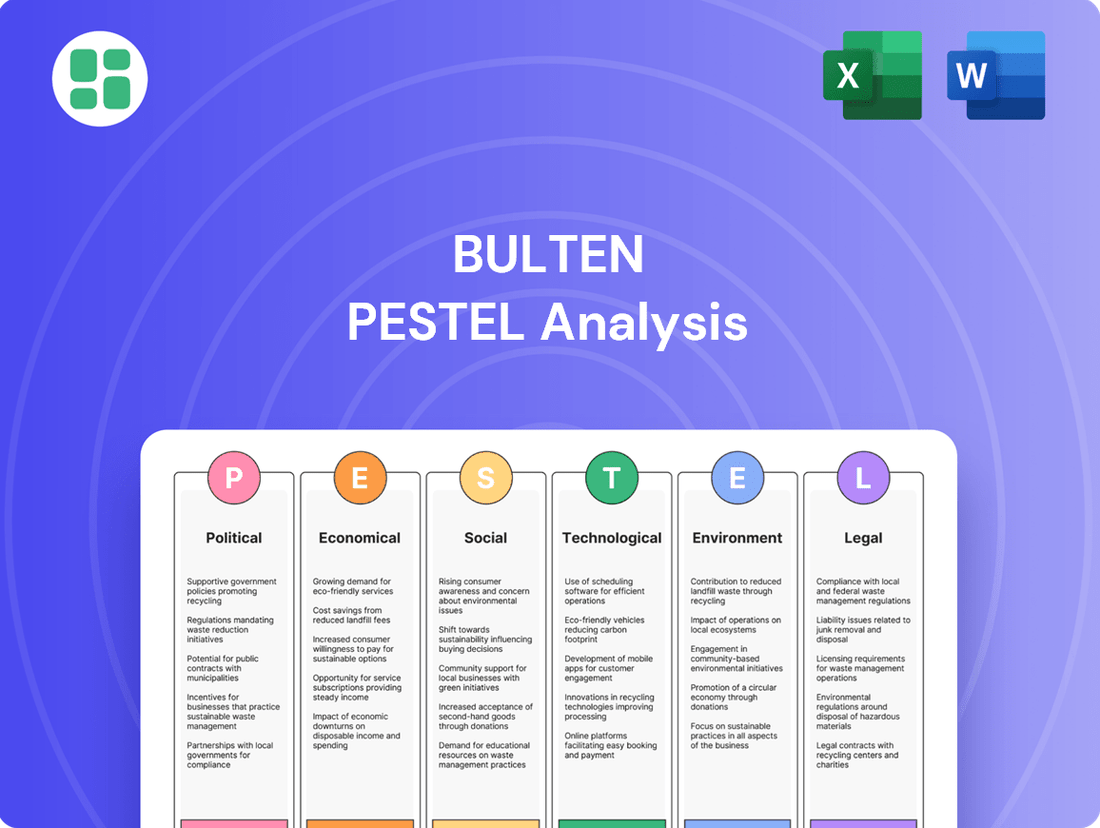

Bulten PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bulten Bundle

Uncover the critical external forces shaping Bulten's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to emerging technological advancements, understand the macro-environmental factors that will impact their future success. Don't get left behind; download the full analysis now to gain a strategic advantage and anticipate market shifts.

Political factors

Stricter CO2 emission standards, especially within the European Union, are significantly influencing the automotive industry's shift towards electric vehicles and lighter vehicle designs. This trend directly impacts the demand for particular types of fasteners used in these evolving vehicle architectures. For instance, the EU's target of an average of 93.6g/km of CO2 for new cars in 2025, a 15% reduction from 2021, underscores this regulatory pressure.

These regulations, which aim for a ban on new non-zero-emission vehicles by 2035, compel automotive manufacturers to accelerate their adoption of zero and low-emission vehicles. Consequently, this necessitates a re-evaluation of fastener materials and designs to meet the specific requirements of EVs and lightweight construction, directly affecting companies like Bulten.

Global trade policies, such as tariffs and anti-dumping duties, directly influence Bulten's operational costs and supply chain efficiency. These measures can escalate the price of essential raw materials and components, compelling adjustments in sourcing strategies and potentially impacting the final cost of automotive fasteners for consumers.

For instance, Bulten's financial performance in the first quarter of 2025 saw a negative impact of SEK 45 million attributed to anti-dumping duties imposed on fasteners imported from China into the European Union. The company is actively pursuing an appeal against this ruling, highlighting the significant financial implications of such trade regulations.

Ongoing geopolitical tensions, particularly in Eastern Europe and the Middle East, continue to create significant uncertainty for global supply chains. This volatility directly impacts the availability and cost of raw materials essential for automotive component manufacturers like Bulten. For instance, disruptions in key metal supply routes could lead to price spikes, affecting Bulten's production costs.

Bulten’s strategic focus on localized production, manufacturing components closer to their end markets, is a crucial response to these geopolitical risks. This approach aims to build greater resilience by reducing reliance on long, complex international supply chains. By producing in regions where vehicles are sold, Bulten can better navigate disruptions and ensure more consistent supply to its automotive clients.

In 2025, automotive companies are prioritizing enhanced supply chain visibility and opportunities for freight consolidation to manage these complexities. This means a greater emphasis on tracking shipments in real-time and optimizing logistics to reduce costs and lead times, a critical factor for suppliers like Bulten to maintain competitiveness amidst global instability.

Government Incentives for EV Production

Government incentives and supportive regulations for electric vehicle adoption are a major catalyst for the EV market's expansion, directly increasing the demand for specialized fasteners. For instance, in 2024, the US Inflation Reduction Act continues to offer substantial tax credits for EV purchases, encouraging higher production volumes from automakers. This trend creates new avenues for Bulten to supply fasteners specifically designed for EV battery systems, lightweight body structures, and electric powertrains, where material science and precision engineering are paramount.

These incentives translate into tangible growth opportunities for companies like Bulten. As automotive manufacturers ramp up EV production to meet consumer demand and regulatory targets, the need for high-quality, specialized fasteners intensifies. For example, the European Union's proposed CO2 emission standards for 2030 are pushing manufacturers towards a significant increase in EV sales, projected to reach over 30% of the market by then. This necessitates a corresponding surge in demand for Bulten's advanced fastening solutions.

- Increased EV Production: Government subsidies and tax credits, such as those in the US and EU, are directly stimulating higher EV manufacturing output globally.

- Demand for Specialized Fasteners: The unique requirements of EV components, like battery packs and lightweight chassis, drive demand for advanced, high-performance fastening solutions.

- Market Growth Projections: The global EV market is expected to continue its robust growth trajectory, with projections indicating a significant increase in production volumes through 2025 and beyond, creating sustained demand.

- Regulatory Tailwinds: Stricter emissions regulations worldwide are compelling automakers to accelerate their EV transition, further bolstering the market for EV-specific components and fasteners.

Industrial Policies and Domestic Manufacturing Support

Governments worldwide are increasingly implementing industrial policies aimed at bolstering domestic manufacturing and regional production. This trend directly impacts companies like Bulten, potentially influencing where they choose to invest and operate. For instance, the European Union's focus on strengthening its automotive supply chain, particularly in light of recent global disruptions, could encourage Bulten to expand its production facilities within the EU. This aligns with the broader push for nearshoring, driven by a desire for greater supply chain resilience and reduced geopolitical risk.

The drive for domestic manufacturing support is evident in various initiatives. For example, the United States' CHIPS and Science Act, while focused on semiconductors, signals a broader governmental commitment to reshoring critical industries. Similarly, many European nations are offering incentives for local production and R&D within the automotive sector. Bulten, as a key supplier to leading automotive manufacturers, will likely see these policies shape its strategic decisions regarding plant locations and capacity expansion to better serve its client base in these key regions.

These policies can create both opportunities and challenges for Bulten:

- Increased demand for locally produced components: Policies favoring domestic manufacturing could lead to higher demand for Bulten's products manufactured within specific regions.

- Potential for new investment incentives: Governments may offer subsidies or tax breaks to companies investing in local production, potentially reducing Bulten's operational costs.

- Navigating varied regulatory landscapes: Bulten must adapt to different national industrial policies and compliance requirements across its operational footprint.

Government incentives for electric vehicle (EV) adoption are a significant driver for Bulten. For instance, the US Inflation Reduction Act continues to offer substantial tax credits for EV purchases in 2024, boosting EV production and thus the demand for specialized fasteners. This trend directly benefits Bulten by increasing opportunities to supply components for EV battery systems and lightweight structures.

Stricter emissions regulations, like the EU's target for average CO2 emissions of 93.6g/km for new cars in 2025, compel automakers to accelerate EV development. This regulatory push, aiming for a ban on new non-zero-emission vehicles by 2035, necessitates advanced fastening solutions for lighter vehicles and EV architectures, directly impacting Bulten's product development and market focus.

Geopolitical instability, particularly in Eastern Europe, creates supply chain volatility impacting raw material availability and cost for manufacturers like Bulten. Bulten's strategy of localized production aims to mitigate these risks by reducing reliance on long international supply chains, enhancing resilience against disruptions.

Global trade policies, including tariffs and anti-dumping duties, directly affect Bulten's operational costs. The company experienced a SEK 45 million negative impact in Q1 2025 due to anti-dumping duties on fasteners imported from China into the EU, underscoring the financial sensitivity to such trade regulations.

| Factor | Impact on Bulten | 2024/2025 Data/Trend |

| EV Incentives | Increased demand for specialized fasteners | US Inflation Reduction Act tax credits boosting EV production. EU projected EV sales over 30% by 2030. |

| Emissions Regulations | Shift towards lightweighting and EV-specific fasteners | EU target: 93.6g/km CO2 average for new cars in 2025. Ban on new ICE vehicles by 2035. |

| Geopolitical Tensions | Supply chain volatility, raw material cost fluctuations | Ongoing instability impacting key supply routes. |

| Trade Policies | Increased operational costs, supply chain adjustments | Bulten's Q1 2025 financial impact of SEK 45 million from anti-dumping duties. |

What is included in the product

This Bulten PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company's operations and strategic positioning.

It provides a detailed, data-driven overview of external influences, highlighting potential threats and opportunities for Bulten's strategic decision-making.

A Bulten PESTLE analysis provides a structured framework to identify and understand external factors influencing the fastener market, thereby alleviating the pain point of navigating complex and unpredictable business environments.

Economic factors

Global economic health is a major driver for the automotive industry, directly influencing Bulten's demand for fasteners. When economies are robust, consumers tend to buy more vehicles, leading to increased production and, consequently, a higher need for components like those Bulten supplies.

The automotive fasteners market is projected for healthy expansion, with forecasts indicating it could reach USD 30.2 billion by 2030. However, this growth trajectory isn't immune to the persistent shadows of economic instability and geopolitical tensions that continue to shape the global landscape.

Bulten's own financial performance in Q1 2025 offers a clear illustration of this relationship. The company reported a decline in net sales, a situation partly attributed to reduced vehicle production volumes, underscoring the direct link between Bulten's business and the broader economic climate.

Inflationary pressures and rising raw material costs, especially for steel and other metals, directly impact Bulten's production expenses for fasteners. For instance, the average price of hot-rolled coil steel in Europe saw significant increases throughout 2023 and into early 2024, impacting input costs for many manufacturing sectors.

The automotive industry, Bulten's primary market, is currently facing increased personnel and material costs. These rising expenses have led to a structural decline in profitability for many suppliers within the automotive value chain, with some reporting profit margins below 5% in recent fiscal years.

Consequently, Bulten must maintain rigorous control over its operational expenses. A strategic focus on enhancing profitability through the development and sale of higher-margin product lines is therefore crucial for navigating these challenging economic conditions.

Bulten, as a global supplier of industrial fastening solutions, is significantly exposed to exchange rate fluctuations. These movements directly impact the translation of its international revenues and the cost of goods sold when converting foreign currencies back to its reporting currency, SEK. For instance, a stronger SEK can make Bulten's products more expensive for overseas buyers, potentially dampening demand, while a weaker SEK could boost reported earnings but increase the cost of imported materials.

Managing these currency risks is paramount for Bulten's profitability, especially given its operational presence across Europe, Asia, and North America. The company's 2024 financial reports will likely detail strategies employed to mitigate these effects, such as hedging instruments. For example, in early 2024, the Euro experienced some volatility against the Swedish Krona, which would have directly influenced Bulten's earnings from its significant European operations.

Consumer Spending and Vehicle Demand

Consumer spending power and confidence directly impact new vehicle sales, a critical factor for automotive fastener demand. For instance, in the first quarter of 2024, U.S. retail sales of new vehicles saw a notable increase, reflecting improved consumer sentiment and disposable income, which benefits suppliers like Bulten.

Shifting consumer preferences, particularly the accelerating adoption of electric vehicles (EVs), are reshaping fastener requirements. EVs often utilize different materials and assembly techniques, necessitating specialized fasteners. By 2025, global EV sales are projected to exceed 15 million units, a significant increase from 2023, highlighting this trend.

The overall upturn in consumer demand for vehicles acts as a strong positive driver for the fasteners market. As vehicle production ramps up to meet this demand, the need for components like those supplied by Bulten grows in tandem. For example, automotive production forecasts for 2024 indicate a global increase, directly translating to higher fastener volumes.

- Consumer Confidence Index: The Conference Board's Consumer Confidence Index in the U.S. averaged 103.5 in Q1 2024, indicating a generally positive outlook supporting vehicle purchases.

- EV Market Growth: Projections suggest the global EV market could reach over $1.5 trillion by 2030, underscoring the long-term shift in vehicle technology and fastener needs.

- Vehicle Production Rates: Major automotive manufacturers reported increased production schedules for 2024 models, directly correlating with higher demand for essential components.

Raw Material Availability and Sourcing

Ensuring a steady supply of essential materials like steel, aluminum, and various alloys is fundamental for Bulten's fastener manufacturing operations. The company actively pursues the use of circular raw materials, particularly scrap-based steel, to bolster its supply chain's sustainability and lessen its dependence on newly extracted resources. This strategic approach not only helps to reduce potential supply disruptions but also aligns Bulten with important environmental objectives.

Bulten's commitment to circularity is evident in its sourcing strategies. By prioritizing recycled content, the company aims to build a more resilient supply chain, less susceptible to the price volatility and availability challenges often associated with primary raw materials. This focus is particularly relevant given global trends towards resource conservation and the increasing demand for sustainable manufacturing practices.

- Circular Sourcing: Bulten emphasizes the use of scrap-based steel, contributing to a more sustainable production model.

- Risk Mitigation: Utilizing recycled materials helps reduce reliance on virgin resources, thereby mitigating supply chain risks.

- Environmental Alignment: The focus on circular raw materials supports Bulten's environmental, social, and governance (ESG) commitments.

- Cost Efficiency: In many cases, recycled materials can offer cost advantages compared to virgin materials, contributing to competitive pricing.

Economic factors significantly shape Bulten's performance, with global economic health directly influencing demand for automotive fasteners. Inflationary pressures and rising raw material costs, particularly for steel, impact production expenses, as seen with hot-rolled coil steel price increases in Europe through early 2024. Bulten's Q1 2025 sales decline, linked to reduced vehicle production, highlights this sensitivity.

Exchange rate fluctuations also pose a risk, affecting Bulten's international revenues and costs. For instance, the Euro's volatility against the Swedish Krona in early 2024 would have directly influenced earnings from European operations. Consumer spending power and confidence are critical, with Q1 2024 U.S. retail sales of new vehicles showing an increase, boosting demand for components.

The automotive industry faces increased personnel and material costs, leading to structural profit declines for many suppliers, with some reporting margins below 5% in recent fiscal years. Bulten must control operational expenses and focus on higher-margin products to navigate these challenges.

Shifting consumer preferences towards electric vehicles (EVs) are also reshaping fastener needs, as EVs often require specialized components. Global EV sales are projected to exceed 15 million units by 2025, a significant rise from 2023.

| Economic Factor | Impact on Bulten | Supporting Data/Trend (2024/2025) |

| Global Economic Health | Influences vehicle demand and fastener sales | Automotive production forecasts for 2024 indicate a global increase. |

| Inflation & Material Costs | Increases production expenses | Hot-rolled coil steel prices in Europe saw significant increases through early 2024. |

| Exchange Rates | Affects international revenue translation and costs | Euro volatility against SEK in early 2024 impacted European operations. |

| Consumer Spending & Confidence | Drives new vehicle sales | U.S. Q1 2024 retail sales of new vehicles saw a notable increase. |

| EV Adoption | Changes fastener requirements | Global EV sales projected to exceed 15 million units by 2025. |

Same Document Delivered

Bulten PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Bulten PESTLE Analysis offers a detailed examination of the external factors impacting the company. You can trust that the insights and structure you see will be yours to leverage immediately.

Sociological factors

Consumer preference for electric vehicles (EVs) is rapidly reshaping the automotive landscape, directly influencing demand for specialized fasteners. As consumers increasingly opt for EVs, the need for components that enhance performance and efficiency, such as lighter and stronger fasteners for battery systems, is on the rise. For instance, by the end of 2023, global EV sales surpassed 13.6 million units, a significant jump from previous years, indicating a strong consumer shift.

This growing consumer demand for EVs necessitates that companies like Bulten adapt their product offerings. The focus is shifting towards innovative fastening solutions tailored for EV battery packs, electric powertrains, and lightweight vehicle structures. This trend is supported by projections indicating continued robust growth in the EV market, with some forecasts suggesting EVs could represent over 50% of new car sales in major markets by 2030.

Urbanization continues to reshape how people move. By 2023, over 60% of the global population lived in urban areas, a figure projected to reach 68% by 2050. This concentration of people in cities fuels demand for efficient transportation, potentially shifting away from individual car ownership towards shared mobility services.

The rise of shared mobility platforms and the anticipated integration of autonomous vehicles are significant trends. These developments could lead to fewer privately owned cars, impacting traditional automotive manufacturing volumes. However, they also present opportunities for specialized fasteners used in the construction and maintenance of these new mobility solutions, as well as within the complex systems of autonomous vehicles.

Changes in workforce demographics, such as an aging population in some regions and a growing demand for younger talent, directly impact Bulten's labor availability and associated costs. The increasing need for specialized skills in advanced manufacturing and digital technologies, driven by Industry 4.0, means Bulten must invest in training or attract workers with expertise in areas like automation, AI, and data analytics to remain competitive.

Sustainability Awareness in Consumers

Consumers are increasingly prioritizing sustainability, driving demand for eco-friendly automotive components. This trend directly impacts suppliers like Bulten, pushing them towards greener manufacturing processes and the use of recycled materials.

Bulten's commitment to sustainability is evident in its EcoVadis Platinum rating, a significant achievement in the industry. This rating highlights their proactive approach to environmental, social, and governance factors.

The automotive sector, including component suppliers, faces mounting pressure to reduce its carbon footprint. This involves transparent reporting on the environmental impact of parts and the supply chain.

- Growing consumer demand for sustainable products: A 2024 report indicated that over 70% of consumers consider sustainability when making purchasing decisions.

- Industry-wide push for greener practices: Many automotive OEMs are setting stringent sustainability targets for their suppliers, effective from 2025.

- Bulten's EcoVadis Platinum rating: This rating places Bulten in the top 1% of companies assessed by EcoVadis, underscoring their leadership in sustainability.

- Focus on recycled materials and emissions reduction: Bulten is actively investing in technologies to increase the use of recycled content and lower production emissions.

Aging Vehicle Fleets and Aftermarket Demand

The average age of vehicles on the road is a significant factor influencing aftermarket demand for replacement fasteners. As vehicles age, components wear out, necessitating replacements. While Bulten's core business is supplying leading automotive manufacturers for new vehicle production, an aging fleet can indirectly create opportunities for standard fasteners through the maintenance and repair sector. This segment, however, typically represents a smaller portion of the business for Original Equipment Manufacturers (OEM) suppliers like Bulten.

In the United States, for instance, the average age of light vehicles reached a record 12.5 years in 2022, according to S&P Global Mobility. This trend continued into 2023, with projections indicating a further increase. This aging demographic suggests a growing need for replacement parts, including fasteners, to keep older vehicles operational. While Bulten's primary focus remains on the new vehicle market, this demographic shift highlights a potential, albeit secondary, avenue for their products.

- Aging Fleet Trend: The average age of vehicles on the road in major markets like the US and Europe has been steadily increasing, reaching over 12 years in some regions.

- Aftermarket Potential: An older vehicle population drives demand for maintenance and repair, creating a market for replacement fasteners.

- Bulten's Focus: Bulten's primary business is supplying fasteners for new vehicle production, serving Tier 1 suppliers and OEMs.

- Secondary Opportunities: While not Bulten's main focus, the aftermarket for standard fasteners represents a potential, smaller revenue stream as vehicles age.

Societal attitudes towards safety and comfort are evolving, influencing vehicle design and the fasteners used within them. Consumers expect advanced safety features and enhanced comfort, which often require sophisticated fastening solutions. For example, the increasing prevalence of advanced driver-assistance systems (ADAS) relies on precise and robust fastening for sensor integration.

The growing emphasis on ethical sourcing and corporate social responsibility also impacts Bulten. Stakeholders, including investors and consumers, are increasingly scrutinizing supply chains for fair labor practices and environmental stewardship. Bulten's commitment to these principles, as demonstrated by its EcoVadis Platinum rating, aligns with these societal expectations.

Consumer preferences are also shifting towards customization and personalization in vehicles. This trend can influence the demand for specialized fasteners that allow for modularity and easier upgrades throughout a vehicle's lifecycle.

| Societal Factor | Impact on Automotive Fasteners | Bulten Relevance/Data |

| Safety & Comfort Expectations | Demand for high-strength, lightweight fasteners for ADAS and interior components. | ADAS adoption is projected to exceed 80% in new vehicles by 2028. |

| Ethical Sourcing & CSR | Increased scrutiny of supply chains for labor and environmental practices. | Bulten's EcoVadis Platinum rating (top 1% globally) demonstrates strong CSR performance. |

| Customization & Modularity | Need for adaptable fastening solutions for personalized vehicle configurations. | Growing trend in aftermarket customization, influencing OEM design for flexibility. |

Technological factors

The automotive sector's swift shift towards electric vehicles (EVs) represents a significant technological force, demanding novel fastener technologies. EVs rely on specialized fasteners for critical components such as battery enclosures, electric powertrains, and lightweight chassis designs that frequently incorporate materials like aluminum and carbon fiber composites.

Bulten faces the imperative to adapt its product portfolio to address the distinct performance demands of EVs, including managing specific vibrational patterns, thermal conductivity, and the unique structural stresses associated with these advanced vehicles. For instance, by 2025, global EV sales are projected to exceed 15 million units, highlighting the scale of this technological transition and the growing need for specialized fastening solutions.

The integration of Industry 4.0 technologies like the Internet of Things (IoT), artificial intelligence (AI), and advanced robotics is fundamentally reshaping fastener manufacturing. These innovations allow for real-time data collection and analysis, leading to more agile and responsive production lines.

Bulten can leverage these advancements to significantly boost production efficiency and product quality. For instance, AI-powered quality control systems can identify defects with greater accuracy than traditional methods, reducing waste and improving customer satisfaction. In 2024, the global market for industrial automation, a key component of Industry 4.0, was projected to reach over $250 billion, indicating a strong trend towards these sophisticated manufacturing techniques.

Innovations in material science are fundamentally reshaping the fastener industry, driving the development of components that are not only lighter and stronger but also significantly more durable. This push for advanced materials directly impacts companies like Bulten, influencing their research and development strategies.

The automotive sector, a key market for fastener manufacturers, is increasingly adopting materials such as titanium, advanced composites, lightweight alloys, and high-strength steels. For instance, the average vehicle weight reduction target in many regions is pushing for a 10% increase in lightweight material usage by 2025, directly impacting fastener material choices to enhance fuel efficiency.

These material science advancements compel Bulten to continuously innovate in fastener design and material selection. By integrating these cutting-edge materials, Bulten can offer solutions that meet the evolving demands for weight reduction and improved performance in various applications, particularly in the automotive and aerospace industries.

Autonomous Driving Technology

The ongoing development of autonomous driving technology is set to reshape vehicle architecture, directly influencing the demands placed on components like fasteners. As self-driving systems become more sophisticated, the integration of advanced sensors, processors, and communication modules will necessitate new fastener solutions capable of accommodating these complex systems and ensuring robust structural integrity.

The increasing connectivity and autonomy in vehicles present an opportunity for 'smart fasteners.' These fasteners could be embedded with sensors to monitor stress, vibration, or temperature, transmitting data in real-time to the vehicle's central control system. This capability promises to enhance safety through predictive maintenance and optimize performance by providing crucial diagnostic information, potentially reducing downtime and improving operational efficiency.

- Market Growth: The global market for autonomous vehicles is projected to reach hundreds of billions of dollars by 2030, with significant investment in sensor and AI technology.

- Component Integration: As vehicles incorporate more advanced driver-assistance systems (ADAS), the complexity of component mounting and fastening increases, requiring specialized solutions.

- Smart Materials: Research into smart materials for fasteners, capable of self-monitoring and reporting, is gaining traction, driven by the demand for enhanced vehicle safety and reliability.

Digitalization and Data Analytics

The automotive sector's increasing digitalization, particularly in supply chain and manufacturing, is a significant technological driver. This trend allows for enhanced data analytics, providing companies like Bulten with deeper insights into their operations. For instance, the global automotive software market was valued at approximately $25.4 billion in 2023 and is projected to reach $43.2 billion by 2028, indicating substantial investment in digital solutions.

Leveraging these digital advancements enables Bulten to achieve end-to-end visibility across its supply chain. This improved visibility is crucial for optimizing inventory control, reducing waste, and ensuring timely delivery of components. In 2024, many automotive manufacturers are focusing on supply chain resilience through digital twins and predictive analytics, aiming to mitigate disruptions.

Furthermore, sophisticated data analytics empower Bulten to manage its supply chains more effectively. By analyzing vast datasets, the company can identify patterns, predict potential bottlenecks, and proactively address issues. This data-driven approach also aids in identifying emerging consumer trends, which is vital for informing product development and maintaining a competitive edge in the evolving automotive market.

- Enhanced Data Analytics: Digitalization provides tools for deeper operational and market insight.

- Supply Chain Optimization: Improved visibility leads to better inventory management and efficiency.

- Trend Identification: Data analytics helps in recognizing and responding to consumer demands for new products.

- Market Growth: The automotive software market's projected growth signifies a strong industry shift towards digital integration.

The automotive sector's rapid electrification and increasing reliance on advanced materials like composites and lightweight alloys present a significant technological shift. This necessitates specialized fasteners capable of withstanding new stresses and thermal conditions, with global EV sales projected to surpass 15 million units by 2025.

Industry 4.0 technologies, including AI and IoT, are revolutionizing fastener manufacturing by enabling real-time data analysis for enhanced efficiency and quality control. The industrial automation market, a key enabler of these technologies, was expected to exceed $250 billion in 2024, underscoring the trend towards sophisticated production methods.

The development of autonomous driving systems and smart materials for components, such as sensors embedded in fasteners, is creating new opportunities for enhanced vehicle safety and performance. The autonomous vehicle market is anticipated to reach substantial figures by 2030, driving innovation in integrated vehicle technologies.

Digitalization across the automotive supply chain and manufacturing processes offers enhanced data analytics for operational insights and supply chain optimization. The automotive software market, valued around $25.4 billion in 2023, is projected for significant growth, highlighting the industry's commitment to digital integration.

| Technological Factor | Impact on Fasteners | Bulten's Opportunity/Challenge | Relevant Data/Projection |

|---|---|---|---|

| Electric Vehicles (EVs) | Need for specialized fasteners for battery enclosures, powertrains, and lightweight materials. | Adapt product portfolio to meet EV-specific performance demands. | Global EV sales projected to exceed 15 million units by 2025. |

| Industry 4.0 (AI, IoT, Robotics) | Reshaping manufacturing for increased efficiency, quality control, and data analysis. | Leverage advancements to boost production efficiency and product quality. | Industrial automation market projected over $250 billion in 2024. |

| Material Science Innovations | Demand for lighter, stronger, and more durable fasteners using advanced materials. | Innovate in fastener design and material selection to meet weight reduction targets. | 10% increase in lightweight material usage targeted by 2025 in automotive. |

| Autonomous Driving & Connectivity | Requirement for fasteners accommodating complex sensor integration and enabling 'smart fasteners'. | Develop solutions for integrated systems and explore smart fastener capabilities. | Autonomous vehicle market projected for significant growth by 2030. |

| Digitalization & Data Analytics | Enabling end-to-end supply chain visibility and optimized operations. | Utilize data analytics for supply chain management and trend identification. | Automotive software market projected to reach $43.2 billion by 2028. |

Legal factors

Stringent vehicle safety regulations, such as those concerning crashworthiness and occupant protection, significantly shape the design and performance standards for fasteners. For instance, regulations like the UN ECE R157, which mandates advanced emergency braking systems, indirectly impact fastener specifications by requiring components that can withstand higher operational stresses and maintain integrity under dynamic conditions.

As critical safety components, fasteners necessitate Bulten's adherence to rigorous testing and quality assurance protocols. This includes compliance with standards like ISO 26262 for functional safety, ensuring product reliability and minimizing potential liability risks associated with component failure in safety-critical applications.

Environmental regulations like REACH and RoHS, along with directives on end-of-life vehicles, significantly impact Bulten's operations by restricting hazardous substances and requiring material recyclability. This means Bulten must carefully select materials and surface treatments to ensure compliance, pushing for more sustainable and environmentally friendly fastener solutions.

Labor laws significantly impact Bulten's operational costs and HR strategies across its global manufacturing footprint. For instance, in Sweden, where Bulten has a strong presence, the average labor cost per employee in manufacturing was approximately SEK 50,000 per month in 2024, a figure influenced by strong union agreements and social security contributions. Navigating varying regulations, from Germany's stringent worker protection laws to those in lower-cost regions, necessitates careful compliance to avoid penalties and maintain positive employee relations.

Product Liability and Quality Standards

Product liability laws are critically important for Bulten, as fasteners are essential components for vehicle safety and performance. A single fastener failure can result in substantial legal claims and financial penalties, emphasizing the necessity of Bulten's rigorous quality control and testing protocols.

The automotive industry, in particular, faces stringent regulations. For instance, in 2024, the U.S. National Highway Traffic Safety Administration (NHTSA) reported over 1,000 vehicle recalls, many of which involved critical safety components where fastener integrity is paramount. Bulten's commitment to exceeding industry standards, such as ISO/TS 16949 (now IATF 16949), directly mitigates these risks.

- Stringent Product Liability: Fastener failures can lead to costly lawsuits and recalls, impacting Bulten's financial stability and reputation.

- Quality Control is Paramount: Bulten's investment in advanced testing, including fatigue and tensile strength analysis, is crucial for compliance and risk mitigation.

- Regulatory Compliance: Adherence to global automotive quality standards like IATF 16949 is non-negotiable for market access and liability protection.

- Impact of Recalls: The average cost of a vehicle recall can range from millions to tens of millions of dollars, highlighting the financial imperative for robust product quality.

Antitrust and Competition Laws

Bulten navigates a global automotive fastener market characterized by fragmentation and intense competition. This landscape necessitates strict adherence to antitrust and competition laws across numerous operating regions. These regulations are designed to prevent any single entity from dominating the market and to ensure a level playing field for all participants, directly impacting Bulten's strategic decisions regarding market entry, partnerships, and pricing.

For instance, the European Union's competition law, enforced by the European Commission, scrutinizes mergers and acquisitions to prevent the creation of monopolies. In 2023, the Commission continued its active enforcement, investigating several sectors for potential anti-competitive practices. Bulten's own market share, while significant in certain niches, remains well below thresholds that would typically trigger major antitrust concerns on a global scale, but local market dominance could attract scrutiny.

Key considerations for Bulten include:

- Merger and Acquisition Scrutiny: Antitrust authorities globally review any potential acquisitions by Bulten to ensure they do not stifle competition.

- Cartel Prohibition: Agreements between competitors to fix prices, allocate markets, or rig bids are illegal and strictly prosecuted.

- Abuse of Dominant Position: Companies with significant market power are prohibited from exploiting that position to disadvantage competitors or consumers.

- Regulatory Compliance Costs: Maintaining compliance with diverse international antitrust regulations adds to operational overhead and requires ongoing legal and strategic evaluation.

Legal frameworks significantly influence Bulten's operations, particularly concerning product safety and liability. Stringent automotive regulations, such as those mandating advanced driver-assistance systems, indirectly affect fastener specifications by requiring components capable of withstanding increased operational stresses. Compliance with standards like IATF 16949 is crucial for market access and mitigating the substantial financial risks associated with product recalls, which in 2024 continued to affect the automotive sector, with costs often running into millions of dollars per incident.

Environmental factors

Global pressure for decarbonization is significantly impacting the automotive sector. For instance, the European Union's ambitious target to reduce CO2 emissions from new cars by 55% by 2030, compared to 1990 levels, is a major driver. This necessitates lighter vehicles, directly influencing Bulten's product development towards lightweight fasteners.

These emission targets compel vehicle manufacturers to innovate, pushing Bulten to adapt its manufacturing processes for greater sustainability. The focus shifts to reducing the carbon footprint of components, meaning Bulten must consider the lifecycle emissions of its fasteners, not just their performance.

Growing worries about the availability of raw materials are pushing the automotive industry towards circular economy models. This shift means more focus on recycled content, refurbishing components, and reusing parts. For Bulten, this translates into a strategic move to use more recycled steel, aiming for a higher percentage in their production, and actively seeking out suppliers committed to sustainable resource management.

Stricter regulations on waste management and recycling of manufacturing by-products and end-of-life vehicle components are a significant environmental factor for Bulten. For instance, the EU's Circular Economy Action Plan, updated in 2020 and with ongoing implementation, sets ambitious targets for waste reduction and increased recycling rates across various sectors, including automotive. Bulten must adapt its production to minimize waste generation and design products with recyclability in mind to comply with these evolving environmental mandates and support circular economy principles.

Energy Consumption and Renewable Energy Adoption

There's a significant push for companies like Bulten to cut down on energy use and switch to cleaner power sources. This isn't just a suggestion; it's becoming a requirement in many sectors, especially manufacturing.

Automotive giants are actively investing in and adopting solar, wind, and even hydrogen energy. This trend directly impacts their suppliers, including Bulten, as they are expected to align their energy strategies to meet these evolving demands and sustainability goals. For instance, by 2024, many automotive OEMs aim to source over 50% of their energy from renewables.

These shifts mean Bulten needs to consider its own energy footprint and explore renewable options to maintain its partnerships and competitiveness. This could involve investing in on-site solar installations or sourcing power from renewable energy providers.

- Growing Demand for Renewables: Automotive manufacturers are increasingly committed to renewable energy, with many setting targets to power their operations with 100% renewable electricity by 2030.

- Supply Chain Pressure: Suppliers like Bulten face direct pressure to demonstrate their own renewable energy adoption and energy efficiency improvements.

- Investment Opportunities: Transitioning to renewables can lead to long-term cost savings and enhanced brand reputation, making it a strategic investment.

Supply Chain Sustainability Requirements

Automotive original equipment manufacturers (OEMs) are increasingly mandating stringent sustainability requirements for their suppliers, including Bulten. This pressure extends across the entire supply chain, pushing companies to actively demonstrate environmental responsibility. For instance, by the end of 2024, major European automakers aim to have at least 75% of their tier-1 suppliers reporting on Scope 3 emissions, a significant increase from previous years.

Bulten must therefore engage proactively with its own suppliers to identify and implement more sustainable solutions. This includes exploring the use of recycled materials and optimizing production processes to reduce waste. Furthermore, adopting greener transportation methods for inbound and outbound logistics is becoming a critical factor in meeting OEM expectations and maintaining competitive advantage in the automotive sector.

- Increased OEM Scrutiny: Automotive OEMs are intensifying their focus on supplier environmental performance, with many setting specific targets for emissions reduction and resource efficiency for their supply chains by 2025.

- Supplier Engagement: Companies like Bulten are expected to collaborate with their suppliers to drive sustainability improvements, fostering a shared responsibility for environmental impact.

- Greener Logistics: The adoption of low-emission vehicles and optimized shipping routes are becoming essential for suppliers to meet the evolving transportation standards set by automotive manufacturers.

- Reporting and Transparency: Suppliers are increasingly required to provide transparent data on their environmental practices, including material sourcing and energy consumption, to satisfy OEM reporting obligations.

The automotive industry faces mounting pressure to decarbonize, with the EU targeting a 55% reduction in car CO2 emissions by 2030. This drives demand for lightweight components, influencing Bulten's product development. Furthermore, evolving regulations on waste and recycling, such as the EU's Circular Economy Action Plan, necessitate Bulten's adaptation to minimize waste and enhance product recyclability.

Automotive OEMs are increasingly mandating stringent sustainability requirements, pushing suppliers like Bulten to demonstrate environmental responsibility. By 2025, many major automakers expect at least 75% of their tier-1 suppliers to report on Scope 3 emissions, requiring Bulten to engage proactively with its own suppliers on sustainable solutions and greener logistics.

The shift towards renewable energy is a significant environmental factor, with many automotive OEMs aiming to power operations with 100% renewable electricity by 2030. This trend pressures suppliers like Bulten to adopt similar strategies, potentially through on-site solar installations or sourcing renewable energy, to maintain competitiveness and meet OEM expectations.

| Environmental Factor | Impact on Bulten | Relevant Data/Targets (2024/2025) |

|---|---|---|

| Decarbonization & Emission Targets | Demand for lightweight fasteners; sustainable manufacturing processes. | EU: 55% CO2 reduction for new cars by 2030. |

| Circular Economy & Waste Management | Increased use of recycled steel; product design for recyclability. | EU Circular Economy Action Plan (ongoing implementation). |

| Renewable Energy Adoption | Need to align energy strategies with OEM demands; explore renewable sourcing. | Many OEMs targeting >50% renewable energy sourcing by 2024. |

| Supply Chain Sustainability Requirements | Proactive supplier engagement; greener logistics; transparent reporting. | Major automakers aiming for 75% tier-1 suppliers reporting Scope 3 emissions by end of 2024. |

PESTLE Analysis Data Sources

Our Bulten PESTLE Analysis draws on a comprehensive blend of data, including official government reports, reputable financial news outlets, and industry-specific market research. This ensures a well-rounded understanding of the political, economic, social, technological, legal, and environmental factors influencing the automotive supply sector.