Calfrac PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calfrac Bundle

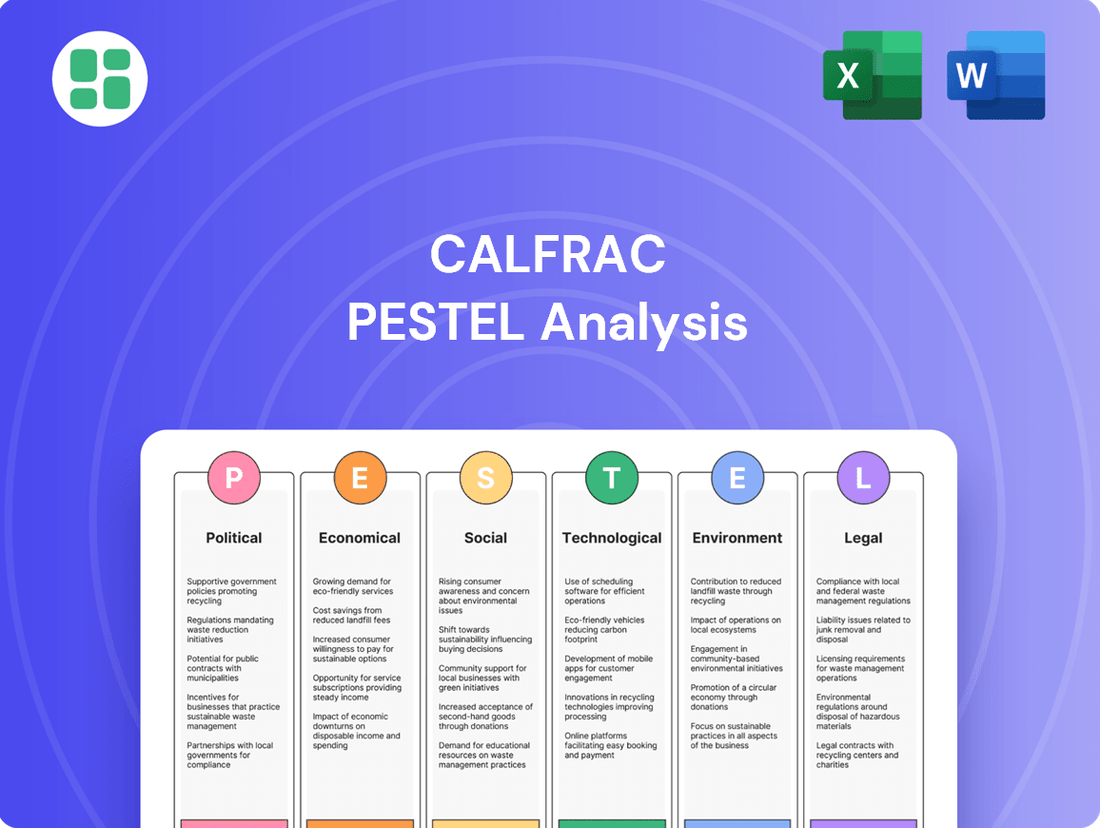

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Calfrac's operational landscape. Our comprehensive PESTLE analysis provides actionable intelligence to navigate these external forces effectively. Gain a competitive edge by understanding the full picture. Download the complete report now to make informed strategic decisions.

Political factors

Government policies in North America and Argentina are crucial for Calfrac. For instance, the U.S. Energy Information Administration reported that crude oil production averaged 12.9 million barrels per day in 2023, a record high, indicating a supportive environment for oilfield services, though this is subject to policy shifts.

Changes in regulations concerning oil and gas extraction, particularly in Canada and the United States, directly influence the demand for Calfrac's services. The Biden administration's focus on transitioning to renewable energy, while promoting domestic oil production to stabilize markets, creates a dynamic regulatory environment that Calfrac must navigate.

Argentina's energy policies, especially regarding the Vaca Muerta shale formation, are also key. The government's commitment to developing this resource, as evidenced by continued investment incentives, generally supports activity for service providers like Calfrac, though political stability can introduce uncertainty.

Geopolitical stability and evolving trade relations significantly shape Calfrac's operational landscape, especially in key markets like Argentina. The country's commitment to attracting foreign capital, exemplified by the Large Investment Incentives Regime (RIGI), aims to foster regulatory certainty and stimulate investment in its energy sector.

Governments worldwide are increasingly implementing energy transition policies, aiming to reduce carbon emissions. For instance, the European Union's Green Deal targets a 55% reduction in net greenhouse gas emissions by 2030 compared to 1990 levels, directly impacting fossil fuel demand.

These policies, including carbon pricing mechanisms and subsidies for renewables, can decrease investment in oil and gas exploration and production, which are core markets for Calfrac's services.

While Calfrac is exploring opportunities in geothermal and carbon capture, utilization, and storage (CCUS), the pace of this transition and the scale of investment in these new areas remain critical factors influencing future demand for its traditional services.

Indigenous and Community Relations

Government policies concerning Indigenous land rights and community involvement in oil and gas development zones significantly impact project approvals and operational schedules. Calfrac's ability to successfully navigate these relationships is crucial for maintaining its social license to operate, particularly in areas with established Indigenous populations. Policies dictating resource revenue sharing and environmental impact assessments are key considerations for the company's operations in Canada and the United States.

For instance, in 2024, ongoing consultations and agreements with First Nations in Alberta, a major operating region for Calfrac, continue to shape the landscape of energy project development. These engagements often involve detailed environmental monitoring and benefit-sharing agreements, directly affecting project economics and timelines.

- Government policies on Indigenous land rights can lead to project delays or cancellations if not adequately addressed.

- Community engagement frameworks often mandate specific consultation periods and impact assessments before new operations can commence.

- Resource revenue sharing agreements are increasingly becoming a standard expectation, influencing the financial viability of projects.

- Environmental assessment processes, often involving Indigenous input, can extend approval timelines and require significant mitigation investments.

Regulatory Stability and Investment Climate

Calfrac's operations are significantly influenced by the regulatory stability in its key markets, including Canada, the United States, and Argentina. Predictable regulatory frameworks are essential for long-term investment decisions and operational planning. For instance, changes in environmental regulations or permitting processes can directly impact operational costs and timelines.

Uncertainty arising from frequent shifts in tax policies or foreign exchange controls can create significant headwinds. In 2024, for example, the energy sector in various regions faced evolving fiscal regimes, necessitating agile financial management. Calfrac's ability to navigate these changes, such as adapting to potential adjustments in corporate tax rates or capital repatriation rules, is vital for maintaining financial health and investor confidence.

- Regulatory Stability: Consistent and predictable regulations in Canada, the US, and Argentina are key to Calfrac's investment planning.

- Impact of Changes: Frequent regulatory shifts, including tax or FX controls, can introduce uncertainty and affect financial performance.

- 2024 Context: The energy sector in 2024 experienced evolving fiscal policies, highlighting the need for adaptability.

- Strategic Importance: Navigating these changes effectively is crucial for Calfrac's financial health and investor relations.

Government policies, particularly concerning energy transition and carbon emissions, directly shape the demand for Calfrac's services. For instance, the U.S. Energy Information Administration noted that in 2023, U.S. crude oil production reached a record 12.9 million barrels per day, indicating a strong underlying market, but this is subject to evolving environmental regulations and climate policies. Similarly, Argentina's focus on developing the Vaca Muerta formation, supported by investment incentives, generally benefits service providers, though political shifts can introduce uncertainty.

The increasing global emphasis on reducing carbon emissions, as exemplified by the European Union's Green Deal aiming for a 55% emissions reduction by 2030, can impact long-term investment in fossil fuels. While Calfrac explores geothermal and CCUS, the pace of this transition and investment in these areas remains a critical factor for its traditional service demand.

Government policies regarding Indigenous land rights and community engagement are paramount for project approvals and operational timelines, especially in Canada and the U.S. For example, ongoing consultations with First Nations in Alberta in 2024 involve detailed environmental monitoring and benefit-sharing, directly affecting project economics and schedules.

Regulatory stability in key markets like Canada, the U.S., and Argentina is vital for Calfrac's planning. Frequent shifts in tax policies or foreign exchange controls, as seen with evolving fiscal regimes in 2024, create headwinds and necessitate agile financial management to maintain investor confidence.

What is included in the product

This Calfrac PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats arising from these dynamic external forces.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights for Calfrac.

Helps support discussions on external risk and market positioning during planning sessions, acting as a readily available reference to navigate Calfrac's operating environment.

Economic factors

Global oil and natural gas prices are a critical economic factor for Calfrac. Fluctuations directly influence the spending habits of exploration and production (E&P) companies, which are Calfrac's primary customers. When commodity prices dip, E&P firms tend to cut back on their capital expenditures, leading to less demand for Calfrac's well completion and stimulation services.

For instance, in the second quarter of 2025, North American operations saw a noticeable slowdown in drilling and completion activity, a direct consequence of lower oil prices. This trend highlights the sensitivity of Calfrac's business to the volatile energy markets.

Robust economic growth in North America, particularly in the United States and Canada, directly fuels energy demand. For instance, the US economy expanded at a 2.5% annualized rate in Q1 2024, according to the Bureau of Economic Analysis, signaling healthy industrial and consumer activity that requires significant energy input.

In Argentina, economic conditions have been more volatile, but any stabilization and growth would translate to increased industrial production and transportation needs, thereby lifting demand for oil and gas services. While Argentina's GDP contracted by an estimated 2.8% in 2023, projections for 2024 suggest a potential rebound, which could positively impact the local energy sector.

The correlation between industrial output and oil and gas demand is clear; higher manufacturing and construction activity, often spurred by economic expansion, necessitates greater fuel consumption and upstream oilfield services. This dynamic is crucial for companies like Calfrac, as it directly influences their operational tempo and revenue generation.

Currency volatility, especially concerning the Argentine peso, significantly impacts Calfrac's financial performance. Fluctuations affect how revenue earned in local currency translates back to the company's reporting currency and also influence the ease of repatriating cash. For instance, in early 2024, the Argentine peso experienced substantial depreciation, creating headwinds for companies operating in the country.

High inflation rates present another challenge, directly increasing Calfrac's operational costs. This can erode profit margins if the company cannot adequately adjust its pricing strategies to offset these rising expenses. In 2023, Argentina's inflation rate soared, exceeding 200%, underscoring the critical need for robust cost management and flexible pricing models for businesses like Calfrac.

Capital Expenditures by E&P Companies

The willingness of Exploration & Production (E&P) companies to invest in new drilling and well completion programs is a direct driver for Calfrac's business. In 2024, the oilfield services sector experienced its strongest year in 34 years, largely fueled by heightened capital expenditures from these producers. However, some E&P companies are adopting a more cautious stance due to ongoing uncertainty surrounding commodity prices, which could impact future spending.

This cautiousness is reflected in projected capital expenditure trends. For instance, while overall spending in the oil and gas sector remained robust through late 2024, forecasts for 2025 suggest a more measured increase, with some analysts anticipating a plateau or even a slight pullback in certain segments if price volatility persists.

- 2024 Oilfield Services Performance: The sector achieved its best performance in 34 years.

- E&P Investment Driver: Capital expenditures by E&P companies are crucial for Calfrac's revenue.

- Commodity Price Impact: Uncertainty in oil and gas prices influences producer investment decisions.

- 2025 Spending Outlook: Projections indicate a potential moderation in E&P capital spending growth for 2025.

Competition and Market Oversupply

The oilfield services sector, especially in North America, has grappled with oversupply, resulting in significant pricing pressure and lower fleet utilization rates. This competitive environment directly impacts companies like Calfrac Well Services.

Calfrac has strategically adjusted its operations to navigate these market conditions. For instance, the company has been actively managing its fleet size and deployment to better align with projected demand. In 2024, the North American rig count, a key indicator of activity, has shown fluctuations, with some periods experiencing lower utilization due to market saturation.

To address the oversupply and its effects, Calfrac has taken steps to optimize its footprint. This includes rationalizing its operational presence in North America, aiming to match its capacity with anticipated activity levels throughout 2025. This proactive approach is crucial for maintaining profitability and operational efficiency in a challenging market.

- Market Oversupply Impact: Periods of oversupply in North American oilfield services have historically led to decreased pricing power and underutilization of equipment.

- Fleet Utilization: Lower fleet utilization directly affects revenue generation and profitability for service providers like Calfrac.

- Calfrac's Response: Calfrac has responded by reducing its operating footprint in North America.

- 2025 Outlook: This reduction is designed to align the company's capacity with anticipated activity levels for 2025, mitigating the impact of market oversupply.

Global economic trends significantly shape Calfrac's operating environment. Robust growth in key markets like the United States, evidenced by a 2.5% annualized GDP expansion in Q1 2024, generally boosts energy demand and thus the need for oilfield services. Conversely, economic contractions, such as Argentina's estimated 2.8% GDP decline in 2023, can dampen activity and service demand in those regions.

Inflation and currency fluctuations, particularly the Argentine peso's depreciation in early 2024 and Argentina's over 200% inflation in 2023, directly impact Calfrac's costs and the translation of foreign earnings, necessitating careful financial management and pricing strategies.

The oilfield services sector experienced its strongest year in 34 years in 2024, driven by E&P capital expenditures. However, projections for 2025 suggest a more moderate growth in these expenditures due to commodity price uncertainty, potentially affecting Calfrac's demand.

North American operations faced pricing pressure and lower fleet utilization in 2024 due to market oversupply, prompting Calfrac to reduce its operational footprint to better align capacity with anticipated 2025 activity levels.

| Economic Factor | Impact on Calfrac | Data Point (2024/2025) |

|---|---|---|

| Global GDP Growth | Drives energy demand and E&P spending. | US GDP grew 2.5% (annualized) in Q1 2024. |

| Inflation & Currency Volatility | Increases operational costs and affects foreign earnings. | Argentina's inflation exceeded 200% in 2023; Peso depreciated significantly in early 2024. |

| E&P Capital Expenditures | Directly influences demand for Calfrac's services. | Oilfield services sector saw strongest performance in 34 years in 2024; 2025 spending growth projected to moderate. |

| Market Oversupply | Leads to pricing pressure and lower fleet utilization. | Calfrac reduced North American footprint to align capacity for 2025. |

Preview the Actual Deliverable

Calfrac PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Calfrac PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides crucial insights for strategic decision-making.

You'll gain a thorough understanding of the external forces shaping Calfrac's operations and future prospects, enabling you to identify opportunities and mitigate risks effectively.

Sociological factors

Public perception of fossil fuels is increasingly shaped by growing awareness of climate change. This sentiment directly impacts investor confidence and can pressure companies like Calfrac to prioritize sustainable operations. For instance, a 2024 survey indicated that over 70% of global consumers are concerned about the environmental impact of energy production, a figure that has steadily climbed.

Calfrac's operational success hinges on a readily available pool of skilled labor, particularly for its specialized services like hydraulic fracturing and coiled tubing. The energy sector, in general, faces ongoing challenges in attracting and retaining talent, a trend expected to continue through 2024 and 2025.

Demographic shifts, such as an aging workforce and varying educational attainment levels, directly influence the supply of qualified candidates. Furthermore, intense competition for these specialized skills within the broader energy industry can significantly affect Calfrac's recruitment and retention strategies, potentially driving up labor costs.

Calfrac's ability to operate hinges on maintaining a positive relationship with the communities where its hydraulic fracturing services are deployed. This social license to operate is crucial for long-term sustainability.

Addressing community concerns regarding land use, water quality, and potential seismic activity is paramount. Transparent communication and proactive engagement are key strategies Calfrac employs to build trust and mitigate opposition. For instance, in 2023, Calfrac reported investing in community initiatives across its operating regions, though specific figures for social investment are not publicly itemized in their financial reports.

Health and Safety Standards

Societal expectations for robust health and safety standards within industrial sectors, especially oil and gas, are on a consistent upward trajectory. This heightened awareness directly impacts companies like Calfrac, influencing their operational licenses and public perception.

Calfrac's demonstrated commitment to safety is a critical differentiator. For instance, the company reported a Total Recordable Injury Frequency (TRIF) rate of 0.75 in 2024, a significant improvement from previous years, underscoring its dedication to employee well-being and operational integrity. This focus is not just about compliance; it's about maintaining a strong reputation and ensuring efficient, uninterrupted operations.

- Increasing Societal Scrutiny: Public and regulatory bodies demand increasingly stringent safety protocols in high-risk industries.

- Reputational Impact: Strong safety records enhance brand image and attract both talent and business partners.

- Operational Efficiency: A safe working environment reduces downtime, accidents, and associated costs, directly boosting productivity.

- Employee Morale and Retention: Prioritizing worker safety fosters a positive workplace culture, leading to better employee engagement and lower turnover.

Shifting Energy Consumption Patterns

Societal shifts are increasingly favoring cleaner energy, impacting long-term demand for fossil fuels. This trend, while gradual, influences the outlook for oil and gas production, the core market for Calfrac. For instance, in 2024, electric vehicle sales are projected to reach over 20% of the global automotive market, a significant jump from previous years, indicating a sustained move away from traditional internal combustion engines.

These evolving consumer preferences and governmental policies promoting renewable energy sources create a complex operating environment. Although Calfrac's services are tied to upstream oil and gas extraction, the broader energy transition necessitates strategic adaptation. By 2025, investments in renewable energy are expected to surpass those in fossil fuels globally, underscoring the magnitude of this societal pivot.

- Growing EV Adoption: Global electric vehicle sales are anticipated to exceed 15 million units in 2024, signaling a clear consumer preference shift.

- Renewable Energy Investment: Projections indicate that renewable energy investments will outpace oil and gas investments by 2025, reflecting a structural change in energy markets.

- Policy Support: Government incentives and regulations worldwide are actively encouraging the adoption of sustainable energy solutions.

- Long-Term Demand Uncertainty: The sustained shift towards cleaner alternatives introduces long-term demand uncertainty for hydrocarbon-based energy services.

Growing public concern over climate change is influencing investor sentiment and driving demand for sustainable practices in the energy sector. By 2025, it's projected that consumer demand for environmentally responsible energy production will continue to rise, impacting companies like Calfrac.

Technological factors

Continuous innovation in hydraulic fracturing techniques, like multi-stage fracturing and smart completion systems, directly impacts Calfrac's service offerings and efficiency. These advancements are crucial for optimizing well performance and reducing operational costs.

These technological leaps enable more effective extraction from unconventional reserves, such as shale oil and gas, which is a key driver for growth in the hydraulic fracturing market. For instance, advancements in proppant technology and fluid chemistry in 2024 continue to improve reservoir contact and hydrocarbon recovery rates.

Calfrac's ability to adopt and deploy these cutting-edge technologies, such as advanced pumping equipment and real-time data analytics for fracturing operations, positions them to capitalize on the increasing demand for efficient resource extraction. The global hydraulic fracturing market was valued at approximately USD 100 billion in 2023 and is projected to grow steadily through 2025.

The oilfield services sector is rapidly embracing digitalization and automation, with AI, big data, and robotics becoming integral to operations. This shift is driven by the need for greater efficiency and cost reduction in a volatile market. For instance, by mid-2025, the global oilfield automation market is projected to reach over $30 billion, showcasing significant investment in these technologies.

Calfrac can capitalize on these technological advancements to refine its drilling processes, improving accuracy and minimizing downtime. Implementing advanced analytics can lead to predictive maintenance, reducing unexpected equipment failures and associated repair costs. This strategic adoption of technology is crucial for maintaining a competitive edge and enhancing operational performance.

Technological advancements, particularly in pressure pumping equipment, are enabling a significant shift towards cleaner energy sources. Dual-fuel capable dynamic gas blending engines are a prime example, allowing for the substitution of diesel fuel with natural gas. This innovation directly addresses environmental concerns by reducing emissions associated with oilfield services.

Calfrac has actively embraced these cleaner technologies, investing in the modernization of its North American fleet. The company anticipates that a substantial portion of its operational fleets will be dual-fuel capable by the close of 2024. This strategic investment positions Calfrac to meet evolving environmental regulations and customer demands for reduced carbon footprints.

Enhanced Well Intervention Solutions

Advancements in coiled tubing technology are significantly boosting efficiency in well intervention. For instance, by mid-2024, the industry saw a notable increase in the depth and complexity of wells that could be serviced using these improved coiled tubing units, directly impacting production optimization for operators.

Calfrac's focus on enhancing its cementing and other well intervention solutions is paramount. These improvements are not just about maintaining wells but actively optimizing them for better output, a critical factor for clients looking to maximize their reservoir potential in the current market.

The company's commitment to innovation in well intervention directly translates to client value. By offering more efficient and effective solutions, Calfrac helps clients achieve:

- Increased production rates from existing wells.

- Reduced downtime and operational costs.

- Improved well integrity and longevity.

Remote Monitoring and Data Analytics

The integration of remote monitoring and sophisticated data analytics is fundamentally reshaping how companies like Calfrac manage their operations. This technological shift enables real-time adjustments to optimize performance, anticipate equipment failures through predictive maintenance, and ultimately foster better-informed strategic decisions. For instance, by analyzing sensor data from fracturing fleets, Calfrac can identify potential issues before they lead to costly downtime, a critical factor in the highly demanding oil and gas services sector.

These advancements directly translate into enhanced operational efficiency and a significant reduction in unplanned service interruptions. Improved decision-making, driven by granular data insights, allows for more precise resource allocation and risk management across Calfrac's various service offerings, from hydraulic fracturing to well completion services. The focus on predictive maintenance, for example, can drastically cut maintenance costs and improve asset utilization rates.

The benefits extend to safety as well. Remote monitoring systems can track equipment performance and environmental conditions in real-time, alerting personnel to potential hazards and enabling proactive safety interventions. This technological layer is becoming indispensable for maintaining high safety standards and operational integrity in complex field environments.

Key benefits realized through these technologies include:

- Enhanced Operational Efficiency: Real-time data allows for dynamic optimization of pumping schedules and equipment usage.

- Reduced Downtime: Predictive maintenance, informed by analytics, minimizes unexpected equipment failures.

- Improved Safety: Continuous monitoring of equipment and environmental factors aids in proactive hazard identification.

- Data-Driven Decision Making: Granular insights empower more accurate and timely strategic and operational choices.

Technological advancements in hydraulic fracturing, such as improved proppant technology and fluid chemistry, are crucial for optimizing well performance and reducing costs. By mid-2024, advancements in coiled tubing technology were significantly boosting efficiency in well intervention, enabling servicing of deeper and more complex wells.

The oilfield services sector is increasingly adopting digitalization and automation, with AI and big data becoming integral. This trend is projected to drive the global oilfield automation market to over $30 billion by mid-2025, indicating substantial investment in these areas.

Calfrac is investing in dual-fuel capable equipment, with a significant portion of its North American fleet expected to be ready by the close of 2024, addressing environmental concerns by reducing emissions through natural gas substitution for diesel.

The integration of remote monitoring and advanced data analytics allows for real-time operational adjustments, predictive maintenance, and improved decision-making, enhancing efficiency and safety. The global hydraulic fracturing market was valued at approximately USD 100 billion in 2023, with continued growth projected through 2025.

Legal factors

Calfrac's operations are significantly shaped by stringent environmental regulations, particularly concerning methane emissions and greenhouse gas caps in both Canada and the United States. These rules directly impact operational costs and technology adoption.

New Environmental Protection Agency (EPA) rules introduced in 2024 are setting performance standards aimed at curbing methane and volatile organic compound (VOC) emissions from the oil and gas industry. Concurrently, Canada is actively developing its own regulatory framework to achieve substantial reductions in oil and gas methane emissions, with a target of a 75% reduction from 2012 levels by 2030.

Calfrac must navigate a complex web of health, safety, and labor laws across its global operations, which directly shape its operational procedures and worker training mandates. For instance, in 2024, the oil and gas sector, where Calfrac operates, saw continued scrutiny on safety protocols following incidents that led to increased regulatory oversight and potential fines for non-compliance. These stringent regulations, covering everything from equipment maintenance to emergency response plans, are critical for maintaining a safe working environment and avoiding costly penalties that could impact financial performance.

Adherence to these legal frameworks is not merely about avoiding fines; it's fundamental to Calfrac's operational continuity and reputation. Labor laws, in particular, dictate employment practices, wage standards, and employee rights, influencing labor costs and workforce management strategies. In 2024, many jurisdictions saw updates to minimum wage laws and new regulations around worker benefits, necessitating constant review and adaptation of HR policies to ensure full compliance and maintain a motivated workforce.

Calfrac, like other oilfield service providers, navigates a complex web of permitting and licensing for its hydraulic fracturing, coiled tubing, and cementing operations. These legal requirements are not static; they evolve with regulatory updates and regional demands. For instance, in key operating areas like the Permian Basin, environmental impact assessments and specific state-level permits are crucial hurdles.

Changes in these permitting processes, such as increased public comment periods or more stringent bonding requirements, can directly affect project timelines and the overall feasibility of operations. In 2024, several states have seen proposed legislation aimed at tightening regulations around water usage and disposal for hydraulic fracturing, which could necessitate additional licensing or permit amendments for companies like Calfrac.

International Trade and Investment Laws

International trade agreements and investment laws significantly shape Calfrac's global operations. These frameworks, especially concerning cross-border activities and foreign direct investment, are paramount. For instance, in 2023, Argentina's Large Investment Incentives Regime (RIGI) continued to provide a stable legal environment and attractive incentives for major capital injections, directly influencing the feasibility and structure of Calfrac's potential projects in the region.

The evolving landscape of international trade policies can introduce both opportunities and challenges for companies like Calfrac. Changes in tariffs, import/export regulations, and bilateral investment treaties can directly impact the cost of equipment, the repatriation of profits, and the overall ease of doing business across different jurisdictions. Keeping abreast of these legal shifts is crucial for strategic planning and risk mitigation.

Calfrac's engagement with international trade and investment laws necessitates careful consideration of compliance and potential disputes. Understanding the nuances of foreign investment protection, dispute resolution mechanisms, and local content requirements in various operating countries is essential for maintaining operational integrity and fostering positive stakeholder relationships.

- Impact of Trade Agreements: International trade agreements can reduce or eliminate tariffs on oilfield services equipment, potentially lowering Calfrac's capital expenditure.

- Foreign Direct Investment Laws: Regulations governing FDI, such as those in Argentina through RIGI, offer legal stability and tax benefits, encouraging long-term investment.

- Regulatory Compliance: Adherence to diverse national and international regulations, including environmental and labor laws, is critical for sustainable operations.

- Dispute Resolution: Knowledge of international arbitration and investment treaty dispute resolution processes is vital for managing cross-border legal challenges.

Corporate Governance and Reporting Standards

Calfrac, being a publicly traded entity, operates under rigorous corporate governance and financial reporting mandates. This necessitates strict adherence to the rules of the stock exchanges where its shares are listed, as well as securities regulations governing disclosure. For instance, their Q2 2025 financial reporting will need to reflect these standards, ensuring transparency for investors.

The company's commitment to these standards is crucial for maintaining market confidence and investor trust. Compliance involves detailed and accurate reporting of financial performance, operational activities, and any material information that could impact the company's valuation. This transparency is a cornerstone of fair market practices.

- Adherence to Stock Exchange Rules: Calfrac must follow listing requirements, impacting trading and disclosure.

- Securities Regulations Compliance: Adherence to regulations set by bodies like the SEC (or equivalent) is mandatory for public companies.

- Transparent Financial Disclosure: Timely and accurate reporting of financial results, such as Q2 2025 earnings, is essential.

- Corporate Governance Best Practices: Implementing strong governance structures ensures accountability and ethical operations.

Calfrac must navigate a complex landscape of environmental, health, safety, and labor laws across its global operations, directly influencing operational procedures and worker training. In 2024, the oil and gas sector faced increased regulatory scrutiny on safety, impacting protocols and potentially leading to fines for non-compliance.

Permitting and licensing for operations like hydraulic fracturing are subject to evolving regulations, with specific state-level permits crucial in areas like the Permian Basin. Proposed legislation in 2024 aimed to tighten regulations on water usage and disposal for hydraulic fracturing, potentially requiring additional licensing.

International trade agreements and investment laws significantly impact Calfrac's cross-border activities and foreign direct investment. For instance, Argentina's RIGI regime in 2023 offered legal stability and incentives for capital injections, influencing regional project feasibility.

As a publicly traded entity, Calfrac adheres to rigorous corporate governance and financial reporting mandates, including stock exchange rules and securities regulations. Transparent financial disclosure, such as Q2 2025 earnings reports, is essential for maintaining market confidence and investor trust.

Environmental factors

The escalating global emphasis on climate change compels Calfrac to actively manage its environmental impact. The company's investment in dual-fuel fleets demonstrates a commitment to lowering emissions, a crucial step in an industry facing increasing scrutiny.

However, stakeholders are demanding more concrete actions and transparent reporting on carbon reduction goals. For instance, by the end of 2023, many energy companies were setting more ambitious Scope 1 and Scope 2 emission reduction targets, a trend Calfrac will need to align with to maintain its social license to operate and investor confidence.

Hydraulic fracturing demands significant water volumes, making responsible sourcing, efficient usage, and proper wastewater disposal paramount environmental concerns for Calfrac. In 2023, the oil and gas industry, including fracturing operations, faced increasing pressure to demonstrate sustainable water practices.

Regulatory bodies and public opinion are closely monitoring water resource impacts, pushing companies like Calfrac to adopt advanced water management techniques. This includes a growing emphasis on recycling and reusing flowback water, a trend that gained further traction throughout 2024 as companies sought to reduce their freshwater footprint and associated costs.

Methane emissions from oil and gas activities are a major environmental focus, prompting more stringent regulations, particularly in North America. Calfrac must navigate these evolving air quality standards and methane reduction goals to lessen its environmental footprint and sidestep potential fines.

In 2023, the U.S. Environmental Protection Agency (EPA) finalized new rules targeting methane emissions from existing oil and gas infrastructure, aiming for a significant reduction. Similarly, Canada has implemented its own methane regulations, with targets for reducing emissions intensity from oil and gas operations by 35-45% below 2012 levels by 2025.

Land Use and Biodiversity Impact

Calfrac's oilfield services operations can significantly affect land use and biodiversity. Infrastructure development, including roads and well pads, alters natural landscapes, potentially fragmenting habitats. Operational activities, such as water sourcing and waste disposal, also pose risks to local ecosystems.

Mitigating these impacts requires robust land management and environmental assessments. In 2024, the energy sector continued to face scrutiny regarding its environmental footprint, with increased emphasis on reclamation and biodiversity protection. Companies like Calfrac are expected to adhere to evolving regulatory standards and implement best practices to minimize disturbance.

Key considerations for Calfrac include:

- Minimizing surface disturbance: Utilizing directional drilling techniques to reduce the number of well pads required.

- Habitat restoration: Implementing effective reclamation plans for decommissioned sites to restore native vegetation and wildlife habitats.

- Water management: Employing responsible water sourcing and disposal methods to protect aquatic ecosystems.

- Biodiversity monitoring: Conducting regular assessments to understand and manage the impact on local flora and fauna.

Waste Management and Spill Prevention

Calfrac’s operations, like many in the oil and gas sector, generate significant waste, including drilling fluids and produced water. Effective waste management is crucial, with companies like Calfrac investing in technologies and processes to minimize environmental impact. For instance, in 2023, the company reported managing substantial volumes of produced water, emphasizing recycling and responsible disposal methods to meet stringent environmental standards.

Robust spill prevention and response protocols are paramount. Calfrac maintains comprehensive plans and invests in training and equipment to mitigate the risks associated with handling chemicals and hydrocarbons. Environmental regulations, such as those enforced by the EPA in the United States and similar bodies globally, mandate strict adherence to waste disposal and hazardous material handling guidelines. Non-compliance can lead to substantial fines and operational disruptions, underscoring the financial and reputational importance of these measures.

Key aspects of Calfrac's environmental approach include:

- Waste Minimization: Implementing technologies to reduce the volume and toxicity of waste generated during well servicing and completion operations.

- Recycling and Reuse: Prioritizing the recycling and reuse of materials, particularly water used in hydraulic fracturing, to conserve resources and reduce disposal needs.

- Spill Response Readiness: Maintaining well-trained emergency response teams and readily available containment and cleanup equipment to address any accidental releases promptly.

- Regulatory Compliance: Ensuring all waste handling and disposal practices align with current and evolving environmental laws and industry best practices.

Calfrac faces increasing pressure to reduce its carbon footprint, with many energy companies setting more ambitious Scope 1 and 2 emission reduction targets by the end of 2023. The company's investment in dual-fuel fleets is a step towards lowering emissions, a critical move given the growing stakeholder demand for transparency and concrete climate action.

Water management remains a significant environmental challenge, as hydraulic fracturing operations are water-intensive. By 2024, the industry continued to focus on sustainable water practices, including increased recycling and reuse of flowback water to conserve freshwater resources and manage costs effectively.

Methane emissions are under intense regulatory scrutiny, particularly in North America. Canada's regulations aim for a 35-45% reduction in methane intensity by 2025, while the U.S. EPA finalized new rules in 2023 targeting existing infrastructure. Calfrac must adapt to these evolving air quality standards to mitigate environmental impact and avoid penalties.

The company must also manage land use impacts and biodiversity concerns, implementing robust land management and environmental assessments. As of 2024, the energy sector's environmental footprint, including reclamation and biodiversity protection, faced heightened scrutiny, requiring adherence to evolving regulations and best practices.

PESTLE Analysis Data Sources

This Calfrac PESTLE Analysis is informed by a comprehensive review of official government publications, reputable industry associations, and leading financial news outlets. We prioritize data from regulatory bodies, economic forecasting firms, and technological trend analyses to ensure a robust understanding of the external environment.