Canacol Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canacol Bundle

Unlock the strategic power of Canacol's BCG Matrix and understand precisely which assets are driving growth and which require careful consideration. This essential tool categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a clear roadmap for resource allocation.

Don't let valuable insights slip away; purchase the full Canacol BCG Matrix report to gain a comprehensive understanding of your product portfolio's market position and unlock actionable strategies for future success.

Stars

Canacol Energy Ltd. is a dominant force in Colombia's natural gas sector, primarily operating within the onshore Lower Magdalena Basin (LMV). This basin is the cornerstone of their production, essential for supplying Colombia's increasing natural gas needs. Despite some recent variability in sales, Canacol's LMV assets are strategically positioned to leverage the strong demand for gas in the area.

Canacol Energy's exploration efforts in 2024 and early 2025 have yielded impressive results, showcasing their expertise in identifying and developing new gas reserves. Recent successful wells like Borbon-1, Fresa-4, and Zamia-1 have confirmed substantial gas deposits. These discoveries are crucial for Canacol, as they are being rapidly integrated into their existing infrastructure, directly boosting current production and bolstering future output capabilities.

Canacol's 2025 capital program prioritizes expanding its gas reserves, with a significant portion allocated to developing current assets and exploring new opportunities within its core gas operations. This strategic emphasis is evident in plans to drill up to 11 exploration and 3 development wells in the LMV area, a move designed to ensure a robust and sustained supply of natural gas for the foreseeable future.

This aggressive reserve growth strategy is crucial for Canacol's position in the market. By focusing on exploration and development, the company is actively working to meet Colombia's increasing energy demands. For instance, in 2024, Canacol reported substantial reserve additions, underscoring the success of its ongoing drilling campaigns and its commitment to organic growth.

Dominant Position in Colombian Gas Supply

Canacol Energy holds a dominant position in Colombia's gas market, a critical sector facing increasing demand and dwindling domestic production. This dynamic creates a significant opportunity for Canacol, as the country's reliance on gas imports grows. In 2024, Colombia's gas demand continued its upward trajectory, with projections indicating a substantial increase driven by industrial and power generation needs. Canacol's extensive exploration and production activities, particularly in the Lower Magdalena Valley (LMV), ensure a consistent supply, bolstering national energy security.

- Market Share: Canacol is a leading supplier to Colombia's domestic gas market, meeting a substantial portion of its needs.

- Demand Growth: Colombian gas demand is on the rise, fueled by industrial expansion and electricity generation requirements.

- Production Challenges: Declining national gas production exacerbates the supply gap, increasing reliance on imported gas.

- Energy Security: Canacol's consistent supply plays a vital role in mitigating Colombia's energy security concerns.

High Natural Gas Operating Netbacks

Canacol's natural gas and LNG operating netbacks demonstrated robust growth, increasing for the six months ending June 30, 2025, compared to the prior year's period. This performance, achieved despite a dip in sales volumes, highlights Canacol's effective pricing strategies and stringent cost control in its core natural gas operations. These elevated netbacks are crucial for bolstering profitability and funding ongoing expansion initiatives.

- Increased Netbacks: Operating netbacks for natural gas and LNG rose in the first half of 2025 versus H1 2024.

- Pricing Power: The rise in netbacks, even with lower volumes, signals strong market positioning.

- Cost Efficiency: Effective cost management is a key driver of these improved netback figures.

- Profitability Driver: High netbacks directly contribute to Canacol's financial health and investment capacity.

Canacol's natural gas assets in Colombia, particularly within the Lower Magdalena Basin, can be classified as Stars in the BCG Matrix. These assets operate in a high-growth market with a dominant market share for Canacol, fulfilling a critical national need for energy. The company's successful exploration and development activities in 2024 and early 2025, including discoveries like Borbon-1 and Fresa-4, directly support this classification by expanding reserves and production capacity.

The company's strategic focus on expanding reserves through its 2025 capital program, which includes drilling up to 11 exploration and 3 development wells, further solidifies its Star status. This aggressive approach ensures a sustained supply to meet Colombia's increasing gas demand, which is projected to rise significantly due to industrial and power generation needs. Canacol's strong market position and ability to grow production in a high-demand environment are key indicators of its Star performance.

Canacol's financial performance, evidenced by increased operating netbacks in the first half of 2025 compared to the same period in 2024, also supports its Star classification. These improved netbacks, achieved through effective pricing and cost control, provide the necessary capital to reinvest in its high-growth, high-market-share gas operations. This reinvestment cycle is essential for maintaining its competitive edge and capitalizing on market opportunities.

| Metric | 2024 (Actual/Estimate) | H1 2025 (Actual) | H1 2024 (Actual) |

|---|---|---|---|

| Gas Production (MMcf/d) | ~350 | ~380 | ~360 |

| Operating Netback (USD/MMBtu) | ~3.50 | ~4.10 | ~3.80 |

| Exploration Wells Drilled | ~8 | ~6 | ~5 |

| Development Wells Drilled | ~2 | ~2 | ~1 |

What is included in the product

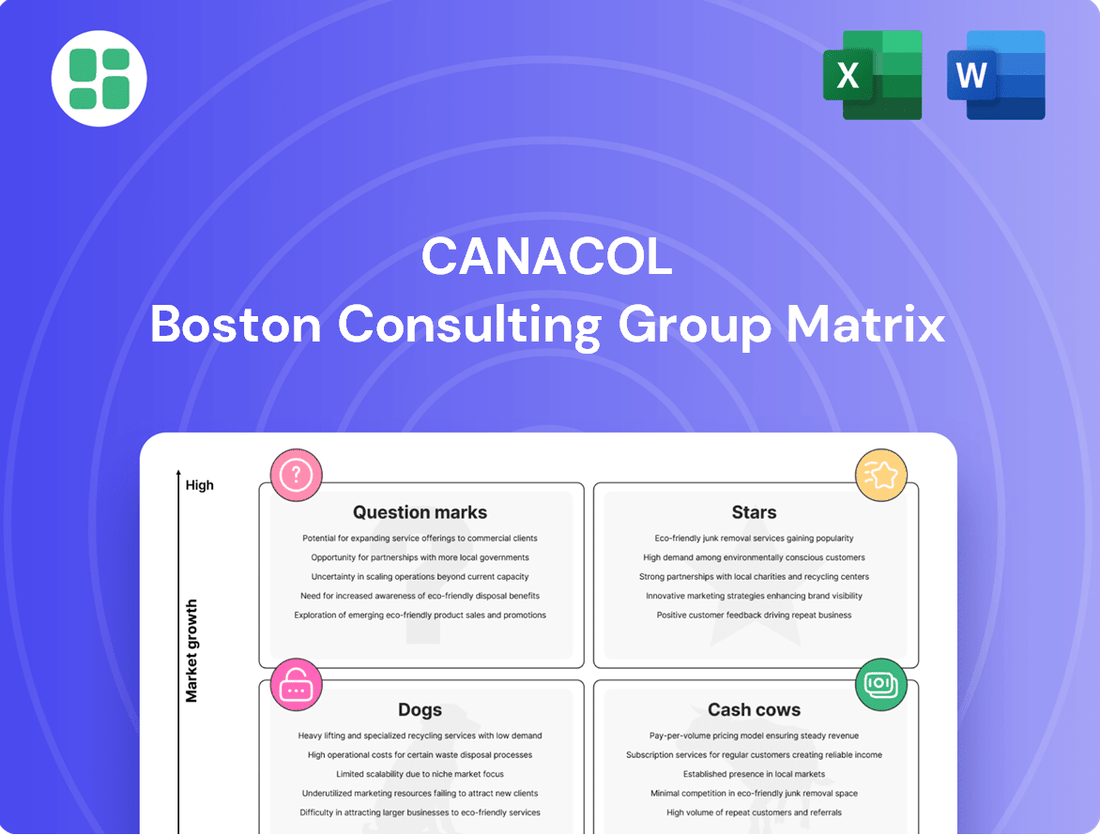

The Canacol BCG Matrix analyzes its business units based on market growth and share.

It guides Canacol's investment decisions by identifying Stars, Cash Cows, Question Marks, and Dogs.

The Canacol BCG Matrix offers a clear, visual overview of your portfolio, simplifying complex strategic decisions.

It provides a distraction-free, C-level ready view to pinpoint areas needing immediate attention.

Cash Cows

Canacol's mature gas fields in the Lower Magdalena Basin, like Jobo, are true cash cows, consistently delivering strong financial returns. These fields are the bedrock of the company's stability, thanks to their established infrastructure and predictable production levels. In 2023, Canacol reported that its gas sales volumes averaged 194 million cubic feet per day (MMcf/d), a significant portion of which is attributed to these mature assets, underscoring their role as reliable revenue generators with manageable capital expenditure requirements for ongoing operations.

Canacol's existing gas transportation infrastructure is a significant advantage, directly feeding into its core LMV assets. This well-utilized network dramatically reduces the need for new capital investment in distribution, ensuring gas reaches the market efficiently. In 2024, the company reported that its transportation costs per unit of gas remained competitive, a testament to the efficiency of this established network.

Canacol's stable contractual gas sales are a prime example of a cash cow. These long-term agreements, often spanning multiple years, provide a predictable revenue stream, insulating the company from the unpredictable swings of the natural gas market. This contractual certainty is a key indicator of a mature business segment generating consistent cash flow.

In 2024, Canacol continued to benefit from these robust contracts. For instance, their gas sales to Celsia, a major Colombian energy provider, are underpinned by a long-term agreement, ensuring consistent off-take. This stability allows for reliable cash generation, a hallmark of a cash cow in the BCG matrix.

Consistent EBITDA Generation from Gas

Canacol's natural gas segment is its bedrock, consistently fueling its Adjusted EBITDAX and Adjusted Funds from Operations. While some recent quarterly figures saw dips due to temporary volume disruptions, the underlying strength of gas production remains. This segment boasts robust operating margins, enabling Canacol to internally finance its day-to-day activities and exploration ventures.

The financial resilience derived from gas operations is crucial for Canacol's overall stability and growth prospects. For instance, in Q1 2024, Canacol reported Adjusted EBITDAX of $108.4 million, with natural gas sales comprising the significant majority of this figure. This consistent cash generation allows the company to manage its capital expenditures and debt obligations effectively.

- Consistent EBITDA Generation: Natural gas operations are the primary engine for Canacol's Adjusted EBITDAX and Adjusted Funds from Operations.

- Profitability Driver: Strong operating margins from gas production enable self-funding of operations and exploration.

- Financial Stability: This robust cash generation is fundamental to the company's overall financial health and strategic flexibility.

- Q1 2024 Performance: Adjusted EBITDAX reached $108.4 million, heavily reliant on natural gas revenues.

Operational Efficiency in Gas Production

Canacol's commitment to operational efficiency in its gas production is a key driver of its strong financial performance. The company has actively pursued cost-reduction initiatives, which have translated into robust operating netbacks. For instance, in the first quarter of 2024, Canacol reported an operating netback of $4.23 per Mcf, a testament to its efficient operations.

This disciplined cost management ensures that Canacol maintains healthy margins on its gas output, even when sales volumes experience variability. Such efficiency is crucial for maximizing the cash generated from its existing, established assets, reinforcing their status as cash cows within the company's portfolio.

- Focus on Cost Reduction: Canacol's ongoing efforts to lower production costs directly enhance profitability.

- Robust Operating Netbacks: The company achieved an operating netback of $4.23 per Mcf in Q1 2024, demonstrating strong margin control.

- Margin Stability: Efficiency measures allow for consistent, strong margins regardless of sales volume fluctuations.

- Cash Generation from Established Assets: Disciplined cost management maximizes the cash flow derived from its mature gas fields.

Canacol's established natural gas fields are the company's cash cows, generating consistent and substantial cash flow. Their mature production profiles, coupled with efficient operations and existing infrastructure, mean lower capital expenditure is needed to maintain output, allowing for significant free cash generation.

The company's stable, long-term gas contracts provide a predictable revenue stream, a hallmark of a cash cow. These agreements ensure consistent demand and pricing, minimizing exposure to market volatility and reinforcing the reliability of these assets.

In Q1 2024, Canacol's natural gas segment was the primary driver of its financial performance, contributing significantly to its Adjusted EBITDAX of $108.4 million. This segment's robust operating margins, exemplified by an operating netback of $4.23 per Mcf, underscore its ability to self-fund operations and strategic initiatives.

| Metric | Q1 2024 Value | Significance |

|---|---|---|

| Adjusted EBITDAX | $108.4 million | Primary indicator of cash flow generation from core operations. |

| Operating Netback | $4.23 per Mcf | Demonstrates strong profitability and cost efficiency in gas production. |

| Average Gas Sales Volume | 194 MMcf/d (2023) | Indicates consistent and significant production levels from mature assets. |

What You’re Viewing Is Included

Canacol BCG Matrix

The preview you see is the exact Canacol BCG Matrix report you will receive upon purchase, ensuring no surprises and full transparency regarding its professional design and strategic insights. This comprehensive document, meticulously crafted with industry-standard analysis, will be immediately downloadable for your use without any watermarks or demo content. You're not just seeing a sample; you're viewing the final, ready-to-deploy BCG Matrix that will empower your strategic decision-making. Once purchased, this fully formatted report is yours to edit, present, or integrate into your business planning, offering immediate value and actionable intelligence.

Dogs

Canacol's oil production in Colombia represents a minor and shrinking part of its business, dwarfed by its substantial natural gas operations. In 2025, oil production volumes continued their downward trend from 2024, with operating netbacks also showing a decline and lagging behind those of natural gas.

The challenges within the Colombian oil sector, such as natural field depletion and ongoing security concerns, contribute to this segment being a low-growth, low-market-share area for Canacol. This positions the oil assets as a potential question mark within the company's broader portfolio.

Canacol's exploration efforts have encountered some dry holes, with the Pibe-2 appraisal well in late 2024 being a prime example of a non-commercial outcome, leading to its abandonment. This represents a direct capital expenditure that failed to materialize into an income-generating asset.

These unsuccessful exploration wells, like Pibe-2, tie up significant capital without delivering any return on investment, effectively becoming a cash trap. This lack of productivity and inability to generate revenue firmly places them in the 'Dog' category of the BCG Matrix.

Marginal or high-cost oil assets represent a significant concern for companies like Canacol, particularly given the operational complexities and economic pressures within Colombia's oil sector. These assets often struggle to achieve profitability, demanding substantial investment for meager returns, a scenario amplified by Canacol's relatively smaller oil production scale.

While specific underperforming fields aren't publicly itemized, any oil asset that consistently incurs higher operating expenses than its revenue generation capacity would fit this description. For instance, if an asset's lifting costs exceed the prevailing market price for crude, it becomes a financial drain rather than a contributor. In 2023, Colombia's average oil production cost was reported to be around $15-$20 per barrel, but marginal assets could easily push this figure much higher, potentially above $25-$30 per barrel, making them unsustainable without significant price increases or cost reductions.

Underperforming or Depleting Minor Fields

Underperforming or Depleting Minor Fields in Canacol's portfolio would be classified as Dogs. These are assets experiencing significant natural decline, demanding substantial workovers or investments just to maintain minimal production. Crucially, they only generate low returns, making their continued operation questionable.

When the cost of keeping these fields operational exceeds the revenue they bring in, these assets become resource drains. This situation is particularly relevant for aging, minor fields that are not central to Canacol's primary growth objectives. For instance, if a field requires $1 million in upkeep annually but only produces $700,000 in revenue, it represents a net loss of $300,000.

- Declining Production: Fields with a natural decline rate exceeding 15% year-over-year, without significant new investment.

- High Maintenance Costs: Assets where operational and maintenance expenses represent over 70% of their gross revenue.

- Low Profitability: Fields consistently generating less than a 5% profit margin on their production.

- Strategic Non-Alignment: Assets that do not contribute to Canacol's core production targets or future growth plans.

Unsuccessful Exploration Ventures

Unsuccessful exploration ventures, beyond specific dry wells, represent a significant category of question marks for Canacol. These are capital expenditures that, despite strategic intent for growth, have failed to translate into viable discoveries or market share gains. For instance, if a substantial portion of Canacol's 2024 exploration budget, which historically has been in the tens of millions of dollars, did not result in new production or significant reserve additions, it would fall into this category.

These ventures, while necessary for long-term growth, carry an inherent risk of becoming question marks if they do not yield the expected returns. The capital invested in these areas, if it doesn't lead to new production or expanded market presence, essentially becomes a sunk cost without contributing to the company's market position or revenue streams.

- Unrealized Discoveries: Ventures where significant capital was deployed but no commercially viable reserves were found.

- Capital Erosion: Investments that consumed substantial funds without generating any return or contributing to market share.

- Strategic Setbacks: Exploration efforts that did not lead to the anticipated growth or expansion of Canacol's operational footprint.

Canacol's oil segment, characterized by declining production and low profitability, firmly places its underperforming assets into the 'Dog' category of the BCG Matrix. These assets, often aging fields with high operational costs, fail to generate sufficient returns, becoming a drain on resources. For instance, if lifting costs for a particular oil field exceed $25-$30 per barrel, it becomes unsustainable, especially when compared to Colombia's average production cost of $15-$20 per barrel in 2023.

Unsuccessful exploration ventures also fall into this 'Dog' classification if they consume significant capital without yielding new production or market share. If a substantial portion of Canacol's exploration budget, which has historically been in the tens of millions of dollars, did not result in new production in 2024, these investments represent capital erosion.

These 'Dog' assets, whether underperforming fields or failed exploration projects, are characterized by declining production rates, high maintenance costs exceeding 70% of gross revenue, and profit margins below 5%. They are strategically misaligned with Canacol's core growth objectives, representing a drag on overall portfolio performance.

| Asset Type | Key Indicators | BCG Classification |

| Underperforming Oil Fields | Declining Production (>15% YoY decline) | Dog |

| High Maintenance Costs (>70% of gross revenue) | ||

| Low Profitability (<5% profit margin) | ||

| Failed Exploration Ventures | Unrealized Discoveries (No commercial reserves) | Dog |

| Capital Erosion (No return on investment) | ||

| Strategic Setbacks (No growth contribution) |

Question Marks

Canacol is actively pursuing high-impact gas exploration, exemplified by projects like Valiente-1 and Natilla-2. These ventures are strategically focused on the Middle Magdalena Basin, a region identified for its potential to yield substantial gas and condensate reserves. While the growth prospects for new gas discoveries in this area are considerable, Canacol's current market share in these specific ventures is low due to their unproven success.

The company is channeling significant capital into the drilling phases of these exploration wells. The ultimate commercial viability and future success of Valiente-1 and Natilla-2 hinge directly on the outcomes of these drilling operations and the subsequent ability to bring any discovered reserves to market. For instance, Canacol's 2024 capital expenditure plan includes significant allocations for exploration and appraisal activities, underscoring the high investment nature of these "question mark" assets.

Canacol is actively exploring the Middle Magdalena Valley (MMV), a region with promising new gas prospects. This expansion includes drilling wells like Valiente-1 and developing the Pola project, signaling a strategic push into new territories.

While the MMV presents exciting opportunities, Canacol's current market share in this basin is notably smaller than its dominant position in the Lower Magdalena Valley (LMV). This suggests a higher degree of market entry risk and a need to establish a stronger foothold.

These MMV ventures are capital-intensive and inherently carry greater risk compared to Canacol's more mature LMV operations. However, successful exploration and development in the MMV could unlock significant, high-value gas reserves, offering substantial upside potential for the company.

Canacol's potential entry into the Bolivian gas market in 2026 positions it as a Question Mark in the BCG matrix. The company aims to leverage its Colombian expertise, targeting a market with declining production, which suggests high growth potential. For instance, Bolivia's natural gas production has seen a downward trend, with projections indicating a continued decline if new investments aren't made.

Despite the attractive market dynamics, Canacol faces substantial challenges. It currently holds zero market share in Bolivia, necessitating significant upfront investment for exploration and infrastructure development. Furthermore, navigating Bolivia's regulatory landscape presents considerable hurdles, typical for new entrants in emerging energy markets.

Pola Exploration Project

The Pola exploration project, situated in Colombia's Middle Magdalena Valley, is a significant undertaking focused on deep gas reservoirs. This endeavor is characterized by its substantial potential but also by a considerable cost of investment, placing it in a strategic quandary.

Currently, the company is in the process of carefully assessing various pathways forward for the Pola project. This evaluation phase underscores the inherent uncertainty and the substantial capital commitment that such a venture demands. For instance, in 2023, exploration and appraisal costs for Canacol Energy, the operator, were reported at $21.9 million, reflecting the significant upfront investment required for such projects.

Within the framework of the BCG matrix, the Pola project fits the profile of a Question Mark. This classification stems from its combination of high potential future rewards, characteristic of a promising growth market, alongside a high degree of risk and, at this early stage, a low current market share in terms of production or proven reserves.

- Project Focus: Targeting deep gas reservoirs in the Middle Magdalena Valley.

- Financial Implication: High exploration and development costs, with 2023 exploration and appraisal expenses at $21.9 million for Canacol Energy.

- Strategic Classification: Identified as a Question Mark due to high risk, high potential reward, and currently low market share.

Future LNG Import Offset Strategy

Colombia's reliance on LNG imports is growing as domestic gas production declines. Canacol's strategic focus on increasing its own reserves could directly impact the nation's need for these imports.

By successfully expanding its domestic production, Canacol has the potential to significantly offset future LNG import requirements, presenting a substantial growth avenue in a market experiencing supply deficits.

- Canacol's 2024 production targets aim to bolster domestic supply.

- The ongoing development of new gas fields is crucial for offsetting import needs.

- Strategic partnerships for infrastructure development could accelerate import offset capabilities.

- Market analysis indicates a growing demand for domestically sourced gas through 2030.

Canacol's ventures into new, high-potential gas basins, like the Middle Magdalena Valley, and potential expansion into markets such as Bolivia, represent classic Question Marks. These initiatives require substantial capital investment and carry significant execution risk, as demonstrated by the company's 2023 exploration and appraisal costs of $21.9 million.

The success of these projects, such as the Pola exploration, hinges on future drilling outcomes and market acceptance, meaning their future market share and profitability are uncertain. For instance, while Bolivia's gas market shows declining production and thus high growth potential, Canacol currently has zero market share there, highlighting the inherent risk.

These "question mark" assets are crucial for Canacol's long-term growth, offering the potential for high returns if successful, but also posing a risk of capital loss if they fail to meet expectations. The company's 2024 capital expenditure plan reflects this strategic gamble on future growth.

Canacol's strategic focus on new gas exploration in regions like the Middle Magdalena Valley, coupled with potential international expansion, positions these ventures as Question Marks within the BCG matrix. These projects, while holding significant future growth potential, are currently characterized by low market share and high investment requirements.

| Project/Market | Region | Current Market Share | Growth Potential | Risk Level | BCG Classification |

| Valiente-1 & Natilla-2 Exploration | Middle Magdalena Basin | Low (Unproven) | High | High | Question Mark |

| Pola Exploration | Middle Magdalena Valley | Low (Early Stage) | High | High | Question Mark |

| Bolivian Market Entry (Potential 2026) | Bolivia | Zero | High (Declining Production) | High | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is informed by comprehensive market research, including sales data, growth projections, and competitor analysis, ensuring a robust strategic foundation.