BW Offshore Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BW Offshore Bundle

BW Offshore's BCG Matrix provides a crucial snapshot of its diverse portfolio, highlighting which segments are driving growth and which require careful management. Understanding these dynamics is key to unlocking strategic advantages in the competitive energy sector.

This preview offers a glimpse into the strategic positioning of BW Offshore's assets. To truly harness this information and make informed decisions about capital allocation and future investments, dive deeper into the full BCG Matrix report.

Gain a comprehensive understanding of BW Offshore's market performance and identify opportunities for optimization. Purchase the full BCG Matrix for actionable insights and a clear roadmap to strategic success.

Stars

BW Offshore is strategically positioning itself with new Floating Production, Storage, and Offloading (FPSO) projects in high-growth basins. These ventures are crucial for expanding its market share in rapidly developing offshore oil and gas regions, especially those requiring deep and ultra-deep water capabilities like Brazil and Guyana.

A standout example is the Barossa FPSO, also known as BW Opal. This newbuild vessel is secured with a long-term contract in a burgeoning gas field. It is anticipated to become a significant contributor to BW Offshore's cash flow once production commences, with first gas expected in mid-2025.

BW Offshore's advanced FPSO technologies represent a significant investment in future-proofing their fleet. These innovations focus on enhancing production capabilities, boosting operational efficiency, and crucially, minimizing environmental impact through reduced greenhouse gas emissions. This strategic focus positions them as leaders in a market increasingly driven by sustainability and technological advancement.

BW Offshore's strategic investment in floating offshore wind, primarily through its stake in BW Ideol, positions it in a burgeoning sector with substantial growth prospects. This segment is experiencing rapid development, driven by the need for renewable energy solutions in deeper waters where fixed-bottom turbines are not feasible.

Projects such as Eolmed in France and Buchan Offshore Wind in the UK exemplify this potential. Eolmed, with a planned capacity of 30 MW, is a pioneering floating wind farm, and Buchan Offshore Wind aims for a significant 1.1 GW capacity. These ventures are crucial in demonstrating the viability and scalability of floating wind technology, paving the way for larger deployments.

The global floating offshore wind market is projected to grow substantially, with estimates suggesting a capacity of over 25 GW by 2030. BW Offshore's early-stage involvement through BW Ideol, which has a pipeline of over 12 GW of floating wind projects, places it at the forefront of this expansion, ready to capitalize on increasing demand and technological advancements.

Strategic Partnerships for Major Developments

Strategic partnerships are crucial for BW Offshore's growth, especially in tackling large, complex developments. These collaborations allow the company to combine its established expertise with new avenues for high-growth opportunities. For instance, being chosen for pre-front-end engineering design (pre-FEED) studies for significant projects like Equinor's Bay du Nord FPSO demonstrates BW Offshore's capability to secure substantial future contracts.

These partnerships are key to moving projects forward and solidifying BW Offshore's position in the market.

- Access to New Markets: Collaborations open doors to regions and project types previously inaccessible.

- Risk Sharing: Large-scale projects often involve significant financial and operational risks, which can be mitigated through partnerships.

- Technological Advancement: Working with partners can foster innovation and the adoption of cutting-edge technologies.

- Securing Future Contracts: Participation in early-stage studies, like the Bay du Nord pre-FEED, directly translates to a stronger pipeline of high-value projects.

Expansion into New Energy Transition Solutions

BW Offshore is actively exploring new frontiers in the energy transition, aiming to leverage its offshore expertise for future energy solutions. The company is developing innovative floating production concepts designed to support the shift away from traditional fossil fuels.

These initiatives include conceptualizing integrated carbon capture and storage (CCS) modules that can be deployed offshore, as well as floating units for the production of zero-carbon fuels. These ventures, though in their early stages, are strategically positioned to tap into burgeoning future energy markets.

For instance, the global carbon capture market is projected to grow significantly, with estimates suggesting it could reach hundreds of billions of dollars by 2030. BW Offshore's focus on floating CCS solutions aligns with this trend, offering a flexible and potentially cost-effective approach to decarbonization.

Furthermore, the demand for green fuels like ammonia and methanol is expected to surge as shipping and other industries seek to reduce their environmental impact. BW Offshore's exploration of floating zero-carbon fuel production units places it at the forefront of this evolving energy landscape.

- Floating CCS Modules: Developing concepts for offshore carbon capture and storage infrastructure.

- Zero-Carbon Fuel Production: Exploring floating units for producing green ammonia and methanol.

- Market Potential: Targeting rapidly growing future energy markets, including decarbonization and green fuels.

- Strategic Alignment: Leveraging existing offshore engineering and operational capabilities for energy transition solutions.

BW Offshore's investments in floating offshore wind, particularly through BW Ideol, position it in a high-growth sector. Projects like Eolmed and Buchan Offshore Wind demonstrate the company's commitment to this renewable energy frontier. The global floating offshore wind market is poised for substantial expansion, with projections indicating over 25 GW of capacity by 2030.

BW Offshore's involvement in floating wind is a strategic move into a market driven by the need for renewable energy in deeper waters. This segment is experiencing rapid development, with BW Ideol's pipeline exceeding 12 GW of floating wind projects.

BW Offshore's strategic direction aligns with the growing demand for sustainable energy solutions. By investing in areas like floating offshore wind, the company is tapping into a market with significant future potential and technological advancement.

BW Offshore's strategic investments in floating offshore wind, particularly through its stake in BW Ideol, are key to its future growth. This segment of the energy market is experiencing rapid development, driven by the global push for renewable energy solutions in deeper waters.

The company's engagement in projects such as Eolmed in France and Buchan Offshore Wind in the UK highlights its commitment to this burgeoning sector. These ventures are crucial for demonstrating the viability and scalability of floating wind technology, paving the way for larger deployments.

The global floating offshore wind market is projected for substantial growth, with estimates suggesting a capacity of over 25 GW by 2030. BW Offshore's early-stage involvement through BW Ideol, which has a pipeline of over 12 GW of floating wind projects, places it at the forefront of this expansion.

| Project/Area | Capacity (GW) | Status/Potential | BW Offshore Involvement |

|---|---|---|---|

| Eolmed (France) | 0.03 | Pioneering floating wind farm | BW Ideol stake |

| Buchan Offshore Wind (UK) | 1.1 | Significant capacity | BW Ideol stake |

| BW Ideol Pipeline | 12+ | Future development potential | Strategic investment |

| Global Floating Wind Market | 25+ (by 2030) | Projected substantial growth | Positioned to capitalize |

What is included in the product

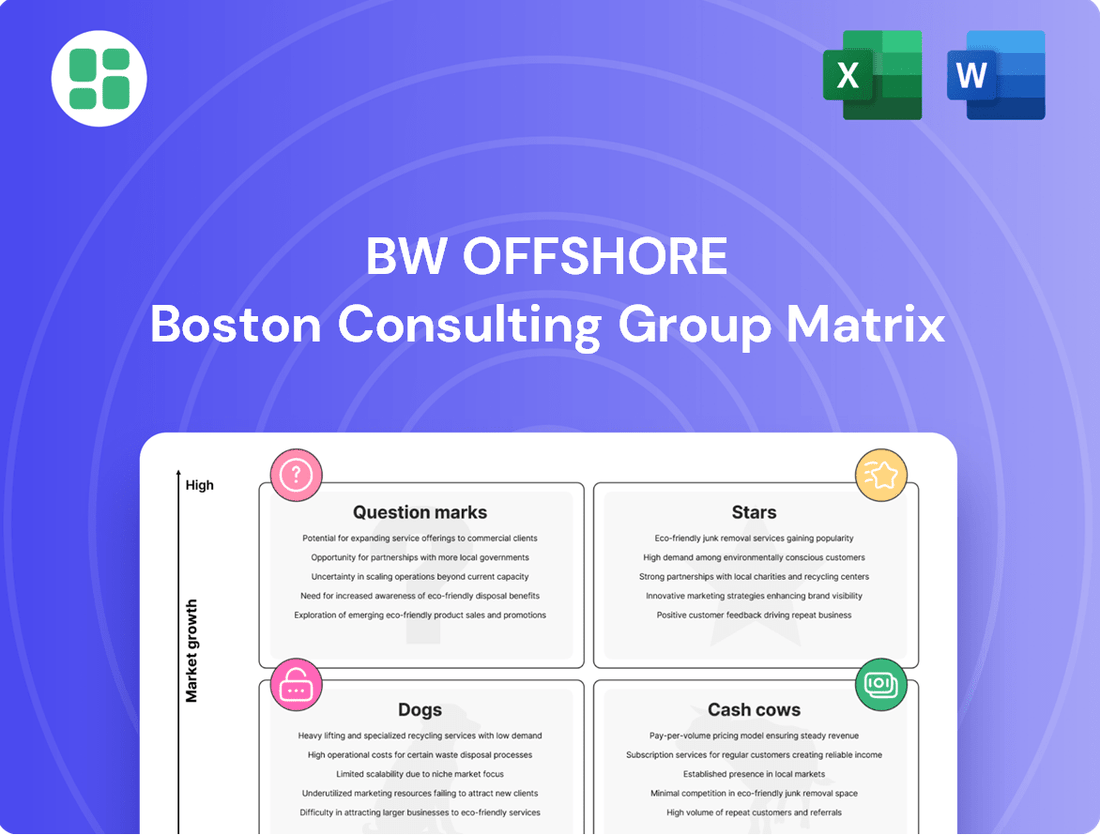

BW Offshore's BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides investment decisions, highlighting units for growth, maintenance, or divestment.

BW Offshore's BCG Matrix offers a clear, one-page overview, instantly relieving the pain of complex portfolio analysis.

Cash Cows

BW Offshore's established long-term FPSO contracts are its core cash cows. These operational units, like the BW Adolo and BW Catcher, are tied to mature fields with stable, long-term agreements, ensuring a predictable and significant income stream. This stability directly translates into consistent contributions to the company's EBITDA, providing a solid financial foundation.

BW Offshore's commitment to high uptime is a cornerstone of its Cash Cow strategy, exemplified by its FPSO fleet consistently achieving over 99% commercial uptime. This operational prowess directly translates to robust revenue generation from their established, high-value assets.

In 2024, this focus on minimizing downtime and maximizing productivity continued to drive strong financial performance for their mature FPSO units. For instance, the company reported that its fleet maintained an average uptime of 99.2% throughout the first half of 2024, underscoring their operational efficiency.

Refurbished Floating Production Storage and Offloading (FPSO) units with extended contracts are prime examples of cash cows within the BW Offshore portfolio. These assets, having already undergone significant capital investment for refurbishment and life extension, are now generating consistent, long-term revenue streams. Their deployment in established basins minimizes exploration risk and operational uncertainty, contributing to predictable cash flows.

BW Offshore's strategy of extending the operational life of existing FPSOs, such as the BW Joko Tole which secured a five-year contract extension with MedcoEnergi in Indonesia through 2028, highlights the cash-generating power of these assets. Compared to the substantial upfront costs of newbuilds, refurbished units offer a more attractive return profile, particularly when secured with multi-year charter agreements. This approach allows BW Offshore to leverage its existing infrastructure while capitalizing on demand in mature oil and gas regions.

Core FPSO Lease and Operate Business

BW Offshore's core FPSO lease and operate business is its bedrock, generating a substantial portion of its revenue backlog. This segment provides a stable and predictable financial foundation, enabling the company to sustain its operations and fund future growth initiatives.

This foundational business is characterized by long-term contracts, offering a degree of certainty in revenue streams. For instance, as of the first quarter of 2024, BW Offshore reported a significant order backlog, primarily driven by its FPSO operations, underscoring the robustness of this segment.

- Core Business: Owning, operating, and leasing Floating Production Storage and Offloading (FPSO) vessels.

- Financial Stability: Provides a predictable and robust financial base through long-term contracts.

- Revenue Backlog: Represents a significant portion of BW Offshore's total revenue backlog.

- Strategic Support: Funds ongoing operations and supports strategic investments in new projects and technologies.

Dividend-Generating Assets

Cash Cows, in the context of BW Offshore's BCG Matrix, represent those assets or business segments that reliably generate substantial cash flow, enabling the company to consistently declare and pay dividends to its shareholders. BW Offshore's fleet of floating production storage and offloading (FPSO) units are prime examples of these cash cows.

The consistent cash generation from BW Offshore's mature and well-established fleet has been a cornerstone of its financial strategy. This robust performance allows the company to maintain a stable and attractive dividend policy, signaling strong financial health and operational efficiency to investors. For instance, in 2023, BW Offshore reported strong operational results, with the fleet contributing significantly to earnings before interest, taxes, depreciation, and amortization (EBITDA), underpinning its ability to return value to shareholders.

- BW Offshore's FPSO fleet consistently generates significant cash flow.

- This cash generation supports a stable dividend policy for shareholders.

- The company's financial health is reflected in its ability to pay dividends.

- Strong EBITDA figures from the fleet in 2023 highlight its cash-generating capacity.

BW Offshore's FPSO fleet serves as its primary cash cow, providing a stable and predictable income stream. These established assets, often operating under long-term contracts, contribute significantly to the company's financial health and ability to pay dividends. The consistent high uptime achieved by these units, frequently exceeding 99%, directly translates into robust revenue generation.

In the first half of 2024, BW Offshore's fleet maintained an impressive average uptime of 99.2%, demonstrating their operational excellence. This reliability ensures a steady flow of cash, underpinning the company's financial stability and its capacity to fund ongoing operations and strategic investments. The company's substantial revenue backlog, largely driven by these FPSO operations, further solidifies their position as reliable cash generators.

| Asset Type | Key Characteristic | Cash Flow Contribution | Example |

|---|---|---|---|

| FPSO Fleet | Long-term contracts, high uptime | Stable, predictable revenue | BW Catcher, BW Adolo |

| Refurbished Units | Extended life, lower risk | Consistent long-term revenue | BW Joko Tole (contract extension) |

Full Transparency, Always

BW Offshore BCG Matrix

The BW Offshore BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no alterations, no watermarks, and no hidden surprises – just a complete, professionally designed strategic analysis ready for your immediate use. You can confidently purchase knowing you're obtaining the exact, high-quality report that has been meticulously prepared for clear business insights and actionable planning.

Dogs

BW Offshore's older FPSO units nearing contract expiration represent the Dogs in their BCG Matrix. These assets, often operating in mature or declining fields, face challenges in securing new, long-term contracts due to their age and potentially lower efficiency compared to newer vessels.

For instance, as of early 2024, BW Offshore has been actively managing its fleet, considering the future of units like the BW Athena, which has a contract ending in 2025. The company's strategy often involves assessing the viability of redeployment or potential divestment for such FPSOs, especially if upgrades are cost-prohibitive or market demand for older units is weak.

Underperforming or divested non-core assets represent ventures that haven't met expectations, often leading to their sale or closure. BW Offshore's strategic move to divest its legacy fleet, including the sale of the BW Opportunity, exemplifies this category. This action was designed to address unfavorable risk-reward profiles inherent in older vessels, thereby streamlining operations.

Projects with limited scope for value addition represent BW Offshore's "Dogs" in the BCG matrix. These are opportunities where the company might engage in early-stage work, like Front-End Engineering Design (FEED) studies, but doesn't secure the full project lifecycle. This often happens when factors such as stringent local content requirements or a perceived insufficient return on investment prevent BW Offshore from progressing beyond initial phases.

A prime example is the Sakarya project. BW Offshore successfully completed the FEED work, demonstrating technical capability. However, their scope was ultimately limited, meaning they couldn't leverage their full expertise for subsequent phases, thereby restricting potential value creation and revenue generation from this particular venture.

Assets Requiring Significant Unjustified Investment

BW Offshore's FPSOs and other significant assets might fall into the Dogs category if they demand substantial capital for upgrades or life extensions, yet lack a clear prospect of securing profitable long-term contracts. These units risk becoming cash traps, draining resources without generating adequate returns.

For instance, an aging FPSO requiring a $200 million life extension but only securing a short-term, low-margin contract would represent a classic Dog. The company must carefully evaluate the return on investment for such expenditures.

- Cash Burn Potential: Assets needing significant investment without guaranteed revenue streams are prime candidates for the Dogs quadrant.

- Contract Uncertainty: A lack of secured, profitable long-term contracts for these assets amplifies the risk of them becoming cash traps.

- Strategic Divestment Consideration: BW Offshore may need to consider divesting or repurposing such underperforming assets to reallocate capital more effectively.

Unsuccessful Renewable Energy Pilot Projects

BW Offshore's strategic positioning within the renewable energy sector, particularly concerning its pilot projects, highlights the inherent risks in exploring new technologies. Some early-stage renewable initiatives, especially in nascent areas like floating wind, may not advance beyond initial testing phases. This can be due to persistent technological hurdles, shifts in market sentiment, or an inability to demonstrate a clear path to commercial profitability.

For instance, while the offshore wind sector saw significant investment in 2024, with global capacity additions continuing their upward trend, not every pilot program translates into a full-scale deployment. BW Offshore, like many energy companies, acknowledges that not all ventures into the energy transition will yield positive outcomes. The company's commitment to exploring new energy solutions is balanced by a realistic understanding of the challenges involved in bringing unproven technologies to market.

The financial implications of unsuccessful pilot projects are a key consideration. These initiatives often require substantial upfront capital investment with no guarantee of return. For example, early-stage floating wind projects, which aim to unlock deeper water resources, have faced challenges in securing financing and demonstrating cost-competitiveness against more established offshore wind technologies. This can lead to project cancellations or significant delays, impacting the overall portfolio performance.

- Technological Hurdles: Early floating wind designs might encounter unforeseen engineering complexities, impacting reliability and cost-effectiveness.

- Market Conditions: Unfavorable power purchase agreements or shifts in government subsidies can render pilot projects commercially unviable.

- Commercial Viability: The inability to achieve projected operational efficiencies or cost targets prevents scaling up from pilot to commercial phases.

- Investment Risk: High capital expenditure for unproven technologies carries significant risk, leading to project abandonment if early results are not promising.

BW Offshore's older FPSO units nearing contract expiration, or those requiring significant, unrecoverable upgrades without clear future contracts, represent "Dogs" in their BCG Matrix. These assets often face challenges in securing new, profitable work, potentially becoming cash drains. For instance, as of early 2024, managing the lifecycle of units like the BW Athena, with contracts ending soon, requires careful consideration of redeployment or divestment to avoid holding underperforming assets.

BW Offshore's strategic moves, such as divesting legacy fleet units like the BW Opportunity, highlight the management of assets with unfavorable risk-reward profiles. Similarly, pilot projects in nascent areas like floating wind, which may not achieve commercial viability due to technological or market hurdles, can also be categorized as Dogs. The company must balance exploration of new energy solutions with a realistic assessment of investment risks, as seen with early-stage floating wind projects facing financing and cost-competitiveness challenges.

Assets that demand substantial capital for life extensions or upgrades but lack secured, profitable long-term contracts risk becoming cash traps. An example could be an aging FPSO needing a significant investment, say $200 million, for life extension but only securing a short-term, low-margin contract. BW Offshore must critically evaluate the return on investment for such expenditures, potentially leading to divestment or repurposing to reallocate capital effectively.

BW Offshore's engagement in early-stage work like FEED studies for projects such as Sakarya, without securing subsequent phases, also falls into the Dog category. This limits value creation and revenue potential, especially when factors like stringent local content requirements or insufficient projected returns prevent full project lifecycle involvement. These ventures represent opportunities with limited scope for significant value addition.

Question Marks

BW Offshore's acquisition of existing Floating Production, Storage, and Offloading (FPSO) units, such as the FPSO Nganhurra, for redeployment signifies a strategic move into a high-growth potential market. These acquisitions, while representing a significant investment, initially place the company in a position of low market share until successful redeployment contracts are secured for new offshore oil projects.

The critical factor for success in this segment, akin to a 'Question Mark' in the BCG Matrix, is the ability to secure profitable redeployment contracts within a defined period. For instance, BW Offshore's acquisition of the Nganhurra in 2023 for a reported $60 million, with the intention of repurposing it for the Kudu gas field development, highlights this strategy. The ultimate market share and success will depend on the commercial viability and execution of these new projects.

BW Ideol is actively seeking Engineering, Procurement, Construction, and Installation (EPCI) contracts for floating wind projects. This strategic focus aligns with the burgeoning global floating wind market, which is projected to reach over 10 GW by 2030, with significant growth expected in Europe and Asia.

While BW Ideol is a key player in floating wind technology, its market share within the EPCI segment is still in its nascent stages. Capturing a larger portion of this expanding market will necessitate substantial capital investment to enhance its project execution capabilities and secure larger-scale contracts, particularly as project sizes are increasing, with recent projects often exceeding 500 MW.

BW Offshore is actively developing floating carbon capture and storage (CCS) solutions, a strategic move to bolster its energy transition portfolio. These innovative units are designed for CO2 storage and injection, targeting a market that, while still emerging, shows substantial growth potential.

The company is channeling investment into technology development for these floating CCS units, aiming to secure a leading position in this nascent sector. This focus aligns with global efforts to decarbonize, with the CCS market projected to reach hundreds of billions of dollars by 2030, driven by policy support and industrial demand.

Gas-to-Power and Floating Ammonia Production Concepts

BW Offshore is exploring gas-to-power and floating ammonia production as strategic growth areas, targeting high-potential, evolving energy markets. These initiatives represent a move into segments where the company currently holds a low market share but sees significant future expansion opportunities.

The company's focus on these innovative concepts aligns with the broader energy transition. For instance, the global ammonia market, particularly for green ammonia, is projected for substantial growth, with estimates suggesting a market size of over $100 billion by 2030, driven by its use in fertilizers and as a potential clean fuel. Similarly, gas-to-power solutions are crucial for countries looking to leverage natural gas resources while reducing emissions compared to coal, with new floating LNG-to-power projects demonstrating significant capacity additions in recent years.

- Gas-to-Power: Leverages existing natural gas resources for electricity generation, often in regions with limited grid infrastructure, offering a cleaner alternative to other fossil fuels.

- Floating Ammonia Production: Explores the potential of producing ammonia, a key component for fertilizers and a promising clean fuel, on floating platforms, reducing the need for extensive onshore facilities.

- Market Potential: These sectors are characterized by rapid innovation and increasing demand, presenting opportunities for BW Offshore to establish a strong presence.

- Strategic Fit: Aligns with BW Offshore's expertise in offshore engineering and project execution, adapting its capabilities to new energy solutions.

Pre-FEED and FEED Studies for Future FPSO Projects

BW Offshore's engagement in Pre-FEED and FEED studies for upcoming FPSO projects, like Bay du Nord and Repsol's Block 29, positions them to capture future market opportunities. These early-stage studies are crucial for developing the technical and economic foundations of potential projects.

While these prospective projects, such as the potential Bay du Nord development which could involve significant FPSO capacity, represent high growth potential, BW Offshore's current market share in them is minimal until contracts are secured. This aligns with the characteristics of a question mark in the BCG matrix, where investment is needed to foster growth.

- Early Engagement: BW Offshore is actively participating in Pre-FEED and FEED for projects like Bay du Nord and Repsol's Block 29.

- Growth Potential: These projects offer substantial future growth prospects if they proceed to Final Investment Decision (FID).

- Current Market Share: BW Offshore's current market share in these specific projects is low until contracts are awarded.

- Strategic Investment: Investment in these early-stage studies is a strategic move to secure future market positions in high-growth offshore developments.

BW Offshore's ventures into emerging energy sectors like floating carbon capture and storage (CCS) and gas-to-power solutions represent classic Question Marks. These areas offer substantial future growth potential, driven by global decarbonization efforts and evolving energy demands, with the CCS market alone projected to be worth hundreds of billions by 2030.

Currently, BW Offshore holds a low market share in these nascent segments. Success hinges on significant investment in technology development and securing early-stage contracts, such as those being explored for floating ammonia production, which could see a market exceeding $100 billion by 2030.

The company's participation in FEED studies for projects like Bay du Nord, a potential high-growth area, also positions them as a Question Mark. Their market share in these prospective developments is minimal until contracts are awarded, requiring strategic investment to convert potential into realized market presence.

BW Ideol's focus on floating wind EPCI contracts is another prime example. While the market is expanding rapidly, with projections of over 10 GW by 2030, BW Ideol's current market share is small, necessitating capital investment to scale up capabilities for increasingly larger projects, often exceeding 500 MW.

| Business Unit/Initiative | BCG Category | Market Growth | Current Market Share | Key Success Factor | Example Project/Focus |

|---|---|---|---|---|---|

| Redeployed FPSOs | Question Mark | High (new offshore projects) | Low (until redeployment) | Securing profitable redeployment contracts | FPSO Nganhurra for Kudu gas field |

| Floating Wind EPCI (BW Ideol) | Question Mark | Very High (>10 GW by 2030) | Low | Securing large-scale EPCI contracts, scaling capabilities | Floating wind projects in Europe and Asia |

| Floating CCS Solutions | Question Mark | High (hundreds of billions by 2030) | Very Low (nascent market) | Technology development, securing early-mover advantage | Developing CCS units for CO2 storage and injection |

| Gas-to-Power & Floating Ammonia | Question Mark | High (Ammonia market >$100B by 2030) | Low | Market penetration, adapting to evolving energy demands | Exploring floating ammonia production, gas-to-power solutions |

| Pre-FEED/FEED for New FPSOs | Question Mark | High (future offshore developments) | Low (until contract award) | Winning future project contracts | Bay du Nord, Repsol's Block 29 |

BCG Matrix Data Sources

Our BW Offshore BCG Matrix leverages a robust blend of financial disclosures, industry-specific market research, and operational performance data to accurately position each business unit.