Calfrac Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calfrac Bundle

Calfrac's competitive landscape is shaped by intense rivalry, significant buyer power, and the constant threat of new entrants, all impacting its profitability. Understanding these forces is crucial for navigating the oilfield services sector.

The complete report reveals the real forces shaping Calfrac’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Calfrac's supplier bargaining power is significantly shaped by supplier concentration and specialization. When a few specialized suppliers provide critical inputs, such as unique fracturing fluids or high-performance proppants, their leverage over Calfrac naturally grows. For instance, if a particular chemical formulation is essential for efficient fracturing and only one or two companies produce it, they can command higher prices.

In 2024, the oilfield services sector, including companies like Calfrac, experienced ongoing supply chain pressures. The demand for specialized materials, driven by advancements in hydraulic fracturing technology and the need for environmentally friendlier chemical solutions, has concentrated production among fewer, highly technical suppliers. This specialization means that for certain essential components, the number of viable alternative suppliers is limited, thereby increasing their bargaining power.

The ease with which Calfrac can switch suppliers is a critical factor in determining supplier power. If Calfrac faces high switching costs, for instance, needing to invest in new specialized equipment or undergo lengthy re-certification processes for new chemical providers, existing suppliers gain leverage. This difficulty in changing suppliers allows them to potentially dictate terms more favorably.

Conversely, low switching costs empower Calfrac to negotiate more aggressively. For example, if a new hydraulic fracturing fluid supplier offers a product that is compatible with existing equipment and requires no additional certifications, Calfrac can more readily switch if pricing or terms are unfavorable. This flexibility directly impacts the bargaining power of suppliers.

In 2024, the oil and gas services sector, including companies like Calfrac, experienced volatile input costs. Suppliers of specialized chemicals and equipment often hold significant power due to the proprietary nature of their products and the specialized training required for their use. For Calfrac, the ability to find readily interchangeable alternatives for key operational inputs directly mitigates this supplier leverage.

Suppliers wield significant power when their products are critical to a company's core business and lack readily available substitutes. For Calfrac, the availability and quality of specialized proppants are absolutely vital for the success of its hydraulic fracturing services. If these essential materials are difficult to source elsewhere or are of a unique, high-performing nature, the suppliers of these proppants can dictate terms and pricing more effectively.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward, meaning they start offering well services themselves, can significantly weaken Calfrac's negotiating power. This scenario is more likely when suppliers possess the necessary expertise and financial resources to enter Calfrac's core business, directly competing and potentially capturing market share.

While not a universal concern across all supplier types, this forward integration risk is particularly pronounced in specialized segments of the oilfield services market. For instance, a manufacturer of advanced hydraulic fracturing equipment might consider offering its own service packages, leveraging its proprietary technology to gain a competitive edge.

This potential for suppliers to become direct competitors limits Calfrac's ability to dictate terms and secure favorable pricing for essential inputs. In 2024, the industry saw continued consolidation and innovation, potentially increasing the capabilities of some key suppliers to consider such strategic moves.

- Supplier Capability: Suppliers with proprietary technology or unique manufacturing processes are better positioned for forward integration.

- Market Dynamics: Niche markets with high margins and limited competition are more attractive for supplier integration.

- Calfrac's Dependence: Calfrac's reliance on specific suppliers for critical components or specialized services increases the supplier's leverage.

Commodity Price Volatility of Inputs

The bargaining power of suppliers is significantly influenced by the commodity price volatility of their own inputs. For instance, suppliers of resins used in proppants or base chemicals crucial for hydraulic fracturing fluids experience fluctuations in their raw material costs. When these input prices surge, suppliers naturally seek to pass on those increased costs to their customers like Calfrac, directly impacting Calfrac's operational expenses.

Calfrac's strategic response to this supplier pressure is paramount. Their capacity to absorb these rising costs or effectively pass them on to their own clients determines how this volatility affects their profitability. For example, if the price of key chemicals like guar gum, a common fracturing fluid additive, increases sharply, Calfrac must decide whether to absorb the margin squeeze or risk losing business by raising its service prices.

- Resin Price Fluctuations: Suppliers of resins, a key component in engineered proppants, face their own input cost volatility, which can translate into higher prices for Calfrac.

- Base Chemical Cost Sensitivity: The cost of base chemicals used in fracturing fluid formulations is subject to global commodity markets, directly affecting supplier pricing strategies.

- Impact on Calfrac's Margins: Rising input costs for suppliers create pressure on Calfrac's cost structure, necessitating careful management of pricing and operational efficiency.

- 2024 Data Point: In early 2024, the cost of certain specialty chemicals used in hydraulic fracturing saw increases of up to 10-15% due to supply chain disruptions and increased demand, illustrating the direct impact of input volatility on service providers.

Calfrac's bargaining power with suppliers is diminished when suppliers are concentrated and offer specialized, critical inputs. In 2024, the oilfield services sector saw continued demand for specialized chemicals and equipment, leading to fewer, highly technical suppliers holding greater sway. This concentration means Calfrac has limited alternatives for essential components, increasing supplier leverage and potentially driving up costs.

The ability for Calfrac to switch suppliers is a key factor; high switching costs, such as needing new equipment or certifications, empower existing suppliers. Conversely, low switching costs allow Calfrac to negotiate more aggressively. In 2024, volatile input costs in the oil and gas services sector meant suppliers of proprietary products and specialized training could command higher prices, directly impacting Calfrac's operational expenses.

Suppliers with proprietary technology or those in niche markets with high margins are better positioned for forward integration, potentially becoming direct competitors to Calfrac. This risk is amplified when Calfrac is highly dependent on specific suppliers for critical components. For instance, a manufacturer of advanced fracturing equipment might consider offering its own service packages, leveraging its technology to gain an edge.

Supplier power is also tied to the commodity price volatility of their own inputs. For example, the cost of resins for proppants or base chemicals for fracturing fluids can surge, leading suppliers to pass these increases onto customers like Calfrac. In early 2024, specialty chemical costs saw increases of up to 10-15% due to supply chain issues, directly impacting Calfrac's margins.

| Factor | Impact on Calfrac | 2024 Relevance |

| Supplier Concentration | Increased leverage for suppliers | Ongoing, due to specialized demand |

| Switching Costs | Higher costs empower suppliers | Significant for specialized equipment/chemicals |

| Forward Integration Threat | Potential for direct competition | Increased with industry consolidation/innovation |

| Input Cost Volatility | Pressure on Calfrac's margins | Specialty chemicals up 10-15% in early 2024 |

What is included in the product

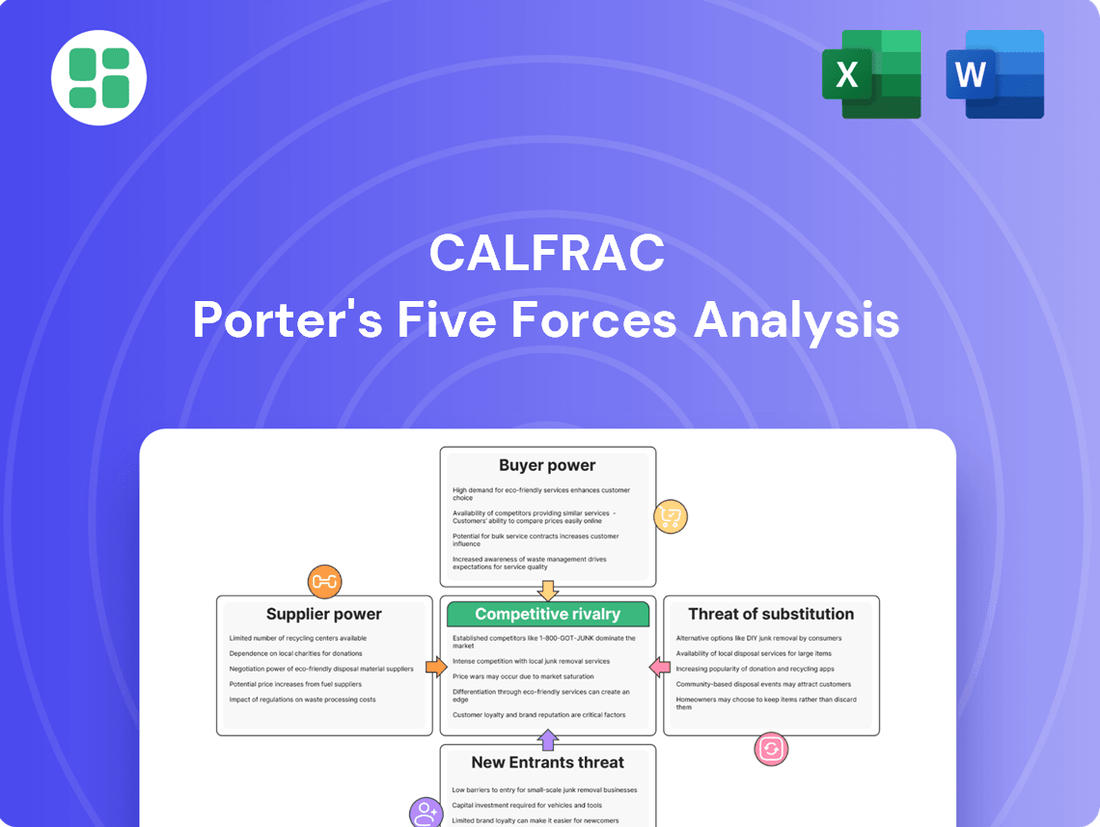

Calfrac's Porter's Five Forces analysis dissects the competitive intensity within the oilfield services industry, examining threats from new entrants, the bargaining power of buyers and suppliers, the risk of substitutes, and the rivalry among existing players.

Instantly visualize Calfrac's competitive landscape with a user-friendly Porter's Five Forces model, simplifying complex industry dynamics for strategic clarity.

Customers Bargaining Power

Calfrac's customers, primarily oil and gas exploration and production (E&P) companies, wield significant bargaining power, particularly when concentrated. If a few large E&P firms represent a substantial portion of Calfrac's revenue, they can dictate terms and pricing. For instance, in 2023, Calfrac's top 10 customers accounted for approximately 60% of its revenue, highlighting the leverage these major players possess.

Customer switching costs significantly impact the bargaining power of Exploration and Production (E&P) companies when dealing with oilfield service providers like Calfrac. If E&P firms can easily shift to another provider, perhaps because services are standardized or alternatives are plentiful, they gain leverage to negotiate better pricing or terms. This ease of switching directly translates to increased customer bargaining power.

Conversely, high switching costs can diminish a customer's ability to exert pressure. For instance, if an E&P company has integrated Calfrac's specialized equipment into its operations or is bound by long-term contracts, the effort and expense involved in switching would be substantial. In 2023, the oilfield services sector saw a notable increase in contract lengths, particularly for specialized hydraulic fracturing fleets, indicating a trend towards higher switching costs for some clients.

Customer price sensitivity is directly linked to the volatility of oil and gas commodity prices. When crude oil prices are low, exploration and production (E&P) companies experience squeezed margins, making them extremely sensitive to the cost of services. For instance, during the downturn of 2020, West Texas Intermediate (WTI) crude oil prices briefly dipped into negative territory, forcing E&P companies to aggressively negotiate service costs.

Conversely, when oil and gas prices surge, E&P companies often prioritize operational efficiency and rapid project execution over absolute cost minimization. For example, in late 2021 and early 2022, as WTI prices climbed back above $80 per barrel, the focus for many E&P firms shifted to securing reliable service providers to maximize production, rather than solely seeking the lowest price.

Threat of Backward Integration by Customers

The threat of Exploration and Production (E&P) companies performing hydraulic fracturing services themselves, known as backward integration, generally serves to temper the bargaining power of Calfrac's customers. This is because the substantial capital outlay for specialized equipment and the need for deep technical expertise make full in-house execution of complex fracturing operations challenging for most E&P firms.

While some E&P companies might handle simpler well services internally, the core, high-intensity services that Calfrac provides require significant investment in fleets of high-pressure pumps, sanders, and waterfrac units. For instance, a single hydraulic fracturing spread can cost upwards of $20 million, and maintaining and upgrading these assets demands ongoing specialized labor and logistical support.

Consequently, the high barriers to entry for sophisticated hydraulic fracturing operations mean that the threat of backward integration, while present, is often limited to specific, less complex tasks. This limitation on backward integration helps to maintain a degree of pricing power for specialized service providers like Calfrac.

- High Capital Expenditure: The cost of a single hydraulic fracturing unit can exceed $20 million, making it a significant barrier for E&P companies considering in-house operations.

- Specialized Expertise Required: Complex fracturing operations demand highly skilled personnel in areas like reservoir engineering, fluid chemistry, and equipment operation, which are not always readily available within E&P firms.

- Operational Complexity: Managing the logistics of water sourcing, sand delivery, fluid mixing, and waste disposal for large-scale fracturing campaigns adds significant operational complexity for E&P companies.

- Focus on Core Competencies: Many E&P companies prefer to focus their resources and management attention on exploration, drilling, and production rather than investing heavily in specialized oilfield services.

Standardization of Services

The increasing standardization of oilfield services, including hydraulic fracturing, significantly amplifies customer bargaining power. When Calfrac's services are perceived as largely interchangeable with those of its competitors, clients can readily shop for the best price. This was evident in early 2024, where a more competitive landscape for pressure pumping services allowed major exploration and production (E&P) companies to negotiate more favorable terms. For instance, some E&P companies reported securing pricing reductions of 5-10% on certain fracturing jobs due to the availability of multiple providers offering similar capabilities.

Calfrac's ability to counter this trend hinges on its capacity to differentiate its service offerings. This differentiation can stem from technological innovation, superior operational efficiency, or exceptional safety records. For example, if Calfrac can demonstrate a proprietary fracturing technique that yields higher production rates for its clients, or a more efficient pumping schedule that reduces overall well completion time, it can command a premium and lessen customer price sensitivity. However, in a market where many players utilize similar equipment and techniques, the perceived uniqueness of any single provider's service can diminish.

- Service Interchangeability: As oilfield services become more commoditized, customers gain leverage by easily switching between providers.

- Price Sensitivity: Little perceived differentiation forces customers to prioritize cost, making price the primary decision factor.

- Competitive Landscape: In 2024, a surplus of fracturing fleets in certain basins gave E&P companies more options and thus greater bargaining power.

- Differentiation Strategy: Calfrac can mitigate this power by highlighting unique technological advantages or operational efficiencies.

Calfrac's customers, primarily oil and gas exploration and production (E&P) companies, hold substantial bargaining power. This power is amplified by the concentration of Calfrac's customer base; in 2023, its top 10 clients represented about 60% of revenue, giving these major players significant leverage in negotiations.

The ease with which customers can switch providers directly increases their bargaining power. If Calfrac's services are seen as standard and alternatives are readily available, E&P firms can more effectively demand lower prices or better terms. This was evident in early 2024, when a competitive market for pressure pumping services allowed some E&P companies to negotiate 5-10% price reductions.

Conversely, customer price sensitivity is closely tied to oil and gas commodity prices. During periods of low oil prices, like the downturn in 2020, E&P companies face squeezed margins and are compelled to aggressively negotiate service costs. For example, when West Texas Intermediate (WTI) briefly traded in negative territory, cost reduction became paramount.

The threat of E&P companies performing services in-house, known as backward integration, generally limits customer bargaining power. The significant capital investment, exceeding $20 million for a single fracturing unit, and the need for specialized expertise create high barriers to entry for most E&P firms, making full in-house operations challenging.

| Factor | Impact on Calfrac's Customer Bargaining Power | 2023/2024 Data Point |

| Customer Concentration | High | Top 10 customers accounted for ~60% of revenue in 2023. |

| Switching Costs | Low (generally) | Reported 5-10% price reductions secured by E&P firms in early 2024 due to service interchangeability. |

| Price Sensitivity | High (when oil prices are low) | Negative WTI prices in 2020 forced aggressive cost negotiations. |

| Threat of Backward Integration | Low | Capital cost of a fracturing unit > $20 million limits in-house capabilities. |

Full Version Awaits

Calfrac Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of Calfrac delves into the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the oilfield services industry. You're previewing the final version—precisely the same document that will be available to you instantly after buying.

Rivalry Among Competitors

The oilfield services sector, especially in North America, is crowded with a wide array of competitors. This includes massive, all-encompassing service providers alongside smaller, focused regional operators. This sheer volume and variety of players significantly ramp up the competition as everyone battles for a bigger slice of the market.

Calfrac finds itself competing against major global players with extensive resources and reach, as well as nimble, specialized firms that can quickly adapt to niche market demands. For instance, in 2024, companies like Schlumberger, Halliburton, and Baker Hughes continue to dominate the global landscape, while numerous smaller, privately held or publicly traded entities focus on specific services or geographic areas within North America, creating a complex competitive environment.

The growth rate of the oil and gas exploration and production (E&P) sector significantly fuels competitive rivalry. When the industry experiences sluggish or negative growth, companies often engage in more aggressive competition for a smaller market share, frequently resulting in price wars and diminished profit margins.

As of early 2024, the global oil and gas market is navigating a complex landscape. While demand remains robust, supply-side constraints and geopolitical factors are influencing growth trajectories, leading to heightened competition among E&P firms vying for market dominance.

A mature market, characterized by limited new exploration opportunities and slower expansion, typically sees intensified rivalry. Companies in such environments often focus on optimizing existing assets and operational efficiencies to maintain profitability, further intensifying the competitive struggle.

Calfrac's ability to differentiate its hydraulic fracturing services through advanced technology, operational efficiency, and superior service quality directly impacts competitive rivalry. When services are seen as interchangeable, the market often devolves into price-based competition, squeezing profit margins for all players.

The oil and gas industry, particularly the North American hydraulic fracturing market, has historically seen intense price competition. For instance, in 2023, average pricing for fracturing services experienced fluctuations, with some periods seeing operators aggressively bid down prices to secure market share, underscoring the commodity nature of basic fracturing services.

Low switching costs for Exploration and Production (E&P) companies exacerbate this rivalry. E&P firms can readily shift to alternative service providers with minimal disruption or financial penalty, often choosing the lowest bidder for standard fracturing jobs, which intensifies pressure on Calfrac to remain cost-competitive and innovative.

High Fixed Costs and Exit Barriers

The oilfield services sector, including companies like Calfrac, faces intense rivalry partly due to substantial fixed costs. These costs, associated with specialized drilling rigs, hydraulic fracturing fleets, and extensive infrastructure, demand high utilization rates to be recouped. For instance, a single hydraulic fracturing spread can cost upwards of $20 million to assemble and deploy.

High exit barriers further intensify this rivalry. Once significant capital is invested in specialized, often non-transferable assets, companies find it difficult and costly to leave the market. Contractual obligations with clients also bind operators, compelling them to continue operations even when market conditions are unfavorable. This persistence in the face of downturns frequently leads to overcapacity.

- High Capital Investment: The oilfield services industry requires massive upfront investment in specialized equipment, such as drilling rigs and fracturing fleets, which can run into tens of millions of dollars per unit.

- Asset Specificity: Equipment is highly specialized for oil and gas extraction, limiting its use or resale value outside the industry, thus increasing exit barriers.

- Contractual Commitments: Long-term service contracts can obligate companies to maintain operations and capacity, even during periods of low demand.

- Persistent Overcapacity: The combination of high fixed costs and exit barriers often results in more capacity than the market demands, forcing companies into aggressive pricing strategies to secure work.

Strategic Commitments and Market Share Drives

Competitive rivalry intensifies when players like Calfrac aggressively invest in new fleets and cutting-edge technology to capture or defend market share. This is particularly true in basins where rivals have established dominance or a strong desire to expand their footprint.

Calfrac faces this dynamic in key North American basins where competitors are known to make significant capital expenditures. For instance, in 2024, the oilfield services sector saw continued investment in high-spec equipment, with companies aiming to leverage technological advancements for efficiency gains. This often translates into periods of heightened pricing pressure as companies vie for contracts.

- Aggressive Capital Expenditure: Competitors are known to deploy substantial capital into upgrading and expanding their fleets, directly impacting market dynamics.

- Basin-Specific Competition: In regions like the Permian or the Montney, Calfrac encounters rivals with deep historical ties and strategic objectives to maintain or grow their market share, fueling intense competition.

- Pricing Pressure: The drive for market share and the deployment of new, efficient technology by rivals can lead to periods of aggressive pricing strategies within the industry.

Competitive rivalry within Calfrac's operating environment is fierce, driven by a fragmented market with numerous players ranging from global giants to specialized regional firms. This intense competition is further fueled by the commodity-like nature of many oilfield services, leading to price wars and squeezed profit margins, especially when the industry experiences slower growth. Low switching costs for clients mean they can easily opt for cheaper alternatives, putting constant pressure on Calfrac to maintain cost-effectiveness and differentiate its offerings through superior technology and service quality.

The industry's high fixed costs and asset specificity create significant barriers to exit, meaning companies remain in the market even during downturns, leading to persistent overcapacity. This situation forces operators to aggressively pursue contracts, often through price reductions, to ensure their expensive equipment remains utilized. For example, in 2023, the average pricing for fracturing services saw significant fluctuations as companies competed for market share.

Calfrac also contends with rivals making substantial capital expenditures to deploy new, efficient technology, particularly in key North American basins like the Permian. This investment in high-spec equipment by competitors intensifies pricing pressure as everyone vies for contracts and market dominance. Companies are investing heavily in upgrading fleets; for instance, a single hydraulic fracturing spread can cost over $20 million.

| Metric | 2023 Data (Illustrative) | 2024 Outlook (General Trend) |

|---|---|---|

| Average Fracturing Pricing | Experienced significant fluctuations, with periods of aggressive price competition. | Continued volatility expected, influenced by demand and competitor activity. |

| Capital Expenditures (Industry-wide) | Increased investment in high-spec equipment by major players. | Sustained or increased capital deployment for technological upgrades and fleet expansion. |

| Market Share Competition | Intense bidding for contracts in key basins. | Ongoing battle for market share, with technological differentiation as a key factor. |

SSubstitutes Threaten

The threat of substitutes for Calfrac's well completion services is a significant consideration. Innovations in alternative well optimization technologies, such as advanced drilling techniques that minimize the need for traditional interventions or novel reservoir stimulation methods that bypass conventional fracturing, pose a direct challenge. For instance, developments in in-situ conversion or enhanced oil recovery (EOR) techniques that don't rely on hydraulic fracturing could reduce Calfrac's market share.

While some enhanced oil recovery (EOR) methods work alongside hydraulic fracturing, others pose a potential threat by offering alternatives for specific well intervention needs. For instance, advancements in chemical flooding and thermal recovery could lessen the dependence on traditional fracturing for older, mature wells if their economic feasibility increases significantly.

This trend represents a longer-term substitution risk for companies like Calfrac, as more efficient or cost-effective EOR techniques gain traction. The global EOR market was valued at approximately $30 billion in 2023 and is projected to grow, indicating a growing interest in these alternative production methods.

The global shift towards renewable energy sources represents a significant, macro-level threat of substitution for oilfield services. As countries and corporations increasingly invest in and demand solar, wind, and other clean energy alternatives, the long-term need for fossil fuel exploration and production services, like those provided by Calfrac, could decline. This transition, driven by environmental concerns and technological advancements, fundamentally alters the energy landscape.

For instance, by the end of 2023, global renewable energy capacity additions reached a record 510 gigawatts (GW), a 50% increase from 2022, according to the International Energy Agency (IEA). This rapid expansion signals a sustained move away from traditional energy sources, directly impacting the market size and demand for oilfield services.

Improved Reservoir Management and Digitalization

Advances in reservoir management, powered by digitalization and data analytics, present a significant threat of substitution for Calfrac. These technologies allow exploration and production (E&P) companies to optimize existing wells, extending their productive life and potentially reducing the need for new well completions or interventions. For instance, predictive maintenance models can anticipate equipment failures, minimizing downtime and the demand for reactive hydraulic fracturing services.

The ability of E&P companies to extract more hydrocarbons from existing reservoirs through enhanced techniques, such as advanced water management and improved proppant selection, directly impacts the demand for Calfrac's core services. If operators can achieve higher recovery rates with fewer fracturing stages or less frequent stimulation jobs, the overall market size for Calfrac’s offerings could shrink.

- Digitalization in Reservoir Management: Companies are investing heavily in AI and IoT for real-time data analysis to optimize production.

- Extended Well Life: Improved reservoir understanding can lead to wells producing economically for longer periods, reducing the need for new drilling and stimulation.

- Efficiency Gains: Predictive analytics can reduce operational costs and the frequency of interventions, directly impacting service providers like Calfrac.

- Data-Driven Optimization: The trend towards data-driven decision-making in the E&P sector means that more efficient methods of production will be prioritized.

Regulatory Changes Favoring Less Intensive Extraction

Regulatory shifts that discourage intensive extraction methods, like hydraulic fracturing, pose a significant threat of substitution for Calfrac. For instance, increased scrutiny and potential bans on fracking in key operating regions could diminish demand for its specialized services. In 2024, several jurisdictions continued to debate or implement stricter environmental regulations on oil and gas extraction, potentially impacting the market size for high-intensity well intervention.

Such policy changes could directly reduce the addressable market for Calfrac's core offerings, forcing a pivot towards less intensive or alternative service lines. This environmental regulatory pressure is a growing concern for the entire oilfield services sector.

- Regulatory shifts: Governmental policies favoring less intensive extraction methods can act as a substitute threat.

- Market impact: Bans or restrictions on hydraulic fracturing directly reduce the addressable market for Calfrac's services.

- Strategic pivot: Companies may need to adapt service offerings to comply with new environmental standards.

The threat of substitutes for Calfrac's services is multifaceted, encompassing technological advancements, shifts in energy demand, and evolving operational strategies. Innovations in drilling and reservoir stimulation, alongside the broader transition to renewable energy, directly challenge the long-term demand for hydraulic fracturing. Furthermore, improved reservoir management and regulatory pressures can also diminish the need for Calfrac's core offerings.

For instance, the increasing efficiency of enhanced oil recovery (EOR) techniques, like chemical flooding, presents a viable alternative for production in certain mature fields. The global EOR market was valued at approximately $30 billion in 2023, highlighting a growing investment in these alternative methods. Concurrently, the rapid expansion of renewable energy capacity, with a 50% increase in additions in 2023 reaching 510 GW globally, signals a fundamental shift away from fossil fuels, impacting the overall market size for oilfield services.

Moreover, digital advancements in reservoir management allow exploration and production companies to optimize existing wells, potentially reducing the need for new completions. Predictive maintenance models, for example, can minimize downtime and the demand for reactive fracturing services. In 2024, stricter environmental regulations on extraction methods, including hydraulic fracturing, continued to emerge in various jurisdictions, further influencing the demand for Calfrac's specialized services.

| Substitution Threat | Description | 2023/2024 Data Point |

|---|---|---|

| Technological Advancements | New drilling techniques, alternative stimulation methods, advanced EOR | Global EOR market valued at ~$30 billion in 2023 |

| Energy Transition | Shift to renewable energy sources | Global renewable energy capacity additions increased 50% in 2023 to 510 GW |

| Digitalization & Reservoir Management | Optimizing existing wells, predictive maintenance | Increased investment in AI and IoT for real-time production analysis |

| Regulatory Shifts | Stricter environmental regulations on extraction | Continued debates and implementations of stricter regulations in key operating regions in 2024 |

Entrants Threaten

The oilfield services sector, especially for specialized operations such as hydraulic fracturing, necessitates massive capital outlays for equipment, cutting-edge technology, and essential infrastructure. New companies entering this arena must overcome substantial financial obstacles to procure and maintain vital assets like fracturing fleets and coiled tubing units, which acts as a significant deterrent for potential rivals.

New entrants face substantial regulatory and environmental hurdles, especially in key markets like North America and Argentina. Obtaining the necessary permits and adhering to stringent safety and environmental standards requires significant investment and time, often deterring potential competitors.

For instance, in 2024, the average time to secure environmental permits for new oil and gas operations in certain North American jurisdictions could extend beyond 18 months, with associated costs often running into hundreds of thousands of dollars. These compliance burdens represent a considerable barrier to entry, favoring established companies like Calfrac that have already invested in and optimized their compliance infrastructure.

New companies entering the well intervention market face a significant hurdle due to the substantial need for specialized expertise and advanced technology. Providing sophisticated solutions demands deep engineering knowledge, intricate technical skills, and often proprietary technological assets, which are not easily replicated.

The process of acquiring or developing this essential intellectual capital, along with attracting and retaining highly skilled personnel, presents a considerable challenge and requires significant time investment for any new entrant. Calfrac, for instance, has cultivated its competitive edge through years of dedicated operational experience and the continuous development of its core capabilities.

Established Customer Relationships and Reputation

Established customer relationships and a strong reputation are significant barriers to entry in the oil and gas sector. Major exploration and production (E&P) companies prioritize reliability, safety, and a proven history when awarding contracts, making it challenging for new entrants to gain traction. Calfrac's long-standing partnerships and demonstrated operational excellence provide a substantial competitive moat.

Building the trust and credibility that established players like Calfrac possess takes considerable time and consistent performance. This is particularly true given the high-stakes nature of oilfield services, where safety incidents can have severe financial and reputational consequences. For instance, in 2024, the industry continued to emphasize stringent safety protocols and performance metrics, areas where Calfrac has a well-documented track record.

- Client Loyalty: Major E&P firms often renew contracts with trusted service providers, creating a stable revenue stream for incumbents.

- Reputational Capital: A history of successful operations and safety compliance is a critical differentiator that new entrants must painstakingly build.

- Contractual Inertia: Existing long-term contracts with major clients lock in business for established companies, limiting opportunities for newcomers.

Economies of Scale and Experience Curve Effects

Existing players in the oilfield services sector, such as Calfrac, leverage significant economies of scale. This means they can negotiate better prices for equipment, chemicals, and labor due to their large purchasing volumes. For instance, Calfrac's 2023 operational expenditures were substantial, allowing for bulk discounts that a new, smaller entrant would struggle to match.

The experience curve effect also creates a barrier. As companies like Calfrac perform more fracturing jobs, they refine their processes, improve efficiency, and reduce waste, leading to lower per-unit costs over time. This accumulated operational knowledge means new entrants start with higher costs and potentially lower service quality until they build their own experience.

- Economies of Scale: Calfrac's large operational footprint in 2023 enabled it to secure favorable terms on essential supplies, a crucial advantage over smaller competitors.

- Experience Curve: Years of operational data allow Calfrac to optimize its fracturing techniques, reducing downtime and material usage, thus lowering costs per well completion.

- Cost Disadvantage for New Entrants: New companies entering the market cannot immediately replicate these cost efficiencies, facing higher initial operating expenses and making it difficult to compete on price.

- Capital Intensity: The oilfield services industry requires significant upfront capital for specialized equipment, further deterring new entrants who lack the scale to justify such investments.

The threat of new entrants in the oilfield services sector, particularly for specialized hydraulic fracturing, is considerably low due to immense capital requirements for equipment and technology. New companies also face steep regulatory and environmental compliance costs, often exceeding 18 months and hundreds of thousands of dollars for permits in key markets as of 2024. Furthermore, the need for specialized expertise and established customer relationships, built over years of reliable performance, creates significant barriers that deter new players from entering the market and competing effectively with incumbents like Calfrac.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024/2023) |

|---|---|---|---|

| Capital Requirements | High cost of specialized equipment (e.g., fracturing fleets) and infrastructure. | Significant financial hurdle, requiring substantial upfront investment. | Fracturing fleet costs can range from $10 million to $30 million per unit. |

| Regulatory & Environmental Compliance | Obtaining permits and adhering to stringent safety/environmental standards. | Time-consuming and costly, favoring established players with existing compliance frameworks. | Permit acquisition in some North American regions took over 18 months in 2024. |

| Expertise & Technology | Need for deep engineering knowledge, technical skills, and proprietary assets. | Difficult to replicate, requiring significant investment in human capital and R&D. | Calfrac's continuous development of core capabilities represents years of accumulated expertise. |

| Customer Relationships & Reputation | Prioritization of reliability, safety, and proven history by E&P companies. | Challenging for new entrants to gain trust and secure contracts without a track record. | Industry emphasis on safety protocols in 2024, where Calfrac has a strong history. |

| Economies of Scale & Experience Curve | Lower costs due to high purchasing volumes and optimized operational processes. | New entrants face higher initial costs and struggle to compete on price. | Calfrac's 2023 operational expenditures allowed for bulk discounts; experience reduces per-unit costs. |

Porter's Five Forces Analysis Data Sources

Our Calfrac Porter's Five Forces analysis is built upon a foundation of data from company annual reports, investor presentations, and industry-specific trade publications. We also incorporate information from financial databases and market intelligence reports to provide a comprehensive view of the competitive landscape.