Calumet Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calumet Bundle

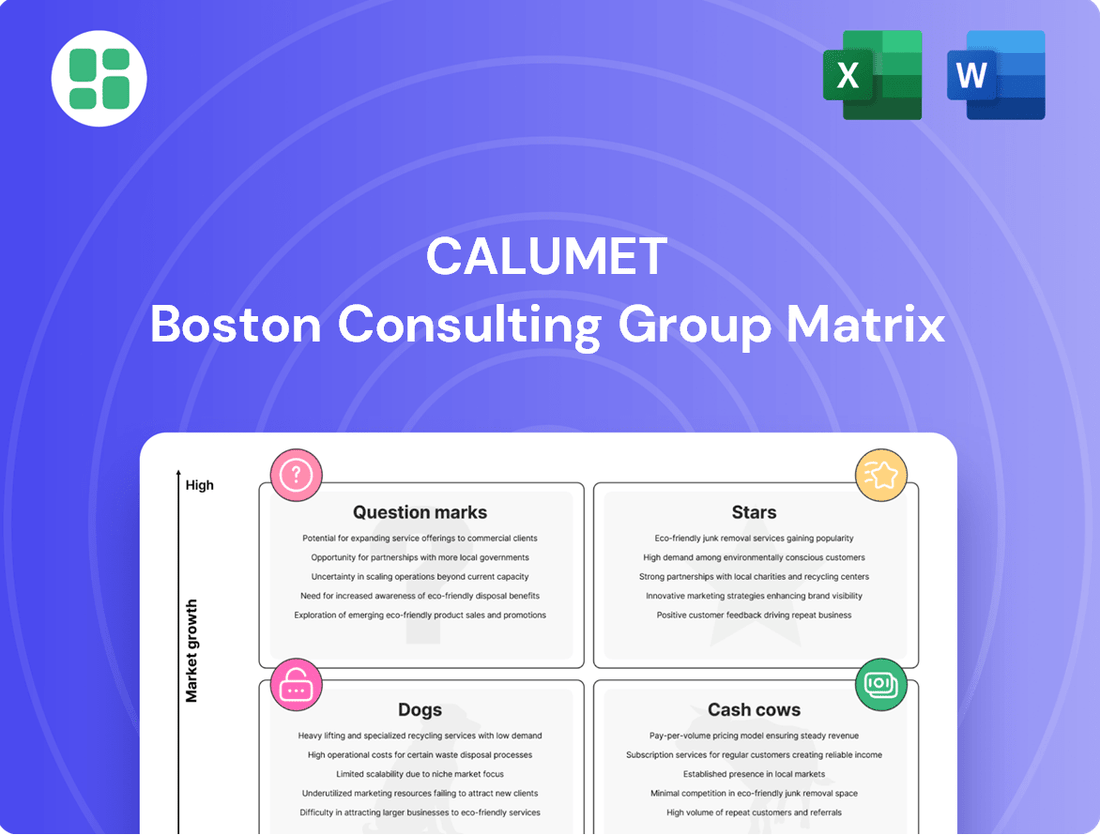

This glimpse into the Calumet BCG Matrix highlights its strategic product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks. Understand which segments are driving growth and which require careful consideration. Purchase the full BCG Matrix for a comprehensive analysis and actionable strategies to optimize your business's performance.

Stars

Calumet's investment in Sustainable Aviation Fuel (SAF) production positions this venture as a Star within its business portfolio. The company is aggressively scaling up its SAF capacity at the Montana Renewables facility, aiming to reach 120-150 million gallons per year (MMgy) ahead of schedule and a substantial 300 MMgy by 2028.

This segment is experiencing robust growth, fueled by worldwide efforts to decarbonize and the aviation industry's increasing need for sustainable alternatives. Calumet is strategically poised to become a leading SAF producer in North America, capitalizing on these strong market tailwinds.

Renewable Diesel (RD) production at Montana Renewables is a clear Star in the company's portfolio, mirroring the strong trajectory of Sustainable Aviation Fuel (SAF). This segment is propelled by robust market demand and supportive governmental mandates for low-carbon fuels across North America. For instance, the U.S. Environmental Protection Agency's Renewable Fuel Standard (RFS) program continues to drive demand for renewable diesel, with projections indicating sustained growth in obligated volumes.

Montana Renewables' strategic investments are focused on optimizing its production capabilities and increasing output volumes. This proactive approach positions the company to effectively capture opportunities within the expanding renewable fuels market. The company's commitment to operational enhancements aims to boost efficiency, further solidifying its competitive edge in this high-growth sector.

The feedstock pre-treatment unit at Montana Renewables is a significant Star for Calumet. This unit allows them to process a wide variety of renewable feedstocks, giving them a strong competitive edge. In 2024, Montana Renewables announced plans to expand its renewable diesel capacity by 15,000 barrels per day, underscoring the importance of efficient feedstock processing.

High-Performance Lubricating Oils (Consumer Segment)

Calumet's Royal Purple® consumer segment, encompassing high-performance motor oils and automotive additives, demonstrates characteristics of a Star in the BCG Matrix. This category has experienced steady year-over-year volume increases, reflecting a robust demand. The brand's strategic multi-channel approach, reaching both national retail chains and specialized automotive stores, solidifies its competitive standing within a dynamic and expanding market niche.

- Market Position: Strong presence in the high-performance automotive lubricants segment.

- Growth Trajectory: Consistent year-over-year volume growth indicates increasing market share and demand.

- Distribution Strategy: Multi-channel approach effectively captures a broad consumer base, from mass retail to specialized outlets.

- Brand Strength: Royal Purple® is recognized for quality, contributing to its Star status.

Specialty Waxes for Emerging Applications

Specialty waxes targeting high-growth areas like advanced materials or specialized cosmetics could be considered Stars within Calumet's portfolio. While the overall wax market may be mature, specific niche applications where Calumet has a strong market position and offers customized formulations are likely experiencing significant growth. Calumet's Specialty Products and Solutions segment consistently demonstrates robust production and sustained demand, highlighting the potential for these specialty waxes to be a Star.

- High-Growth Niches: Focus on waxes for cosmetics, advanced packaging, and materials science.

- Market Leadership: Calumet's strong position in customized wax formulations.

- Segment Strength: Specialty Products and Solutions showing consistent demand and production.

- Emerging Applications: Potential for significant growth in new and developing industries.

Calumet's Sustainable Aviation Fuel (SAF) and Renewable Diesel (RD) segments at Montana Renewables are strong Stars, driven by decarbonization efforts and supportive policies. The company aims for 300 MMgy of SAF by 2028, with RD production also experiencing robust demand. The feedstock pre-treatment unit is crucial, enabling the processing of diverse feedstocks and supporting a 15,000 barrels per day RD capacity expansion in 2024.

The Royal Purple® consumer segment is another Star, showing consistent volume growth due to its strong brand and multi-channel distribution. Specialty waxes for high-growth niches like advanced materials and cosmetics also represent Star opportunities, supported by strong demand within Calumet's Specialty Products and Solutions segment.

| Business Segment | BCG Category | Key Growth Drivers |

| Sustainable Aviation Fuel (SAF) | Star | Decarbonization mandates, aviation industry demand |

| Renewable Diesel (RD) | Star | Low-carbon fuel mandates (e.g., RFS), North American demand |

| Feedstock Pre-treatment Unit | Star (Enabler) | Feedstock flexibility, capacity expansion support |

| Royal Purple® Consumer | Star | Brand strength, multi-channel distribution, consistent demand |

| Specialty Waxes (Niche) | Star | Demand in advanced materials, cosmetics, customized formulations |

What is included in the product

The Calumet BCG Matrix provides a strategic overview of its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides Calumet in making informed decisions about resource allocation, focusing on growth opportunities and managing underperforming assets.

A visually clear Calumet BCG Matrix, showing each business unit's position, alleviates the pain of strategic uncertainty.

Cash Cows

Calumet's traditional specialty lubricating oils and solvents, a cornerstone of its Specialty Products and Solutions (SPS) segment, represent a classic cash cow. These products cater to well-established industrial and consumer needs, enjoying a strong foothold in mature, predictable markets.

This segment consistently delivers robust cash flow, often requiring less aggressive marketing spend compared to burgeoning product categories. For instance, in 2024, Calumet reported that its SPS segment continued to be a significant contributor to overall profitability, demonstrating the stable demand for these essential products.

Petrolatums and white oils, key components of Calumet's portfolio, represent mature specialty products. These items are crucial for stable industries such as pharmaceuticals, personal care, and food manufacturing, indicating a consistent and reliable demand.

As a leading independent producer, Calumet likely holds a significant market share in these segments. This strong position, coupled with the essential nature of petrolatums and white oils, translates into substantial and dependable cash flow for the company. For instance, the global white oils market was valued at approximately $2.5 billion in 2023 and is projected to grow steadily, underscoring the enduring demand for these products.

The specialty asphalt production facility in Great Falls, Montana, functions as a cash cow within Calumet's portfolio. It processes crude oil into various asphalt grades for local markets, benefiting from a stable, regional demand. This segment consistently generates revenue with limited growth potential, contributing reliably to the company's overall profitability.

Established Industrial Waxes

Established industrial waxes represent a significant portion of Calumet's portfolio, likely fitting into the Cash Cow quadrant of the BCG matrix. These products cater to fundamental industrial needs, exhibiting stable demand and benefiting from Calumet's established market position.

Their consistent performance generates reliable profits and cash flow, minimizing the need for extensive reinvestment to drive growth. For instance, in 2023, Calumet reported Specialty Products and Services revenue of $3.6 billion, with industrial waxes being a core component of this segment.

- Stable Demand: Industrial waxes are essential for numerous applications, ensuring a consistent customer base.

- Strong Market Share: Calumet's long-standing presence in the industrial wax market provides a competitive advantage.

- Profit Generation: These products contribute significantly to overall profitability without requiring substantial capital expenditure for expansion.

- Cash Flow Contribution: The steady sales of industrial waxes provide a reliable source of cash for the company.

TruFuel Brand Products

TruFuel, a prominent brand within Calumet's Performance Brands segment, offers pre-mixed fuels specifically designed for outdoor power equipment. This product line caters to a specialized yet consistent consumer base.

The brand exhibits steady growth in both sales volume and profit margins, underscoring its robust market standing and dependable cash flow generation. This performance is particularly noteworthy within a market segment that has reached maturity.

- Brand Focus: Pre-mixed fuels for outdoor power equipment.

- Market Position: Niche but stable consumer demand.

- Financial Performance: Consistent volume and margin growth, indicating strong cash generation.

Calumet's established product lines, such as traditional specialty lubricating oils and solvents within its Specialty Products and Solutions (SPS) segment, function as prime examples of cash cows. These mature offerings serve consistent industrial and consumer demands, generating reliable profits with minimal need for aggressive expansion investment.

The company's petrolatums and white oils are critical for stable sectors like pharmaceuticals and personal care, ensuring predictable revenue streams. Similarly, the specialty asphalt facility in Great Falls, Montana, benefits from consistent regional demand, contributing steady cash flow. Industrial waxes, a core component of the SPS segment, also exhibit stable demand and strong market share, providing dependable profits.

| Segment/Product | BCG Quadrant | Key Characteristics | 2024/2023 Data Point |

| Specialty Lubricating Oils & Solvents (SPS) | Cash Cow | Mature markets, stable demand, consistent cash flow | SPS segment significant contributor to profitability in 2024 |

| Petrolatums & White Oils | Cash Cow | Essential for pharma/personal care, consistent demand | Global white oils market valued at ~$2.5 billion in 2023 |

| Specialty Asphalt (Great Falls) | Cash Cow | Stable regional demand, reliable revenue | N/A (facility specific) |

| Industrial Waxes (SPS) | Cash Cow | Fundamental industrial needs, strong market position | Specialty Products and Services revenue of $3.6 billion in 2023 |

| TruFuel (Performance Brands) | Cash Cow | Niche but stable consumer base, consistent growth | Consistent volume and margin growth |

What You See Is What You Get

Calumet BCG Matrix

The Calumet BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just the complete, analysis-ready strategic tool designed for immediate application.

What you see here is the actual Calumet BCG Matrix report that will be delivered to you upon completion of your purchase. This preview accurately represents the professional quality and comprehensive analysis contained within the final document, ready for your strategic decision-making.

Rest assured, the Calumet BCG Matrix you are previewing is the exact file you will download after your purchase. It has been meticulously prepared to provide clear, actionable insights, ensuring you receive a polished and professional document for your business strategy needs.

Dogs

Calumet Specialty Products Partners' divestiture of its industrial Royal Purple® business for $110 million in early 2025 clearly illustrates a Dog in the BCG Matrix. This segment likely faced stagnant growth and a diminished market position within the industrial lubricants sector.

The decision to sell this unit underscores a strategic move to reallocate resources away from underperforming assets. Calumet aimed to bolster its financial health by reducing debt and concentrating on more promising business segments with greater potential for future expansion and profitability.

Certain conventional fuel products within Calumet's portfolio, like specific gasoline or diesel grades, might be categorized as Dogs. This classification stems from areas experiencing heightened competition or a downturn in consumer demand, impacting their market performance.

Calumet's strategic pivot towards renewable energy sources inherently signals that some of its established fuel lines may be lagging. These legacy products could be situated in markets characterized by minimal growth or even contraction, making them candidates for the Dog quadrant.

Calumet Specialty Products Partners' fuel products, particularly gasoline and diesel, are prime examples of commodity-oriented businesses with low margins. These segments are heavily influenced by volatile commodity crack spreads, which are the difference between the price of crude oil and the refined products. For instance, in 2024, gasoline crack spreads experienced significant fluctuations, often trading in the low to mid-teens per barrel, reflecting the inherent volatility.

These low-margin fuel operations can consume substantial cash without generating commensurate returns, especially if Calumet holds a minor market share or lacks a distinct competitive edge in these highly commoditized markets. For example, while Calumet’s Montana Renewables segment, focusing on renewable diesel, is a growth area, its traditional fuel refining operations face these margin pressures.

Given their cash consumption and low profitability, these fuel products could be candidates for strategic review, including optimization efforts to improve efficiency or potential divestment if they don't align with Calumet's long-term strategic objectives. This approach is crucial for focusing resources on higher-growth, higher-margin segments within the company's portfolio.

Certain Niche Solvents with Declining Demand

Certain niche solvents within Calumet's portfolio might be experiencing declining demand. This is often due to shifts in industrial practices or increasing environmental regulations. For instance, solvents heavily used in industries like traditional printing or certain types of metal degreasing could fall into this category. The market for these specific products may be shrinking, making them less attractive for continued investment.

If Calumet has a small market share in these particular solvent niches, it further complicates their viability. Maintaining production for low-volume, low-growth products can become a drain on financial and operational resources. These resources could potentially yield higher returns if redirected to more promising business segments.

Consider the case of specific chlorinated solvents, which have faced increasing regulatory scrutiny and substitution in many applications. If Calumet's product mix includes such solvents and their market share is minimal, the cost of compliance and production might outweigh the revenue generated. For example, in 2024, the global market for certain specialty solvents saw a contraction of approximately 3-5% due to these pressures.

- Declining Industry End-Use: Solvents tied to industries like traditional automotive manufacturing or specific types of textile processing, which are seeing reduced output or shifts to alternative materials.

- Regulatory Headwinds: Products facing stringent environmental regulations, such as those impacting Volatile Organic Compounds (VOCs) or specific hazardous substance classifications, leading to phase-outs or reduced usage.

- Low Market Share Impact: In 2023, companies with less than a 5% market share in niche, declining solvent segments often struggled with economies of scale, increasing per-unit production costs.

- Resource Allocation Dilemma: The potential to reallocate capital expenditure and R&D efforts from these low-return solvent niches to higher-growth areas like bio-based solvents or advanced cleaning agents.

Outdated or Low-Demand Wax Formulations

Outdated or low-demand wax formulations represent a challenge within Calumet's product portfolio. These are waxes that technology, evolving tastes, or better options have made less relevant. Think of specialty waxes that once served a niche but now have fewer buyers.

Calumet's position in these specific, older wax markets is likely small. This means they don't capture a significant portion of the sales available for these particular products. The revenue generated is minimal, and the effort to keep these formulations available might outweigh the financial return.

These products are essentially a drain on resources without a clear path to future growth. Calumet needs to evaluate if maintaining these low-demand, low-share offerings is strategically sound. The focus should be on products with higher market penetration and growth prospects.

- Obsolescence: Wax formulations rendered irrelevant by new materials or processes.

- Low Market Share: Calumet's minimal presence in specific, older wax segments.

- Minimal Revenue: These products contribute very little to overall sales figures.

- Resource Drain: Maintenance costs outweigh the profit generated by these outdated waxes.

Calumet's traditional fuel products, like gasoline and diesel, often fall into the Dog category due to low margins and intense competition. The fluctuating crack spreads, for example, saw gasoline crack spreads in the low to mid-teens per barrel in 2024, highlighting this volatility. These segments can consume significant cash without yielding substantial returns, especially for companies with limited market share in these commoditized areas.

Niche solvents facing declining demand due to evolving industrial practices or stricter environmental regulations also represent Dogs. For instance, certain chlorinated solvents have seen market contraction, with the global market for some specialty solvents shrinking by approximately 3-5% in 2024 due to these pressures. Products with minimal market share in these declining niches, such as those under 5% in 2023, struggle with economies of scale.

Outdated wax formulations that have become less relevant due to technological advancements or changing consumer preferences are also considered Dogs. These products typically have minimal revenue contribution and can drain resources without a clear growth path, making them candidates for divestment or optimization.

| Business Segment | BCG Category | Rationale | Key Financial Indicator Example (2024) |

|---|---|---|---|

| Traditional Fuels (Gasoline/Diesel) | Dog | Low margins, high competition, volatile crack spreads | Gasoline crack spreads: Low to mid-teens $/barrel |

| Niche Solvents (e.g., Chlorinated) | Dog | Declining demand, regulatory headwinds, low market share | Global specialty solvent market contraction: ~3-5% |

| Outdated Wax Formulations | Dog | Obsolescence, minimal revenue, resource drain | Low market share in niche segments: <5% (2023) |

Question Marks

The MaxSAF™ expansion initiative represents a significant undertaking for Calumet, positioning it within the Question Mark quadrant of the BCG matrix. This ambitious project targets a substantial increase in Sustainable Aviation Fuel (SAF) and renewable diesel production. The market for these products is experiencing robust growth, offering considerable future potential.

However, the initiative requires a substantial upfront capital commitment, underscored by a $1.44 billion loan commitment from the Department of Energy. With a projected completion timeline extending to 2028, this expansion currently demands significant cash outflow relative to its current market contribution. Its future success, and transition to a Star, is contingent upon efficient project execution and strong market acceptance.

Calumet's venture into renewable hydrogen production at its Montana Renewables complex positions it as a Question Mark within the BCG framework. This segment is crucial for the company's renewable fuels strategy, tapping into a high-growth area of the energy transition.

While the demand for hydrogen in renewable fuels is strong, Calumet's market position and the immediate profitability of this specific production capability are still being established. Significant ongoing investment is likely needed to achieve economies of scale and solidify its competitive standing in this emerging market.

The production of renewable naphtha and renewable propane at Calumet's Montana Renewables facility signifies a strategic move into emerging, high-growth segments of the renewable energy market. These products, while new to Calumet's portfolio, are poised to capitalize on increasing demand for sustainable alternatives in transportation and industrial applications.

While precise 2024 market share and profitability figures for these specific streams are still developing, the overall renewable fuels market is experiencing significant expansion. For instance, the global renewable fuels market was valued at approximately $110 billion in 2023 and is projected to grow substantially in the coming years, indicating a strong potential for these nascent products to evolve into Stars within Calumet's BCG portfolio.

Emerging Bio-environmental Lubricants (Post-Divestiture)

Even after divesting the industrial segment of Royal Purple, Calumet may be nurturing emerging bio-environmental lubricant technologies within its Specialties division. These advanced formulations are likely targeting specialized, eco-conscious markets that exhibit strong growth potential but currently hold a small market share. Significant investment in marketing and research will be crucial for these products to capture a larger portion of this emerging segment.

- Market Focus: Targeting environmentally sensitive industries and consumers.

- Investment Needs: High R&D and marketing expenditure to build brand awareness and market penetration.

- Growth Potential: Positioned in a high-growth, albeit currently niche, market.

New Strategic Partnerships for Renewable Feedstocks

New strategic partnerships for renewable feedstocks represent Calumet's strategic move into the Stars quadrant of the BCG Matrix. This initiative is vital for expanding its renewable fuels segment, aiming to capture growing market demand. For instance, in 2023, Calumet announced a significant agreement with a new supplier to bolster its supply of used cooking oil, a key renewable feedstock. This aligns with the broader industry trend, where renewable diesel production capacity in the U.S. was projected to reach approximately 6.5 billion gallons per year by the end of 2024, according to industry reports.

- Strategic Alignment: These partnerships directly support Calumet's strategic objective to become a leading producer of renewable fuels, moving away from traditional fossil fuel reliance.

- Growth Potential: The renewable feedstock market offers substantial growth opportunities, driven by regulatory mandates and increasing consumer preference for sustainable products.

- Investment and Risk: While promising, these ventures require significant upfront investment and carry inherent risks related to feedstock availability, price volatility, and processing technology.

- Market Position: Successfully integrating these new partnerships will solidify Calumet's competitive position in the burgeoning renewable fuels market.

Calumet's expansion into Sustainable Aviation Fuel (SAF) and renewable diesel, alongside its renewable hydrogen and naphtha/propane ventures, firmly places these initiatives within the Question Mark quadrant. These segments demand significant investment due to their nascent stage and the need to establish market share and operational efficiencies.

The company's commitment, evidenced by substantial financing like the $1.44 billion DOE loan for SAF expansion, highlights the capital-intensive nature of these emerging markets. Success hinges on achieving economies of scale and gaining strong market acceptance to transition these ventures from high-investment, uncertain-return Question Marks to profitable Stars.

The bio-environmental lubricant technologies also represent a Question Mark, requiring substantial R&D and marketing to penetrate niche, high-growth segments. These efforts are crucial for building brand recognition and capturing market share in an evolving landscape.

| Initiative | BCG Quadrant | Key Characteristics | Investment Focus | Market Outlook |

|---|---|---|---|---|

| MaxSAF™ Expansion | Question Mark | High capital expenditure, growing market demand, uncertain future market share. | Project execution, market adoption. | Robust growth expected for SAF and renewable diesel. |

| Renewable Hydrogen Production | Question Mark | Emerging technology, high growth potential, market position still developing. | Economies of scale, competitive positioning. | Strong demand from energy transition initiatives. |

| Renewable Naphtha & Propane | Question Mark | Nascent products, capitalizing on sustainable alternatives, market share still building. | Market penetration, product development. | Significant expansion in the global renewable fuels market. |

| Bio-Environmental Lubricants | Question Mark | Targeting niche eco-conscious markets, requires R&D and marketing investment. | Brand awareness, market penetration. | High-growth potential in specialized segments. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and expert commentary to ensure reliable, high-impact insights.