BW Offshore Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BW Offshore Bundle

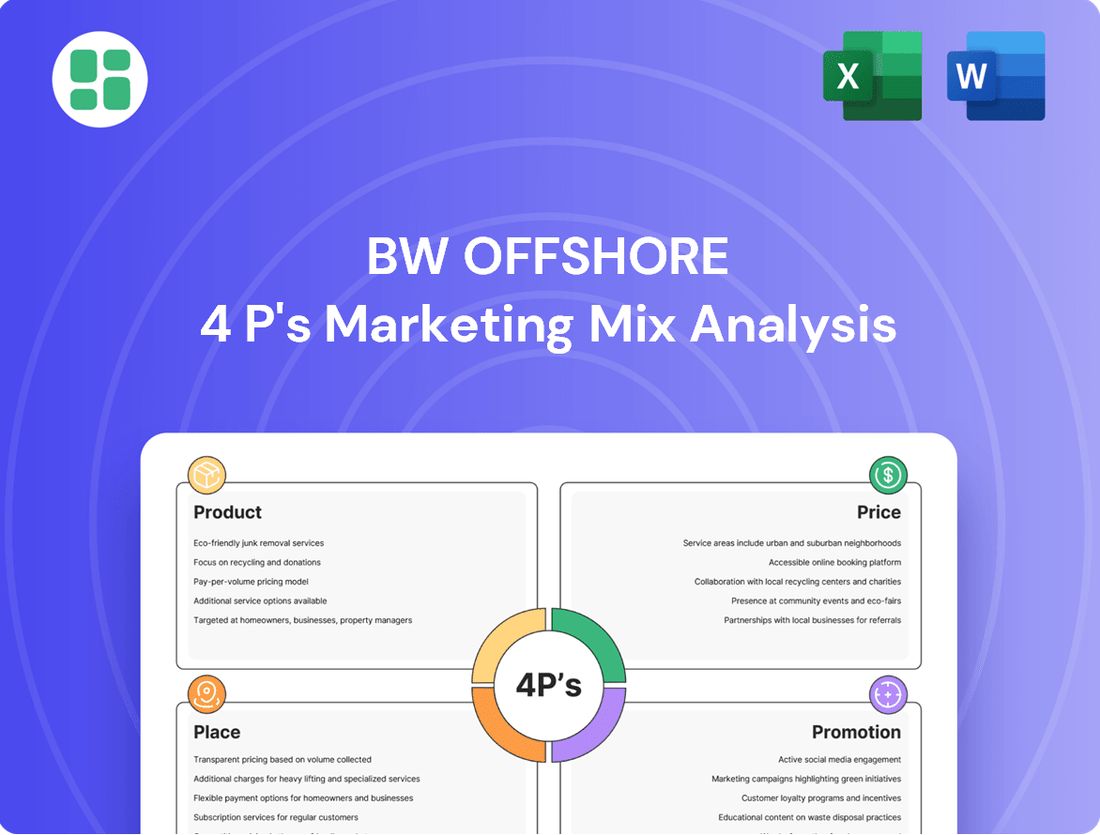

Discover how BW Offshore leverages its Product, Price, Place, and Promotion strategies to dominate the offshore energy sector. This analysis goes beyond surface-level observations, offering a strategic blueprint for success.

Uncover the intricate details of BW Offshore's product innovation, competitive pricing, strategic placement of assets, and impactful promotional campaigns. Get a comprehensive understanding of their market dominance.

Ready to elevate your own marketing strategy? Gain instant access to our in-depth, editable 4Ps Marketing Mix Analysis of BW Offshore, a valuable resource for professionals and students alike.

Product

BW Offshore's Integrated FPSO Solutions offer a complete package for oil and gas production, handling everything from the drawing board to ongoing operations. This end-to-end service means clients get a custom-built offshore facility designed for their unique field needs.

The company's commitment to a full lifecycle approach ensures maximum uptime and efficiency in extracting, processing, and storing hydrocarbons. For instance, BW Offshore's fleet achieved an average operational uptime of 98.7% in 2023, demonstrating their reliability.

BW Offshore's Global Fleet Operation is the core of its service offering, managing a diverse fleet of Floating Production Storage and Offloading (FPSO) units. Vessels like the BW Opal, BW Catcher, and BW Adolo are strategically deployed in key offshore basins worldwide, acting as essential hubs for oil and gas production. These FPSOs are vital for clients, enabling efficient extraction, processing, and storage of hydrocarbons directly at the production site.

A key differentiator for BW Offshore is its unwavering commitment to operational excellence, evidenced by its fleet’s consistently high commercial uptime, which regularly surpasses 99%. This exceptional reliability ensures uninterrupted production for their clients, a critical factor in the demanding offshore energy sector. For instance, in 2023, the company reported a fleet-wide uptime of 99.1%, underscoring their operational prowess.

BW Offshore's Product strategy extends beyond traditional oil and gas to embrace the energy transition. A key offering is leveraging their Floating Production Storage and Offloading (FPSO) expertise for emerging low-carbon sectors. This is exemplified by their majority ownership in BW Ideol, a significant player in floating offshore wind projects, a market projected to reach over $100 billion by 2030.

The company is also actively developing innovative solutions for a net-zero future. These include concepts for floating CO2 storage and injection units, crucial for carbon capture utilization and storage (CCUS) initiatives. Furthermore, BW Offshore is exploring gas-to-power solutions and clean fuel production, positioning itself as a provider of integrated energy infrastructure for a decarbonized world.

Customized Project Delivery

BW Offshore's Customized Project Delivery focuses on adapting its offshore energy solutions to the precise requirements of its diverse global clients. This means going beyond standard offerings to craft solutions that fit unique operational needs and challenging environments.

The company actively engages in Front-End Engineering Design (FEED) studies, a critical step in tailoring projects. This collaborative approach ensures that the final delivery is optimized from the outset. For instance, BW Offshore's ability to offer flexible contracting models further underscores its commitment to client-specific delivery.

Leveraging four decades of experience, BW Offshore excels at managing complex projects. This deep expertise allows them to develop solutions that are not only efficient but also robust, even in demanding marine conditions. Their project delivery is geared towards specific production profiles, ensuring maximum effectiveness for each client.

- Tailored Solutions: BW Offshore designs and delivers offshore energy solutions specifically for client needs.

- FEED Engagement: The company utilizes Front-End Engineering Design studies to customize project scopes.

- Flexible Contracting: BW Offshore offers adaptable contracting models to suit project requirements.

- Experience-Driven Delivery: With 40 years of experience, they manage complex projects for optimized performance in challenging environments.

Operations and Maintenance (O&M) Services

BW Offshore's Operations and Maintenance (O&M) services are a crucial component of their offering, extending beyond mere vessel leasing. They ensure the ongoing efficiency and safety of their FPSO fleet, and sometimes even client-owned vessels. This commitment to O&M demonstrates a deep operational expertise that clients can rely on.

A prime example of this is the continued O&M services provided for FPSO BW Pioneer, even after its sale. This long-term contract underscores BW Offshore's dedication to operational continuity and highlights their ability to leverage their extensive experience to manage complex assets. In 2023, BW Offshore reported revenue of USD 1.03 billion, with a significant portion attributable to their operational services, reflecting the value placed on these offerings.

- Extended Asset Lifespan: O&M services are designed to maximize the operational life of FPSOs.

- Operational Continuity: BW Offshore ensures vessels remain productive and safe, even post-ownership transfer.

- Expertise Leverage: The company capitalizes on its deep knowledge of FPSO operations for both owned and third-party vessels.

- Revenue Stream Diversification: O&M contracts contribute a stable and significant revenue stream, supporting overall financial performance.

BW Offshore's product is its integrated Floating Production Storage and Offloading (FPSO) solutions, offering a comprehensive lifecycle approach from design to operation. The company's diverse fleet, including vessels like the BW Opal and BW Catcher, ensures efficient hydrocarbon extraction and processing globally, with a remarkable 99.1% fleet-wide uptime in 2023.

Beyond traditional oil and gas, BW Offshore is actively involved in the energy transition. This includes leveraging FPSO expertise for floating offshore wind projects through its stake in BW Ideol, a sector poised for significant growth. They are also developing innovative solutions for carbon capture and storage (CCS) and clean fuel production, positioning themselves for a net-zero future.

BW Offshore's product strategy emphasizes customized project delivery, utilizing Front-End Engineering Design (FEED) studies and flexible contracting to meet specific client needs. With 40 years of experience, they excel at managing complex projects in challenging marine environments, ensuring optimized performance and robust solutions.

The company's Operations and Maintenance (O&M) services are a vital part of its product offering, ensuring the ongoing efficiency and safety of its FPSO fleet. This commitment, demonstrated by continued O&M for FPSO BW Pioneer post-sale, highlights their deep operational expertise and contributes significantly to their revenue, which reached USD 1.03 billion in 2023.

| Product Aspect | Description | Key Metric/Fact |

|---|---|---|

| Integrated FPSO Solutions | End-to-end service for oil and gas production, from design to operation. | 99.1% fleet-wide uptime in 2023. |

| Energy Transition Focus | Leveraging FPSO expertise for floating offshore wind and developing CCS/clean fuel solutions. | Majority ownership in BW Ideol; market projected over $100 billion by 2030. |

| Customized Project Delivery | Tailored solutions using FEED studies and flexible contracting. | 40 years of experience in complex project management. |

| Operations & Maintenance (O&M) | Ensuring ongoing efficiency and safety of FPSO fleet. | Significant revenue contributor; USD 1.03 billion total revenue in 2023. |

What is included in the product

This analysis offers a comprehensive examination of BW Offshore's marketing mix, detailing their Product offerings, Pricing strategies, Place (distribution) channels, and Promotion activities.

It provides a strategic overview of BW Offshore's marketing positioning, grounded in their actual business practices and competitive landscape.

Simplifies complex marketing strategies into actionable insights, directly addressing the challenge of understanding and optimizing BW Offshore's 4Ps for market success.

Provides a clear, concise framework to identify and resolve marketing challenges, enabling more effective resource allocation and strategic decision-making.

Place

BW Offshore's direct client engagement strategy focuses on building relationships with major international and national oil and gas companies, alongside emerging renewable energy developers. This approach is crucial for securing and executing complex Floating Production Storage and Offloading (FPSO) projects, which often involve bespoke solutions tailored to specific client needs.

This direct sales model facilitates highly customized offerings and cultivates enduring partnerships with key industry stakeholders. For instance, BW Offshore's recent contract awards, such as the Abu Dhabi National Oil Company (ADNOC) deal in late 2023 for the Fateh field, exemplify this direct engagement, securing long-term revenue streams and showcasing their ability to meet specific client operational requirements.

BW Offshore's global operational hubs are a cornerstone of its marketing mix, ensuring worldwide reach and efficient service delivery. With headquarters strategically located in Singapore and Oslo, Norway, the company maintains a strong presence in key offshore energy regions. This extensive network allows for the swift deployment of its Floating Production Storage and Offloading (FPSO) units and skilled project teams to diverse international fields.

The company's global footprint is crucial for timely project execution and responsive client engagement across various continents. For instance, BW Offshore's significant involvement in projects off the coast of Brazil, a major offshore production hub, highlights the importance of its regional operational capabilities. This distributed operational structure directly supports its ability to manage complex, geographically dispersed projects, a key differentiator in the offshore energy sector.

BW Offshore's 'place' is intrinsically tied to the geographical location of offshore energy projects. Their Floating Production Storage and Offloading (FPSO) units are deployed directly to these sites, which are often in remote and demanding offshore environments. For instance, their FPSO BW Pioneer was deployed to the Jack field in the US Gulf of Mexico.

The deployment process itself is a critical element of this 'place' strategy. It involves intricate logistical operations, including the towage of massive FPSO units and complex hook-up procedures once they reach their designated operational sites. This ensures the production facility is ready to commence operations, like the recent redeployment of FPSO Agogo to a new field in Angola.

Strategic Partnerships and JVs

BW Offshore actively utilizes strategic partnerships and joint ventures to penetrate specific markets and foster technological innovation. A prime example is its majority stake in BW Ideol, a recognized leader in floating wind technology, which significantly broadens BW Offshore's footprint in the burgeoning offshore renewable energy sector. This approach is key to navigating capital-intensive projects and leveraging shared knowledge across diverse geographies and emerging energy landscapes.

These collaborations are instrumental in BW Offshore's strategy to access new markets and develop cutting-edge solutions. By partnering, the company can mitigate risks associated with large-scale ventures and accelerate the development of new technologies. For instance, BW Ideol's involvement in projects like the floating wind farm off the coast of Brittany, France, demonstrates the tangible benefits of these alliances in securing market share and advancing renewable energy capabilities.

BW Offshore's strategic alliances allow for greater participation in complex, capital-intensive projects, fostering a sharing of expertise and resources. This collaborative model is particularly vital in the evolving energy industry, where innovation and market access are paramount. The company's engagement in joint ventures enables it to tackle more ambitious projects and expand its operational reach into new territories.

Key aspects of BW Offshore's strategic partnerships include:

- Market Access: Gaining entry into new geographic regions and emerging energy sectors through established partners.

- Technology Development: Collaborating on innovative solutions, such as floating wind foundations with BW Ideol.

- Risk Mitigation: Sharing the financial and operational burdens of large, capital-intensive projects.

- Expertise Sharing: Leveraging the specialized knowledge and capabilities of joint venture partners.

Digital Connectivity for Remote Operations

BW Offshore's 'Place' strategy is significantly enhanced by robust digital connectivity, enabling seamless remote operations for its offshore assets. This infrastructure is crucial for maintaining continuous oversight and control, even when physical assets are deployed in distant locations.

The company leverages advanced digital solutions for real-time data analysis and proactive maintenance, ensuring operational efficiency and safety. This remote management capability, supported by strong digital infrastructure, is a cornerstone of their operational strategy.

- Remote Monitoring: BW Offshore utilizes sophisticated systems to monitor asset performance remotely, minimizing the need for constant on-site personnel.

- Data-Driven Decisions: Real-time data streams from offshore units inform maintenance schedules and operational adjustments, optimizing uptime.

- Cost Efficiency: Enhanced digital connectivity reduces travel and logistical costs associated with traditional offshore support.

- Safety Enhancement: Remote diagnostics and predictive maintenance through digital channels contribute to a safer working environment by anticipating potential issues.

BW Offshore's 'Place' strategy is defined by the physical deployment of its FPSO units to client-specified offshore project sites worldwide. This involves managing complex logistics for asset positioning and hook-up, ensuring operational readiness in diverse and often challenging environments. For example, the company's fleet operates across key regions like the North Sea, Brazil, and West Africa, demonstrating its global reach and commitment to serving clients wherever their projects are located.

The company's operational hubs in Singapore and Oslo serve as critical support centers, facilitating the management and deployment of assets across its international portfolio. This distributed operational model is essential for providing timely and efficient support to offshore projects, a key factor in securing and retaining long-term contracts. BW Offshore's ability to manage projects in geographically dispersed locations, such as its work in the US Gulf of Mexico with FPSO BW Pioneer, underscores the strategic importance of its global presence.

BW Offshore's strategic partnerships, particularly with BW Ideol in floating wind, expand its 'Place' into new renewable energy markets. These collaborations are vital for accessing geographically diverse renewable energy projects and leveraging shared expertise. The company's involvement in projects like the Brittany floating wind farm showcases its expansion into emerging energy sectors, demonstrating a forward-looking approach to its operational footprint.

Digital connectivity is integral to BW Offshore's 'Place' strategy, enabling remote monitoring and management of its offshore assets. This advanced digital infrastructure ensures operational efficiency and safety by facilitating real-time data analysis and proactive maintenance, regardless of the physical location of the FPSOs. This capability is crucial for optimizing performance and reducing operational costs across its global fleet.

What You See Is What You Get

BW Offshore 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive BW Offshore 4P's Marketing Mix Analysis is fully complete and ready for your immediate use, offering a detailed breakdown of their strategy.

Promotion

BW Offshore prioritizes clear communication with its investors, a key part of its marketing strategy. They regularly share financial results, annual reports, and presentations that detail their performance and future plans. This commitment to transparency helps build trust and attract capital.

For instance, in their 2024 reports, BW Offshore highlighted a strong EBITDA of $550 million for the first half of 2024, demonstrating robust operational performance. These detailed disclosures, including project updates and strategic outlooks, are crucial for financially-literate decision-makers assessing investment opportunities.

The company utilizes webcasts and comprehensive reports to ensure investors have access to vital financial data. This proactive approach to investor relations is designed to keep stakeholders informed and confident in BW Offshore's long-term value proposition.

BW Offshore leverages industry conferences as a key promotional tool, actively participating in major energy and offshore events. In 2024, the company presented at key forums like the Offshore Technology Conference (OTC), showcasing its expertise in floating production storage and offloading (FPSO) solutions and its growing involvement in the energy transition. This engagement helps position BW Offshore as a thought leader, fostering valuable connections with potential clients and partners in a highly specialized market.

BW Offshore's corporate website is a robust digital platform, offering comprehensive details on its services, fleet operations, and commitment to sustainability. In 2024, the company continued to leverage this site as a key channel for stakeholder communication, providing up-to-date company profiles and news releases.

Sustainability and ESG Reporting

BW Offshore actively champions its dedication to sustainable development and Environmental, Social, and Governance (ESG) principles. This commitment is showcased through their comprehensive sustainability reports and public statements. For instance, their 2023 Sustainability Report details significant progress in reducing emissions and enhancing safety protocols.

The company's strategy emphasizes minimizing environmental impact, prioritizing safety, and actively contributing to the global energy transition. This focus resonates strongly with investors and stakeholders who are increasingly prioritizing corporate responsibility and long-term vision. In 2023, BW Offshore reported a 10% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2022 baseline.

- Commitment to ESG: BW Offshore publishes detailed sustainability reports outlining their environmental, social, and governance performance.

- Environmental Focus: The company actively works to minimize its environmental footprint and contribute to the energy transition.

- Investor Appeal: Their transparent reporting attracts investors and stakeholders focused on sustainable and responsible business practices.

- Safety and Responsibility: BW Offshore highlights its dedication to operational safety and corporate responsibility in its communications.

Targeted Client Presentations and Direct Marketing

BW Offshore's marketing strategy heavily relies on targeted client presentations and direct marketing, a crucial element for its high-value, complex offshore solutions. This approach is designed to directly engage with key decision-makers within major oil and gas companies and emerging energy developers. For instance, in 2024, BW Offshore continued to focus on securing long-term contracts for its floating production storage and offloading (FPSO) units, with specific outreach tailored to companies advancing projects in regions like the North Sea and West Africa.

This personalized engagement allows BW Offshore to effectively communicate the specific benefits and technical prowess of its offerings, such as the BW Catcher FPSO which has been a significant asset for its clients. By directly addressing the unique needs and challenges of potential clients, the company builds credibility and fosters trust. This B2B focus necessitates a direct line of communication to navigate complex sales cycles and secure substantial project commitments.

BW Offshore's direct marketing efforts in 2024 included participation in key industry conferences and targeted digital campaigns aimed at project managers and procurement teams in the energy sector. These efforts are supported by case studies demonstrating successful project delivery and operational efficiency, such as the performance of their FPSOs in challenging environments, which often translate into significant cost savings for operators.

The company's commitment to building strong client relationships through direct interaction is a cornerstone of its marketing mix. This is evident in their proactive engagement with potential clients for upcoming offshore developments, where early dialogue can shape project specifications to align with BW Offshore's capabilities, potentially securing future business. Their 2024 order book reflects the success of this strategy, with significant contract awards for new projects.

BW Offshore's promotional efforts center on transparent investor relations and strategic industry engagement. They actively communicate financial performance, such as the $550 million EBITDA reported for H1 2024, through detailed reports and webcasts to build investor confidence. Participation in events like the 2024 Offshore Technology Conference highlights their expertise and thought leadership in the FPSO sector.

The company also emphasizes its commitment to ESG principles, detailing progress in sustainability reports, including a 10% reduction in Scope 1 and 2 emissions in 2023. This focus on corporate responsibility appeals to a growing segment of ethically-minded investors and stakeholders.

Direct client engagement and targeted marketing are vital for BW Offshore's high-value offshore solutions. In 2024, this involved tailored outreach for FPSO contracts, particularly in regions like the North Sea and West Africa, reinforcing their position as a key partner in major energy projects.

Price

BW Offshore's pricing strategy is heavily anchored in long-term contractual agreements for its Floating Production, Storage, and Offloading (FPSO) units. These contracts typically have a base term of 15 years, with built-in options for extensions, ensuring predictable revenue.

This pricing model directly reflects the substantial capital expenditure and ongoing operational dedication needed for these complex offshore assets. The company's robust backlog, which stood at USD 5.3 billion at the close of 2024, underscores the enduring nature and significant value of these long-term commitments.

BW Offshore structures its FPSO offerings primarily through day rates or lease fees. These fees encompass all operational aspects, including vessel costs, ongoing maintenance, and crew expenses.

Negotiating these rates involves a deep dive into specific project parameters. Key considerations include the FPSO's technical specifications, the intricate nature of the field development, prevailing environmental conditions, and the agreed-upon contract length. For example, the dayrate secured for the BW Opal during its initial operational phase is designed to be recouped over its substantial 15-year contract term.

BW Offshore's pricing is deeply rooted in the value delivered and is tailored to each specific project. This means that the price for an FPSO (Floating Production, Storage, and Offloading) unit isn't a one-size-fits-all number; it's carefully calculated based on the unique requirements of each offshore field and the customized solutions BW Offshore provides.

The cost reflects the significant value the client receives, encompassing the FPSO's processing capabilities, its storage capacity, and the comprehensive suite of integrated services. For instance, in 2024, the successful execution of projects like the Barossa FPSO, which has a processing capacity of 130,000 barrels of oil per day and 400 million standard cubic feet of gas per day, demonstrates the substantial value proposition offered.

This value-based strategy ensures that BW Offshore's pricing directly correlates with the economic benefits generated for clients, whether that's through enhanced hydrocarbon production or by facilitating crucial energy transition projects. This alignment is key to their market approach, ensuring that the investment in their FPSO solutions translates into tangible returns for their partners.

Capital Investment and Financing Structures

BW Offshore's pricing strategy reflects the significant capital expenditure (CAPEX) required for FPSO construction and deployment, typically financed through corporate and project-specific loans. For instance, the company secured a $700 million credit facility in 2023 to support its growth and refinancing efforts, demonstrating a reliance on debt financing.

The company actively structures contracts to include substantial day rate prepayments during the construction phase for new lease and operate agreements. This approach, exemplified by their strategy for projects like the Abu Dhabi National Oil Company (ADNOC) contract, effectively mitigates financial risk and enhances project viability by securing early cash flow.

Key financing elements include:

- Project-specific loan facilities to fund the substantial CAPEX for FPSO construction and conversion.

- Corporate debt used for broader company growth and refinancing initiatives, such as the 2023 credit facility.

- Day rate prepayments during the construction period for new contracts, reducing financial exposure and improving project economics.

- Strategic partnerships and joint ventures to share capital costs and risks on large-scale projects.

Competitive Landscape and Market Conditions

BW Offshore navigates a dynamic market shaped by fluctuating global energy demand and oil and gas prices, with financing availability also playing a crucial role. In 2024, the offshore energy sector continues to see increased activity, driven by higher commodity prices, though interest rate environments can impact project financing.

Pricing strategies are carefully calibrated against competitor offerings and the market's demand for floating production units. The company's focus remains on securing contracts that align with its return requirements, particularly those that mitigate residual value risk, a strategy that proved beneficial in 2023 as several FPSO projects moved forward.

- Market Volatility: Global oil prices, while showing resilience in early 2024, remain a key determinant of offshore project investment.

- Financing Environment: Access to capital, influenced by central bank policies, directly impacts the feasibility of new FPSO projects.

- Competitive Benchmarking: BW Offshore continuously monitors competitor pricing and contract terms to maintain market competitiveness.

- Risk Mitigation: The preference for contracts with no residual value risk reflects a prudent approach to market uncertainty.

BW Offshore's pricing is fundamentally value-driven, reflecting the bespoke nature of its FPSO solutions and the substantial economic benefits delivered to clients. This approach ensures that the rates negotiated, whether day rates or lease fees, directly correlate with the client's expected returns from enhanced production and operational efficiency. The company's robust backlog of USD 5.3 billion at the end of 2024 highlights the market's acceptance of this value-based pricing for long-term, complex offshore projects.

The pricing structure inherently covers all operational costs, including maintenance and crewing, embedded within the day rates or lease fees. This comprehensive approach simplifies financial planning for clients and aligns BW Offshore's incentives with the successful, long-term performance of the FPSO units. For instance, the pricing for the BW Opal is designed to ensure profitability over its 15-year contract, showcasing the long-term perspective in their rate setting.

Negotiating these prices involves a detailed assessment of project-specific factors such as FPSO technical requirements, field complexity, environmental conditions, and contract duration, ensuring a fair reflection of the value and risk involved. The successful execution of projects like the Barossa FPSO in 2024, with its significant processing capacity, exemplifies the substantial value proposition that underpins BW Offshore's pricing strategy.

4P's Marketing Mix Analysis Data Sources

Our BW Offshore 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, investor relations materials, and industry-specific market intelligence. We leverage insights from their fleet deployment, contract awards, and public financial disclosures to accurately assess their Product, Price, Place, and Promotion strategies.