BW Offshore PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BW Offshore Bundle

Navigate the complex external landscape impacting BW Offshore with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, technological advancements, environmental regulations, and social trends are shaping the company's strategic direction. Gain a competitive edge by leveraging these critical insights to inform your investment decisions and business strategies. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Global geopolitical tensions and regional conflicts directly influence oil and gas supply chains and energy prices, impacting BW Offshore's operational environment. For instance, ongoing conflicts in regions like Eastern Europe and the Middle East have contributed to significant volatility in crude oil prices, with Brent crude futures trading around $80-$90 per barrel in early 2024, affecting project economics for offshore developments.

BW Offshore's global footprint exposes it to political instability across its operating regions, potentially delaying projects and influencing investment decisions. In 2023, the company reported that certain projects faced extended timelines due to local political uncertainties, highlighting the need for robust risk mitigation strategies.

Navigating complex international relations is crucial for BW Offshore's business continuity and asset protection. The company actively monitors geopolitical developments and maintains strong relationships with local stakeholders to manage risks associated with political shifts and potential disruptions to its offshore production facilities.

Government energy policies significantly shape BW Offshore's operational landscape. For instance, the European Union's ambitious Green Deal, aiming for climate neutrality by 2050, is driving substantial investment in renewable energy sources, directly impacting BW Offshore's strategic pivot towards offshore wind projects. Conversely, policies affecting fossil fuel production, such as potential carbon taxes or production quotas, can influence the demand for their Floating Production Storage and Offloading (FPSO) units, their traditional core business.

In 2024, many nations are increasing renewable energy subsidies to meet climate targets. For example, the United States' Inflation Reduction Act continues to provide significant tax credits for offshore wind development, a crucial factor for companies like BW Offshore looking to expand in this sector. However, regulatory hurdles and permitting processes for offshore wind farms can still pose challenges, requiring careful navigation by the company to capitalize on these incentives.

The regulatory landscape for offshore energy projects, crucial for BW Offshore, is a patchwork of national and international laws. These govern everything from initial licensing and environmental impact assessments to day-to-day operational safety standards. For instance, in Norway, the Petroleum Safety Authority (PSA) sets stringent requirements for offshore installations, impacting BW Offshore's operational planning and investment in safety technologies.

BW Offshore navigates a complex web of compliance, where adherence to varying country-specific regulations can significantly influence project feasibility, overall costs, and development timelines. A new environmental permit in Brazil, for example, could add months and millions to a project's lifecycle.

Shifts in these regulations, such as the introduction of enhanced safety protocols or stricter emissions standards, directly translate to increased operational expenditures and necessitate ongoing investment in compliance measures. For 2024, many regions are seeing increased scrutiny on emissions, potentially raising operational costs for companies like BW Offshore.

Trade Policies and Sanctions

International trade policies, including tariffs and economic sanctions, significantly influence BW Offshore's global operations. For instance, the ongoing trade tensions between major economies can lead to unpredictable cost increases for essential equipment and disrupt project timelines. In 2024, the World Trade Organization (WTO) reported that the value of trade-restrictive measures implemented by its members had been steadily increasing, impacting sectors reliant on global supply chains.

These policies directly affect BW Offshore's ability to secure contracts and procure necessary components. Sanctions imposed on certain nations can create significant barriers to market entry or force the company to reroute supply chains, potentially escalating operational expenses. For example, sanctions affecting key oil-producing regions can limit BW Offshore's access to new projects or impact existing contracts.

- Tariff increases on specialized offshore equipment can raise project capital expenditures.

- Economic sanctions can restrict access to vital markets for offshore services.

- Evolving trade agreements necessitate continuous risk assessment and compliance adjustments.

- Disruptions to global shipping routes, often influenced by trade policies, can delay equipment delivery and increase logistics costs.

Fiscal Regimes and Taxation

Changes in fiscal regimes, royalties, and corporate taxation directly affect BW Offshore's profitability and the appeal of its projects. For instance, Brazil, a key operational area, has seen adjustments in its oil and gas tax framework, influencing investment decisions.

Governments worldwide are revising tax structures, sometimes to increase revenue from natural resources, as seen with potential shifts in production sharing agreements in some regions. Other times, these changes aim to encourage specific energy developments, such as renewables or lower-emission offshore operations.

BW Offshore must remain agile in adapting to these evolving fiscal landscapes to ensure long-term financial health and the viability of its ongoing and future projects. For example, changes in corporate tax rates in Norway, where BW Offshore has significant operations, can impact net earnings.

- Fiscal Policy Impact: Fluctuations in corporate tax rates or royalty percentages in key markets like Brazil or Norway can alter BW Offshore's project economics.

- Incentive Structures: Government initiatives to promote offshore wind or carbon capture projects through tax credits or subsidies can influence BW Offshore's strategic investment choices.

- Revenue Sharing: Modifications to production sharing agreements or revenue-sharing models can directly affect the profitability of BW Offshore's floating production storage and offloading (FPSO) contracts.

Government stability and the rule of law are foundational for BW Offshore's operations, influencing contract security and investment. Political instability in regions where BW Offshore operates can lead to project delays and increased operational risks, as seen in 2023 with certain projects facing extended timelines due to local political uncertainties.

Governments' energy policies, including subsidies for renewables and regulations on fossil fuels, directly shape BW Offshore's market opportunities and challenges. For instance, the US Inflation Reduction Act in 2024 continues to boost offshore wind development, a key growth area for BW Offshore.

International trade policies and sanctions create a dynamic operating environment for BW Offshore, impacting supply chains and market access. The increasing value of trade-restrictive measures reported by the WTO in 2024 highlights the need for continuous risk assessment.

Changes in fiscal regimes, such as tax rates and royalty structures in key markets like Brazil, directly affect BW Offshore's profitability and project economics. Navigating these evolving fiscal landscapes is crucial for the company's financial health.

| Political Factor | Impact on BW Offshore | Example/Data Point (2023-2024) |

| Geopolitical Tensions | Volatility in energy prices, project economics affected. | Brent crude futures around $80-$90/barrel in early 2024. |

| Political Instability | Project delays, investment decision influence. | Projects faced extended timelines due to local uncertainties in 2023. |

| Government Energy Policies | Drives investment in renewables, impacts fossil fuel demand. | US Inflation Reduction Act provides significant tax credits for offshore wind. |

| Regulatory Landscape | Affects operational planning, safety, and compliance costs. | Norway's PSA sets stringent offshore installation requirements. |

| Trade Policies & Sanctions | Impacts supply chains, market access, and costs. | Increasing value of trade-restrictive measures reported by WTO. |

| Fiscal Regimes | Influences profitability and project appeal. | Adjustments in Brazil's oil and gas tax framework affect investment. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing BW Offshore across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by highlighting key trends and their implications for the company's operations and future growth.

A concise, actionable summary of BW Offshore's PESTLE analysis, designed to quickly identify and address external challenges, thereby relieving the pain of strategic uncertainty.

Economic factors

Global oil and gas prices are a critical economic factor for BW Offshore. Fluctuations directly impact the demand for their Floating Production Storage and Offloading (FPSO) vessels and the profitability of their ongoing contracts. For instance, if oil prices remain below a certain threshold, like the $70-$80 per barrel range seen intermittently in late 2023 and early 2024, companies may postpone or cancel offshore exploration projects, thereby reducing the need for new FPSO units and potentially pressuring day rates for existing ones.

Conversely, sustained high oil prices, perhaps exceeding $90 per barrel as observed at various points in 2024, tend to encourage significant investment in offshore oil and gas fields. This increased activity directly translates into higher demand for BW Offshore's specialized services and vessels, creating more opportunities for new contracts and potentially leading to improved contract terms.

The global economic shift towards renewable energy is profoundly impacting investment flows, steering capital away from traditional fossil fuel infrastructure and towards sectors like offshore wind. This trend presents BW Offshore with diversification opportunities but also intensifies competition and could potentially reduce capital availability for new FPSO projects as investors increasingly favor green portfolios. For instance, global investment in the energy transition reached an estimated $2 trillion in 2023, a significant portion of which is directed towards renewables, highlighting the scale of this economic driver.

Global economic growth is a significant driver for energy demand, directly influencing the prospects for BW Offshore's core business in oil and gas, as well as its emerging renewable energy ventures. A healthy global economy generally translates to increased energy consumption, which in turn boosts the need for floating production, storage, and offloading (FPSO) units and supports the ongoing energy transition. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight uptick from 3.1% in 2023, indicating a steady, albeit moderate, demand environment.

A strong economic performance worldwide typically fuels higher energy consumption, thereby bolstering demand for FPSO services and potentially accelerating investments in the energy transition. This increased activity can lead to more project awards for companies like BW Offshore. Conversely, economic downturns or slowdowns can dampen energy demand, leading to reduced commodity prices and a tendency for companies to postpone or cancel capital expenditure, directly impacting the pipeline of new FPSO projects.

Interest Rates and Access to Capital

Interest rates significantly influence BW Offshore's financial flexibility. For instance, the US Federal Reserve maintained its benchmark interest rate between 5.25% and 5.50% through early 2024, a level that increases borrowing costs for capital-intensive projects like FPSOs. This environment directly impacts the company's ability to secure favorable financing for new developments and existing debt servicing, making higher capital expenditures less attractive.

The availability and cost of capital are critical for BW Offshore's strategic growth, particularly in expanding its fleet and venturing into offshore wind. Companies like BW Offshore often rely on syndicated loans and bond markets, where higher global interest rates translate to increased financing expenses. For example, in 2023, the average yield on high-yield corporate bonds, a common funding source for such projects, remained elevated, reflecting the broader trend of tightening financial conditions.

- Financing Costs: Elevated global interest rates, such as the US Federal Reserve's target range of 5.25%-5.50% in early 2024, directly increase BW Offshore's cost of capital for new projects and debt.

- Investment Attractiveness: Higher borrowing costs can diminish the financial viability of capital-intensive offshore projects, potentially slowing down investment in FPSO and offshore wind infrastructure.

- Capital Access: BW Offshore's growth strategy hinges on access to competitive financing; a challenging capital market environment can impede expansion plans.

- Market Conditions: The yield on corporate bonds, a key indicator of borrowing costs, remained relatively high in 2023, underscoring the impact of interest rate policies on companies like BW Offshore.

Supply Chain Costs and Inflation

Inflationary pressures continue to impact the offshore energy sector, with significant implications for BW Offshore's operational costs. For instance, the global shipping container spot rates, a key indicator of transportation costs, saw a notable increase in late 2024 and early 2025 due to geopolitical tensions and increased demand, directly affecting the delivery of materials and equipment for FPSO construction and maintenance.

Rising costs for essential commodities like steel and specialized components, crucial for offshore infrastructure, are also a major concern. Reports from early 2025 indicated that steel prices, a primary input for offshore structures, remained elevated compared to pre-2023 levels, driven by production constraints and robust industrial demand. This directly translates to higher capital expenditure for BW Offshore.

The labor market in specialized offshore industries also presents cost challenges. Shortages of skilled welders, engineers, and technicians, exacerbated by ongoing project pipelines in both oil and gas and renewable energy, have led to increased wage demands. This upward pressure on labor costs affects both project execution and ongoing operational expenses for BW Offshore.

- Elevated Steel Prices: Global steel prices, a key input for offshore infrastructure, remained significantly higher in early 2025 compared to pre-2023 averages, impacting capital expenditure.

- Increased Shipping Costs: Spot rates for shipping containers experienced a surge in late 2024 and early 2025, raising transportation expenses for materials and equipment.

- Skilled Labor Shortages: Demand for specialized offshore labor has driven up wage expectations, contributing to higher operational and project costs for BW Offshore.

Global energy markets are central to BW Offshore's performance, with oil and gas prices directly dictating demand for their FPSO services. For example, Brent crude oil futures traded in the $80-$90 per barrel range for much of 2024, supporting investment in offshore exploration and production, which benefits BW Offshore. The ongoing energy transition also influences capital allocation, with significant investments, estimated to exceed $2 trillion globally in 2023, flowing into renewables, potentially diverting funds from traditional oil and gas projects.

Economic growth underpins energy demand. The IMF's projection of 3.2% global growth for 2024 suggests a steady, albeit moderate, demand environment for energy, which is positive for BW Offshore's business. However, higher interest rates, exemplified by the US Federal Reserve's target range of 5.25%-5.50% through early 2024, increase BW Offshore's cost of capital for projects. Inflationary pressures are also a concern, with steel prices remaining elevated in early 2025 and shipping costs rising in late 2024, impacting project economics.

| Economic Factor | Impact on BW Offshore | Supporting Data (2023-2025) |

|---|---|---|

| Oil & Gas Prices | Drives demand for FPSOs; higher prices encourage investment. | Brent crude futures averaged $80-$90/barrel in much of 2024. |

| Energy Transition Investment | Creates diversification opportunities but shifts capital away from fossil fuels. | Global energy transition investment estimated at $2 trillion in 2023. |

| Global Economic Growth | Influences overall energy demand and project pipelines. | IMF projected 3.2% global growth for 2024. |

| Interest Rates | Increases cost of capital for projects and debt servicing. | US Federal Reserve rate target: 5.25%-5.50% (early 2024). |

| Inflation (Commodity/Shipping) | Raises operational and capital expenditure costs. | Steel prices elevated in early 2025; shipping costs surged late 2024. |

What You See Is What You Get

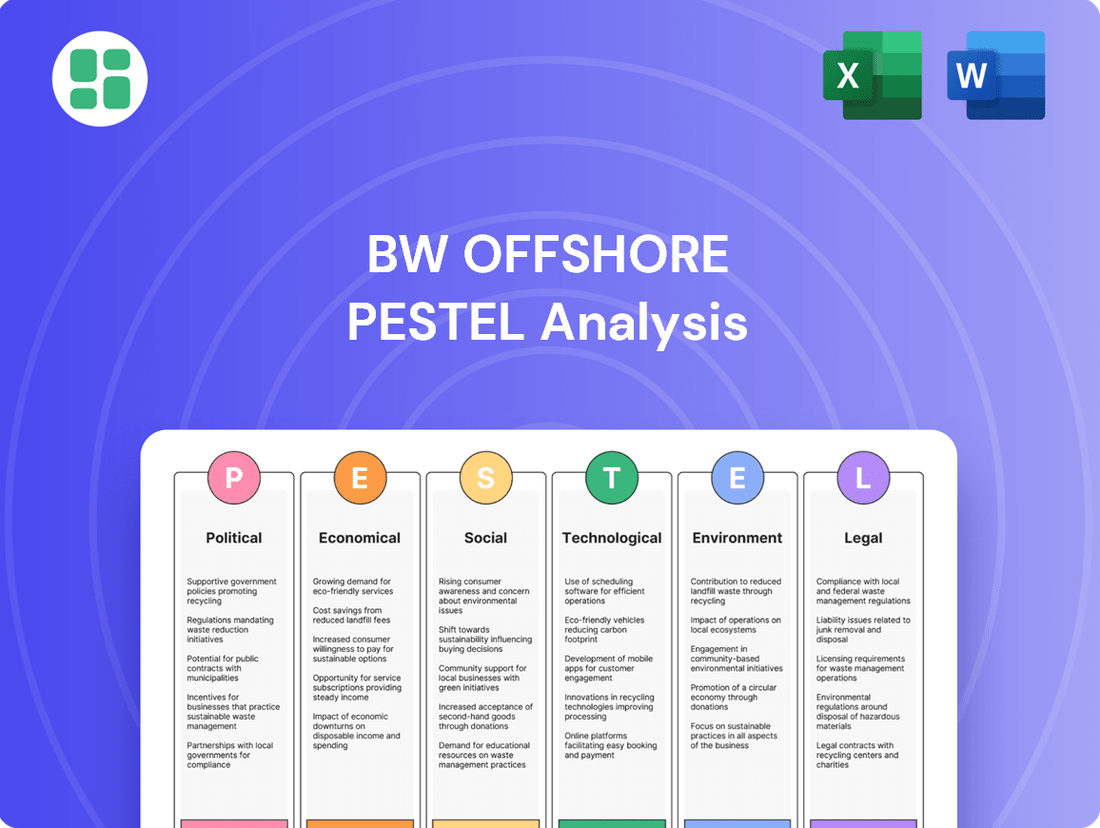

BW Offshore PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, providing comprehensive insights into BW Offshore's PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors influencing BW Offshore.

The content and structure shown in the preview is the same document you’ll download after payment, offering a complete and actionable PESTLE analysis for BW Offshore.

Sociological factors

Public sentiment towards fossil fuels is increasingly negative due to growing awareness of climate change. This trend directly impacts companies like BW Offshore, as it can sway investor decisions and intensify calls for stricter environmental regulations. For instance, a 2024 survey indicated that over 60% of global consumers are willing to pay more for sustainable products, highlighting a significant shift in consumer values that extends to corporate behavior.

This evolving public perception necessitates that BW Offshore demonstrate robust environmental stewardship to maintain its social license to operate. A strong reputation for sustainability is no longer just a bonus; it's becoming a critical factor for stakeholder relations and long-term business viability. Companies that proactively invest in and communicate their commitment to renewable energy solutions are better positioned to attract capital and public support.

BW Offshore's operational success hinges on a readily available pool of skilled personnel, including engineers, maritime experts, and offshore technicians. The global shortage of these specialized roles, exacerbated by demographic shifts and intense competition from both the established oil and gas industry and the rapidly expanding renewable energy sector, presents a significant challenge for talent acquisition and retention. For instance, the International Energy Agency (IEA) projected in 2024 that the offshore wind sector alone would require hundreds of thousands of new workers by 2030, highlighting this competitive landscape.

BW Offshore faces growing pressure from investors, employees, and the public to uphold robust corporate social responsibility (CSR) practices. This includes a strong emphasis on ethical conduct, respecting human rights, and actively engaging with local communities in its operating regions.

Demonstrating a genuine commitment to social well-being and maintaining impeccable ethical standards are crucial for BW Offshore's reputation and its ability to operate sustainably in the long term. For instance, in 2023, BW Offshore reported a total recordable injury frequency rate of 0.69, highlighting their focus on employee safety, a key aspect of social responsibility.

The company is actively integrating CSR principles into its core business model, recognizing that responsible operations are not just a compliance issue but a strategic imperative for future success and stakeholder trust.

Health, Safety, and Well-being of Employees

BW Offshore places immense importance on the health, safety, and well-being of its employees, especially given the inherently hazardous nature of offshore operations. This commitment is not merely about adhering to stringent regulations; it's fundamental to maintaining high employee morale, ensuring smooth operational continuity, and safeguarding the company's reputation. In 2023, BW Offshore reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.66 per million man-hours worked, demonstrating a continued focus on incident reduction.

The company actively cultivates a robust safety culture through comprehensive training programs and the implementation of rigorous safety management systems. These initiatives are designed to proactively identify and mitigate risks, thereby minimizing accidents and safeguarding the workforce. BW Offshore's dedication to worker protection is a cornerstone of its operational philosophy.

Key aspects of BW Offshore's approach to employee well-being include:

- Proactive Risk Management: Implementing systems to identify and address potential hazards before they lead to incidents.

- Safety Culture Development: Fostering an environment where safety is prioritized by all employees at every level.

- Incident Reduction: Continuously striving to lower the frequency and severity of workplace accidents, as evidenced by their TRIFR.

- Employee Support Programs: Offering resources and support to ensure the overall health and well-being of their global workforce.

Community Relations and Local Impact

BW Offshore's commitment to fostering strong community relations is paramount for its operational success. By actively engaging with local populations in regions where its projects are situated, such as its FPSO operations off the coast of Brazil, the company aims to build trust and ensure social license to operate. This engagement is crucial for navigating potential disruptions and maintaining a stable business environment.

Addressing community concerns, including environmental stewardship and the creation of local employment opportunities, is a key focus. For instance, BW Offshore's initiatives in Nigeria have often highlighted efforts to increase local content in its workforce and supply chains, aiming to deliver tangible economic benefits. Such proactive measures are vital for securing community buy-in and mitigating reputational risks.

BW Offshore's ability to manage its local impact effectively can directly influence its project timelines and overall profitability. Positive community relationships, evidenced by successful local content targets and minimal operational disputes, contribute to a more predictable and cost-effective operating model. This was particularly noted in their efforts to integrate local suppliers for maintenance services on their vessels, aiming for a significant percentage of spend to remain within the host country.

- Community Engagement: BW Offshore prioritizes dialogue with local communities to address concerns and build partnerships, crucial for projects in diverse operational areas like Southeast Asia and West Africa.

- Local Impact Management: The company focuses on mitigating negative environmental effects and maximizing positive economic contributions, including local job creation and sourcing, as seen in its efforts to boost local employment by 15% in certain project phases by 2024.

- Risk Mitigation: Effective stakeholder engagement helps BW Offshore preemptively address potential social conflicts, thereby safeguarding operational continuity and reducing unforeseen costs, a strategy that proved beneficial in navigating regulatory hurdles in a key Latin American market during 2024.

Societal attitudes towards sustainability are rapidly evolving, with a growing emphasis on environmental responsibility influencing corporate behavior and investment decisions. BW Offshore must actively demonstrate its commitment to green initiatives to maintain public trust and attract capital, as evidenced by a 2024 survey showing over 60% of consumers willing to pay more for sustainable products.

The demand for specialized offshore talent is intensifying, with sectors like offshore wind competing for skilled engineers and technicians. BW Offshore faces the challenge of attracting and retaining this workforce, especially as the IEA projected in 2024 that the offshore wind sector alone would need hundreds of thousands of new workers by 2030.

BW Offshore's operational success is deeply intertwined with its ability to foster positive community relations and uphold robust corporate social responsibility (CSR). This includes prioritizing ethical conduct, human rights, and local economic development, a commitment reflected in their 2023 TRIFR of 0.66 per million man-hours, indicating a strong focus on employee safety.

Technological factors

BW Offshore's competitive edge is significantly shaped by ongoing advancements in Floating Production, Storage, and Offloading (FPSO) unit design. These innovations focus on boosting processing power, expanding storage volumes, and refining operational efficiency, all of which are critical for securing new projects and enhancing asset profitability.

Technologies that minimize operational interruptions, streamline production, and reduce costs are paramount for BW Offshore. For instance, the company's investment in R&D aims to maintain its technological leadership, ensuring its fleet remains competitive in a dynamic market. This focus on efficiency is key to its strategy for maximizing asset value and securing future contracts.

BW Offshore's operations are increasingly shaped by digitalization and automation, promising significant gains in safety and efficiency. Technologies like AI and remote monitoring are central to this transformation, aiming to optimize performance and reduce risks in offshore environments.

The integration of data analytics and digital twins is crucial for predictive maintenance, allowing for proactive interventions rather than reactive repairs. This shift enhances operational integrity and drives cost-effectiveness. For instance, a recent industry report from 2024 highlighted that companies leveraging advanced analytics in offshore operations saw a 15% reduction in unplanned downtime.

The advancement of Carbon Capture, Utilization, and Storage (CCUS) for offshore use offers BW Offshore a significant chance to cut emissions from its Floating Production Storage and Offloading (FPSO) units. This also allows them to provide clients with new low-carbon services.

By investing in or collaborating on CCUS projects, BW Offshore can better align with global decarbonization goals and create new income sources. For instance, the International Energy Agency (IEA) reported in 2024 that global CCUS capacity is projected to reach over 200 million tonnes per annum (Mtpa) by 2030, showcasing substantial market growth.

CCUS is becoming essential for the sustained viability of oil and gas production, helping companies meet stricter environmental regulations and stakeholder expectations. BW Offshore's engagement in this area positions them as a forward-thinking player in the evolving energy landscape.

Offshore Wind Technology Advancements

Technological advancements in floating offshore wind are a game-changer for BW Offshore's energy transition. Innovations in turbine design, like larger rotor diameters and advanced materials, are boosting energy capture. For instance, by 2025, turbines exceeding 15 MW are expected to be widely deployed, significantly increasing power output per unit.

Improvements in mooring systems and installation techniques are also crucial. These developments reduce the complexity and cost of deploying turbines in deeper waters, opening up new geographical markets. The industry is seeing a push towards more robust and cost-effective anchoring solutions, with some projects in 2024 utilizing dynamic positioning for installation, reducing the need for traditional heavy-lift vessels.

BW Offshore's strategy hinges on embracing these innovations to lower the levelized cost of energy (LCOE) for offshore wind. By adopting cutting-edge technology, the company can enhance operational efficiency and expand the potential for offshore wind development. This focus is vital for competitiveness as the renewable energy sector matures, with LCOE targets for floating offshore wind aiming to reach below $50/MWh by 2030.

Key technological factors influencing BW Offshore include:

- Enhanced Turbine Efficiency: Development of larger, more powerful turbines (e.g., 15 MW+ by 2025) increases energy generation per installation.

- Advanced Mooring & Anchoring: Innovations in mooring systems and anchoring techniques reduce installation costs and enable deployment in deeper, more challenging waters.

- Streamlined Installation Methods: New installation techniques, potentially including semi-autonomous systems, aim to lower logistical costs and improve safety.

- Digitalization & AI: Integration of AI for predictive maintenance and operational optimization enhances overall project performance and reduces downtime.

Subsea Production and Tie-back Technologies

Innovations in subsea production and tie-back technologies are significantly broadening the reach of offshore oil and gas exploration. These advancements allow companies like BW Offshore to tap into reservoirs that were previously considered too difficult or too remote to access economically. For instance, the development of longer tie-back capabilities means that fields further from existing infrastructure can now be developed, directly increasing the potential market for Floating Production Storage and Offloading (FPSO) units.

The efficiency gains from these subsea technologies are also noteworthy. By enabling more production to be handled on the seabed, the requirement for larger, more complex topside facilities on FPSOs can be reduced. This not only streamlines operations but also has the potential to lower overall project capital expenditure and minimize the environmental impact of offshore developments. BW Offshore actively tracks these technological shifts to ensure its FPSO solutions remain competitive and integrated.

- Subsea Tie-back Advancements: Technologies enabling tie-backs of up to 200 km are becoming more common, opening up previously uneconomic marginal fields.

- Cost Reduction Potential: Estimates suggest that optimized subsea systems can reduce overall project CAPEX by 10-20% for certain developments.

- Market Expansion: The global subsea processing market is projected to grow, with tie-backs being a key driver, reaching an estimated USD 15 billion by 2028.

BW Offshore is actively integrating digitalization and AI to enhance operational efficiency and safety. This includes leveraging data analytics for predictive maintenance, which industry reports from 2024 indicated can reduce unplanned downtime by up to 15%. The company's focus on these technologies is crucial for optimizing performance and minimizing risks in its offshore operations.

Advancements in Carbon Capture, Utilization, and Storage (CCUS) present a significant opportunity for BW Offshore to offer low-carbon services and align with global decarbonization efforts. The International Energy Agency (IEA) projected in 2024 that global CCUS capacity could exceed 200 million tonnes per annum by 2030, highlighting substantial market growth potential.

Technological progress in floating offshore wind, such as the anticipated widespread deployment of turbines exceeding 15 MW by 2025, is vital for BW Offshore's energy transition strategy. Innovations in mooring and installation are also key, with industry trends in 2024 showing the use of dynamic positioning to reduce reliance on heavy-lift vessels, ultimately lowering the levelized cost of energy (LCOE).

Subsea tie-back technologies are expanding the reach of offshore exploration, with capabilities now extending up to 200 km, making previously marginal fields economically viable. These advancements can potentially reduce overall project CAPEX by 10-20% for certain developments, with the global subsea processing market, driven by tie-backs, projected to reach USD 15 billion by 2028.

| Key Technological Factors | Impact on BW Offshore | Relevant Data/Projections |

| Digitalization & AI | Enhanced operational efficiency, predictive maintenance, reduced downtime | 15% reduction in unplanned downtime (2024 industry reports) |

| CCUS Integration | New low-carbon services, alignment with decarbonization goals | Global CCUS capacity projected >200 Mtpa by 2030 (IEA 2024) |

| Floating Offshore Wind Tech | Increased energy capture, lower LCOE, market expansion | 15 MW+ turbines by 2025; LCOE target <$50/MWh by 2030 |

| Subsea Tie-back Advancements | Access to marginal fields, cost reduction, market growth | Tie-backs up to 200 km; 10-20% CAPEX reduction potential; Market size USD 15 billion by 2028 |

Legal factors

BW Offshore's extensive global operations are fundamentally shaped by international maritime law. Key conventions like the International Convention for the Prevention of Pollution from Ships (MARPOL) and the Standards of Training, Certification and Watchkeeping for Seafarers (STCW) dictate operational standards for its Floating Production Storage and Offloading (FPSO) units. These regulations are crucial for maintaining safety and environmental protection across its fleet, which in 2024 included a significant number of FPSOs operating in various international waters.

BW Offshore must adhere to a complex web of national oil and gas regulations in each country of operation. These laws cover everything from obtaining exploration licenses and meeting local content quotas to conducting thorough environmental impact assessments and upholding stringent operational safety standards. For instance, in Brazil, the National Agency of Petroleum, Natural Gas and Biofuels (ANP) sets rigorous requirements for offshore operations, including specific local content percentages that have seen adjustments over time, impacting project economics.

The dynamic nature of these regulations, often subject to change based on government policy and market conditions, presents a significant challenge. BW Offshore's ability to secure and successfully execute projects hinges on its capacity to effectively navigate and comply with these diverse, and sometimes evolving, national legal frameworks. Failure to do so can result in project delays, fines, or even the loss of operating licenses, as seen in past instances where companies have faced penalties for non-compliance with environmental or safety regulations in various jurisdictions.

BW Offshore operates under stringent Health, Safety, and Environmental (HSE) regulations, critical for preventing offshore incidents and safeguarding personnel and marine ecosystems. These regulations, enforced by national maritime authorities and international bodies, are continually evolving, demanding constant adaptation from the company.

For instance, the International Maritime Organization (IMO) regularly revises its safety and environmental conventions, impacting vessel design, operational procedures, and emissions. BW Offshore's commitment to HSE compliance is demonstrated through its investment in advanced safety systems and rigorous training programs, aiming to avoid costly penalties and operational disruptions that could arise from non-adherence.

Contract Law and Commercial Agreements

BW Offshore's operations are fundamentally built upon long-term contracts for Floating Production Storage and Offloading (FPSO) units, making contract law a critical legal factor. These agreements are complex, requiring meticulous attention to commercial and contract law principles to ensure clarity and enforceability.

Any disputes arising from these contracts, modifications to their terms, or difficulties in enforcing them can directly affect BW Offshore's revenue streams and overall financial health. For instance, a protracted legal battle over contract interpretation could tie up significant capital and disrupt project timelines.

The company must maintain strong, well-defined legal frameworks for all its commercial agreements to effectively manage and mitigate the inherent commercial risks associated with its business model. This includes ensuring contracts are compliant with international maritime law and relevant national regulations in the operating jurisdictions.

- Contractual Dependence: BW Offshore's revenue is heavily reliant on securing and maintaining long-term FPSO leases, typically spanning 5-15 years, with oil and gas companies.

- Risk of Disputes: Contractual disputes can lead to significant financial penalties, project delays, and reputational damage, impacting BW Offshore's ability to secure future contracts.

- Legal Compliance: Adherence to international maritime law, environmental regulations, and local contract laws in operating regions is paramount for smooth operations and risk mitigation.

- Enforceability Challenges: Ensuring the enforceability of contract terms, especially in diverse legal jurisdictions, is crucial for revenue certainty and financial stability.

Anti-Corruption and Compliance Laws

BW Offshore navigates a complex web of global anti-corruption and compliance laws, including the US Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act. These regulations mandate stringent adherence to prevent bribery and fraud, crucial for maintaining operational integrity. For instance, in 2024, companies faced increased scrutiny and penalties for compliance failures, underscoring the need for robust internal controls.

Maintaining strong compliance programs is not just a legal necessity but a strategic imperative to mitigate significant legal and reputational risks. Failure to comply can lead to substantial fines and damage brand trust. BW Offshore's commitment to these standards is vital for its continued success in international markets.

- FCPA and UK Bribery Act Compliance: BW Offshore must ensure all global operations align with these key anti-corruption statutes.

- Risk Mitigation: Robust internal controls and compliance programs are essential to prevent illicit activities and associated penalties.

- Reputational Safeguarding: Adherence to these laws protects BW Offshore's brand image and stakeholder confidence.

- Global Operations Impact: Operating in diverse jurisdictions necessitates a comprehensive and consistently applied compliance framework.

BW Offshore's operations are heavily influenced by international maritime law, such as MARPOL and STCW, which govern safety and environmental standards for its FPSO fleet. National oil and gas regulations in each operating country, like Brazil's ANP requirements for local content, also dictate operational specifics and can impact project economics.

The company must also comply with stringent HSE regulations, which are continually updated by bodies like the IMO, necessitating ongoing investment in safety systems and training. Furthermore, contract law is paramount, as BW Offshore's revenue relies on complex, long-term FPSO lease agreements, where disputes can lead to significant financial and operational disruptions.

Adherence to global anti-corruption laws, including the FCPA and UK Bribery Act, is critical for maintaining operational integrity and mitigating substantial legal and reputational risks. Robust compliance programs are essential to prevent bribery and fraud, safeguarding stakeholder confidence and brand trust in its international markets.

Environmental factors

Global and national climate change policies, such as carbon pricing mechanisms and ambitious emissions reduction targets, are increasingly shaping BW Offshore's strategic direction. For instance, many nations are reinforcing their net-zero commitments, with some aiming for significant emission cuts by 2030. This regulatory environment directly influences BW Offshore's investment decisions, pushing for cleaner technologies and a greater focus on renewable energy integration.

The escalating pressure to decarbonize operations and curb greenhouse gas emissions is a significant driver for BW Offshore. The company is actively responding by investing in solutions that reduce its environmental footprint, such as exploring electrification of offshore assets and developing technologies for carbon capture. This proactive approach is crucial for aligning with evolving global environmental goals and maintaining a competitive edge in a transitioning energy market.

Growing concerns over ocean pollution, from potential oil spills to the discharge of operational waste, directly impact offshore companies like BW Offshore. These issues threaten marine biodiversity, leading to increasingly strict environmental regulations. For instance, the International Maritime Organization (IMO) continues to refine its strategies for reducing marine pollution from ships, with ongoing discussions in 2024 and 2025 focusing on ballast water management and emissions.

BW Offshore is therefore compelled to maintain advanced environmental management systems. These systems are crucial for preventing pollution incidents and safeguarding fragile marine ecosystems. A strong track record in this area is not just about compliance; it's essential for retaining BW Offshore's social license to operate, particularly as public and regulatory scrutiny intensifies.

Effective waste management and resource efficiency are paramount for Floating Production Storage and Offloading (FPSO) operations. This includes handling hazardous waste and optimizing the use of water and energy. BW Offshore is actively working to reduce waste at its source, increase recycling rates, and improve resource consumption to lessen its environmental impact.

These initiatives not only support sustainability objectives but also lead to tangible operational cost savings. For instance, in 2023, BW Offshore reported a reduction in waste intensity by 5% compared to the previous year, alongside a 3% decrease in specific energy consumption across its fleet.

Transition to Renewable Energy Sources

The global shift towards renewable energy sources, particularly offshore wind, presents a dual-edged sword for BW Offshore. While the demand for traditional fossil fuel-related offshore services may wane over time, the company's strategic investments in floating offshore wind technology offer a significant growth avenue. For instance, the International Energy Agency (IEA) projected that offshore wind capacity could increase tenfold by 2040, reaching 500 GW, with floating wind expected to play a crucial role in deeper waters where fixed-bottom turbines are not feasible.

BW Offshore's focus on floating wind solutions, such as its involvement in projects like the Windamérica project in the US, directly addresses this burgeoning market. The company aims to leverage its extensive offshore engineering and operational expertise to secure a substantial share of this expanding sector. This transition requires substantial capital allocation and a clear strategic roadmap to effectively pivot its business model.

Key considerations for BW Offshore include:

- Market Penetration: Capitalizing on the projected growth of the offshore wind market, which the IEA estimates could reach 500 GW by 2040.

- Technological Advancement: Investing in and developing floating offshore wind technology to unlock new geographical markets and project opportunities.

- Regulatory Support: Monitoring and adapting to evolving government policies and incentives that support renewable energy development, which are critical for project viability.

- Competitive Landscape: Navigating a competitive environment with established players and new entrants in the offshore wind sector.

Environmental Impact Assessments and Permitting

BW Offshore's projects, including Floating Production Storage and Offloading (FPSO) units and offshore wind ventures, necessitate thorough environmental impact assessments (EIAs) and the acquisition of numerous permits. These regulatory hurdles are becoming more stringent, potentially extending project schedules and increasing overall expenses. For instance, the company's commitment to sustainability is evident in its ongoing efforts to minimize the environmental footprint of its operations, a factor critical for securing approvals and maintaining positive public perception.

The complexity of these environmental reviews can be significant. For example, in 2023, the average time for obtaining key environmental permits for major offshore infrastructure projects in Europe often extended beyond 18 months, with some cases reaching over two years, depending on the project's scale and location. BW Offshore's proactive approach to addressing these requirements is therefore a vital component of its operational strategy.

Demonstrating a commitment to environmental stewardship is paramount for project approval and societal acceptance. This includes detailed plans for waste management, emissions control, and biodiversity protection. For example, BW Offshore's recent projects have incorporated advanced technologies to reduce greenhouse gas emissions, aiming to meet or exceed the stringent targets set by international maritime organizations and national environmental agencies.

Key considerations in these assessments include:

- Marine ecosystem impact: Assessing potential effects on marine life, including noise pollution, habitat disruption, and the risk of spills.

- Emissions control: Quantifying and mitigating air and water emissions from offshore facilities.

- Waste management: Developing robust plans for the handling and disposal of operational waste.

- Decommissioning strategies: Planning for the eventual removal and disposal of offshore structures to minimize long-term environmental impact.

Global climate policies, like net-zero targets and carbon pricing, are increasingly steering BW Offshore's strategy. Many nations are reinforcing their 2030 emissions reduction goals, directly influencing investment in cleaner technologies and renewables.

The push for decarbonization is a major factor, prompting BW Offshore to invest in solutions like asset electrification and carbon capture technology to reduce its environmental footprint and stay competitive.

Concerns over ocean pollution, including potential oil spills and waste discharge, are leading to stricter regulations. The IMO's ongoing efforts in 2024 and 2025 to curb marine pollution from ships highlight the need for robust environmental management systems.

BW Offshore must maintain advanced environmental management systems to prevent pollution and protect marine ecosystems, which is crucial for its social license to operate amidst growing scrutiny.

PESTLE Analysis Data Sources

Our BW Offshore PESTLE Analysis is meticulously crafted using data from reputable sources including the International Energy Agency (IEA), leading financial news outlets, and government regulatory bodies. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the offshore energy sector.