Calfrac Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calfrac Bundle

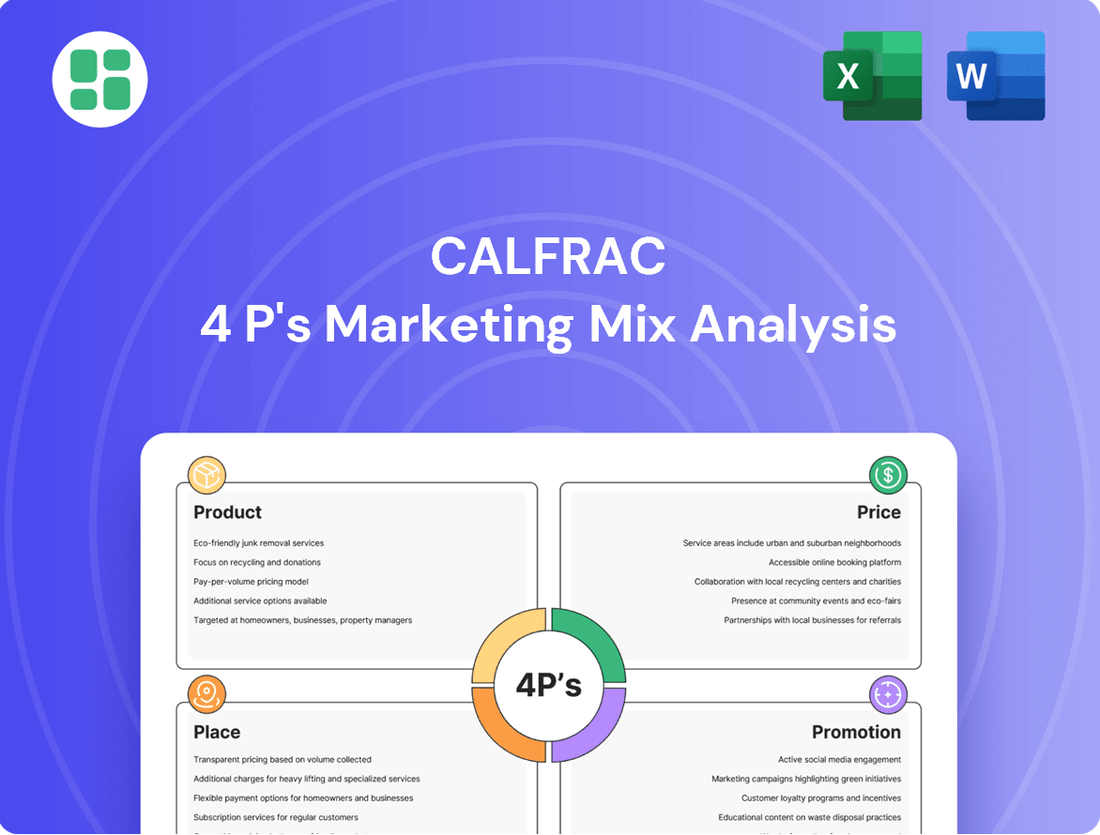

Unlock the secrets behind Calfrac's market dominance with a comprehensive 4Ps Marketing Mix Analysis. Understand their product innovation, strategic pricing, expansive distribution, and impactful promotion.

Go beyond the surface and gain access to an in-depth, ready-made Marketing Mix Analysis covering Calfrac's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants seeking strategic insights.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights and structured thinking—perfect for reports, benchmarking, or business planning. Get the full analysis now!

Product

Calfrac Well Services Ltd. excels in specialized well intervention, a crucial component of their marketing mix for optimizing oil and gas production. Their core offerings, including hydraulic fracturing, coiled tubing, and cementing, directly address the need for enhanced recovery and well integrity, particularly in complex unconventional plays. This focus positions them as a key partner for operators seeking to maximize output from their assets.

Calfrac's advanced pressure pumping technology is a cornerstone of its marketing mix, leveraging a formidable fleet of approximately 1.2 million horsepower across its global operations. This substantial capacity positions Calfrac as a dominant force in the pressure pumping industry, capable of handling complex and large-scale projects.

The company's commitment to innovation is evident in its strategic investment in next-generation technologies. A prime example is the ongoing modernization of its North American fleet, which includes the integration of dual-fuel capable dynamic gas blending engines. This initiative directly addresses environmental concerns by aiming to displace diesel fuel, thereby significantly reducing emissions.

Calfrac's tailored fluid and cementing programs are a cornerstone of their offering, meticulously designed to address the unique geological characteristics and operational objectives of each well. This bespoke approach ensures optimal performance and well integrity.

The company actively invests in research and development, evidenced by their focus on novel fluid and cementing technologies, the integration of green chemistries, and sophisticated rheological fluid studies conducted in their advanced laboratories. This commitment to innovation aims to enhance efficiency and environmental sustainability.

For instance, in 2024, Calfrac reported a significant increase in demand for its specialized cementing services, particularly in unconventional resource plays where precise fluid properties are critical for successful wellbore isolation. This demand underscores the value placed on their customized solutions.

Comprehensive Well Stimulation Services

Calfrac's comprehensive well stimulation services extend beyond its core offerings of hydraulic fracturing, coiled tubing, and cementing. These specialized techniques are crucial for optimizing hydrocarbon recovery from oil and gas formations.

These advanced stimulation methods are engineered to significantly enhance the reservoir's permeability, ensuring a more efficient and sustained flow of oil and gas. This directly translates into higher production volumes for their clients. For instance, in 2024, Calfrac reported a notable increase in demand for its specialized stimulation services, contributing to improved well productivity across its operational regions.

- Enhanced Reservoir Contact: Techniques designed to reach further into the reservoir rock.

- Improved Permeability: Services that increase the ease with which fluids flow through the formation.

- Production Optimization: Focus on maximizing the economic recovery of hydrocarbons.

- Extended Well Life: Stimulation methods that can help maintain production rates over longer periods.

Commitment to Safety and Quality

Safety is the cornerstone of Calfrac's operations, deeply embedded in its culture and reflected in its brand promise: 'Do it Safely, Do it Right, Do it Profitably.' This dedication is actively demonstrated through comprehensive pre-job training and a rigorous safety management program designed to minimize risks at every worksite. In 2024, Calfrac achieved a significant milestone with its Total Recordable Injury Frequency rate reaching a historic low, underscoring the effectiveness of these safety initiatives.

This unwavering commitment to safety translates directly into operational excellence and client confidence. Calfrac's proactive approach to risk mitigation not only protects its workforce but also ensures reliable and efficient service delivery. The company's focus on safety is a key differentiator, reinforcing its reputation as a trusted partner in the oil and gas industry.

- Safety Culture: Embedded in all operations and brand promise.

- Training & Management: Extensive pre-job training and robust safety programs.

- Performance: Achieved a record low Total Recordable Injury Frequency rate in 2024.

- Impact: Enhances operational reliability and client trust.

Calfrac's product offering centers on specialized well completion and stimulation services. These include hydraulic fracturing, coiled tubing, and cementing, all designed to enhance oil and gas recovery. Their extensive fleet, boasting approximately 1.2 million horsepower, allows them to handle large-scale projects efficiently.

Innovation is a key product differentiator, with investments in dual-fuel engines to reduce emissions. Calfrac also emphasizes tailored fluid and cementing programs, backed by R&D in areas like green chemistry. This focus on advanced, customized solutions directly addresses client needs for improved well performance and environmental responsibility.

| Service Category | Key Offerings | 2024 Performance Highlight | Strategic Focus |

|---|---|---|---|

| Well Stimulation | Hydraulic Fracturing, Coiled Tubing | Increased demand for specialized stimulation services | Enhanced reservoir contact, production optimization |

| Well Completion | Cementing | Significant increase in demand for cementing in unconventional plays | Improved permeability, extended well life |

| Technology & Innovation | Dual-fuel engines, Green Chemistry | Ongoing fleet modernization | Reduced emissions, enhanced efficiency |

What is included in the product

This analysis provides a comprehensive examination of Calfrac's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights into their market positioning and competitive landscape.

Provides a clear, actionable framework for understanding and optimizing Calfrac's marketing strategy, alleviating the pain of complex decision-making.

Offers a simplified yet comprehensive view of Calfrac's marketing efforts, easing the burden of strategic planning and execution.

Place

Calfrac’s strategic North American basin operations are a cornerstone of its market presence. The company boasts significant activity across the Williston Basin in North Dakota, the extensive Rockies region encompassing the Piceance, Uinta, and Powder River Basins, and the vital Appalachia Basin in the United States. This widespread footprint allows Calfrac to capitalize on diverse geological plays and client needs.

In Canada, Calfrac’s operational focus is firmly planted in the Western Canadian Sedimentary Basin, with key activities concentrated in Alberta and the northeastern reaches of British Columbia. This Canadian presence is crucial, especially given the projected capital expenditures in Canadian oil and gas for 2024, which are anticipated to see a modest increase. For instance, in 2023, Canadian upstream capital spending was estimated around CAD 70 billion, with expectations for continued investment in 2024, supporting demand for Calfrac's services.

Calfrac Well Services has established a significant and expanding footprint in Argentina. The company actively provides essential fracturing, coiled tubing, and cementing services across key operational areas, notably in the Neuquén Basin, Las Heras, and Comodoro Rivadavia. This strategic presence includes vital operations within the prolific Vaca Muerta shale play, a region increasingly recognized for its hydrocarbon potential.

Argentina has emerged as a crucial engine for Calfrac's revenue expansion. In 2024, the country was a primary contributor to the company's top-line growth, and this positive trajectory is anticipated to persist through 2025. This robust performance underscores the strategic importance of the Argentine market to Calfrac's overall business strategy and financial outlook.

Calfrac's direct service delivery model places its specialized oilfield equipment and skilled personnel directly at customer well sites. This hands-on approach is crucial for executing complex fracturing and coiled tubing operations. The company managed 13 active fracturing fleets and 3 coiled tubing units in North America as of Q1 2024, demonstrating its operational capacity.

Global Reach and Operational Footprint

Calfrac's operational reach, while heavily concentrated in North America and Argentina, demonstrates a historical and inherent capability for global deployment. This expansive footprint allows them to service oil and gas exploration and production needs across various international markets.

The company's dedicated workforce is distributed across its key operating regions, underscoring its commitment to localized expertise and service delivery. As of early 2024, Calfrac reported a significant employee base, with numbers fluctuating based on market activity but consistently representing a substantial operational team.

- North American Dominance: Calfrac's primary operational hubs are in Canada and the United States, where it holds a substantial market share in hydraulic fracturing services.

- Argentinian Presence: The company maintains a strong operational base in Argentina, catering to the Vaca Muerta shale play, a key growth area.

- Global Capability: Historically, Calfrac has operated or provided services in other regions, showcasing its adaptability to diverse geological and market conditions.

- Workforce Strength: In 2023, Calfrac employed thousands of individuals across its global operations, with a significant portion dedicated to field personnel.

Logistical and Infrastructure Capabilities

Calfrac's logistical prowess is critical for its extensive North American operations, ensuring efficient deployment and upkeep of its specialized hydraulic fracturing equipment. This robust network is designed for rapid response and on-site support, a key differentiator in the demanding oil and gas sector.

Supporting these operations are advanced, state-of-the-art laboratories strategically situated across key districts in the United States and Canada. These facilities are not just for maintenance; they provide direct, localized support to Calfrac's clientele, fostering closer relationships and quicker problem resolution.

For instance, in 2024, Calfrac continued to invest in its logistical infrastructure, aiming to reduce equipment transit times and enhance on-site service delivery. This focus on logistical efficiency directly impacts operational uptime for their customers.

- Strategic Lab Placement: Calfrac operates advanced laboratories in key U.S. and Canadian districts to offer direct customer and operational support.

- Equipment Deployment Efficiency: Robust logistical capabilities ensure timely and effective deployment of specialized fracturing equipment across widespread operational areas.

- Maintenance and Support Network: The infrastructure supports state-of-the-art maintenance, minimizing downtime and maximizing operational readiness.

Calfrac's physical presence is strategically distributed across key North American basins, including the Williston, Rockies, and Appalachia, alongside significant operations in Canada's Western Canadian Sedimentary Basin. The company also boasts a growing footprint in Argentina, particularly within the Vaca Muerta play, which significantly contributed to its revenue in 2024 and is expected to continue doing so through 2025. This extensive network ensures proximity to clients and efficient service delivery.

Calfrac's operational model emphasizes direct service delivery, placing specialized equipment and personnel at customer well sites. As of Q1 2024, the company operated 13 fracturing fleets and 3 coiled tubing units in North America. Its logistical infrastructure, including strategically located laboratories in the U.S. and Canada, supports efficient equipment deployment and maintenance, crucial for minimizing customer downtime.

| Region | Key Basins/Areas | 2024/2025 Significance |

|---|---|---|

| North America | Williston, Rockies, Appalachia (US); Western Canadian Sedimentary Basin (Canada) | Core operational hubs, significant market share in fracturing services. |

| Argentina | Neuquén Basin, Vaca Muerta shale play | Primary revenue growth engine for 2024, projected continued expansion through 2025. |

Full Version Awaits

Calfrac 4P's Marketing Mix Analysis

The preview shown here is the actual Calfrac 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This comprehensive analysis covers product, price, place, and promotion strategies for Calfrac. You're viewing the exact version of the analysis you'll receive, fully complete and ready for your strategic planning.

Promotion

Calfrac's client relationship management is built on a foundation of trust and proven performance, serving a broad spectrum of clients from global giants to smaller private operators. Their promotional efforts are deeply rooted in showcasing operational excellence and successful project execution, which cultivates enduring client loyalty and encourages repeat business.

The company's commitment to client satisfaction is evident in its consistent delivery, as demonstrated by their robust project pipeline. For instance, in the first quarter of 2024, Calfrac reported a significant increase in revenue, partly driven by strong demand from its established client base, underscoring the effectiveness of their relationship-centric approach.

Calfrac leverages its deep industry expertise to showcase technological advancements and a commitment to innovation in well completion and stimulation. This is evident in their proprietary designs and strategic alliances with manufacturers, ensuring clients benefit from cutting-edge solutions.

A key aspect of their innovation is the adoption of next-generation propulsion systems, such as the Allison FracTran. This focus on advanced technology, including their 2024 fleet upgrades, positions Calfrac as a leader in efficiency and performance within the energy services sector.

Calfrac's promotional messaging strongly emphasizes safety and operational excellence, a cornerstone of their brand promise: 'Do it Safely, Do it Right, Do it Profitably.' This commitment resonates deeply with clients in the oil and gas industry, where reliability and responsible practices are paramount. For instance, in 2024, Calfrac reported a Total Recordable Incident Frequency (TRIF) of 0.75, significantly below the industry average, underscoring their dedication to safe operations.

Participation in Industry Events and Publications

Calfrac's participation in industry events and publications is a key component of its marketing strategy. While specific 2024-2025 event details aren't publicly available, companies like Calfrac typically leverage these avenues to showcase innovation and build relationships. These engagements are crucial for staying competitive in the oilfield services sector.

Attending and presenting at industry conferences allows Calfrac to directly engage with a targeted audience, demonstrating their technical expertise and operational capabilities. This visibility can translate into new business opportunities and strengthened partnerships. The company's presence at these events underscores its commitment to industry leadership.

Key benefits of this promotional activity include:

- Showcasing Technological Advancements: Presenting new technologies and service offerings to industry peers and potential clients.

- Networking Opportunities: Building and maintaining relationships with customers, suppliers, and other stakeholders.

- Brand Visibility and Credibility: Enhancing Calfrac's reputation as a reliable and innovative service provider.

- Market Intelligence Gathering: Understanding competitor activities and emerging industry trends.

Investor Relations and Financial Communications

Calfrac actively engages its investor base through comprehensive financial communications. This includes timely dissemination of financial performance data, strategic updates, and operational highlights via press releases, investor presentations, and quarterly conference calls. For instance, in their Q1 2024 earnings call, Calfrac provided detailed segment performance and outlook, reinforcing their commitment to transparency.

This consistent flow of information directly supports the investor relations function, building trust and informing stakeholders about the company's trajectory. By clearly articulating financial results and future plans, Calfrac aims to cultivate a perception of stability and growth potential. This strategic transparency is crucial for attracting and retaining investment capital.

The company's commitment to robust investor relations is evident in its proactive approach to market communication. For example, Calfrac's 2023 Annual Report, released in early 2024, offered a detailed review of their financial and operational achievements, including a significant increase in revenue and adjusted EBITDA compared to 2022. This detailed reporting serves to indirectly market the company's value proposition to the financial community.

- Financial Transparency: Calfrac utilizes news releases, annual reports, and conference calls to share financial performance and strategic direction.

- Stakeholder Information: This communication strategy aims to keep financial stakeholders well-informed about the company's progress.

- Market Perception: The transparency fosters an image of stability and growth prospects, influencing broader market perception.

- 2023 Performance: Calfrac reported a notable revenue increase and improved adjusted EBITDA in their 2023 financial year, as detailed in their early 2024 annual report.

Calfrac's promotion strategy effectively highlights operational excellence and technological innovation, fostering strong client loyalty and repeat business. Their emphasis on safety, exemplified by a 2024 TRIF of 0.75, reinforces their brand promise and appeals to the oil and gas industry's need for reliability.

Industry event participation and robust investor relations are key promotional pillars, showcasing advancements and building credibility. Calfrac's transparent financial communications, including detailed 2023 performance data released in early 2024, aim to cultivate a perception of stability and growth potential.

The company's commitment to next-generation technology, such as the Allison FracTran, and fleet upgrades in 2024, positions them as an industry leader in efficiency. This focus on innovation, coupled with a strong safety record, is central to their promotional messaging.

Calfrac's promotional efforts are deeply integrated with their client-centric approach, emphasizing proven performance and successful project execution. Their proactive investor relations, including detailed Q1 2024 updates, further bolster market confidence.

| Key Promotional Aspect | Focus Area | Evidence/Data Point |

|---|---|---|

| Operational Excellence & Safety | Client Trust & Reliability | 2024 TRIF: 0.75 (below industry average) |

| Technological Innovation | Efficiency & Performance | 2024 fleet upgrades; Allison FracTran adoption |

| Industry Engagement | Brand Visibility & Networking | Participation in industry events (ongoing) |

| Investor Relations | Financial Transparency & Growth Perception | 2023 Revenue & Adjusted EBITDA increase (reported early 2024) |

Price

Calfrac's pricing for value-based service contracts likely centers on the demonstrable production increases and cost efficiencies clients experience. This means contracts are structured to reflect the direct economic uplift generated by their specialized oilfield services, rather than a simple cost-plus model.

For example, in 2024, the oilfield services sector saw a significant demand for technologies that improve well productivity. Calfrac's ability to deliver these improvements, leading to higher hydrocarbon recovery rates for its clients, directly justifies a premium pricing structure that captures a portion of that enhanced value.

Calfrac operates in a highly competitive oilfield services sector where pricing is directly tied to market conditions, including oil and gas demand and the actions of rivals. This dynamic means Calfrac must remain agile in its pricing strategies.

In 2024, Calfrac encountered substantial pricing pressure within the United States market. This reflects the company's need to adjust its pricing in response to evolving market demand and competitive pressures, a common challenge in this industry.

Pricing for Calfrac's services is highly sensitive to regional market dynamics. In early 2024, North America experienced a softer pricing environment, with utilization rates reflecting this trend.

Conversely, Argentina showcased robust activity in Q1 2025, leading to improved pricing for spot jobs. This highlights how localized demand and service availability directly impact Calfrac's revenue generation across different operating areas.

Project Complexity and Scope

The cost of Calfrac's well intervention services is directly tied to the intricacy and demands of each project. For instance, a complex deep horizontal well requiring specialized fracturing fluids and extended pumping hours will naturally incur higher costs than a simpler vertical well intervention.

Several elements influence this pricing. These include:

- Well Type and Depth: Deeper and more complex well designs, such as unconventional horizontal wells, necessitate more advanced equipment and longer operational times, driving up costs.

- Geological Formations: The hardness and permeability of the rock being treated significantly impact the type and volume of fluids and proppants required, as well as the pumping pressures needed.

- Equipment and Fluid Chemistry: Specialized pumping units, advanced downhole tools, and custom-blended fluid chemistries, often required for challenging formations or environmental regulations, add to the overall project expense.

In 2024, the North American oil and gas industry saw continued focus on efficiency and cost optimization. While specific project pricing for Calfrac is proprietary, industry trends indicate that projects demanding higher proppant concentrations and more sophisticated fluid systems, often necessary for maximizing recovery in challenging plays, would represent the higher end of the cost spectrum.

Strategic Capital Deployment and Returns

Calfrac strategically deploys capital to maximize net income and deliver sustainable shareholder returns, influencing its pricing. The company balances investments in new technologies and fleet upgrades with prevailing market conditions, aiming for profitability and long-term financial stability. For instance, in the first quarter of 2024, Calfrac reported a net income of $28 million, demonstrating its focus on profitable operations.

This approach ensures that pricing reflects both the value delivered through advanced services and the need to maintain a healthy balance sheet. The company's capital expenditure in 2024 is projected to be between $300 million and $350 million, a significant investment aimed at enhancing operational efficiency and technological capabilities, which will ultimately support its pricing strategy.

- Capital Allocation: Calfrac's capital deployment prioritizes investments that enhance service offerings and operational efficiency, directly impacting its ability to command premium pricing.

- Fleet Modernization: Ongoing investments in modernizing its fleet, such as the integration of advanced fracturing technologies, support higher service pricing by delivering superior performance and environmental benefits.

- Market Responsiveness: Pricing strategies are dynamically adjusted to align with market demand and competitive pressures, ensuring that capital is deployed efficiently and profitability is maintained.

- Shareholder Value Focus: The ultimate goal of prudent capital deployment and effective pricing is to generate sustainable net income and maximize returns for Calfrac's shareholders.

Calfrac's pricing strategy is deeply intertwined with the value it delivers, focusing on production increases and cost efficiencies for clients. This value-based approach, rather than a simple cost-plus model, allows Calfrac to capture a share of the economic uplift generated by its specialized services.

Market conditions significantly influence Calfrac's pricing, with regional dynamics playing a crucial role. For instance, while North America experienced softer pricing in early 2024, Argentina saw robust activity and improved pricing for spot jobs in Q1 2025.

The company's capital allocation, including a projected $300 million to $350 million in capital expenditures for 2024, aims to enhance operational efficiency and technological capabilities, supporting its ability to command premium pricing and maintain profitability.

Calfrac's net income of $28 million in Q1 2024 underscores its commitment to profitable operations, which is a key consideration in its overall pricing structure and financial strategy.

| Metric | 2024 (Projected/Actual) | 2025 (Q1 Actual) |

|---|---|---|

| North America Pricing Environment | Softer | N/A |

| Argentina Pricing Environment | N/A | Robust (Spot Jobs) |

| Capital Expenditures | $300M - $350M | N/A |

| Net Income | N/A | $28M (Q1) |

4P's Marketing Mix Analysis Data Sources

Our Calfrac 4P's Marketing Mix Analysis leverages a comprehensive suite of data, including official company reports, investor relations materials, and industry-specific market research. We meticulously examine product portfolios, pricing structures, distribution channels, and promotional activities to provide a robust understanding of their market strategy.