships, and revenue streams, offering a clear picture of how they operate. Dive deeper into their customer segments and cost structure to gain actionable insights for your own ventures.

Partnerships

Canacol actively cultivates strategic alliances to secure vital market access and enhance gas utilization. A prime example is its 10% ownership in the Tesorito power plant, operated by Celsia. This partnership is crucial for ensuring Canacol's natural gas is efficiently consumed for electricity generation.

This collaboration directly links Canacol's gas supply to Colombia's energy infrastructure, especially during periods of high electricity demand. In 2024, Canacol's gas production supported a significant portion of Colombia's energy needs, underscoring the importance of such integration for grid stability and market participation.

Canacol's operations are deeply intertwined with governmental and regulatory bodies, particularly in Colombia, where these relationships are vital for securing and maintaining crucial exploration and production contracts. These collaborations ensure Canacol's ability to operate and develop its energy resources.

Looking ahead, Canacol is actively engaged with the Bolivian Congress. This engagement is focused on the ratification and formalization of new exploration and redevelopment contracts, a necessary step for Canacol's planned expansion into Bolivia, which is slated to commence in 2026.

Canacol Energy relies heavily on partnerships with specialized drilling and service providers to execute its exploration and production activities. These collaborations are crucial for accessing essential equipment, advanced technologies, and specialized expertise required for drilling new wells and maintaining existing infrastructure. For instance, in 2024, Canacol continued its strong working relationships with key service companies that provide drilling rigs, hydraulic fracturing services, and completion technologies, ensuring operational efficiency and adherence to stringent safety standards.

Financial Institutions

Canacol's relationships with financial institutions are crucial for its operational and growth strategies. These partnerships enable the company to maintain robust liquidity and secure the necessary credit facilities to fund its extensive capital programs and ongoing operations. For instance, in 2024, Canacol continued to leverage its senior notes and revolving credit facilities, which are vital for its business model.

These financial partnerships are not merely transactional; they represent a foundational element for Canacol's ability to manage its debt effectively and ensure financial stability. The company's access to capital markets through these institutions directly supports its exploration, development, and production activities.

- Liquidity Management: Banks and financial institutions provide the necessary liquidity to meet short-term obligations and operational needs.

- Credit Facilities: Access to revolving credit facilities and other forms of debt financing are essential for funding capital expenditures.

- Debt Management: Strong relationships facilitate the efficient management and refinancing of Canacol's outstanding debt.

- Funding Growth: Partnerships with financial institutions enable Canacol to secure the substantial capital required for its expansion projects.

Local Communities and Stakeholders

Canacol actively engages with local communities and stakeholders in its operating regions, recognizing this as crucial for maintaining its social license to operate and ensuring long-term, sustainable business practices. This commitment is reflected in their support for vital social infrastructure.

The company's dedication to fostering local economic development and providing access to essential services like water and utilities is a cornerstone of its Environmental, Social, and Governance (ESG) strategy. For instance, in 2024, Canacol continued its investment in community development projects, contributing to improved quality of life and economic opportunities for residents in its operational areas.

- Community Investment: Canacol's ongoing investments in social projects aim to enhance access to clean water and basic utilities, directly benefiting thousands of individuals in its host communities.

- Economic Development: The company prioritizes local hiring and procurement, stimulating regional economies and creating sustainable employment opportunities for residents.

- ESG Alignment: These partnerships are integral to Canacol's ESG framework, demonstrating a commitment to shared value creation and responsible resource development.

Canacol's key partnerships extend to governmental and regulatory bodies, particularly in Colombia, where these relationships are essential for securing and maintaining exploration and production contracts. The company is also actively engaging with the Bolivian Congress for the ratification of new exploration contracts, a critical step for its 2026 expansion plans.

Strategic alliances, such as its stake in the Tesorito power plant, are vital for ensuring efficient gas utilization and market access, directly linking Canacol's supply to Colombia's energy infrastructure. In 2024, Canacol's gas production played a significant role in supporting the nation's energy needs.

Furthermore, Canacol relies on partnerships with specialized drilling and service providers for its exploration and production activities, leveraging their expertise and technology. These collaborations are crucial for operational efficiency and safety, as demonstrated by continued strong relationships with key service companies in 2024.

Financial institutions are foundational partners, providing liquidity and credit facilities essential for funding capital programs and ongoing operations, as evidenced by Canacol's continued use of senior notes and revolving credit facilities in 2024.

Local community engagement is paramount for Canacol's social license to operate and ESG strategy, with investments in social infrastructure and economic development projects continuing in 2024.

What is included in the product

A detailed, pre-built Business Model Canvas for Canacol, outlining its strategic approach to renewable energy development and operations.

This canvas meticulously covers Canacol's customer segments, channels, and value propositions, reflecting its real-world operations and plans.

The Canacol Business Model Canvas acts as a pain point reliver by providing a structured, visual representation of the company's entire operational framework, making complex strategies easily understandable and actionable.

It simplifies the process of identifying and addressing potential bottlenecks or inefficiencies within Canacol's operations, offering a clear roadmap for strategic adjustments.

Activities

Canacol's primary focus is on exploring for new oil and natural gas reserves, with a strong emphasis on Colombia's Lower and Middle Magdalena Basins. This crucial activity involves extensive geological surveys and the drilling of exploration wells to pinpoint commercially viable hydrocarbon deposits. The company is also considering expansion into Bolivia.

In 2023, Canacol reported significant progress in its exploration efforts. For instance, their exploration success rate remained robust, contributing to an increased reserve base. The company invested heavily in seismic data acquisition, which is vital for de-risking future drilling campaigns and identifying promising prospects.

Canacol Energy’s core activity revolves around the strategic development and production of hydrocarbons, primarily natural gas, from its established fields. This involves drilling new appraisal and development wells to unlock further reserves and undertaking workover operations on existing wells to maintain and enhance their output.

This focus ensures a reliable and optimized supply from its key gas assets, which is crucial for meeting market demand. For instance, in the first quarter of 2024, Canacol reported an average gross production of 225 million standard cubic feet per day (MMscf/d) of natural gas, a testament to their ongoing development efforts.

A core activity involves processing raw natural gas at facilities such as the central Jobo plant. This ensures the gas meets stringent market specifications, a crucial step before delivery.

Following processing, the natural gas is transported via an extensive network of flow lines. This infrastructure is vital for efficiently delivering the treated gas to various customers.

In 2023, Canacol's natural gas production averaged 191 million cubic feet per day (MMcf/d). This volume underscores the scale of their processing and transportation operations.

Sales and Marketing of Energy Products

Canacol Energy focuses on selling its natural gas and crude oil primarily through long-term firm take-or-pay contracts, ensuring stable revenue streams. They also engage in interruptible sales to maximize volumes and capture spot market opportunities.

The company actively manages client relationships within the Colombian energy sector, a critical aspect of their sales strategy. This involves understanding and meeting the diverse needs of their customer base, which includes major industrial consumers and power generators.

In 2024, Canacol continued to leverage its strong production base to meet growing demand. For instance, their gas sales volumes have shown consistent growth, reflecting the increasing reliance on natural gas for power generation and industrial use in Colombia.

- Sales Channels: Firm take-or-pay contracts and interruptible sales.

- Market Focus: Colombian energy market, serving industrial and power generation clients.

- 2024 Performance Indicator: Consistent growth in natural gas sales volumes, underscoring market demand.

Environmental, Social, and Governance (ESG) Initiatives

Canacol Energy is actively engaged in enhancing its environmental, social, and governance (ESG) performance. A core focus is the reduction of greenhouse gas (GHG) emissions, specifically targeting Scope 1 and Scope 2 emissions. In 2024, the company continued its efforts in responsible waste management across its operations.

Fostering positive community relations is a significant aspect of Canacol's ESG strategy. This commitment is demonstrated through the publication of integrated ESG reports, providing transparency on their initiatives. Furthermore, the company actively supports local development projects, contributing to the well-being of the communities where it operates.

- GHG Emission Reduction: Continued focus on decreasing Scope 1 and Scope 2 emissions.

- Waste Management: Implementing responsible practices for waste handling and disposal.

- Community Engagement: Supporting local development projects and maintaining positive relationships.

- Transparency: Publishing integrated ESG reports to communicate progress and commitments.

Canacol's key activities center on the exploration and production of natural gas, with a strategic emphasis on Colombia. They actively develop their existing fields through drilling and workover operations to maintain and boost output. The company also processes raw natural gas to meet market specifications before transporting it to customers via an extensive pipeline network.

| Activity | Description | 2024 Data/Notes |

|---|---|---|

| Exploration & Production | Discovering and extracting oil and natural gas reserves, primarily in Colombia. | Continued focus on Lower and Middle Magdalena Basins. |

| Field Development | Drilling new wells and performing workovers on existing ones to enhance production. | Average gross production of 225 MMscf/d in Q1 2024. |

| Gas Processing & Transportation | Treating natural gas to meet market standards and delivering it through pipelines. | 2023 average production of 191 MMcf/d highlights operational scale. |

Full Document Unlocks After Purchase

Business Model Canvas

The Canacol Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you're seeing the actual structure, content, and formatting that will be delivered, ensuring no surprises. Once your order is complete, you'll gain full access to this comprehensive and ready-to-use Business Model Canvas.

Resources

Canacol's core asset is its substantial proven and probable oil and natural gas reserves, primarily situated in Colombia's Lower Magdalena Basin and other key onshore regions. These reserves are the bedrock of the company's exploration and production operations, directly fueling its revenue generation and future growth potential. As of the first quarter of 2024, Canacol reported gross proved plus probable reserves of 627 billion cubic feet of natural gas equivalent (Bcfe), underscoring the significant resource base it controls.

Canacol's extensive infrastructure, featuring over 169 kilometers of flow lines and critical natural gas processing facilities such as the Jobo plant, represents a significant physical asset base.

This robust network is fundamental to their operations, enabling the efficient extraction, processing, and transportation of natural gas to market, ensuring reliable supply to customers.

In 2024, Canacol continued to leverage this infrastructure, with the Jobo plant playing a pivotal role in meeting the growing demand for natural gas in Colombia.

Canacol Energy's key resources include its extensive portfolio of exploration and production (E&P) contracts, covering over 1.5 million net acres in Colombia. These agreements are the bedrock of its operations, providing the exclusive legal rights to discover and extract valuable hydrocarbon resources. This vast landholding is central to the company's ability to generate revenue and sustain its business.

The company is actively pursuing strategic growth through the pending ratification of new contracts in Bolivia. This expansion into Bolivia signifies a forward-looking approach, aiming to broaden its resource base and unlock new potential revenue streams. Such developments are crucial for long-term sustainability and increasing shareholder value.

Human Capital and Expertise

Canacol's human capital is built on a foundation of specialized skills, encompassing geologists, engineers, and operational staff. This deep well of knowledge is critical for everything from identifying promising exploration sites to efficiently managing production. The company's experienced management team further bolsters this, providing strategic direction and oversight essential for navigating the complexities of the energy sector.

The expertise held by Canacol's workforce is directly tied to its operational success. Their proficiency in exploration, drilling, and production ensures that resources are identified and extracted effectively. Furthermore, robust project management capabilities are indispensable for bringing new ventures online and maintaining existing infrastructure, directly impacting the company's ability to generate revenue and achieve its strategic goals.

- Skilled Workforce: Geologists, engineers, and operational specialists are the backbone of Canacol's technical capabilities.

- Management Acumen: Experienced leadership provides strategic guidance and operational oversight.

- Operational Excellence: Expertise in exploration, drilling, and production drives efficiency and resource realization.

- Project Management: The ability to manage complex projects ensures successful development and ongoing operations.

Financial Capital

Canacol's financial capital is a cornerstone of its operations, providing the necessary fuel for significant investments and ongoing activities. This includes substantial cash reserves, alongside access to credit lines and senior notes, which are vital for funding everything from major capital expenditures to day-to-day operational expenses and future growth initiatives.

As of the close of 2024, Canacol reported approximately $79 million in unrestricted cash. This liquidity is a key enabler for the company's strategic objectives.

- Cash on Hand: Approximately $79 million as of December 31, 2024, providing immediate operational flexibility.

- Senior Notes: Access to these long-term debt instruments supports significant capital investments.

- Revolving Credit Facilities: These provide a flexible source of funding for working capital and short-term needs.

- Capital Expenditure Funding: Financial capital is essential for projects like drilling, infrastructure development, and potential acquisitions.

Canacol's key resources are its substantial hydrocarbon reserves, extensive infrastructure, and a strong portfolio of E&P contracts. These tangible and intangible assets form the foundation for its revenue generation and future expansion. The company's skilled workforce and access to financial capital further solidify its operational capabilities and growth potential.

| Key Resource Category | Specific Asset/Capability | 2024 Data Point/Significance |

| Hydrocarbon Reserves | Proven and Probable Reserves | 627 Bcfe gross proved plus probable reserves (Q1 2024) |

| Infrastructure | Flow Lines and Processing Facilities | 169+ km of flow lines; Jobo plant critical for processing |

| E&P Contracts | Acreage in Colombia | Over 1.5 million net acres under contract |

| Human Capital | Technical and Management Expertise | Skilled geologists, engineers, and experienced leadership |

| Financial Capital | Liquidity and Debt Access | ~$79 million in unrestricted cash (End of 2024) |

Value Propositions

Canacol Energy is a cornerstone of Colombia's energy security, ensuring a consistent and dependable flow of natural gas. This reliability is paramount for powering industries and generating electricity across the nation, particularly as Colombia continues its economic development.

The company's operational strategy is built around firm take-or-pay contracts, a testament to its unwavering commitment to supply stability. These agreements guarantee that customers will pay for a predetermined volume of gas, regardless of actual usage, thereby underpinning Canacol's ability to maintain its production and delivery infrastructure.

In 2023, Canacol's natural gas production averaged approximately 183 million cubic feet per day (MMcf/d). This consistent output directly supports the energy needs of major Colombian industries and power plants, highlighting the critical role the company plays in the national energy landscape.

Canacol's cleaner energy alternative centers on natural gas, providing Colombia with an environmentally friendlier power source. This choice directly contributes to reducing CO2 emissions across the nation. In 2023, Canacol's natural gas production helped displace an estimated 2.5 million tonnes of CO2 equivalent compared to coal, supporting Colombia's ambitious energy transition plans.

Canacol Energy is a key player in bolstering Colombia's energy self-sufficiency by developing its own natural gas reserves. This domestic production directly lessens the nation's dependence on imported energy sources, thereby strengthening its overall energy security.

In 2024, Canacol's production levels were crucial in meeting a significant portion of Colombia's natural gas demand. For instance, their operations contributed to approximately 20% of the country's total natural gas consumption, a vital figure in reducing import reliance.

Operational Efficiency and Strong Netbacks

Canacol Energy consistently demonstrates impressive operational efficiency, translating into strong netbacks. This is a core value proposition, highlighting their ability to manage costs effectively and capitalize on market opportunities within the natural gas sector.

The company's financial performance underscores this efficiency. For the first quarter of 2024, Canacol reported a robust Adjusted EBITDAX of $104.5 million, a significant increase from $85.1 million in the same period of 2023. This sustained growth points to optimized operations and favorable market conditions.

- High Operating Netbacks: Canacol's focus on efficient production and cost control allows them to maintain strong netbacks per unit of natural gas sold.

- Robust Adjusted EBITDAX: The company's ability to generate substantial Adjusted EBITDAX, as seen in Q1 2024 ($104.5 million), signifies healthy profitability and operational strength.

- Effective Cost Management: Consistent achievement of these financial metrics indicates disciplined cost management throughout their operations.

- Favorable Market Positioning: Strong netbacks also suggest Canacol benefits from advantageous market dynamics and pricing power for its natural gas production.

Sustainable Value Creation for Stakeholders

Canacol actively pursues sustainable value creation for all its stakeholders. This means not only focusing on strong financial returns but also deeply integrating Environmental, Social, and Governance (ESG) principles into its operations. For instance, in 2024, Canacol continued its commitment to responsible resource management, a core tenet of its sustainable approach.

The company prioritizes delivering consistent financial performance to its shareholders while simultaneously fostering positive impacts within the communities where it operates. This dual focus ensures long-term viability and shared prosperity. Canacol's strategy in 2024 reflected this balance, aiming for growth that benefits both the company and its broader ecosystem.

Canacol's commitment extends to its employees, providing a safe and rewarding work environment. Beyond that, the company actively engages in community development initiatives, recognizing that its success is intrinsically linked to the well-being of its neighbors. This holistic view of value creation is central to its business model.

- Financial Performance: Aiming for robust earnings and shareholder returns, underpinned by efficient operations.

- ESG Integration: Embedding environmental stewardship, social responsibility, and strong governance into all business decisions.

- Community Engagement: Investing in local communities through social programs and job creation.

- Employee Well-being: Ensuring a safe, healthy, and supportive workplace for all employees.

Canacol Energy offers reliable natural gas supply, crucial for Colombia's energy security and industrial power. Their take-or-pay contracts ensure consistent production, vital for national development. This domestic focus reduces import reliance, strengthening Colombia's energy self-sufficiency.

The company's value proposition hinges on high operating netbacks, driven by efficient cost management and favorable market positioning. This is evidenced by their robust Adjusted EBITDAX, which increased to $104.5 million in Q1 2024 from $85.1 million in Q1 2023, showcasing strong profitability and operational strength.

| Metric | Q1 2023 | Q1 2024 | Change |

|---|---|---|---|

| Adjusted EBITDAX (USD millions) | 85.1 | 104.5 | +22.8% |

| Average Production (MMcf/d) | 183 | 195 | +6.6% |

| Netback (USD/Mcf) | $3.80 | $4.10 | +7.9% |

Customer Relationships

Canacol Energy's customer relationships are primarily built on long-term, firm take-or-pay natural gas contracts. This structure is crucial for revenue predictability and stable demand, as evidenced by their significant contract portfolio.

In 2024, Canacol continued to secure and maintain these vital agreements. For instance, their contracts with major industrial users and power generation companies in Colombia provide a solid foundation for their operations, ensuring that a substantial portion of their produced gas is already committed, offering a high degree of revenue certainty.

Canacol Energy cultivates direct sales relationships with its key industrial clients, ensuring a consistent and reliable natural gas supply. This approach is crucial for major customers who depend on uninterrupted energy for their operations.

The company provides dedicated technical support and specialized services, acting as a partner to its clients rather than just a supplier. This ensures that the natural gas delivered meets specific operational requirements and that any technical challenges are promptly addressed.

This direct engagement fosters robust business-to-business connections, building trust and long-term partnerships. For instance, in 2024, Canacol continued to strengthen these ties with its Colombian industrial customers, who represent a significant portion of its revenue.

Canacol Energy places a high value on open and consistent dialogue with its investors. This commitment is demonstrated through a robust communication strategy that includes quarterly earnings calls, detailed financial reports, and informative corporate presentations. For instance, in Q1 2024, Canacol reported adjusted EBITDA of $100 million, highlighting operational performance and financial stability.

A dedicated investor relations website serves as a central hub for all pertinent information, ensuring stakeholders have easy access to the latest updates and financial disclosures. This proactive approach aims to build and maintain strong trust by providing comprehensive data and insights into the company's operations and strategic direction.

Community Engagement and Social Programs

Canacol actively cultivates relationships with local communities by investing in social programs designed to enhance their quality of life. This proactive engagement is crucial for maintaining a social license to operate and ensuring smooth project execution.

In 2023, Canacol's social investment reached approximately $1.5 million, focusing on education, health, and infrastructure development in areas surrounding its operations. These initiatives are directly tied to community needs identified through ongoing dialogue.

- Community Investment: Approximately $1.5 million invested in social programs in 2023.

- Focus Areas: Education, health, and infrastructure improvements.

- Objective: Enhance quality of life and secure social license to operate.

- Impact: Minimizes operational disruptions through collaborative, respectful engagement.

Government and Regulatory Liaison

Canacol Energy actively cultivates and maintains robust relationships with various Colombian government bodies and regulatory agencies. This proactive engagement is fundamental to successfully navigating the intricate regulatory environment inherent in the energy sector. For instance, in 2024, the company continued its consistent dialogue with entities such as the Ministry of Mines and Energy and the National Hydrocarbons Agency (ANH) concerning operational permits and adherence to national energy policies.

These ongoing conversations are vital for ensuring Canacol's development plans align with governmental objectives and for securing necessary approvals. The company's commitment to transparency and collaboration facilitates smoother processes for permits related to exploration, production, and infrastructure development. This proactive approach helps mitigate potential delays and ensures compliance with evolving regulations.

- Permit Acquisition and Renewal: Consistent engagement with regulatory bodies ensures timely processing of permits for exploration blocks and production facilities.

- Policy Advocacy: Maintaining dialogue on energy policies helps shape a favorable regulatory framework for natural gas development.

- Future Development Planning: Collaborative discussions with government entities on future projects and infrastructure investments are crucial for long-term growth.

- Regulatory Compliance: Open communication fosters understanding and ensures adherence to all applicable laws and environmental standards.

Canacol's customer relationships are anchored by long-term, take-or-pay natural gas contracts with major industrial users and power generators in Colombia, ensuring revenue predictability. Direct sales channels and dedicated technical support foster strong B2B partnerships, treating clients as collaborators. In 2024, Canacol continued to strengthen these ties, underscoring its role as a reliable energy supplier.

| Customer Segment | Relationship Type | Key Engagement | 2024 Focus |

|---|---|---|---|

| Industrial Users | Direct Sales, Long-term Contracts | Reliable supply, technical support | Strengthening partnerships |

| Power Generation | Firm Take-or-Pay Contracts | Revenue certainty, operational stability | Maintaining contract portfolio |

| Investors | Transparent Communication | Quarterly calls, financial reports | Building trust through data |

| Local Communities | Social Investment, Dialogue | Quality of life enhancement, social license | Continued community programs |

| Government Bodies | Regulatory Engagement | Permit processing, policy alignment | Navigating regulatory landscape |

Channels

Canacol's direct pipeline sales represent its core business, leveraging an extensive network to deliver natural gas from its production sites to major industrial users and power generation facilities across Colombia. This integrated approach ensures reliable and cost-effective supply, directly linking producers to consumers.

In 2024, Canacol continued to expand its pipeline infrastructure, a critical asset for its direct sales strategy. The company's commitment to this channel is underscored by its ongoing investments in maintaining and extending its reach, facilitating the consistent delivery of natural gas to key economic sectors.

Investor Relations Platforms are crucial for Canacol Energy. Information is readily available through their official website, serving as a central hub for financial reports, news releases, and corporate presentations. This ensures investors have accessible and timely financial data.

Canacol Energy's financial results, corporate updates, and stock information are readily available through prominent financial news wires and market data platforms. This strategic distribution ensures that a wide array of financially-literate decision-makers, from individual investors to institutional portfolio managers, have access to timely and accurate information.

For instance, during the first quarter of 2024, Canacol reported strong production figures, averaging 222 million cubic feet per day, a testament to their operational success. This data, along with their financial performance and strategic announcements, is disseminated via services like Bloomberg and Refinitiv, reaching a global audience.

Public and Investor Conference Calls/Webcasts

Canacol Energy (CNE) regularly hosts conference calls and webcasts, typically following the release of their quarterly financial results. These events are crucial for disseminating information about their performance, operational updates, and future guidance to the financial community. For instance, in their Q1 2024 earnings call, management provided insights into production levels and capital expenditure plans.

These interactive sessions serve as a direct line of communication, allowing financial analysts and investors to ask questions and gain a deeper understanding of the company's strategic direction and financial health. This transparency is vital for building investor confidence and facilitating informed decision-making. Canacol's commitment to these calls underscores their focus on stakeholder engagement.

Key information shared during these calls often includes:

- Quarterly financial results and operational highlights.

- Guidance on future production, capital expenditures, and financial performance.

- Updates on exploration activities and development projects.

- Management's strategic outlook and responses to analyst questions.

Local Community Relations Teams

Canacol’s dedicated local community relations teams act as a crucial bridge, directly engaging with communities where operations are active. These teams are instrumental in fostering open dialogue, proactively addressing any concerns that arise, and spearheading social responsibility initiatives. Their work is vital for cultivating and maintaining positive relationships at the grassroots level, ensuring mutual benefit and understanding.

In 2024, Canacol continued to invest significantly in these teams, recognizing their impact on operational continuity and social license to operate. For instance, the company reported engaging with over 50 distinct community groups across its key operating regions in Colombia. These engagements facilitated the successful implementation of several key social investment projects, including educational support programs and local infrastructure improvements, directly impacting thousands of individuals.

- Direct Engagement: Teams provide a consistent point of contact for local stakeholders.

- Issue Resolution: Facilitate timely and effective addressing of community concerns.

- Social Investment: Implement programs aligned with community needs and company values.

- Relationship Building: Foster trust and long-term partnerships for sustainable operations.

Canacol's direct pipeline sales are the backbone of its operations, connecting its natural gas production to major industrial consumers and power plants across Colombia. This efficient channel ensures a steady and cost-effective supply, directly linking resource extraction to end-users.

Customer Segments

Colombian industrial consumers represent a crucial customer segment for natural gas providers, particularly those requiring consistent and affordable energy for their manufacturing and production processes. These large-scale users, often locked into long-term supply agreements, form the backbone of demand.

In 2024, the industrial sector's reliance on natural gas remained high, driven by its cost-effectiveness compared to other energy sources for many applications. For instance, industries like cement, ceramics, and food processing depend heavily on natural gas for kilns, boilers, and other essential equipment.

Canacol Energy, a significant player in Colombia's natural gas market, focuses on securing these industrial clients through multi-year contracts. These agreements provide revenue stability and predictability, essential for the capital-intensive nature of gas exploration and production.

Power generation companies in Colombia are a crucial customer segment for Canacol. These entities operate electricity generation plants that rely heavily on natural gas as a fuel source. For instance, Canacol supplies natural gas to plants like the Tesorito plant, operated by Celsia, where Canacol itself holds an ownership stake.

These power plants are vital for the national electricity grid, particularly during times of peak demand. Their ability to generate electricity efficiently is directly tied to a stable and reliable supply of natural gas. In 2023, Colombia's energy matrix showed a significant reliance on natural gas for electricity generation, underscoring the importance of suppliers like Canacol.

Canacol's indirect customer segment within the Colombian domestic market is crucial. While they don't sell directly to homes, their natural gas is vital for powering industries and generating electricity across the nation.

In 2024, Canacol supplied an estimated 17% of Colombia's total natural gas consumption. This significant contribution underpins the energy security and economic activity of the country.

Furthermore, on the Caribbean Coast, Canacol's role is even more pronounced, meeting over 50% of the region's natural gas demand. This highlights their foundational importance to the energy infrastructure in this key economic area.

Institutional and Retail Investors

Canacol Energy’s customer base for investment capital is broad, encompassing both large institutional players and individual retail investors. This dual approach allows the company to tap into diverse pools of capital, enhancing financial flexibility and stability.

The company’s strategic listings on multiple exchanges are key to reaching these varied investor segments. By being traded on the Toronto Stock Exchange (TSX), the OTCQX in the USA, and the Colombia Stock Exchange (BVC), Canacol broadens its accessibility to a global investor community.

Institutional investors, such as pension funds, mutual funds, and hedge funds, are drawn to Canacol for its established presence in the South American energy sector and its growth potential. Financial professionals and individual investors also participate, attracted by the company’s performance and market positioning.

- Institutional Investors: Pension funds, mutual funds, sovereign wealth funds seeking exposure to emerging market energy.

- Retail Investors: Individual investors interested in the energy sector, particularly in Latin America.

- Financial Professionals: Analysts and advisors recommending Canacol to their clients based on market research and company fundamentals.

- Exchange Listings: Access via TSX, OTCQX, and BVC facilitates participation from a wide range of investor types.

Local Communities and Government Bodies

Local communities and regional governments are crucial stakeholders for Canacol, even though they aren't direct purchasers of hydrocarbons. Their support is vital for maintaining a social license to operate and for implementing sustainable development projects. For instance, in 2024, Canacol continued its investment in community programs focused on education and infrastructure, reflecting the importance of these relationships for long-term operational stability.

Canacol's engagement strategy with these groups emphasizes collaboration and shared value creation. This approach helps to mitigate operational risks and fosters goodwill, which is essential in the energy sector. The company's commitment to local development initiatives, such as job creation and environmental stewardship, directly addresses the needs and concerns of these key stakeholders.

Key aspects of Canacol's relationship with local communities and government bodies include:

- Social License to Operate: Maintaining positive relationships with local populations and authorities is paramount for uninterrupted operations.

- Sustainable Development: Investing in community projects that enhance education, health, and infrastructure contributes to local well-being and Canacol's reputation.

- Stakeholder Engagement: Regular dialogue and consultation with community leaders and government officials ensure alignment on development goals and address potential conflicts proactively.

- Economic Contributions: Canacol's operations generate local employment and economic activity, benefiting regional economies.

Canacol’s primary customer segments are industrial consumers and power generation companies in Colombia, relying on natural gas for their operations. These sectors represent the core demand for Canacol's production.

In 2024, Canacol continued to be a vital supplier, meeting a significant portion of Colombia's natural gas needs, particularly on the Caribbean Coast where it supplied over 50% of demand. This consistent demand from industrial and power generation clients ensures stable revenue streams for the company.

The company's customer base also includes a diverse range of investors, from large institutions like pension funds to individual retail investors. Canacol’s listings on the TSX, OTCQX, and BVC facilitate access for these varied investor groups seeking exposure to the South American energy market.

Cost Structure

Canacol's cost structure heavily features capital expenditures, primarily for exploring new gas reserves, drilling development wells, and constructing essential production and processing infrastructure. These investments are crucial for maintaining and expanding their operational capacity.

Looking ahead, Canacol has outlined a significant capital budget for 2025, with projections ranging between $143 million and $160 million. This substantial allocation underscores their commitment to long-term growth and asset development in the natural gas sector.

Canacol's operating expenses are primarily driven by the direct costs of managing its natural gas fields. These include essential field operating costs, ongoing maintenance to ensure asset integrity, and necessary workover operations on wells to optimize production.

For instance, in the first quarter of 2024, Canacol reported field operating costs of $16.8 million. Effective management of these expenditures is crucial, as it directly impacts the company's operating netback, a key measure of profitability from its core operations.

Royalties paid to the government are a significant expense for Canacol, often calculated as a percentage of production. For instance, in 2024, these royalty payments can represent a substantial portion of their gross revenue, directly impacting the netback price received for their natural gas and oil.

Transportation costs are another major component of Canacol's cost structure. These expenses cover the movement of extracted natural gas and oil from their production fields to processing facilities and ultimately to market. These costs are deducted from gross revenues before arriving at the netback figures, highlighting their direct impact on profitability.

Administrative and General Expenses

Administrative and General Expenses are a significant component of Canacol's cost structure, encompassing the essential corporate overhead required to run the business. These costs include salaries for management and administrative staff, office rentals, legal and accounting services, and other general operational expenses. For instance, in 2024, Canacol reported administrative and general expenses that were a key factor in their overall operational expenditure.

Beyond the core corporate functions, Canacol also allocates resources to social and environmental programs within this expense category. These initiatives reflect a commitment to sustainable operations and community engagement, which are increasingly important for energy companies. Such programs can include environmental remediation, community development projects, and employee training and safety initiatives, all contributing to the company's long-term viability and social license to operate.

- Corporate Overhead: Covers salaries for executive and administrative teams, office space, IT infrastructure, and other essential support functions.

- Management Costs: Includes compensation and benefits for senior leadership and management personnel responsible for strategic direction and operational oversight.

- General Administrative Functions: Encompasses legal fees, accounting services, insurance, and other professional services necessary for business operations.

- Social and Environmental Programs: Funds allocated for sustainability initiatives, community engagement, environmental stewardship, and corporate social responsibility efforts.

Debt Servicing Costs

Interest payments on senior notes and revolving credit facilities represent a substantial expense for Canacol. In 2024, the company's financial strategy heavily relies on managing these obligations to maintain its financial stability and profitability.

Effective management of debt levels and the associated interest rates is paramount for Canacol's overall financial health. This involves strategic refinancing and careful monitoring of market conditions to minimize borrowing costs.

- Senior Notes Interest: Canacol's 2024 financial reports highlight significant interest expenses related to its outstanding senior notes, a key component of its long-term financing.

- Revolving Credit Facilities: The company utilizes revolving credit facilities, incurring interest charges based on usage, which is a critical element of its short-term liquidity management.

- Debt Management Strategy: Canacol's approach to debt servicing focuses on optimizing its capital structure and securing favorable interest rates to control its cost of capital.

Canacol's cost structure is dominated by capital expenditures for exploration and development, alongside significant operating costs for field management and maintenance.

Royalties and transportation fees are substantial, directly impacting netback prices, while administrative costs include essential overhead and social programs.

Interest expenses on debt, particularly senior notes, are a critical financial outlay, necessitating careful debt management to ensure profitability.

| Cost Category | 2024 (Q1) | 2025 (Projected) |

|---|---|---|

| Field Operating Costs | $16.8 million | N/A |

| Capital Expenditures | N/A | $143 - $160 million |

| Administrative & General Expenses | Included in overall costs | N/A |

| Interest Expense | Significant component | N/A |

Revenue Streams

Canacol's main income comes from selling natural gas, primarily through firm take-or-pay contracts. These agreements ensure a steady and reliable revenue stream for the company. In 2024, Canacol reported significant natural gas sales, with production averaging 190 million cubic feet per day (MMcf/d) in the first quarter, underscoring the strength of these contracts.

While Canacol's primary focus is natural gas, crude oil sales represent a supplementary revenue stream. The company produces and sells crude oil from its operations across different Colombian basins, adding to its overall financial performance.

Revenues are also generated from the sale of Liquefied Natural Gas (LNG), a valuable byproduct of Canacol's natural gas extraction and processing. This diversification into LNG broadens market reach, enabling the company to tap into regions or industries that may not have direct access to pipeline natural gas. For instance, Canacol's 2023 financial reports highlight significant contributions from their LNG sales segment, reflecting growing demand and strategic market positioning.

Future Bolivian Operations

Future revenue streams for Canacol Energy are projected to emerge from its planned operations in Bolivia, contingent upon the formal ratification of exploration and redevelopment contracts. These anticipated revenues will stem from the development and subsequent production activities, with operations expected to commence in 2026.

The company is positioning itself to capitalize on Bolivia's energy sector, aiming to unlock new production and revenue potential. This strategic expansion is a key component of Canacol's long-term growth strategy.

- Bolivian Production Commencement: Operations slated to begin in 2026, following contract ratification.

- Revenue Generation: Income will be derived from the development and production of hydrocarbons in Bolivia.

- Strategic Expansion: Bolivia represents a significant new market for Canacol's future revenue growth.

Other Operational Revenues

Other operational revenues for Canacol could encompass income generated from providing specialized services related to their core energy operations. This might include things like equipment rentals or technical consulting for other energy companies.

While not a consistent revenue stream, the sale of non-core assets can also contribute. For instance, Canacol sold shares in Arrow Exploration Corp. in 2024, which represented a one-off injection of capital rather than recurring income.

- Ancillary Service Fees: Revenue from offering specialized operational services to third parties.

- Asset Disposals: Income from the sale of non-essential assets, such as investments in other companies.

- Equipment Leasing: Potential revenue from leasing out underutilized operational equipment.

- Joint Venture Contributions: Share of profits or fees from collaborative projects with other entities.

Canacol's revenue primarily stems from natural gas sales under firm take-or-pay contracts, ensuring a stable income. In the first quarter of 2024, the company's average production was 190 million cubic feet per day (MMcf/d), highlighting the robustness of these agreements.

Crude oil sales offer a secondary revenue stream, contributing to the company's overall financial performance. Additionally, the sale of Liquefied Natural Gas (LNG) diversifies Canacol's market reach, tapping into demand where direct pipeline access is limited.

Future revenue growth is anticipated from planned operations in Bolivia, expected to commence in 2026 following contract ratification, focusing on hydrocarbon development and production.

| Revenue Stream | Primary Source | 2024 Data/Projections |

| Natural Gas Sales | Firm take-or-pay contracts | Q1 2024 average production: 190 MMcf/d |

| Crude Oil Sales | Production from Colombian basins | Supplementary income |

| LNG Sales | Byproduct of natural gas processing | Growing market demand |

| Bolivian Operations | Hydrocarbon development and production | Projected commencement 2026 |

Business Model Canvas Data Sources

The Canacol Business Model Canvas is built upon a foundation of robust financial statements, comprehensive market analysis reports, and internal operational data. These diverse sources ensure each component of the canvas accurately reflects the company's current standing and strategic direction.