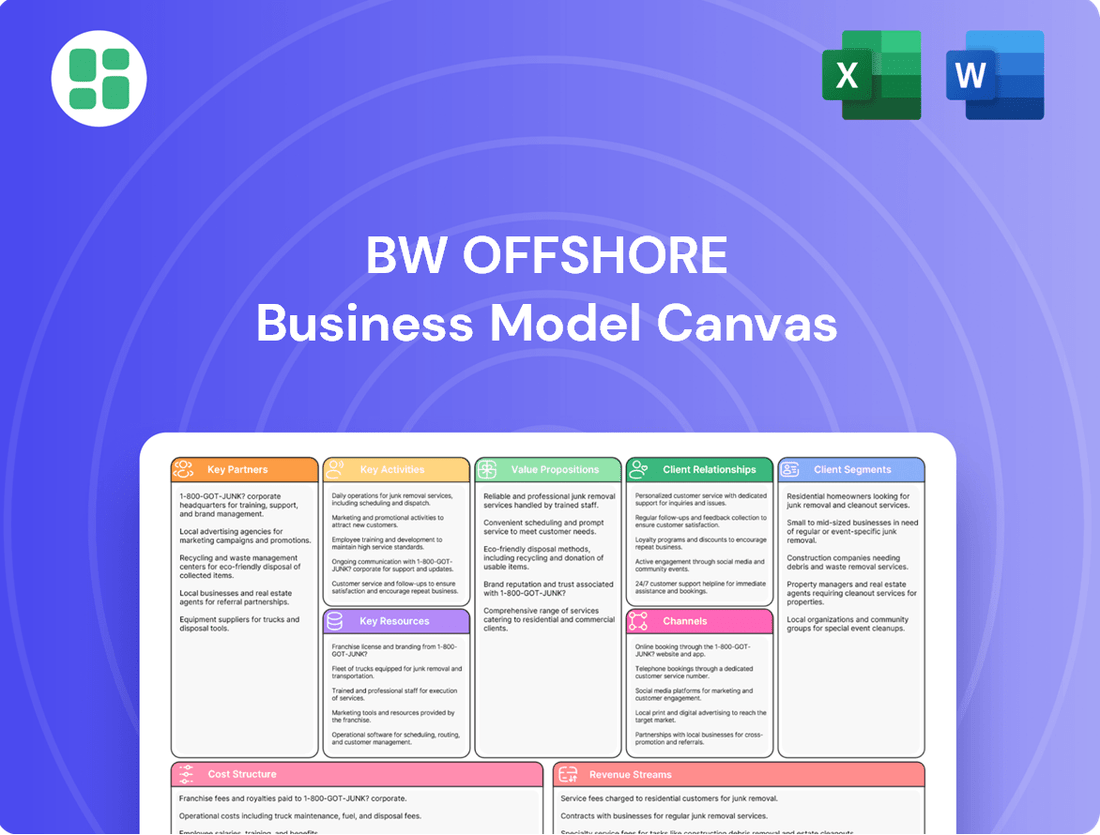

BW Offshore Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BW Offshore Bundle

Discover the strategic core of BW Offshore with our comprehensive Business Model Canvas. This detailed analysis unpacks how they deliver value through innovative offshore solutions and secure long-term client relationships. Ready to explore their competitive advantage?

Unlock the full strategic blueprint behind BW Offshore's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

BW Offshore actively forms strategic alliances with technology providers and other industry leaders to drive the development of new energy solutions. A prime example is their partnership with McDermott, focusing on offshore blue ammonia production, a key area for decarbonization.

These collaborations are vital for BW Offshore to tap into specialized expertise and accelerate their progress in nascent low-carbon markets. By working with partners, they can share the risks associated with innovative projects and efficiently expand their reach into new geographical and technological territories.

BW Offshore's strategic approach to offshore wind involves significant co-development partnerships, most notably its 64% ownership in BW Ideol, a frontrunner in floating offshore wind technology. This substantial stake underscores BW Offshore's dedication to advancing renewable energy, enabling shared risk and expertise in the execution of floating wind projects.

Collaborations with other key developers are crucial for bringing these ambitious projects to fruition. For instance, partnerships with entities like EDF Renewables and Maple Power were instrumental in securing projects from the Mediterranean Tender, highlighting the importance of these alliances in navigating complex tender processes and project development.

BW Offshore collaborates with premier shipyards worldwide for the construction, conversion, and upkeep of its Floating Production Storage and Offloading (FPSO) units. These partnerships are vital for accessing specialized infrastructure and skilled labor necessary for complex, large-scale maritime projects, ensuring the operational readiness of their fleet.

A prime example of this synergy is BW Offshore's relationship with Seatrium in Singapore. Seatrium played a crucial role in delivering significant FPSO projects, such as the BW Opal. This collaboration underscores the importance of strong shipyard relationships in executing major vessel developments and maintaining BW Offshore's extensive fleet capabilities.

Oil and Gas Field Operators

BW Offshore's core strength lies in its strategic alliances with international and national oil and gas field operators. These vital partnerships are the bedrock of its operations, enabling the deployment of Floating Production, Storage, and Offloading (FPSO) units for hydrocarbon extraction and processing. For instance, BW Offshore's collaboration with Santos on the Barossa project highlights this crucial relationship, as does its involvement with Equinor for the Bay du Nord pre-FEED study.

These long-term contracts with field operators are not merely transactional; they represent a symbiotic relationship where BW Offshore provides essential infrastructure and services, and the operators secure reliable production solutions. This reliance translates directly into a stable revenue stream and a robust project pipeline for BW Offshore, underscoring the significance of these key partnerships in its business model.

- Client Reliance: Operators like Santos and Equinor depend on BW Offshore's FPSO technology for efficient offshore field development and production.

- Revenue Generation: Long-term contracts with these major oil and gas companies are the primary drivers of BW Offshore's financial performance and project visibility.

- Strategic Importance: These partnerships are fundamental to BW Offshore's ability to execute complex offshore projects and maintain its market position.

Financial Institutions and Investors

BW Offshore's financial partnerships are crucial for its capital-intensive operations. The company actively collaborates with a wide array of financial institutions, including major banks and investment funds, to secure project financing and various debt facilities. These relationships are fundamental for raising the necessary capital to fund its substantial fleet expansion and to support its strategic pivot towards energy transition initiatives.

Maintaining robust connections with these financial stakeholders is paramount. It ensures BW Offshore has consistent access to liquidity, which is vital for undertaking large-scale projects. For instance, in 2024, the company continued to leverage its strong banking relationships to manage its debt portfolio and explore new funding avenues for its growing renewable energy ventures, such as the floating solar projects.

- Project Financing: BW Offshore secures funding for specific offshore projects through syndicated loans and partnerships with development banks.

- Debt Facilities: The company utilizes various credit facilities and bond issuances to manage its overall capital structure and operational needs.

- Capital Raising: Equity offerings and private placements are employed to raise capital for strategic growth, including fleet upgrades and investments in new energy technologies.

- Investor Relations: Consistent engagement with institutional investors and shareholders is maintained to ensure confidence and support for the company's long-term strategy.

BW Offshore's key partnerships are multifaceted, spanning technology providers, shipyards, and crucially, oil and gas field operators. These alliances are essential for project execution and revenue generation. For example, collaborations with technology firms are driving innovation in blue ammonia production, while shipyard partnerships ensure the construction and maintenance of their FPSO fleet. In 2024, BW Offshore continued to rely on these relationships to navigate complex offshore projects and maintain its operational capabilities.

What is included in the product

This BW Offshore Business Model Canvas provides a structured overview of their operations, detailing key partnerships, core activities, and revenue streams derived from offshore production and floating storage solutions.

It clearly outlines their value propositions to oil and gas clients, customer relationships, and cost structures, offering a comprehensive view of their strategic approach to the offshore energy sector.

BW Offshore's Business Model Canvas acts as a pain point reliever by providing a clear, visual framework to identify and address operational inefficiencies and strategic gaps.

It simplifies complex challenges, enabling rapid understanding and targeted solutions for improved performance and profitability.

Activities

BW Offshore's core strength lies in its comprehensive approach to FPSO (Floating Production, Storage, and Offloading) vessels, encompassing design, engineering, and construction. This end-to-end capability allows them to manage the entire lifecycle of these complex offshore assets.

The company's expertise is evident in projects like the BW Opal for the Barossa field, a testament to their ability to handle intricate technical planning and execution. This project highlights their commitment to delivering specialized offshore production solutions.

Leveraging decades of accumulated experience, BW Offshore excels at creating bespoke FPSO units tailored to specific field requirements. Their track record demonstrates a consistent ability to deliver high-quality, integrated offshore production facilities.

BW Offshore's core activity revolves around the operation and maintenance of its Floating Production Storage and Offloading (FPSO) vessels. This ensures their fleet achieves high commercial uptime and maximizes hydrocarbon production efficiency.

This crucial function demands robust technical support, intricate logistics planning, and skilled personnel management, all executed within challenging offshore conditions. For instance, in 2023, BW Offshore reported an average fleet availability of 95%, underscoring their operational prowess.

These comprehensive FPSO services are typically secured through long-term contracts, which are vital for generating predictable and stable revenue streams for the company.

BW Offshore is actively developing offshore wind projects, focusing on floating wind technology via its subsidiary, BW Ideol. This strategic move diversifies their energy portfolio, moving beyond traditional oil and gas operations.

The company participates in competitive tenders and manages project progression from initial design through to potential installation phases. For instance, BW Ideol is involved in the development of the Windfloat Atlantic project, a significant floating offshore wind farm.

This expansion into offshore wind aligns with global energy transition goals and represents a key part of BW Offshore's strategy to capitalize on the growing renewable energy market.

Strategic Asset Management and Divestments

BW Offshore actively manages its fleet through strategic asset management and divestments to maintain a competitive and modern operational base. This involves the careful selection of assets for sale or acquisition, aiming to optimize capital allocation and align the fleet with evolving market needs and technological advancements.

The company's approach ensures a dynamic portfolio, shedding older units while integrating newer, more efficient vessels. For instance, the divestment of the FPSO BW Pioneer exemplifies this strategy, freeing up capital and resources. Simultaneously, the acquisition of FPSO Nganhurra signals a commitment to acquiring assets with potential for future redeployment, demonstrating foresight in fleet expansion and optimization.

- Fleet Optimization: BW Offshore continuously evaluates its fleet, divesting older assets like FPSO BW Pioneer to improve overall efficiency and financial performance.

- Strategic Acquisitions: The company acquires new or repurposed assets, such as FPSO Nganhurra, to enhance its operational capabilities and meet future project demands.

- Capital Allocation: Divestment proceeds are strategically reinvested into new projects or fleet upgrades, ensuring efficient use of capital.

- Market Alignment: These activities ensure the fleet remains modern and capable of servicing current and future offshore production requirements.

Low-Carbon Energy Solution Development

BW Offshore is actively developing innovative low-carbon energy solutions. This includes venturing into areas like CO2 transport, gas-to-power projects, and pioneering floating ammonia production facilities. These efforts are designed to address the growing global demand for cleaner energy sources.

Leveraging their extensive experience with Floating Production Storage and Offloading (FPSO) units, BW Offshore is strategically expanding its capabilities. This expansion into new energy sectors is a direct response to shifting market dynamics and the urgent need for decarbonization.

These initiatives are crucial for BW Offshore’s long-term strategy, aligning with worldwide decarbonization goals. For instance, in 2024, the company continued to explore opportunities in the renewable energy space, building on its established offshore engineering expertise.

- Focus on CO2 Transport: BW Offshore is developing solutions for the safe and efficient transportation of captured carbon dioxide, a key component of carbon capture and storage (CCS) value chains.

- Gas-to-Power Solutions: The company is exploring and developing projects to convert natural gas into electricity offshore, offering a more flexible and potentially lower-emission power generation option.

- Floating Ammonia Production: BW Offshore is investing in the development of floating facilities for ammonia production, recognizing ammonia's potential as a clean fuel and hydrogen carrier.

- Leveraging FPSO Expertise: The company's core competency in designing, building, and operating FPSOs is being adapted and applied to these new low-carbon energy ventures.

BW Offshore's core activities center on the design, engineering, construction, operation, and maintenance of FPSO units. This integrated approach ensures high fleet availability, with 2023 seeing an average of 95% uptime. These services are primarily delivered through long-term contracts, providing a stable revenue foundation.

The company is also strategically expanding into offshore wind, notably through its subsidiary BW Ideol and its involvement in projects like Windfloat Atlantic. This diversification into renewables is a key part of their strategy to capitalize on the growing clean energy market.

Furthermore, BW Offshore is actively developing low-carbon energy solutions. This includes exploring CO2 transport, gas-to-power projects, and pioneering floating ammonia production, all leveraging their extensive offshore engineering expertise to align with global decarbonization goals.

Fleet optimization is another critical activity, involving strategic divestments of older assets, such as the FPSO BW Pioneer, and acquisitions of new or repurposed vessels, like the FPSO Nganhurra, to maintain a modern and competitive operational base.

What You See Is What You Get

Business Model Canvas

The BW Offshore Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive overview details their operational strategy, key partners, revenue streams, and cost structure, providing a clear roadmap of their business. You'll gain full access to this same professionally structured and informative canvas, ready for your analysis.

Resources

BW Offshore's core assets are its fleet of Floating Production Storage and Offloading (FPSO) vessels. These are the critical infrastructure enabling offshore oil and gas production and storage. Operational units like BW Adolo and BW Catcher, alongside newbuilds such as BW Opal, demonstrate the breadth of their fleet.

The company's capacity to capitalize on market opportunities is significantly bolstered by its fleet. For instance, the acquisition of FPSO Nganhurra in 2024 directly expands their ability to service new projects and existing fields.

BW Offshore's specialized engineering and project execution expertise is a cornerstone of its business model. With over four decades of experience, the company excels in the entire lifecycle of offshore production units, from initial engineering and procurement through to installation and commissioning.

This extensive technical know-how is a critical intangible asset, allowing BW Offshore to craft bespoke solutions for even the most demanding offshore conditions. This capability is crucial for their success in both traditional Floating Production, Storage, and Offloading (FPSO) projects and their ventures into new energy sectors.

BW Offshore's robust financial position and liquidity are foundational to its business model. A strong balance sheet, bolstered by substantial available liquidity and a significant firm contract backlog, provides the necessary capital to pursue new project developments and effectively manage operational risks. This financial resilience is crucial for maintaining investor confidence and enabling strategic growth initiatives.

The company's financial health is evident in its recent performance. For example, BW Offshore's 2024 results showcased strong liquidity and consistent cash generation. This trend continued into Q1 2025, where the company again reported healthy liquidity levels, underscoring its capacity to fund operations and investments reliably.

Proprietary Technology and Innovation

BW Offshore's ownership in BW Ideol grants it access to cutting-edge, proprietary technologies such as the Damping Pool® system. This patented technology is a significant differentiator for floating offshore wind solutions, enhancing stability and performance in challenging marine environments. This technological leadership is key to their competitive edge in the burgeoning offshore renewable energy sector.

This proprietary technology directly fuels BW Offshore's ability to develop more efficient and reliable energy solutions. In 2024, the company continued to leverage these innovations to secure and execute projects, demonstrating a commitment to advancing offshore energy infrastructure. The ongoing investment in innovation ensures they remain at the forefront of the energy transition.

- Proprietary Technology: BW Ideol's Damping Pool® for enhanced floating offshore wind stability.

- Competitive Advantage: Advanced and efficient energy solutions due to technological ownership.

- Market Adaptation: Continuous innovation is vital for meeting evolving energy demands.

- Energy Transition: Contribution to the global shift towards sustainable energy sources.

Experienced Global Workforce and Management Team

BW Offshore’s approximately 1,100 employees, drawn from diverse nationalities, are a cornerstone of its operations. This global workforce, complemented by a seasoned management team, brings a wealth of experience in offshore engineering, project execution, and stringent safety protocols. Their combined knowledge is crucial for achieving high operational uptime and successfully delivering complex projects.

The expertise embedded within BW Offshore’s human capital directly translates into operational efficiency and reliability. This skilled team is instrumental in maintaining the company's strong track record in the demanding offshore energy sector. Their dedication to safety and performance underpins the company’s ability to secure and manage long-term contracts.

- Global Workforce: BW Offshore employs around 1,100 individuals worldwide, reflecting a broad range of international expertise.

- Experienced Management: The leadership team possesses deep industry knowledge in offshore operations and project management.

- Operational Excellence: The workforce's collective skills ensure high commercial uptime and efficient project delivery.

- Strategic Growth Driver: This human resource is fundamental to the company's capacity for strategic expansion and continued success.

BW Offshore's key resources are its extensive fleet of FPSO vessels, specialized engineering and project execution capabilities, strong financial standing, proprietary technology through BW Ideol, and its skilled global workforce. These elements collectively form the foundation for its operations and strategic growth in the offshore energy sector.

The company's fleet, including units like BW Adolo and the recently acquired FPSO Nganhurra (in 2024), represents its primary physical asset. This fleet is complemented by intangible assets such as decades of engineering expertise and the innovative Damping Pool® technology. A robust financial position, evidenced by strong liquidity in 2024 and Q1 2025, ensures capital availability for new projects and operational resilience. The team of approximately 1,100 employees provides the human capital essential for executing complex projects and maintaining operational excellence.

| Resource Category | Key Resources | Supporting Data/Facts (as of latest available, leaning towards 2024/2025) |

|---|---|---|

| Physical Assets | FPSO Fleet | Includes operational units like BW Adolo, BW Catcher, and newbuilds like BW Opal. Acquisition of FPSO Nganhurra in 2024 expanded fleet capacity. |

| Intellectual Property | Engineering & Project Execution Expertise | Over four decades of experience across the full lifecycle of offshore production units. |

| Intellectual Property | Proprietary Technology (BW Ideol) | Damping Pool® system for enhanced floating offshore wind stability. |

| Financial Resources | Liquidity and Contract Backlog | Strong liquidity reported in 2024 and Q1 2025; significant firm contract backlog provides revenue visibility. |

| Human Capital | Global Workforce & Management | Approximately 1,100 employees worldwide with extensive experience in offshore operations, engineering, and safety. |

Value Propositions

BW Offshore provides a complete package for offshore oil and gas production, handling everything from the initial design and engineering of Floating Production Storage and Offloading (FPSO) vessels to their installation and ongoing operation. This all-in-one service streamlines the often-complicated process of developing offshore fields for energy companies.

By offering this integrated solution, BW Offshore acts as a single point of contact for clients, making it easier to manage their production requirements. This unified approach enhances efficiency and ensures better coordination throughout the project lifecycle.

In 2024, BW Offshore continued to leverage its expertise, managing a fleet of FPSOs that contribute significantly to global energy supply. For instance, the company's FPSO Catcher, operating in the North Sea, has consistently met production targets, demonstrating the effectiveness of their integrated operational model.

BW Offshore's commitment to high reliability and operational uptime is a cornerstone of its value proposition. The company consistently achieves commercial uptime exceeding 99% for its Floating Production Storage and Offloading (FPSO) units. This exceptional performance directly translates into minimized production downtime for clients, thereby maximizing their hydrocarbon output and revenue streams.

This dependable performance is built on a strong operational track record, showcasing BW Offshore's ability to deliver consistent results even in challenging offshore conditions. For instance, in 2023, the company reported an average fleet uptime of 99.3%, underscoring its dedication to operational excellence and client satisfaction.

BW Offshore crafts bespoke floating energy solutions, drawing on 40 years of expertise to precisely match client needs and demanding offshore environments. This means they can adapt their offerings, whether it's a unique contract arrangement or a specific technological setup.

Their flexibility is key to tackling complex projects, ensuring that each solution is as unique as the challenge it addresses. For instance, in 2024, BW Offshore continued to secure and execute projects requiring highly specialized configurations, demonstrating this core capability.

This tailored approach directly boosts client satisfaction and significantly contributes to the overall success of their energy projects. By understanding and adapting to specific field conditions and operational demands, BW Offshore solidifies its position as a reliable partner.

Commitment to Energy Transition and Low-Carbon Solutions

BW Offshore is actively driving the energy transition by developing innovative low-carbon offshore energy production solutions. This includes pioneering work in floating wind technology and conceptualizing systems for CO2 transport and the production of blue ammonia.

This strategic focus makes BW Offshore a valuable partner for clients aiming to reduce their environmental impact and adopt cleaner energy sources. The company's commitment directly addresses the increasing global demand for sustainable energy and aligns with future energy market trends.

- Floating Wind Development: BW Offshore is a key player in advancing floating wind technology, a critical component for expanding offshore renewable energy generation.

- CO2 Transport Solutions: The company is exploring and developing concepts for the safe and efficient transport of captured carbon dioxide, supporting carbon capture and storage (CCS) initiatives.

- Blue Ammonia Concepts: BW Offshore is also working on solutions for blue ammonia production, a cleaner fuel alternative that plays a role in decarbonizing various industries.

- Sustainability Alignment: These initiatives position BW Offshore to capitalize on the global shift towards sustainability and meet the evolving needs of the energy sector.

Reduced Lead Times and Cost Efficiency through Asset Reuse

BW Offshore's strategy centers on reusing existing energy production infrastructure, significantly shortening the time from project approval to the commencement of production. This reuse of assets is inherently more cost-effective than constructing entirely new facilities, translating into substantial economic advantages for clients by minimizing capital expenditure and accelerating revenue generation.

This approach offers a competitive edge by reducing project execution risks and delivering faster returns on investment. For instance, the acquisition and potential redeployment of vessels like the FPSO Nganhurra underscore BW Offshore's commitment to this asset-reuse model, demonstrating a tangible pathway to enhanced efficiency and cost savings.

- Asset Reuse: BW Offshore leverages existing production units, reducing the need for new builds.

- Shorter Lead Times: This strategy enables quicker project sanction to first oil/gas delivery.

- Cost Efficiency: Redeploying assets typically offers a lower overall project cost compared to greenfield developments.

- Example: The acquisition of FPSO Nganhurra for potential redeployment highlights this value proposition.

BW Offshore delivers integrated offshore energy production solutions, managing the entire lifecycle from design to operation of FPSOs. This end-to-end service simplifies complex field development for clients, acting as a single, efficient point of contact.

The company's value proposition is built on exceptional operational reliability, consistently achieving fleet uptime above 99%. In 2023, BW Offshore reported an average fleet uptime of 99.3%, ensuring maximized hydrocarbon output and revenue for clients.

BW Offshore offers flexible, bespoke floating energy solutions, adapting to unique client needs and challenging offshore environments, as demonstrated by their continued execution of specialized projects in 2024.

The company is also a leader in the energy transition, developing low-carbon solutions like floating wind and concepts for CO2 transport and blue ammonia production, aligning with future market demands for sustainability.

BW Offshore’s strategy of reusing existing infrastructure significantly shortens project lead times and reduces costs. The acquisition and potential redeployment of FPSO Nganhurra exemplify this cost-efficient approach, accelerating client revenue generation.

| Value Proposition | Description | Key Metric/Example |

|---|---|---|

| Integrated FPSO Solutions | Full lifecycle management from design to operation. | Streamlined project execution for clients. |

| High Operational Uptime | Ensuring maximum production and revenue. | Fleet uptime consistently exceeds 99% (99.3% in 2023). |

| Bespoke & Flexible Solutions | Tailored offerings for specific client needs and environments. | Continued execution of specialized projects in 2024. |

| Energy Transition Focus | Development of low-carbon offshore energy technologies. | Floating wind, CO2 transport, and blue ammonia concepts. |

| Asset Reuse & Cost Efficiency | Leveraging existing infrastructure for faster, cheaper projects. | FPSO Nganhurra acquisition for potential redeployment. |

Customer Relationships

BW Offshore secures its customer relationships primarily through long-term contractual engagements, predominantly multi-year lease and operate contracts for its Floating Production, Storage, and Offloading (FPSO) units. These agreements are the bedrock of their business model, offering a stable revenue stream and predictable operational planning.

These contracts often include extension options, which further solidify the long-term nature of the partnerships and provide BW Offshore with visibility on future business. For instance, the company has a 15-year contract for the BW Opal FPSO with Santos, highlighting the significant duration of their client commitments.

The BW Catcher FPSO also exemplifies these extended relationships, having secured contract extensions. Such arrangements not only ensure consistent revenue but also foster deep operational expertise and trust between BW Offshore and its clients, leading to repeat business and a strong reputation in the industry.

BW Offshore actively partners with clients from the outset of new projects, engaging in crucial pre-Front-End Engineering Design (pre-FEED) and FEED studies. This deep involvement ensures that proposed solutions precisely match the unique demands of specific oil and gas fields and align with client goals.

A prime example of this collaborative philosophy in action is BW Offshore's pre-FEED study for Equinor's Bay du Nord project. This early-stage engagement allows for the co-creation of tailored solutions, minimizing risks and maximizing efficiency for the client.

BW Offshore extends its customer relationships beyond initial FPSO delivery by offering dedicated operations and maintenance support. This commitment ensures clients receive continued technical expertise, even post-sale, as exemplified by their ongoing support for the BW Pioneer. These long-term service agreements are crucial for maintaining asset integrity and fostering a strong operational partnership.

Strategic Partnerships for New Ventures

BW Offshore cultivates strategic partnerships with clients and technology providers to drive its emerging energy transition solutions. These collaborations are fundamental to achieving shared objectives in innovation and market growth, particularly in pioneering areas such as offshore blue ammonia production.

These relationships transcend conventional client-vendor arrangements, fostering a spirit of co-creation. For instance, in 2024, BW Offshore announced an agreement with Equinor to develop a floating solar project, showcasing a commitment to new energy ventures beyond its core FPSO business.

- Client Collaboration: Engaging clients in joint development of new energy solutions, like offshore wind or hydrogen production facilities.

- Technology Alliances: Partnering with technology innovators to integrate cutting-edge solutions into offshore platforms.

- Market Expansion: Leveraging partnerships to access new markets and accelerate the adoption of sustainable energy technologies.

- Co-Creation: Moving beyond service provision to jointly develop and commercialize novel energy transition concepts.

Emphasis on Health, Safety, and Environmental Performance

BW Offshore prioritizes building trust with clients by demonstrating unwavering commitment to health, safety, and environmental (HSE) performance. This focus on operational integrity is not just a compliance measure but a cornerstone of their customer relationships.

Their dedication to high safety standards and minimizing environmental impact resonates particularly with clients who are themselves environmentally conscious operators. This shared value fosters stronger, more resilient partnerships.

BW Offshore's sustainability statements and consistent operational uptime are tangible proof of this commitment. For example, in 2023, the company reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.26, showcasing their dedication to a safe working environment.

- Operational Integrity: Maintaining a strong safety culture and robust procedures to ensure reliable operations.

- Environmental Stewardship: Actively working to reduce emissions and environmental footprint, aligning with client sustainability goals.

- Client Alignment: Building trust by meeting and exceeding the HSE expectations of environmentally focused partners.

- Performance Metrics: Demonstrating commitment through measurable HSE achievements and high operational uptime.

BW Offshore's customer relationships are built on long-term contracts, deep project involvement from inception, and ongoing operational support. They foster co-creation in new energy ventures, like the 2024 floating solar project with Equinor, and prioritize trust through exceptional health, safety, and environmental (HSE) performance, evidenced by a 2023 TRIFR of 0.26.

| Customer Relationship Aspect | Description | Example/Data Point |

|---|---|---|

| Contractual Foundation | Long-term lease and operate contracts for FPSOs | 15-year contract for BW Opal FPSO with Santos |

| Early Project Engagement | Involvement in pre-FEED and FEED studies | Pre-FEED study for Equinor's Bay du Nord project |

| Post-Delivery Support | Operations and maintenance services | Ongoing support for the BW Pioneer |

| Energy Transition Partnerships | Collaborations for new energy solutions | Agreement with Equinor for floating solar (2024) |

| HSE Commitment | Focus on safety and environmental performance | 2023 TRIFR of 0.26 |

Channels

BW Offshore's primary customer acquisition strategy revolves around direct sales and competitive tendering for Floating Production Storage and Offloading (FPSO) units and related services. This direct approach enables tailored solutions and negotiation for complex, long-term energy infrastructure projects.

In 2024, the company continued to focus on securing new contracts by actively participating in tenders. For instance, BW Offshore secured a significant contract extension for the Dussafu FPSO in Gabon, demonstrating their ability to leverage existing client relationships and secure long-term revenue streams through direct engagement.

The company's business development efforts are guided by stringent financial return targets and robust counterparty risk assessments. This selective approach ensures that new project pursuits align with BW Offshore's strategic objectives and financial discipline, a critical factor in the capital-intensive offshore sector.

BW Offshore actively participates in key industry gatherings like Gastech, a premier global forum for the gas, LNG, and hydrogen industries. For instance, at Gastech 2023, the company showcased its floating production storage and offloading (FPSO) solutions and its expanding offshore wind capabilities, directly engaging with a global audience of energy professionals and potential clients.

These exhibitions are crucial for BW Offshore to demonstrate its technological advancements and project execution expertise, fostering valuable connections with industry leaders and decision-makers. The company leverages these platforms to not only present its existing offerings but also to explore emerging trends and potential collaborations within both the traditional oil and gas sector and the rapidly growing renewable energy market.

Attending and exhibiting at these events provides BW Offshore with direct access to market intelligence, enabling them to gauge competitor activities and client needs. In 2024, continued strategic presence at such conferences will be vital for securing new contracts and reinforcing its position as a leading offshore energy solutions provider.

BW Offshore's investor relations website and readily available financial reports are key channels for informing stakeholders about its strategic direction and operational achievements. These resources offer transparent access to critical business information, enabling investors and analysts to assess performance and future prospects.

The company's investor presentations, often released alongside quarterly and annual financial results, delve into BW Offshore's performance, market positioning, and strategic outlook. For instance, in their 2024 reporting, BW Offshore highlighted a significant increase in their order backlog, underscoring the strength of their market engagement and future revenue streams.

Strategic Collaborations and Joint Ventures

BW Offshore leverages strategic collaborations and joint ventures as key channels to expand its market reach and tap into specialized segments of the energy industry. These partnerships are crucial for accessing new customer bases and sharing risks and rewards in complex projects. For instance, the company's involvement in floating wind technology through BW Ideol exemplifies this strategy, allowing BW Offshore to gain expertise and market presence in a burgeoning sector.

These alliances are not just about market access; they are about pooling complementary strengths and technologies. The collaboration with McDermott for blue ammonia projects highlights how BW Offshore combines its offshore engineering and operational capabilities with McDermott's process technology and project execution expertise. This synergy is vital for developing innovative solutions in the energy transition landscape.

- Market Expansion: Joint ventures provide direct access to new geographic regions and customer segments that might be difficult to penetrate independently.

- Technology & Expertise Sharing: Partnerships allow for the integration of specialized knowledge and technologies, such as BW Ideol's floating wind solutions, enhancing the company's service offering.

- Risk Mitigation: By sharing the financial and operational burdens of large-scale projects, joint ventures reduce BW Offshore's exposure to individual project risks.

- Accelerated Growth: Collaborations can speed up the development and deployment of new energy solutions, like blue ammonia, positioning BW Offshore at the forefront of industry innovation.

Corporate Website and Digital Presence

The BW Offshore corporate website and its associated digital channels are the primary conduits for disseminating information about the company's extensive service offerings, its diverse fleet, ongoing and completed projects, and its commitment to sustainability. This digital infrastructure ensures constant availability of crucial data for prospective clients, strategic partners, and the general public.

These platforms are consistently updated with press releases and the latest news, keeping stakeholders informed of BW Offshore's activities and developments. For instance, as of early 2024, BW Offshore actively uses its website to detail its fleet, which includes FPSOs and other offshore production units, highlighting their operational capabilities and geographical deployment.

- Information Hub: The corporate website acts as a central repository for all company-related information, ensuring transparency and accessibility.

- Stakeholder Engagement: Digital channels facilitate continuous engagement with clients, partners, and the public through news updates and press releases.

- Fleet and Project Showcase: The website provides detailed insights into BW Offshore's operational assets and project portfolio.

- Sustainability Communication: Environmental, social, and governance (ESG) initiatives and progress are prominently featured, reflecting the company's commitment to responsible operations.

BW Offshore utilizes direct engagement through competitive tendering and industry events like Gastech to connect with clients and showcase its FPSO and offshore wind capabilities. The company's investor relations website and financial reports serve as key channels for transparent communication with stakeholders, detailing performance and strategic direction.

Strategic collaborations and joint ventures, such as with BW Ideol for floating wind and McDermott for blue ammonia, are vital for market expansion, technology sharing, and risk mitigation. The corporate website and digital channels act as a central information hub, continuously updating on fleet, projects, and sustainability efforts, reinforcing market presence and client engagement.

| Channel | Key Function | 2024 Focus/Example |

|---|---|---|

| Direct Sales & Tendering | Securing FPSO contracts | Contract extension for Dussafu FPSO in Gabon |

| Industry Events (e.g., Gastech) | Showcasing solutions, market intelligence | Presenting FPSO and floating wind capabilities |

| Investor Relations | Stakeholder communication, performance reporting | Highlighting increased order backlog in 2024 reports |

| Strategic Alliances | Market access, technology sharing, risk sharing | BW Ideol (floating wind), McDermott (blue ammonia) |

| Corporate Website & Digital | Information dissemination, fleet showcase | Detailing fleet operational capabilities and deployments |

Customer Segments

Global Oil and Gas Majors are BW Offshore's primary customers, seeking integrated Floating Production Storage and Offloading (FPSO) solutions for their extensive offshore operations across the globe. These industry giants, including companies like ExxonMobil and Shell, demand robust, high-capacity FPSOs capable of supporting long-term, complex field development projects.

BW Offshore's business model is heavily aligned with serving these majors, with a significant portion of its current fleet and project pipeline dedicated to their needs. For instance, BW Offshore's 2023 revenue of $814 million was largely driven by contracts with such major players, highlighting their critical importance to the company's financial performance.

National Oil Companies (NOCs) represent a crucial customer segment for BW Offshore, often acting as the primary operators within their national energy landscapes. These entities frequently incorporate local content mandates and national strategic objectives into their project requirements, shaping BW Offshore's operational approach and partnership models.

BW Offshore's extensive global footprint enables it to effectively engage with a diverse array of NOCs, adapting its service offerings to meet their unique operational and regulatory demands. For instance, in 2024, BW Offshore continued to pursue opportunities with NOCs in regions like West Africa and Southeast Asia, where such partnerships are vital for energy development.

BW Offshore, through its BW Ideol investment, directly targets offshore wind farm developers and operators, with a specific emphasis on those pioneering floating wind technology. This strategic focus aligns with the global push for renewable energy and positions BW Offshore as a key partner in the evolving energy landscape.

These clients are actively seeking cutting-edge, dependable solutions to harness wind power at sea, especially in locations where fixed-bottom foundations are not feasible. The demand for floating wind is accelerating, with projections indicating a significant expansion of this market in the coming years. For instance, by 2030, the global floating offshore wind market is expected to reach a capacity of over 10 GW, representing a substantial growth opportunity.

Companies Pursuing Low-Carbon Energy Solutions

BW Offshore is actively engaging with companies focused on developing low-carbon energy solutions. This includes pioneering ventures in CO2 transport, gas-to-power projects, and the production of offshore blue ammonia. These are critical areas for the future of energy.

BW Offshore's role is to supply the essential floating infrastructure and operational expertise required to bring these innovative, albeit nascent, energy markets to life. Their involvement is key to unlocking the potential of these new sectors.

- Emerging Markets: Companies exploring CO2 transport, gas-to-power, and blue ammonia production represent a significant growth frontier.

- Infrastructure Provider: BW Offshore offers crucial floating production, storage, and offloading (FPSO) units and related services tailored for these new energy applications.

- Energy Transition Focus: This customer segment aligns with the global shift towards cleaner energy sources and positions BW Offshore at the forefront of this transition.

- Market Potential: The global carbon capture, utilization, and storage (CCUS) market is projected to reach hundreds of billions of dollars by 2030, highlighting the substantial opportunity in CO2 transport.

Existing FPSO Contract Holders

Existing FPSO contract holders represent a cornerstone for BW Offshore, offering a predictable revenue stream. These clients, already engaged with BW Offshore's services, are prime candidates for contract extensions and the adoption of supplementary services, solidifying a stable revenue base.

BW Offshore's existing FPSO clients are crucial for sustained financial performance. In 2024, the company continued to leverage these relationships, with a significant portion of its revenue derived from ongoing lease and operate agreements. For instance, the FPSO Catcher, operating for Premier Oil, exemplifies a long-term contract contributing to stable cash flow.

- Stable Revenue: Existing contracts provide a predictable and recurring revenue base, essential for financial planning and investment.

- Contract Extensions: Strong client relationships foster opportunities for extending current FPSO contracts, ensuring continued service provision and revenue generation.

- Upselling Opportunities: These clients are more receptive to additional services, such as maintenance, upgrades, or new project integration, enhancing overall value.

- Reduced Acquisition Costs: Retaining existing clients is generally more cost-effective than acquiring new ones, improving profitability.

BW Offshore's customer base is diverse, encompassing global oil and gas majors, national oil companies (NOCs), offshore wind farm developers, and companies venturing into new low-carbon energy solutions. These clients require specialized floating production, storage, and offloading (FPSO) units and related services, tailored to their specific operational needs and strategic objectives. The company's ability to adapt to varied regulatory environments and technological demands is key to serving these distinct segments effectively.

BW Offshore's strategic focus extends to the burgeoning offshore wind sector through its BW Ideol investment, targeting developers of floating wind technology. Furthermore, the company is actively supporting the energy transition by providing infrastructure for CO2 transport, gas-to-power projects, and offshore blue ammonia production. This dual approach allows BW Offshore to capitalize on both traditional and emerging energy markets.

| Customer Segment | Key Needs | BW Offshore's Offering | 2024 Relevance/Data Point |

|---|---|---|---|

| Global Oil & Gas Majors | High-capacity, long-term FPSO solutions | Integrated FPSO units, lifecycle services | Continued major contracts driving revenue; e.g., FPSO Espirito Santo operations. |

| National Oil Companies (NOCs) | Compliance with local content, strategic development | Adaptable FPSO solutions, local partnership models | Pursuing opportunities in West Africa and Southeast Asia. |

| Offshore Wind Developers | Floating wind technology, reliable infrastructure | Floating foundation solutions (BW Ideol), project support | Market growth projected; over 10 GW capacity expected by 2030. |

| Low-Carbon Energy Ventures | Infrastructure for CO2 transport, gas-to-power, blue ammonia | Floating infrastructure, operational expertise | CCUS market projected to reach hundreds of billions by 2030. |

Cost Structure

BW Offshore's cost structure heavily features substantial capital expenditures for both building new Floating Production, Storage, and Offloading (FPSO) units and converting existing oil tankers into these specialized vessels. These investments are crucial for scaling the company's operational fleet and securing future projects.

A notable example of this significant CAPEX is the Barossa FPSO project, which represents a considerable outlay for BW Offshore. Such expenditures are long-term commitments directly influencing the company's capacity to undertake and deliver large-scale offshore oil and gas projects.

Operations and Maintenance (O&M) expenses are a significant component of BW Offshore's cost structure, encompassing salaries for skilled personnel, routine repairs, periodic dry-docking, and general upkeep of their Floating Production Storage and Offloading (FPSO) units. For instance, in 2023, BW Offshore reported O&M expenses of approximately $598 million, reflecting the continuous investment needed to ensure the fleet's operational readiness and longevity.

Maintaining high uptime is paramount, directly correlating with the ongoing investment in asset integrity and operational efficiency. These expenditures are critical for BW Offshore to meet stringent contractual obligations with clients and uphold the highest safety and environmental standards across its global operations.

BW Offshore's cost structure significantly includes substantial investments in research and development aimed at pioneering new energy technologies. These expenditures are vital for staying at the forefront of innovation in areas like floating offshore wind, blue ammonia, and other emerging low-carbon solutions.

These R&D efforts are not just about innovation; they are a strategic imperative for BW Offshore to diversify its business and tap into future energy markets. For instance, the company's commitment to advancing BW Ideol's technological capabilities, a key player in floating offshore wind, represents a significant portion of these costs. Furthermore, funding for strategic collaborations with industry partners and research institutions also falls under this R&D umbrella, ensuring access to cutting-edge knowledge and shared development risks.

In 2024, BW Offshore continued to prioritize these forward-looking investments. While specific figures for R&D spending can fluctuate, the company's strategic focus on renewable energy projects, including their participation in offshore wind tenders and the development of ammonia-related technologies, indicates a sustained and significant allocation of capital towards these cost centers. This commitment is essential for building a robust pipeline of future revenue streams and maintaining a competitive edge in the evolving energy landscape.

Project Development and Engineering Study Costs

BW Offshore incurs significant costs during the project development phase, even before a final investment decision is made. These include expenses for front-end engineering design (FEED) studies and other crucial development activities. These upfront investments are essential for securing future contracts and projects.

The Sakarya project's FEED work serves as a prime example of these pre-decision expenditures. While some of these costs may be reimbursed or directly transition into full contracts, they represent a necessary initial outlay to position the company for potential future revenue streams.

- Project Development Costs: Expenses related to FEED studies and other pre-investment decision activities.

- Risk Mitigation: These costs are incurred to assess project viability and secure future opportunities.

- Sakarya Example: FEED work for the Sakarya project highlights these upfront development investments.

General Administrative and Corporate Overheads

General Administrative and Corporate Overheads are the foundational costs supporting BW Offshore's global operations. These encompass salaries for the essential onshore team, the expenses of maintaining corporate offices, and crucial legal and compliance services. These are the costs of doing business at a high level, ensuring the company can strategize and execute effectively across its diverse portfolio.

These essential corporate functions, while not directly linked to the day-to-day running of a single Floating Production Storage and Offloading (FPSO) unit, are critical for the company's overall health and strategic trajectory. BW Offshore's commitment to a global workforce underscores its capacity to manage complex, international projects and maintain a competitive edge in the offshore energy sector.

- Salaries for onshore staff: This includes management, engineering, finance, HR, and administrative personnel crucial for business oversight.

- Office expenses: Costs associated with maintaining corporate headquarters and regional offices globally.

- Legal and professional fees: Expenses for legal counsel, accounting services, and other professional support vital for compliance and governance.

- Corporate IT and communication systems: Investment in technology infrastructure that enables seamless global operations and communication.

BW Offshore's cost structure is dominated by significant capital expenditures for FPSO construction and conversion, alongside substantial operations and maintenance expenses to ensure fleet readiness. The company also invests heavily in research and development for new energy technologies, such as floating offshore wind and blue ammonia, reflecting a strategic shift towards sustainability.

In 2024, BW Offshore continued its focus on these key cost drivers. The company's commitment to R&D is evident in its ongoing development of floating offshore wind solutions, aiming to secure future market share. These strategic investments are crucial for maintaining competitiveness and adapting to the evolving energy landscape.

Operational costs remain a core component, with a strong emphasis on asset integrity and safety. The company's proactive approach to maintenance, including routine dry-docking and repairs, ensures high uptime and client satisfaction, directly impacting revenue generation. These ongoing expenditures are vital for the long-term viability of their FPSO fleet.

| Cost Category | 2023 Data (Approximate) | 2024 Focus Areas |

|---|---|---|

| Capital Expenditures (CAPEX) | Significant investment in new FPSO units and conversions | Continued investment in fleet expansion and upgrades |

| Operations & Maintenance (O&M) | $598 million | Maintaining fleet readiness, safety, and asset integrity |

| Research & Development (R&D) | Investment in new energy technologies (e.g., offshore wind, ammonia) | Advancing BW Ideol's capabilities, exploring new energy markets |

| Project Development Costs | Expenses for FEED studies and pre-investment activities | Securing future contracts and assessing project viability |

| General Administrative & Corporate Overheads | Salaries, office expenses, legal & professional fees | Supporting global operations and strategic management |

Revenue Streams

BW Offshore's core revenue is generated through long-term lease and operate agreements for its Floating Production, Storage, and Offloading (FPSO) units. These contracts are structured as daily rates, offering a consistent and reliable income stream.

The company benefits from a substantial firm contract backlog, which stood at USD 5.4 billion as of the end of March 2025, providing significant revenue visibility. A prime illustration of these long-term commitments is the BW Opal's 15-year charter agreement with Santos.

BW Offshore earns significant revenue from Operations and Maintenance (O&M) service fees, which complement its bareboat charter income. These fees are crucial for ensuring the ongoing efficient operation of its Floating Production Storage and Offloading (FPSO) units.

The company strategically offers O&M services even when it divests an FPSO. A prime example is the sale of the BW Pioneer FPSO to Murphy Oil, where BW Offshore retained a long-term O&M contract, securing a recurring revenue stream.

BW Offshore generates revenue through the strategic divestment of its Floating Production Storage and Offloading (FPSO) assets. This occurs when older vessels are sold, as seen with the USD 125 million sale of FPSO BW Pioneer. These asset sales not only bring in direct income but also help BW Offshore refine its fleet and unlock capital for future growth opportunities.

Project Development and Engineering Study Fees

BW Offshore generates revenue by offering specialized project development and engineering study services, such as Front-End Engineering Design (FEED). These fees are a direct result of their deep expertise in engineering and project management, providing value even when a full Floating Production Storage and Offloading (FPSO) contract is not secured.

For instance, the company highlighted that its FEED work on the Sakarya project was a significant contributor to its earnings before interest, taxes, depreciation, and amortization (EBITDA). This demonstrates the financial impact of these early-stage development services.

- Project Development Fees: Revenue earned from specialized engineering and project management services.

- FEED Studies: Income generated from conducting Front-End Engineering Design, crucial for project feasibility.

- EBITDA Contribution: Specific projects, like Sakarya FEED, directly bolster the company's EBITDA.

Volume-Based Tariffs from Hydrocarbon Production

BW Offshore's revenue can also be generated through volume-based tariffs tied directly to the quantity of hydrocarbons produced. This model offers a direct correlation between the company's operational efficiency and its earnings, incentivizing peak performance from its Floating Production Storage and Offloading (FPSO) units and the fields they serve.

This structure allows for an additional revenue stream that complements fixed charter rates. For instance, the BW Adolo FPSO operating on the Abrodoh-Abou Field offshore Nigeria exemplifies this, where production volumes directly influence tariff income. This creates a shared upside with the client, directly linking BW Offshore's success to the field's output.

- Volume-Based Tariffs: Revenue is directly linked to the amount of oil and gas produced.

- Performance Incentive: Encourages high operational uptime and production efficiency for FPSOs.

- Example: BW Adolo FPSO on the Abrodoh-Abou Field demonstrates this revenue model.

- Upside Sharing: Aligns BW Offshore's interests with the client's production goals.

BW Offshore's revenue streams are diversified, primarily stemming from long-term FPSO lease and operate agreements, which provide a stable income base. These contracts are typically structured as daily rates, ensuring predictable earnings. The company also generates income from Operations and Maintenance (O&M) services, often retained even after asset divestments, as seen with the BW Pioneer FPSO sale. Furthermore, BW Offshore earns revenue through strategic asset sales, such as the USD 125 million divestment of BW Pioneer, and from specialized project development and FEED studies, like the significant EBITDA contribution from Sakarya FEED work.

| Revenue Stream | Description | Example/Data Point |

|---|---|---|

| Lease & Operate Agreements | Daily rates for FPSO units under long-term contracts. | USD 5.4 billion firm contract backlog as of March 2025. |

| Operations & Maintenance (O&M) | Fees for ongoing efficient operation of FPSO units. | Retained O&M contract for BW Pioneer FPSO after sale. |

| Asset Divestment | Income from selling older FPSO assets. | USD 125 million sale of FPSO BW Pioneer. |

| Project Development & FEED | Fees for specialized engineering and study services. | Sakarya FEED project contributed significantly to EBITDA. |

| Volume-Based Tariffs | Tariffs directly linked to hydrocarbon production volumes. | BW Adolo FPSO on the Abrodoh-Abou Field. |

Business Model Canvas Data Sources

The BW Offshore Business Model Canvas is built upon a foundation of comprehensive market analysis, financial disclosures, and operational data. These sources provide the necessary insights into customer needs, competitive landscapes, and cost structures.