Calfrac SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calfrac Bundle

Calfrac's operational efficiency and strong customer relationships are key strengths, but they face significant market volatility and intense competition. Understanding these dynamics is crucial for any investor or strategist looking to navigate the oilfield services sector.

Want the full story behind Calfrac's competitive advantages, potential threats, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment decisions and strategic planning.

Strengths

Calfrac demonstrated a remarkable financial turnaround in the first quarter of 2025, reporting a profit of $7.8 million, a significant improvement from a loss in the prior year. This positive shift was accompanied by a 12 percent increase in overall revenue.

The primary driver for this enhanced performance was the exceptional activity and favorable pricing within Calfrac's Argentine operations. Revenue from this region nearly doubled year-over-year, highlighting Calfrac's capacity to leverage specific market conditions for substantial profit gains.

Calfrac Well Services boasts a diversified service portfolio, encompassing hydraulic fracturing, coiled tubing, cementing, and other critical well intervention solutions. This breadth allows them to address a wide array of client requirements for optimizing oil and gas well production.

As a leading provider across these specialized segments, Calfrac is well-positioned to offer integrated solutions. This capability serves as a significant competitive advantage, enhancing their ability to secure contracts and foster client loyalty. For instance, in 2023, Calfrac reported total revenue of CAD 1.7 billion, underscoring the demand for their comprehensive service offerings.

Calfrac's established geographic presence is a significant strength, with operations spanning key North American basins in Canada and the United States, alongside a notable presence in Argentina. This wide footprint, supported by a substantial fleet of over 1.2 million horsepower, allows the company to tap into diverse energy markets.

This broad operational reach diversifies Calfrac's revenue streams, effectively mitigating the risks tied to localized market downturns. The company's strategic positioning in the burgeoning Vaca Muerta shale play in Argentina, a region experiencing considerable growth, further enhances its market access and potential for future expansion.

Commitment to Safety and Operational Excellence

Calfrac's unwavering commitment to safety is a significant strength, evidenced by its impressive achievement of a record low Total Recordable Injury Frequency (TRIF) rate of 0.92 in 2024. This marks a notable improvement from the 1.05 TRIF rate recorded in 2023.

This dedication to operational excellence, intertwined with a focus on delivering high-quality service, leveraging expertise, and fostering innovation, directly supports their core brand promise: 'Do It Safely, Do It Right, Do It Profitably.' A robust safety record not only bolsters their reputation but also actively mitigates operational risks and can lead to reduced insurance premiums.

- Record Low TRIF: Achieved a TRIF of 0.92 in 2024, down from 1.05 in 2023.

- Brand Alignment: Safety is integral to their 'Do It Safely, Do It Right, Do It Profitably' ethos.

- Risk Mitigation: A strong safety culture reduces operational hazards and potential liabilities.

- Enhanced Reputation: Prioritizing safety builds trust with employees, clients, and stakeholders.

Strategic Fleet Modernization and Investment

Calfrac's strategic fleet modernization is a significant strength, marked by substantial investments in advanced equipment. This includes the deployment of high-capacity sand transport units and the operation of Tier 4 dual-fuel fracturing fleets across North America, improving operational efficiency and reducing environmental impact.

These upgrades are designed to lower operating costs and align with a more sustainable approach to oil and gas services. For example, the company's commitment to cleaner energy is reflected in its dual-fuel fleet, a key differentiator in the current market.

Further demonstrating this strategic focus, Calfrac expanded its fracturing fleet capacity in Argentina's Vaca Muerta shale play. This expansion was complemented by the integration of in-house wireline capabilities, enhancing its comprehensive service offerings in a key growth region.

- Fleet Efficiency: Investments in Tier 4 dual-fuel fleets enhance operational efficiency and reduce emissions.

- Cost Reduction: Modernization directly contributes to lower operating costs per job.

- Market Expansion: Fleet expansion in Vaca Muerta, Argentina, targets growth in key international plays.

- Service Integration: Addition of in-house wireline capabilities broadens service portfolio and customer value.

Calfrac's diversified service portfolio, covering hydraulic fracturing, coiled tubing, and cementing, allows it to meet a broad range of client needs. This integrated approach, demonstrated by CAD 1.7 billion in total revenue in 2023, provides a significant competitive edge and fosters client loyalty.

The company's expansive geographic footprint across North America and Argentina, supported by over 1.2 million horsepower in its fleet, diversifies revenue and mitigates regional market risks. Its strategic presence in Argentina's Vaca Muerta shale play positions it for significant future growth.

Calfrac's commitment to safety is a core strength, evidenced by a record low TRIF rate of 0.92 in 2024, down from 1.05 in 2023. This focus on safety aligns with its brand promise and reduces operational risks.

Significant investments in fleet modernization, including Tier 4 dual-fuel fracturing fleets and in-house wireline capabilities, enhance operational efficiency, reduce costs, and support expansion in key markets like Argentina.

| Strength | Description | Supporting Data |

| Diversified Services | Offers hydraulic fracturing, coiled tubing, cementing, and well intervention. | CAD 1.7 billion total revenue in 2023. |

| Geographic Diversification | Operations in Canada, US, and Argentina. | Over 1.2 million horsepower fleet. Presence in Vaca Muerta shale play. |

| Safety Record | Commitment to operational safety. | TRIF rate of 0.92 in 2024 (down from 1.05 in 2023). |

| Fleet Modernization | Investment in advanced, efficient equipment. | Deployment of Tier 4 dual-fuel fleets. Expansion in Argentina with wireline capabilities. |

What is included in the product

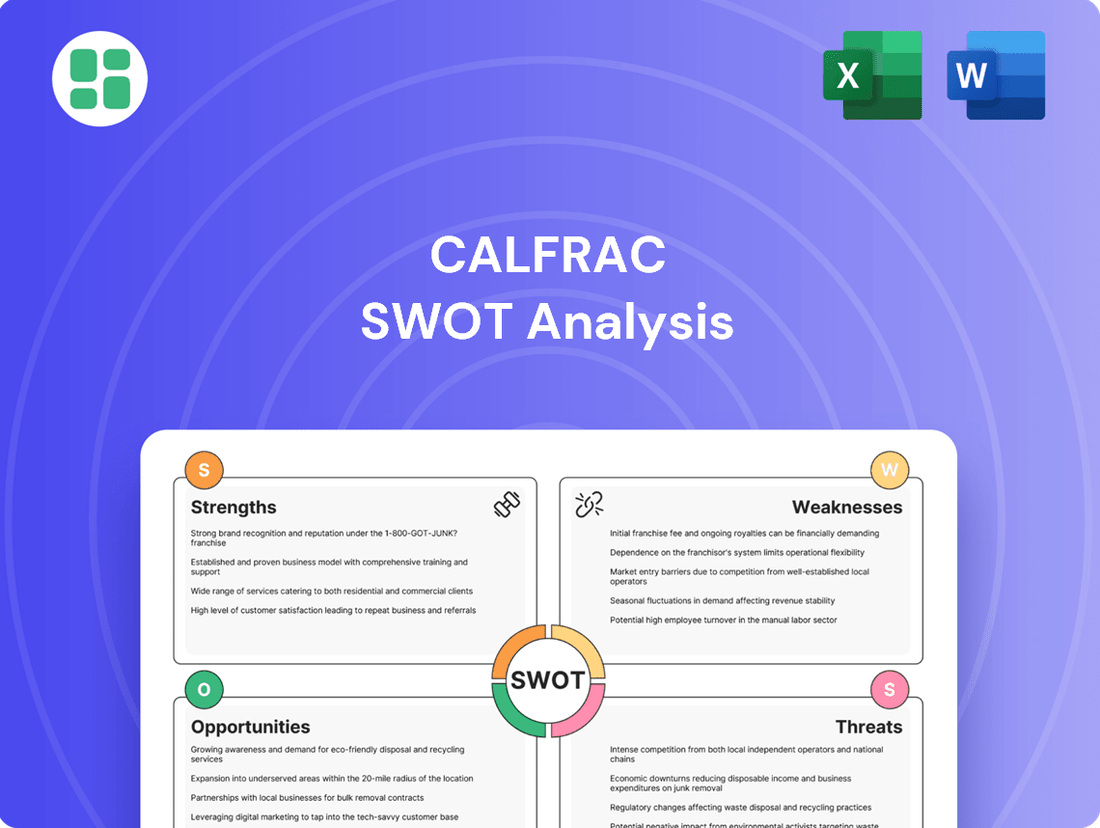

Outlines the strengths, weaknesses, opportunities, and threats of Calfrac, providing a comprehensive view of its internal capabilities and external market dynamics.

Offers a clear, actionable framework to identify and address Calfrac's strategic challenges and opportunities.

Weaknesses

Calfrac's North American segment, its largest market, faced a revenue dip to $227.9 million in the first quarter of 2025, a decrease from $249.0 million in the same period of 2024. This downturn was primarily driven by reduced pricing and a sluggish start to the year, influenced by customers postponing projects and the impact of low natural gas prices.

The decline in North American revenue, despite overall company growth, underscores a critical weakness. This regional underperformance, particularly in its core market, directly impacts Calfrac's consolidated financial results and presents a significant hurdle for future performance.

Calfrac's significant exposure to the North American oilfield services market presents a key weakness. This region is currently grappling with cautious spending from customers and budget tightening by producers, largely driven by volatile oil prices. For instance, in the first quarter of 2024, the company noted lower fracturing and coiled tubing utilization in North America, especially in areas like the Rockies during typical seasonal lulls.

Calfrac's significant debt burden presents a notable weakness. As of December 2024, the company reported CA$344.39 million in debt, with net debt hovering around CA$276.9 million. This substantial leverage, especially when compared to its market capitalization, could restrict its ability to pursue new growth opportunities or weather economic slowdowns.

Furthermore, Calfrac's current liabilities, including those due within the next twelve months, significantly exceed its readily available cash and short-term receivables. This liquidity gap raises concerns about its short-term financial health and its capacity to meet immediate financial obligations without resorting to additional financing.

Exposure to Commodity Price Volatility

Calfrac's reliance on the oil and gas sector means its financial health is directly linked to the unpredictable swings in commodity prices. When oil and gas prices fall, exploration and production companies often reduce their capital expenditures, directly impacting the demand for Calfrac's services.

For instance, during periods of lower oil prices, like those seen in late 2023 and early 2024, drilling activity tends to slow down. This reduction in activity translates into fewer opportunities for Calfrac to deploy its pressure pumping and other well completion services. The company's revenue and profitability are therefore highly susceptible to these market fluctuations, creating an inherently volatile operating environment.

- Commodity Price Sensitivity: Calfrac's revenue is significantly influenced by the price of oil and natural gas.

- Demand Impact: Lower commodity prices lead exploration and production companies to decrease spending on drilling and well completion.

- Profitability Erosion: Price volatility creates an unpredictable market, which can quickly diminish profit margins for oilfield service providers.

Limited ESG Disclosure

Calfrac Well Services faces a significant weakness in its limited Environmental, Social, and Governance (ESG) disclosure. Notably, the company lacks publicly accessible carbon emissions data for the most recent reporting period, a critical gap in today's environmentally focused market.

This absence of transparent reporting extends to specific reduction targets or commitments, such as those aligned with the Science Based Targets initiative (SBTi). Such omissions can indeed deter investors and stakeholders who prioritize sustainability and corporate responsibility in their decision-making processes.

- Lack of Publicly Available Carbon Emissions Data: Calfrac has not disclosed its most recent annual carbon emissions figures.

- Absence of Specific Reduction Targets: The company has not outlined concrete goals for reducing its environmental impact.

- No Commitment to Initiatives like SBTi: Calfrac has not formally joined or reported against frameworks like the Science Based Targets initiative.

- Potential Investor Alienation: This limited ESG transparency may reduce its attractiveness to environmentally conscious investors and partners.

Calfrac's substantial debt load remains a significant concern, with CA$344.39 million in debt reported as of December 2024. This leverage, coupled with a net debt of approximately CA$276.9 million, could hinder its capacity for strategic investments or its resilience during market downturns.

The company's short-term liquidity position is also a weakness, as current liabilities exceed readily available cash and short-term receivables. This gap highlights potential challenges in meeting immediate financial obligations without securing additional funding.

Calfrac's heavy reliance on the volatile oil and gas sector exposes it to significant price fluctuations. When commodity prices drop, exploration and production companies often cut back on spending, directly reducing the demand for Calfrac's services and impacting its revenue and profitability.

Furthermore, Calfrac's limited ESG disclosures, particularly the absence of recent carbon emissions data and specific reduction targets, could alienate investors prioritizing sustainability. This lack of transparency may hinder its attractiveness in an increasingly environmentally conscious market.

Full Version Awaits

Calfrac SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for Calfrac. The complete version, offering a comprehensive breakdown of its Strengths, Weaknesses, Opportunities, and Threats, becomes available immediately after purchase.

Opportunities

Argentina's Vaca Muerta shale formation represents a prime opportunity for growth, with significant investments by major players like YPF aiming to boost shale oil and gas output. This burgeoning market is expected to see substantial development in the coming years.

Calfrac is well-positioned to capitalize on this expansion, currently operating two unconventional fracturing spreads and enhancing its capabilities with in-house wireline services. This strategic deployment of capital allows Calfrac to capture a greater share of the increasing demand.

Argentina's stated ambition to become a major oil-producing nation further underscores the attractive long-term prospects within Vaca Muerta, offering a compelling avenue for Calfrac's continued development and market penetration.

The North American oilfield services market is poised for expansion, fueled by renewed shale oil output in key areas like the Permian Basin and growing unconventional oil extraction in Canada. This trend is expected to directly benefit Calfrac, with its specialized DGB fracturing fleets anticipated to see higher utilization rates throughout the second and third quarters of 2025.

The oilfield services sector, including hydraulic fracturing, is experiencing significant growth driven by technological leaps aimed at boosting efficiency and resource extraction. Innovations such as enhanced drilling techniques, extended horizontal wellbores, and automated drilling operations are fueling a greater need for sophisticated services. For instance, the adoption of advanced technologies in hydraulic fracturing is projected to increase the overall market size, with some reports estimating the global hydraulic fracturing market to reach over $100 billion by 2028, growing at a CAGR of approximately 5% from 2023.

Calfrac is strategically positioned to capitalize on these advancements through its continuous modernization initiatives. The company's integration of next-generation hydraulic fracturing transmissions, for example, directly addresses the market's demand for more efficient and powerful equipment. This focus on technological upgrades allows Calfrac to offer superior services, potentially leading to higher utilization rates and improved profitability in a competitive landscape.

Potential for Market Consolidation and Strategic Partnerships

The oilfield services sector is ripe for consolidation, evidenced by significant merger and acquisition activity in the upstream segment. For Calfrac, this trend presents a clear opportunity to pursue strategic acquisitions or forge partnerships. These moves could bolster its service portfolio, broaden its geographic presence, or enhance its technological prowess, ultimately leading to greater market share and operational efficiencies.

Consolidation within the industry offers Calfrac the chance to achieve significant economies of scale. By integrating operations, the company can potentially lower its cost structure and improve profitability. Furthermore, strategic alliances or acquisitions can reduce competitive pressures, allowing Calfrac to operate in a more favorable market environment. For instance, the proposed acquisition of ChampionX by SLB, valued at approximately $7.8 billion as of early 2024, highlights the scale of consolidation occurring in the broader energy services landscape.

- Industry Consolidation: Major M&A deals are reshaping the upstream oil and gas services sector, creating a dynamic environment for strategic growth.

- Partnership Potential: Calfrac can leverage this trend to form alliances that expand its service capabilities and market reach.

- Acquisition Avenues: Strategic acquisitions offer a direct path to acquiring new technologies and increasing market share.

- Efficiency Gains: Consolidation can unlock economies of scale, leading to reduced operational costs and improved competitive positioning.

Increasing Global Energy Demand and Natural Gas as a Bridge Fuel

Global energy consumption is projected to increase significantly, with the International Energy Agency (IEA) forecasting a 25% rise by 2050. Natural gas is increasingly recognized as a vital "bridge fuel" in the ongoing energy transition, offering a cleaner alternative to coal. This sustained demand for natural gas directly fuels the need for advanced extraction technologies, positioning Calfrac favorably.

Calfrac's specialized hydraulic fracturing services are essential for unlocking these natural gas reserves. The company's ability to efficiently and effectively extract natural gas aligns with the growing global reliance on this energy source. For instance, natural gas accounted for approximately 24% of global primary energy consumption in 2023, highlighting its continued importance.

- Rising Demand: Global energy demand is expected to grow substantially through 2050.

- Bridge Fuel Status: Natural gas is a key component in the transition to cleaner energy sources.

- Extraction Needs: Increased natural gas demand necessitates efficient hydraulic fracturing services.

- Calfrac's Role: The company is well-positioned to capitalize on the ongoing need for hydrocarbon extraction.

The burgeoning Vaca Muerta shale formation in Argentina presents a significant growth opportunity for Calfrac, with major players investing heavily to boost production. Calfrac is actively expanding its presence there, operating two unconventional fracturing spreads and enhancing its capabilities with in-house wireline services to meet the increasing demand.

North America's oilfield services market is also set for expansion, driven by renewed shale oil output and growing unconventional extraction in Canada. Calfrac's specialized DGB fracturing fleets are expected to see higher utilization rates in the second and third quarters of 2025, benefiting from these trends.

The global oilfield services sector is experiencing a wave of consolidation, with significant merger and acquisition activity creating opportunities for Calfrac to pursue strategic acquisitions or partnerships to expand its service portfolio and market share.

Global energy demand is projected to rise substantially, with natural gas increasingly viewed as a crucial "bridge fuel" in the energy transition. This sustained demand for natural gas directly translates to a need for advanced extraction technologies, a sector where Calfrac's specialized hydraulic fracturing services are essential.

| Opportunity Area | Key Driver | Calfrac's Position/Action | Market Data/Projection |

|---|---|---|---|

| Vaca Muerta, Argentina | Shale oil and gas production increase | Operating 2 unconventional fracturing spreads, enhancing wireline services | Significant investment by major players like YPF |

| North American Oilfield Services | Renewed shale output, unconventional extraction growth | DGB fracturing fleets expected higher utilization in Q2/Q3 2025 | Permian Basin and Canadian unconventional extraction growth |

| Industry Consolidation | M&A activity in upstream services | Potential for strategic acquisitions or partnerships | SLB's proposed acquisition of ChampionX (approx. $7.8 billion as of early 2024) |

| Global Energy Demand | Increased need for natural gas as a bridge fuel | Specialized hydraulic fracturing services essential for reserve unlocking | IEA forecasts 25% rise in global energy consumption by 2050; Natural gas ~24% of global primary energy in 2023 |

Threats

The global oilfield service sector is facing a noticeable slowdown in activity heading into 2025. This is evident in declining rig counts and a general hesitancy from customers to increase spending.

Analysts are consequently revising their global activity forecasts downward, making it challenging to anticipate a strong recovery for the industry in the near term. This widespread downturn, influenced by broader economic trends and OPEC+ production decisions, presents a substantial obstacle for Calfrac's operations.

Top US oilfield service firms are facing a challenging period as oil prices have declined, causing producers to scale back drilling and capital expenditures. Many producers find drilling uneconomical if oil prices fall below specific levels, resulting in a reduction in the number of wells drilled and completed.

These budget reductions directly impact the demand for Calfrac's services. For instance, in the first quarter of 2024, many North American oil and gas producers announced plans to decrease their capital spending for the year, with some projections indicating a 10-15% reduction in overall industry spending compared to 2023. This slowdown can lead to idle fleets and diminished revenue streams for service providers like Calfrac.

Calfrac faces a formidable competitive environment, contending with global giants such as Schlumberger, Halliburton, and Baker Hughes, alongside numerous regional service providers. These larger entities often possess superior financial muscle, more comprehensive service portfolios, and a wider international footprint, creating significant pressure on smaller players.

This intense rivalry directly translates into pricing challenges and makes it difficult for Calfrac to defend or expand its market share. For instance, in the oilfield services sector, pricing power can be significantly diminished during periods of low oil prices, as seen in the volatility of 2023 and early 2024, forcing companies to compete aggressively on cost.

Geopolitical and Macroeconomic Uncertainties

Geopolitical and macroeconomic uncertainties present a significant challenge for Calfrac. Global tensions, trade disputes, and volatile exchange rates create an unpredictable operating landscape. For instance, tariffs on imported equipment can directly increase operational expenditures, impacting profitability. Political instability in key markets, such as the ongoing economic and political challenges in Argentina, can introduce unforeseen operational risks and disrupt investment flows, directly affecting demand for oilfield services.

These external pressures can have a tangible effect on Calfrac's financial performance and strategic planning. The fluctuating cost of essential equipment due to tariffs, coupled with potential disruptions from political instability, necessitates robust risk management strategies. For example, the International Monetary Fund (IMF) projected global growth to moderate in 2024 and 2025, signaling a potentially cautious environment for capital investment in the energy sector, which directly influences the demand for Calfrac's services.

- Tariffs increase equipment costs: Higher import duties on machinery and parts directly inflate capital expenditure.

- Political instability raises operational risk: Unforeseen events in regions like Argentina can lead to project delays or cancellations.

- Exchange rate volatility impacts earnings: Fluctuations in currency values affect the translation of foreign earnings and the cost of international operations.

- Global economic slowdown dampens demand: A general cooling of the global economy can reduce overall investment in oil and gas exploration and production.

Increasing Environmental Regulations and Shift to Renewables

Calfrac, like many in the oil and gas sector, is navigating a landscape of tightening environmental regulations. These rules, particularly concerning water management and potential subsurface contamination in hydraulic fracturing, directly impact operational procedures and costs. For instance, in 2024, several US states have proposed or enacted stricter rules on wastewater disposal and chemical disclosure in fracking fluids, adding compliance burdens.

The broader global shift towards renewable energy sources presents a significant long-term threat. As investments pour into solar, wind, and other cleaner alternatives, the demand for traditional oil and gas services, including those provided by Calfrac, could see a sustained decline. This transition is accelerating, with many nations setting ambitious net-zero targets. For example, the International Energy Agency (IEA) projected in late 2024 that renewable energy capacity additions in 2025 would continue to break records, further challenging fossil fuel demand.

- Heightened compliance costs: Increased regulatory scrutiny on water usage and disposal can lead to higher operational expenses for Calfrac.

- Legal and reputational risks: Non-compliance or environmental incidents can result in substantial fines and damage the company's reputation.

- Market demand erosion: The ongoing energy transition to renewables directly reduces the long-term need for oilfield services.

- Capital expenditure shifts: Investors are increasingly prioritizing ESG factors, potentially diverting capital away from traditional oil and gas services companies.

The oilfield services sector faces a slowdown into 2025, with declining rig counts and cautious customer spending. This downturn, influenced by economic trends and OPEC+ decisions, presents a substantial obstacle for Calfrac.

Intense competition from global giants like Schlumberger and Halliburton pressures Calfrac on pricing and market share. Geopolitical uncertainties and tariffs on imported equipment also increase operational costs and risks, as seen with the IMF's projection of moderated global growth for 2024-2025.

Calfrac must also navigate tightening environmental regulations, with stricter rules on water management and chemical disclosure impacting compliance costs. Furthermore, the accelerating global energy transition to renewables poses a long-term threat by eroding demand for traditional oil and gas services, with the IEA projecting record renewable capacity additions in 2025.

| Threat Category | Specific Threat | Impact on Calfrac | Supporting Data/Trend |

|---|---|---|---|

| Market Activity | Industry Slowdown | Reduced demand for services, fleet utilization | Analyst downward revisions of global activity forecasts for 2025 |

| Competition | Intense Rivalry | Pricing pressure, market share challenges | Dominance of larger players with greater financial resources |

| Economic/Geopolitical | Global Economic Moderation | Lower capital investment in E&P | IMF projected moderated global growth for 2024-2025 |

| Regulatory/Environmental | Stricter Environmental Rules | Increased compliance costs, operational adjustments | New state-level regulations on water disposal and chemical disclosure in 2024 |

| Energy Transition | Shift to Renewables | Long-term erosion of demand for oilfield services | IEA projected record renewable capacity additions in 2025 |

SWOT Analysis Data Sources

This Calfrac SWOT analysis is built upon a foundation of comprehensive data, including publicly available financial statements, detailed industry reports, and expert market analyses, ensuring a robust and informed strategic perspective.