Bulten Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bulten Bundle

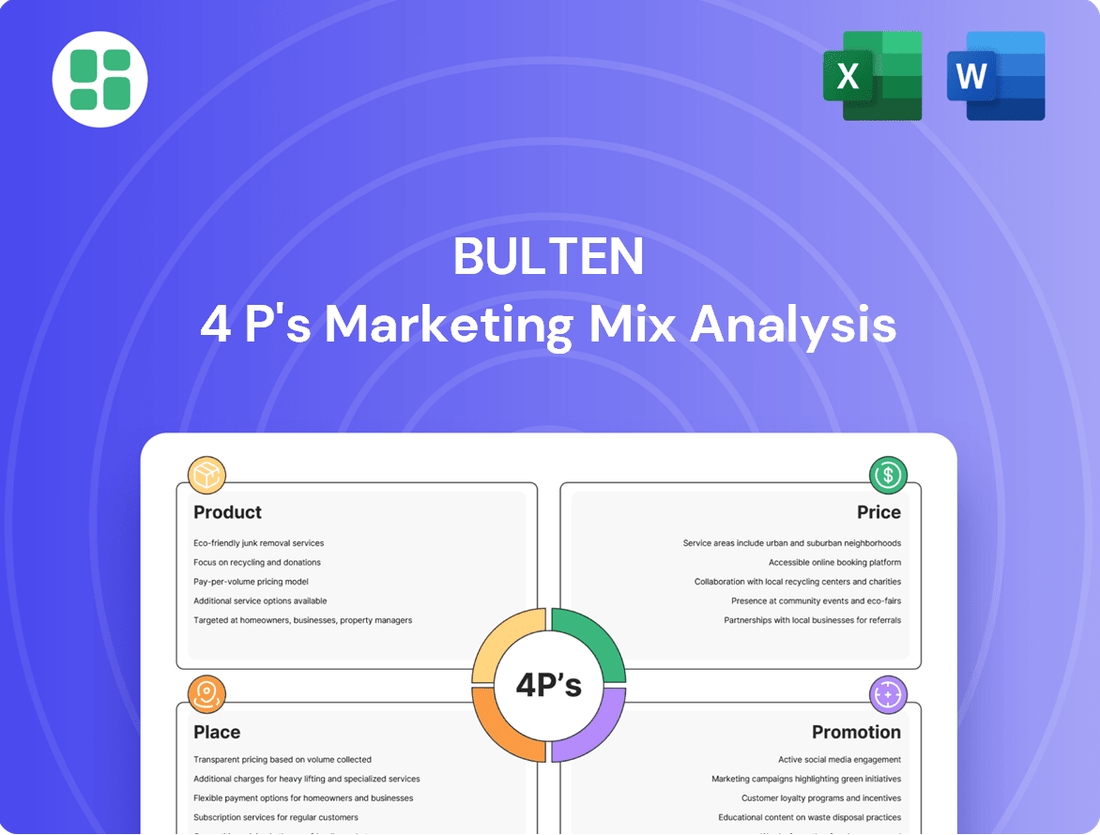

Discover the core of Bulten's market strategy with a focused look at their Product, Price, Place, and Promotion. See how these elements combine to create their competitive edge.

Ready to move beyond the overview? Unlock a comprehensive, editable 4Ps Marketing Mix Analysis for Bulten, packed with actionable insights and strategic examples.

Product

Bulten's specialized fasteners for automotive are engineered for demanding applications, meeting the rigorous quality and performance standards of global car manufacturers. Their extensive portfolio ranges from high-volume standard components to custom-engineered solutions designed for specific vehicle platforms and functionalities.

The company's commitment to innovation is evident in their development of lightweight fasteners and advanced materials, crucial for improving fuel efficiency and reducing emissions in vehicles. In 2024, Bulten reported a net sales of SEK 4,142 million, highlighting their significant market presence and the demand for their specialized automotive solutions.

Bulten's Full Service Provider (FSP) concept extends beyond just delivering fasteners. It allows clients to fully outsource their fastener management, covering everything from initial product development and global sourcing to intricate logistics and continuous after-sales support. This holistic approach aims to create a highly efficient and streamlined supply chain for Bulten's customers.

This FSP model represents a significant strategic shift for Bulten, positioning them not merely as a component supplier but as a crucial strategic partner in their clients' operations. For instance, Bulten's commitment to innovation is evident in their ongoing investment in R&D, with a focus on sustainable solutions and advanced materials, which directly benefits their FSP clients by providing cutting-edge fastener technology as part of the outsourced service.

Bulten champions product innovation with a strong sustainability ethos, targeting a reduced carbon footprint throughout its operations. This involves adopting greener surface treatments and investigating circular materials, such as steel derived from scrap.

Their commitment to environmental responsibility is validated by a Platinum EcoVadis rating, positioning them among the top 1% of companies evaluated. This focus on eco-friendly solutions is a key differentiator in the fastener market, appealing to increasingly environmentally conscious customers.

C-Parts Management Expertise

Bulten's C-Parts Management Expertise is a crucial element of their offering, focusing on standardized, high-volume components like screws and nuts. These items, while low in unit value, are essential for preventing production stoppages and controlling costs. Their proprietary Full Service Provider (FSP) concept is designed to streamline the handling of these critical C-parts, directly boosting customer operational efficiency.

The strategic focus for this segment is not solely on the automotive industry; Bulten is actively pursuing increased sales in sectors beyond automotive. This diversification aims to broaden their market reach and leverage their C-parts management capabilities across a wider range of industries. For example, in 2024, Bulten reported a significant increase in non-automotive sales, indicating successful penetration into new markets.

- Efficient Handling: Bulten's FSP concept ensures the smooth flow of essential C-parts, minimizing disruptions.

- Cost Control: Expert management of low-unit-value items prevents unnecessary expenses and optimizes inventory.

- Market Expansion: A dedicated strategy to grow C-parts sales outside the traditional automotive sector is a key growth driver.

- Operational Synergy: By managing C-parts, Bulten enhances the overall operational efficiency of their clients.

Customization and Technical Partnership

Bulten positions itself as a crucial development partner, not just a supplier. They actively collaborate from the earliest stages of vehicle design, integrating their deep technical and innovation expertise to ensure fasteners are optimally suited for complex automotive systems. This proactive engagement, often starting at the initial design and technical design phases, highlights their commitment to performance and integration.

Their technical partnership extends to forward-looking initiatives. Bulten undertakes research-related development projects with universities, fostering innovation and staying at the forefront of material science and fastening technology. This collaborative approach is vital for addressing the evolving demands of the automotive industry, particularly with the increasing complexity of electric vehicles and advanced materials.

- Development Partnership: Bulten engages from the initial design phase of vehicle programs.

- Technical Expertise: Leverages in-house technical and innovation competence for optimal fastener integration.

- Research Collaboration: Conducts research projects with universities to drive innovation.

Bulten's product strategy centers on specialized fasteners, particularly for the demanding automotive sector, offering both standard and custom-engineered solutions. Their innovation focus includes lightweight fasteners and advanced materials, crucial for fuel efficiency and emission reduction. In 2024, Bulten's net sales reached SEK 4,142 million, demonstrating strong market demand for their specialized offerings.

| Product Focus | Key Features | Market Impact (2024) |

|---|---|---|

| Specialized Automotive Fasteners | High quality, performance-driven, custom solutions | Significant contributor to SEK 4,142 million net sales |

| Lightweight & Advanced Materials | Fuel efficiency, emission reduction | Driving innovation and customer adoption |

| C-Parts Management | Efficient handling of high-volume components | Enhancing operational efficiency for clients |

What is included in the product

This analysis provides a comprehensive examination of Bulten's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic decision-making.

It delves into Bulten's specific market positioning and competitive landscape, making it an invaluable resource for understanding their approach to product development, pricing, distribution, and communication.

Simplifies complex marketing strategy into a clear, actionable framework, alleviating the pain of strategic confusion.

Provides a concise overview of Bulten's 4Ps, easing the burden of understanding and communicating their market approach.

Place

Bulten's global manufacturing footprint is a key element of its marketing mix, with production facilities strategically positioned across Europe, Asia, and North America. This distributed network enables localized manufacturing, bringing production closer to their customer base in these key regions.

This localized approach offers significant advantages, including enhanced flexibility in meeting regional demand, shorter lead times for product delivery, and a reduced vulnerability to the impacts of geopolitical instability and currency exchange rate volatility. Bulten aims for a balanced operational presence across these vital geographic markets.

For instance, in 2024, Bulten reported that its European operations continued to be a significant contributor to its overall revenue, while its Asian facilities saw increased demand, particularly from the automotive sector. The company's North American presence also demonstrated resilience, benefiting from reshoring trends observed in the automotive supply chain.

Bulten's direct-to-OEM distribution strategy is central to its marketing mix, focusing on building enduring partnerships with major automotive players. This approach, characterized by long-term contracts, underscores the company's commitment to serving the needs of global car manufacturers directly.

This business-to-business model thrives on cultivating robust customer relationships and demonstrating an in-depth comprehension of the intricate automotive supply chain dynamics. For instance, Bulten's ability to integrate seamlessly into OEM production schedules is a key differentiator.

Direct engagement allows for unparalleled collaboration in product development and service provision, ensuring that Bulten's fastening solutions are precisely tailored to evolving automotive engineering requirements. This close working relationship was evident in their Q1 2024 performance, where direct OEM sales accounted for a significant portion of their revenue.

Bulten's Full Service Provider (FSP) model fundamentally integrates logistics, transforming the supply chain for automotive clients. This means Bulten actively manages fastener availability, ensuring they are precisely where and when needed, which is critical for efficient automotive production lines. For instance, Bulten's commitment to just-in-time delivery, a cornerstone of their FSP logistics, directly supports manufacturers aiming to minimize on-site inventory and associated carrying costs, a strategy that became even more pronounced in the supply chain disruptions of 2021-2023.

Strategic Review of Operations

Bulten is undertaking a significant strategic review of its operational framework. This involves a deep dive into its manufacturing processes, specifically determining which product lines are best kept in-house and which are more efficiently outsourced. This critical assessment aims to streamline production and enhance overall cost-effectiveness.

The company is also examining its organizational structure and the potential consolidation or divestment of manufacturing sites. This move is geared towards optimizing resource allocation and paving the way for sustainable, profitable expansion. For instance, Bulten has been actively managing its production footprint, with recent reports highlighting efforts to improve efficiency in its European facilities.

- Operational Efficiency: Bulten's strategic review is focused on enhancing manufacturing efficiency, a key element in its 4P's analysis.

- Make-or-Buy Decisions: The company is critically evaluating its product sourcing strategy, deciding between in-house manufacturing and external procurement.

- Facility Optimization: Potential consolidation or divestment of manufacturing plants is being considered to improve resource utilization and profitability.

- Distribution Impact: The outcomes of this review will directly influence Bulten's future distribution networks and production planning.

Expansion into New Markets and Segments

Bulten is strategically expanding its global footprint, with a significant focus on the Asian market. This includes establishing joint ventures for micro screw manufacturing in Vietnam and India, with production slated to commence in 2025. This move is designed to tap into burgeoning demand and diversify revenue streams.

The company's expansion strategy goes beyond geographical reach; it also targets new customer segments. By entering markets like consumer electronics, Bulten aims to leverage its expertise in fastening solutions for a broader range of applications. This diversification is crucial for long-term growth and resilience.

- Asia Focus: Joint ventures in Vietnam and India for micro screw manufacturing.

- 2025 Production: Production targets are set for 2025 in these new Asian facilities.

- Segment Diversification: Expansion into consumer electronics alongside the automotive sector.

- Market Reach: Aiming to strengthen position and diversify customer base.

Bulten's Place strategy centers on its strategically distributed global manufacturing footprint, with facilities across Europe, Asia, and North America. This allows for localized production, reducing lead times and enhancing flexibility in meeting regional automotive demand. The company's expansion into Asia, with new joint ventures in Vietnam and India for micro screw manufacturing commencing production in 2025, further strengthens its global presence and market access.

This localized approach, combined with a direct-to-OEM distribution model, ensures Bulten is positioned close to its key automotive clients, facilitating seamless integration into their production processes. The company's Full Service Provider (FSP) model also plays a crucial role in its 'Place' strategy by optimizing logistics and ensuring just-in-time delivery of fasteners, thereby minimizing inventory costs for manufacturers.

Bulten's ongoing strategic review of its operational framework, including its manufacturing processes and facility optimization, will directly impact its future production and distribution capabilities. For example, in 2024, European operations remained a significant revenue contributor, while Asian facilities experienced increased demand, highlighting the importance of this geographically diversified approach.

| Region | Key Activities/Developments | 2024/2025 Focus |

|---|---|---|

| Europe | Significant revenue contributor, operational efficiency review | Streamlining production, optimizing resource allocation |

| Asia | Increased demand (automotive), new joint ventures in Vietnam & India | Commencing micro screw production in 2025, market diversification |

| North America | Resilience, benefiting from reshoring trends | Maintaining strong automotive supply chain integration |

What You See Is What You Get

Bulten 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This Bulten 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

Bulten's promotion strategy centers on targeted B2B relationship marketing, aiming to cultivate enduring partnerships with leading global automotive manufacturers. This approach emphasizes direct engagement, with dedicated sales teams and technical specialists collaborating closely with clients throughout the entire product development lifecycle, from initial concept to final production.

The core of this strategy lies in building profound trust and showcasing extensive industry expertise, crucial elements for success in the business-to-business automotive sector. For instance, Bulten's focus on customer collaboration was evident in their 2023 financial reports, which highlighted a stable revenue stream driven by long-term contracts with major automotive OEMs, underscoring the effectiveness of their relationship-centric promotional efforts.

Bulten's Full Service Provider (FSP) concept is a key promotional pillar, simplifying fastener management for Original Equipment Manufacturers (OEMs). This value proposition centers on Bulten handling the entire fastener lifecycle, from development and sourcing to logistics and after-sales service.

Marketing efforts highlight the significant benefits of this integrated approach, such as substantial cost savings and optimized resource allocation for customers. By entrusting all fastener needs to Bulten, OEMs can streamline operations and focus on their core competencies.

Bulten effectively communicates its sustainability leadership, a key element of its marketing mix. This includes highlighting its EcoVadis Platinum rating, a testament to its strong environmental, social, and governance performance. This recognition is crucial as the automotive industry increasingly demands sustainable supply chains.

The company's commitment to reducing its environmental footprint across the value chain is a significant competitive differentiator. Bulten's annual reports and investor communications detail their climate roadmap and the integration of eco-friendly materials, providing tangible evidence of their progress. For instance, their 2024 sustainability report details a 15% reduction in Scope 1 and 2 emissions compared to their 2020 baseline.

Investor Relations and Transparency

Bulten's investor relations strategy acts as a crucial promotional element, fostering trust and attracting capital by clearly articulating financial achievements, strategic direction, and environmental, social, and governance (ESG) commitments. This proactive communication targets a broad spectrum of stakeholders, from individual investors to institutional portfolio managers.

The company's commitment to transparency is evident through its consistent delivery of key financial disclosures. For instance, Bulten reported a net sales increase to SEK 12,034 million in 2023, demonstrating operational growth. This consistent reporting, including annual and sustainability reports, alongside quarterly updates, reinforces investor confidence and strengthens Bulten's standing in the market.

- Financial Reporting: Regular publication of annual and quarterly reports detailing performance, such as the 2023 net sales of SEK 12,034 million.

- Sustainability Communication: Inclusion of sustainability reports to highlight ESG initiatives and performance.

- Investor Engagement: Active participation in investor calls and presentations to discuss strategic progress and financial outlook.

- Market Perception: Enhanced market position and investor confidence through consistent and transparent communication.

Industry Events and Digital Presence

Bulten, like many B2B industrial suppliers, likely prioritizes industry events and a robust digital footprint to connect with its audience. These platforms are vital for demonstrating product advancements and highlighting their Full Service Provider (FSP) model. For instance, participation in key automotive trade shows in 2024 and 2025 would offer direct engagement opportunities.

A strong digital presence, including an informative website and active LinkedIn profile, serves as a continuous touchpoint. This allows Bulten to showcase its technical prowess and FSP capabilities, reinforcing its position as a leader in the fastener sector. In 2024, many industrial companies reported increased investment in digital marketing to compensate for potentially reduced physical event attendance.

The effectiveness of these channels is often measured by lead generation and brand visibility. For example, a well-executed LinkedIn campaign in 2024 could significantly boost awareness among engineering and procurement professionals in the automotive industry.

- Industry Trade Shows: Essential for showcasing new fastener technologies and FSP solutions to automotive and industrial clients.

- Digital Presence: A strong website and LinkedIn presence are crucial for continuous brand reinforcement and lead generation.

- Technical Seminars: Offer platforms to deep-dive into product innovation and application expertise.

- B2B Marketing Trends (2024-2025): Increased focus on digital engagement and data-driven outreach to target specific professional segments.

Bulten's promotion strategy is deeply rooted in relationship building and showcasing its comprehensive Full Service Provider (FSP) model. This approach highlights cost savings and operational efficiencies for automotive OEMs, reinforcing Bulten's value proposition. Their sustainability leadership, underscored by a Platinum EcoVadis rating and a commitment to reducing emissions, as evidenced by a 15% reduction in Scope 1 and 2 emissions by 2024 compared to 2020, is a key differentiator. Investor relations efforts, marked by transparent financial reporting, such as the 2023 net sales of SEK 12,034 million, further bolster market confidence.

Digital channels and industry events are critical for Bulten's promotional activities, enabling them to display product advancements and their FSP concept. In 2024, many industrial firms escalated digital marketing investments to enhance brand visibility and lead generation among engineering and procurement professionals. This focus on digital engagement is projected to continue through 2025, aligning with broader B2B marketing trends.

| Promotional Channel | Objective | Key Metrics (Illustrative for 2024-2025) | Bulten's Focus Areas |

|---|---|---|---|

| Direct Sales & Technical Collaboration | Cultivate long-term OEM partnerships, showcase expertise | Contract renewals, client satisfaction scores | Full Service Provider (FSP) model, product development support |

| Sustainability Communication | Enhance brand reputation, meet industry demand | EcoVadis rating, emissions reduction targets met | EcoVadis Platinum, 15% Scope 1 & 2 emission reduction (2024 vs 2020) |

| Investor Relations | Attract capital, build stakeholder trust | Net sales growth, stock performance, ESG reporting adherence | 2023 Net Sales: SEK 12,034 million, transparent quarterly/annual reports |

| Digital Presence & Trade Shows | Increase brand visibility, generate leads, showcase innovation | Website traffic, LinkedIn engagement, trade show leads | FSP model promotion, technical seminars, digital marketing investment |

Price

Bulten's pricing strategy heavily relies on long-term contracts with automotive manufacturers, often linked to specific vehicle production cycles. These agreements, typically spanning several years, detail the cost of fasteners and integrated supply chain solutions, fostering predictable revenue streams and cost management for both parties.

The pricing within these contracts is generally determined through rigorous competitive bidding and direct negotiation, reflecting the highly competitive nature of the automotive supply chain. For instance, Bulten's focus on securing multi-year agreements for new vehicle platforms in 2024 and 2025 aims to solidify its market position and ensure consistent demand for its specialized products.

Value-based pricing for Bulten's Full Service Provider (FSP) concept acknowledges the holistic value delivered, not just the price of individual fasteners. This approach incorporates the benefits of integrated services like development, streamlined sourcing, optimized logistics, and expert technical support, all contributing to substantial cost reductions and enhanced operational efficiency for customers.

The FSP's value proposition centers on the total cost of ownership for the client, moving beyond a simple component price comparison. For instance, Bulten's FSP model aims to reduce a customer's total supply chain costs by an estimated 5-10% through these integrated services, a significant driver in a competitive manufacturing landscape as of late 2024.

Bulten is prioritizing profitability by shifting sales towards higher-margin products and expanding its customer base beyond the automotive sector. This strategy suggests a pricing approach focused on maximizing revenue per offering, particularly given the economic uncertainties of 2024 and 2025.

For instance, Bulten's efforts to enhance its product mix are designed to improve gross profit margins. While specific margin improvements are proprietary, the company's stated strategy in its 2024 investor communications highlights a deliberate move to balance volume with value, aiming for sustainable profitability.

Adaptation to Raw Material Costs

Bulten's pricing strategy directly addresses the volatility of raw material costs, especially steel, a critical component in fastener production. This requires a flexible approach to pricing to ensure profitability amidst supply chain fluctuations.

The company employs cost-efficient manufacturing processes and invests in alloy innovation to mitigate the impact of rising material expenses. This proactive stance allows Bulten to maintain healthy profit margins even in challenging market conditions.

- Steel Price Volatility: Global steel prices experienced significant fluctuations throughout 2023 and into early 2024, impacting production costs for fastener manufacturers like Bulten.

- Cost Management Initiatives: Bulten's focus on operational efficiency and R&D in new materials aims to offset a portion of these raw material cost increases.

- Flexible Pricing: The company's ability to adjust pricing in response to market pressures is crucial for preserving profitability in a competitive landscape.

Financial Performance and Shareholder Returns

Bulten's pricing strategy is intrinsically linked to its financial objectives, prioritizing a robust balance sheet and dependable shareholder returns. This focus means that pricing must not only cover costs and generate profit but also contribute to the company's overall financial health.

The company's dividend policy, which targets distributing at least one-third of its net earnings after tax to shareholders, underscores the need for strong financial performance. This policy directly influences pricing decisions, as they must generate sufficient profits to meet these payout commitments while also retaining capital for reinvestment in growth opportunities.

For instance, Bulten's reported net sales for the first quarter of 2024 reached SEK 3,014 million. This revenue generation is a direct outcome of their pricing and sales efforts, and a portion of the profit derived from these sales is earmarked for dividends, reflecting the connection between pricing, profitability, and shareholder value.

- Dividend Policy: Bulten aims to distribute at least one-third of net earnings after tax as dividends.

- Financial Health: Pricing decisions are made with the goal of maintaining a strong balance sheet.

- Revenue Generation: Q1 2024 net sales were SEK 3,014 million, demonstrating the impact of pricing on top-line performance.

- Investor Expectations: Pricing must support profitability to meet investor expectations and fund growth.

Bulten's pricing strategy is a dynamic interplay of long-term contracts, value-based propositions for its Full Service Provider (FSP) model, and a keen awareness of raw material cost fluctuations. The company aims to balance volume with value, focusing on higher-margin products and expanded customer bases to ensure profitability, especially in the uncertain economic climate of 2024 and 2025.

| Pricing Aspect | Description | Impact/Example |

|---|---|---|

| Long-Term Contracts | Agreements with automotive manufacturers tied to vehicle production cycles. | Ensures predictable revenue and cost management; examples include securing multi-year agreements for new vehicle platforms in 2024-2025. |

| Value-Based Pricing (FSP) | Pricing reflects holistic value, including development, sourcing, logistics, and technical support. | Aims to reduce customer total supply chain costs by an estimated 5-10% (as of late 2024). |

| Raw Material Cost Management | Flexible pricing to address volatility, particularly in steel prices. | Global steel prices fluctuated significantly in 2023-early 2024; Bulten uses cost-efficient processes and alloy innovation to mitigate impacts. |

| Profitability Focus | Shifting sales to higher-margin products and expanding beyond automotive. | Supports dividend policy (at least one-third of net earnings) and financial health; Q1 2024 net sales were SEK 3,014 million. |

4P's Marketing Mix Analysis Data Sources

Our Bulten 4P's Marketing Mix Analysis leverages a comprehensive array of data, including official company reports, investor relations materials, and detailed product specifications. We also incorporate market research, competitor analysis, and publicly available sales data to ensure a holistic view of Bulten's strategy.