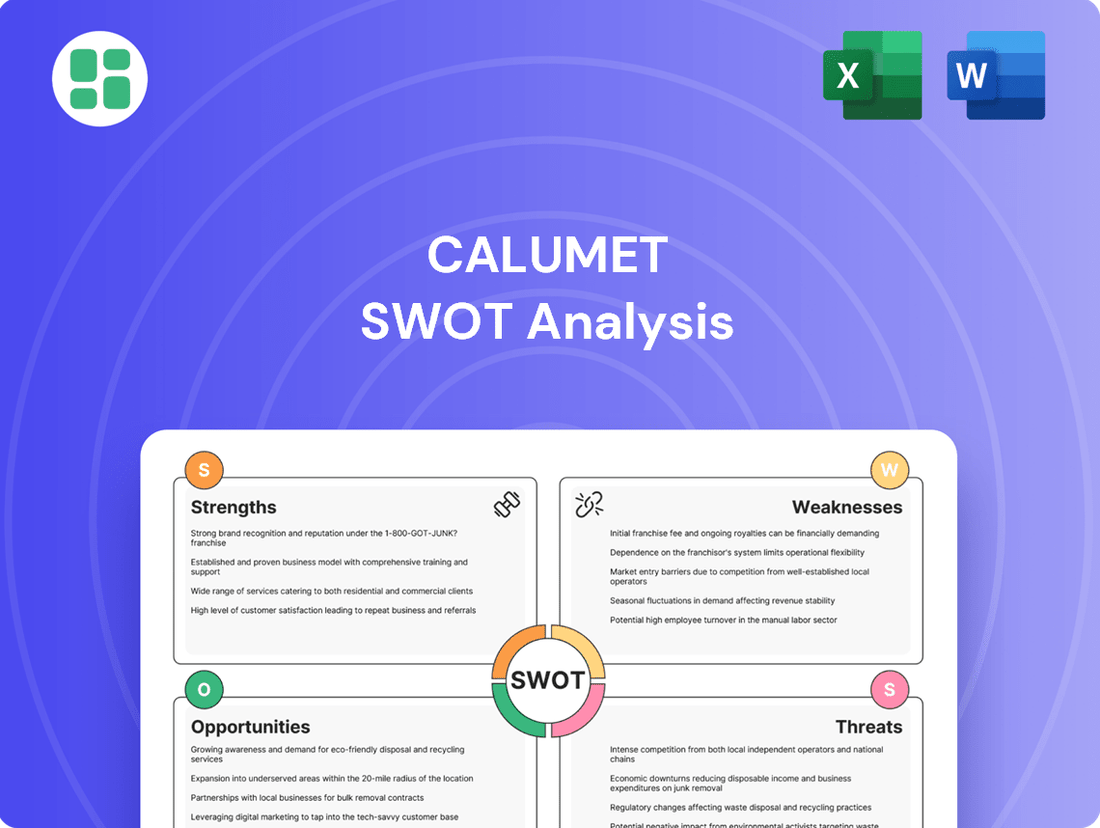

Calumet SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calumet Bundle

Calumet's market position is defined by its robust refining capabilities and a diverse product portfolio, but also faces challenges from fluctuating commodity prices and increasing environmental regulations. Understanding these dynamics is crucial for any stakeholder looking to navigate the energy sector.

Want the full story behind Calumet's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Calumet Specialty Products Partners, L.P. boasts a diverse product portfolio, encompassing specialty hydrocarbon products such as lubricating oils, solvents, and waxes, alongside fuels like gasoline, diesel, and jet fuel. This wide range caters to numerous industrial and consumer sectors, effectively reducing the risk tied to overdependence on any single product line.

Calumet holds a dominant position as a premier independent producer of specialty hydrocarbon products throughout North America. This leadership extends to its significant role in the evolving energy landscape.

The company's Montana Renewables facility is a standout, having become the largest producer of sustainable aviation fuel (SAF) in North America. This achievement underscores Calumet's commitment to and success in the burgeoning renewable energy market.

This dual strength in both established specialty markets and the high-growth renewable fuels sector provides Calumet with a robust and diversified business model, well-positioned for future expansion and profitability.

Calumet has consistently demonstrated strong operational efficiency and a disciplined approach to cost management. This focus resulted in significant year-over-year operating cost reductions, with the company achieving $42 million in savings during the first half of 2025 alone.

The company's commitment to efficiency is particularly evident in its Montana Renewables segment. This division reported its lowest operating costs per gallon since its inception in the second quarter of 2025, underscoring the effectiveness of their cost-control initiatives.

This rigorous cost discipline not only enhances Calumet's profitability but also bolsters its resilience, allowing it to navigate fluctuating market conditions more effectively.

Resilient Performance Brands Segment

Calumet's Performance Brands segment, notably featuring its TruFuel product, consistently exhibits robust market performance and commands a substantial market share within its specialized sector. This segment is a key contributor of stable earnings for the company, underscoring Calumet's capability to sustain strong profit margins and a prominent brand presence in consumer-oriented specialty fuel markets.

The resilience of the Performance Brands segment is a critical factor in buffering the company against the inherent volatility experienced in other business segments. For instance, in the first quarter of 2024, Calumet reported that its Specialty Products and Solutions segment, which encompasses Performance Brands, saw adjusted EBITDA grow by 12% year-over-year, reaching $173 million. This growth was partially driven by strong demand and pricing within the branded consumer fuels category.

- Market Leadership: TruFuel holds a leading position in the premium branded outdoor power equipment fuel market.

- Stable Earnings: The segment provides a reliable stream of income, contributing positively to overall financial stability.

- Margin Strength: Calumet maintains healthy profit margins within this consumer-facing segment, demonstrating effective cost management and pricing power.

- Diversification Benefit: The segment's consistent performance helps to mitigate risks associated with more cyclical parts of Calumet's business.

Strategic Investment in Sustainable Aviation Fuel (SAF) Expansion

Calumet is strategically investing in the expansion of sustainable aviation fuel (SAF) through its MaxSAF project. This initiative is set to boost SAF production capacity, with a target completion by Q2 2026. This move positions Calumet to benefit from the growing demand for greener fuel options.

The company's focus on renewable fuels aligns with worldwide efforts towards an energy transition and government-backed decarbonization goals. This strategic direction allows Calumet to tap into a burgeoning market for sustainable alternatives.

- MaxSAF Expansion: On track to significantly increase SAF production capacity by Q2 2026.

- Market Alignment: Capitalizes on global energy transition trends and decarbonization targets.

- Cost Efficiency: Achieved through relatively low capital expenditure for expansion.

Calumet's market leadership in specialty hydrocarbon products, particularly its independent producer status in North America, provides a strong foundation. The company's Montana Renewables facility, the largest SAF producer in North America, highlights its strategic pivot and success in the high-growth renewable energy sector.

The Performance Brands segment, anchored by TruFuel, demonstrates consistent market strength and stable earnings, contributing positively to the company's overall financial health. This segment's resilience helps offset volatility in other business areas, as seen in its 12% year-over-year adjusted EBITDA growth in Q1 2024.

Calumet's disciplined cost management is a significant strength, evidenced by $42 million in operating cost reductions in the first half of 2025. This efficiency extends to Montana Renewables, which achieved its lowest operating costs per gallon in Q2 2025, enhancing profitability and market competitiveness.

The strategic expansion of its sustainable aviation fuel (SAF) capacity through the MaxSAF project, targeting completion by Q2 2026, positions Calumet to capitalize on the growing demand for green fuels and align with global decarbonization efforts.

What is included in the product

Analyzes Calumet’s competitive position through key internal and external factors.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential weaknesses into opportunities.

Weaknesses

Calumet's profitability is intrinsically tied to the volatile nature of crude oil prices, as it's a primary processor of this commodity. This direct correlation means that significant swings in feedstock costs can substantially affect refining margins and, consequently, the company's overall financial performance. For instance, during the first quarter of 2024, West Texas Intermediate (WTI) crude oil prices experienced fluctuations, averaging around $77 per barrel, highlighting the ongoing price sensitivity Calumet faces.

Despite ongoing cost reduction initiatives and robust sales in its specialty products, Calumet continued to grapple with significant financial headwinds, reporting a substantial net loss in the second quarter of 2025. This persistent red ink highlights a core weakness in the company's ability to translate operational improvements into overall profitability.

The Montana Renewables segment, while demonstrating growth, continues to face challenges with its underlying gross profit, often relying on tax attributes like Production Tax Credits to achieve positive Adjusted EBITDA. This dependence on external factors for segment profitability underscores the difficulty in establishing consistent, broad-based financial success across all of Calumet's operations.

Calumet's operations are inherently capital-intensive, demanding substantial investments for essential maintenance, crucial upgrades, and strategic growth initiatives within the refining and specialty chemicals sectors. This constant need for capital can strain financial resources.

The company has outlined significant capital expenditure plans for 2025, underscoring the ongoing financial commitment required to maintain and advance its operational capabilities. This necessitates careful financial planning.

Calumet has been actively engaged in managing its debt, notably through actions like calling its senior notes. This demonstrates a focus on deleveraging, a critical strategy for companies operating in capital-heavy industries to improve financial flexibility and reduce risk.

Reliance on Regulatory Support for Renewable Fuels

Calumet's Montana Renewables segment's financial health is heavily reliant on government support, including Production Tax Credits. For instance, in the first quarter of 2024, this segment reported Adjusted EBITDA with Tax Attributes of $95 million, a figure significantly influenced by these incentives.

Any shifts in the regulatory landscape or modifications to Renewable Volume Obligations (RVOs) pose a direct risk to the segment's profitability and its competitive standing in the market.

- Production Tax Credits: These are crucial for the financial performance of the Montana Renewables segment.

- Regulatory Uncertainty: Changes in government policies or incentive programs can negatively impact profitability.

- RVO Impact: Fluctuations in Renewable Volume Obligations directly affect the demand and pricing of renewable fuels.

- Competitive Positioning: Dependence on subsidies can make the segment vulnerable compared to less regulated competitors.

Vulnerability to Broader Refining Industry Headwinds

Calumet's reliance on fuel production leaves it susceptible to broader refining industry headwinds. For instance, the International Energy Agency (IEA) projected global oil demand growth to moderate in 2024 and 2025, potentially impacting sales volumes. Furthermore, tightening crack spreads, a key profitability metric for refiners, could squeeze margins across its conventional fuel businesses.

These industry-wide challenges can directly translate into reduced profitability and lower utilization rates for Calumet's refining assets. As of early 2024, many refineries globally were grappling with slimmer margins due to increased feedstock costs and fluctuating product demand, a trend that could continue to pressure Calumet's operational performance.

The potential for overcapacity in the refining sector, especially with new capacity coming online in some regions, further exacerbates these vulnerabilities. This scenario could lead to increased price competition, further eroding the profitability of Calumet's fuel segments.

- Slowing Global Oil Demand: The IEA's outlook for 2024-2025 suggests a deceleration in oil demand growth, directly impacting the volume of fuels Calumet can sell.

- Pressured Crack Spreads: Narrowing margins between crude oil and refined product prices, a common industry trend, directly affects Calumet's profitability on its fuel output.

- Refining Overcapacity Concerns: An oversupplied market can intensify price competition, putting downward pressure on Calumet's fuel segment revenues.

Calumet's profitability is highly sensitive to fluctuations in crude oil prices, a direct consequence of its role as a primary processor. This means that significant swings in feedstock costs can dramatically impact refining margins and, consequently, the company's overall financial performance. For instance, during the first quarter of 2024, West Texas Intermediate (WTI) crude oil prices averaged around $77 per barrel, underscoring the ongoing price sensitivity Calumet faces.

Despite efforts to reduce costs and strong sales in its specialty products, Calumet reported a substantial net loss in the second quarter of 2025, indicating a persistent weakness in translating operational improvements into overall profitability. The Montana Renewables segment, while growing, often relies on tax credits like Production Tax Credits to achieve positive Adjusted EBITDA, highlighting a difficulty in establishing consistent, broad-based financial success across all operations.

Calumet's operations are inherently capital-intensive, requiring substantial investments for maintenance, upgrades, and growth initiatives in its refining and specialty chemicals sectors. This constant need for capital can strain financial resources, as evidenced by significant capital expenditure plans outlined for 2025 to maintain and advance operational capabilities.

The company's financial health is also impacted by its reliance on government support for its Montana Renewables segment, particularly Production Tax Credits. In the first quarter of 2024, this segment reported Adjusted EBITDA with Tax Attributes of $95 million, a figure significantly influenced by these incentives. Any changes in regulatory landscapes or Renewable Volume Obligations (RVOs) pose a direct risk to this segment's profitability and market competitiveness.

Calumet's dependence on fuel production makes it vulnerable to broader refining industry headwinds, such as moderating global oil demand growth projected by the IEA for 2024 and 2025, and potentially narrowing crack spreads. These industry-wide challenges can lead to reduced profitability and lower utilization rates for Calumet's refining assets, with many refineries globally experiencing slimmer margins due to increased feedstock costs and fluctuating product demand as of early 2024.

| Weakness Category | Specific Issue | Impact on Calumet | 2024/2025 Data Point |

|---|---|---|---|

| Price Volatility | Crude Oil Price Sensitivity | Affects refining margins and overall financial performance. | WTI crude averaged ~$77/barrel in Q1 2024. |

| Profitability Challenges | Persistent Net Losses | Difficulty translating operational improvements into overall profitability. | Substantial net loss reported in Q2 2025. |

| Segment Profitability Dependence | Reliance on Tax Credits (Montana Renewables) | Segment financial health tied to external government support. | Q1 2024 Adjusted EBITDA with Tax Attributes: $95 million. |

| Capital Intensity | High Capital Expenditure Needs | Strains financial resources for maintenance, upgrades, and growth. | Significant CAPEX plans for 2025 outlined. |

| Industry Headwinds | Slowing Demand & Narrowing Crack Spreads | Reduced profitability and utilization rates for refining assets. | IEA projected moderated global oil demand growth for 2024-2025. |

Preview Before You Purchase

Calumet SWOT Analysis

You’re viewing a live preview of the actual Calumet SWOT analysis file. The complete version becomes available after checkout, offering a comprehensive look at the company's strategic position.

This is the actual Calumet SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and actionable insights.

The file shown below is not a sample—it’s the real Calumet SWOT analysis you'll download post-purchase, in full detail and ready for your strategic planning.

Opportunities

The North American specialty chemicals market is poised for substantial expansion, with forecasts indicating a Compound Annual Growth Rate (CAGR) ranging from 4.5% to 6.7% between 2025 and 2034. This upward trend is fueled by robust demand from key industries like automotive, construction, and electronics, creating a fertile ground for Calumet's varied specialty chemical offerings.

Furthermore, the lubricants market is also experiencing considerable growth, particularly for advanced, high-performance, and environmentally conscious formulations. This presents a significant opportunity for Calumet to leverage its expertise in developing and supplying these specialized products to meet evolving market needs.

Calumet's strategic expansion of its Sustainable Aviation Fuel (SAF) production, targeting 120-150 million gallons of annualized capacity by Q2 2026, is a significant growth avenue. This move capitalizes on the accelerating global demand for decarbonization in aviation.

The strong governmental and regulatory support for SAF, including incentives and mandates, creates a favorable market for Calumet as it solidifies its position as a key SAF producer. This provides a clear pathway to increased revenue and market share in a rapidly evolving sector.

Calumet can leverage its established operational base and market presence to explore strategic acquisitions and partnerships. These alliances offer a pathway to bolster its specialty product portfolio and extend its reach into new geographic markets, potentially targeting high-demand areas like sustainable lubricants or advanced materials. For instance, acquiring a company with expertise in bio-based additives could significantly enhance Calumet's offering in the growing green chemicals sector.

Innovation in Bio-based and Sustainable Products

The growing consumer and industrial demand for bio-based and sustainable products presents a significant opportunity for Calumet. This trend is particularly evident in sectors like automotive, packaging, and consumer goods, where eco-friendly alternatives are increasingly favored. For instance, the global bio-based chemicals market was valued at approximately $100 billion in 2023 and is projected to grow substantially in the coming years, driven by environmental regulations and consumer awareness. Calumet can leverage this by focusing R&D on developing greener lubricants, solvents, and specialty chemicals that align with these market shifts and enhance its competitive edge.

Calumet has the chance to capitalize on this by:

- Developing bio-lubricants: The market for biodegradable lubricants is expanding, with a projected CAGR of over 5% through 2030, offering Calumet a niche to explore.

- Innovating eco-friendly solvents: As regulations tighten on traditional solvents, bio-based alternatives are gaining traction, creating a demand Calumet can meet.

- Expanding sustainable product lines: This aligns with corporate ESG (Environmental, Social, and Governance) goals, which are increasingly important for investor relations and brand reputation.

Further Leveraging Cost Efficiencies and Operational Improvements

Calumet's track record of successfully implementing cost reduction programs and achieving operational efficiencies presents a significant opportunity for continued growth. By refining its processes, optimizing its supply chain, and improving asset utilization, the company can boost its profit margins and solidify its competitive edge, even when market conditions are tough.

This ongoing commitment to efficiency can directly translate into better financial results. For instance, in the first quarter of 2024, Calumet reported a significant improvement in its operating income, partly driven by diligent cost management across its refining and specialty products segments.

- Enhanced Profitability: Continued focus on cost efficiencies can directly increase profit margins, as seen in the Q1 2024 results where operating income saw a notable uplift.

- Supply Chain Optimization: Further streamlining the supply chain can reduce logistics costs and improve inventory management, contributing to a stronger bottom line.

- Asset Utilization: Maximizing the efficiency of existing assets, such as refineries and production facilities, can lead to higher output and reduced per-unit costs.

Calumet is well-positioned to benefit from the growing demand for specialty chemicals, with the North American market projected to grow at a CAGR of 4.5% to 6.7% between 2025 and 2034. The company's expansion into Sustainable Aviation Fuel (SAF), targeting 120-150 million gallons of capacity by Q2 2026, aligns with the accelerating global push for aviation decarbonization. Furthermore, the increasing consumer and industrial preference for bio-based and sustainable products, exemplified by the bio-based chemicals market valued at around $100 billion in 2023, offers Calumet a significant opportunity to innovate and expand its eco-friendly product lines.

| Opportunity Area | Market Trend | Calumet's Strategic Advantage/Action | Relevant Data/Projection |

|---|---|---|---|

| Specialty Chemicals Growth | North American market expansion | Leveraging diverse specialty chemical offerings | CAGR of 4.5%-6.7% (2025-2034) |

| Sustainable Aviation Fuel (SAF) | Global aviation decarbonization | Expanding SAF production capacity | Targeting 120-150 million gallons by Q2 2026 |

| Bio-based & Sustainable Products | Increasing consumer/industrial demand | Developing greener lubricants, solvents, and chemicals | Bio-based chemicals market ~$100 billion (2023) |

Threats

The intensifying global focus on environmental protection and the urgent need for decarbonization present a substantial threat to companies like Calumet, which are heavily involved in traditional hydrocarbon production. Stricter emissions standards, such as those being implemented or considered in major markets throughout 2024 and 2025, will likely increase operational expenses. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM) is already impacting imports, and similar domestic policies could emerge, directly affecting the cost of doing business.

Meeting these evolving environmental mandates will necessitate significant capital outlays for facility modernization and the adoption of cleaner technologies. This could divert funds from other strategic initiatives and potentially reduce profitability if the costs cannot be fully passed on to consumers or offset by efficiency gains. The ongoing push for renewable energy sources also signals a long-term shift away from fossil fuels, potentially impacting demand for Calumet's core products.

Calumet operates in fiercely competitive arenas, both for its specialty products and its fuel offerings. The refining sector, in particular, is grappling with rising global capacity alongside decelerating demand growth. This dynamic can compress profit margins and intensify pricing challenges.

The burgeoning renewable fuels market presents its own set of threats. In the U.S., there's a tangible risk of market oversupply, potentially exacerbated by factors such as Renewable Volume Obligations (RVOs) falling short of expectations. Such an imbalance could significantly erode profitability in this segment.

Economic downturns pose a significant threat to Calumet, as a broad slowdown or recession directly impacts demand in both industrial and consumer sectors. For instance, a contraction in manufacturing activity, a key driver for industrial lubricants and specialty products, could severely curtail sales volumes. Similarly, reduced consumer spending, especially on discretionary items or during inflationary periods, would affect demand for Calumet's refined products.

Volatility in Feedstock Availability and Supply Chain Disruptions

Calumet, as a processor of crude oil and other feedstocks, faces significant threats from volatility in feedstock availability and supply chain disruptions. Geopolitical events, natural disasters, and logistical hurdles can severely impact its operations. For instance, the ongoing global supply chain strains, exacerbated by events in 2024, have led to increased shipping costs and delivery delays for many industrial inputs, a trend likely to persist through 2025.

These disruptions directly translate into higher raw material costs for Calumet. When supply tightens, the price of crude oil and other essential feedstocks can surge, squeezing profit margins. Furthermore, reduced availability can lead to lower production volumes, making it challenging to meet existing market demand. This inability to fulfill orders can damage customer relationships and negatively affect financial performance.

- Supply Chain Vulnerability: Geopolitical instability and climate-related events in 2024 and projected for 2025 continue to pose risks to global logistics, impacting feedstock sourcing.

- Cost Inflation: Rising energy prices and transportation costs, observed throughout 2024, are expected to maintain pressure on Calumet's raw material expenses into 2025.

- Operational Impact: Disruptions can force production curtailments, potentially leading to missed sales opportunities and a decline in revenue.

Long-term Shift Away from Fossil Fuels

The global energy transition poses a significant long-term threat to Calumet. The increasing popularity of electric vehicles (EVs) and the broader adoption of renewable energy sources are structurally altering the demand for traditional transport fuels. For instance, by the end of 2023, global EV sales surpassed 13.5 million units, a substantial increase from previous years, indicating a clear shift away from internal combustion engines. This trend directly impacts the market for refined fuel products that form a core part of Calumet's business.

This sustained decline in demand for fossil fuels necessitates continuous adaptation and strategic diversification for Calumet. The company must navigate this evolving energy landscape by exploring and investing in alternative energy sources and related products. Failure to adapt could lead to reduced profitability and market share as consumer preferences and regulatory environments continue to favor cleaner energy alternatives.

The International Energy Agency (IEA) projects that under stated policies, oil demand for road transport could peak before 2030. This forecast underscores the urgency for companies like Calumet to pivot their business models.

- Growing EV Adoption: Global EV sales are rapidly increasing, directly impacting demand for gasoline and diesel.

- Renewable Energy Growth: Expansion of solar, wind, and other renewables reduces reliance on fossil fuels for power generation and transportation.

- Regulatory Pressures: Governments worldwide are implementing policies to accelerate the energy transition, further pressuring fossil fuel demand.

- Shifting Consumer Preferences: Consumers are increasingly seeking sustainable and environmentally friendly transportation options.

The increasing focus on environmental regulations and decarbonization poses a significant threat to Calumet's traditional hydrocarbon business. Stricter emissions standards, like those seen in the EU's CBAM, could raise operational costs throughout 2024 and 2025. Adapting to these mandates requires substantial investment in cleaner technologies, potentially diverting capital from other growth areas and impacting profitability if costs aren't passed on.

The competitive landscape for both specialty products and fuels remains intense, with rising global refining capacity and slowing demand growth pressuring profit margins. Furthermore, the renewable fuels market faces risks of oversupply, particularly in the U.S., which could erode profitability in that segment. Economic downturns also directly reduce demand for Calumet's industrial and consumer products.

| Threat Category | Description | Potential Impact | Relevant Data/Trend |

|---|---|---|---|

| Environmental Regulations | Stricter emissions standards and carbon pricing | Increased operational costs, capital expenditure for compliance | EU CBAM implementation, global push for net-zero targets |

| Market Competition | Overcapacity in refining, intense competition in specialty products | Margin compression, pricing pressure | Global refining capacity growth vs. demand |

| Renewable Fuels Market | Potential oversupply, regulatory uncertainty (e.g., RVOs) | Reduced profitability in renewable fuels segment | U.S. renewable fuels market dynamics |

| Economic Downturns | Recessions impacting industrial and consumer demand | Reduced sales volumes, lower revenue | Global economic growth forecasts, inflation rates |

| Energy Transition | Shift to EVs and renewable energy sources | Long-term decline in demand for refined fuels | Global EV sales exceeding 13.5 million units (end of 2023), IEA oil demand projections |

SWOT Analysis Data Sources

This Calumet SWOT analysis is built upon a foundation of credible data, including the company's audited financial statements, comprehensive market research reports, and insights from industry experts. These sources ensure a robust and accurate assessment of Calumet's strategic position.