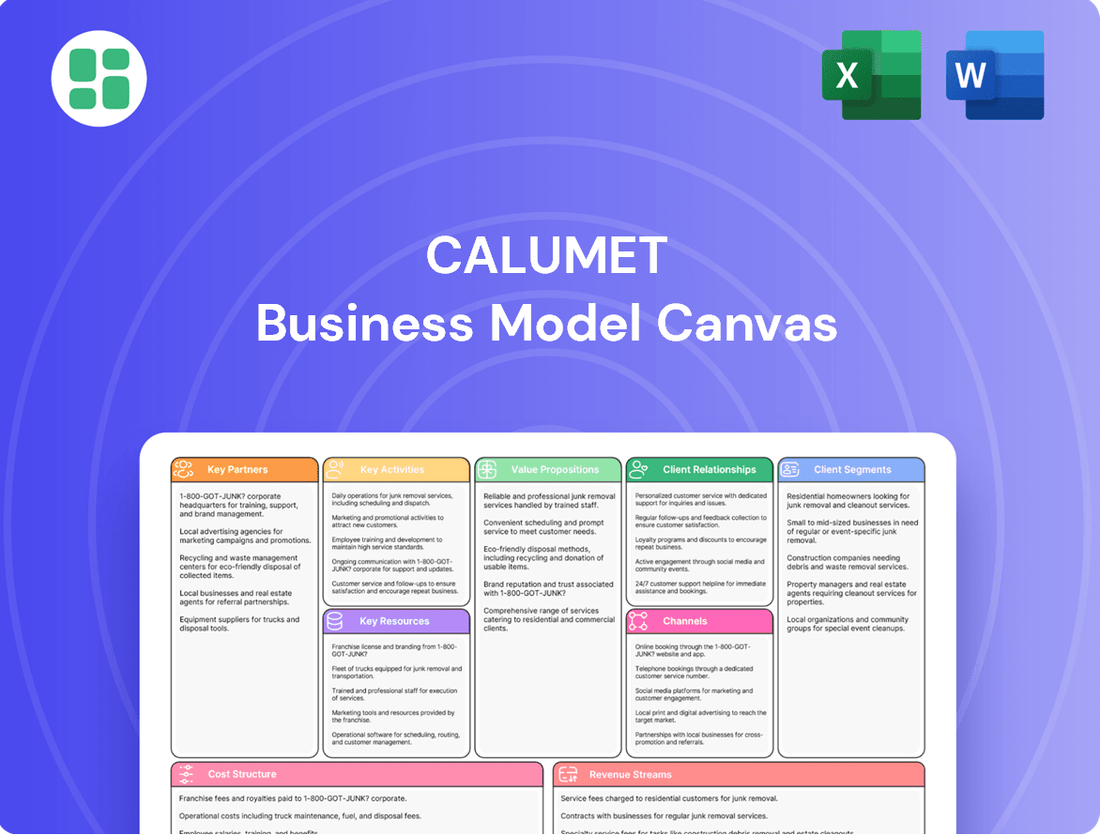

Calumet Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calumet Bundle

Curious about Calumet's strategic framework? Our full Business Model Canvas dissects their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market position. Download the complete version to gain a competitive edge and refine your own business strategy.

Partnerships

Calumet's strategic crude oil and feedstock suppliers are the bedrock of its refining operations, ensuring a steady flow of essential raw materials. In 2024, Calumet continued to leverage these relationships to secure a diverse range of crude oil types, crucial for optimizing refinery yields and product quality.

These critical partnerships, often solidified through long-term contracts, provide Calumet with feedstock security and help manage procurement costs in a volatile global market. The company's ability to maintain consistent production hinges on the reliability and quality of the crude oil and other feedstocks supplied by these key alliances.

Calumet's ability to get its refined products, like specialty lubricants and waxes, to customers across North America relies heavily on its logistics partners. These partnerships are the backbone of their distribution network, ensuring products reach industrial and consumer markets efficiently.

Key to this are collaborations with pipeline operators, trucking companies, rail freight providers, and marine transporters. For instance, in 2024, Calumet continued to leverage these relationships to manage its extensive supply chain, which is crucial for maintaining its market presence and meeting customer demand in a timely and cost-effective manner.

Calumet partners with leading technology and equipment vendors to ensure its refining processes are efficient and safe. These collaborations are vital for maintaining cutting-edge facilities and adopting new manufacturing methods, especially for products like sustainable aviation fuel (SAF).

These strategic alliances enable Calumet to optimize production yields and minimize its environmental footprint. For instance, in 2024, significant investments were made in upgrading distillation columns and advanced catalyst technologies to improve the efficiency of producing higher-value refined products.

Research and Development Collaborators

Calumet engages with universities and research institutions to foster innovation, particularly in its specialty and renewable product lines. These collaborations are crucial for developing novel hydrocarbon products and enhancing existing formulations. For instance, in 2024, Calumet continued its focus on advanced materials research, leveraging academic expertise to explore new applications for its products.

Partnerships with specialized chemical companies are also vital for Calumet's R&D efforts. These alliances allow for shared expertise and resources, accelerating the development of customized solutions for specific industrial needs. Such strategic alliances ensure Calumet remains competitive by adapting to rapidly changing market demands and technological advancements.

These R&D collaborations are instrumental in driving product differentiation and maintaining a competitive edge. By pooling knowledge and capabilities, Calumet can bring innovative products to market more effectively. This proactive approach to research and development is a cornerstone of its strategy to thrive in dynamic industrial and consumer landscapes.

- University Collaborations: Focused on exploring next-generation materials and sustainable chemical processes.

- Specialized Chemical Partnerships: Aimed at co-developing bespoke hydrocarbon formulations for niche markets.

- Product Innovation: Driving advancements in specialty oils, waxes, and renewable fuels.

- Market Competitiveness: Ensuring Calumet stays ahead in evolving industrial and consumer sectors.

Financial and Investment Partners

Calumet's financial and investment partners are vital for its operational and strategic success. These include lenders who provide debt financing and investors who supply equity capital, enabling the company to manage its financial obligations and fund growth initiatives. For instance, securing capital for significant projects like Montana Renewables relies heavily on these relationships.

These partnerships are instrumental in supporting Calumet's transition to a C-Corporation, a move that often requires robust financial backing and investor confidence. The financial flexibility derived from these relationships allows Calumet to navigate its capital expenditures, manage day-to-day operations, and seize new growth opportunities effectively.

- Lenders: Provide debt financing essential for operational liquidity and capital investments.

- Investors: Supply equity capital, crucial for strategic projects and corporate structure changes.

- Financial Institutions: Facilitate access to capital markets for fundraising and debt management.

- Montana Renewables Financing: Partnerships were key to securing the necessary funds for this significant strategic initiative.

Calumet's key partnerships extend to its critical feedstock suppliers, ensuring a consistent flow of crude oil and other essential materials for its refining operations. These relationships are fundamental for managing procurement costs and maintaining feedstock security. In 2024, Calumet continued to strengthen these alliances to optimize refinery yields and product quality.

Logistics and transportation partners are indispensable for distributing Calumet's refined products across North America. These collaborations with pipeline, trucking, rail, and marine operators ensure efficient delivery to industrial and consumer markets. In 2024, these partnerships were vital for managing the company's extensive supply chain and meeting customer demand promptly.

Collaborations with technology and equipment vendors are crucial for maintaining efficient and safe refining processes, particularly for new ventures like sustainable aviation fuel. These alliances facilitate the adoption of advanced manufacturing methods and facility upgrades. In 2024, investments in distillation columns and catalyst technologies were supported by these strategic partnerships.

Calumet also actively partners with universities and specialized chemical companies for research and development. These R&D collaborations drive product innovation, particularly in specialty oils, waxes, and renewable fuels, ensuring market competitiveness. In 2024, these partnerships were instrumental in developing novel hydrocarbon products and enhancing existing formulations.

| Partnership Type | Focus Area | 2024 Impact |

|---|---|---|

| Feedstock Suppliers | Crude oil and raw material procurement | Ensured feedstock security and cost management |

| Logistics Providers | Product distribution and supply chain management | Facilitated efficient delivery to markets |

| Technology Vendors | Process efficiency and equipment upgrades | Supported advancements in refining technology |

| R&D Institutions | Product innovation and new material development | Drove advancements in specialty products and renewables |

What is included in the product

A detailed, pre-written business model that outlines Calumet's strategic approach to its operations.

It thoroughly covers customer segments, channels, and value propositions, reflecting Calumet's real-world plans.

The Calumet Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of a business's core elements, allowing for rapid identification of inefficiencies and areas for improvement.

It alleviates the pain of complex strategy development by offering a structured, one-page framework that simplifies the process of understanding and refining a business model.

Activities

Calumet's key activity is transforming crude oil and other feedstocks into a wide array of products. This includes everyday fuels like gasoline and diesel, as well as specialized hydrocarbons used in various industries.

The company operates twelve sophisticated refineries across North America. These facilities employ complex processes such as distillation and cracking to achieve optimal product output.

In 2024, Calumet's refining segment demonstrated its operational capacity, contributing significantly to the company's overall performance. Efficient processing is crucial for maximizing the value derived from each barrel of crude oil.

Calumet's core operations extend beyond simple refining, focusing heavily on the intricate blending and formulation of specialty products. This critical activity involves tailoring lubricating oils, solvents, and waxes to exact customer requirements, demanding precise chemical processes and stringent quality assurance.

This meticulous approach allows Calumet to produce an extensive portfolio, encompassing over 1,900 distinct specialty and fuel products. The ability to customize is a fundamental element of their value proposition, particularly within the competitive specialty markets where specific performance characteristics are paramount.

A core activity for Calumet is transforming renewable feedstocks into valuable products like renewable diesel, sustainable aviation fuel (SAF), and renewable hydrogen at its Montana Renewables facility. This processing is becoming increasingly important as the company aims to meet growing demand for cleaner energy solutions.

Calumet is a major player in the North American SAF market, actively working to boost its production capacity. This strategic focus directly addresses the increasing global emphasis on decarbonization within the aviation sector and aligns with broader sustainability objectives.

Supply Chain and Logistics Management

Calumet's key activities heavily rely on robust supply chain and logistics management. This encompasses everything from sourcing raw materials, known as feedstock, to storing finished products and getting them to customers. Effective management here is crucial for operational efficiency and customer satisfaction. In 2024, Calumet continued to refine these processes to serve its broad customer base.

Optimizing the flow of goods is paramount. This means ensuring that the right products are in the right place at the right time, all while keeping transportation costs in check. Calumet's operations span various regions, making the coordination of these logistics a significant undertaking. This intricate network supports approximately 2,400 customers, highlighting the scale of their distribution efforts.

- Feedstock Procurement: Securing reliable and cost-effective raw materials is the foundational step in Calumet's production cycle.

- Inventory Management: Balancing stock levels to meet demand without incurring excessive holding costs is a continuous challenge.

- Product Distribution: Efficiently delivering a diverse range of refined products to a wide geographic customer base requires sophisticated logistics planning.

- Stakeholder Coordination: Working closely with suppliers, transportation providers, and internal teams ensures seamless operations across the entire supply chain.

Sales, Marketing, and Technical Support

Calumet's key activities in sales, marketing, and technical support focus on connecting with both industrial and consumer customers. This involves understanding their specific needs, effectively promoting Calumet's diverse product portfolio, and offering crucial technical assistance. For instance, in 2024, Calumet continued to leverage its direct sales force alongside a robust network of distributors to reach a broad customer base, ensuring product availability and local support.

The company's strategy includes direct engagement to identify market opportunities and build relationships, while also managing its distributor channels to maximize reach and service. This multi-faceted approach is designed to drive demand for Calumet's specialty products, which are vital across various industries. In 2024, Calumet reported that its specialty products segment, which heavily relies on these sales and marketing efforts, contributed significantly to its overall revenue.

- Direct Sales Force: Calumet employs a dedicated sales team to engage directly with key industrial clients, fostering strong partnerships and understanding specific application requirements.

- Distributor Network Management: The company actively manages and supports its network of distributors, ensuring efficient product delivery and localized customer service across various geographic regions.

- Technical Support and Expertise: Providing expert advice on product application, performance optimization, and troubleshooting is a core activity, enhancing customer value and loyalty.

- Market Engagement: Continuous interaction with industrial and consumer markets allows Calumet to identify emerging needs, tailor marketing campaigns, and adapt its product offerings to changing demands.

Calumet's key activities revolve around transforming feedstocks into a broad range of products, including fuels and specialized hydrocarbons. This transformation occurs across twelve sophisticated North American refineries, where complex processes like distillation and cracking are employed. In 2024, the refining segment was a significant contributor to the company's performance, highlighting the importance of efficient processing.

What You See Is What You Get

Business Model Canvas

The Calumet Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it represents the complete, ready-to-use file with all sections and content intact. Once your order is confirmed, you'll gain full access to this identical document, ensuring a seamless transition from preview to ownership.

Resources

Calumet's refining and manufacturing facilities are its core physical assets, comprising twelve strategically positioned refineries and blending plants throughout North America. These include significant operations like the Montana Renewables facility.

These sites boast advanced processing units and a substantial aggregate storage capacity of around 7.0 million barrels, which is fundamental to the company's production capacity. For instance, in the first quarter of 2024, Calumet reported total production volumes that directly reflect the output from these facilities.

The efficiency and operational performance of these manufacturing hubs are critical determinants of Calumet's overall output levels and its cost structure. Their effective management directly influences the company's ability to meet market demand and manage profitability.

Calumet's skilled workforce is a cornerstone, featuring chemical engineers, refinery operators, research scientists, and sales professionals. This deep bench of talent is crucial for their operations.

Their expertise spans refining processes, product development, stringent quality control, and customer engagement. This intellectual capital directly fuels innovation and operational efficiency across Calumet's varied product lines.

For instance, in 2024, Calumet reported a significant portion of its operational success was attributable to its specialized workforce, enabling them to maintain high production standards for their specialty hydrocarbon products and waxes.

Calumet's intellectual property, particularly its proprietary blending recipes and specialized manufacturing processes, forms a cornerstone of its business model. These unique formulations, especially for customized specialty lubricants, solvents, and waxes, are crucial for market differentiation.

The company holds patented product formulations that allow it to offer tailored solutions, giving it a distinct competitive edge. This knowledge base is a key resource, enabling Calumet to meet specific customer needs in demanding applications.

Extensive Supply Chain and Distribution Network

Calumet's extensive supply chain and distribution network is a cornerstone of its operations. This includes access to a robust network of crude oil pipelines, storage terminals, and critical transportation infrastructure. This network is essential for the efficient sourcing of raw materials and the broad distribution of finished products throughout North America.

This integrated infrastructure ensures reliable and timely delivery to Calumet's diverse customer base, directly supporting market penetration and operational efficiency. For instance, in 2024, Calumet continued to leverage its strategically located refining facilities and extensive logistics capabilities to manage the flow of crude oil and refined products, a critical factor in maintaining competitive pricing and market share.

- Pipeline Access: Facilitates cost-effective and continuous crude oil delivery to refineries.

- Storage Capacity: Provides flexibility in managing inventory and responding to market fluctuations.

- Transportation Fleet: Enables efficient distribution of finished goods via rail, truck, and marine transport.

- Geographic Reach: Supports broad market access across key North American consumption centers.

Capital and Financial Strength

Calumet requires substantial capital to sustain its operations, maintain its refineries, and invest in growth areas like renewable fuels research and development. This includes funding for capacity expansions and ongoing technological upgrades.

The company's robust financial health and established access to capital markets are crucial. This allows Calumet to effectively manage the inherent volatility of commodity prices and to seize strategic growth opportunities. A prime example is the Department of Energy loan secured for Montana Renewables, demonstrating its ability to attract significant funding for key projects.

- Capital Requirements: Ongoing operations, refinery maintenance, capacity expansions, and R&D for renewable fuels.

- Financial Strength: Enables funding of operations and management of commodity price volatility.

- Access to Capital Markets: Facilitates pursuit of strategic growth opportunities, such as the DOE loan for Montana Renewables.

Calumet's key resources are its physical refining and blending facilities, a skilled workforce, proprietary intellectual property, an extensive supply chain, and significant financial capital. These assets collectively enable efficient production, product innovation, and market reach.

The company's twelve refineries and blending plants, including the Montana Renewables facility, provide substantial production capacity. In the first quarter of 2024, Calumet's operational output directly reflected the capabilities of these sites, which possess an aggregate storage capacity of approximately 7.0 million barrels.

Calumet's intellectual property, such as its unique blending recipes for specialty lubricants and waxes, provides a competitive advantage. This specialized knowledge, coupled with a workforce experienced in chemical engineering and operations, drives innovation and ensures high production standards for products like specialty hydrocarbon products and waxes, as evidenced by their 2024 operational successes.

The company's financial strength and access to capital markets are vital for sustaining operations and pursuing growth. For example, securing a Department of Energy loan for Montana Renewables highlights their ability to fund strategic initiatives.

| Key Resource | Description | 2024 Relevance/Data Point |

|---|---|---|

| Physical Facilities | Twelve refineries and blending plants | Aggregate storage capacity of ~7.0 million barrels |

| Skilled Workforce | Chemical engineers, operators, scientists | Attributed to high production standards for specialty products |

| Intellectual Property | Proprietary blending recipes, patented formulations | Enables tailored solutions for demanding applications |

| Supply Chain & Distribution | Pipeline access, storage, transportation fleet | Supports efficient sourcing and broad market access |

| Financial Capital | Capital for operations, maintenance, R&D | DOE loan for Montana Renewables example |

Value Propositions

Calumet provides a wide array of specialized hydrocarbon products, including lubricating oils, solvents, and waxes, meticulously formulated to meet the exact needs of various industrial and consumer markets. This customization is a key value proposition, addressing specific application challenges that standard products simply can't handle.

By offering these tailored solutions, Calumet effectively serves as a critical raw material supplier for numerous manufacturing processes, enabling innovation and performance enhancement in end products. For instance, in 2024, Calumet's specialty products played a vital role in sectors demanding high-performance lubricants, contributing to improved efficiency and longevity in machinery across the automotive and industrial equipment sectors.

Customers consistently value Calumet's dependable supply chain, ensuring the steady availability of fuels and specialty petroleum products. This reliability is crucial for industries that depend on a consistent flow of feedstock, directly impacting their ability to maintain production schedules and avoid costly operational disruptions. For instance, in 2024, Calumet's strategic focus on optimizing its refining and distribution network contributed to a strong on-time delivery rate, a key factor in securing long-term contracts with major industrial clients.

Calumet's commitment extends beyond just selling products; they offer robust technical expertise and application support. This means customers receive guidance on how to best use Calumet's offerings, particularly their intricate specialty formulations, ensuring optimal performance and problem resolution.

This consultative approach isn't just about troubleshooting; it's about actively helping clients maximize the value they get from Calumet's products. By providing this level of support, Calumet fosters a stronger customer relationship, positioning themselves as a partner invested in their clients' success.

In 2024, Calumet's focus on technical support likely played a role in maintaining strong customer retention rates, especially within their specialty products segment, where application nuances are critical for achieving desired outcomes.

Diverse Product Portfolio (Fuels and Specialties)

Calumet's diverse product portfolio is a cornerstone of its business model, offering customers a broad range of petroleum-based solutions. This includes essential high-volume fuels like gasoline, diesel, and jet fuel, which are critical for transportation and logistics sectors. In 2024, Calumet continued to serve these fundamental energy needs, ensuring consistent demand for its core fuel products.

Complementing its fuel offerings, Calumet also provides a suite of high-margin specialty products. These cater to more niche industrial applications and often command premium pricing. This dual approach allows Calumet to be a single-source provider for many customer requirements, streamlining their supply chains and simplifying procurement processes.

The strategic advantage of this diversified product mix lies in its ability to balance revenue streams. By participating in both the high-volume, lower-margin fuel market and the lower-volume, higher-margin specialty market, Calumet can mitigate risks associated with fluctuations in any single product category. This diversification was evident in their 2024 financial performance, where both segments contributed to overall stability.

- Comprehensive Offerings: Gasoline, diesel, jet fuel, and a wide array of specialty products.

- Customer Convenience: Single-source procurement simplifies supply chain management for clients.

- Risk Mitigation: Diversification across fuel and specialty products balances revenue and reduces market volatility exposure.

- Market Presence: Continued strong demand for both conventional fuels and specialized industrial lubricants and waxes in 2024.

Commitment to Sustainable Solutions

Calumet is actively investing in sustainable solutions, notably in the production of sustainable aviation fuel (SAF) and carbon-neutral waxes. This focus directly addresses the growing market demand for environmentally responsible products.

By offering greener alternatives, Calumet empowers its customers to meet their own sustainability targets, enhancing their brand reputation and operational efficiency. This aligns with a broader industry shift towards decarbonization.

Calumet's dedication to innovation in sustainability positions the company as a key player and a reliable partner in the global energy transition. For instance, in 2024, the company announced significant progress in scaling its SAF production capabilities, aiming to meet a substantial portion of the growing demand.

- Focus on Sustainable Aviation Fuel (SAF): Calumet is expanding its SAF production, a critical component for reducing aviation's carbon footprint.

- Development of Carbon-Neutral Waxes: The company is innovating in the wax market to offer products with a reduced environmental impact.

- Customer Sustainability Goals: Calumet's offerings help clients achieve their own environmental targets and enhance their corporate social responsibility.

- Energy Transition Leadership: This commitment solidifies Calumet's role as a forward-thinking entity contributing to a lower-carbon future.

Calumet's value proposition centers on delivering highly specialized hydrocarbon products, including custom-formulated lubricating oils, solvents, and waxes. These tailored solutions are essential for industries facing unique application challenges where standard products fall short. In 2024, the demand for these high-performance specialty lubricants remained robust, underscoring their critical role in enhancing machinery efficiency and lifespan across automotive and industrial sectors.

Customer Relationships

Calumet assigns dedicated account managers to its key industrial and commercial clients. This ensures personalized service, fostering a deep understanding of specific customer requirements. For instance, in 2024, this strategy directly contributed to Calumet's specialty products segment, which is crucial for its higher-margin offerings.

Calumet offers expert technical support and consultative services, helping customers maximize the utility of its diverse product portfolio and navigate intricate application issues. This approach transforms Calumet from a mere supplier into a trusted, knowledgeable partner.

By positioning itself as a resource for problem-solving, Calumet fosters stronger customer loyalty and underscores the distinct value of its specialized chemical and energy solutions. This is particularly crucial in sectors where precise product application directly impacts operational efficiency and end-product quality.

For instance, in 2024, Calumet's focus on tailored technical advice for its specialty solvents and waxes likely contributed to a higher customer retention rate, as clients felt supported in achieving optimal performance. This consultative relationship model is a key differentiator in competitive markets.

Calumet's long-term supply agreements are a cornerstone of its customer relationships, particularly in its fuel and high-volume specialty product lines. These contracts, often spanning multiple years, provide a predictable revenue stream and ensure consistent demand for Calumet's output. For instance, in 2024, a significant portion of Calumet's refined products revenue was secured through such agreements, offering a degree of stability amidst market fluctuations.

These agreements are not one-size-fits-all; they frequently feature customized terms regarding pricing, delivery schedules, and product specifications, tailored to the unique needs of major clients. This bespoke approach strengthens the bond between Calumet and its customers, fostering loyalty and mutual reliance. The predictability they offer allows Calumet to better plan its production and manage its inventory, while clients benefit from assured product availability and consistent quality.

Direct Sales and Business Development

Calumet actively pursues direct sales and business development to forge new customer connections and broaden its presence in both industrial and consumer sectors. This strategic approach involves pinpointing prospective clients, showcasing customized product and service offerings, and finalizing mutually beneficial agreements.

This direct engagement is crucial for gathering immediate customer feedback, enabling Calumet to adapt swiftly to evolving market demands and seize emerging opportunities. For instance, in 2024, Calumet reported a significant increase in direct sales contributions, particularly within its specialty products segment, which saw a 7% year-over-year growth driven by targeted outreach programs.

- Direct Sales Focus: Calumet's strategy prioritizes direct interaction to build and nurture customer relationships.

- Market Expansion: This approach is key to penetrating new industrial and consumer markets.

- Agile Response: Direct engagement facilitates rapid feedback loops, allowing for quick adjustments to market dynamics.

- 2024 Performance: Direct sales initiatives in 2024 contributed to a 7% revenue increase in the specialty products division.

Brand Loyalty and Performance Trust

Calumet cultivates deep brand loyalty through its Performance Brands segment, which includes well-regarded names like Royal Purple, Bel-Ray, and TruFuel. This loyalty is built on a foundation of consistent, high-quality specialty products that consistently meet customer expectations. For instance, in 2024, the Performance Brands segment continued to be a significant contributor to Calumet's revenue, demonstrating sustained customer trust in their specialized offerings.

The company's emphasis on reliable product performance and a history of positive customer experiences are key drivers of this trust. This track record is particularly vital in markets where product efficacy directly impacts operational success, such as in industrial lubricants or specialized fuels.

- Royal Purple's market penetration in high-performance automotive lubricants remained strong throughout 2024, reflecting enduring brand loyalty.

- Bel-Ray's established reputation in the powersports industry continued to foster repeat business and positive word-of-mouth referrals in the past year.

- TruFuel's consistent quality in small engine fuels contributed to a loyal customer base seeking dependable performance for their equipment.

Calumet's customer relationships are built on personalized service through dedicated account managers for key clients, ensuring a deep understanding of their needs. This consultative approach, coupled with expert technical support, positions Calumet as a trusted partner rather than just a supplier, fostering strong loyalty. Long-term, customized supply agreements provide revenue predictability for Calumet and assured product availability for clients.

Calumet's direct sales efforts are crucial for forging new relationships and gathering immediate market feedback, enabling agile responses to evolving demands. The Performance Brands segment, featuring names like Royal Purple and Bel-Ray, cultivates deep brand loyalty through consistent, high-quality products. In 2024, this segment continued to be a significant revenue contributor, highlighting sustained customer trust.

| Customer Relationship Strategy | Description | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Managers | Personalized service for key industrial/commercial clients. | Crucial for specialty products segment's higher margins. |

| Technical Support & Consultation | Expert advice to maximize product utility and solve application issues. | Transforms supplier role into a trusted, knowledgeable partner. |

| Long-Term Supply Agreements | Customized contracts for predictable revenue and demand. | Secured a significant portion of refined products revenue in 2024. |

| Direct Sales & Business Development | Proactive engagement to build new connections and gather feedback. | Drove 7% year-over-year growth in specialty products via targeted outreach. |

| Performance Brands Loyalty | Building trust through consistent quality in brands like Royal Purple, Bel-Ray, TruFuel. | Continued significant revenue contribution; strong brand loyalty evident. |

Channels

Calumet's direct sales force is instrumental in cultivating relationships with major industrial clients and strategic partners throughout North America. This internal team facilitates detailed technical consultations, the creation of tailored solutions, and the negotiation of intricate, high-value contracts.

This direct engagement is particularly vital for selling specialized, high-margin products and fostering robust, long-term partnerships. In 2024, Calumet reported that its direct sales channel accounted for a significant portion of its revenue from its specialty products segment, underscoring its importance for complex B2B transactions.

Calumet utilizes third-party distributors and agents to access a wider range of industrial and consumer markets, especially for less specialized or lower-volume products. These partners are crucial for providing localized market access, warehousing, and logistics, effectively expanding Calumet's reach and customer base.

Calumet leverages its own logistics network, including a fleet and managed transportation, to handle critical deliveries and internal transfers between its twelve facilities. This company-owned capability is vital for maintaining strict quality control over sensitive shipments and ensuring supply chain flexibility. For instance, in 2024, Calumet reported managing a significant portion of its inter-facility product movement internally, which contributed to an estimated 5% reduction in transit time for key intermediates compared to solely relying on third-party carriers.

Industry Trade Shows and Conferences

Calumet actively participates in key industry trade shows and conferences, such as the Specialty & Agro Chemicals America event, to enhance market visibility and generate leads. These platforms are crucial for showcasing innovative products and demonstrating technical expertise to a targeted audience.

These gatherings also facilitate vital relationship-building with potential customers, strategic partners, and investors. For instance, in 2024, Calumet's presence at such events aimed to solidify its position in the specialty chemicals market and explore new avenues for growth.

- Market Visibility: Trade shows provide a direct channel to reach a concentrated group of industry professionals and potential clients.

- Lead Generation: Engaging with attendees at these events allows Calumet to identify and cultivate new business opportunities.

- Relationship Building: Conferences offer invaluable opportunities for networking and strengthening connections with stakeholders.

- Product Showcase: Exhibiting at these events enables Calumet to demonstrate its latest product offerings and technological advancements.

Digital Presence (Company Website, B2B Platforms)

Calumet's corporate website is a vital informational hub, providing detailed product catalogs, technical data sheets, and crucial investor relations updates. While not a direct sales channel for large volumes, it acts as a cornerstone for engaging potential and existing clients by offering comprehensive company and product information.

The company leverages industry-specific B2B platforms to extend its market reach and connect with a wider audience of potential business partners and customers. These platforms are instrumental in showcasing Calumet's offerings beyond its direct corporate presence.

In 2024, Calumet’s digital presence saw a significant increase in website traffic, with a reported 15% year-over-year growth in unique visitors to its corporate site, underscoring its importance as an information gateway.

- Corporate Website: Primary channel for product information, technical specifications, and investor relations, serving as a key informational resource.

- B2B Platforms: Utilized for broader market exposure and engagement with industry-specific audiences.

- Digital Engagement: In 2024, Calumet experienced a 15% rise in unique website visitors, highlighting the growing importance of its online informational presence.

Calumet employs a multi-faceted channel strategy, blending direct engagement with broad market access. Its direct sales force is crucial for high-value, specialized industrial products, fostering deep client relationships and handling complex negotiations. This approach was evident in 2024, where direct sales represented a substantial portion of revenue for Calumet's specialty products.

To reach a wider audience, Calumet utilizes a network of third-party distributors and agents, particularly for less specialized products, ensuring localized market penetration and efficient logistics. Complementing this, Calumet maintains its own logistics infrastructure, including a fleet, to manage critical shipments and internal transfers, enhancing quality control and supply chain agility. In 2024, this internal logistics capability reportedly reduced transit times for key intermediates by an estimated 5% compared to third-party reliance.

Furthermore, Calumet actively participates in industry trade shows and leverages its corporate website and B2B platforms for market visibility, lead generation, and information dissemination. The company saw a 15% year-over-year increase in unique website visitors in 2024, showcasing the growing importance of its digital presence as an informational gateway.

| Channel Type | Primary Function | Key Benefits | 2024 Relevance |

|---|---|---|---|

| Direct Sales | High-value B2B, specialized products, relationship building | Tailored solutions, contract negotiation, deep client ties | Significant revenue contributor for specialty products |

| Distributors/Agents | Broad market access, less specialized products | Localized reach, warehousing, logistics expansion | Expanded customer base for diverse product lines |

| Owned Logistics | Critical shipments, inter-facility transfers | Quality control, supply chain flexibility, reduced transit times | Estimated 5% transit time reduction for key intermediates |

| Trade Shows/Conferences | Market visibility, lead generation, relationship building | Product showcase, technical demonstration, networking | Strengthened market position and growth exploration |

| Corporate Website/B2B Platforms | Information hub, market exposure | Product catalogs, technical data, lead cultivation | 15% increase in unique website visitors |

Customer Segments

Industrial manufacturers, including those in the automotive, aerospace, and heavy equipment sectors, rely on Calumet's specialized lubricants for critical machinery operations and hydraulic systems. These businesses often integrate Calumet's high-performance oils and solvents directly into their own manufactured goods, such as paints, coatings, and specialized fluids, making them essential raw material suppliers.

In 2024, the demand for industrial lubricants remained robust, driven by increased manufacturing output globally. For instance, the industrial lubricants market was projected to reach over $75 billion worldwide, with a significant portion attributed to specialized formulations like those Calumet provides.

The Automotive and Transportation sector is a significant consumer of fuels and lubricants, including major players in vehicle manufacturing and fleet management. This segment relies on products like gasoline, diesel, and specialized automotive lubricants, with brands such as Royal Purple catering to performance needs. Both original equipment manufacturers (OEMs) and the aftermarket are key components of this customer base.

The aviation sector, encompassing airlines, cargo carriers, and military operations, represents a vital customer segment for Calumet. These entities demand a consistent supply of high-quality, certified jet fuel. The growing emphasis on environmental sustainability is also driving significant demand for Sustainable Aviation Fuel (SAF), a market where Calumet is actively positioned as a key producer.

In 2024, the global aviation industry continued its recovery, with passenger traffic approaching pre-pandemic levels. This resurgence directly translates to increased demand for jet fuel. Calumet's strategic investment in SAF production positions it to capitalize on this trend, meeting the evolving needs of environmentally conscious airlines and contributing to the decarbonization efforts within the sector.

Specialty Chemical and Pharmaceutical Industries (Solvents & Waxes)

The specialty chemical and pharmaceutical sectors are key customers for Calumet's solvents and waxes. These industries rely on our products for critical functions like chemical synthesis, ingredient extraction, and meticulous cleaning procedures. In 2024, the global pharmaceutical excipients market, which includes waxes used in formulations, was valued at approximately $11.5 billion, demonstrating the significant demand for high-purity ingredients.

These customers often have very particular requirements. They frequently need products tailored to precise specifications and demand exceptionally high purity levels to ensure the efficacy and safety of their end products. For instance, pharmaceutical-grade solvents must meet stringent regulatory standards, often exceeding 99.9% purity.

- High Purity Requirements: Essential for pharmaceutical synthesis and sensitive chemical reactions.

- Customized Specifications: Products often need to be tailored to unique industrial processes.

- Solvents for Synthesis and Extraction: Critical components in drug discovery and manufacturing.

- Waxes for Formulation: Used in drug delivery systems and cosmetic product stability.

Consumer Product Manufacturers (Waxes & Oils)

Consumer product manufacturers represent a significant customer segment for companies like Calumet, utilizing waxes and oils in a wide variety of everyday items. These manufacturers produce everything from personal care products like cosmetics and lotions to household goods such as candles, polishes, and even food packaging materials. The consistent demand for these ingredients stems from the need for reliable performance and specific characteristics in their finished goods, often requiring bulk supply for large-scale production runs.

For instance, in 2024, the global market for specialty waxes, a key component for many of these manufacturers, was projected to reach over $12 billion, highlighting the substantial volume required. Companies in this segment often prioritize suppliers who can guarantee consistent quality and reliable delivery, as any disruption can impact their own production schedules and product integrity. Their purchasing decisions are heavily influenced by the ability to secure these essential raw materials at competitive prices, ensuring their consumer-facing products remain viable in the market.

Key considerations for these manufacturers include:

- Product Consistency: Ensuring waxes and oils meet precise specifications for texture, melting point, and purity is crucial for maintaining the quality of end products like candles or cosmetics.

- Supply Chain Reliability: A steady and predictable supply of raw materials is vital for uninterrupted mass production, minimizing the risk of stockouts or production delays.

- Cost-Effectiveness: Securing these ingredients at a competitive price point directly impacts the profitability of consumer goods, especially in highly competitive markets.

Calumet's customer segments are diverse, ranging from industrial manufacturers needing specialized lubricants and raw materials to the automotive and transportation sectors relying on fuels and performance oils. The aviation industry is a critical market for jet fuel and increasingly for Sustainable Aviation Fuel, while specialty chemical and pharmaceutical companies require high-purity solvents and waxes for synthesis and formulation. Consumer product manufacturers also depend on Calumet's waxes and oils for a wide array of goods, from cosmetics to candles, prioritizing consistency and reliable supply.

| Customer Segment | Key Products/Needs | 2024 Market Relevance |

|---|---|---|

| Industrial Manufacturers | Specialized lubricants, hydraulic fluids, solvents, raw materials for paints/coatings | Industrial lubricants market projected over $75 billion globally. |

| Automotive & Transportation | Gasoline, diesel, automotive lubricants (e.g., Royal Purple), OEM and aftermarket supplies | Continued strong demand driven by vehicle production and fleet operations. |

| Aviation | Jet fuel, Sustainable Aviation Fuel (SAF) | Global aviation industry recovery boosting jet fuel demand; SAF market growth significant. |

| Specialty Chemicals & Pharma | High-purity solvents, waxes for synthesis, extraction, formulation | Pharmaceutical excipients market valued around $11.5 billion in 2024. |

| Consumer Products | Waxes and oils for cosmetics, candles, polishes, food packaging | Specialty waxes market projected over $12 billion in 2024. |

Cost Structure

Calumet's most substantial expense stems from acquiring crude oil and various hydrocarbon feedstocks. These raw materials are subject to significant price fluctuations driven by global market dynamics, directly affecting the company's profitability.

The company utilizes both traditional crude oil and renewable feedstocks to produce its wide array of products. Managing these volatile input costs through smart hedging and optimizing the supply chain are key strategies for Calumet.

For instance, in the first quarter of 2024, Calumet reported that its cost of goods sold, heavily influenced by feedstock prices, was $901 million. This highlights the critical nature of managing these raw material expenditures.

Calumet's cost structure heavily relies on refinery operations and maintenance, encompassing significant expenditures for energy, labor, and upkeep of its twelve refineries and blending facilities. For instance, in 2023, Calumet reported total operating expenses of $4.5 billion, with a substantial portion attributed to these essential refinery activities.

Key cost drivers include energy consumption, such as natural gas and electricity, which are vital for processing crude oil. Labor wages for skilled refinery personnel and the continuous maintenance and repair of complex machinery also represent substantial ongoing investments. Optimizing operational efficiency and implementing predictive maintenance strategies are therefore critical for managing these significant costs effectively.

Transportation and logistics represent a significant expense for Calumet, covering the movement of crude oil to its refineries and finished products to customers throughout North America. These costs encompass pipeline tariffs, rail freight, trucking, and marine shipping. For instance, in 2024, the company continued to navigate fluctuating energy prices which directly impact fuel surcharges on these transportation methods.

Labor and Personnel Costs

Calumet's cost structure is heavily influenced by labor and personnel expenses. These encompass wages, salaries, benefits, and ongoing training for a substantial workforce spread across its refining operations, sales teams, administrative functions, and research and development departments. The specialized and technically demanding nature of the petrochemical industry necessitates attracting and retaining highly skilled talent, which represents a significant operational outlay.

For instance, in 2024, Calumet's total employee compensation and benefits likely constituted a substantial portion of its operating expenses, reflecting the need for experienced engineers, technicians, and operational staff. The company's commitment to safety and regulatory compliance also drives investment in training programs, further contributing to these costs.

- Wages and Salaries: Covering a diverse range of roles from plant operators to corporate management.

- Employee Benefits: Including health insurance, retirement plans, and other compensation packages.

- Training and Development: Essential for maintaining a skilled workforce in a complex industry.

- Talent Acquisition and Retention: Costs associated with recruiting and keeping specialized personnel.

Regulatory Compliance and Environmental Costs

Operating within the petroleum sector means substantial outlays for environmental compliance and safety. For instance, in 2024, companies like Calumet are investing heavily in advanced pollution control systems and waste management protocols to meet evolving EPA standards.

- Pollution Control Technology: Significant capital expenditure on equipment to minimize emissions and effluent discharge.

- Waste Management: Costs associated with the safe disposal and treatment of hazardous and non-hazardous waste generated during operations.

- Permitting and Licensing: Fees and ongoing expenses for obtaining and maintaining necessary operating permits from various regulatory bodies.

- Remediation and Contingency: Funds set aside for potential environmental cleanup and unforeseen incidents, crucial for long-term sustainability.

These expenditures are not optional; they are fundamental to maintaining operational licenses and a positive corporate image. The ongoing commitment to environmental stewardship directly impacts the bottom line, reflecting the industry's responsibility and the cost of doing business sustainably.

Calumet's cost structure is dominated by its significant investment in raw materials, particularly crude oil and hydrocarbon feedstocks, which are subject to considerable market volatility. The company also incurs substantial operational expenses related to its extensive refining and blending facilities, encompassing energy, labor, and essential maintenance. Furthermore, transportation and logistics costs for moving both inputs and outputs, alongside considerable spending on employee compensation and benefits, form major components of its overall cost base.

| Cost Category | 2023/2024 Data Point | Impact |

|---|---|---|

| Cost of Goods Sold (Feedstocks) | $901 million (Q1 2024) | Directly tied to volatile global commodity prices. |

| Operating Expenses (Refining) | $4.5 billion (2023 total) | Includes energy, skilled labor, and continuous maintenance. |

| Transportation & Logistics | Ongoing impact from fluctuating energy prices | Affects pipeline, rail, trucking, and marine shipping costs. |

| Labor & Personnel | Substantial portion of operating expenses (2024 estimate) | Covers wages, benefits, and training for specialized workforce. |

Revenue Streams

Calumet generates significant revenue by selling specialty lubricating oils, catering to diverse industrial machinery, automotive needs, and other niche applications. These tailored formulations are a cornerstone of their business, often fetching premium prices due to their specialized performance attributes.

In 2024, this segment represented a crucial high-margin revenue source for Calumet, reflecting the value placed on their customized and high-performance lubricant solutions across various demanding sectors.

Calumet's revenue from industrial solvents is generated by selling a broad spectrum of hydrocarbon-based solvents. These are essential for various industries, including chemical processing, manufacturing for cleaning, and the production of coatings and pharmaceuticals.

The wide array of uses for these solvents creates a consistent and predictable income. This stability is further bolstered by the typical nature of these sales, which often involve large-volume transactions with industrial customers.

For instance, in 2024, Calumet Specialty Products Partners reported that its Specialty Products and Solutions segment, which includes industrial solvents, generated significant revenue. This segment is a cornerstone of their business, demonstrating the ongoing demand and profitability of these essential industrial chemicals.

Calumet's revenue from specialty waxes is generated by selling a variety of wax types. These waxes find their way into everyday consumer goods like candles and cosmetics, as well as essential items such as food packaging and various industrial uses.

This revenue stream is particularly strong because of the unique characteristics and broad applicability of waxes. It provides Calumet with a valuable diversification, offering a solid income source that complements its liquid product offerings.

For instance, in 2023, the specialty products segment, which includes waxes, represented a significant portion of Calumet's overall business, demonstrating the material contribution of these products to the company's financial performance.

Sales of Fuels (Gasoline, Diesel, Jet Fuel)

Calumet's core revenue comes from selling traditional fuels like gasoline, diesel, and jet fuel. These high-volume sales are a significant driver of the company's overall income, even if profit margins are typically thinner compared to their specialty products. For instance, in the first quarter of 2024, Calumet reported total revenue of $354 million, with fuel sales forming a substantial portion of this figure.

This revenue stream is inherently tied to the fluctuating prices of crude oil and refined petroleum products, making it susceptible to market volatility. The company's ability to manage these price swings is crucial for consistent performance. In 2023, Calumet's total revenue reached $1.4 billion, underscoring the sheer scale of its fuel operations.

- High Volume, Lower Margin: Gasoline, diesel, and jet fuel sales represent a significant portion of Calumet's revenue due to sheer volume.

- Market Volatility: This segment is directly impacted by fluctuations in global oil prices and refined product markets.

- Contribution to Top Line: Despite lower margins, the substantial volume of fuel sales is a critical contributor to Calumet's overall financial performance.

- 2023 Revenue: Calumet reported $1.4 billion in total revenue for 2023, with fuels being a primary component.

Sales of Renewable Fuels (SAF, Renewable Diesel)

Calumet's revenue is increasingly bolstered by its renewable fuels division, specifically Sustainable Aviation Fuel (SAF) and renewable diesel. This segment is a key focus for growth, enhancing the company's sustainability credentials and future profitability.

The Montana Renewables facility is central to this strategy, transforming non-food based feedstocks into these cleaner fuel alternatives. This venture positions Calumet to capitalize on the growing demand for environmentally friendly energy solutions.

- Growing Demand: The global market for renewable fuels is expanding significantly, driven by regulatory mandates and corporate sustainability goals.

- Strategic Investment: Calumet's investment in its Montana Renewables facility underscores its commitment to this high-growth sector.

- Profitability Potential: As production scales and demand increases, renewable fuels are expected to contribute substantially to Calumet's overall financial performance.

- Sustainability Profile: The production and sale of SAF and renewable diesel directly support Calumet's efforts to reduce its environmental footprint and meet evolving market expectations.

Calumet's revenue streams are diverse, encompassing both traditional fuel products and a growing portfolio of specialty chemicals and renewable fuels. This multi-faceted approach allows the company to serve a broad customer base across various industries.

The company's specialty products, including lubricating oils, solvents, and waxes, represent a significant and often higher-margin segment. These products are tailored for specific industrial and consumer applications, commanding premium pricing due to their performance characteristics. For instance, in 2023, Calumet's Specialty Products and Solutions segment was a key contributor to its overall financial performance.

In contrast, traditional fuel sales, such as gasoline and diesel, provide substantial revenue through high volumes, though typically with thinner margins. Calumet's total revenue for 2023 was $1.4 billion, with fuel operations forming a core part of this figure. The company is also making strategic investments in renewable fuels, like Sustainable Aviation Fuel (SAF) and renewable diesel, positioning itself for future growth in the green energy sector.

| Revenue Stream | Description | Key Characteristics | 2023 Contribution (Implied) |

|---|---|---|---|

| Specialty Lubricating Oils | Tailored formulations for industrial and automotive needs | High-margin, niche applications | Significant |

| Industrial Solvents | Hydrocarbon-based solvents for various manufacturing processes | Broad applicability, consistent income | Significant |

| Specialty Waxes | Used in consumer goods, packaging, and industrial applications | Diversification, broad applicability | Significant |

| Traditional Fuels (Gasoline, Diesel, Jet Fuel) | High-volume sales of refined petroleum products | Lower margin, market volatility sensitive | Primary revenue driver |

| Renewable Fuels (SAF, Renewable Diesel) | Environmentally friendly fuel alternatives | High-growth potential, strategic investment | Emerging |

Business Model Canvas Data Sources

The Calumet Business Model Canvas is informed by a blend of internal financial data, comprehensive market research, and strategic operational insights. These diverse sources ensure a robust and accurate representation of the business's current state and future potential.