Canacol Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canacol Bundle

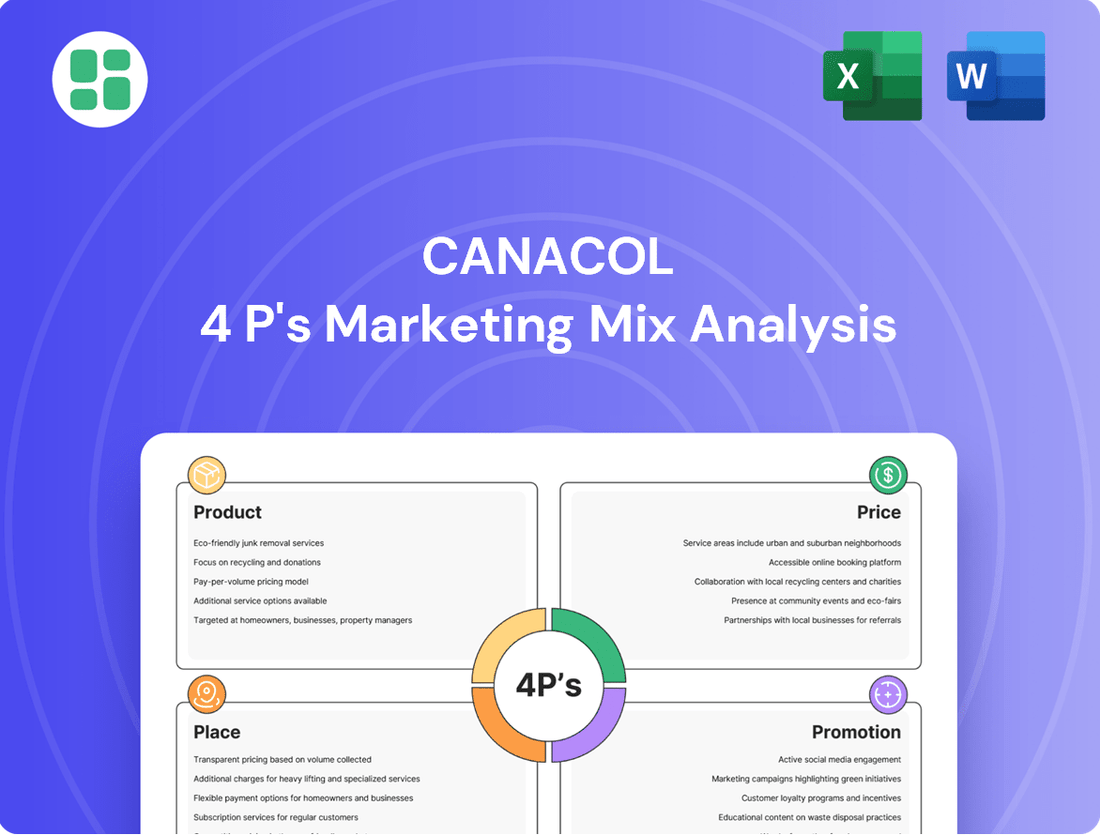

Unlock the secrets behind Canacol's market dominance with a comprehensive 4Ps Marketing Mix Analysis. This isn't just a surface-level overview; it's a deep dive into their product innovation, strategic pricing, effective distribution, and impactful promotions.

Discover how Canacol masterfully orchestrates its Product, Price, Place, and Promotion strategies to resonate with its target audience and drive consistent growth. This analysis provides actionable insights that can inform your own marketing endeavors.

Ready to elevate your marketing strategy? Gain instant access to the full, editable 4Ps Marketing Mix Analysis for Canacol, a valuable resource for professionals, students, and anyone seeking to understand successful market execution.

Product

Canacol Energy Ltd.'s core product is natural gas, meticulously processed to meet Colombian regulatory standards for a diverse customer base, including industrial and residential sectors. This processing ensures the gas is suitable for direct consumption.

The company's operational focus is on the onshore Lower Magdalena Basin in Colombia, a region rich in natural gas reserves. Canacol's exploration and production activities are concentrated here, highlighting their strategic geographical advantage.

The natural gas product undergoes several critical processing stages, including primary separation, dehydration, and hydrocarbon dew point conditioning. These steps, along with compression, filtration, and measurement, guarantee the gas's quality and readiness for market delivery, reflecting a commitment to product integrity.

Canacol's crude oil product, primarily extracted from blocks like Rancho Hermoso in Colombia, represents a significant component of its hydrocarbon portfolio, even as natural gas remains its core focus. This oil production contributes to the company's overall revenue stream and diversifies its energy offerings. In 2023, Canacol reported average oil production of approximately 2,000 barrels per day, a figure that influences its financial performance and market positioning.

Canacol's small-scale liquefied natural gas (LNG) plant in Colombia represents a significant product innovation, transforming natural gas into a more versatile commodity. This pioneering facility, processing gas from the Jobo fields, allows Canacol to meet diverse market demands by offering gas in a liquefied form for easier storage and distribution.

Energy Solutions for Colombia

Canacol's energy solutions are fundamental to Colombia's power landscape, directly addressing the nation's growing energy requirements. As of early 2024, the company reliably supplies around 17% of Colombia's total natural gas demand, a significant contribution to national energy security.

The company's impact is even more pronounced on the Caribbean Coast, where it fulfills over 50% of the region's gas needs. This makes Canacol an indispensable energy partner for this vital economic hub.

Canacol's strategic emphasis on natural gas production and distribution is well-aligned with Colombia's broader energy transition objectives. This focus supports cleaner energy alternatives for power generation and industrial processes.

- Meeting National Demand: Canacol provides approximately 17% of Colombia's natural gas.

- Regional Dominance: Over 50% of the Caribbean Coast's gas demand is met by Canacol.

- Energy Transition Alignment: The company's natural gas focus supports Colombia's shift towards cleaner energy sources.

- Critical Infrastructure: Canacol's supply is vital for power generation, industry, and residential use.

Reserve Base Growth and Optimization

Canacol's product offering, centered on its hydrocarbon reserves, is actively strengthened through continuous exploration and development. This commitment ensures a robust and expanding reserve base to meet future market demands.

To optimize production and boost reserves, Canacol is strategically drilling new exploration and development wells. These efforts are complemented by the installation of new compression and processing facilities, enhancing the efficiency and output of their operations.

This proactive approach guarantees a sustainable supply of hydrocarbons. For instance, Canacol's 2024 operational plans include significant capital expenditure dedicated to reserve growth and production optimization.

- Reserve Base Growth: Ongoing exploration and development are key to expanding Canacol's hydrocarbon reserves.

- Production Optimization: Drilling new wells and upgrading facilities are central to maximizing output.

- Sustainable Supply: These initiatives ensure a reliable long-term supply of energy resources.

- Capital Allocation: Significant investment in 2024 is earmarked for these growth and optimization projects.

Canacol's primary product is natural gas, processed to meet stringent Colombian standards for industrial and residential use, underpinning the nation's energy needs. Their LNG plant offers a versatile product, enhancing storage and distribution capabilities.

Canacol's natural gas supply is critical, meeting over 50% of the Caribbean Coast's demand and approximately 17% of Colombia's total demand as of early 2024. This positions them as a vital contributor to national energy security and the country's energy transition.

| Product | Key Feature | Market Share (Colombia) | Regional Dominance (Caribbean Coast) | 2024 Focus |

|---|---|---|---|---|

| Natural Gas | Processed to Colombian Standards | ~17% of Total Demand (Early 2024) | >50% of Regional Demand | Reserve Growth & Production Optimization |

| Liquefied Natural Gas (LNG) | Enhanced Storage & Distribution | N/A (Small-Scale Plant) | N/A | Meeting Diverse Market Demands |

What is included in the product

This analysis provides a comprehensive examination of Canacol's marketing strategies, detailing their Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

It's designed for professionals seeking a deep understanding of Canacol's market positioning and offers a solid foundation for case studies or strategy development.

Provides a clear, actionable framework to address marketing challenges, transforming complex strategies into manageable solutions.

Simplifies the identification and resolution of marketing roadblocks, ensuring efficient and effective campaign execution.

Place

Canacol leverages an extensive pipeline infrastructure, a cornerstone of its marketing strategy, to ensure efficient natural gas delivery. This network is vital for reaching key demand centers, highlighting the physical embodiment of their product's accessibility.

The company's 240-kilometer, 20-inch pipeline connects its Jobo gas processing facilities directly to major consumption hubs like Cartagena and Barranquilla. This significant artery is complemented by a 10-inch pipeline serving the Cerromatoso mine, demonstrating a commitment to broad market penetration.

This robust pipeline system is not merely a transport mechanism; it's a critical enabler of Canacol's market reach and customer service. The capacity and reach of this infrastructure directly impact the company's ability to meet demand reliably and competitively in 2024 and beyond.

Canacol Energy primarily focuses its sales strategy on direct engagement with major industrial clients and power generation facilities. This direct sales approach is crucial for securing consistent demand for its natural gas output.

These direct sales are typically structured through long-term, US dollar-denominated, fixed-price take-or-pay contracts. For instance, Canacol reported in its 2024 investor presentations that its average realized natural gas price for the first quarter of 2024 was $4.68 per million British thermal units (MMbtu), reflecting the stability these contracts provide.

By bypassing intermediaries, Canacol ensures significant revenue streams and establishes strong relationships with key energy consumers. This strategy directly addresses the needs of large-scale users who require reliable and predictable natural gas supplies for their operations.

Canacol's marketing strategy hinges on a tight geographic concentration, primarily within Colombia's onshore Lower Magdalena Basin. This focus is crucial as it hosts the company's core natural gas assets, enabling streamlined logistics and efficient infrastructure development. By concentrating operations here, Canacol can effectively serve the country's most populous and energy-hungry regions.

This strategic placement within the Lower Magdalena Basin, along with its presence in the Middle Magdalena Valley Basin, allows Canacol to optimize its supply chain. For instance, in 2024, the company continued to leverage its proximity to key industrial customers, reporting an average production of 150 MMcf/d from its Colombian operations, underscoring the efficiency of its concentrated asset base.

Micro LNG Facility for Specialized Distribution

A micro LNG facility offers a specialized distribution channel for natural gas, reaching locations beyond traditional pipeline networks. This capability is crucial for serving niche markets and remote areas that are uneconomical to connect via extensive pipeline infrastructure, as seen in Canacol's strategy. For instance, in 2024, Canacol Energy reported continued progress in expanding its natural gas production and transportation infrastructure, aiming to serve a growing industrial and commercial customer base in Colombia, including those requiring off-pipeline solutions.

This approach enhances market penetration by providing a flexible supply chain. It allows for the liquefaction of natural gas on-site or at a nearby hub, making it transportable via truck or ship to end-users. This is particularly beneficial for industrial clients or communities that require a reliable gas supply but lack direct pipeline access. Canacol's investments in midstream infrastructure, including potential LNG capabilities, align with the growing demand for cleaner energy solutions in regions like Latin America, where pipeline networks can be challenging to establish.

The strategic advantage lies in accessing previously untapped customer segments. By liquefying natural gas, it becomes more manageable and cost-effective to transport to diverse locations, thereby broadening the customer base. This specialized distribution model can be a key differentiator, especially in emerging markets where energy infrastructure is still developing.

Key benefits of this specialized distribution include:

- Market Access: Ability to serve customers not connected to existing pipeline grids.

- Flexibility: Adaptable to various transport modes (truck, ship) for diverse delivery needs.

- Cost-Effectiveness: Potentially lower infrastructure costs compared to extending pipelines to remote areas.

- New Revenue Streams: Opens opportunities in niche markets and off-grid industrial applications.

Future Expansion into New Basins and Regions

Canacol is strategically positioning itself for sustained growth by actively exploring new high-impact gas opportunities. The company is focusing its efforts on both the Lower and Middle Magdalena Valley Basins, areas identified for their significant potential. This proactive exploration is a key component of their strategy to diversify and enhance their asset base.

Beyond its established Colombian operations, Canacol is laying the groundwork for a significant international expansion. The company plans to commence operations in Bolivia in 2026, marking a major step in broadening its geographical reach. This move is expected to unlock new revenue streams and further solidify Canacol's presence in South America.

This forward-looking approach to expansion is designed to significantly increase Canacol's operational footprint and distribution capabilities. By venturing into new basins and regions, the company aims to secure future growth and reduce reliance on its current core areas. This diversification is crucial for long-term resilience and market leadership.

- Exploration Focus: Lower and Middle Magdalena Valley Basins in Colombia.

- International Expansion: Planned commencement of operations in Bolivia in 2026.

- Strategic Objective: Expand operational footprint and distribution reach.

- Growth Driver: Securing future growth through diversification and new market entry.

Canacol's place strategy is defined by its extensive pipeline network, directly connecting production to major demand centers like Cartagena and Barranquilla. This 240-kilometer, 20-inch pipeline, along with a 10-inch line to the Cerromatoso mine, ensures efficient and reliable delivery, underpinning its market accessibility in 2024.

The company's geographic focus on Colombia's onshore Lower Magdalena Basin optimizes its supply chain and allows for efficient infrastructure development, serving energy-hungry regions. This concentration, coupled with a micro LNG capability, extends market reach to areas not served by traditional pipelines.

Canacol's strategic placement within key basins, like the Lower Magdalena Valley, allows for optimized logistics and proximity to industrial customers. For instance, in 2024, the company reported an average production of 150 MMcf/d from its Colombian operations, showcasing the efficiency of its concentrated asset base.

Canacol is also expanding its geographical footprint, with planned operations in Bolivia starting in 2026. This international expansion aims to diversify revenue streams and solidify its market presence across South America.

| Asset Location | Pipeline Infrastructure | Key Markets Served | 2024 Production (MMcf/d) |

|---|---|---|---|

| Lower Magdalena Basin, Colombia | 240 km, 20-inch (Jobo to Cartagena/Barranquilla) | Cartagena, Barranquilla | 150 (average) |

| 10-inch (to Cerromatoso mine) | Cerromatoso mine | ||

| Planned Bolivia Operations | TBD | TBD | N/A (operations commence 2026) |

What You Preview Is What You Download

Canacol 4P's Marketing Mix Analysis

The preview you see here is the exact same, fully completed Canacol 4P's Marketing Mix Analysis that you will receive instantly after purchase. There are no hidden surprises or missing sections; what you view is precisely what you'll download. This ensures you get a comprehensive and ready-to-use document immediately upon completing your order.

Promotion

Canacol actively engages its investor base through comprehensive financial reporting, including quarterly earnings releases and detailed investor presentations. This commitment to transparency equips financially-literate decision-makers with the essential data for thorough investment analysis.

Key performance indicators such as EBITDAX, net income, and production volumes are consistently highlighted in these communications. For instance, Canacol reported a significant increase in its average production to approximately 220 MMcf/d in the first quarter of 2024, demonstrating strong operational performance that directly impacts financial metrics.

Canacol Energy, in its strategic corporate communications, consistently disseminates vital information to its stakeholder base. This includes timely press releases detailing operational milestones, such as drilling campaign outcomes and updated capital expenditure forecasts for 2024 and into 2025. These announcements are crucial for transparency and managing market expectations.

The company's proactive approach to communication aims to clearly articulate its progress and future trajectory, specifically highlighting achievements in exploration and production. For instance, updates on production levels, such as the reported average production of 183 MMcf/d in Q1 2024, underscore the tangible results of their strategic initiatives and provide a basis for investor confidence.

These communications are meticulously crafted to resonate with a diverse audience, encompassing individual investors, financial analysts, and media outlets. By providing a clear narrative of their operational performance and strategic direction, Canacol seeks to build and maintain strong relationships within the financial community, fostering informed investment decisions.

Canacol actively participates in key industry conferences and delivers corporate presentations. This strategy directly engages the investment community and industry peers, offering a platform to showcase their valuable natural gas assets and ambitious growth plans. For instance, in 2024, the company presented at conferences like the Colombia Investment Summit, highlighting their proven track record and future development pipeline.

Commitment to ESG Strategy

Canacol actively communicates its deep commitment to Environmental, Social, and Governance (ESG) principles to all stakeholders. This proactive approach highlights their dedication to fostering a cleaner energy future, implementing robust waste management practices, nurturing strong community relationships, and upholding transparent governance. This focus on sustainability is particularly attractive to investors prioritizing responsible and forward-thinking companies.

This commitment translates into tangible actions and measurable results, aligning with growing investor demand for sustainable investments. For example, Canacol's ongoing investments in natural gas, a cleaner-burning fuel compared to coal, directly contribute to reducing greenhouse gas emissions. Their community engagement programs aim to create shared value, fostering positive local development. The company's transparent reporting on its ESG performance further solidifies stakeholder trust.

- Environmental Stewardship: Focus on cleaner energy sources and responsible resource management.

- Social Responsibility: Emphasis on community relations and positive social impact.

- Governance Excellence: Commitment to transparent and ethical business practices.

- Investor Appeal: Attracting capital from a growing segment of ESG-focused investors.

Market Positioning as a Key Energy Provider

Canacol actively positions itself as a cornerstone of Colombia's energy infrastructure, emphasizing its status as the nation's largest independent natural gas producer. This strategic market positioning underscores its substantial contribution to meeting the country's energy demands, reinforcing its reliability for both industrial consumers and residential households. In 2024, Canacol's production played a vital role in supplying a significant portion of Colombia's natural gas needs, a trend expected to continue into 2025.

The company's market presence is further solidified by its consistent delivery and operational excellence, making it a trusted energy provider. This focus on being a key player in the national energy landscape directly supports its marketing objectives by establishing credibility and dependability. Canacol's commitment to supplying natural gas is crucial for powering industries and homes across Colombia.

- Largest Independent Producer: Canacol leads Colombia's independent natural gas production sector.

- Energy Security: The company's output is critical for national energy security.

- Reliable Supply: Canacol ensures a dependable gas supply to industrial and residential markets.

- Economic Impact: Its role as a major producer contributes significantly to Colombia's economy.

Canacol's promotional strategy centers on transparent communication and active engagement with its diverse stakeholder base. The company leverages financial reports, investor presentations, and press releases to highlight operational achievements and growth prospects, ensuring key metrics like production volumes and financial performance are readily accessible. This proactive dissemination of information, including updates on drilling campaigns and capital expenditure forecasts for 2024-2025, builds investor confidence and manages market expectations effectively.

Furthermore, Canacol actively participates in industry conferences, such as the Colombia Investment Summit in 2024, to showcase its natural gas assets and strategic plans. The company also emphasizes its commitment to ESG principles, highlighting its role in cleaner energy and community development, which appeals to a growing segment of sustainability-focused investors. By positioning itself as Colombia's largest independent natural gas producer, Canacol reinforces its critical role in national energy security and economic stability.

| Metric | Q1 2024 | 2024 Forecast (Average) | 2025 Outlook (Average) |

|---|---|---|---|

| Average Production (MMcf/d) | 183 | ~220 | Projected increase |

| EBITDAX | Reported in quarterly financials | Key performance indicator | Key performance indicator |

| Capital Expenditures | Detailed in press releases | Updated forecasts provided | Updated forecasts provided |

Price

Canacol's marketing strategy heavily relies on long-term, US dollar-denominated, fixed-price take-or-pay contracts for its natural gas sales. This structure offers substantial revenue stability and predictability, shielding the company from market price fluctuations.

Looking ahead to 2025, Canacol has secured firm take-or-pay contracts projecting an average of 111 million cubic feet per day (MMcfpd). The anticipated wellhead prices for these contracts are expected to fall within the range of $7.33 to $7.65 per thousand cubic feet (Mcf).

Canacol's interruptible sales pricing strategy directly reflects Colombia's dynamic energy market. When electrical demand surges or natural gas supply becomes constrained, typically during dry seasons or due to operational issues, prices for these interruptible volumes can rise significantly. This flexibility allows Canacol to optimize revenue by selling gas at premium rates during peak demand periods.

For instance, during periods of heightened demand in 2024, Canacol reported achieving higher average sales prices for its interruptible gas. This strategy is crucial for maximizing profitability, as these sales are contingent on market conditions, enabling the company to capitalize on favorable supply-demand imbalances and achieve stronger financial performance when the market allows.

Canacol's crude oil pricing is directly linked to international benchmarks like Brent crude. This means its revenue is sensitive to global supply and demand dynamics, as well as geopolitical events that can influence oil prices. For instance, in early 2024, Brent crude oil prices hovered around $80 per barrel, reflecting ongoing global economic recovery and production adjustments by major oil-producing nations.

Cost Efficiency and Netback Optimization

Canacol's commitment to cost efficiency directly fuels its netback optimization strategy. By diligently managing operating expenses and enhancing production efficiency, the company ensures that a larger portion of its sales revenue converts into profit. This focus is crucial for maximizing profitability in the competitive energy market.

The tangible results of this approach are evident in Canacol's financial performance. For instance, the company achieved a notable 12% increase in its natural gas netback, reaching $5.48 per Mcf in the first quarter of 2025. This improvement underscores the effectiveness of their operational and cost management initiatives.

- Operating Expense Control: Proactive measures to minimize costs across all operational facets.

- Production Efficiency: Streamlining processes to maximize output from existing assets.

- Netback Improvement: A 12% increase in natural gas netback to $5.48 per Mcf in Q1 2025.

Capital Budgeting and Debt Management Influence

Canacol's pricing strategy is intrinsically linked to its capital budgeting and debt management. The company's guidance for its average wellhead natural gas sales price in 2025, for instance, takes into account significant planned investments in drilling and infrastructure. These investments are crucial for supporting robust EBITDA generation.

Furthermore, these capital expenditure plans are balanced against the objective of maintaining a healthy leverage ratio. This dual focus ensures that pricing decisions not only fund growth but also contribute to financial stability.

- 2025 Natural Gas Price Guidance: Reflects investment needs and debt reduction goals.

- EBITDA Generation: Capital expenditures are designed to boost earnings before interest, taxes, depreciation, and amortization.

- Leverage Ratio: Pricing supports the company's aim to keep its debt levels manageable.

Canacol's pricing strategy is built on a foundation of stable, long-term contracts for natural gas, predominantly denominated in US dollars and featuring fixed prices. This approach provides significant revenue predictability, insulating the company from volatile market price swings.

For 2025, Canacol has secured firm take-or-pay contracts projecting an average of 111 MMcfpd, with anticipated wellhead prices ranging from $7.33 to $7.65 per Mcf. This pricing structure directly supports robust EBITDA generation and aids in managing leverage ratios, aligning with capital budgeting and debt management objectives.

| Contract Type | Volume (MMcfpd) | Price Range (per Mcf) | Year |

|---|---|---|---|

| Take-or-Pay | 111 | $7.33 - $7.65 | 2025 |

4P's Marketing Mix Analysis Data Sources

Our Canacol 4P's Marketing Mix Analysis is constructed using a blend of official company disclosures, including annual reports and investor presentations, alongside industry-specific data and competitive intelligence. We also leverage information from their website and public announcements to ensure a comprehensive view of their strategy.