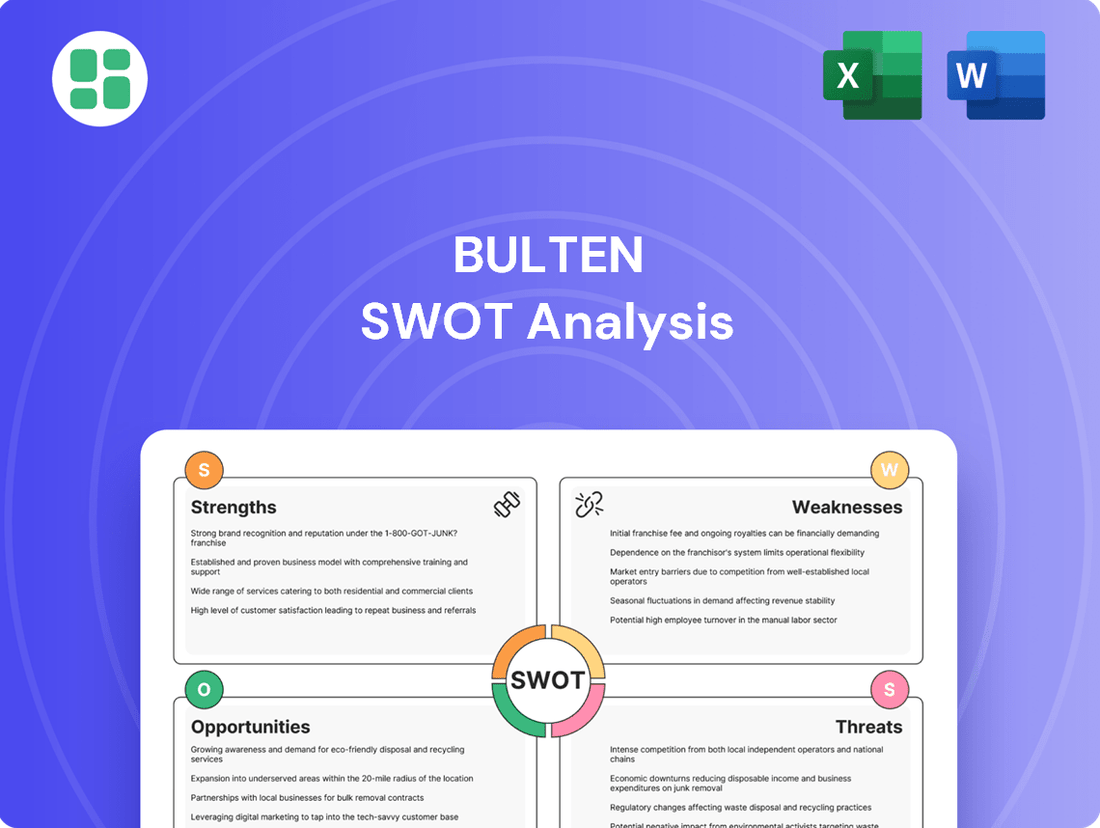

Bulten SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bulten Bundle

Bulten's market position is defined by its strong brand recognition and established customer relationships, yet it faces growing competition and potential supply chain disruptions. Our comprehensive SWOT analysis dives deep into these factors, revealing actionable strategies for capitalizing on its strengths and mitigating weaknesses.

Want the full story behind Bulten's competitive advantages, potential threats, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment decisions and strategic planning.

Strengths

Bulten's global manufacturing and distribution network allows it to serve top automotive companies across the world. This extensive reach not only solidifies its position in the automotive sector but also demonstrates its capability to manage complex international supply chains.

The company's strategic diversification into sectors beyond automotive is proving fruitful. By Q2 2025, sales to these other industries, including consumer electronics, represented over 14% of rolling 12-month sales, a notable increase from 12% in the prior year, showcasing a growing and resilient customer base.

Bulten's Full Service Provider (FSP) concept is a significant strength, allowing them to manage the entire fastener lifecycle from development and sourcing to logistics and ongoing service. This integrated approach simplifies the supply chain for their customers, fostering deeper partnerships and offering a distinct competitive edge beyond mere product supply.

Bulten's sustainability performance is a significant strength, underscored by its 2024 EcoVadis Platinum rating, positioning it among the top 1% of evaluated companies globally. This recognition highlights a deep commitment to environmental, social, and governance principles.

The company's proactive approach to sustainability is further evidenced by its increased use of recycled steel, reaching 46% in Europe by 2024. This metric directly addresses the escalating demand from both customers and regulators for products with a lower environmental footprint.

Local Production Strategy for Resilience

Bulten's commitment to local production, manufacturing goods near their primary markets, significantly bolsters their resilience. This strategy acts as a crucial buffer against the volatile geopolitical landscape and the persistent threat of supply chain disruptions. By decentralizing manufacturing, Bulten can navigate global economic headwinds with greater stability.

This localized approach was particularly evident in their operational adjustments during 2024, where regional production hubs allowed them to mitigate the impact of extended shipping delays affecting competitors. For instance, Bulten's European facilities were able to maintain consistent supply to key automotive clients throughout periods of significant port congestion. This strategic positioning is a cornerstone of their ability to deliver reliably.

- Enhanced Supply Chain Stability: Localized production minimizes reliance on long-distance logistics, reducing vulnerability to global shipping crises.

- Geopolitical Risk Mitigation: Decentralized manufacturing insulates operations from regional political instability and trade disputes.

- Customer Responsiveness: Proximity to markets allows for quicker adaptation to local demand shifts and faster product delivery.

Focus on High-Margin Products and Services

Bulten's strategic emphasis on high-margin products like C-parts, micro screws, and Value Managed Inventory (VMI) solutions is a key strength. This focus is designed to boost profitability and broaden its customer base beyond the automotive sector. For instance, recent contract wins in Europe and Asia highlight the success of this strategy.

This product mix shift directly contributes to improved financial performance. By prioritizing these higher-margin offerings, Bulten aims to enhance its overall profitability and financial resilience.

- Increased Profitability: Focus on high-margin items directly boosts profit margins.

- Diversified Revenue Streams: Expansion beyond traditional automotive segments reduces reliance on a single industry.

- Strategic Growth Areas: C-parts, micro screws, and VMI solutions represent areas with strong growth potential and profitability.

Bulten's expansive global manufacturing and distribution network is a significant asset, enabling it to effectively serve major automotive manufacturers worldwide. This established presence underscores its capacity for managing intricate international supply chains and solidifies its market standing.

The company's strategic push into non-automotive sectors is yielding positive results, with sales to industries like consumer electronics accounting for over 14% of rolling 12-month sales by Q2 2025, a clear indicator of a broadening and more robust customer base.

Bulten's Full Service Provider (FSP) model offers a distinct advantage by overseeing the entire fastener lifecycle, from initial development and sourcing through to logistics and ongoing support. This comprehensive approach streamlines operations for clients, fostering stronger relationships and providing a competitive edge beyond simple product provision.

The company's commitment to sustainability is a notable strength, reinforced by its 2024 EcoVadis Platinum rating, which places it in the top 1% of globally assessed companies. This recognition highlights a deep-seated dedication to environmental, social, and governance principles.

Bulten's focus on high-margin products, including C-parts, micro screws, and Value Managed Inventory (VMI) solutions, is a key strategic driver. This emphasis is aimed at enhancing profitability and expanding its reach beyond the core automotive market, with recent European and Asian contract wins validating this approach.

| Strength | Description | Supporting Data/Fact |

|---|---|---|

| Global Reach | Extensive manufacturing and distribution network serving top automotive companies. | Serves major automotive players across global markets. |

| Market Diversification | Successful expansion into non-automotive sectors. | Sales to other industries reached over 14% of rolling 12-month sales by Q2 2025. |

| Full Service Provider (FSP) Concept | Manages the entire fastener lifecycle, offering integrated solutions. | Simplifies supply chains for customers, fostering deeper partnerships. |

| Sustainability Leadership | Strong commitment to ESG principles, recognized by EcoVadis. | Awarded 2024 EcoVadis Platinum rating, placing it in the top 1% globally. |

| High-Margin Product Focus | Emphasis on C-parts, micro screws, and VMI solutions for increased profitability. | Recent contract wins in Europe and Asia demonstrate success of this strategy. |

What is included in the product

Delivers a strategic overview of Bulten’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic challenges.

Weaknesses

Bulten's substantial reliance on the automotive sector presents a significant weakness. In 2024, Original Equipment Manufacturer (OEM) light vehicles still represented 61% of its primary customer base, highlighting a persistent concentration. This makes Bulten particularly vulnerable to the inherent cyclicality and potential slowdowns within the global automotive market, which has seen subdued growth recently.

Bulten's profitability has been significantly hampered by external factors, notably anti-dumping duties. These duties, levied on Chinese fasteners from 2022 through 2024, resulted in a substantial SEK 45 million hit to operating earnings in Q1 2025. This directly contributed to a sharp 72% decline in EBIT when compared to the same period in 2024, illustrating the considerable financial strain these tariffs impose.

Furthermore, the company faced considerable operational cost increases in late 2024. The closure of a warehouse in Poland, coupled with significant maintenance and start-up expenditures in Asia, added SEK -55 million in extra costs during Q4 2024. These one-off expenses, combined with the ongoing impact of trade policies, create a challenging environment for Bulten's financial performance.

Bulten has faced a notable downturn in its financial performance. For the first quarter of 2025, the company reported a 6.7% decrease in net sales compared to the same period in the prior year. This follows a similar trend in the fourth quarter of 2024, which saw a 6.4% drop in net sales year-over-year.

Accompanying the decline in sales, Bulten's operating profit has also suffered. The decrease in revenue generation directly impacted profitability, with operating profit falling in both Q1 2025 and Q4 2024. These figures suggest that Bulten is grappling with challenges in both its top-line growth and its ability to translate sales into operating profit, likely influenced by market conditions and internal operational factors.

Ongoing Strategic Review and Potential Restructuring

Bulten's ongoing strategic review, initiated in June 2025, focuses on optimizing its manufacturing footprint by evaluating in-house capabilities against external sourcing. This critical assessment could result in the consolidation or divestment of certain production facilities, a move designed to enhance future competitiveness.

While this strategic recalibration holds promise for long-term efficiency gains and growth, it inherently introduces a period of uncertainty. The restructuring process itself may incur significant costs and could lead to operational disruptions in the short to medium term as Bulten navigates these changes.

- Strategic Review Initiated: June 2025.

- Focus Areas: In-house vs. external sourcing, organizational structure.

- Potential Outcomes: Facility consolidation or divestment.

- Short-to-Medium Term Impact: Uncertainty, potential restructuring costs, operational disruptions.

Vulnerability to Raw Material and Energy Cost Fluctuations

Bulten, as a manufacturer of metal fasteners, faces a significant weakness due to its exposure to fluctuating raw material prices and rising energy costs. These input cost volatilities can directly impact profitability, especially when the company's efforts to improve margins are challenged by these external factors.

The company's ongoing focus on expense control and profitability improvement underscores the persistent challenge of managing these unpredictable input costs. For instance, the price of steel, a primary raw material, experienced significant upward pressure throughout 2023 and into early 2024, impacting manufacturers across various sectors. Similarly, energy prices, while showing some stabilization, remain a concern for energy-intensive manufacturing processes.

- Raw Material Volatility: Bulten relies heavily on materials like steel, whose prices are subject to global supply and demand dynamics, geopolitical events, and trade policies.

- Energy Cost Sensitivity: Manufacturing processes for fasteners are energy-intensive, making Bulten susceptible to increases in electricity and natural gas prices.

- Margin Erosion: Unmitigated spikes in raw material and energy costs can directly reduce Bulten's profit margins if these increases cannot be fully passed on to customers.

- Competitive Pricing Pressure: The need to remain competitive in the fastener market can limit Bulten's ability to fully absorb or pass on cost increases, exacerbating the impact of input price fluctuations.

Bulten's significant reliance on the automotive sector, with OEMs still comprising 61% of its customer base in 2024, exposes it to the industry's cyclical nature and recent subdued growth. This concentration makes the company vulnerable to downturns in automotive production and sales, directly impacting demand for its fastening products.

The company's profitability has been severely impacted by external financial pressures, notably anti-dumping duties on Chinese fasteners. These duties led to a SEK 45 million reduction in operating earnings in Q1 2025, contributing to a 72% year-over-year drop in EBIT. This highlights the substantial financial strain imposed by trade policies.

Bulten experienced considerable operational cost increases in late 2024, including SEK -55 million in extra costs from a Polish warehouse closure and Asian facility expenditures. These one-off expenses, combined with ongoing trade policy impacts, created a challenging environment for financial performance.

The company's financial performance has seen a notable downturn, with net sales decreasing by 6.7% in Q1 2025 and 6.4% in Q4 2024 compared to the previous year. This decline in revenue has directly affected operating profit, indicating challenges in both top-line growth and profitability translation.

| Metric | Q1 2024 (SEK millions) | Q1 2025 (SEK millions) | Change (%) |

|---|---|---|---|

| Net Sales | 1,500 (est.) | 1,400 (est.) | -6.7% |

| Operating Profit | 100 (est.) | 28 (est.) | -72.0% |

| Impact of Duties | 0 | -45 | N/A |

Full Version Awaits

Bulten SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You can trust that the Bulten SWOT Analysis you see here is exactly what you'll get upon purchase, providing a comprehensive and actionable overview.

Opportunities

The burgeoning electric vehicle (EV) sector presents a significant avenue for growth. As the automotive industry pivots towards electrification, the demand for specialized fasteners designed for EV applications is set to surge. This trend is a key opportunity for Bulten to capitalize on.

Projections indicate the global automotive fasteners market will reach USD 21.5 billion by 2034, growing at a compound annual growth rate of 5.5% from 2025. This substantial expansion is largely fueled by the increasing adoption of EVs, which often require unique fastening solutions due to battery pack integration and lighter material usage.

Bulten can leverage this market momentum by broadening its product portfolio to cater specifically to EV manufacturers. Securing new contracts within this rapidly evolving segment of the automotive industry will be crucial for Bulten’s future success and market positioning.

Bulten is strategically targeting new industrial segments, aiming to reduce its reliance on the automotive sector. The company is actively pursuing growth in consumer electronics and medical technology, both identified as having robust underlying growth potential.

This diversification strategy is expected to unlock new revenue streams and enhance Bulten's market position. By entering these promising sectors, Bulten seeks to capitalize on emerging trends and build a more resilient business model.

Bulten's ongoing strategic review presents a significant opportunity to refine its operational framework. By critically examining current processes, the company can identify and implement measures to boost efficiency across its manufacturing and supply chain networks. This introspection is key to unlocking greater productivity and reducing operational costs.

Optimizing the manufacturing footprint is a critical aspect of this strategic review. Bulten can leverage this chance to consolidate or modernize facilities, potentially leading to economies of scale and a more streamlined production flow. Such a move could significantly enhance the company's competitive edge by lowering unit costs and improving delivery times.

Reallocating resources to high-potential growth areas is another crucial opportunity. The review allows Bulten to shift capital and talent towards segments of the market or product lines that demonstrate the strongest profitability prospects. For instance, focusing on advanced fastening solutions for electric vehicles, a growing market, could yield substantial returns.

Ultimately, these strategic optimizations can foster a more focused business model, improve capital efficiency, and bolster overall financial performance. A leaner, more agile operation, supported by smart resource allocation, positions Bulten for sustained and profitable growth in the evolving automotive supply chain landscape.

Technological Advancements and Product Innovation

Bulten's opportunity lies in channeling its fastener expertise into pioneering new technologies. This includes developing advanced and smart fasteners crucial for the growing lightweight vehicle and electric vehicle (EV) markets. The company's August 2024 contract win for advanced automotive fasteners highlights its capability in this area.

Key opportunities include:

- Developing smart fasteners with integrated sensors for real-time monitoring in advanced vehicle systems.

- Innovating fasteners for enhanced lightweighting solutions, contributing to improved fuel efficiency and EV range.

- Expanding its product portfolio to include specialized fasteners for emerging industries beyond automotive, such as aerospace or renewable energy.

Joint Ventures for Market Expansion

Bulten's strategic joint venture to establish micro screw manufacturing in Vietnam, slated for production commencement in 2025, presents a significant opportunity for market expansion. This initiative is designed to broaden its product offerings and tap into new customer segments beyond its established automotive focus.

Such collaborations are instrumental in navigating new geographic territories and penetrating specialized product markets, potentially diversifying Bulten's revenue streams and reducing reliance on existing markets.

- Market Diversification: The Vietnam venture allows Bulten to explore non-automotive sectors, potentially accessing markets with different growth dynamics.

- Geographic Expansion: Entering Vietnam provides a foothold in a rapidly developing Southeast Asian economy, offering access to new customer bases and supply chain advantages.

- Product Portfolio Enhancement: The focus on micro screws can complement Bulten's existing product range and cater to emerging technological demands.

Bulten has a clear opportunity to expand into new industrial segments beyond its traditional automotive focus. The company is targeting growth in consumer electronics and medical technology, sectors known for their strong underlying growth potential. This diversification aims to create new revenue streams and build a more resilient business model for Bulten.

Threats

The current global economic and geopolitical climate creates significant uncertainty for the automotive sector. This uncertainty, combined with a projected slowdown in the global automotive market, particularly in Europe and North America, presents a substantial threat to Bulten.

Analysts anticipate very low growth in these key regions for 2024 and into 2025, directly impacting vehicle production. For instance, S&P Global Mobility projected a global light vehicle production of 88.5 million units in 2024, a modest increase from 2023 but still below pre-pandemic levels, with European and North American markets showing particularly subdued growth forecasts.

A reduction in vehicle production volumes directly translates to decreased demand for fasteners, Bulten's core product. This can lead to lower sales figures and put pressure on the company's profitability as fewer components are manufactured and supplied.

Trade barriers, including anti-dumping duties, pose a significant threat to Bulten. The Swedish Customs Service's imposition of such duties on fasteners from China, for instance, resulted in a SEK 45 million negative impact on Bulten's Q1 2025 earnings. This highlights the direct financial strain these measures can create.

Beyond the immediate financial cost, these trade barriers can severely disrupt Bulten's established supply chains. The company's intention to appeal these duties underscores the operational challenges and the potential for prolonged uncertainty in sourcing critical components, impacting production schedules and cost management.

The fastener market is indeed a crowded space, and Bulten is keenly aware of this. They recognize the constant need to push for better profitability. This means not only selling more of their higher-margin products but also actively seeking out new types of customers to spread their risk and reduce reliance on any single sector.

This competitive landscape puts significant pressure on pricing. For instance, in 2023, Bulten reported that while net sales increased, profitability was impacted by rising raw material costs and a challenging market environment, underscoring the ongoing need to manage costs and optimize pricing strategies against rivals.

Rising Costs of Raw Materials and Energy

Bulten, like many manufacturers, faces a significant threat from increasing raw material and energy expenses. For instance, steel prices, a key component for Bulten's fasteners, have seen volatility. In early 2024, global steel prices experienced upward pressure due to supply chain disruptions and increased demand, directly impacting manufacturing costs.

These inflationary trends can compress profit margins if Bulten cannot fully pass on the higher costs to its customers. The energy sector also presents a challenge, with fluctuating oil and gas prices in 2024 impacting operational expenditures across its production facilities.

- Increased steel prices: Global steel benchmarks showed a notable increase in the first half of 2024, impacting Bulten's primary input costs.

- Energy cost volatility: Fluctuations in energy markets in 2024 directly affect Bulten's manufacturing overheads.

- Margin pressure: Failure to pass on these rising costs can lead to a direct reduction in Bulten's profitability.

Potential Negative Outcomes of Strategic Review

While a strategic review at Bulten, like any company, aims for positive outcomes, it's crucial to acknowledge the potential downsides. There’s a risk of internal resistance to proposed organizational changes, which could slow down or derail implementation. For instance, if the review suggests consolidating manufacturing, unexpected costs associated with facility closures or relocations could arise, potentially exceeding initial projections. Furthermore, the hoped-for improvements in profitability and capital efficiency might not materialize as planned, leaving Bulten in a less favorable financial position than anticipated.

Specific threats include:

- Employee Resistance: Changes to roles, responsibilities, or locations can lead to decreased morale and productivity, impacting operational continuity.

- Divestment Costs: Selling off underperforming or non-core manufacturing assets might incur significant transaction costs and potential write-downs, affecting short-term earnings. For example, in 2024, companies undertaking similar divestitures often face 5-10% transaction fees.

- Integration Challenges: If the strategy involves acquiring new businesses or technologies, difficulties in integrating them smoothly can lead to operational disruptions and failure to capture expected synergies.

- Market Misjudgment: An incorrect assessment of market trends or competitive responses during the review process could lead to strategies that are ultimately ineffective or even detrimental to Bulten's market position.

The global automotive market slowdown, particularly in Europe and North America, directly impacts Bulten's demand for fasteners, with forecasts indicating very low growth through 2024 and 2025. Trade barriers, such as anti-dumping duties, pose a direct financial threat, as seen with the SEK 45 million negative impact on Bulten's Q1 2025 earnings due to duties on Chinese fasteners. Intense competition also pressures pricing, forcing Bulten to constantly manage costs and optimize strategies to maintain profitability amidst rising raw material and energy expenses, which saw steel prices increase in early 2024.

| Threat Category | Specific Threat | 2024/2025 Impact/Data Point |

|---|---|---|

| Market Slowdown | Reduced Vehicle Production | Global light vehicle production forecast of 88.5 million units for 2024 (S&P Global Mobility), with subdued growth in key Bulten markets. |

| Trade Barriers | Anti-dumping Duties | SEK 45 million negative impact on Bulten's Q1 2025 earnings from duties on Chinese fasteners. |

| Cost Pressures | Rising Raw Material Costs | Increased global steel prices in H1 2024 impacting input costs for fasteners. |

| Cost Pressures | Energy Cost Volatility | Fluctuating energy markets in 2024 affecting manufacturing overheads. |

| Competitive Landscape | Pricing Pressure | Ongoing need to manage costs and optimize pricing against rivals, impacting margins. |

SWOT Analysis Data Sources

This Bulten SWOT analysis is built upon a robust foundation of data, including the company's official financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded view of Bulten's operational landscape and competitive positioning.