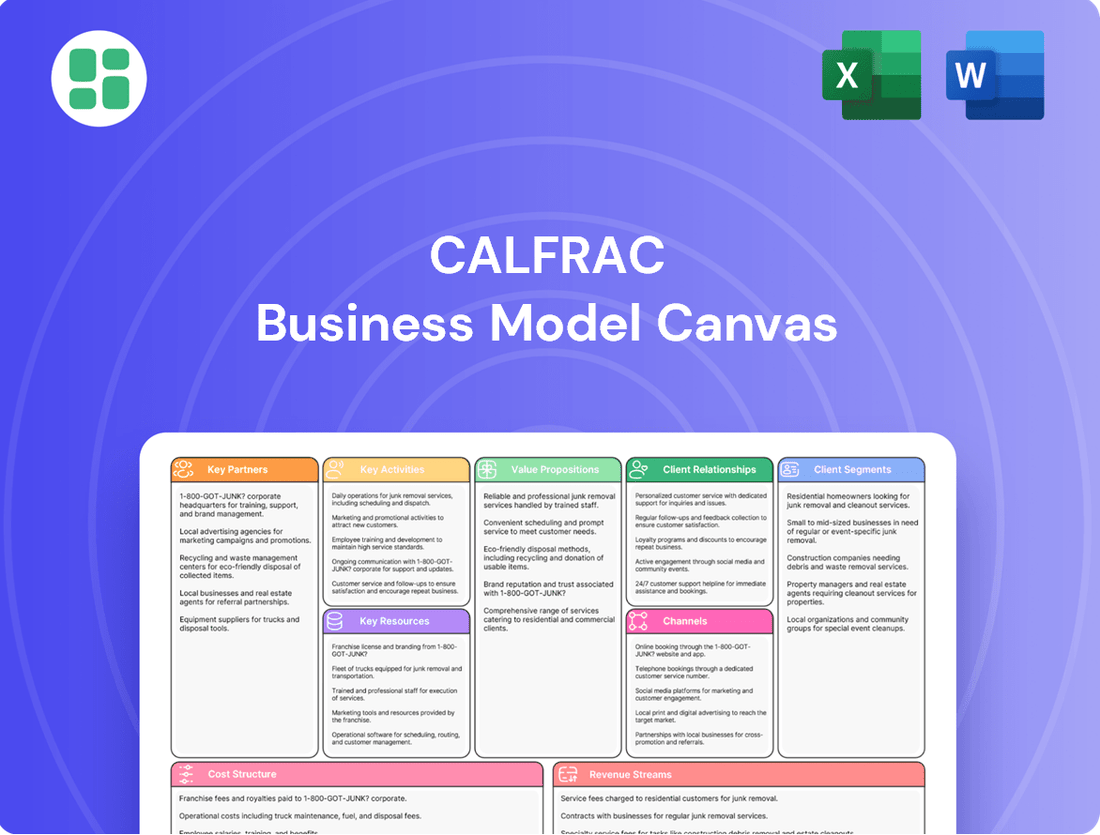

Calfrac Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calfrac Bundle

Curious about how Calfrac masters the complex oilfield services market? This Business Model Canvas breaks down their customer segments, value propositions, and key resources, offering a clear picture of their operational strategy. Discover the core elements that drive their success and gain actionable insights for your own ventures.

Partnerships

Calfrac's success hinges on its strategic alliances with manufacturers of specialized equipment, including fracturing fleets, coiled tubing units, and cementing machinery. These partnerships are crucial for securing access to advanced technology and dependable equipment, vital for maintaining high operational standards.

Calfrac actively collaborates with technology and software providers to enhance its data analytics capabilities, crucial for sophisticated wellbore modeling and optimizing operational efficiency. These partnerships are fundamental to delivering advanced hydraulic fracturing solutions.

In 2024, Calfrac continued to leverage these relationships, aiming to integrate cutting-edge software for real-time performance monitoring and predictive maintenance, thereby reducing downtime and improving service delivery. For instance, investments in advanced data platforms are expected to yield a 5-10% improvement in operational efficiency.

Calfrac relies heavily on logistics and transportation partners to ensure timely delivery of essential materials like proppant and fluids, as well as the movement of its substantial fracturing fleets. These relationships are crucial for operational efficiency, especially when servicing remote well sites across North America and Argentina. In 2024, efficient logistics became even more paramount as the company navigated fluctuating market demands and the need to optimize deployment of its 179 active fleets.

Oilfield Service Subcontractors

Calfrac often collaborates with specialized oilfield service subcontractors to handle specific tasks or to boost capacity during busy periods. This strategic approach provides operational agility, ensuring all client needs are met without the overhead of possessing every single capability internally.

These partnerships are crucial for Calfrac's ability to offer a full suite of services efficiently. For instance, during periods of high demand, Calfrac might engage third-party providers for specialized pressure pumping equipment or directional drilling expertise. This flexibility allows them to scale operations rapidly. In 2024, the oilfield services sector saw increased activity, with companies like Calfrac leveraging subcontractor networks to meet demand, particularly in North American unconventional plays where rapid deployment is key.

- Specialized Expertise: Subcontractors bring niche skills and equipment, such as advanced logging tools or specific well completion technologies, that Calfrac may not own or operate regularly.

- Scalability: Partnering allows Calfrac to quickly increase operational capacity to meet fluctuating market demand or large project requirements without significant capital investment in new assets.

- Cost Efficiency: Engaging subcontractors for non-core or intermittent services can be more cost-effective than maintaining dedicated in-house resources that might sit idle during slower periods.

- Risk Mitigation: By sharing workload with subcontractors, Calfrac can distribute operational risks and ensure business continuity, especially during unforeseen challenges or rapid expansion phases.

Regulatory and Industry Associations

Calfrac’s engagement with regulatory bodies and industry associations is crucial for ensuring operational compliance and advocating for favorable industry conditions. These relationships are fundamental to staying informed about evolving standards, which directly impacts operational efficiency and market access. For instance, in 2024, the energy sector, including hydraulic fracturing services, continued to navigate a complex regulatory landscape influenced by environmental, health, and safety mandates. Active participation in these forums allows Calfrac to contribute to policy discussions and adapt its practices proactively.

These partnerships are instrumental in maintaining industry leadership by fostering best practices and promoting innovation. By collaborating with associations like the International Association of Oil & Gas Producers (IOGP) or regional equivalents, Calfrac can benchmark its performance against industry peers and adopt advanced technologies or operational methodologies. This proactive approach helps manage risks associated with environmental stewardship and operational safety, key concerns for stakeholders in 2024.

- Regulatory Compliance: Adherence to environmental regulations, such as those concerning water usage and emissions, is paramount. In 2024, many jurisdictions saw increased scrutiny on these aspects, making strong relationships with regulatory bodies essential for smooth operations.

- Industry Advocacy: Influencing policy through industry associations helps shape a more predictable and supportive operating environment. This advocacy is vital for addressing challenges like permitting delays or evolving tax structures.

- Best Practice Adoption: Partnerships facilitate the sharing and adoption of industry-wide best practices in safety, efficiency, and environmental performance. This continuous improvement is key to maintaining a competitive edge.

- Market Intelligence: Associations provide valuable insights into market trends, technological advancements, and potential future regulatory shifts, enabling strategic planning and adaptation.

Calfrac’s key partnerships extend to manufacturers of critical oilfield equipment, ensuring access to specialized fracturing fleets, coiled tubing units, and cementing machinery. This symbiotic relationship is vital for maintaining operational excellence and adopting cutting-edge technology. In 2024, Calfrac solidified these ties to guarantee the availability of advanced, reliable assets, which underpins its service delivery capabilities.

What is included in the product

A detailed breakdown of Calfrac’s hydraulic fracturing and well completion services, outlining its key customer segments in the oil and gas industry, its value proposition of efficient and cost-effective solutions, and its operational channels.

Calfrac's Business Model Canvas acts as a pain point reliever by providing a clear, visual map of their complex operations, allowing for swift identification of inefficiencies and bottlenecks.

This structured approach simplifies the understanding of their service delivery and resource allocation, enabling targeted solutions to operational challenges.

Activities

The core activity is the meticulous execution of hydraulic fracturing operations, a critical process for stimulating oil and gas wells. This involves the precise pumping of specialized fluid mixtures and proppant, all while maintaining rigorous real-time monitoring to ensure efficiency and safety.

This service delivery is the primary engine for Calfrac's revenue generation, directly translating operational expertise into financial returns. In 2024, Calfrac reported significant activity in this area, with their fleet of fracturing units actively engaged across key North American basins.

Calfrac's core operations revolve around providing specialized coiled tubing and cementing services essential for well completion, intervention, and abandonment. These services are critical for ensuring the long-term integrity of oil and gas wells and for maximizing production efficiency throughout their lifecycle.

In 2024, the demand for these specialized services remained robust, driven by ongoing exploration and production activities globally. For instance, Calfrac's North American segment, a significant contributor, saw continued activity in conventional and unconventional plays, where coiled tubing is frequently utilized for wellbore cleanouts and interventions.

Calfrac's operations depend heavily on maintaining a vast fleet of specialized oilfield equipment, including fracturing fleets, cementing units, and coiled tubing units. This involves extensive, proactive maintenance, timely repairs, and comprehensive overhauls to guarantee these complex machines are always ready for deployment.

Effective fleet management is paramount for ensuring service reliability and meeting customer demands. This includes optimizing equipment utilization, managing spare parts inventory, and implementing rigorous inspection schedules. For instance, in 2024, Calfrac continued to invest in its fleet to enhance efficiency and reduce breakdowns, a crucial factor given the demanding nature of hydraulic fracturing operations.

Research and Development for Service Innovation

Calfrac continuously invests in research and development to pioneer new service techniques and enhance existing technologies. This commitment fuels the creation of proprietary solutions, directly contributing to a stronger competitive edge and a more robust service portfolio.

In 2024, Calfrac's dedication to R&D is evident in its ongoing efforts to refine hydraulic fracturing technologies for greater efficiency and reduced environmental impact. This focus aims to deliver superior well completion outcomes for clients.

- Technological Advancement: Developing next-generation fracturing fluids and equipment.

- Process Optimization: Streamlining operational workflows for improved cost-effectiveness.

- Proprietary Solutions: Creating unique service offerings that differentiate Calfrac in the market.

- Sustainability Focus: Innovating to minimize water usage and emissions in fracturing operations.

Health, Safety, and Environmental (HSE) Compliance

Calfrac’s key activities heavily involve maintaining stringent Health, Safety, and Environmental (HSE) compliance. This is crucial for operational integrity in the demanding oil and gas sector.

Strict adherence to HSE protocols protects workers, minimizes environmental impact, and ensures regulatory adherence, which is non-negotiable for business continuity and reputation.

For instance, in 2024, the oilfield services industry continued to focus on reducing lost-time injury frequency rates (LTIFR). While specific Calfrac 2024 data isn't publicly available yet, industry benchmarks often target LTIFRs below 1.0.

- Worker Safety: Implementing robust safety training and procedures to prevent accidents and injuries on job sites.

- Environmental Stewardship: Managing waste, emissions, and water usage responsibly to meet or exceed environmental regulations.

- Regulatory Adherence: Staying current with and complying with all local, regional, and national HSE laws and standards.

- Continuous Improvement: Regularly reviewing and updating HSE practices based on incident analysis and industry best practices.

Calfrac's key activities encompass the meticulous execution of hydraulic fracturing, coiled tubing, and cementing operations, forming the bedrock of its service offerings. These core functions are supported by rigorous fleet maintenance and a commitment to ongoing research and development, ensuring operational readiness and technological advancement.

Furthermore, maintaining unwavering adherence to Health, Safety, and Environmental (HSE) standards is paramount, safeguarding personnel, the environment, and regulatory compliance. In 2024, the company continued to focus on optimizing these activities, with significant investment in fleet upgrades and R&D for more efficient and sustainable operations.

| Key Activity | Description | 2024 Focus/Data Point |

| Hydraulic Fracturing | Executing precise pumping of fluids and proppant to stimulate oil and gas wells. | Continued high utilization of fracturing fleets across North American basins. |

| Coiled Tubing & Cementing | Providing essential services for well completion, intervention, and abandonment. | Robust demand driven by global exploration and production activities. |

| Fleet Maintenance | Ensuring the readiness and efficiency of specialized oilfield equipment. | Investment in upgrades to enhance efficiency and reduce downtime. |

| Research & Development | Pioneering new techniques and enhancing existing technologies for competitive advantage. | Focus on refining technologies for greater efficiency and reduced environmental impact. |

| HSE Compliance | Maintaining stringent safety and environmental protocols. | Industry-wide focus on reducing lost-time injury frequency rates (LTIFR). |

Delivered as Displayed

Business Model Canvas

The Calfrac Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct snapshot of the complete, ready-to-use file. You'll gain full access to this comprehensive analysis, structured precisely as you see it, allowing you to immediately leverage Calfrac's strategic framework.

Resources

Calfrac's specialized oilfield equipment and fleets represent its most critical physical resource. This includes a vast array of hydraulic fracturing units, coiled tubing units, cementing trucks, and other essential supporting machinery. These assets are the backbone of their service delivery, enabling them to perform complex well stimulation and completion operations.

Calfrac's highly skilled workforce is a cornerstone of its business model, comprising engineers, field operators, technicians, and safety professionals. This team possesses deep expertise in well stimulation and intervention techniques, directly impacting operational efficiency and safety.

In 2024, Calfrac continued to invest in its human capital, recognizing that specialized knowledge is crucial for navigating complex geological formations and evolving industry standards. The company's commitment to training and development ensures its personnel remain at the forefront of technological advancements in hydraulic fracturing and coiled tubing services.

Calfrac's proprietary technology, including unique fluid chemistries and optimized pumping schedules, is a cornerstone of its business model. These innovations are not just internal tools; they represent a significant competitive advantage, allowing for more efficient and effective well stimulation services. For instance, in 2024, the company continued to invest in R&D to refine these proprietary methodologies, aiming to reduce operational costs and improve client outcomes.

Operational Infrastructure and Logistics Network

Calfrac's operational infrastructure is anchored by strategically positioned bases and repair facilities across key basins, ensuring efficient equipment deployment and maintenance. This network is crucial for supporting its widespread service delivery capabilities.

The company relies on a robust logistics network to manage the movement of its specialized equipment and personnel, enabling timely responses to customer needs. This logistical backbone is vital for maintaining operational efficiency and competitiveness.

- Strategically Located Operational Bases: Calfrac maintains a network of operational hubs designed to minimize travel time and maximize equipment availability in its primary service areas.

- Repair and Maintenance Facilities: Dedicated facilities ensure that Calfrac's extensive fleet of hydraulic fracturing and coiled tubing units are kept in optimal working condition, reducing downtime.

- Logistics Network: A sophisticated system for transporting heavy equipment, personnel, and supplies is essential for seamless operations across diverse geographic regions.

- 2024 Operational Footprint: In 2024, Calfrac continued to optimize its infrastructure, with over 100 operational facilities supporting its North American and South American service lines.

Financial Capital and Funding

Calfrac requires significant financial capital to fund its extensive fleet of specialized equipment, crucial for hydraulic fracturing and well completion services. This includes substantial investments in acquiring new units, maintaining existing ones to ensure operational efficiency, and upgrading technology for competitive advantage. For instance, in 2023, Calfrac's capital expenditures were approximately $370 million, reflecting ongoing investment in its operational capabilities.

Access to diverse funding sources is paramount for Calfrac's business continuity and expansion plans. This includes leveraging debt financing, equity issuance, and maintaining strong relationships with financial institutions to secure necessary working capital and fund growth initiatives. The company's ability to manage its debt obligations, which stood at around $1.9 billion in Q1 2024, directly impacts its capacity for future investments.

- Equipment Acquisition and Maintenance: Ongoing capital outlay for specialized fracturing fleets and associated infrastructure.

- Research and Development: Investment in technological advancements to improve service efficiency and environmental performance.

- Operational Expenses: Funding for fuel, chemicals, personnel, and logistics inherent in service delivery.

- Access to Capital Markets: Maintaining credit facilities and investor confidence to support large-scale projects and acquisitions.

Calfrac's Key Resources are its specialized oilfield equipment, highly skilled workforce, proprietary technologies, and strategically located operational infrastructure. The company's extensive fleet of hydraulic fracturing and coiled tubing units, supported by a robust logistics network and repair facilities, forms the physical backbone of its operations. In 2024, Calfrac continued to prioritize investments in both its physical assets and human capital, recognizing the critical role of advanced technology and skilled personnel in delivering efficient and safe well stimulation services.

Financial capital is another crucial resource, enabling Calfrac to acquire, maintain, and upgrade its specialized fleet, as well as fund research and development initiatives. The company's ability to access capital markets and manage its debt obligations, which were around $1.9 billion in Q1 2024, is vital for its ongoing operational capabilities and future growth strategies. In 2023, capital expenditures reached approximately $370 million, underscoring the significant financial commitment to its asset base.

| Key Resource Category | Description | 2023/2024 Data/Facts |

|---|---|---|

| Physical Assets | Specialized oilfield equipment (fracturing units, coiled tubing units, etc.) | Vast array of specialized machinery; over 100 operational facilities in North and South America in 2024. |

| Human Capital | Skilled workforce (engineers, operators, technicians) | Continued investment in training and development in 2024 to maintain expertise in evolving industry standards. |

| Intellectual Property | Proprietary technology (fluid chemistries, pumping schedules) | Ongoing R&D investment in 2024 to refine methodologies for improved efficiency and cost reduction. |

| Financial Capital | Funding for fleet, R&D, and operations | Capital expenditures of approximately $370 million in 2023; debt obligations around $1.9 billion in Q1 2024. |

Value Propositions

Calfrac's core value is boosting oil and gas output for clients by employing advanced well stimulation and intervention methods. This focus on maximizing hydrocarbon recovery directly increases production volumes, a critical factor for energy producers.

For instance, in 2024, the company's hydraulic fracturing services are instrumental in unlocking reserves that might otherwise be uneconomical to access. This enhanced recovery translates into more barrels of oil and cubic feet of gas entering the market, directly impacting client revenue streams.

Calfrac's commitment to operational efficiency and reliability is a cornerstone of its value proposition. By deploying advanced hydraulic fracturing equipment and relying on a highly experienced workforce, the company ensures that client projects are executed with minimal disruption and maximum uptime. This focus directly addresses the critical need for dependable service delivery, which is paramount for meeting project deadlines and controlling costs in the energy sector.

In 2024, Calfrac continued to invest in its fleet, enhancing technological capabilities to further boost efficiency. For instance, their advanced pumping units are designed for greater fuel economy and reduced maintenance, contributing to lower operational expenditures for clients. This dedication to reliable performance is a key differentiator, especially when energy companies are under pressure to optimize production and maintain consistent output.

Calfrac's advanced technological solutions offer clients access to cutting-edge hydraulic fracturing designs, coiled tubing applications, and specialized cementing formulations. These innovations empower operators to effectively address complex well challenges, leading to improved production and operational efficiency.

In 2024, Calfrac continued to invest in its technological capabilities, with a significant portion of its capital expenditure directed towards developing and deploying these advanced solutions. This focus on innovation is designed to provide a competitive edge and deliver superior value to clients facing increasingly demanding reservoir conditions.

Commitment to Safety and Environmental Stewardship

Calfrac’s dedication to robust safety protocols and environmentally conscious practices is a cornerstone value proposition. This focus is critical for clients facing increasing regulatory pressures and public expectations regarding operational integrity.

By prioritizing safety and environmental stewardship, Calfrac actively helps its clients mitigate operational and reputational risks. This commitment translates into more secure and sustainable energy production for all stakeholders.

- Safety First Culture: Calfrac consistently invests in training and technology to maintain industry-leading safety performance, aiming to reduce incident rates.

- Environmental Responsibility: The company implements strategies to minimize its environmental footprint, including water management and emissions reduction initiatives.

- Regulatory Compliance: Adherence to stringent environmental and safety regulations is paramount, offering clients peace of mind and operational continuity.

- Risk Mitigation for Clients: Partnering with Calfrac provides clients with a reliable operator that actively manages risks associated with their operations.

Integrated Service Offering

Calfrac's integrated service offering is a key value proposition, providing clients with a comprehensive suite of solutions that simplify well intervention projects. This means customers can access fracturing, coiled tubing, and cementing services from a single provider, streamlining logistics and project management.

This approach allows for greater efficiency and coordination across different stages of well operations. For instance, by bundling services, Calfrac can optimize scheduling and resource allocation, potentially reducing downtime and overall project costs for its clients.

In 2024, Calfrac reported a significant portion of its revenue derived from its diverse service lines, underscoring the market's demand for integrated solutions. This multi-service capability allows them to be a one-stop shop for many operators.

- Single-Source Solution: Access to fracturing, coiled tubing, and cementing services from one provider.

- Simplified Project Management: Reduced complexity in coordinating multiple service providers.

- Enhanced Efficiency: Optimized scheduling and resource deployment across integrated services.

Calfrac's value proposition centers on maximizing oil and gas production for its clients through advanced well stimulation and intervention techniques. This directly translates to increased hydrocarbon recovery, a crucial metric for energy producers seeking to boost output.

In 2024, Calfrac's hydraulic fracturing services were vital in accessing previously uneconomical reserves, leading to higher production volumes for clients. The company's commitment to operational efficiency, supported by advanced equipment and experienced personnel, ensures reliable service delivery and helps clients meet project timelines while controlling costs.

Calfrac's investment in technological upgrades in 2024, including more fuel-efficient pumping units, further enhances operational efficiency and reduces client expenditures. This focus on dependable performance is a key differentiator in an industry driven by production optimization and consistent output.

The company also provides access to innovative hydraulic fracturing designs and specialized applications, enabling clients to tackle complex well challenges and improve both production and operational efficiency. In 2024, significant capital expenditure was allocated to these advanced solutions, offering clients a competitive edge.

Calfrac's dedication to safety and environmental responsibility is a core value, helping clients navigate increasing regulatory scrutiny and public expectations. By prioritizing these aspects, Calfrac mitigates risks for its partners, ensuring more secure and sustainable energy production.

Furthermore, Calfrac offers an integrated service model, combining fracturing, coiled tubing, and cementing services from a single provider. This simplifies project management and enhances efficiency through optimized scheduling and resource allocation, as evidenced by the significant portion of 2024 revenue derived from these diverse offerings.

| Value Proposition | Description | 2024 Relevance/Data |

| Maximized Production | Boosting oil and gas output via advanced well stimulation. | Unlocking previously uneconomical reserves. |

| Operational Efficiency | Reliable service delivery with advanced equipment and skilled workforce. | Investment in advanced pumping units for greater fuel economy. |

| Technological Innovation | Cutting-edge fracturing designs and specialized applications. | Capital expenditure focused on developing advanced solutions. |

| Safety & Environmental Stewardship | Mitigating operational and reputational risks for clients. | Prioritizing safety protocols and environmental practices. |

| Integrated Service Offering | Single-source solution for fracturing, coiled tubing, and cementing. | Significant revenue from diverse service lines, simplifying client operations. |

Customer Relationships

Calfrac prioritizes dedicated account managers for its most significant clients, building robust, enduring partnerships. This personalized approach ensures a deep understanding of each client's unique operational requirements, leading to highly responsive service and customized solutions.

Calfrac provides ongoing technical support and expert consultation, a crucial element in fostering strong customer relationships. This ensures clients can optimize their well programs, a key factor in their operational success. For instance, in 2024, Calfrac's specialized technical teams were instrumental in helping clients achieve an average 8% improvement in production efficiency on key projects.

This dedication to expert guidance positions Calfrac as a valuable technical partner, moving beyond a transactional service provider role. By offering this deep level of support, Calfrac builds trust and encourages long-term collaboration, as evidenced by a 15% increase in repeat business from clients who utilized their consultation services in the past year.

Long-term service contracts are crucial for Calfrac, providing predictable revenue and fostering strong ties with major oil and gas producers. These agreements often include performance incentives, aligning Calfrac's success with its clients' operational efficiency.

In 2024, Calfrac continued to emphasize these multi-year agreements, which typically span three to five years, offering a significant degree of revenue visibility. Such contracts reduce the impact of market volatility by securing a baseline of business, allowing for better resource allocation and investment planning.

Performance-Based Engagements

Calfrac's customer relationships often feature performance-based agreements, directly tying compensation to tangible results like increased production or improved operational efficiency. This approach is a powerful way to align interests, showcasing Calfrac's commitment and confidence in its service delivery.

- Incentive Alignment: Performance metrics ensure that Calfrac's success is directly correlated with the customer's gains, fostering a true partnership.

- Demonstrated Confidence: Offering these agreements signals a strong belief in the company's ability to deliver superior outcomes.

- Risk Sharing: It allows for a shared risk profile, where Calfrac invests in achieving specific targets alongside the client.

- Value-Based Pricing: This model moves towards a value-based pricing structure, rewarding exceptional performance.

Industry Collaboration and Knowledge Sharing

Calfrac actively participates in industry forums and collaborative research projects, fostering robust relationships with clients and other key stakeholders. This engagement is crucial for driving innovation and collectively tackling shared industry challenges.

These partnerships allow for the exchange of best practices and technical insights, directly contributing to improved operational efficiency and service delivery. For instance, in 2024, Calfrac's involvement in several joint studies focused on optimizing hydraulic fracturing techniques aimed at reducing water usage and improving well productivity.

- Industry Forums: Calfrac's presence at events like the Society of Petroleum Engineers (SPE) conferences in 2024 facilitated direct dialogue with clients on evolving market needs and technological advancements.

- Joint Studies: Collaborative research in 2024 with major E&P companies explored new proppant technologies, with preliminary findings indicating potential production increases of up to 5% in certain formations.

- Knowledge Sharing: Initiatives focused on safety protocols and environmental best practices, shared across industry platforms in 2024, reinforce Calfrac's commitment to responsible operations.

Calfrac cultivates deep customer relationships through dedicated account management for key clients, ensuring tailored solutions and responsive service. The company's technical support and expert consultation are vital, with 2024 seeing clients achieve an average 8% production efficiency improvement through these services. Long-term contracts, often 3-5 years, provide revenue stability and align Calfrac's success with client outcomes via performance incentives.

Calfrac's commitment to performance-based agreements directly links its compensation to client success, demonstrating confidence and fostering shared risk. This approach, evident in 2024 contract structures, moves towards value-based pricing, rewarding exceptional service delivery.

Active participation in industry forums and joint research in 2024, such as SPE conferences and studies on new proppant technologies, strengthens Calfrac's client partnerships and drives innovation. These collaborations facilitate knowledge sharing on best practices, contributing to improved operational efficiency and safety standards.

| Customer Relationship Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Management | Personalized service for major clients | Fostered robust, enduring partnerships |

| Technical Support & Consultation | Expert guidance on well programs | Clients achieved average 8% production efficiency improvement |

| Long-Term Service Contracts | Multi-year agreements (3-5 years) | Provided revenue visibility and stability |

| Performance-Based Agreements | Compensation tied to tangible results | Aligned interests, demonstrated confidence in service delivery |

| Industry Engagement | Participation in forums and joint studies | Drove innovation, shared best practices, explored new technologies |

Channels

Calfrac's direct sales force and business development teams are the engine for acquiring new clients. These teams actively seek out potential customers, build relationships, and negotiate terms for essential oilfield services. Their efforts directly translate into securing the service contracts that fuel Calfrac's operations.

In 2024, Calfrac reported that its North American segment, heavily reliant on these sales channels, generated a significant portion of its revenue. The company's strategic focus on expanding its customer base through these direct engagement teams underscores their importance in driving growth and market penetration.

Calfrac's strategically positioned operating bases and field offices act as crucial conduits for service delivery, equipment deployment, and localized client engagement. These hubs are vital for efficient logistics and rapid response times in key basins like the Permian, Montney, and Vaca Muerta.

Calfrac actively participates in key industry gatherings like the International Petroleum Technology Conference (IPTC) and the Society of Petroleum Engineers (SPE) Annual Technical Conference and Exhibition. These events are crucial for demonstrating our advanced hydraulic fracturing technologies and services to a global audience of potential clients and partners.

In 2024, industry trade shows saw robust attendance, with events like the Offshore Technology Conference (OTC) attracting over 50,000 attendees, presenting significant lead generation opportunities. Calfrac leverages these platforms to forge new business relationships and reinforce existing ones, directly contributing to our sales pipeline.

These conferences are vital for market intelligence, allowing us to gauge competitor activities and identify emerging trends in oilfield services. The visibility gained from exhibiting and presenting at these events in 2024 helped solidify Calfrac's reputation as an industry leader.

Online Presence and Digital Marketing

Calfrac's online presence, including its corporate website and investor relations portal, serves as a crucial channel for stakeholders to access vital company information and services. This digital storefront is key for brand awareness and disseminating essential updates.

In 2024, companies are increasingly leveraging digital marketing to connect with a broader audience. For Calfrac, this could involve targeted campaigns to highlight its technological advancements and service offerings in the oil and gas sector.

- Corporate Website: A central hub for company news, financial reports, and service details.

- Investor Relations Portal: Dedicated space for shareholders and potential investors, offering easy access to SEC filings, annual reports, and webcast information.

- Digital Marketing: Utilizing platforms for brand building, lead generation, and communicating industry expertise.

- Information Dissemination: Ensuring timely and transparent communication of operational updates and strategic initiatives.

Client Referrals and Reputation

A solid industry standing, forged through consistent, dependable performance and the successful completion of numerous projects, directly fuels a robust stream of client referrals. This positive track record is Calfrac's most potent marketing asset.

Word-of-mouth endorsements and the tangible benefits clients experienced from past engagements act as a highly effective, organic channel for acquiring new business, significantly reducing customer acquisition costs.

- Industry Reputation: Calfrac's commitment to operational excellence and safety has cultivated a reputation for reliability, a key driver for repeat business and referrals.

- Client Testimonials: Positive feedback and documented success stories from satisfied clients serve as powerful endorsements, attracting new customers.

- Referral Programs: While organic referrals are strong, potential for formalizing client referral incentives could further amplify this channel.

- Market Trust: In 2024, the energy services sector continued to value trusted partners. Calfrac's sustained operational uptime and project execution rates reinforce this trust, leading to increased inbound inquiries.

Calfrac's direct sales teams are instrumental in securing new contracts by building relationships and negotiating service agreements, directly driving revenue. Strategically located operating bases ensure efficient service delivery and client engagement in key operational areas.

Industry events and digital platforms serve as vital channels for showcasing technological advancements, generating leads, and enhancing brand visibility. A strong reputation built on reliable performance fosters client referrals, a powerful and cost-effective acquisition method.

| Channel | Description | 2024 Relevance/Data |

|---|---|---|

| Direct Sales Force | Acquiring new clients and negotiating contracts. | Key to North American revenue generation. |

| Operating Bases/Field Offices | Service delivery, equipment deployment, local engagement. | Facilitates rapid response in key basins. |

| Industry Events (e.g., IPTC, SPE) | Showcasing technology, lead generation, market intelligence. | Events like OTC saw over 50,000 attendees in 2024. |

| Online Presence (Website, IR Portal) | Brand awareness, information dissemination. | Digital marketing is increasingly important for sector engagement. |

| Client Referrals/Reputation | Organic business acquisition through trust and performance. | Sustained uptime and project execution build market trust. |

Customer Segments

Major integrated oil and gas companies represent a core customer segment, characterized by their substantial production volumes and the need for sophisticated, specialized well services. These entities, often global giants, prioritize long-term partnerships built on demonstrated technical expertise and an unwavering commitment to safety and environmental compliance.

In 2024, these companies continued to invest heavily in exploration and production, with global upstream capital expenditure projected to reach approximately $570 billion, according to industry analysts. Their demand for hydraulic fracturing, well completion, and other essential services remains a significant driver for service providers like Calfrac.

Independent Exploration and Production (E&P) companies, particularly those of mid-to-large size with a focus on specific geological basins, represent a core customer segment. These entities are driven by the need for efficient and cost-effective well stimulation, aiming to unlock the full potential of their hydrocarbon assets. Their decision-making often hinges on maximizing asset value through optimized production.

Calfrac's value proposition resonates with these E&P players by offering tailored hydraulic fracturing and well completion services designed for their particular operational environments. Responsiveness and the ability to provide customized solutions are key differentiators that appeal to this segment, as they seek partners who understand and can adapt to their unique basin challenges and economic objectives. For instance, during 2024, many independent E&Ps faced volatile commodity prices, making cost efficiency in well services a paramount concern.

National Oil Companies (NOCs) represent a significant customer segment, especially in countries like Argentina, where they are tasked with developing and managing national energy reserves. These entities often require sophisticated oilfield services, such as those provided by Calfrac, to extract and process hydrocarbons effectively.

Operating within complex regulatory and contractual environments, NOCs demand partners who can navigate these intricacies seamlessly. For instance, in 2023, state-owned oil companies in Latin America collectively invested billions in upstream exploration and production, underscoring the substantial market opportunity and the need for specialized service providers.

Private Equity-Backed E&P Ventures

Private equity-backed E&P ventures represent a dynamic segment of the oil and gas industry. These companies are typically smaller and more nimble than their publicly traded counterparts, allowing them to react swiftly to market shifts and capitalize on specific opportunities. Their funding structure from private equity firms often enables a more aggressive approach to asset acquisition and development.

These ventures are keenly focused on maximizing the value of their existing assets through efficient operations and targeted development strategies. Their objective is to achieve rapid production growth and optimize operational costs, often with a defined exit strategy in mind, such as a sale to a larger entity or an initial public offering.

Key characteristics and priorities for these clients include:

- Focus on Efficiency and Rapid Returns: They seek service providers who can deliver measurable improvements in drilling and completion times and overall operational efficiency, aiming for quick paybacks on their investments.

- Asset Optimization Expertise: These companies value partners with a proven track record in enhancing production from mature or underperforming assets, often through advanced completion techniques and data-driven insights.

- Cost-Conscious Operations: While seeking high performance, they are highly sensitive to cost structures and require transparent pricing and cost-effective solutions to maintain profitability.

- Agility and Responsiveness: Their smaller size and private funding allow for quicker decision-making, and they expect their service providers to match this pace and be readily available to support their fast-paced development schedules.

International Oil and Gas Operators

International Oil and Gas Operators represent a key customer segment for Calfrac, particularly those operating in regions beyond its core North American and Argentinian markets. These companies, often major integrated oil firms or national oil companies, might require Calfrac's specialized hydraulic fracturing and well completion services for challenging projects or in areas where local expertise is limited.

For instance, a global operator developing a new, complex shale play in Eastern Europe or Southeast Asia might look to Calfrac for its proven technological capabilities and operational experience. This engagement could manifest through direct contracts for specific well services or, more strategically, through joint ventures to leverage Calfrac's operational footprint and technical know-how. In 2024, the global oil and gas industry saw continued investment in unconventional resources, with many operators expanding their reach into new territories, creating opportunities for service providers like Calfrac.

- Geographic Expansion: Companies operating in regions like the Middle East, Africa, or Asia-Pacific, where Calfrac may have a less established presence, could seek its services for complex unconventional development.

- Specialized Needs: International operators might require Calfrac's advanced fracturing techniques or specialized equipment for reservoirs with unique geological characteristics not commonly encountered in North America.

- Joint Ventures: Collaborations with international operators can provide Calfrac with access to new markets and projects, while offering partners the benefit of Calfrac's specialized expertise and technology.

Calfrac's customer base is diverse, encompassing major integrated oil and gas companies, independent E&Ps, national oil companies, and private equity-backed ventures. Each segment has distinct needs, from large-scale, long-term partnerships with integrated majors to cost-efficient, agile solutions for private equity firms.

Independent E&Ps, in particular, seek efficient and cost-effective well stimulation to maximize asset value, a priority amplified by volatile commodity prices observed in 2024. National oil companies, such as those in Argentina, require sophisticated services and partners adept at navigating complex regulatory landscapes, reflecting significant upstream investment trends in Latin America during 2023.

Private equity-backed companies prioritize efficiency and rapid returns, valuing partners who can optimize assets and offer cost-conscious, responsive services. International operators may engage Calfrac for specialized needs in new geographic markets, potentially through joint ventures, as global investment in unconventional resources continued to grow in 2024.

| Customer Segment | Key Characteristics | 2024/2023 Data Points |

|---|---|---|

| Major Integrated Oil & Gas Companies | Large production volumes, need for sophisticated services, long-term partnerships, focus on safety and compliance. | Global upstream capex projected ~$570 billion in 2024. |

| Independent E&Ps (Mid-to-Large) | Focus on specific basins, need for efficient/cost-effective stimulation, maximizing asset value. | Cost efficiency a paramount concern due to volatile commodity prices in 2024. |

| National Oil Companies (NOCs) | Development of national reserves, need for sophisticated services, navigating complex regulations. | State-owned oil companies in Latin America invested billions in upstream in 2023. |

| Private Equity-Backed E&Ps | Nimble, focus on efficiency, rapid returns, cost-conscious, agile, responsive. | Seeking quick paybacks and optimized operational costs. |

| International Operators | Operating in new territories, specialized needs, potential for joint ventures. | Continued investment in unconventional resources globally in 2024. |

Cost Structure

Calfrac's cost structure is heavily influenced by the acquisition of specialized oilfield equipment like fracturing fleets and coiled tubing units. These significant capital expenditures are then recognized as depreciation expenses over the equipment's operational lifespan, impacting profitability.

For instance, in 2023, Calfrac reported capital expenditures of approximately $178.5 million, a substantial investment directly tied to maintaining and expanding its operational fleet. This ongoing investment in new and upgraded equipment is a primary driver of their cost base.

Calfrac's cost structure heavily relies on personnel wages, benefits, and training, reflecting the specialized nature of its workforce. These labor costs, encompassing salaries, comprehensive benefits packages, and continuous training programs, are essential for maintaining high levels of expertise and stringent safety standards across its operations.

For instance, in 2023, Calfrac's total employee compensation and benefits represented a significant portion of its operating expenses, underscoring the value placed on its skilled engineers, field operators, technicians, and administrative personnel. This investment ensures the company can deploy qualified teams to demanding well completion and stimulation projects.

Calfrac's operational costs are heavily influenced by expenditures on fuel, proppant, and various consumables. Diesel fuel for its extensive fleet of hydraulic fracturing equipment represents a significant ongoing expense. In 2024, fluctuating diesel prices directly impacted the profitability of these services.

The company also incurs substantial costs for proppants, primarily sand or ceramic beads, which are crucial for keeping fractures open during the hydraulic fracturing process. These materials are sourced and transported to well sites, adding to the logistical and material cost components.

Furthermore, a range of specialized chemicals are used in fracturing fluids to enhance efficiency and control fluid properties. These chemicals, along with other essential consumables like water treatment agents and equipment maintenance parts, contribute to the overall cost structure for delivering well services.

Maintenance, Repairs, and Spare Parts

Maintaining Calfrac's extensive fleet of well stimulation equipment, which includes hydraulic fracturing fleets and coiled tubing units, incurs significant costs. This involves routine servicing, unexpected repairs, and the procurement of specialized spare parts to keep the machinery operational and efficient in demanding field conditions.

These expenditures are crucial for ensuring equipment reliability and minimizing downtime, which directly impacts service delivery and revenue generation. For instance, in 2023, Calfrac's cost of sales, which includes these maintenance expenses, was approximately $1.6 billion, highlighting the scale of these operational outlays.

- Fleet Upkeep: Regular maintenance schedules and preventative measures for hydraulic fracturing units and other specialized equipment.

- Repair Costs: Addressing wear and tear, component failures, and damage incurred during operations.

- Spare Parts Inventory: Managing the stock of essential components like pumps, engines, and hydraulic systems.

- Specialized Services: Engaging third-party experts for complex repairs or component overhauls.

Regulatory Compliance and Insurance

Calfrac's cost structure includes substantial expenses for regulatory compliance and insurance. These are critical for operating in the oil and gas services sector, which is heavily regulated. Adhering to environmental, safety, and operational standards across various jurisdictions represents a significant and ongoing cost. For instance, in 2024, companies in this industry often allocate a considerable portion of their operating budget to ensure compliance with evolving regulations, which can include investments in new technologies or training programs.

Comprehensive insurance coverage is another major component of Calfrac's cost structure, reflecting the high-risk nature of hydraulic fracturing and well completion services. This includes general liability, workers' compensation, and specialized coverage for equipment and environmental incidents. These premiums are often substantial, acting as both fixed and variable costs depending on operational activity and risk exposure. The 2024 insurance market for energy services saw premiums reflecting increased operational risks and potential liabilities.

- Regulatory Compliance: Costs associated with meeting environmental (e.g., emissions standards, water management), safety (e.g., OSHA, industry-specific safety protocols), and operational regulations in Canada, the United States, and Argentina.

- Insurance Premiums: Expenses for comprehensive coverage including general liability, pollution liability, workers' compensation, and auto insurance, which are essential given the inherent risks of oilfield operations.

- Legal and Consulting Fees: Costs incurred for legal advice, expert consultation, and auditing to ensure ongoing compliance with diverse regulatory frameworks.

- Training and Certification: Investments in employee training and certifications to meet mandated safety and operational standards, a recurring cost to maintain workforce competency.

Calfrac's cost structure is dominated by the significant capital expenditures required for its specialized oilfield equipment, such as fracturing fleets and coiled tubing units. These assets are depreciated over their useful lives, forming a substantial portion of the company's expenses. For instance, in 2023, Calfrac reported capital expenditures of $178.5 million, underscoring the ongoing investment in its fleet.

Operational costs are heavily influenced by consumables like diesel fuel, proppants (sand or ceramic beads), and various chemicals essential for hydraulic fracturing. In 2024, the price volatility of diesel directly impacted these operational outlays. The company also faces considerable costs for maintaining its extensive equipment fleet, including routine servicing, repairs, and spare parts, which are critical for operational uptime.

Labor costs, encompassing wages, benefits, and training for its skilled workforce, are another key element of Calfrac's cost structure. In 2023, employee compensation and benefits formed a significant part of operating expenses, reflecting the specialized nature of its personnel. Additionally, regulatory compliance and insurance premiums, driven by the high-risk environment of oilfield services, represent substantial and ongoing expenditures.

| Cost Category | Description | 2023 Impact (Approximate) |

| Capital Expenditures (Depreciation) | Acquisition and depreciation of specialized equipment | $178.5 million (Capex) |

| Operational Consumables | Fuel, proppants, chemicals | Significant portion of cost of sales ($1.6 billion in 2023) |

| Fleet Maintenance & Repair | Servicing, repairs, spare parts | Included in cost of sales |

| Labor Costs | Wages, benefits, training for skilled workforce | Significant portion of operating expenses |

| Regulatory Compliance & Insurance | Meeting safety, environmental standards; insurance premiums | Ongoing, substantial expenses |

Revenue Streams

Calfrac's main income comes from charging for hydraulic fracturing services. These fees are usually calculated based on how long a job takes, how much sand or other material (proppant) is used, or a set price agreed upon for the entire project. This is the core of their earnings.

In 2024, the demand for oil and gas services, including hydraulic fracturing, saw fluctuations. For instance, during the first quarter of 2024, Calfrac reported revenue of approximately $300 million, with a significant portion attributed to their fracturing operations in North America and Argentina.

Calfrac generates revenue from coiled tubing and cementing services, charging clients based on the project's complexity, how much equipment is used, and the materials needed for well intervention and completion tasks.

In 2024, the oil and gas services sector, including coiled tubing and cementing, saw continued demand driven by global energy needs. For instance, companies in this space often report revenue figures tied to the number of wells serviced and the duration of these operations.

This revenue model is directly linked to the operational activity of oil and gas companies, meaning higher drilling and completion activity translates to increased demand for these specialized services.

Ancillary well intervention services, such as acidizing and nitrogen treatments, represent a significant revenue stream for Calfrac. These specialized offerings complement their primary hydraulic fracturing services, addressing specific wellbore issues and enhancing production. In 2024, Calfrac reported that these complementary services played a crucial role in their overall revenue generation, contributing to a more diversified and resilient business model.

Equipment and Personnel Standby Charges

Calfrac can earn revenue through standby charges. These apply when their specialized equipment and skilled personnel are deployed to a customer's location but cannot commence operations immediately due to factors like waiting for specific operational windows or delays caused by the client. This ensures Calfrac is compensated for maintaining readiness and availability.

These standby charges are crucial for covering the costs associated with having assets and teams prepared to work. For instance, in 2024, the energy services sector, which Calfrac operates within, experienced fluctuating demand. This meant that periods of mobilization without immediate work were not uncommon, making these charges a vital revenue stream.

- Compensation for Readiness: Standby charges cover the costs of having equipment and personnel ready for deployment, even if operations are delayed.

- Mitigating Operational Disruptions: This revenue stream helps offset financial impacts from client-induced or environmental waiting periods.

- Ensuring Asset Utilization: It provides a baseline revenue even when full operational deployment is temporarily stalled.

Technology Licensing or Consulting Fees

Calfrac could generate revenue by licensing its proprietary well stimulation technologies to other industry players. This allows them to monetize their innovation without directly expanding operational capacity. For instance, in 2024, the demand for advanced hydraulic fracturing techniques remains strong, creating a market for such licensing agreements.

Additionally, Calfrac can offer specialized consulting services. These services would leverage their expertise in optimizing well performance and efficiency for other operators. This stream taps into the knowledge base built from years of operational experience.

- Technology Licensing: Monetizing patented or proprietary stimulation techniques.

- Consulting Services: Offering expert advice on well optimization and operational efficiency.

- Potential Market: Other oil and gas operators seeking to improve their well productivity.

- 2024 Context: Continued industry focus on efficiency and advanced fracturing methods supports this revenue stream.

Calfrac's primary revenue stems from providing hydraulic fracturing services, with pricing structured around job duration, proppant volume, or project-based contracts.

Complementary services like coiled tubing and cementing also contribute significantly, with fees dictated by job complexity and equipment usage.

In 2024, Calfrac reported substantial revenue from these core services, with North America and Argentina being key operational regions, reflecting ongoing demand in the energy sector.

Ancillary services, including acidizing and nitrogen treatments, further diversify Calfrac's income, addressing specific wellbore needs and boosting overall earnings.

| Revenue Stream | Description | 2024 Context/Data |

|---|---|---|

| Hydraulic Fracturing Services | Core service, priced by job duration, proppant volume, or project contract. | Significant contributor to overall revenue; demand influenced by oil and gas activity. |

| Coiled Tubing & Cementing | Well intervention and completion services, priced by complexity and equipment/material usage. | Continued demand driven by global energy needs; revenue tied to wells serviced and operation duration. |

| Ancillary Well Intervention | Specialized services like acidizing and nitrogen treatments to enhance production. | Played a crucial role in 2024 revenue, contributing to a diversified business model. |

| Standby Charges | Compensation for equipment and personnel readiness during operational delays. | Vital for covering readiness costs, especially during fluctuating demand periods in 2024. |

Business Model Canvas Data Sources

The Calfrac Business Model Canvas is built upon a foundation of comprehensive financial reports, detailed operational data, and extensive market analysis. These sources provide the critical insights needed to accurately define customer segments, value propositions, and revenue streams.