Calumet Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calumet Bundle

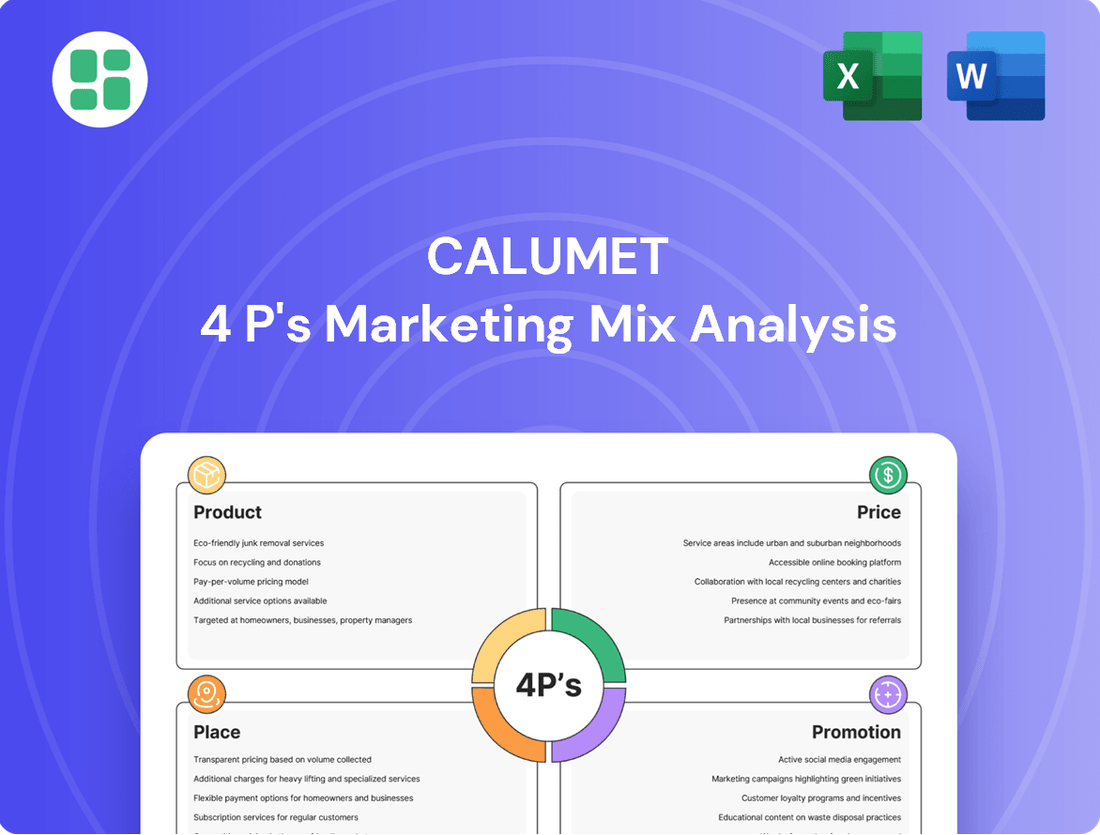

Unlock the secrets behind Calumet's market dominance with a comprehensive 4Ps Marketing Mix Analysis. Discover how their product innovation, strategic pricing, widespread distribution, and impactful promotions create a winning formula.

This isn't just a summary; it's your blueprint for understanding Calumet's success. Get instant access to an editable, presentation-ready report packed with actionable insights and real-world examples.

Save yourself hours of research and gain a competitive edge. This detailed analysis provides the strategic thinking you need for your own business planning, benchmarking, or academic projects.

Product

Calumet Specialty Products Partners, L.P. boasts a diverse portfolio of specialty hydrocarbon products, encompassing customized lubricating oils, solvents, and waxes. This broad offering serves numerous industrial and consumer markets, highlighting a commitment to providing solutions precisely tailored to client requirements.

The company's distinct capability to manufacture all four primary categories of lubricating oils—naphthenic and paraffinic—alongside waxes and solvents, carves out a significant competitive advantage. For instance, as of the first quarter of 2024, Calumet reported total revenue of $373 million, underscoring the market demand for its specialized hydrocarbon products.

Calumet's renewable fuels initiative represents a significant diversification beyond its specialty products. The company is a key player in producing renewable diesel, sustainable aviation fuel (SAF), renewable hydrogen, and renewable naphtha, addressing the growing demand for cleaner energy alternatives.

The Montana Renewables facility is central to Calumet's strategy, emphasizing sustainable solutions for the dynamic energy sector. This facility is designed to leverage advanced technologies for producing these next-generation fuels.

Calumet is making substantial investments to boost its SAF production capacity. They aim to significantly increase annual SAF output, reflecting a strong commitment to meeting future aviation fuel needs with sustainable options. This expansion is crucial for capturing market share in the burgeoning SAF market.

Calumet's dedication to customization is a cornerstone of its marketing strategy, allowing them to craft products that precisely match client needs, thereby boosting value and setting them apart from competitors.

This bespoke approach is intrinsically linked to a rigorous quality focus. For instance, in 2024, Calumet reported that over 90% of its industrial lubricant customers cited product performance and reliability as key factors in their purchasing decisions, underscoring the importance of this quality commitment.

By consistently delivering high-quality, tailored solutions, Calumet cultivates enduring partnerships within demanding industrial sectors, a testament to their ability to solve complex customer challenges.

Strategic Portfolio Evolution

Calumet's product strategy centers on actively shaping its portfolio to boost profitability and concentrate on high-potential markets. A prime example is the divestiture of its industrial Royal Purple® segment, a strategic move to streamline operations and sharpen focus.

This portfolio refinement allows Calumet to better allocate resources towards expanding its consumer-centric brands, such as Royal Purple®'s automotive lubricant offerings. The company aims to optimize its asset utilization, driving greater efficiency and ultimately improving financial performance.

- Strategic Divestiture: Sale of industrial Royal Purple® business to focus on core strengths.

- Consumer Brand Expansion: Increased investment in high-growth consumer-facing product lines.

- Asset Optimization: Streamlining the asset base to enhance operational efficiency and profitability.

- Market Focus: Concentrating on segments with stronger growth prospects and higher margins.

Sustainability-Driven Development

Calumet's product strategy heavily emphasizes sustainability, offering environmentally responsible solutions like ultra-low sulfur gasoline and recyclable asphalt. This focus directly addresses the growing global demand for greener alternatives in the energy and materials sectors.

They are pioneers in technological innovation, developing cutting-edge products such as plant-based waxes and lubricants derived from renewable resources. This forward-thinking approach positions Calumet to capitalize on evolving market preferences for bio-based and eco-friendly materials.

- Environmental Responsibility: Calumet's commitment includes products like ultra-low sulfur gasoline, reducing harmful emissions.

- Circular Economy: Development of recyclable asphalt supports waste reduction and resource efficiency.

- Renewable Sourcing: Investment in plant-based waxes and lubricants from renewable sources aligns with bio-economy trends.

- Market Alignment: These initiatives directly meet increasing consumer and regulatory pressure for sustainable products.

Calumet's product strategy is a dual-pronged approach, balancing its established specialty hydrocarbon business with a significant push into renewable fuels. This involves divesting non-core assets, such as the industrial Royal Purple® segment, to sharpen focus on higher-margin consumer brands and strategic growth areas. The company is actively expanding its renewable diesel and sustainable aviation fuel (SAF) capabilities, aiming to capture a larger share of the burgeoning green energy market.

| Product Category | Key Characteristics | 2024/2025 Strategic Focus |

|---|---|---|

| Specialty Hydrocarbons | Customized lubricating oils, solvents, waxes; high-quality, tailored solutions | Portfolio optimization, focus on consumer brands (e.g., automotive lubricants) |

| Renewable Fuels | Renewable diesel, SAF, renewable hydrogen, renewable naphtha | Capacity expansion (especially SAF), leveraging Montana Renewables facility |

| Sustainability Initiatives | Ultra-low sulfur gasoline, recyclable asphalt, plant-based waxes/lubricants | Meeting growing demand for eco-friendly alternatives, bio-economy alignment |

What is included in the product

This analysis offers a comprehensive examination of Calumet's marketing mix, detailing its Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

Simplifies complex marketing strategies by clearly outlining Calumet's Product, Price, Place, and Promotion, alleviating the pain of strategic ambiguity.

Provides a clear, actionable framework for marketing teams, reducing the frustration of unfocused campaigns and enabling efficient resource allocation.

Place

Calumet's extensive North American operations are anchored by twelve manufacturing facilities strategically positioned across the continent. These sites are crucial for processing crude oil and other feedstocks, transforming them into a wide array of specialized products. The company's headquarters in Indianapolis, Indiana, directs this vast network, ensuring efficient production and distribution.

Calumet leverages a comprehensive distribution strategy, employing direct sales for industrial customers and various channels to reach consumer markets. This multi-pronged approach ensures broad product accessibility.

For its renewable fuels segment, distribution is strategically concentrated within the western half of North America, targeting key renewable fuel markets. This focus aims to align supply with demand in specific geographical areas.

In 2023, Calumet reported that its Specialty Products and Solutions segment, which includes many of its distributed goods, generated $3.4 billion in revenue, highlighting the scale of its market reach.

Calumet's marketing mix is significantly strengthened by its integrated supply chain management, which capitalizes on its substantial aggregate storage capacity of approximately 7.0 million barrels. This robust infrastructure, combined with its refinery operations, enables agile product distribution and rapid responses to shifting market demands.

This integrated model is particularly advantageous for the Montana Renewables segment, allowing for dynamic product placement and efficient logistics. By optimizing the movement of goods, Calumet enhances its sales potential and ensures a higher level of customer satisfaction.

Proximity to Key Markets

Calumet's strategic placement of its facilities, particularly in relation to key consumption hubs, significantly bolsters its market position. This geographic advantage translates directly into lower logistical expenses and enhanced agility in meeting customer demands across its product lines.

A prime example of this is Calumet's proximity to emerging markets for sustainable aviation fuel (SAF) within the Western Hemisphere. This closeness facilitates more efficient market entry and streamlined product distribution, a critical factor in the rapidly developing SAF sector.

- Reduced Transportation Costs: Calumet's facilities are positioned to minimize freight expenditures, a crucial element for commodity-based products.

- Enhanced Market Responsiveness: Being closer to end-users allows for quicker order fulfillment and adaptation to regional market shifts.

- Strategic SAF Advantage: Proximity to Western Hemisphere SAF demand centers offers a competitive edge in a growth-oriented market.

- Operational Efficiencies: Geographic concentration can lead to better coordination and optimization of supply chain operations.

Strategic Asset Conversion and Development

Calumet's strategic asset conversion, notably the Great Falls refinery's shift to specialty asphalt and renewable fuels, exemplifies a proactive approach to aligning physical assets with evolving market needs. This transformation is designed to capitalize on growing demand for specialized products and sustainable energy solutions.

Further investments in capacity enhancement, such as the MaxSAF project, underscore Calumet's dedication to bolstering its production and distribution infrastructure. These initiatives are geared towards solidifying their market position and improving operational efficiency.

- Asset Optimization: The Great Falls refinery's conversion to specialty asphalt and renewable fuels targets higher-margin markets.

- Capacity Expansion: Projects like MaxSAF aim to increase throughput and meet growing demand for their products.

- Competitive Advantage: These strategic moves are designed to deepen Calumet's competitive edge in key segments.

- Market Responsiveness: The company is demonstrating agility in adapting its asset base to specific market demands.

Calumet's place strategy centers on its twelve strategically located North American manufacturing facilities. This network, managed from its Indianapolis headquarters, allows for efficient processing and broad distribution of its diverse product portfolio. The company's proximity to key consumption hubs, particularly for emerging markets like sustainable aviation fuel (SAF) in the Western Hemisphere, provides a significant logistical advantage and reduces transportation costs.

| Facility Location Aspect | Impact on Distribution | Strategic Benefit |

|---|---|---|

| Twelve Manufacturing Facilities | Enables continent-wide processing and distribution | Broad market reach and operational efficiency |

| Proximity to SAF Demand Centers (Western Hemisphere) | Facilitates efficient market entry and streamlined distribution | Competitive edge in a high-growth market |

| Integrated Supply Chain and Storage (7.0 million barrels) | Supports agile product distribution and rapid response to market shifts | Enhanced sales potential and customer satisfaction |

What You Preview Is What You Download

Calumet 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Calumet 4P's Marketing Mix Analysis details Product, Price, Place, and Promotion strategies. You're viewing the exact version of the analysis you'll receive, fully complete and ready to use.

Promotion

Calumet's promotional strategy heavily targets the financial community, evidenced by its robust schedule of earnings calls, investor presentations, and comprehensive SEC filings. This consistent engagement aims to keep stakeholders informed and attract new investment.

The pivotal conversion from a Master Limited Partnership (MLP) to a C-Corporation in July 2024 was a key promotional lever. This strategic shift was designed to expand its appeal to a wider investor base, particularly institutional investors who often face restrictions with MLP structures.

This corporate structure change is anticipated to enhance market liquidity and foster increased investor interest, as the C-Corp structure generally offers greater flexibility and broader accessibility for a diverse range of investment funds and strategies.

Calumet actively communicates its strategic transformation, emphasizing deleveraging and operational enhancements. The company highlights significant advancements in its Montana Renewables segment, a key driver of its future growth narrative.

Key milestones, such as securing a $1.44 billion U.S. Department of Energy loan for its renewable fuels facility in 2023, are consistently shared through press releases and investor events. This transparent communication aims to build confidence among stakeholders and the financial community.

Calumet's operational excellence is a cornerstone of its marketing strategy, showcasing tangible achievements that resonate with investors and customers alike. The company reported record sales volumes in its specialties business, a testament to its enhanced production capabilities and market demand.

Furthermore, Calumet experienced robust volume growth in its Performance Brands, notably TruFuel, indicating successful product positioning and consumer adoption. These operational wins are directly linked to the company's ability to realize significant cost savings and improve efficiency across its diverse segments, underscoring strong execution and a clear path for future earnings growth.

Sustainability and Responsibility Messaging

Calumet actively communicates its dedication to sustainability and environmental stewardship, highlighting innovation in its product offerings. This emphasis is crucial for building a positive brand image and attracting stakeholders who prioritize responsible business practices.

The company's messaging prominently features its position as North America's largest producer of sustainable aviation fuel (SAF). This leadership role underscores Calumet's commitment to reducing carbon emissions and advancing environmental performance throughout its operations.

Calumet's efforts to lower its carbon footprint and improve the environmental performance of its facilities are central to its sustainability narrative. This focus resonates with an increasingly environmentally aware consumer base and the investment community.

- North American SAF Leader: Calumet is the largest producer of sustainable aviation fuel in North America, a significant differentiator.

- Carbon Footprint Reduction: The company actively works to decrease its carbon footprint across all operational areas.

- Brand Reputation: Sustainability messaging enhances Calumet's brand, appealing to eco-conscious markets and investors.

- Environmental Performance: Continuous improvement in environmental performance is a key communication point.

Targeted Industry Engagement and Brand Building

Calumet's promotional strategy for its specialty products centers on direct engagement within specific industries. This often involves participation in key trade shows and advertising in relevant industry publications, ensuring their message reaches a targeted professional audience. For instance, their presence at events like the 2024 Specialty & Agro Chemical America Conference would be crucial for connecting with potential industrial clients.

For its consumer brands, Calumet focuses on building brand awareness and loyalty through strategic initiatives. Recent efforts include the introduction of more robust and environmentally friendly packaging for brands like Royal Purple® and Bel-Ray®. This commitment to product improvement, coupled with potential brand partnerships, aims to resonate with a broader consumer base looking for quality and sustainability.

The company's promotional mix effectively addresses its diverse market segments. By tailoring approaches—direct industry engagement for specialty products and consumer-focused campaigns for brands—Calumet ensures its marketing efforts are both efficient and impactful. This dual strategy is vital for maintaining market share and driving growth in both B2B and B2C sectors.

Calumet's investment in brand building for consumer products is evident. The company likely allocated significant marketing spend in 2024 to support product launches and partnerships, aiming to capture a larger share of the automotive and industrial lubricants market. This focus on tangible product improvements, like the new bottle design, provides a clear differentiator.

Calumet's promotional efforts are multifaceted, targeting both the financial community and specific market segments. The company's transition to a C-Corporation in July 2024 was a significant promotional event, designed to attract a broader investor base by overcoming MLP-related restrictions. This strategic move, coupled with consistent communication about deleveraging and operational improvements, particularly in its Montana Renewables segment, aims to bolster investor confidence and market appeal.

The company actively promotes its leadership in sustainable aviation fuel (SAF), highlighting its position as North America's largest producer. This focus on environmental stewardship and carbon footprint reduction is a key element of its brand building, resonating with eco-conscious consumers and investors. For its specialty products, Calumet engages directly with industries through trade shows and publications, while consumer brands benefit from initiatives like improved packaging and potential partnerships, as seen with Royal Purple® and Bel-Ray® in 2024.

Calumet's promotional strategy leverages tangible operational achievements, such as record sales volumes in its specialties business and robust growth for TruFuel in 2024. These successes are communicated to underscore the company's enhanced production capabilities and market demand. The company's commitment to sustainability, including its efforts to lower its carbon footprint and improve environmental performance, is central to its narrative, enhancing its brand reputation and attracting stakeholders who prioritize responsible business practices.

Price

Calumet's pricing strategy is a carefully balanced act, acknowledging its diverse product lines. For its commodity fuels, like gasoline and diesel, prices are heavily influenced by global crude oil benchmarks and the refining margin, or crack spread. For instance, in early 2024, the average gasoline crack spread in the US Gulf Coast hovered around $20 per barrel, a key driver in retail fuel pricing.

In contrast, Calumet leverages value-based pricing for its specialty products, such as lubricating oils and waxes. These prices are set not just on cost, but on the unique benefits and performance characteristics they deliver to customers. This allows for higher margins when formulations meet specific, high-demand industrial needs, reflecting the premium placed on customization and specialized application.

Calumet's renewable fuels, especially Sustainable Aviation Fuel (SAF), see their pricing and profitability heavily shaped by government support like the Production Tax Credit (PTC). The company anticipates leveraging these tax credits to boost its financial results, directly affecting how it prices its offerings. For instance, the Inflation Reduction Act of 2022 extended and enhanced the PTC for SAF, offering up to $1.73 per gallon, a crucial factor for Calumet's pricing strategy in 2024 and beyond.

Furthermore, regulatory mandates such as the Renewable Volume Obligations (RVOs) under the Renewable Fuel Standard (RFS) directly influence market demand and, consequently, the pricing of renewable fuels. These mandates create a baseline demand, providing Calumet with a more predictable revenue stream and supporting competitive pricing for its SAF and other renewable products in the 2024 market.

Calumet's pricing strategy is deeply rooted in its commitment to operational cost reduction and efficiency enhancements across its diverse business segments. This focus is crucial for maintaining competitive pricing and boosting profit margins, especially when market conditions are volatile.

For instance, in the first quarter of 2024, Calumet reported a significant reduction in its operating expenses, contributing to a lower cost per barrel. This disciplined approach to cost management allows them to navigate market fluctuations effectively, ensuring sustained profitability.

Competitive Market Analysis and Positioning

Calumet actively tracks competitor pricing and market demand to ensure its products remain competitive. While its specialty lubricants and waxes can command premium pricing due to differentiation, its fuel products face a more volatile, price-sensitive market. For instance, in the first quarter of 2024, Calumet's Specialty Products segment reported strong performance, but the broader fuels market experienced fluctuating margins influenced by crude oil prices and refinery utilization rates.

Effective pricing strategies are crucial for Calumet to align with its market positioning and communicate the value of its diverse product portfolio. This involves balancing the higher margins achievable in specialty markets with the volume-driven, competitive nature of fuels. The company's ability to adapt its pricing based on these market dynamics is key to maintaining profitability across its business segments.

- Competitive Monitoring: Calumet continuously analyzes competitor pricing and market demand to inform its own pricing strategies.

- Product Mix Pricing: Specialty products allow for value-based pricing, while fuels require a more cost-conscious approach.

- Market Sensitivity: Fuel pricing is particularly sensitive to external factors like crude oil costs and refinery capacity.

- Value Perception: Pricing decisions aim to reflect the perceived value of Calumet's offerings to different customer segments.

Financial Structure and Debt Management Influence

Calumet's financial structure, particularly its debt management, plays a crucial role in its market positioning and pricing capabilities. The company's efforts to deleverage, including the significant restructuring of debt terms supported by the Department of Energy (DOE) loan, directly impact its operational flexibility.

This improved debt profile, which saw Calumet reduce its overall debt by approximately $200 million in 2023 through its refinancing initiatives, lowers financing expenses. Consequently, this deleveraging frees up capital, enabling more strategic pricing adjustments and investments in areas like product development and market expansion.

- Debt Reduction: Calumet reported a net debt of $1,279 million as of December 31, 2023, a notable decrease from prior periods due to refinancing and debt repayment.

- Financing Costs: Lower interest expenses resulting from debt restructuring enhance cash flow available for strategic initiatives.

- Market Perception: A healthier balance sheet generally leads to a more favorable market perception, potentially influencing investor confidence and customer relationships.

- Pricing Flexibility: Reduced financial burdens allow Calumet to respond more effectively to market price fluctuations and competitive pressures.

Calumet's pricing strategy is multifaceted, adapting to the distinct characteristics of its product segments. For commodity fuels, pricing is closely tied to global crude oil benchmarks and refining margins, such as the US Gulf Coast gasoline crack spread, which averaged around $20 per barrel in early 2024. Conversely, specialty products like lubricating oils and waxes employ value-based pricing, reflecting their enhanced performance and customization, allowing for higher profit margins when meeting specific industrial demands.

The company's renewable fuels, including Sustainable Aviation Fuel (SAF), benefit from government incentives like the Production Tax Credit (PTC), extended and enhanced by the Inflation Reduction Act of 2022, offering up to $1.73 per gallon. Regulatory mandates, such as Renewable Volume Obligations (RVOs) under the Renewable Fuel Standard (RFS), also create a predictable demand baseline, supporting competitive pricing for these products in the 2024 market.

Calumet's pricing is underpinned by a commitment to operational efficiency and cost reduction. For example, the company reported a reduction in operating expenses in Q1 2024, contributing to a lower cost per barrel. This focus on cost management enables Calumet to maintain competitive pricing and navigate market volatility effectively, ensuring profitability across its diverse business units.

The company's financial health, including its debt management, directly influences its pricing flexibility. By reducing its overall debt by approximately $200 million in 2023 through refinancing, Calumet lowered financing expenses, freeing up capital for strategic pricing adjustments and investments. As of December 31, 2023, Calumet's net debt stood at $1,279 million, a decrease reflecting these deleveraging efforts.

| Product Segment | Pricing Strategy | Key Influences | Example Data (Early 2024) |

|---|---|---|---|

| Commodity Fuels (Gasoline, Diesel) | Market-driven, cost-plus | Global crude oil prices, refining margins (crack spreads) | USGC Gasoline Crack Spread: ~$20/barrel |

| Specialty Products (Lubricants, Waxes) | Value-based, differentiation | Performance characteristics, customization, industrial demand | Higher margins for specialized formulations |

| Renewable Fuels (SAF) | Incentive-driven, market-based | Government tax credits (PTC), regulatory mandates (RVOs) | PTC for SAF: Up to $1.73/gallon (IRA 2022) |

4P's Marketing Mix Analysis Data Sources

Our Calumet 4P's Marketing Mix Analysis is constructed using a robust blend of official company disclosures, including annual reports and investor presentations, alongside detailed e-commerce data and industry-specific market research. This comprehensive approach ensures our insights into Product, Price, Place, and Promotion are grounded in verifiable market realities.