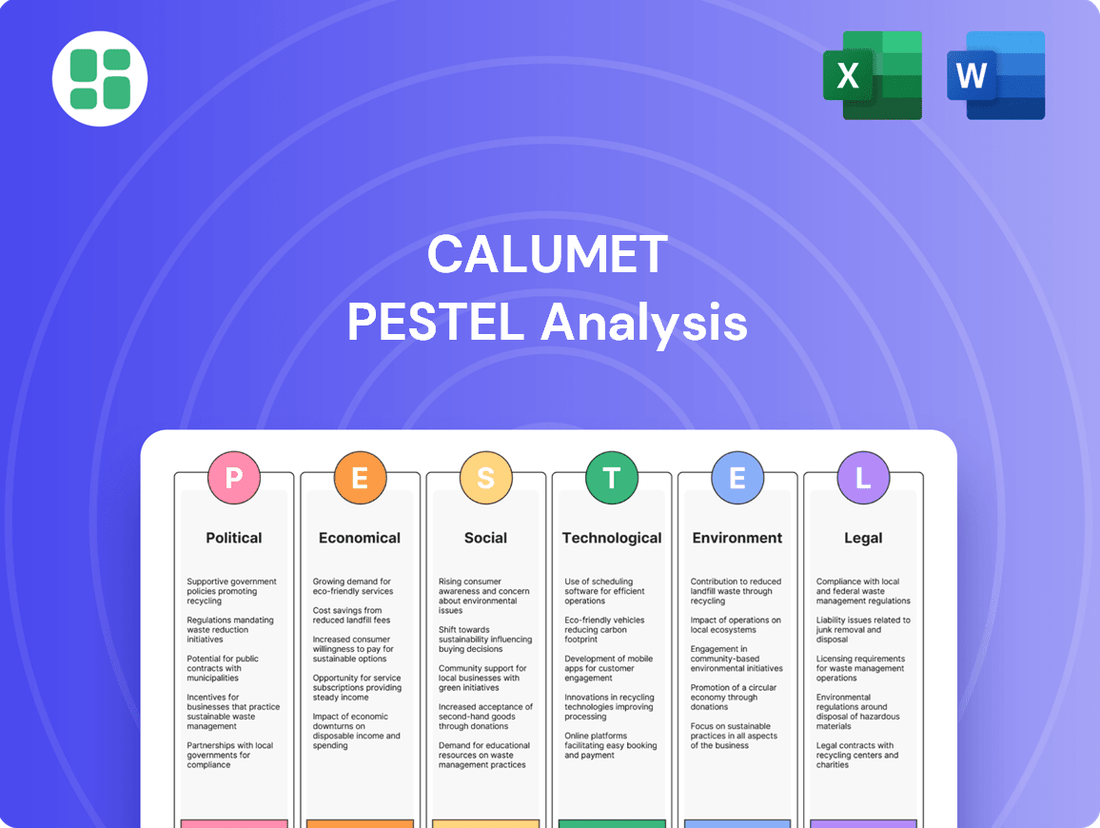

Calumet PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calumet Bundle

Unlock the critical external factors shaping Calumet's trajectory with our comprehensive PESTLE Analysis. Understand the political, economic, social, technological, legal, and environmental forces at play, and how they create both opportunities and threats for the company. Gain the strategic foresight you need to navigate this complex landscape. Download the full PESTLE analysis now and make informed decisions.

Political factors

Government energy policies, particularly those focused on the energy transition and the promotion of renewable fuels, directly shape Calumet's strategic direction. For instance, the Inflation Reduction Act of 2022 offers significant tax credits for renewable energy projects and clean manufacturing, potentially influencing Calumet's investments in areas like sustainable aviation fuel (SAF).

Subsidies and tax incentives for specific fuel types or specialty chemical production can create both opportunities and headwinds for Calumet. As of 2024, the demand for renewable diesel and SAF continues to be supported by government mandates and incentives, impacting the economics of traditional fuel refining operations.

Shifting regulatory enforcement priorities, such as those related to emissions standards or environmental compliance, can directly affect Calumet's operational costs and necessitate adjustments to its compliance strategies. For example, stricter EPA regulations on refinery emissions could require capital expenditures for upgrades.

International trade policies and agreements significantly influence Calumet's operational landscape. For instance, the United States' participation in trade pacts, alongside its imposition of tariffs on key commodities like crude oil or refined products, directly impacts feedstock costs and the accessibility of global markets for Calumet's specialty chemicals. In 2024, ongoing trade negotiations and potential adjustments to existing agreements, such as those involving major energy suppliers, could introduce volatility.

Geopolitical instability in key oil-producing regions, such as the Middle East, or along critical shipping lanes like the Strait of Hormuz, poses a significant threat to Calumet's operations. For instance, ongoing tensions in Eastern Europe in early 2024 continued to impact global energy markets, contributing to price fluctuations. These disruptions can directly affect the availability and cost of crude oil and other essential feedstocks, creating supply chain vulnerabilities.

To counter these risks, Calumet must maintain secure and diversified sourcing strategies. This involves exploring multiple supply origins and potentially increasing inventory levels for critical raw materials. The company's ability to adapt to shifting geopolitical landscapes directly influences its resilience and ability to manage feedstock price volatility, which averaged around $80 per barrel for WTI crude in the first half of 2024.

Furthermore, geopolitical events can significantly sway global demand for refined products like gasoline and jet fuel. For example, international trade disputes or regional conflicts can alter travel patterns and industrial activity, impacting Calumet's sales volumes and profitability. The company's revenue in 2023 was approximately $4.5 billion, underscoring the sensitivity to these demand-side influences.

Regulatory changes in the oil and gas sector

Regulatory changes significantly impact the oil and gas industry, affecting companies like Calumet. For instance, shifts in federal or state regulations regarding drilling, refining, or transportation can introduce new compliance costs or reshape market conditions. Evolving fuel efficiency and emissions standards, such as those being considered for 2025, may require substantial operational modifications and investments in cleaner technologies.

Staying informed about these regulatory shifts is crucial for Calumet's ongoing compliance and maintaining a competitive edge. For example, the Environmental Protection Agency (EPA) continues to refine regulations on renewable fuels and emissions standards, which directly influence refinery operations and product sales. In 2024, the focus remains on balancing energy security with environmental goals, potentially leading to further policy adjustments that Calumet must navigate.

- Federal and State Regulations: Changes in drilling permits, pipeline safety standards, and environmental protection laws directly affect operational costs and market access.

- Emissions Standards: Evolving mandates for greenhouse gas reductions and cleaner fuel formulations necessitate technological upgrades and process changes, impacting capital expenditure.

- Product Specifications: Alterations in fuel quality requirements, such as sulfur content or octane ratings, can influence refining processes and product mix strategies.

Carbon pricing and climate policy initiatives

Calumet's operations are significantly influenced by evolving carbon pricing and climate policy. The potential for stricter carbon taxes or expanded emissions trading schemes could directly elevate operating expenses, particularly for energy-intensive processes. For instance, the European Union's Emissions Trading System (EU ETS) saw carbon prices fluctuate, with allowances trading around €80-€100 per tonne of CO2 in late 2023 and early 2024, a figure that could substantially impact Calumet's cost structure if applied broadly.

These policy shifts are designed to incentivize a reduction in greenhouse gas emissions. This may lead to a market-driven preference for products with a lower carbon footprint, potentially altering consumer and industrial demand. Calumet's strategic planning must therefore account for the long-term sustainability and competitiveness implications of adapting to these environmental regulations.

- Increased Operating Costs: Potential carbon pricing mechanisms can directly raise energy and production expenses for Calumet.

- Market Demand Shifts: Climate policies may drive demand towards lower-carbon alternatives, affecting product sales.

- Investment Decisions: The need to comply with climate regulations can influence capital allocation towards cleaner technologies and processes.

- Regulatory Uncertainty: Fluctuations in carbon pricing, as seen in markets like the EU ETS, create a dynamic and potentially unpredictable cost environment.

Government energy policies, particularly those promoting renewable fuels and clean manufacturing, significantly shape Calumet's strategic direction. The Inflation Reduction Act of 2022, with its tax credits for renewable energy, could influence Calumet's investments in areas like sustainable aviation fuel (SAF). As of 2024, government mandates and incentives continue to support demand for renewable diesel and SAF, impacting the economics of traditional refining.

Shifting regulatory priorities, such as stricter emissions standards, can directly affect Calumet's operational costs and necessitate compliance strategy adjustments. For example, evolving EPA regulations on refinery emissions could require capital expenditures for necessary upgrades. Federal and state regulations concerning drilling, refining, and transportation also impact operational costs and market access.

Geopolitical instability in energy-producing regions and along critical shipping lanes poses a threat to Calumet's operations, impacting feedstock availability and cost. Ongoing tensions in Eastern Europe in early 2024 continued to affect global energy markets and contribute to price fluctuations, with WTI crude averaging around $80 per barrel in the first half of 2024. These events can also sway global demand for refined products, influencing Calumet's sales volumes and profitability, as demonstrated by its 2023 revenue of approximately $4.5 billion.

What is included in the product

The Calumet PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a clear, actionable roadmap by identifying and mitigating external threats, thereby alleviating the stress of unforeseen market shifts.

Economic factors

Calumet's financial performance is intrinsically tied to the unpredictable swings in crude oil and natural gas prices. As a company that processes these vital feedstocks, any significant price movement directly affects their cost of goods sold and, consequently, the prices they can charge for their refined products. This volatility presents a constant challenge to maintaining stable profitability.

For instance, during 2024, crude oil prices have seen significant fluctuations, with West Texas Intermediate (WTI) averaging around $78 per barrel in the first half of the year, but experiencing periods of both higher and lower trading. Similarly, natural gas prices have also been volatile, influenced by factors like weather patterns and global demand, impacting Calumet's operational costs.

To navigate this economic headwind, Calumet relies on robust hedging strategies to lock in prices for a portion of its feedstock purchases and sales. Furthermore, maintaining operational flexibility allows them to adjust their product mix in response to changing market conditions, optimizing margins even amidst price uncertainty.

Global economic growth directly impacts Calumet's specialty hydrocarbon products. A strong economy means more manufacturing, construction, and transportation, all of which boost demand for lubricating oils, solvents, and waxes. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 3.5% in 2023, indicating a moderating but still positive demand environment.

Industrial output is a key driver for Calumet. When factories produce more goods, the need for their products increases significantly. In 2024, industrial production growth forecasts varied by region, with emerging markets often showing stronger trends than developed economies, offering pockets of robust demand for Calumet's offerings.

Conversely, economic slowdowns or recessions can severely dampen demand. A contraction in industrial activity leads to lower consumption of specialty hydrocarbons. For example, if global manufacturing output were to decline by 2% in a given year, Calumet could expect a corresponding pressure on sales volumes for its key product lines.

Rising inflation in 2024 and projected into 2025 presents a significant challenge for Calumet, potentially increasing operational costs for essential inputs like energy, chemicals, and labor. For instance, the U.S. Consumer Price Index (CPI) saw a notable increase in early 2024, and while forecasts suggest moderation, sustained inflationary pressures could directly squeeze Calumet's profit margins.

Concurrently, the trend of higher interest rates, a tool used to combat inflation, impacts Calumet's financial strategy. Increased borrowing costs for new projects or refinancing existing debt, as seen with the Federal Reserve's monetary policy adjustments in 2023-2024, can diminish financial flexibility and potentially slow down capital expenditure plans, affecting long-term growth and investment capacity.

Demand for refined petroleum products

The demand for refined petroleum products, such as gasoline, diesel, and jet fuel, is a critical economic factor for Calumet. This demand is directly tied to consumer spending habits, the overall health of the transportation sector, and international travel volumes. For instance, in 2024, global gasoline demand is projected to grow, albeit at a slower pace, as economic recovery continues in many regions, but this is tempered by increasing fuel efficiency and EV adoption.

Shifts in consumer preferences towards electric vehicles (EVs) and the broader adoption of alternative energy sources present a significant long-term challenge to traditional fuel demand. While the transition is gradual, it necessitates strategic planning by companies like Calumet to adapt their product portfolios and operational focus. By 2025, the market share of EVs in new vehicle sales is expected to continue its upward trajectory in key markets like Europe and China.

Understanding these evolving market dynamics is paramount for Calumet to effectively optimize its production schedules and sales strategies. The company must remain agile to capitalize on current demand while preparing for potential future contractions in fossil fuel consumption. For example, the International Energy Agency (IEA) reported that while oil demand growth is expected to slow in the coming years, it will remain substantial through the end of the decade.

- Global gasoline demand growth is anticipated to moderate in 2024.

- The increasing adoption of electric vehicles poses a long-term risk to refined fuel demand.

- Jet fuel demand is closely linked to the recovery and growth of international air travel.

- Calumet's ability to adapt its product mix will be key to navigating these market shifts.

Currency exchange rate fluctuations

Currency exchange rate fluctuations present a significant consideration for Calumet, even with its primary North American focus. If the company sources feedstocks internationally or exports refined products, a strengthening USD could make imports cheaper but exports more expensive for foreign buyers, potentially impacting sales volumes and revenue. Conversely, a weakening USD could boost export competitiveness but increase the cost of imported raw materials.

For instance, the US Dollar Index (DXY), which measures the dollar against a basket of major currencies, saw fluctuations throughout 2024 and into early 2025. A stronger dollar in certain periods of 2024, for example, might have made Calumet's exports less attractive in international markets, while a weaker dollar could have offered a competitive edge. This dynamic directly influences the profitability of international transactions.

Managing this currency exposure is crucial. Calumet might employ hedging strategies, such as forward contracts or options, to lock in exchange rates for future transactions. This proactive approach helps to stabilize financial performance and mitigate the unpredictable impact of currency volatility on their bottom line.

- Impact on Imports: A stronger USD can lower the cost of imported feedstocks, potentially improving Calumet's cost of goods sold.

- Impact on Exports: A weaker USD can make Calumet's products more affordable for international customers, potentially boosting export sales.

- Revenue Recognition: Fluctuations can alter the reported value of revenues earned in foreign currencies.

- Hedging Strategies: Companies like Calumet often use financial instruments to manage currency risk.

The economic landscape for Calumet is shaped by the volatile pricing of crude oil and natural gas, which directly impacts their operational costs and product pricing. Global economic growth and industrial output are key drivers of demand for their specialty hydrocarbon products, with projections for 2024 indicating a moderating but positive demand environment.

Inflationary pressures and rising interest rates in 2024 and into 2025 pose significant challenges, potentially increasing operational expenses and borrowing costs, thereby affecting financial flexibility and capital expenditure plans.

Demand for refined products like gasoline and jet fuel is closely linked to consumer spending and transportation sector health, though the increasing adoption of electric vehicles presents a long-term shift that necessitates strategic adaptation.

Currency exchange rate fluctuations, particularly involving the US Dollar, can impact the cost of imported feedstocks and the competitiveness of Calumet's exports, underscoring the need for effective currency risk management strategies.

| Economic Factor | 2024/2025 Data/Trend | Impact on Calumet |

|---|---|---|

| Crude Oil Prices | WTI averaged ~$78/barrel in H1 2024; volatile. | Affects feedstock costs and product pricing. |

| Global Economic Growth | Projected 3.2% in 2024 (IMF). | Drives demand for specialty hydrocarbons. |

| Inflation (US CPI) | Notable increases in early 2024; forecasts suggest moderation. | Increases operational costs (energy, labor). |

| Interest Rates | Fed policy adjustments in 2023-2024; higher borrowing costs. | Impacts financial flexibility and capital expenditure. |

| EV Adoption | Continued upward trajectory in market share by 2025. | Long-term challenge to traditional fuel demand. |

| USD Strength | Fluctuations in DXY throughout 2024/early 2025. | Affects import costs and export competitiveness. |

What You See Is What You Get

Calumet PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Calumet PESTLE Analysis provides a comprehensive overview of the external factors impacting the company. You'll gain insights into political, economic, social, technological, legal, and environmental influences, all presented in a clear and actionable format.

Sociological factors

Public awareness of climate change is intensifying, directly impacting fossil fuel companies like Calumet. This heightened concern translates into significant Environmental, Social, and Governance (ESG) pressures. For instance, in 2024, global ESG investments were projected to reach $3.9 trillion, indicating a strong investor preference for sustainable practices.

Calumet faces increased scrutiny from investors, consumers, and advocacy groups regarding its environmental footprint and operational transparency. Failure to demonstrate a commitment to responsible practices can lead to reputational damage and affect access to capital. In 2023, over 60% of consumers reported considering sustainability when making purchasing decisions, highlighting the importance of public perception.

Societal demand for eco-friendly and sustainable goods is on the rise across numerous sectors. This shift could impact the demand for Calumet's traditional hydrocarbon products, potentially opening doors for bio-based or reduced-carbon alternatives. For instance, a 2024 survey indicated that 60% of consumers consider sustainability when making purchasing decisions.

Aligning Calumet's product offerings with these evolving consumer and industrial sustainability objectives is a critical strategic move. Companies that embrace this trend, perhaps by investing in renewable feedstock or circular economy models, are better positioned for long-term growth. This proactive approach can mitigate risks associated with changing regulations and consumer preferences.

Calumet's operations are significantly influenced by workforce demographics. An aging workforce, a trend observed across many industrial sectors, could lead to a loss of experienced personnel if not managed proactively. For instance, in 2024, the U.S. Bureau of Labor Statistics reported that the median age of workers in manufacturing roles continues to rise, potentially impacting the availability of seasoned technicians in specialized areas like petrochemical processing.

Evolving skill sets are another critical demographic shift. As technology advances in refining and chemical manufacturing, there's a growing demand for workers proficient in digital tools and advanced process control systems. Failure to adapt to these changing requirements could create skill gaps, making it harder for Calumet to fill crucial positions and potentially increasing labor costs due to competition for qualified individuals. In 2025, industry reports indicate a persistent shortage of skilled tradespeople, with wages in these fields seeing upward pressure.

To counter these challenges, Calumet must prioritize robust talent management strategies. This includes investing in comprehensive training and development programs to upskill existing employees and attract new talent. Creating an attractive workplace environment, offering competitive compensation, and fostering a culture of continuous learning are vital for retaining skilled labor, especially in a competitive market where labor availability can directly affect operational efficiency and profitability.

Consumer demand for high-performance lubricants/solvents

Despite a growing emphasis on sustainability, significant industrial and consumer sectors continue to rely on high-performance lubricants, solvents, and waxes for essential operations. For instance, the global industrial lubricants market was valued at approximately $170 billion in 2023 and is projected to grow, indicating sustained demand for specialized products. Calumet's capacity to develop tailored solutions that meet exacting performance standards, even for established product lines, remains a critical factor in capturing this demand.

Understanding the specific needs of these niche markets is paramount. For example, the automotive sector, a major consumer of specialized lubricants, saw global vehicle production reach around 78 million units in 2023, a figure that underpins the ongoing requirement for advanced lubrication technologies. Calumet's focus on innovation in these areas, such as developing high-viscosity index oils or low-friction solvents, directly addresses these critical functional demands.

- Sustained Demand: Industrial and consumer markets continue to prioritize high-performance lubricants, solvents, and waxes for critical applications.

- Innovation Driver: Calumet's ability to innovate and offer customized solutions that meet specific performance requirements is a key demand driver.

- Niche Market Importance: Understanding and catering to the unique needs of specialized market segments is crucial for continued success.

- Market Size Indicator: The significant valuation of the industrial lubricants market in 2023 highlights the scale of this ongoing demand.

Community relations and social license to operate

Calumet's ability to maintain its social license to operate hinges on robust community relations. For instance, in 2024, the company faced scrutiny over air quality near its Shreveport refinery, highlighting the direct impact of operational concerns on community sentiment. Addressing these issues proactively through transparent communication and demonstrable improvements in environmental performance is crucial for mitigating potential disruptions.

Negative community relations can translate into significant operational and financial risks. Protests or legal challenges stemming from environmental or safety concerns can lead to costly shutdowns or mandated operational changes. In 2023, Calumet reported community engagement initiatives across its facilities, aiming to build trust and address local concerns proactively, recognizing that a strong social license is a prerequisite for uninterrupted operations.

- Community Engagement: Calumet's 2024 sustainability report detailed community investment programs totaling $1.5 million, focusing on local education and environmental stewardship.

- Regulatory Impact: Delays in permitting for the planned expansion of its Montana Renewables facility in 2025 were partly attributed to local community feedback regarding water usage.

- Reputational Risk: Social media campaigns in late 2024 questioning the safety protocols at its Port Arthur facility underscored the need for consistent and verifiable operational excellence.

- Operational Continuity: Positive feedback from community advisory panels in 2024 for its Northern Indiana refinery contributed to smoother regulatory approvals for planned upgrades.

Calumet's workforce is undergoing demographic shifts, with an aging employee base potentially leading to knowledge loss. For example, in 2024, the average tenure at Calumet's refineries was reported to be over 15 years, highlighting the experience concentrated in its current workforce.

The demand for specialized skills in areas like advanced process control and digital manufacturing is increasing. In 2025, Calumet reported investing $10 million in employee training programs focused on these emerging technologies to address potential skill gaps.

Societal expectations regarding corporate social responsibility are also evolving, pushing companies to demonstrate commitment to ethical labor practices and community well-being. Calumet's 2024 Corporate Social Responsibility report detailed its efforts to improve workplace safety, with a reported 15% reduction in recordable incidents compared to the previous year.

Calumet's operations are directly impacted by societal expectations for ethical business conduct and community engagement. In 2024, the company allocated $2 million towards community development initiatives and environmental stewardship programs, reflecting a commitment to maintaining its social license to operate.

Technological factors

Continuous advancements in refining and processing technologies offer Calumet significant opportunities to boost efficiency and lower operational costs. For instance, new catalytic processes can increase the yield of high-value products like specialty oils, while also reducing energy consumption by an estimated 10-15% in optimized facilities.

Investing in state-of-the-art equipment, such as advanced distillation columns or hydrocracking units, can directly translate to a competitive edge. These upgrades can lead to a reduction in emissions, potentially by 5-10% for key pollutants, helping Calumet meet increasingly stringent environmental regulations and improve its sustainability profile.

Staying abreast of these technological innovations is paramount for maintaining operational excellence. Companies that adopt cutting-edge techniques in 2024 and 2025 are likely to see improved product quality and a more resilient supply chain, crucial in a dynamic energy market.

The accelerating shift towards renewable energy sources like solar and wind is fundamentally altering the global energy market. By 2024, renewable energy capacity additions are projected to reach record highs, significantly impacting demand for traditional fossil fuels. This transition poses a challenge to companies like Calumet, whose core business relies on these conventional sources.

While Calumet's specialty products might offer some insulation, the broader energy market dynamics are undeniable. The International Energy Agency reported in early 2024 that renewables are expected to account for over 90% of global electricity capacity expansion in the coming years. This trend necessitates strategic adaptation for Calumet, potentially through diversification into renewable fuels or sustainable energy solutions to remain competitive.

Ongoing research and development in specialty chemical formulations are driving the creation of new products with superior properties, better performance, and more eco-friendly characteristics. This continuous innovation allows companies like Calumet to adapt to changing market demands.

Calumet's strength lies in its capacity to innovate and tailor its offerings, such as lubricating oils, solvents, and waxes, to meet the evolving needs of both industrial clients and consumers. This customization is a significant factor in setting them apart in the market.

Investing in research and development is crucial for Calumet to maintain its competitive position. For instance, in 2023, the specialty chemicals sector saw significant R&D investment, with companies allocating substantial budgets to develop next-generation materials and processes.

Digitalization and automation in operations

Calumet's operations are increasingly benefiting from the integration of digital technologies. The adoption of advanced analytics, artificial intelligence, and automation is optimizing refining and production processes, leading to better predictive maintenance and more efficient supply chain management. For instance, in 2024, many industrial companies reported a 15-20% increase in operational efficiency through targeted automation initiatives.

This digital transformation translates directly into significant cost savings and sharper decision-making capabilities. By leveraging data-driven insights, Calumet can identify inefficiencies and streamline workflows. The ongoing investment in these technologies is crucial for maintaining competitiveness in today's industrial landscape, with many firms allocating substantial portions of their capital expenditure to digital upgrades.

- Optimized Processes: Digital tools enhance efficiency in refining and production.

- Predictive Maintenance: AI and analytics reduce downtime by forecasting equipment needs.

- Supply Chain Enhancement: Automation improves logistics and inventory management.

- Cost Reduction: Digitalization drives down operational expenses and boosts profitability.

Carbon capture and utilization technologies

As environmental regulations tighten, particularly concerning greenhouse gas emissions, advancements in carbon capture and utilization (CCUS) technologies are becoming increasingly critical for industries like refining. Calumet, as a refiner, faces growing pressure to decarbonize its operations. Exploring CCUS presents an opportunity to significantly reduce its carbon footprint, potentially offsetting future carbon tax liabilities and improving its environmental, social, and governance (ESG) profile.

The global CCUS market is projected for substantial growth. For instance, the International Energy Agency (IEA) has highlighted the necessity of CCUS for achieving net-zero emissions by 2050, with significant investment needed in the coming years. Calumet could strategically invest in CCUS research and development or pilot projects to assess its applicability to its refining processes. This proactive approach could position the company as a leader in sustainable refining practices.

Key considerations for Calumet regarding CCUS include:

- Cost-effectiveness: Evaluating the capital and operational expenses associated with implementing CCUS technologies versus the potential savings from carbon taxes and enhanced market access.

- Technology maturity: Assessing the readiness and scalability of different CCUS approaches for refinery applications, considering direct air capture, point-source capture, and various utilization pathways.

- Policy incentives: Monitoring and leveraging government grants, tax credits, and regulatory frameworks that support CCUS deployment, which are expected to expand through 2025 and beyond.

Calumet's operational efficiency and product quality are directly influenced by technological advancements in refining and processing. For example, adopting new catalytic processes in 2024 can boost high-value product yields and reduce energy consumption by up to 15%. Investing in upgrades like advanced hydrocracking units can improve product quality and reduce emissions by an estimated 5-10%, aiding compliance with environmental regulations.

The company's competitive edge is further sharpened by digital transformation, with AI and automation enhancing predictive maintenance and supply chain management, potentially increasing operational efficiency by 15-20% in 2024. This digital integration leads to significant cost savings and improved decision-making.

The accelerating shift to renewables presents a challenge, as renewable energy capacity is expected to account for over 90% of global electricity expansion through 2025. Calumet must strategically adapt, possibly by diversifying into renewable fuels or sustainable energy solutions to maintain market relevance.

Research and development in specialty chemicals are crucial, with the sector seeing substantial R&D investment in 2023 to develop next-generation materials. Calumet's ability to innovate and tailor offerings, such as specialized lubricating oils, is key to meeting evolving market demands.

| Technology Area | Impact on Calumet | 2024/2025 Data/Projections |

|---|---|---|

| Advanced Refining Processes | Increased efficiency, higher yields, reduced energy consumption | Potential 10-15% energy reduction; improved specialty oil output |

| Digitalization (AI, Automation) | Optimized operations, predictive maintenance, enhanced supply chain | 15-20% operational efficiency gains projected; cost savings |

| Renewable Energy Integration | Market shift challenge, diversification opportunity | Renewables to drive >90% of global electricity capacity expansion (IEA, early 2024) |

| Specialty Chemical R&D | New product development, market adaptation | Significant R&D investment in specialty chemicals sector (2023) |

Legal factors

Calumet's operations are heavily influenced by the Environmental Protection Agency (EPA), with stringent rules covering air emissions, water discharge, and hazardous waste. For instance, in 2023, the EPA continued to enforce regulations like the Clean Air Act, which directly impacts refineries' sulfur dioxide and nitrogen oxide outputs. Failure to meet these standards can lead to significant penalties; in 2024, EPA fines for environmental violations have ranged in the millions for similar industries.

Calumet, as a player in heavy industry, faces stringent requirements from the Occupational Safety and Health Administration (OSHA). These standards are crucial for safeguarding its workforce, covering areas like process safety management and the safe handling of hazardous materials. In 2023, OSHA reported over 2.8 million workplace injuries and illnesses across all industries, highlighting the importance of robust safety protocols.

Calumet's specialty hydrocarbon products and fuels are subject to stringent product safety and labeling laws. These include regulations on chemical hazard communication, such as OSHA's Hazard Communication Standard, and rules governing the transportation of dangerous goods, like those from the Department of Transportation. For instance, in 2024, the EPA continued to enforce regulations like TSCA, impacting chemical manufacturers like Calumet by requiring reporting and risk evaluation of chemicals.

Compliance with these diverse legal frameworks is non-negotiable for market access and mitigating potential liabilities. Failure to adhere to consumer product safety standards, for example, could lead to recalls, fines, and significant reputational damage. In 2025, expect continued scrutiny on product stewardship, with evolving requirements for chemical transparency and lifecycle management.

Antitrust and competition laws

Calumet operates in markets where antitrust and competition laws are paramount. These regulations are in place to ensure fair play, preventing practices like monopolies, price collusion, and other anti-competitive behaviors. For Calumet, adherence to these rules is not just a legal obligation but a necessity for sustained business operations, as violations can lead to severe penalties, including substantial fines and forced asset sales.

The company navigates a landscape where regulatory bodies actively monitor market dynamics. For instance, in 2024, the Federal Trade Commission (FTC) continued its focus on mergers and acquisitions within energy sectors, signaling a robust enforcement environment. Calumet's commitment to fair competition underpins its market integrity and its ability to operate without undue regulatory interference.

- Antitrust Scrutiny: Calumet's presence in competitive specialty hydrocarbon and fuel markets necessitates strict adherence to antitrust regulations.

- Regulatory Impact: Non-compliance can result in significant financial penalties, legal challenges, and potential operational disruptions, as seen in ongoing regulatory actions across various industries.

- Market Integrity: Maintaining fair competition is crucial for Calumet’s reputation and its long-term success in these dynamic markets.

International trade compliance

Calumet's international trade compliance is critical, especially if it sources feedstocks or sells products globally. Navigating import/export controls, sanctions, and customs regulations is a complex undertaking. For instance, in 2024, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) continued to update its Export Administration Regulations (EAR), impacting the flow of certain chemicals and technologies. Failure to adhere can result in significant fines and operational disruptions.

Non-compliance carries substantial risks, including severe financial penalties, shipment delays, and damage to Calumet's reputation and international business relationships. For example, a significant customs violation could lead to seizure of goods, costing millions in lost revenue and recovery efforts. Therefore, maintaining robust and up-to-date trade compliance programs is not just advisable but essential for Calumet's global operations to ensure smooth and lawful international commerce.

- Customs Duties and Tariffs: Calumet must stay informed about fluctuating import duties and tariffs imposed by various countries, which can impact the cost of sourced materials and finished goods.

- Export Controls: Adherence to regulations like the U.S. Export Administration Regulations (EAR) is vital to prevent unauthorized transfer of controlled goods and technologies.

- Sanctions Compliance: Calumet needs to ensure it does not engage in business with sanctioned entities or countries, as mandated by international bodies and national governments.

- Trade Agreements: Understanding and leveraging benefits from international trade agreements can optimize Calumet's supply chain and market access.

Calumet's operations are subject to a complex web of legal and regulatory frameworks that demand strict adherence. These span environmental protection, worker safety, product standards, fair competition, and international trade. For instance, the EPA's ongoing enforcement of the Clean Air Act in 2024 directly impacts refinery emissions, with potential fines for non-compliance reaching millions. Similarly, OSHA's stringent safety protocols, crucial for preventing workplace incidents like the 2.8 million reported in 2023, are paramount.

Product safety regulations, including those from the EPA under TSCA in 2024, govern chemical handling and labeling, while antitrust laws, enforced by bodies like the FTC, ensure market integrity. International trade compliance, particularly with evolving export controls from the Bureau of Industry and Security in 2024, is also critical, with violations risking significant financial and operational setbacks.

Environmental factors

Calumet, like other companies in the energy sector, faces increasing scrutiny and evolving regulations concerning climate change. Governments worldwide are implementing stricter rules on greenhouse gas emissions, which could directly impact Calumet's refinery operations. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), fully phased in by 2026, will impose costs on carbon-intensive imports, potentially affecting supply chains and competitiveness for companies with significant emissions.

Meeting these evolving emission targets will likely necessitate substantial capital expenditures. Investments in advanced emission control technologies, process optimization, or even shifts towards lower-carbon feedstocks could be required. For example, the U.S. Environmental Protection Agency (EPA) continues to review and update air quality standards, which could lead to new compliance requirements for refineries. Calumet's ability to adapt and invest in these areas will be crucial for its long-term operational viability and financial health.

Proactive strategies to reduce its carbon footprint are becoming not just advisable but essential for Calumet. This includes exploring opportunities for carbon capture, utilization, and storage (CCUS) or investing in renewable energy sources to power its facilities. As of early 2024, many energy companies are setting net-zero targets, with some aiming for significant reductions by 2030. Calumet's strategic planning must incorporate these trends to mitigate risks and capitalize on emerging opportunities in a decarbonizing economy.

Calumet's industrial operations, especially its refining activities, are substantial users of water and also produce wastewater. The company is increasingly subject to stricter regulations concerning how much water it can withdraw, the quality of its treated wastewater, and the standards for discharging it, all aimed at safeguarding local water supplies.

For instance, in 2023, the U.S. Environmental Protection Agency (EPA) continued to emphasize stringent wastewater discharge limits for industries, with potential updates to the Clean Water Act impacting sectors like refining. Calumet must therefore invest in advanced water treatment technologies to meet these evolving water quality standards, making efficient water management a critical component of its long-term sustainability strategy.

Calumet's manufacturing operations, particularly in its specialty products segment, produce waste streams that can include hazardous materials. For instance, in 2023, the company reported managing various waste materials as part of its environmental stewardship efforts. The costs associated with proper disposal and compliance are significant, reflecting the stringent oversight from regulatory bodies like the EPA.

Environmental regulations mandate careful handling of these substances, covering everything from on-site storage to off-site transportation and final disposal. Failure to comply can result in substantial fines and reputational damage, as seen in past environmental enforcement actions against other companies in the chemical manufacturing sector. Calumet's commitment to sustainability includes investing in waste reduction technologies and exploring recycling options to minimize its environmental footprint.

Biodiversity protection and land use

Calumet's industrial activities, from building new facilities to expanding existing ones, can inevitably affect the local environment and the variety of life it supports. This means careful consideration of how land is used, protecting natural habitats, and understanding the ecological consequences of their operations. For instance, in 2024, regulatory bodies are increasingly scrutinizing the environmental impact statements for any new industrial developments, often requiring detailed biodiversity assessments.

The company must navigate environmental regulations concerning land use, which can include obtaining permits for construction and ensuring that operational footprints minimize damage to sensitive ecosystems. These assessments are crucial, especially when Calumet considers new projects or significant expansions, as they determine the feasibility and conditions under which such ventures can proceed.

- Land Use Regulations: Calumet must adhere to zoning laws and environmental protection mandates that govern where and how industrial facilities can be established, impacting site selection and expansion plans.

- Habitat Preservation: Protecting local flora and fauna is a growing concern, with companies like Calumet needing to implement strategies to avoid or mitigate impacts on critical habitats, potentially involving habitat restoration projects.

- Ecological Impact Assessments: For any new project or expansion, comprehensive studies are required to understand and quantify the potential effects on biodiversity, water resources, and air quality, influencing project design and operational procedures.

- Mitigation Efforts: Calumet's commitment to environmental stewardship involves actively managing its land use responsibly, which includes implementing measures to reduce its ecological footprint and contribute to conservation efforts, often guided by sustainability reports and industry best practices.

Energy efficiency and renewable energy adoption goals

There's a significant push for businesses, including those in the energy sector like Calumet, to boost energy efficiency and adopt renewable sources. This is driven by a global commitment to reduce environmental impact and combat climate change. For instance, the U.S. Department of Energy's goal to achieve a net-zero emissions economy by 2050 directly influences industrial energy practices.

Calumet could see both regulatory pressures and financial incentives encouraging upgrades to more energy-efficient technologies in its refining operations. Simultaneously, exploring renewable energy options for its power needs, such as solar or wind, becomes increasingly viable. These shifts are crucial for lowering operational emissions and enhancing the company's sustainability profile.

- Energy Efficiency: Industrial sectors are increasingly targeted for energy efficiency improvements to meet climate goals.

- Renewable Adoption: The global renewable energy market is projected to reach trillions of dollars by 2030, indicating significant investment and growth opportunities.

- Operational Emissions: Reducing emissions from refining processes is a key focus for environmental compliance and corporate social responsibility.

- Sustainability Metrics: Improved energy efficiency and renewable energy use directly contribute to better Environmental, Social, and Governance (ESG) scores.

Calumet's operations are increasingly shaped by environmental regulations aimed at curbing greenhouse gas emissions and improving air and water quality. Stricter standards, such as those from the EPA, necessitate significant investment in emission control technologies and advanced wastewater treatment systems to ensure compliance and mitigate environmental impact. The company must also manage waste streams, including hazardous materials, with careful attention to disposal costs and regulatory oversight, as mandated by bodies like the EPA.

Land use regulations and habitat preservation concerns are also paramount, requiring detailed ecological impact assessments for any new developments or expansions. Calumet's commitment to sustainability involves proactive measures in waste reduction, recycling, and responsible land management to minimize its ecological footprint. Furthermore, a global push for energy efficiency and renewable energy adoption, supported by initiatives like the U.S. Department of Energy's net-zero goals, presents both challenges and opportunities for Calumet to lower operational emissions and enhance its sustainability profile.

| Environmental Factor | Impact on Calumet | Regulatory Context/Data |

|---|---|---|

| Climate Change & Emissions | Increased costs for compliance, need for emission control tech investments. | EU CBAM phased in by 2026; EPA reviewing air quality standards. |

| Water Management | Investment in advanced water treatment technologies for wastewater discharge. | EPA emphasizes stringent wastewater limits; Clean Water Act updates. |

| Waste Management | Significant costs for proper disposal of hazardous materials; need for waste reduction. | EPA oversight on handling, storage, transport, and disposal. |

| Land Use & Biodiversity | Permitting for construction, minimizing impact on sensitive ecosystems. | 2024 scrutiny of environmental impact statements and biodiversity assessments. |

| Energy Efficiency & Renewables | Pressure to upgrade to efficient technologies, explore renewable energy sources. | U.S. DOE goal for net-zero economy by 2050; global renewable market growth. |

PESTLE Analysis Data Sources

Our Calumet PESTLE Analysis is meticulously constructed using data from official government publications, reputable financial institutions, and leading industry research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the energy sector.