BW Offshore Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BW Offshore Bundle

BW Offshore operates in a dynamic offshore energy sector, facing significant pressures from intense rivalry and the substantial bargaining power of its clients. Understanding these forces is crucial for navigating the competitive landscape.

The complete report reveals the real forces shaping BW Offshore’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of highly specialized Floating Production Storage and Offloading (FPSO) components, like turrets and advanced processing modules, exert considerable bargaining power. This is due to the unique, tailor-made nature and essential role these parts play in BW Offshore's operations. For instance, in 2024, the development of next-generation FPSOs often requires proprietary technologies where only a handful of vendors possess the necessary expertise and manufacturing capabilities.

The limited pool of qualified suppliers for these complex systems translates into higher pricing and less favorable contractual terms for BW Offshore. The significant investment and extended lead times required to procure these bespoke components further consolidate supplier leverage. This situation is common in the offshore oil and gas sector, where innovation drives demand for highly specific, often patented, equipment.

The bargaining power of shipyards and fabrication facilities is significant for BW Offshore due to the concentrated global capacity for constructing and converting FPSO vessels. This concentration means a limited number of specialized yards can handle these complex projects, giving them leverage in negotiations.

Cost overruns and delays at these shipyards can directly impact BW Offshore's profitability and project schedules. For instance, the Barossa FPSO project experienced significant delays and cost increases, highlighting the financial risks associated with shipyard performance.

The demand for new FPSO builds, particularly for larger capacity units, further strengthens the negotiating position of these key fabrication facilities. As of early 2024, the offshore energy sector continues to see demand for FPSOs, especially for projects in emerging deepwater regions, which keeps shipyard order books robust.

BW Offshore's success hinges on its access to a highly skilled workforce, encompassing specialized engineers, experienced project managers, and proficient offshore technicians. These professionals are essential for the complex operations of Floating Production Storage and Offloading (FPSO) units and the development of new projects.

A scarcity of this specialized talent, a trend observed across the offshore energy sector, can significantly escalate labor costs. For instance, in 2024, the demand for experienced offshore engineers remained robust, leading to competitive salary packages and increased reliance on specialized recruitment firms. This situation grants these labor suppliers greater bargaining power.

BW Offshore's dependence on this critical human capital directly influences its ability to execute projects on time and maintain operational uptime. When specialized skills are in short supply, the cost and availability of these resources can impact project timelines and overall operational efficiency, demonstrating the significant bargaining power of skilled labor suppliers.

Financial Institutions and Capital Providers

Financial institutions and capital providers wield significant influence over BW Offshore due to the immense capital requirements of Floating Production Storage and Offloading (FPSO) projects. The terms and availability of financing, including loans and other capital solutions, directly dictate BW Offshore's capacity to initiate and grow its fleet. For instance, in 2024, the cost of capital remains a critical factor, influenced by global interest rate trends and overall market liquidity, which can substantially alter project economics.

The bargaining power of these financial entities is amplified by the inherent risks associated with large-scale offshore projects. BW Offshore relies heavily on securing favorable financing terms to maintain competitive project bids and ensure profitability. Any tightening of credit markets or an increase in benchmark interest rates, such as the Federal Reserve's policy rates which remained elevated through much of 2024, directly translates to higher borrowing costs for BW Offshore, thereby increasing the suppliers' leverage.

- Capital Intensity: FPSO projects often exceed billions of dollars, making access to finance paramount.

- Financing Terms: Interest rates, loan covenants, and repayment schedules are key negotiation points.

- Market Liquidity: The general availability of funds in the financial markets affects competition among lenders and thus BW Offshore's negotiating position.

- Risk Perception: Lenders' assessment of project and BW Offshore's risk directly impacts the cost and availability of capital.

Raw Material and Energy Input Suppliers

While not as critical as specialized FPSO suppliers, BW Offshore's reliance on raw materials like steel and energy inputs for its fleet and construction projects means these suppliers can influence costs. Price swings in global commodity markets, often driven by geopolitical factors, directly impact BW Offshore's operational expenses and capital expenditure for new builds. For instance, steel prices saw significant fluctuations in 2023 and early 2024, with benchmarks like the S&P Global Platts average for hot-rolled coil in Northern Europe experiencing periods of upward pressure.

The bargaining power of these suppliers is amplified by potential supply chain disruptions. Events affecting global energy markets or major steel-producing regions can lead to shortages or increased lead times.

- Steel Price Volatility: Global steel benchmarks have shown considerable price swings in 2023-2024, directly impacting BW Offshore's material costs for vessel construction and maintenance.

- Energy Input Costs: Fluctuations in oil and gas prices affect BW Offshore's operational expenses, as energy is a key input for vessel operations.

- Supply Chain Risks: Geopolitical events and logistical challenges can disrupt the supply of essential raw materials and energy, potentially delaying projects and increasing costs.

The bargaining power of suppliers for BW Offshore is significant, particularly for specialized FPSO components where only a few vendors possess the necessary expertise and proprietary technology. This limited supplier base, coupled with the high cost and long lead times for these bespoke parts, grants suppliers considerable leverage in pricing and contract terms. For example, in 2024, the demand for advanced turret systems, critical for FPSO operations, was met by a concentrated group of manufacturers, allowing them to command premium prices.

Shipyards and fabrication facilities also hold substantial bargaining power due to the limited global capacity for constructing and converting complex FPSO vessels. This scarcity of specialized yards means BW Offshore faces challenges in securing favorable terms, with project delays and cost overruns being significant risks, as evidenced by industry-wide issues impacting major offshore projects throughout 2023 and into 2024.

Furthermore, the scarcity of highly skilled labor, such as specialized offshore engineers and technicians, empowers these professionals and their employers. In 2024, competitive salary demands and increased reliance on recruitment firms for these in-demand roles directly translated to higher labor costs for BW Offshore, impacting project execution timelines and operational efficiency.

What is included in the product

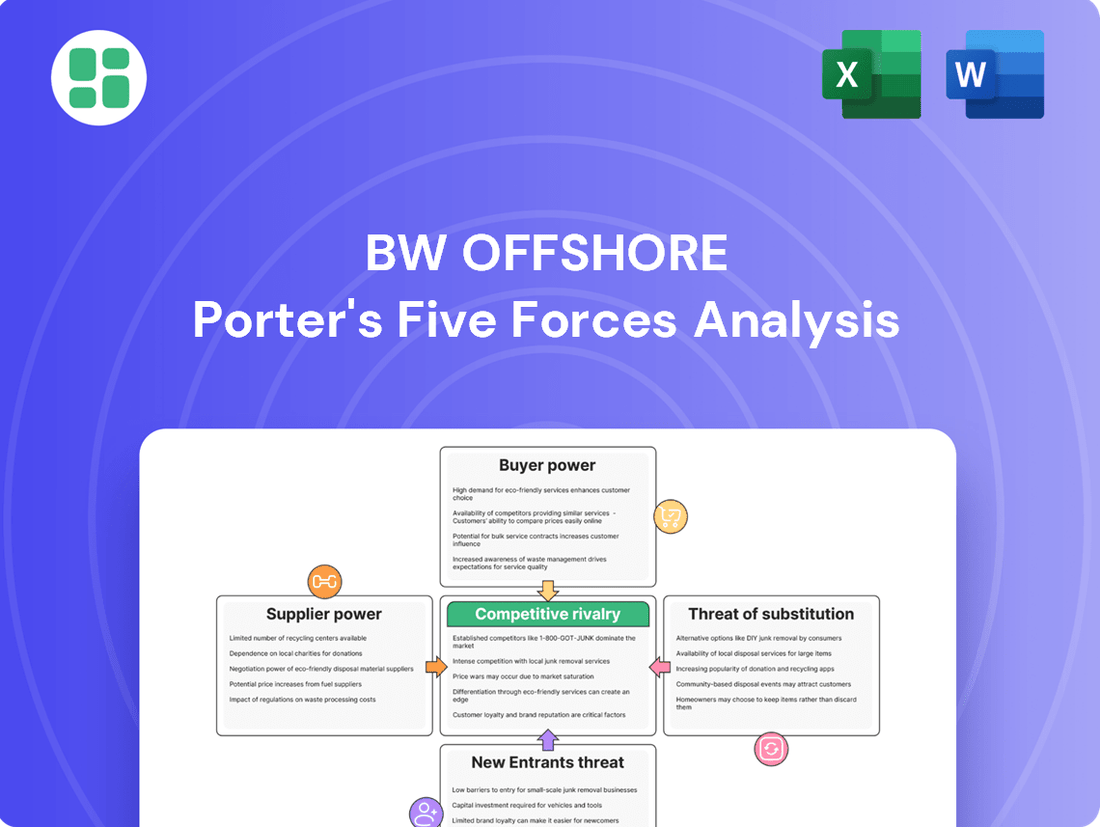

Analyzes the competitive intensity, buyer and supplier power, threat of new entrants, and substitute products impacting BW Offshore's strategic decisions.

Instantly identify and mitigate competitive threats with a dynamic, visual representation of BW Offshore's market landscape.

Customers Bargaining Power

BW Offshore's customers, primarily major international and national oil and gas companies, wield considerable bargaining power. These clients, such as ExxonMobil and Saudi Aramco, often have substantial financial clout and numerous development projects, allowing them to negotiate favorable terms on the long-term charters of BW Offshore's Floating Production Storage and Offloading (FPSO) units.

BW Offshore's long-term FPSO contracts, often spanning 5 to 15 years, create a degree of customer power. While these agreements offer revenue predictability, they lock BW Offshore into fixed terms, potentially limiting its ability to adapt to evolving market conditions or technological advancements. This can empower clients to negotiate favorable terms, particularly when BW Offshore has invested heavily in a bespoke FPSO for a specific field.

Once a Floating Production Storage and Offloading (FPSO) unit is deployed and fully integrated into an offshore oil or gas field, the customer faces exceptionally high costs if they decide to switch providers or alternative production solutions. This inherent stickiness significantly limits the customer's ability to easily change suppliers mid-project, fostering a reliance on BW Offshore's ongoing operational performance and dependability.

Customer's Project Portfolio and Financial Health

BW Offshore's customers, particularly major oil and gas companies, wield significant bargaining power, influenced by their own project portfolios and financial standing. A customer undertaking numerous large-scale projects, like Equinor or Shell, can leverage their substantial capital expenditure plans to negotiate more favorable day rates and contract terms for Floating Production Storage and Offloading (FPSO) units. For instance, in 2024, major oil producers continued to manage vast project pipelines, with global upstream capital expenditure projected to reach approximately $565 billion, according to Rystad Energy. This scale allows them to shop around for the best value.

The financial health of these clients is a critical determinant. Companies with robust balance sheets and strong cash flows, such as ExxonMobil which reported a net income of $36.0 billion for 2023, are less pressured and can demand premium services at competitive prices. Conversely, a customer experiencing financial headwinds or re-evaluating investment strategies might seek more flexible payment structures or shorter contract durations, increasing pressure on BW Offshore to adapt its offerings.

- Customer Project Scale: Major oil companies often manage portfolios of multiple offshore projects, increasing their leverage in FPSO contract negotiations.

- Financial Strength: A client's strong balance sheet and consistent profitability, exemplified by the significant earnings of supermajors in 2023, enhance their ability to negotiate better terms.

- Market Conditions Impact: Fluctuations in oil prices and overall industry investment strategies directly affect customer financial health and their bargaining power with FPSO providers like BW Offshore.

- Contract Flexibility Demands: Financially constrained customers may push for more adaptable contract terms, creating negotiation challenges for BW Offshore.

Demand for Integrated Production Solutions

Customers are increasingly demanding integrated production solutions, encompassing everything from initial design and engineering to construction, installation, and ongoing operation. This shift means clients aren't just looking for individual services but a complete, seamless package. For BW Offshore, being able to offer this end-to-end capability significantly enhances its appeal.

However, this integrated approach also creates a leverage point for customers. By consolidating their needs with a single provider like BW Offshore, they can exert greater pressure during negotiations, expecting competitive pricing and consistently high performance across all service segments. This demand for comprehensive solutions means BW Offshore must excel in every phase of the project lifecycle to maintain its competitive edge.

- Customer Integration Demand: Clients prefer a single point of contact for design, engineering, construction, installation, and operation.

- BW Offshore's Value Proposition: Offering integrated solutions strengthens BW Offshore's market position and client appeal.

- Customer Bargaining Power: The ability to bundle services allows customers to negotiate more effectively on price and performance.

BW Offshore's customers, predominantly large oil and gas corporations, possess significant bargaining power due to their substantial project scale and financial muscle. These entities, such as Shell and Equinor, often manage multiple offshore developments, enabling them to negotiate favorable terms for FPSO charters. For example, global upstream capital expenditure was anticipated to be around $565 billion in 2024, highlighting the immense financial capacity of these clients.

| Customer Type | Financial Strength Indicator (2023) | Bargaining Power Driver |

|---|---|---|

| Major Oil & Gas Companies (e.g., ExxonMobil, Shell) | ExxonMobil Net Income: $36.0 billion | Large project portfolios, significant capital availability |

| National Oil Companies (e.g., Saudi Aramco) | (Specific 2023 data varies, but generally strong state backing) | Government support, long-term development plans |

Preview Before You Purchase

BW Offshore Porter's Five Forces Analysis

This preview displays the complete BW Offshore Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the offshore oil and gas sector. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

The Floating Production Storage and Offloading (FPSO) operator market is quite concentrated, meaning a few big players dominate. Companies like SBM Offshore, MODEC, Yinson, and BW Offshore itself are the main operators. This limited number of experienced global companies means competition is fierce, especially when bidding for new offshore oil and gas projects and for renewing existing contracts.

This intense rivalry is particularly noticeable in the high-stakes, deepwater development sector. For instance, in 2023, BW Offshore secured contracts for projects like the Kudu gas field development offshore Namibia, facing bids from these same major competitors. The need to secure these lucrative, long-term contracts drives aggressive pricing and innovation among these key FPSO operators.

The intense rivalry in the FPSO market stems from the highly project-specific and bespoke nature of these vessels. Each FPSO is essentially a custom-engineered solution tailored to the unique geological and operational requirements of a particular oil and gas field, making direct product-to-product comparisons difficult.

Competition therefore centers on a provider's technical prowess, demonstrated experience with similar projects, a strong safety record, and the crucial ability to deliver complex, integrated systems on schedule and within financial parameters. This often leads to bidding wars where differentiation is key.

For instance, in 2024, BW Offshore secured a contract for the development of the Santos Basin field, highlighting their capability in delivering these specialized solutions. The value of such bespoke projects can run into billions of dollars, intensifying the competition among the few major players capable of undertaking such undertakings.

The floating production, storage, and offloading (FPSO) market is seeing robust growth, with projections indicating a significant expansion in the coming years. This upward trend is particularly evident in areas like South America, where heightened exploration and production efforts in challenging deep and ultra-deepwater environments are a key driver. For instance, by the end of 2024, the market is expected to see substantial new project awards, fueling this expansion.

This burgeoning market activity naturally escalates competitive rivalry. As BW Offshore and its peers recognize the increasing demand for FPSO solutions, they are actively competing to secure contracts and market share. The race to develop and deploy advanced, cost-effective FPSO units in these high-potential regions intensifies the pressure on all players.

Operational Efficiency and Uptime

Maintaining high operational uptime and efficiency is a critical competitive factor in the offshore oil and gas sector, directly impacting revenue and client satisfaction. BW Offshore's consistent reporting of high commercial uptime across its fleet, often exceeding 95%, serves as a significant differentiator. For instance, in 2023, BW Offshore reported an average fleet commercial uptime of 97.5%, a testament to their robust operational capabilities.

However, this focus on uptime creates intense rivalry, as competitors like Equinor and Shell, who also operate significant offshore assets, continuously invest in technology and maintenance to achieve similar or better performance levels. This drives a constant need for operational excellence and innovation to remain competitive.

- High Commercial Uptime: BW Offshore's fleet achieved 97.5% commercial uptime in 2023, a key performance indicator.

- Competitive Benchmarking: Competitors like Equinor and Shell also prioritize high uptime, creating pressure for BW Offshore to maintain its edge.

- Investment in Reliability: Continuous investment in advanced maintenance, technology upgrades, and skilled personnel is crucial to sustain operational efficiency.

- Impact on Revenue: Extended periods of downtime directly translate to lost revenue, making uptime a critical factor in profitability and market share.

Diversification into Energy Transition

BW Offshore's diversification into the energy transition, particularly offshore wind, intensifies competitive rivalry. The company now faces competition not only from traditional offshore oil and gas service providers but also from specialized offshore wind developers and engineering firms. This broader competitive set includes companies with established expertise in renewable energy infrastructure.

The offshore wind sector is attracting significant investment, leading to a growing number of players vying for projects. For instance, by the end of 2024, global offshore wind capacity is projected to exceed 70 GW, with substantial new installations expected in the coming years. This expansion fuels intense competition for engineering, procurement, construction, and installation (EPCI) contracts, where BW Offshore aims to leverage its offshore project management skills.

- Increased Competition: BW Offshore competes with established offshore wind developers and EPCI contractors in addition to its traditional FPSO rivals.

- Market Growth: The global offshore wind market is expanding rapidly, attracting new entrants and intensifying competition for project awards.

- Technological Advancements: Companies with advanced floating wind technologies and efficient installation methods gain a competitive edge.

The competitive rivalry within the FPSO operator market is intense due to the concentrated nature of the industry, with a few major global players like SBM Offshore, MODEC, Yinson, and BW Offshore itself vying for lucrative contracts. This fierce competition is particularly evident in high-stakes deepwater developments, where securing long-term projects drives aggressive pricing and innovation. For example, BW Offshore's securing of a Santos Basin field development contract in 2024 underscores the high value and competitive nature of these bespoke projects, often worth billions.

This rivalry is further amplified by the drive for operational excellence, with high commercial uptime being a critical differentiator. BW Offshore's achievement of 97.5% commercial uptime in 2023 sets a benchmark that competitors like Equinor and Shell are also striving to meet through continuous investment in technology and maintenance. The expansion of BW Offshore into the offshore wind sector also broadens its competitive landscape, pitting it against specialized renewable energy firms in a rapidly growing market.

| Company | Key Market Segment | 2023 Uptime (approx.) | Notable 2024 Contract |

|---|---|---|---|

| BW Offshore | FPSO Operations, Offshore Wind | 97.5% | Santos Basin Field Development |

| SBM Offshore | FPSO Operations | High (industry standard) | N/A (specific contracts vary) |

| MODEC | FPSO Operations | High (industry standard) | N/A (specific contracts vary) |

| Yinson | FPSO Operations | High (industry standard) | N/A (specific contracts vary) |

SSubstitutes Threaten

Fixed platforms and subsea tie-backs represent significant threats of substitutes for BW Offshore's FPSO (Floating Production Storage and Offloading) solutions. For certain offshore oil and gas fields, particularly those in shallower waters or with particular reservoir characteristics, these alternatives can be more cost-effective or operationally advantageous. For instance, in 2024, the cost of installing a fixed platform can range from hundreds of millions to billions of dollars, depending on complexity and location, while subsea tie-backs can offer a more modular approach, potentially reducing upfront capital expenditure compared to a full FPSO development for smaller fields.

While BW Offshore primarily operates offshore, a substantial global reallocation of capital towards onshore oil and gas extraction, especially from shale resources, presents a threat. This shift can diminish the overall market demand for offshore infrastructure and services, including floating production, storage, and offloading (FPSO) units. For instance, in 2024, continued advancements in onshore drilling efficiency and cost reductions, particularly in regions like the Permian Basin, could make onshore projects more economically attractive relative to complex offshore developments.

While BW Offshore primarily focuses on Floating Production Storage and Offloading (FPSO) units, other floating production systems can act as substitutes for specific applications. Floating Storage and Offloading (FSO) units, Floating Liquefied Natural Gas (FLNG) vessels, and Floating Storage and Regasification Units (FSRU) offer alternative solutions for offshore energy handling. For instance, FSOs are solely for storage and offloading, lacking the integrated production capabilities of FPSOs, which limits their direct substitutability in full production scenarios.

The market for FLNG and FSRU units is growing, particularly in regions with stranded gas reserves or for regasification needs. For example, the global FLNG market was valued at approximately USD 20 billion in 2023 and is projected to grow significantly, indicating a developing substitute landscape. However, the complexity and cost associated with these technologies, especially FLNG, mean they often target different project types than traditional FPSO applications.

Renewable Energy Sources

Renewable energy sources like solar and wind present a significant long-term threat to traditional oil and gas demand, which directly impacts the need for Floating Production Storage and Offloading (FPSO) services. As the global energy transition accelerates, the market share of renewables is expected to grow substantially. For instance, by 2024, global renewable energy capacity additions are projected to reach new heights, further solidifying their position as viable alternatives to fossil fuels.

This shift can lead to reduced investment in new oil and gas extraction projects, consequently diminishing the market for offshore production facilities like those BW Offshore provides. BW Offshore itself recognizes this trend, evidenced by its strategic investments in offshore wind projects, directly engaging with the substitution threat rather than solely relying on its traditional FPSO business.

- Growing Renewable Capacity: Global renewable energy capacity is on an upward trajectory, with significant expansion anticipated through 2024 and beyond, pressuring fossil fuel demand.

- Impact on Oil & Gas Demand: Increased adoption of renewables directly substitutes for oil and gas, potentially leading to lower long-term demand for offshore extraction services.

- BW Offshore's Diversification: BW Offshore's own investments in offshore wind demonstrate an acknowledgment of and a proactive response to the substitution threat posed by renewable energy sources.

Technological Advancements in Extraction

Innovations in extraction technologies present a nuanced threat of substitution for BW Offshore's FPSO services. As new methods emerge, they can unlock reserves previously considered uneconomical or improve recovery from existing fields without relying on traditional FPSO setups. For example, advancements in subsea processing are reducing the necessity for large topside facilities, potentially diminishing the demand for the integrated solutions FPSOs provide.

The ongoing evolution of offshore extraction techniques is a key factor to monitor. Consider the impact of enhanced oil recovery (EOR) methods, which can significantly boost output from mature fields. If these technologies become more cost-effective and widely adopted, they could lessen the reliance on new FPSO projects for incremental production. For instance, in 2024, significant investments were made in subsea technologies aimed at improving efficiency and reducing the surface footprint of offshore operations.

- Subsea Processing Growth: Investments in subsea processing technologies are projected to grow, potentially reducing the need for extensive topside facilities on FPSOs.

- EOR Advancements: Enhanced Oil Recovery techniques are becoming more sophisticated, enabling greater extraction from existing reservoirs and potentially lowering demand for new FPSO units.

- Cost-Effectiveness: As alternative extraction methods become more cost-competitive, they pose a greater substitution threat to traditional FPSO solutions.

Fixed platforms and subsea tie-backs offer viable alternatives to BW Offshore's FPSO solutions, especially for certain field types and shallower waters. In 2024, the capital expenditure for fixed platforms can range from hundreds of millions to billions, while subsea tie-backs can present a more cost-effective, modular approach for smaller fields.

The growing market for FLNG and FSRU units, valued at approximately USD 20 billion in 2023, represents another evolving substitute. While these technologies are often more complex and costly, targeting different project scopes than traditional FPSOs, their expansion indicates a diversifying offshore energy infrastructure landscape.

Advancements in extraction technologies, such as subsea processing and enhanced oil recovery (EOR), also pose a threat. By reducing the need for extensive topside facilities and improving recovery from existing fields, these innovations can lessen the demand for new FPSO projects, with significant investments in subsea tech occurring in 2024.

| Substitute Technology | Typical Application | Cost Consideration (2024 estimate) | BW Offshore Relevance |

| Fixed Platforms | Mature fields, shallower waters | Hundreds of millions to billions USD | Direct competitor for certain field developments |

| Subsea Tie-backs | Smaller fields, marginal reserves | Potentially lower CAPEX than full FPSO | Alternative for incremental production or smaller projects |

| FLNG/FSRU | Stranded gas, LNG import/export | High complexity and cost | Emerging alternative for specific gas projects |

| Subsea Processing | Improving reservoir recovery, reducing topside needs | Varies by complexity | Reduces reliance on FPSO's integrated facilities |

| EOR Technologies | Mature field revitalization | Varies by method | Decreases need for new FPSOs for production boosts |

Entrants Threaten

The sheer cost of building or acquiring Floating Production Storage and Offloading (FPSO) units is a massive hurdle for potential new players in the BW Offshore market. We are talking about investments that can easily run into billions of dollars for a single vessel.

For instance, the construction of a new, state-of-the-art FPSO can easily exceed $1 billion, with some projects reaching upwards of $2 billion. This immense capital requirement means that only well-established companies with significant financial resources and access to large-scale funding can even consider entering this space.

This high capital expenditure effectively deters smaller, less capitalized firms from challenging incumbents like BW Offshore, thereby reducing the threat of new entrants and reinforcing the existing market structure.

The threat of new entrants in the FPSO sector is significantly mitigated by the immense technological complexity and specialized expertise required. Designing, engineering, constructing, and operating these sophisticated floating production, storage, and offloading units demand deep knowledge across naval architecture, process engineering, materials science, and subsea technology. New players would need to invest heavily and over extended periods to build this critical technical capability, a substantial barrier to entry.

The offshore oil and gas sector presents substantial regulatory barriers for potential new entrants. Companies must navigate complex international and national regulations concerning safety, environmental protection, and operational integrity. For instance, adherence to standards set by bodies like the International Maritime Organization (IMO) and national agencies such as the U.S. Bureau of Safety and Environmental Enforcement (BSEE) requires significant investment in compliance infrastructure and expertise.

Meeting these stringent safety and environmental standards translates into considerable upfront costs for new players. This includes developing robust safety management systems, investing in advanced technology to minimize environmental impact, and securing necessary permits and certifications. The capital expenditure required to establish a credible safety record and achieve regulatory approval can deter smaller or less capitalized entrants, effectively raising the barrier to entry.

Establishing a proven safety record is paramount in the offshore industry, where incidents can have catastrophic consequences. New entrants must demonstrate a history of safe operations, which is a lengthy and costly process. For example, securing insurance and financing often hinges on a company's safety performance and its ability to meet the rigorous requirements of established industry players and regulatory bodies, making it difficult for newcomers to compete on a level playing field.

Established Customer Relationships and Track Record

Established customer relationships and a proven track record significantly deter new entrants in the FPSO (Floating Production, Storage, and Offloading) market. Companies like BW Offshore have cultivated deep, trust-based partnerships with major oil and gas producers over many years. This history is crucial because these clients are inherently risk-averse and prioritize reliability and proven performance for their substantial, long-term projects.

Newcomers face a steep climb in replicating this level of confidence. Demonstrating the technical expertise, operational excellence, and financial stability necessary to win multi-billion dollar FPSO contracts requires a substantial and successful history. For instance, a new entrant would need to overcome the established credibility that BW Offshore built through its successful delivery of numerous complex projects, often valued in the hundreds of millions to over a billion dollars each.

- Long-standing client relationships: Major oil and gas companies prefer to work with experienced FPSO providers they trust.

- Proven project execution: A history of successfully delivering complex, large-scale FPSO projects is a significant barrier.

- Operational reliability track record: Demonstrating consistent, safe, and efficient operations is paramount for attracting risk-averse clients.

- High capital investment and specialized assets: The immense cost and specialized nature of FPSO vessels and related infrastructure further limit new entrants.

Long Project Development Cycles

The extended development timelines for Floating Production Storage and Offloading (FPSO) units present a substantial barrier to new entrants. These projects, from conception to the first flow of oil, can easily take several years to complete. This lengthy gestation period means that any new competitor would face a considerable delay before seeing any return on their investment, thereby elevating the financial risks associated with entering the market.

This extended cycle directly impacts the attractiveness of the FPSO sector for newcomers. For instance, a typical FPSO project can involve a capital expenditure ranging from $500 million to over $1 billion, with the development phase alone often lasting 3-5 years. Such significant upfront investment coupled with a prolonged period without revenue makes the threat of new entrants relatively low.

- Long Development Cycles: FPSO projects typically span several years from concept to first oil.

- High Financial Risk: Extended timelines increase the financial risk for new market participants.

- Delayed Revenue Generation: New entrants must wait years before generating revenue, deterring entry.

- Capital Intensity: The substantial capital required for FPSO development further discourages new players.

The threat of new entrants for BW Offshore is significantly low due to the colossal capital requirements. Building a single Floating Production Storage and Offloading (FPSO) unit can cost upwards of $1 billion, a sum only accessible to established, well-funded corporations. This financial barrier effectively screens out smaller, less capitalized firms, solidifying the market position of incumbents.

Furthermore, the specialized technical expertise and stringent regulatory compliance needed in the FPSO sector create substantial entry hurdles. New players must demonstrate advanced engineering capabilities and a proven safety record, often requiring years and significant investment to achieve. For example, adherence to International Maritime Organization (IMO) standards demands robust infrastructure and specialized knowledge, making it difficult for newcomers to compete.

Established customer relationships and a history of successful project execution also act as powerful deterrents. Major oil and gas companies, inherently risk-averse, prefer to partner with experienced FPSO providers like BW Offshore, who have a track record of reliability and operational excellence. Replicating this level of trust and proven performance is a formidable challenge for any new entrant, especially when contracts often exceed hundreds of millions to over a billion dollars.

The extended development timelines, often spanning several years from project inception to first oil, further amplify the financial risks for potential new entrants. This prolonged period without revenue generation, coupled with the substantial upfront capital investment, makes the FPSO market a less attractive proposition for companies without significant financial resilience and a long-term strategic outlook.

| Barrier | Description | Impact on New Entrants | Example Data Point (2024 context) |

| Capital Requirements | Enormous cost to build or acquire FPSO units. | Significantly limits the pool of potential entrants. | New FPSO construction costs can range from $1 billion to over $2 billion. |

| Technical Expertise | Requires deep knowledge in naval architecture, engineering, and subsea technology. | Demands extensive investment in talent and R&D. | Developing the necessary engineering and operational capabilities can take 5-10 years. |

| Regulatory Compliance | Navigating complex international and national safety and environmental regulations. | Requires substantial investment in compliance infrastructure and certifications. | Meeting standards from bodies like the IMO and national agencies necessitates significant upfront expenditure. |

| Customer Relationships & Track Record | Cultivating trust and demonstrating proven performance with major oil and gas producers. | New entrants struggle to gain credibility against established players. | BW Offshore's long history of successful project delivery builds client confidence. |

| Development Timelines | Extended project cycles from conception to operation. | Increases financial risk and delays revenue generation for new players. | FPSO projects can have development phases of 3-5 years before generating revenue. |

Porter's Five Forces Analysis Data Sources

Our BW Offshore Porter's Five Forces analysis is built upon a foundation of publicly available data, including the company's annual reports and investor presentations. We also leverage industry-specific market research reports and news articles from reputable financial publications to capture current market dynamics.