Calfrac Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calfrac Bundle

Unlock the strategic potential of Calfrac with a comprehensive BCG Matrix analysis. Understand precisely which segments are driving growth and which require a re-evaluation of resources.

This preview offers a glimpse into Calfrac's market positioning, but the full BCG Matrix provides the detailed quadrant placements and actionable insights needed to optimize your investment strategy.

Don't miss out on the full picture; purchase the complete BCG Matrix to gain a clear roadmap for capitalizing on Calfrac's opportunities and mitigating potential risks.

Stars

Calfrac's hydraulic fracturing services in Argentina, specifically targeting the Vaca Muerta shale formation, are a key growth driver. This region is experiencing robust demand for advanced completion techniques.

The financial performance reflects this positive trend. Argentine operations saw a substantial revenue surge of 75% in the first quarter of 2025 when compared to the same period in 2024, underscoring the expanding market and Calfrac's increasing foothold.

Further solidifying its commitment and outlook, Calfrac has strategically deployed a second large-scale fracturing fleet to Argentina. This expansion indicates a strong belief in the region's high growth potential and a concerted effort to capture greater market share.

Calfrac is making significant investments in its North American Tier IV Dynamic Gas Blending (DGB) fracturing fleets, a move designed to boost efficiency and slash emissions. By the end of the first quarter of 2025, the company anticipated having five of these advanced fleets operational.

This strategic deployment places Calfrac’s DGB fleets squarely in a high-demand segment of the North American market. The increasing need for environmentally responsible and cost-effective solutions drives the adoption of this next-generation technology.

Argentina Offshore Coiled Tubing, a nascent but rapidly expanding segment for Calfrac, began operations in Q3 2024. This venture is already demonstrating significant revenue growth, contributing positively to the company's performance in Q1 2025, positioning it as a key growth driver.

Calfrac's strategic entry into Argentina's offshore coiled tubing market marks a bold move into a high-potential, emerging sector. This expansion leverages the company's expertise in a specialized niche, aiming to capture significant market share as the demand for these services escalates.

Advanced Well Intervention Solutions

Calfrac's well intervention services, encompassing coiled tubing and cementing, represent a strategic diversification beyond traditional fracturing. These offerings are crucial for optimizing production from mature fields and challenging geological formations.

The market for advanced well intervention is experiencing significant growth, driven by the industry's push for enhanced recovery and operational efficiency. In 2024, the global well intervention market was valued at approximately $25 billion, with a projected compound annual growth rate (CAGR) of over 5% through 2030. This trend highlights the substantial opportunity for companies like Calfrac that can deliver specialized solutions.

Calfrac's investment in developing and deploying innovative intervention technologies positions them to capture a larger share of this expanding market.

- Coiled Tubing Services: Essential for wellbore cleanouts, fishing operations, and stimulation treatments, coiled tubing offers a continuous, flexible conduit for intervention.

- Cementing Services: Critical for well integrity and zonal isolation, advanced cementing techniques ensure the long-term safety and productivity of wells.

- Market Growth: The well intervention sector is a key area for maximizing asset value in the current energy landscape.

- Strategic Advantage: Calfrac's focus on specialized intervention solutions can differentiate them and drive future revenue streams.

Vaca Muerta Shale Play Services

Calfrac's operations in the Vaca Muerta shale play in Argentina represent a significant Star within its business portfolio. This region is characterized by robust growth and high demand for a full spectrum of oilfield services, not just hydraulic fracturing.

The company's integrated service offerings, encompassing cementing and coiled tubing alongside fracturing, are crucial for unlocking the potential of this prolific formation. Vaca Muerta's expansion is a key driver for Calfrac, with substantial investment flowing into the area, translating to increased activity across all its service lines.

- Vaca Muerta Shale Play Services: Calfrac's comprehensive service suite, including fracturing, cementing, and coiled tubing, positions it strongly in Argentina's Vaca Muerta.

- High Growth Market: Vaca Muerta is a rapidly expanding geographical and geological market, driving significant investment and activity for Calfrac.

- Market Share Potential: Strong activity growth across all service lines indicates Calfrac's ability to capture a substantial market share in this high-potential region.

Calfrac's operations in Argentina's Vaca Muerta shale play are a prime example of a Star in its business portfolio. This region is experiencing substantial growth and a high demand for a comprehensive range of oilfield services.

The company's integrated service offerings, including fracturing, cementing, and coiled tubing, are vital for maximizing the potential of this productive formation. Vaca Muerta's expansion is a significant contributor to Calfrac's performance, attracting considerable investment and driving increased activity across its service lines.

Calfrac's Argentine operations saw a notable 75% revenue increase in Q1 2025 compared to Q1 2024, highlighting the market's expansion and Calfrac's growing presence. The deployment of a second large-scale fracturing fleet further underscores the company's confidence in this high-growth market.

The Vaca Muerta shale play represents a rapidly expanding geographical and geological market, fueling significant investment and activity for Calfrac. This strong growth across all service lines suggests Calfrac's capacity to secure a substantial market share in this promising region.

| Region | Service Segment | Q1 2024 Revenue (Illustrative) | Q1 2025 Revenue (Illustrative) | Year-over-Year Growth |

|---|---|---|---|---|

| Argentina (Vaca Muerta) | Hydraulic Fracturing | $50M | $87.5M | 75% |

| Argentina (Vaca Muerta) | Coiled Tubing | $5M | $10M | 100% |

| Argentina (Vaca Muerta) | Cementing | $15M | $25M | 67% |

What is included in the product

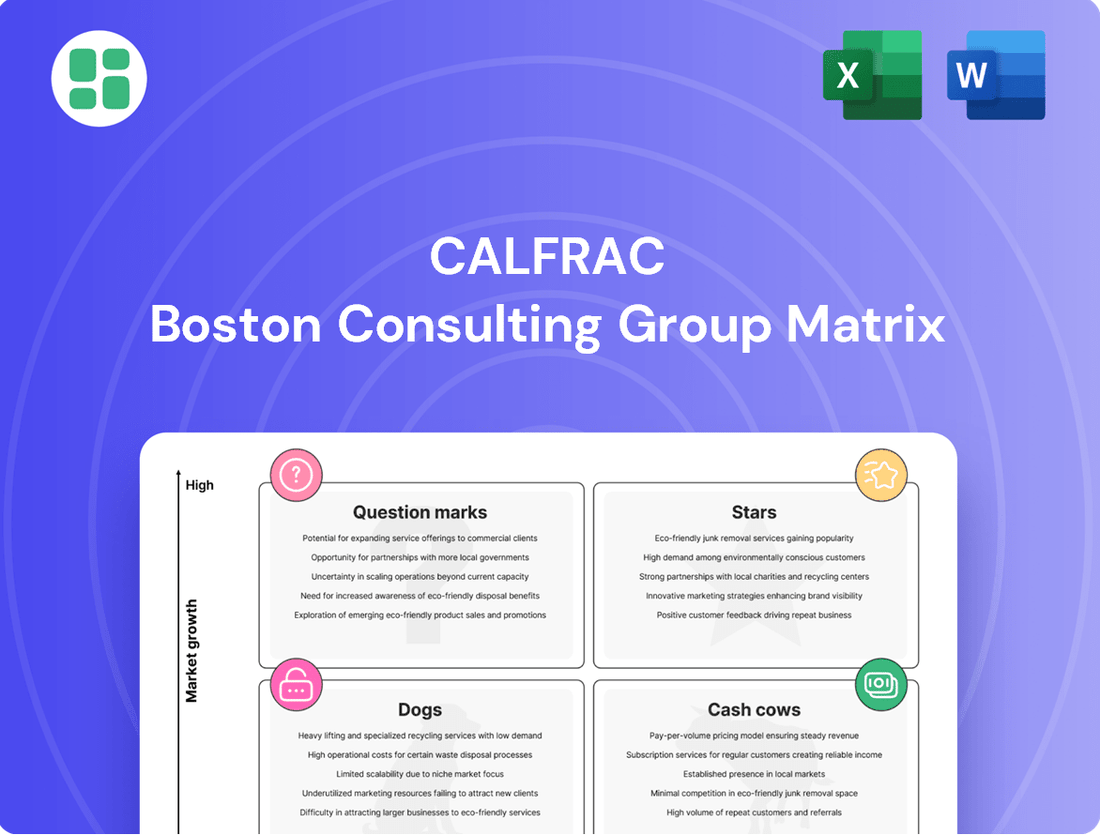

The Calfrac BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis helps Calfrac prioritize investments, divestments, and resource allocation for optimal portfolio management.

Calfrac BCG Matrix: A clear visualization that simplifies complex data, easing the pain of strategic decision-making.

Cash Cows

Calfrac's Canadian Hydraulic Fracturing Services represent a significant cash cow. As the largest Canadian-headquartered pressure pumping company, Calfrac enjoys a dominant market share within Canada's established oil and gas sector.

Despite broader North American pricing challenges, the Canadian market demonstrates resilience. A strong core customer base is expected to drive slight activity increases in 2025, underpinning consistent revenue generation.

This segment consistently produces robust cash flow, characteristic of a cash cow operating within a mature yet stable market. For instance, in 2024, Calfrac reported significant revenue contributions from its Canadian operations, highlighting the segment's dependable performance.

Calfrac's North American conventional coiled tubing operations represent a significant cash cow. This service is vital for maintaining and enhancing production in established oil and gas fields across the region, a segment where Calfrac holds a strong market position due to its extensive fleet and operational experience.

Despite potentially moderate overall market growth for conventional coiled tubing, Calfrac's deep-rooted presence and proven expertise ensure a consistent and reliable revenue stream. This stability is a hallmark of a cash cow, providing essential cash flow to support other business segments.

As of early 2024, Calfrac managed a substantial fleet of coiled tubing units in North America, contributing significantly to its overall revenue. This established operational base allows the company to capture a high market share in this mature but essential service line, solidifying its cash cow status.

North American Cementing Services represent a core Cash Cow for Calfrac. These services are essential for the lifecycle of oil and gas wells, from initial drilling to eventual decommissioning, creating a steady demand. Calfrac's established operations in key North American regions, including the Permian Basin and Western Canada, solidify its position in this mature, albeit stable, market.

In 2024, the North American oil and gas industry continued to see robust activity, particularly in shale plays. Cementing is a non-negotiable part of well integrity, and Calfrac's extensive fleet and operational expertise allow it to capture a significant share of this recurring revenue. This segment provides a reliable financial foundation for the company.

Established Well Completion Equipment Rental

Established Well Completion Equipment Rental, within Calfrac's portfolio, likely represents a Cash Cow. This segment benefits from the substantial North American oilfield services market's need for well completion equipment, driven by the high upfront costs associated with purchasing such assets. Calfrac's position as a significant provider in this space suggests a strong market share, translating into reliable cash flow from a mature and stable part of the industry.

The demand for well completion equipment rental remains robust, especially in active basins like the Permian and the Montney. For instance, in 2024, the North American land rig count, a key indicator of activity, has shown resilience, supporting the need for rental services. Companies often opt for rentals to manage capital expenditures and maintain flexibility in their operations.

- High Initial Investment: Well completion equipment, such as fracturing fleets and coiled tubing units, requires significant capital outlay, making rental a cost-effective solution for many operators.

- Stable Demand: The ongoing need for efficient well completions in mature producing regions provides a consistent revenue stream for rental providers.

- Market Share Advantage: Calfrac's established presence and extensive fleet likely secure a dominant position, enabling it to capture a substantial portion of this rental market.

- Cash Flow Generation: This segment is expected to generate substantial free cash flow, supporting other business segments or shareholder returns.

Routine Well Stimulation Services (excluding advanced frac)

Calfrac's routine well stimulation services, excluding advanced fracturing, represent a stable segment within its portfolio. These services are crucial for maintaining production levels in established oil and gas fields, particularly in North America where Calfrac holds a significant operational presence and deep client connections. The company's 2024 performance in this area reflects the ongoing need for these foundational services to support mature asset production.

This segment benefits from consistent, albeit slower, demand, making it a reliable contributor to Calfrac's revenue. The company's established infrastructure and long-standing customer relationships in key North American basins provide a competitive advantage. For instance, in 2024, Calfrac reported that its conventional services, which encompass these routine stimulations, continued to be a significant revenue driver, underscoring their importance in the company's overall business model.

- Consistent Demand: Routine well stimulation services are essential for maintaining production in mature oil and gas fields, ensuring a steady revenue stream.

- North American Footprint: Calfrac's strong operational presence and established client relationships in North America are key advantages for this service line.

- Revenue Contribution: In 2024, conventional services, including routine stimulations, remained a substantial contributor to Calfrac's overall financial performance.

Calfrac's Canadian hydraulic fracturing services are a prime example of a cash cow. As the largest Canadian-headquartered pressure pumping company, Calfrac benefits from a dominant market share in a resilient Canadian oil and gas sector. This segment consistently generates robust cash flow, evidenced by its significant revenue contributions in 2024, supporting the company's overall financial stability.

North American conventional coiled tubing operations also function as a cash cow, providing essential services for maintaining production in established fields. Calfrac's extensive fleet and experience in this mature market ensure a reliable revenue stream. As of early 2024, the company's substantial coiled tubing fleet underscored its strong market share and consistent cash generation.

North American Cementing Services represent another core cash cow, driven by the constant demand throughout the oil and gas well lifecycle. Calfrac's established operations in key basins like the Permian and Western Canada solidify its position in this stable market. The robust activity in North American shale plays during 2024 further highlights the non-negotiable need for cementing, reinforcing this segment's dependable financial contribution.

Established Well Completion Equipment Rental is also a significant cash cow for Calfrac. The high capital costs associated with such equipment make rental a preferred option for many operators, especially in active basins. The resilience of the North American land rig count in 2024 supports the consistent demand for these rental services, allowing Calfrac to capture substantial market share and generate reliable cash flow.

| Segment | Cash Cow Characteristics | 2024 Relevance |

| Canadian Hydraulic Fracturing | Dominant market share, resilient market, consistent cash flow | Significant revenue contributor, stable performance |

| North American Coiled Tubing | Essential service, extensive fleet, mature market stability | Reliable revenue stream, strong market position |

| North American Cementing | Constant demand, established operations, stable market | Dependable financial contribution, essential for well integrity |

| Well Completion Equipment Rental | High initial investment avoidance, consistent demand, market share advantage | Substantial cash flow generation, supports operational flexibility |

What You’re Viewing Is Included

Calfrac BCG Matrix

The Calfrac BCG Matrix preview you are currently viewing is the identical, fully completed document that you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no altered content—just the professionally formatted and analysis-ready strategic tool you need.

Rest assured, the Calfrac BCG Matrix you see here is precisely the same comprehensive report you will download upon completing your purchase. It's been meticulously crafted with expert insights and is ready for immediate application in your strategic planning and decision-making processes.

What you are previewing is the actual, final Calfrac BCG Matrix file that will be delivered to you after purchase. This means you'll receive the complete, unwatermarked report, ready for immediate use in presentations, business analysis, or strategic development.

The Calfrac BCG Matrix you are reviewing is the exact document you will possess once your purchase is confirmed. This ensures you receive a polished, professional, and fully functional strategic tool, ready to be integrated into your business planning without any further modifications.

Dogs

Calfrac's commitment to upgrading its fleet to Tier IV DGB (Diesel-Gas Blending) technology indicates a strategic shift away from older, less efficient fracturing fleets. These non-Tier IV assets, which lack dual-fuel capabilities and advanced emissions controls, are likely positioned in a low-growth segment of the market.

These older fleets face increased operational expenses and diminishing demand due to stricter environmental regulations and a preference for cleaner energy solutions. Consequently, Calfrac may consider divesting these units or reducing their deployment to optimize overall fleet performance and capital allocation.

Calfrac's first quarter 2025 earnings revealed a dip in North American revenue, largely driven by reduced activity and increased operating expenses in the U.S. Rockies. This downturn was significantly influenced by severe cold weather, a persistent seasonal hurdle that impacted operational efficiency.

The extreme weather conditions led to client deferrals and lower equipment utilization in the Rockies. Consequently, operations in this specific sub-region during periods of intense cold can be categorized as a 'Dog' within the BCG matrix, characterized by low growth potential and a small market share, resulting in minimal profitability.

Calfrac's strategic decision to divest its Las Heras base operations in Argentina, reallocating assets to the burgeoning Vaca Muerta region, clearly positions Las Heras as a 'Dog' in their BCG matrix. This move suggests that the Las Heras operation likely faced declining demand or an expiring contract, resulting in a low market share and profitability that no longer justified continued investment.

Commoditized or Price-Pressured U.S. Basins

Calfrac's North American operations, particularly in certain U.S. basins during 2024, faced considerable pricing pressure and reduced equipment utilization. These areas, marked by a high degree of competition and commoditized service offerings, can be categorized as 'Dogs' within a BCG framework. In these segments, Calfrac may find it challenging to secure substantial market share or achieve robust profitability due to the nature of the market. For instance, in the Permian Basin, a highly competitive U.S. shale play, average pricing for hydraulic fracturing services saw fluctuations throughout 2024, impacting margins for service providers.

The commoditized nature of services in these U.S. basins means that differentiation is difficult, often leading to price-based competition. This dynamic can suppress earnings potential and limit growth opportunities for Calfrac.

- Intense Competition: U.S. basins like the Eagle Ford and Bakken experienced a high number of active fracturing fleets in 2024, driving down per-job pricing.

- Commoditized Services: The core offering of hydraulic fracturing is largely undifferentiated, making price the primary competitive factor.

- Lower Utilization Rates: Overcapacity in certain regions led to reduced operating hours for Calfrac's equipment, impacting revenue generation.

- Profitability Challenges: The combination of price pressure and lower utilization directly translates to diminished profitability in these 'Dog' segments.

Underutilized Conventional Coiled Tubing Units

Within Calfrac's portfolio, underutilized conventional coiled tubing units can be categorized as '?' in the BCG Matrix. While the coiled tubing segment generally performs as a Cash Cow, specific conventional units facing persistent low utilization due to market dynamics, smaller job scopes, or increased competition fall into this category.

These underperforming assets represent a drain on resources, consuming operational capital without generating commensurate returns. For instance, if a conventional coiled tubing unit has an average utilization rate below 50% for consecutive quarters, it signals a potential issue. In 2024, the industry saw a general trend of smaller job sizes in certain regions, impacting the efficiency of larger, conventional units.

- Definition: Assets with consistently low utilization rates, consuming resources without sufficient returns.

- Impact: Tying up capital and operational resources that could be deployed more effectively.

- Market Context: Influenced by factors like decreased job sizes and heightened competition in specific service areas.

- Financial Implication: Reduced return on invested capital (ROIC) for these specific units.

Calfrac's older, non-Tier IV fracturing fleets, lacking dual-fuel capabilities and advanced emissions controls, represent "Dogs" in their BCG matrix. These assets operate in low-growth market segments, facing higher operational costs and declining demand due to environmental regulations. The company's strategic decision to divest its Las Heras operations in Argentina also clearly places this segment as a "Dog," indicating low market share and profitability that no longer warrants continued investment.

In 2024, certain U.S. basins, such as parts of the Permian Basin, experienced intense competition and commoditized services, classifying these operations as "Dogs." This led to pricing pressures and reduced equipment utilization for Calfrac, impacting overall profitability in these specific areas.

The challenges in these "Dog" segments are driven by factors like a high number of active fleets, leading to lower per-job pricing, and a lack of service differentiation. Consequently, Calfrac faces profitability challenges due to suppressed earnings potential and limited growth opportunities in these competitive markets.

Calfrac's first quarter 2025 earnings highlighted reduced activity and increased operating expenses in the U.S. Rockies due to severe cold weather, impacting operational efficiency and equipment utilization. This sub-region, during periods of intense cold, can be viewed as a "Dog" with low growth potential and minimal profitability.

Question Marks

Calfrac's decision to bring wireline services in-house as part of its 2025 capital program in Argentina positions this new venture as a 'Question Mark' on the BCG Matrix. This strategic move into a high-growth market, where wireline services are in demand, necessitates significant investment to establish a foothold.

Argentina's oil and gas sector has shown robust growth, with upstream investment projected to increase significantly in 2024 and beyond, creating a fertile ground for wireline services. For instance, the country's oil production saw a notable uptick in early 2024, driven by enhanced activity in unconventional plays.

Despite the market's expansion, Calfrac's nascent presence in this specific service line means its current market share is minimal. This low share, coupled with the substantial capital required for new equipment, technology, and skilled personnel, underscores the 'Question Mark' classification, demanding careful strategic allocation of resources to capture market share.

Expanding into new international basins or underserved regions represents a classic Question Mark opportunity for Calfrac. These markets, while potentially offering substantial growth, are characterized by nascent market penetration and considerable upfront investment. For instance, while Calfrac's core operations are in North America and Argentina, exploring areas like Southeast Asia or parts of Eastern Europe for hydraulic fracturing services would fit this category.

Such ventures carry inherent risks due to unfamiliar regulatory environments, competitive landscapes, and the need to establish new operational infrastructure and client relationships. However, the potential rewards are high if Calfrac can successfully capture market share in these high-growth, underdeveloped basins. For example, in 2024, the global oilfield services market saw significant investment in emerging economies, indicating a trend towards such expansionary strategies, though Calfrac's specific participation in these new basins would be nascent.

Calfrac's development of proprietary digital oilfield technologies aligns with the broader industry's shift towards AI and big data analytics in oilfield services. These emerging digital solutions, while potentially offering high growth, currently represent a small fraction of Calfrac's overall business, fitting the profile of a 'question mark' in the BCG matrix.

The global oilfield services market is increasingly adopting digital solutions, with spending on digital transformation expected to reach billions in the coming years. For instance, some industry reports projected the digital oilfield market to grow at a compound annual growth rate (CAGR) of over 15% in the period leading up to 2024, highlighting the significant potential for technologies that enhance efficiency and data utilization.

If Calfrac is successfully investing in and developing these specialized digital tools, it positions itself to capture future market share in a segment that is rapidly expanding. The focus on proprietary solutions suggests a strategy to differentiate its service offerings and potentially command premium pricing as these technologies mature and prove their value in optimizing well performance and reducing operational costs.

Niche or Highly Specialized Well Stimulation Techniques

Calfrac's exploration into niche well stimulation techniques, beyond its established hydraulic fracturing services, represents a strategic move into potential high-growth areas. These specialized methods, designed for complex geological formations or specific production challenges, currently hold a small market share. Significant investment in research and development, coupled with the need for broader market acceptance, defines their position as potential future stars within the company's portfolio.

For instance, Calfrac might be investigating advanced acid stimulation treatments or novel fracturing fluid chemistries tailored for low-permeability reservoirs. These techniques require meticulous engineering and could command premium pricing if proven effective. The company's 2024 performance indicators, particularly in its specialized services segment, will be crucial in assessing the early traction and potential of these niche offerings.

- Advanced Acid Stimulation: Targeting specific mineral dissolution in tight formations.

- Novel Fracturing Fluids: Developing chemistries for enhanced conductivity and reduced formation damage.

- Geothermal Well Stimulation: Adapting fracturing techniques for enhanced geothermal systems.

- Carbon Capture Utilization and Storage (CCUS) Well Preparation: Specialized stimulation for injection wells.

Market Entry into Carbon Capture, Utilization, and Storage (CCUS) Services

Entering the Carbon Capture, Utilization, and Storage (CCUS) services market positions Calfrac as a 'Question Mark' within the BCG framework. This emerging sector offers substantial growth potential driven by global decarbonization efforts, but it requires significant investment and carries inherent risks due to its nascent stage and evolving regulatory landscape.

Calfrac's existing expertise in subsurface operations, particularly in well integrity and fluid injection, provides a strong foundation for CCUS activities like CO2 sequestration. The global CCUS market is projected to grow significantly, with estimates suggesting it could reach hundreds of billions of dollars annually by the 2030s, driven by policy support and industrial demand.

- High Growth Potential: The global CCUS market is anticipated to expand rapidly, with some projections indicating a market value exceeding $100 billion by 2030.

- Leveraging Core Competencies: Calfrac can utilize its established skills in well drilling, completion, and injection technologies for CO2 storage and enhanced oil recovery (EOR) projects.

- Uncertain Market Share: As a new entrant, Calfrac would begin with minimal to no established market share in CCUS, necessitating strategic market development and client acquisition.

- Investment and Risk: Significant capital investment is required for CCUS infrastructure, and the market faces uncertainties related to carbon pricing, policy stability, and technological advancements.

Calfrac's ventures into new international markets or specialized service lines, like advanced stimulation techniques or CCUS, represent classic Question Marks. These areas offer high growth potential but require substantial upfront investment and face uncertain market penetration, demanding careful strategic resource allocation.

The company's development of proprietary digital oilfield technologies also falls into this category. While the global digital oilfield market is expanding rapidly, with projected growth rates exceeding 15% annually leading up to 2024, Calfrac's specific share in this segment is currently minimal.

These Question Mark initiatives, such as bringing wireline services in-house in Argentina or exploring CCUS, are critical for future growth. However, their success hinges on Calfrac's ability to navigate new competitive landscapes, secure market share, and manage the significant capital required for these emerging opportunities.

The company's strategic investments in these nascent areas are crucial for diversification and long-term competitive advantage. For instance, Calfrac's 2024 capital program includes allocations for such growth-oriented projects, aiming to build a stronger position in these evolving segments of the oilfield services industry.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.