Calumet Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calumet Bundle

Calumet's competitive landscape is shaped by significant forces, including the bargaining power of its buyers and the intense rivalry within the industry. Understanding these dynamics is crucial for any stakeholder looking to navigate this market effectively.

The complete report reveals the real forces shaping Calumet’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Calumet's reliance on crude oil and various feedstocks means supplier power can fluctuate. While commodity crude oil often has a broad global market with many suppliers, specific grades or specialized feedstocks for niche products might be sourced from a limited number of powerful suppliers.

The uniqueness of these inputs is a key driver of supplier power. If Calumet requires specialized feedstocks for its unique specialty products, and few alternatives exist, those suppliers gain significant leverage. For instance, in 2024, the global oil market saw price volatility influenced by supply chain disruptions, highlighting the impact of even a few key producers on feedstock availability and cost for refiners like Calumet.

Calumet's switching costs for specialized feedstocks or specific crude types are substantial. These costs encompass potential operational disruptions, the need for recalibrating refining processes, and the expense of qualifying new suppliers. For instance, a shift in crude supplier might require significant adjustments to distillation units and processing parameters, impacting efficiency and output quality.

The ongoing high investment levels in both traditional oil and gas and emerging new energy sectors are placing additional strain on the overall supply system. This increased demand and potential for supply chain bottlenecks can make it more difficult and costly for Calumet to switch suppliers, as alternatives may be scarce or command premium pricing.

Consequently, these high switching costs empower existing suppliers with greater leverage. They can potentially command higher prices or impose less favorable terms, knowing that Calumet faces significant hurdles in finding and integrating alternative sources for its critical raw materials.

The availability of substitute inputs significantly impacts supplier power. For Calumet, while crude oil is a primary feedstock, its price fluctuations necessitate exploring alternatives like bio-based or recycled oils to manage production costs and reduce reliance on a single source.

In 2024, the global market for sustainable aviation fuel, a potential substitute for traditional jet fuel derived from crude oil, saw significant growth, with production projected to reach 15 billion liters by 2028, indicating a growing capacity for alternative feedstocks.

If Calumet can readily adopt different crude sources or alternative feedstocks without a substantial dip in product quality or a sharp rise in expenses, the bargaining power of its current suppliers is naturally weakened.

Threat of Forward Integration by Suppliers

Suppliers to Calumet, particularly those providing specialized feedstocks or additives, might consider forward integration into refining or specialty product manufacturing. This is more plausible if their offerings are highly proprietary and represent a significant portion of Calumet's value creation, allowing them to capture more margin.

While large crude oil suppliers face immense capital barriers to forward integration, smaller, niche suppliers could leverage their unique products. For instance, a supplier of a critical, patented lubricant additive might explore producing finished specialty lubricants themselves, directly competing with Calumet's existing product lines.

This potential threat, even if not immediately realized, shapes Calumet's negotiating leverage. It necessitates maintaining strong supplier relationships and potentially exploring long-term supply contracts to mitigate the risk of a key supplier becoming a direct competitor.

- Forward Integration Risk: Specialized feedstock or additive suppliers may integrate forward into refining or specialty product manufacturing.

- Proprietary Products: The threat is amplified if suppliers offer highly proprietary and value-adding components.

- Competitive Landscape: Even a remote threat influences Calumet's bargaining power and strategic considerations.

Impact of Geopolitical and Regulatory Factors on Supply

Global energy supply chains in 2025 continue to be shaped by geopolitical friction and rising protectionist policies. These factors can cause significant disruptions and price swings for essential raw materials such as crude oil and base oils, directly impacting Calumet's operational costs.

Stringent environmental regulations are also a major driver of change, necessitating considerable investment in advanced, cleaner production technologies. This shift towards sustainability can elevate supplier costs, thereby augmenting their bargaining power over Calumet.

- Geopolitical Tensions: Ongoing conflicts and trade disputes in key oil-producing regions can lead to unexpected supply shortages, pushing up raw material prices. For instance, disruptions in the Middle East, a critical source of global oil, can have immediate ripple effects.

- Regulatory Compliance: New environmental standards, such as those related to emissions or waste management in refining processes, require capital expenditures. Companies failing to adapt may face penalties or reduced operational capacity, indirectly strengthening the position of compliant suppliers.

- Supplier Investment: Suppliers investing in greener technologies to meet evolving regulations may pass these increased costs onto buyers like Calumet. This can create a scenario where suppliers with advanced, compliant facilities command higher prices.

Calumet's bargaining power with suppliers is influenced by the concentration of suppliers, the uniqueness of inputs, and switching costs. While broad commodity markets offer leverage, specialized feedstocks or additives sourced from fewer providers can significantly increase supplier influence. In 2024, the energy sector experienced notable supply chain fragilities, underscoring how limited availability of critical inputs can empower suppliers.

The potential for suppliers to forward integrate into Calumet's product lines, especially with proprietary components, poses a strategic risk that enhances their negotiating stance. Furthermore, increasing regulatory pressures and geopolitical instability in 2025 continue to create an environment where suppliers with compliant and stable operations can command premium pricing, impacting Calumet's raw material costs.

| Factor | Impact on Calumet's Supplier Bargaining Power | 2024/2025 Context |

|---|---|---|

| Supplier Concentration | High for specialized inputs, low for commodities | Global oil market volatility in 2024 highlighted dependence on key producers. |

| Uniqueness of Inputs | Increases power for suppliers of proprietary additives/feedstocks | Growth in sustainable aviation fuel (projected 15 billion liters by 2028) shows evolving feedstock landscape. |

| Switching Costs | High for specialized processes, moderate for commodity crude | Recalibrating refining units for new crude types incurs significant expense. |

| Forward Integration Threat | Moderate for niche suppliers, low for large commodity producers | Patented additive suppliers could explore finished product manufacturing. |

| Geopolitical/Regulatory Environment | Increases power for compliant, stable suppliers | 2025 geopolitical tensions and environmental regulations drive up costs for non-compliant suppliers. |

What is included in the product

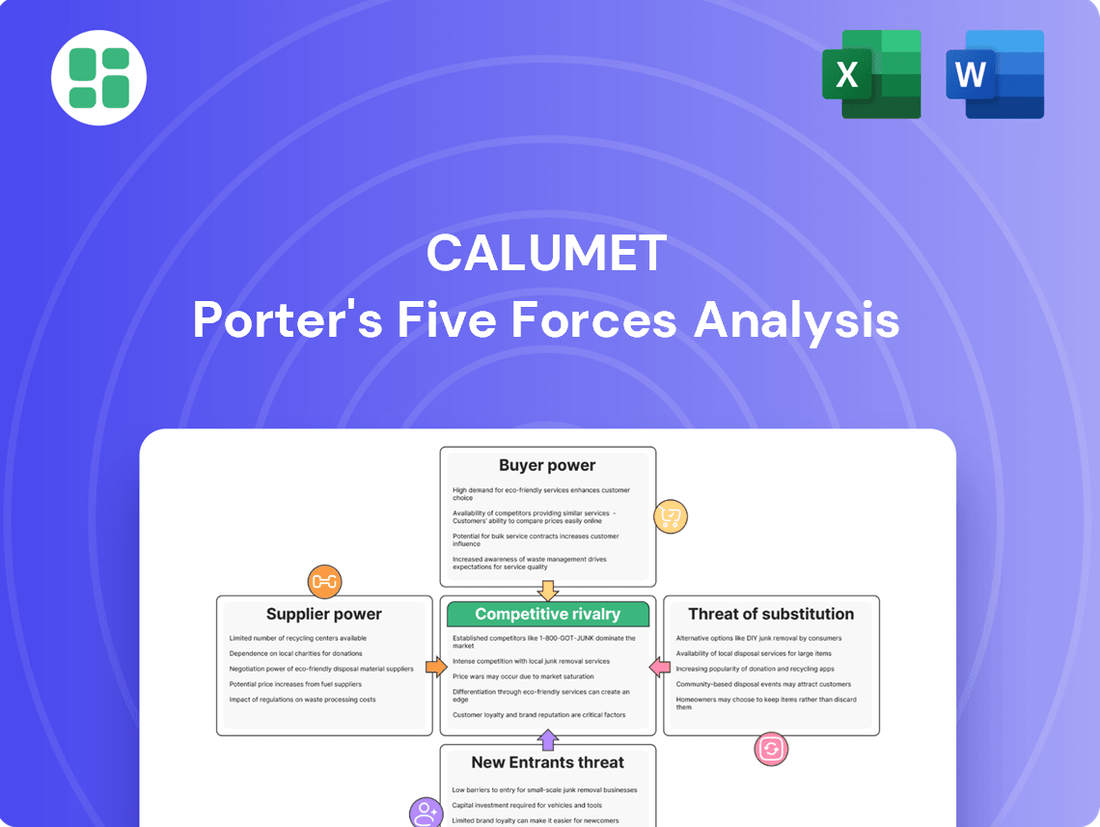

Analyzes the competitive intensity and profitability of the specialty petroleum products market for Calumet by examining supplier power, buyer power, threat of new entrants, threat of substitutes, and existing rivalry.

Effortlessly identify and address competitive threats with a visual representation of industry power dynamics.

Customers Bargaining Power

Calumet's extensive reach, with over 1,900 products sold to roughly 2,400 customers in fiscal year 2023, generally limits the power of any single buyer. This wide distribution across industrial and consumer sectors means most customers represent a small fraction of Calumet's overall business.

However, the situation shifts for large industrial clients or major fuel distributors who may purchase substantial volumes. These significant buyers can exert considerable bargaining power, potentially demanding lower prices or more favorable contract terms due to their concentrated purchasing volume.

If Calumet experiences customer concentration for specific product lines, these key customers could leverage their importance to negotiate better deals. This highlights the importance of managing relationships with high-volume buyers to mitigate potential price erosion.

Calumet's customers show a notable difference in price sensitivity. For its fuel products, customers are very sensitive to price changes. This is largely because fuel is a commodity, making it easy to compare prices across different suppliers. In 2024, this sensitivity was amplified as refining margins declined due to lower demand and a greater supply of global fuel, putting direct pressure on Calumet's pricing.

However, the situation is different for Calumet's specialty products. Customers in this segment may be less concerned about minor price fluctuations. This is because these specialty products often offer unique performance advantages or cost-saving benefits tailored to specific industrial needs. When a specialty product delivers significant value, customers are often willing to pay a premium, reducing their overall price sensitivity.

Customers wield significant bargaining power when readily available substitute products exist from competing suppliers. For Calumet's fuel products, this means customers can easily switch to refiners offering similar gasoline or diesel, putting pressure on pricing and margins.

In contrast, the power of substitutes for Calumet's specialty lubricants, solvents, and waxes is more nuanced. If Calumet's custom formulations offer unique performance characteristics or if customers have specific, hard-to-meet requirements, the availability of direct substitutes diminishes, thereby reducing customer bargaining power. Calumet's strategy to enhance technical support and provide bespoke services aims to solidify these customer relationships and differentiate its offerings.

Customers' Switching Costs

Customers' switching costs significantly shape their bargaining power. For commodity fuels, these costs are minimal, enabling customers to readily switch to competitors offering more favorable pricing. This ease of switching amplifies customer leverage.

Conversely, for Calumet's customized specialty products, switching costs can be considerably higher. These costs often involve rigorous re-qualification processes, extensive performance testing, and the complexities of integrating new products into existing customer operations. Such hurdles tend to diminish the bargaining power of these customers.

In 2024, the energy sector saw continued volatility, impacting customer price sensitivity. For instance, the average price of gasoline in the US fluctuated throughout the year, creating opportunities for customers to seek lower prices by switching suppliers for commodity fuels. This market dynamic underscores the importance of low switching costs in driving customer bargaining power for these products.

- Low Switching Costs for Commodities: Customers can easily switch between fuel suppliers for standard products, leading to increased bargaining power due to price competition.

- High Switching Costs for Specialties: For customized products, the need for re-qualification, testing, and integration creates barriers, reducing customer bargaining power.

- 2024 Market Context: Price volatility in commodity fuels in 2024 heightened customer sensitivity and their ability to switch for better deals.

- Impact on Calumet: Calumet must manage the trade-off between commodity product competitiveness and the value proposition of its specialty products, where higher switching costs offer more pricing stability.

Demand Trends and Market Dynamics

Demand trends significantly influence the bargaining power of customers for Calumet. The ongoing shift towards electric vehicles (EVs) and alternative fuels is dampening the demand for traditional refined products like gasoline. For instance, by the end of 2023, EV sales in the US had surpassed 1.2 million units, a substantial increase from previous years, directly impacting gasoline consumption.

This evolving energy landscape can empower customers by increasing their options and reducing their reliance on Calumet's core offerings. Refiners face pressure on their margins as gasoline demand softens, potentially leading to customers seeking more competitive pricing or alternative suppliers. The International Energy Agency (IEA) projected that global oil demand growth would slow considerably in 2024 and 2025, further highlighting this trend.

However, the picture isn't entirely bleak for Calumet. Demand for distillates, such as jet fuel, remains robust, supported by the continued recovery of air travel. In 2023, global air passenger traffic reached 88% of pre-pandemic levels, according to IATA, indicating sustained demand for jet fuel. Specialty products also continue to perform well, offering Calumet some resilience against broader demand shifts.

- EV Adoption Impact: Over 1.2 million EVs sold in the US in 2023, reducing gasoline demand.

- Global Oil Demand Slowdown: IEA forecasts slower oil demand growth for 2024-2025.

- Jet Fuel Resilience: Global air passenger traffic reached 88% of pre-pandemic levels in 2023, supporting distillate demand.

Calumet's broad customer base generally limits individual buyer power, as most customers represent a small portion of sales. However, large industrial clients and major fuel distributors can wield significant influence due to their substantial purchase volumes, enabling them to negotiate better pricing and terms.

Price sensitivity is high for Calumet's commodity fuels, exacerbated in 2024 by declining refining margins and increased global fuel supply. Conversely, customers of specialty products, valued for unique performance benefits, exhibit lower price sensitivity, allowing Calumet more pricing flexibility.

The availability of substitutes significantly impacts bargaining power. For commodity fuels, easy substitution empowers customers to switch for better prices. For Calumet's specialized formulations, limited direct substitutes reduce customer leverage, especially when accompanied by strong technical support and customized services.

Switching costs are minimal for commodity fuels, amplifying customer bargaining power. However, for specialty products, higher switching costs associated with re-qualification and integration protect Calumet's pricing power. The 2024 energy market volatility further highlighted this, as customers readily switched fuel suppliers for cost savings.

| Factor | Impact on Customer Bargaining Power | Calumet's Situation |

| Customer Concentration | High for large buyers | Generally low due to broad customer base, but significant for key industrial clients. |

| Price Sensitivity | High for fuels, low for specialties | Commodity fuels highly sensitive, especially in 2024's volatile market. Specialties less so due to unique value. |

| Availability of Substitutes | High for fuels, low for specialties | Customers can easily switch fuel suppliers; specialized products offer differentiation. |

| Switching Costs | Low for fuels, high for specialties | Minimal for commodities, significant for custom formulations requiring re-qualification. |

Full Version Awaits

Calumet Porter's Five Forces Analysis

This preview shows the exact Calumet Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual, professionally written document that meticulously details the competitive landscape for Calumet, covering industry rivalry, buyer power, supplier power, threat of new entrants, and threat of substitutes. Once you complete your purchase, you’ll get instant access to this exact, fully formatted file, ready for your strategic decision-making.

Rivalry Among Competitors

The North American refining and specialty hydrocarbon market is quite crowded, featuring many players. You'll find giants like ExxonMobil and Shell alongside independent companies such as Valero and Marathon. This means there are plenty of capable rivals, making things competitive.

Competition is especially fierce in the standard fuel market, which is largely a commodity. While there are many companies, market concentration isn't extremely high, meaning no single company dominates the entire landscape.

The refining industry experienced significant headwinds in 2024, marked by subdued demand for petroleum products and an increase in global refining capacity. This imbalance led to a sharp decline in refining margins, putting pressure on industry profitability.

Looking ahead to 2025, U.S. refining capacity is projected to contract by 3% as several refineries are slated for closure. This capacity reduction could offer a modest uplift to the margins of the remaining operational refineries.

In contrast, the specialty chemicals sector is poised for robust expansion, with market forecasts indicating growth beyond $800 billion by 2025, presenting a more optimistic outlook for companies operating in this segment.

Calumet's fuel products face intense rivalry as they are largely undifferentiated commodities, meaning customers can easily switch to competitors with little to no cost. This commodity nature drives down prices and intensifies competition. For instance, in 2024, the gasoline market, a significant segment for Calumet, continued to be characterized by price sensitivity and readily available alternatives.

However, Calumet differentiates its specialty products like lubricating oils, solvents, and waxes. These customized offerings create higher switching costs for customers who rely on specific formulations and performance characteristics. This niche focus allows Calumet to potentially escape the direct price wars seen in the fuel sector, fostering more stable margins.

Calumet's strategy of maintaining a diversified product portfolio, coupled with robust technical support for its specialty products, serves as a key competitive advantage. This approach helps build customer loyalty and provides a buffer against the intense rivalry prevalent in its more commoditized fuel segments.

Exit Barriers for Competitors

The refining industry, where Calumet Specialty Products Partners operates, is characterized by substantial exit barriers. These include massive investments in fixed assets like refineries and pipelines, along with highly specialized equipment. For instance, constructing a new refinery can cost billions of dollars, making it incredibly difficult for existing players to simply walk away from their operations, even if they are not profitable.

These high exit barriers trap capital and resources within the industry. Unprofitable competitors often remain active due to the inability to divest these specialized assets without significant losses. This situation directly fuels sustained overcapacity and leads to aggressive price competition as companies fight for market share, even in challenging economic conditions. In 2024, the refining sector continued to grapple with these structural issues, impacting overall profitability for many participants.

- High Fixed Asset Investment: Refineries represent enormous capital expenditures, often in the billions, making divestment costly.

- Specialized Equipment: The unique nature of refining machinery limits its resale value and alternative uses.

- Environmental Liabilities: Decommissioning and managing environmental risks associated with refinery operations add significant costs to exiting the market.

- Sustained Overcapacity: The inability to exit easily contributes to an ongoing imbalance between supply and demand, intensifying price wars.

Diversity of Competitors and Strategic Commitments

Calumet Specialty Products Partners, L.P. operates in a highly competitive landscape characterized by a diverse range of players. This includes large, integrated oil majors with significant refining capacity and capital, as well as smaller, independent refiners who may focus on specific product niches or regional markets. Additionally, pure-play specialty chemical companies compete directly for market share in high-margin segments.

The strategic objectives and cost structures of these varied competitors create a dynamic and often unpredictable competitive environment. For instance, a major integrated player might absorb lower margins in certain product lines to maintain overall refinery utilization, while a specialty chemical company might prioritize higher-margin niche products, even if it means lower volumes. This disparity in approach makes it challenging to anticipate competitive moves.

A significant trend observed in 2024 and continuing into 2025 is the strategic pivot towards sustainable platforms, particularly renewable diesel. Several companies are investing heavily in converting existing facilities or building new ones to produce renewable fuels. This shift is driven by regulatory incentives and increasing market demand, aiming to defend margins in a traditional refining sector that faces long-term structural challenges. For example, some refiners are reconfiguring their operations to process bio-feedstocks alongside traditional crude oil.

- Diverse Competitor Base: Integrated majors, independent refiners, and specialty chemical firms all vie for market position.

- Varied Strategic Goals: Different competitors pursue distinct objectives, influencing their market behavior and pricing strategies.

- Cost Structure Differences: Disparities in operational costs create an uneven playing field and impact competitive intensity.

- Sustainability Investments: A notable strategic commitment in 2024 involved significant capital allocation towards renewable diesel production to enhance future profitability.

The competitive rivalry within the North American refining and specialty hydrocarbon market is intense due to a crowded field of players, ranging from integrated giants to independent refiners. This rivalry is particularly sharp in the commoditized fuel market, where undifferentiated products lead to price sensitivity and easy customer switching. For instance, gasoline, a key product for Calumet, saw significant price competition in 2024 due to readily available alternatives.

Calumet's specialty products, however, offer a degree of differentiation, creating higher switching costs for customers who value specific formulations. This niche focus allows for potentially more stable margins compared to the fuel segment. The industry's high exit barriers, including massive capital investments and specialized equipment, mean that even struggling competitors often remain active, contributing to sustained overcapacity and aggressive pricing throughout 2024.

| Competitor Type | Key Characteristics | 2024 Market Dynamics |

|---|---|---|

| Integrated Majors (e.g., ExxonMobil, Shell) | Large scale, diversified operations, significant capital access | Navigating subdued demand, investing in renewable transitions |

| Independent Refiners (e.g., Valero, Marathon) | Focused refining operations, varying degrees of specialization | Facing margin pressure due to overcapacity, strategic shifts towards renewables |

| Specialty Chemical Firms | Niche product focus, higher-margin segments | Poised for growth, competing on product performance and customization |

SSubstitutes Threaten

The threat of substitutes for traditional petroleum products is substantial, particularly from non-petroleum-based alternatives. The accelerating adoption of electric vehicles (EVs) has demonstrably reduced oil demand, with estimates suggesting a displacement of over 1.3 million barrels per day in 2024 alone.

Furthermore, biofuels represent a growing competitive force. Ethanol, biodiesel, and sustainable aviation fuel (SAF) are gaining traction, with global production capacity for renewable diesel and SAF projected to surpass 57 million tonnes per year by 2035, directly impacting the market share of conventional fuels.

The attractiveness of substitutes for Calumet's products hinges significantly on their price-performance ratio. While some alternatives, like bio-based chemicals or renewable energy sources, might currently carry a higher price tag, their costs are steadily declining. For instance, the global cost of solar photovoltaic (PV) electricity generation has seen a dramatic decrease, falling by approximately 89% between 2010 and 2022, making it increasingly competitive with traditional energy sources.

Customers may be willing to pay a premium for substitutes due to their environmental benefits, a factor that is gaining prominence in purchasing decisions. This willingness to pay more, coupled with the ongoing technological advancements that improve efficiency and reduce costs for these alternatives, poses a growing threat. As these technologies mature, their economic viability will improve, potentially accelerating their adoption and impacting Calumet's market share.

Customer propensity to substitute is significantly shaped by growing environmental awareness and regulatory shifts. For instance, in 2024, the global market for sustainable chemicals, a potential substitute for many traditional industrial inputs, was projected to reach over $200 billion, indicating a strong customer interest in greener alternatives.

Industrial clients, especially those prioritizing Environmental, Social, and Governance (ESG) goals, are increasingly willing to explore bio-based or eco-friendly substitutes. This trend is evident as companies actively seek to reduce their carbon footprint, even if these alternatives carry a slightly higher upfront price tag.

Technological Advancements in Substitutes

Technological advancements are making substitutes increasingly attractive. For instance, improvements in electric vehicle (EV) battery technology are enhancing their range and reducing charging times, directly challenging traditional internal combustion engine vehicles. In 2024, the global EV market continued its robust growth, with sales projected to reach over 15 million units, a significant increase from previous years.

The renewable energy sector is also seeing rapid innovation, with solar and wind power becoming more cost-effective and efficient. This trend directly impacts industries reliant on fossil fuels, offering cleaner and often cheaper alternatives. By the end of 2023, global renewable energy capacity additions reached a record high, exceeding 500 gigawatts, demonstrating the accelerating shift away from traditional energy sources.

Furthermore, advancements in green chemistry are driving the adoption of sustainable feedstocks. Specialty chemical manufacturers are increasingly exploring and utilizing biomass-derived materials. For example, companies are investing in bio-based ethylene and other platform chemicals, which can serve as direct replacements for petrochemical-derived counterparts, with the bio-based chemicals market expected to grow substantially in the coming years.

- EV Battery Technology: Ongoing research is focused on increasing energy density and reducing reliance on rare earth minerals, making EVs more competitive.

- Renewable Energy Efficiency: Innovations in solar panel efficiency and wind turbine design are lowering the levelized cost of energy (LCOE) for renewables.

- Biomass Feedstocks: The development of advanced biorefineries allows for the conversion of agricultural waste and other biomass into valuable chemicals, reducing dependence on fossil fuels.

- Green Chemistry Processes: New catalytic processes are enabling more efficient and environmentally friendly production of chemicals from renewable sources.

Regulatory and Environmental Pressures

Increasing regulatory scrutiny and evolving environmental policies are potent drivers for substitute products. As governments worldwide intensify efforts to curb carbon emissions and champion sustainable practices, the appeal and adoption rate of alternatives to conventional industrial inputs are set to rise. For instance, the U.S. Department of Energy's significant loan commitment to Calumet's Montana Renewables for a new renewable fuels facility underscores this trend, signaling substantial backing for greener alternatives.

These governmental pushes, often manifested through incentives for renewable fuels and mandates for eco-friendly industrial components, can dramatically shift market demand away from traditional offerings. Such policies directly encourage investment and innovation in substitute technologies. For example, in 2023, the Inflation Reduction Act in the United States provided substantial tax credits for renewable energy production, further incentivizing the shift away from fossil fuels.

The threat of substitutes is amplified when these regulatory and environmental pressures create a more favorable economic landscape for greener options. This can lead to a faster decline in the market share of incumbent products if they cannot adapt or if their production processes are deemed environmentally unsustainable. The increasing focus on ESG (Environmental, Social, and Governance) criteria by investors also pressures companies to adopt more sustainable practices, indirectly promoting substitutes.

- Regulatory Shifts: Governments are implementing stricter environmental regulations, pushing industries towards sustainable alternatives.

- Incentives for Renewables: Policies like tax credits and loan programs actively support the development and adoption of renewable fuels and materials.

- Market Demand Impact: These pressures can accelerate the adoption of substitutes, directly affecting the demand for conventional products.

- Investor Pressure: Growing emphasis on ESG factors encourages companies to explore and invest in environmentally friendly solutions.

The threat of substitutes for traditional petroleum products is significant, driven by advancements in renewable energy and materials science. The global push for decarbonization, supported by policies and increasing consumer awareness, directly fuels the adoption of alternatives. For instance, the projected global market for sustainable chemicals, a key substitute category, was expected to exceed $200 billion in 2024, highlighting a substantial shift in demand.

Technological progress in areas like electric vehicles (EVs) and bio-based chemicals offers compelling alternatives. EV sales continued their upward trajectory, with global figures anticipated to surpass 15 million units in 2024, directly impacting gasoline demand. Similarly, innovations in green chemistry are making bio-derived feedstocks more competitive with petrochemicals, with the bio-based chemicals market showing robust growth potential.

The economic viability of substitutes is improving, often driven by falling costs and government incentives. For example, the U.S. Department of Energy's support for renewable fuel facilities, like the one for Calumet's Montana Renewables, signals a favorable environment for these alternatives. These factors, combined with a growing willingness among industrial clients to prioritize ESG goals, intensify the threat posed by substitutes to established petroleum-based products.

Entrants Threaten

The refining and specialty hydrocarbon sectors demand immense capital, often running into billions of dollars for constructing new facilities. This high barrier significantly deters potential new entrants. For instance, building a new refinery can easily cost upwards of $10 billion, a prohibitive sum for most aspiring companies.

Existing companies, including Calumet, leverage significant economies of scale. This advantage spans production efficiency, bulk purchasing power for raw materials, and streamlined distribution networks. These established efficiencies make it incredibly challenging for newcomers to match their cost structures and compete effectively in the market.

The oil and gas industry presents significant barriers to entry due to rigorous environmental regulations and complex permitting requirements. New companies must allocate substantial capital and time to ensure compliance with safety standards and secure necessary approvals.

For instance, the Environmental Protection Agency's (EPA) updated rules in 2025 have extended compliance deadlines for various oil and gas sources, underscoring the persistent and evolving nature of these regulatory demands. Navigating these intricate processes acts as a substantial deterrent for potential new market participants.

Newcomers face significant hurdles in building effective distribution channels and securing reliable supply chains for crude oil and specialized feedstocks. Calumet, like its competitors, benefits from decades of established relationships and intricate logistics networks, making it exceedingly difficult and costly for any new player to match.

Product Differentiation and Brand Loyalty

While commodity fuels like gasoline and diesel typically exhibit low brand loyalty, Calumet's focus on customized specialty products offers a degree of differentiation. This specialization can foster customer stickiness, making it more challenging for new entrants to capture market share by simply offering lower prices.

Newcomers would face significant hurdles in establishing a reputation for specialized formulations and earning the trust required for critical industrial applications where performance and reliability are paramount. For instance, in the lubricants sector, where Calumet operates, a proven track record with specific industrial equipment can be a substantial barrier to entry for unproven competitors.

- Calumet's specialty products create differentiation, unlike commodity fuels.

- Customer loyalty is built on specialized formulations and proven performance.

- New entrants face challenges in replicating specialized expertise and building trust in industrial markets.

- In 2023, Calumet reported revenue of $4.5 billion, with a significant portion likely driven by its specialty products segment.

Incumbent Reaction and Retaliation

Existing players like Calumet are likely to react aggressively to new entrants through price cuts, increased marketing, or strategic alliances. The threat of such retaliation, especially in a mature industry with high fixed costs and intense rivalry, can deter potential newcomers who might fear an unprofitable market entry.

For instance, in the refining sector where Calumet operates, significant capital investment is required, creating high barriers. Newcomers face the daunting prospect of competing against established firms with economies of scale and entrenched customer relationships. In 2024, the average operating margin for independent refiners hovered around 5-7%, a tight range that leaves little room for new, less efficient players to absorb aggressive pricing strategies from incumbents.

- Price Wars: Established companies may initiate price wars to make it difficult for new entrants to gain market share, potentially driving down profitability for all.

- Marketing Campaigns: Increased advertising and promotional activities by incumbents can overwhelm new entrants' marketing budgets.

- Strategic Partnerships: Existing firms might form alliances to present a united front against newcomers, leveraging combined resources and market power.

The threat of new entrants in Calumet's operating sectors is significantly mitigated by substantial capital requirements, with refinery construction alone costing billions. Furthermore, established players benefit from economies of scale, efficient production, and robust distribution networks, making it difficult for newcomers to compete on cost. Stringent environmental regulations and complex permitting processes also act as considerable deterrents, demanding significant investment and time for compliance.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024/2025) |

|---|---|---|---|

| Capital Requirements | High cost of building new facilities (e.g., refineries). | Prohibitive for most new companies. | Refinery construction costs can exceed $10 billion. |

| Economies of Scale | Lower per-unit costs for established firms due to high production volume. | Newcomers struggle to match cost structures. | Incumbent refiners' operating margins in 2024 were around 5-7%. |

| Regulatory Hurdles | Complex environmental laws and permitting processes. | Requires significant capital, time, and expertise. | Evolving EPA regulations add ongoing compliance burdens. |

| Distribution & Supply Chains | Established logistics and supplier relationships. | Difficult and costly for new players to replicate. | Calumet benefits from decades of established networks. |

Porter's Five Forces Analysis Data Sources

Our Calumet Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research, and public financial filings. We also incorporate insights from trade publications and economic databases to provide a comprehensive view of competitive pressures.