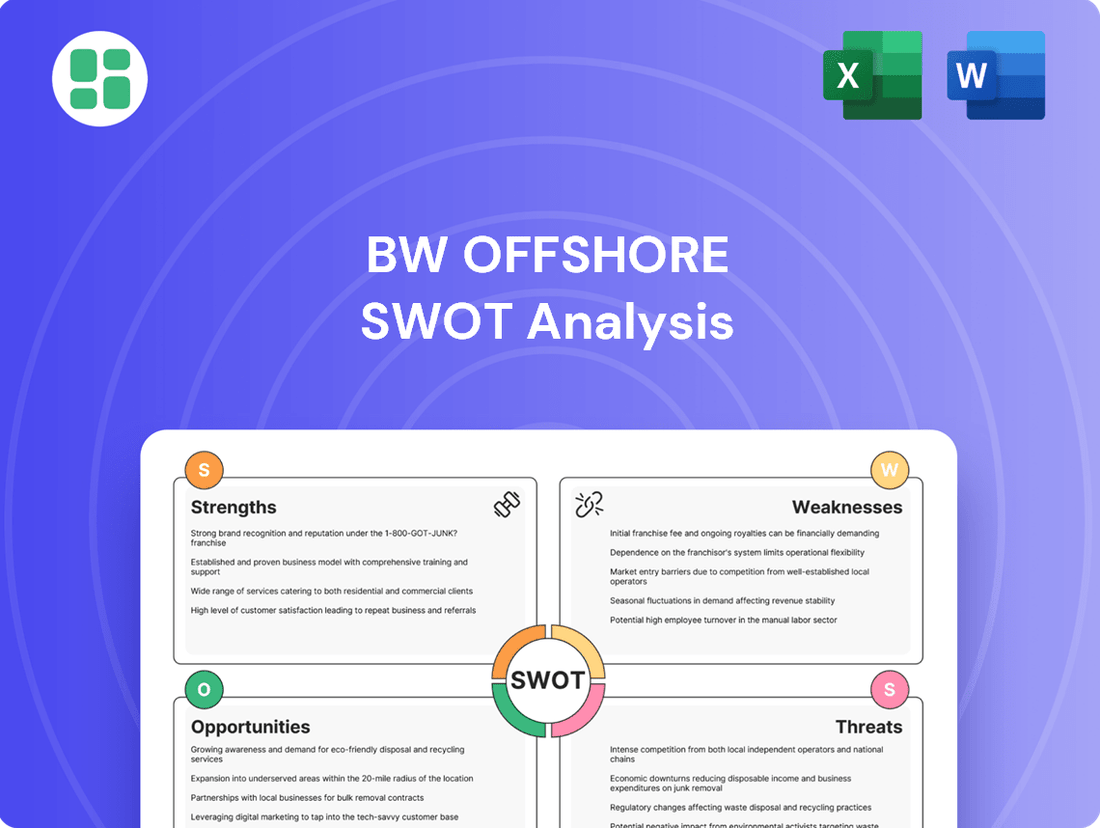

BW Offshore SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BW Offshore Bundle

BW Offshore's market position is shaped by its strong operational expertise and a fleet of floating production storage and offloading (FPSO) units, but also faces challenges from evolving energy markets and project execution risks. Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

BW Offshore stands as a preeminent global leader in Floating Production Storage and Offloading (FPSO) vessel operations, built on more than 40 years of offshore experience. This deep well of expertise has been honed through the successful execution of 40 FPSO and Floating Storage and Offloading (FSO) projects.

The company's operational prowess is further evidenced by its consistent high commercial uptime across its entire fleet, a critical metric for reliability and client trust in the demanding offshore sector. This strong track record underpins BW Offshore's robust foundation for continued success and expansion in the FPSO market.

BW Offshore's extensive service portfolio, covering everything from initial design and engineering to the full operation of offshore production units, is a significant strength. This integrated model allows them to provide complete, end-to-end solutions for oil and gas clients, streamlining the complex process of hydrocarbon extraction and processing.

This comprehensive capability positions BW Offshore as a valuable partner for demanding offshore projects. For instance, their successful delivery of the floating production storage and offloading (FPSO) vessel for the Tortue Ahmeyim project in 2024, a complex undertaking involving multiple phases, highlights their integrated approach and execution prowess.

BW Offshore's financial standing is exceptionally strong, with Q1 2025 results showing a robust balance sheet and substantial liquidity. The company reported being net cash positive, a testament to its sound financial management and operational efficiency.

This financial health is further bolstered by a significant firm contract backlog, which provides a predictable and stable revenue stream for the foreseeable future. This backlog not only secures current operations but also offers a solid foundation for future investments and strategic growth initiatives, enhancing overall business resilience.

Strategic Diversification into Energy Transition

BW Offshore's strategic move into the energy transition is a significant strength, with the company actively pursuing offshore wind projects and embracing technologies like carbon capture and storage (CCS). This proactive approach is crucial for long-term relevance in a rapidly changing energy landscape. For instance, by 2024, BW Offshore's commitment to renewables is underscored by its growing portfolio of offshore wind development projects, aiming to capture a substantial share of this expanding market.

Their investment in BW Ideol, a key player in floating offshore wind technology, further solidifies this strategic advantage. This partnership allows BW Offshore to leverage cutting-edge solutions for offshore wind deployment, particularly in areas where fixed-bottom foundations are not feasible. As of early 2025, BW Ideol has secured a robust pipeline of projects, demonstrating the tangible progress and market validation of their technology.

- Active involvement in offshore wind development, positioning BW Offshore for growth in the renewable energy sector.

- Exploration of carbon capture and storage (CCS) technologies, aligning with global decarbonization efforts.

- Strategic ownership stake in BW Ideol, a leader in floating offshore wind, enhancing technological capabilities.

- Diversification strategy is expected to contribute an increasing percentage of revenue from renewable projects by 2025.

High Commercial Uptime and Operational Excellence

BW Offshore's commitment to operational excellence is a significant strength, directly translating into high commercial uptime for its Floating Production, Storage, and Offloading (FPSO) units. This reliability is crucial for consistent revenue generation in the offshore energy sector.

The company's operational performance is underscored by impressive uptime figures. For example, BW Offshore reported a weighted average uptime of 100.0% across its fleet in the first quarter of 2025. This exceptional performance highlights the effectiveness of their maintenance strategies and operational management.

This consistent high uptime ensures predictable cash flows, which is a key factor for investors and stakeholders. It also reflects a deep-seated commitment to safety and efficiency, building a reputation for dependable service delivery in a demanding industry.

- Consistent High Commercial Uptime: BW Offshore's fleet consistently achieves excellent uptime, demonstrating robust operational capabilities.

- Q1 2025 Fleet Uptime: The company achieved a weighted average uptime of 100.0% in Q1 2025, showcasing superior operational reliability.

- Steady Cash Generation: High uptime directly contributes to stable and predictable revenue streams, a critical advantage in the industry.

- Commitment to Safety and Efficiency: This operational excellence is a testament to BW Offshore's dedication to maintaining high standards in safety and operational efficiency.

BW Offshore's extensive experience, spanning over 40 years and 40 successful FPSO/FSO projects, forms a bedrock of operational strength. This deep expertise is directly reflected in their fleet's exceptional uptime, with a weighted average of 100.0% achieved in Q1 2025, ensuring reliable revenue generation.

What is included in the product

Analyzes BW Offshore’s competitive position through key internal and external factors, highlighting its operational strengths and market opportunities while acknowledging potential weaknesses and industry threats.

Uncovers hidden opportunities and mitigates potential threats, offering a clear path to improved operational efficiency.

Weaknesses

BW Offshore's reliance on the oil and gas sector means its revenue is indirectly exposed to the volatile nature of global commodity prices. A sharp decline in oil and gas prices, such as the significant drops seen in early 2020 impacting Brent crude futures, can curb exploration and production investments by clients. This downturn in client spending can translate to fewer new project opportunities and less favorable contract renegotiations for BW Offshore.

BW Offshore faces a significant hurdle with its high capital expenditure requirements. Building and maintaining its fleet of floating production, storage, and offloading (FPSO) vessels demands massive upfront investments for new construction, conversions, and ongoing upgrades. For instance, the Barossa FPSO project alone represents a substantial capital outlay.

These substantial investments can lock up considerable amounts of capital, thereby amplifying financial risks, particularly for ambitious, large-scale projects. The escalating costs associated with FPSOs, coupled with persistent concerns regarding supply chain expenses, further exacerbate this weakness.

BW Offshore's business model hinges on long-term contracts with oil and gas majors, offering a degree of revenue predictability. However, this reliance also presents a significant weakness. For instance, the company's Barossa FPSO project experienced initial timing adjustments, which can disrupt the anticipated flow of cash and revenue recognition, directly impacting financial performance.

These project delays are not merely about timing; they often translate into increased operational costs for BW Offshore. The extended timelines necessitate continued resource allocation and can introduce unforeseen expenses, potentially eroding profit margins on these crucial long-term agreements. This sensitivity to project execution timelines remains a key vulnerability.

Aging Fleet Considerations

BW Offshore's aging fleet presents a significant challenge. While the company is investing in new assets, some existing Floating Production Storage and Offloading (FPSO) units will necessitate substantial maintenance and upgrades to ensure they remain competitive and meet increasingly stringent environmental regulations. For instance, as of the first half of 2024, BW Offshore reported that its fleet utilization remained strong, but the ongoing operational demands of managing a diverse and aging asset base require continuous capital allocation for upkeep.

The complexity of maintaining larger, more advanced vessels is escalating. This trend is driving a strategic shift within BW Offshore towards more condition-based maintenance approaches rather than traditional time-based schedules. This evolution aims to optimize asset performance and manage costs more effectively across the fleet.

- Fleet Age Profile: While specific average age data fluctuates, a portion of BW Offshore's FPSO fleet operates beyond 20 years, requiring proactive lifecycle management.

- Maintenance Costs: Capex for maintenance and upgrades on older units can be substantial, impacting profitability and cash flow.

- Environmental Compliance: Evolving emissions standards and operational efficiency requirements necessitate investments to keep older assets compliant.

- Operational Complexity: Managing the technical intricacies of older, yet still operational, FPSOs demands specialized expertise and resources.

Environmental and Regulatory Scrutiny

BW Offshore, like others in the offshore oil and gas sector, faces heightened environmental and regulatory pressures. These regulations, particularly those focused on reducing carbon emissions and preventing pollution, demand significant and ongoing investment in cleaner technologies and operational adjustments. For instance, the increasing focus on carbon capture, utilization, and storage (CCUS) solutions, while vital for long-term sustainability, can directly impact operational expenditures and introduce greater complexity.

The industry's commitment to lowering its carbon intensity is not merely a compliance issue but a critical factor for future market access and financial health. Companies are increasingly evaluated on their environmental, social, and governance (ESG) performance, which can influence investor confidence and access to capital. For 2024, many energy companies are reporting increased CAPEX for decarbonization efforts, with some allocating upwards of 15-20% of their total capital expenditure towards these initiatives to meet evolving climate targets.

- Increased Compliance Costs: Stricter environmental regulations necessitate higher spending on emissions reduction technologies and pollution prevention measures.

- Carbon Capture Investment: Implementing carbon capture solutions, while environmentally beneficial, adds to operational costs and technical complexity.

- ESG Performance Scrutiny: Investor and stakeholder focus on ESG metrics means companies must demonstrate tangible progress in reducing their environmental footprint to maintain market favor.

- Operational Adjustments: Adapting operations to meet new environmental standards can require significant changes, potentially impacting efficiency and requiring specialized expertise.

BW Offshore's significant capital expenditure for newbuilds and conversions, such as the Barossa FPSO, ties up substantial capital and increases financial risk. Supply chain cost escalations further compound these expenses, potentially impacting project profitability and cash flow. The company's reliance on long-term contracts, while providing revenue predictability, also creates vulnerability if projects face delays, as seen with initial timing adjustments on the Barossa FPSO, leading to increased operational costs and potential margin erosion.

The company's aging fleet requires continuous, substantial investment in maintenance and upgrades to remain competitive and compliant with evolving environmental standards. This ongoing capital allocation for upkeep, alongside the increasing complexity of managing advanced vessels, presents a persistent financial drain. For instance, managing the lifecycle of FPSOs operating beyond 20 years demands proactive management and significant capital for upkeep.

BW Offshore faces considerable financial pressure from increased environmental and regulatory compliance costs. Investing in cleaner technologies and operational adjustments, such as carbon capture solutions, adds to operational expenditures and technical complexity. The industry's push for lower carbon intensity requires companies to demonstrate strong ESG performance, influencing investor confidence and access to capital, with many energy firms allocating 15-20% of CAPEX to decarbonization in 2024.

Full Version Awaits

BW Offshore SWOT Analysis

The file shown below is not a sample—it’s the real BW Offshore SWOT analysis you'll download post-purchase, in full detail. This comprehensive report covers all key internal and external factors influencing the company's strategic position. Upon purchase, you gain access to the complete, actionable insights.

Opportunities

The global Floating Production Storage and Offloading (FPSO) market is experiencing robust growth, with projections indicating a substantial expansion driven by the increasing focus on offshore exploration and the ongoing depletion of onshore oil and gas reserves. This trend is particularly pronounced in deepwater and ultra-deepwater environments, which are becoming increasingly vital for future production.

BW Offshore is well-positioned to capitalize on this demand. For instance, in 2024, the company secured a significant contract for the development of the Kudu gas field offshore Namibia, which will utilize an FPSO. This project, expected to commence production in 2027, underscores the company's ability to secure and execute large-scale deepwater projects.

Geographically, regions such as South America, Africa, and Asia are demonstrating considerable investment in large FPSO projects. These areas represent key growth markets where BW Offshore can leverage its expertise and fleet to secure new, lucrative contracts, further solidifying its market presence.

BW Offshore's strategic investment in BW Ideol positions it for significant expansion in the burgeoning floating offshore wind market. This sector is projected to grow substantially, with global capacity expected to reach over 30 GW by 2030, according to industry forecasts. BW Offshore's involvement in developing floating wind platforms and securing participation in major projects directly taps into this expanding renewable energy landscape, aligning with urgent global decarbonization mandates.

Beyond floating wind, BW Offshore is actively diversifying its low-carbon portfolio. The company is exploring opportunities in CO2 transport and storage solutions, as well as gas-to-power projects. This multi-pronged approach to the energy transition, including its significant stake in BW Ideol which secured a key contract for the upcoming Yeu-Madao floating wind farm in Vietnam, demonstrates a commitment to evolving energy needs and opens new revenue streams.

Ongoing technological advancements in Floating Production Storage and Offloading (FPSO) systems, particularly the integration of digital tools for condition-based maintenance and remote inspections, present significant opportunities for BW Offshore. These innovations are expected to drive improved operational efficiency and substantial cost reductions. For instance, predictive maintenance algorithms can minimize downtime, a critical factor in offshore operations where every day of lost production translates to significant revenue loss.

The strategic integration of Carbon Capture and Storage (CCS) technologies into FPSO designs offers BW Offshore a dual advantage. This not only positions the company to meet increasingly stringent environmental regulations but also opens up new service offerings and revenue streams in the burgeoning carbon management sector. By embracing CCS, BW Offshore can differentiate itself in the market and capture value from the global energy transition.

Strategic Acquisitions and Redeployment of Assets

BW Offshore's strategic acquisition of vessels, such as the FPSO Nganhurra, demonstrates a proactive approach to capitalizing on market opportunities. This strategy allows the company to secure assets that can be redeployed, potentially accelerating project timelines and reducing capital expenditure compared to constructing new builds. This focus on asset utilization is crucial in a fluctuating market, ensuring investments are put to work efficiently.

By acquiring and redeploying existing assets, BW Offshore can achieve faster project execution, a key advantage in the offshore energy sector. This also translates to potentially lower capital costs, making projects more financially attractive. This agile approach to asset management is a significant opportunity for the company to maximize returns on its investments.

- Acquisition of FPSO Nganhurra: Acquired in 2023 for approximately $60 million, highlighting the strategy of acquiring suitable assets for redeployment.

- Faster Project Execution: Redeployment of existing FPSOs can shave months, even years, off project delivery compared to new builds.

- Cost Efficiency: Acquiring and upgrading existing units typically involves lower upfront capital costs than constructing new vessels.

- Market Responsiveness: This strategy enables BW Offshore to adapt quickly to emerging field development opportunities.

Emerging Markets and New Project FIDs

The FPSO market anticipates stability, with a steady stream of final investment decisions (FIDs) for offshore production, especially in key areas like Brazil. BW Offshore is strategically positioned to capitalize on this, actively targeting new FPSO projects that align with its operational and financial parameters, suggesting a robust pipeline for future contract awards in these active regions.

BW Offshore's proactive engagement in securing new FPSO contracts highlights its commitment to growth within the offshore energy sector. The company's focus on projects meeting specific criteria demonstrates a disciplined approach to expansion, aiming to leverage opportunities in markets with high development activity.

In 2024, the outlook for FPSO newbuilds and redeployments remains positive, with an estimated 10-15 FIDs anticipated for offshore projects globally. BW Offshore's strategy is to secure a significant portion of these opportunities, particularly those in established basins like Brazil, which continues to be a major driver of FPSO demand.

- Project Pipeline: BW Offshore is actively evaluating and bidding on multiple FPSO projects globally, with a strong focus on regions demonstrating consistent FID activity.

- Market Stability: The FPSO market is projected to see between 10 to 15 new project FIDs in 2024, providing a stable base for contract awards.

- Geographic Focus: Brazil remains a critical market, expected to account for a substantial number of these FIDs, aligning with BW Offshore's strategic priorities.

BW Offshore is strategically positioned to benefit from the growing demand for floating offshore wind technology, with its investment in BW Ideol. This sector is projected for significant expansion, with global capacity anticipated to exceed 30 GW by 2030, offering BW Offshore substantial opportunities for growth and alignment with decarbonization goals.

The company is actively diversifying its low-carbon energy portfolio, exploring avenues such as CO2 transport and storage, and gas-to-power projects. This broad approach to the energy transition, including its stake in BW Ideol and its involvement in projects like the Yeu-Madao floating wind farm in Vietnam, opens new revenue streams and addresses evolving energy needs.

Technological advancements in FPSO systems, particularly in digital maintenance and remote inspections, offer BW Offshore a chance to boost operational efficiency and cut costs. Predictive maintenance, for example, can significantly reduce downtime, which is crucial for maximizing revenue in offshore operations.

Integrating Carbon Capture and Storage (CCS) into FPSO designs presents BW Offshore with a competitive edge, enabling compliance with stricter environmental regulations and creating new service offerings in the carbon management market.

Threats

Significant fluctuations in global oil and gas prices present a persistent threat to BW Offshore. For instance, the Brent crude oil price, a key benchmark, experienced considerable volatility throughout 2024, trading in a range that impacted upstream investment sentiment. This volatility directly influences decisions regarding offshore exploration and production, potentially leading to project cancellations or delays.

A sustained downturn in oil prices, such as the dips seen in early 2024, could force BW Offshore to accept lower day rates for its Floating Production, Storage, and Offloading (FPSO) units. This directly squeezes revenue and profitability, as seen in the sector's performance during previous price slumps. For example, in 2020, when oil prices plummeted, many offshore projects were put on hold, directly affecting the utilization and contract values of FPSO providers.

The FPSO sector is highly competitive, with BW Offshore facing established global players vying for new contracts. This intense rivalry, particularly from national oil companies and other major FPSO providers, can lead to downward pressure on contract pricing and terms, impacting BW Offshore's profitability and market share.

Stricter environmental regulations, particularly concerning emissions and waste management, pose a significant threat to BW Offshore. For instance, the International Maritime Organization's (IMO) 2020 sulfur cap, which came into full effect in January 2020, already increased operational costs for many maritime operators, and future regulations are expected to be even more stringent. The push towards net-zero emissions by 2050, as outlined by various international bodies, will likely necessitate substantial investments in greener technologies for FPSOs, potentially impacting profitability.

Geopolitical Risks and Regional Instability

Geopolitical tensions, particularly in regions like the Middle East, pose significant threats to BW Offshore's operations. Conflicts can severely disrupt global supply chains, impacting the delivery of essential equipment and services for offshore projects. For instance, the ongoing Red Sea crisis, which began in late 2023, has already led to rerouting of shipping lanes, increasing transit times and costs for many industries, including offshore services.

Such instability directly translates to higher operational risks and pervasive uncertainty for offshore developments. This can lead to delays or cancellations in project sanctioning and contract awards, as clients become hesitant to commit capital in volatile environments. The overall investment climate in key operational areas can deteriorate, affecting BW Offshore's ability to secure new business and execute existing contracts efficiently.

- Supply Chain Disruptions: Increased transit times and costs due to rerouting of shipping lanes, as seen with the Red Sea crisis impacting global trade routes.

- Increased Operational Risks: Potential for damage to assets or personnel in conflict zones, necessitating enhanced security measures and higher insurance premiums.

- Project Delays and Cancellations: Investor caution in unstable regions can lead to postponed final investment decisions and a reduced pipeline of new offshore projects.

- Impact on Investment Climate: Reduced foreign direct investment in politically sensitive areas, making it harder to secure financing for large-scale offshore ventures.

Supply Chain Disruptions and Cost Inflation

BW Offshore, like many in the FPSO sector, faces significant risks from global supply chain snags. These disruptions can cause project delays and drive up the cost of essential equipment and services. For instance, the ongoing geopolitical tensions and shipping capacity issues that characterized late 2023 and early 2024 have continued to impact lead times for specialized components.

Inflationary pressures remain a key concern, directly affecting fabrication facilities and shipyards. This translates to higher operational expenses and can eat into project profitability. Reports from industry analysts in early 2024 indicated that the average cost for new FPSO construction had seen an upward trend, with some projects experiencing cost overruns of 10-15% due to these factors.

- Supply Chain Vulnerability: Delays in delivery of critical components for FPSOs, such as turbines and processing modules, can push back project timelines.

- Cost Escalation: Increased prices for steel, labor, and specialized engineering services contribute to higher overall project budgets.

- Inflationary Impact: Rising operational costs for shipyards and fabrication yards directly impact BW Offshore's project execution expenses.

- Project Profitability Squeeze: Higher input costs and potential delays can erode the profit margins on contracted FPSO projects.

BW Offshore faces significant threats from fluctuating oil and gas prices, which directly impact investment in offshore projects. For example, Brent crude prices saw considerable volatility in 2024, affecting upstream investment decisions and potentially leading to project delays or cancellations. This price volatility can force lower day rates for BW Offshore's FPSO units, squeezing revenue and profitability, as observed during previous downturns like in 2020.

Intense competition within the FPSO sector, from both established global players and national oil companies, exerts downward pressure on contract pricing and terms. This rivalry can impact BW Offshore's market share and profitability. Furthermore, increasingly stringent environmental regulations, such as those aimed at reducing emissions, will likely require substantial investments in greener technologies, potentially affecting profit margins. Geopolitical instability in key operating regions also poses a threat, disrupting supply chains, increasing operational risks, and creating uncertainty that can lead to project delays or cancellations.

Supply chain disruptions, exacerbated by geopolitical tensions and shipping capacity issues in late 2023 and early 2024, continue to impact lead times for critical FPSO components. Inflationary pressures are also a concern, driving up fabrication and shipyard costs. Industry reports from early 2024 indicated a trend of rising FPSO construction costs, with some projects experiencing cost overruns. These factors collectively contribute to higher operational expenses, potentially squeezing project profitability for BW Offshore.

SWOT Analysis Data Sources

This BW Offshore SWOT analysis is built upon a foundation of robust data, drawing from the company's official financial filings, comprehensive market intelligence reports, and expert analyses of the offshore energy sector.