Bulten Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bulten Bundle

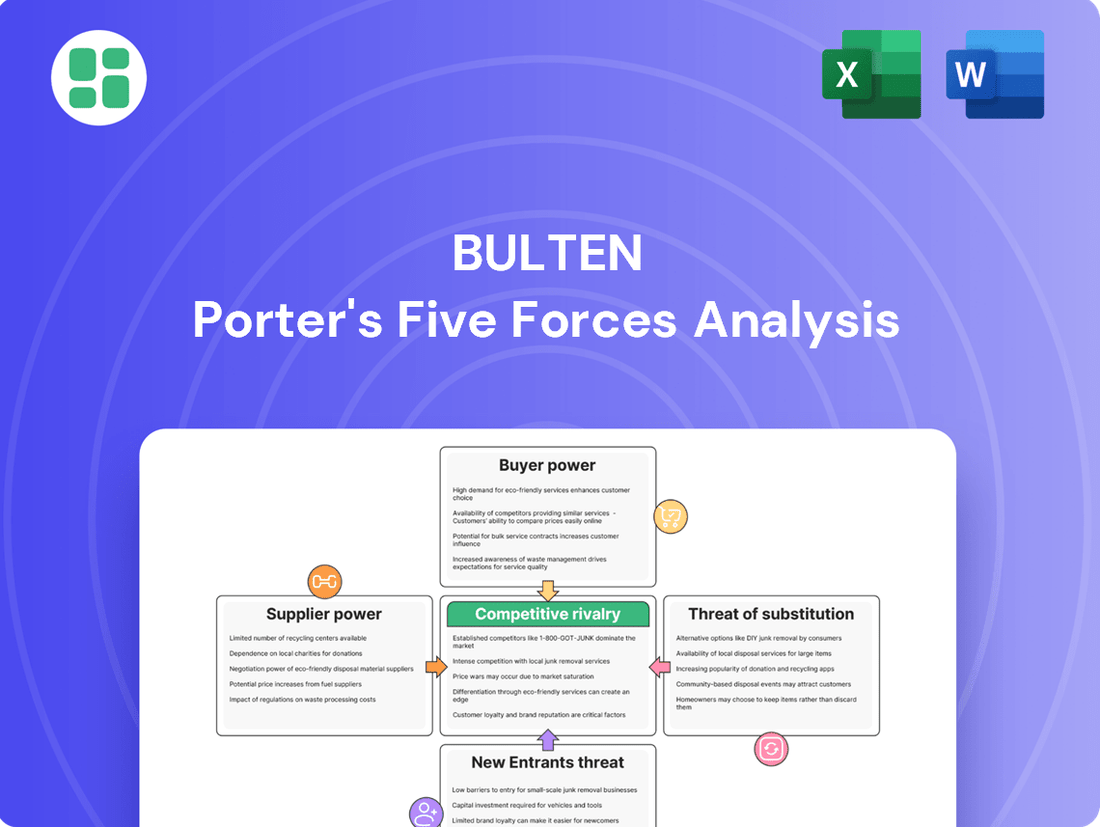

Bulten's competitive landscape is shaped by the interplay of buyer power, supplier leverage, and the threat of substitutes, each presenting unique challenges and opportunities. Understanding these forces is crucial for navigating the fastener industry.

The complete report reveals the real forces shaping Bulten’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The automotive fastener sector, which includes companies like Bulten, faces considerable risk from fluctuating raw material prices, especially for steel and related metals. This volatility directly strengthens the hand of raw material suppliers.

Industry analysis for 2024 showed an increase in raw material expenses ranging from 20% to 30%. Projections suggest this pricing pressure will continue into 2025, squeezing supplier margins and giving those suppliers more leverage in negotiations.

Bulten's first-quarter 2025 operating earnings experienced a setback of SEK 45 million due to anti-dumping duties imposed by Swedish Customs on fasteners and related materials imported from China into the EU. This situation underscores how government trade policies can significantly impact sourcing costs and operational complexity.

These duties effectively bolster the bargaining power of suppliers who are not subject to such tariffs, including alternative, compliant international sources or domestic raw material providers. For Bulten, this means a potential shift in supplier dynamics, where non-Chinese suppliers may command higher prices or more favorable terms.

Bulten's reliance on specialized machinery for high-precision fastener production grants significant bargaining power to suppliers of this advanced technology. The unique nature of their equipment means Bulten has limited alternatives, making it harder to switch suppliers without substantial cost and disruption.

The constant drive for innovation, particularly in areas like lightweighting and electric vehicle (EV) components, necessitates ongoing investment in new manufacturing technology. For instance, the automotive sector's shift towards EVs is projected to see a compound annual growth rate (CAGR) of over 15% in EV fastener demand by 2025, requiring Bulten to adopt new equipment. This continuous need for upgrades enhances the leverage of technology suppliers who can dictate terms based on their cutting-edge offerings.

Logistics and Supply Chain Disruptions

Ongoing logistics and supply chain disruptions, exacerbated by factors such as port congestion and elevated fuel prices, continue to present significant challenges within the automotive sector. These persistent issues directly amplify the bargaining power of logistics and transport suppliers. Their ability to provide efficient and reliable services becomes paramount for companies like Bulten to meet delivery schedules and control operational expenses.

The increased reliance on these service providers means they can command higher rates and stricter terms. For instance, global shipping costs saw substantial increases in 2023 and early 2024, with some routes experiencing double-digit percentage hikes compared to pre-pandemic levels, directly impacting the cost structure for manufacturers dependent on timely transportation.

- Increased Freight Costs: Spot rates for ocean freight, a key indicator, remained volatile throughout 2023, with some lanes showing year-over-year increases exceeding 50% at peak times.

- Port Congestion Impact: Delays at major global ports in 2023 averaged 3-5 days longer than historical norms, directly affecting inventory management and production continuity for automotive component suppliers.

- Fuel Price Volatility: Fluctuations in diesel and jet fuel prices in 2023 and early 2024 directly translate into higher operating costs for trucking and air freight services, which are then passed on to customers.

- Supplier Reliability Premium: Companies prioritizing reliable logistics partners, even at a premium, are willing to pay more, further strengthening the negotiating position of dependable transport providers.

Limited Specialized Component Suppliers

If Bulten relies on a narrow group of suppliers for highly specialized coatings, treatments, or sub-components, those suppliers gain significant leverage. This is especially apparent in the evolving automotive sector, where advanced materials and manufacturing processes are critical. For instance, the demand for specialized fasteners in electric vehicles (EVs) is projected to grow substantially. The global EV market, valued at approximately $380 billion in 2023, is expected to reach over $1.5 trillion by 2030, indicating a robust need for these niche components.

This limited supplier base can lead to price increases or unfavorable supply terms for Bulten. Suppliers of these specialized items, knowing their offerings are essential and difficult to substitute, can command higher prices. This situation is amplified when these components are integral to new technologies, such as the advanced lightweight alloys or corrosion-resistant treatments required for EV battery enclosures and powertrains.

- Limited availability of specialized treatments or coatings can give suppliers significant pricing power.

- The growing EV market, projected for substantial growth, increases demand for specialized automotive components.

- Key components for new vehicle technologies, like EVs, can be supplied by a small number of niche providers.

- Bulten's reliance on these few suppliers could result in less favorable contract terms.

Suppliers of raw materials like steel and specialized components hold significant sway over Bulten due to price volatility and limited alternatives. Increased raw material costs, potentially 20-30% in 2024, directly empower these suppliers. Furthermore, anti-dumping duties on Chinese fasteners in the EU, impacting Bulten's Q1 2025 earnings by SEK 45 million, bolster the power of non-tariffed suppliers.

The automotive sector's shift towards electric vehicles (EVs) fuels demand for specialized fasteners, with EV fastener demand projected to grow at over 15% CAGR by 2025. This reliance on advanced technology and niche components, often supplied by a few key players, grants these suppliers considerable leverage in pricing and terms. For example, the global EV market's expansion, from $380 billion in 2023 to an anticipated $1.5 trillion by 2030, highlights the critical nature of these specialized inputs.

| Factor | Impact on Supplier Bargaining Power | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Raw Material Price Volatility | Increased | 20-30% increase in raw material expenses in 2024. |

| Trade Policies (Anti-Dumping Duties) | Increased for compliant suppliers | SEK 45 million impact on Bulten's Q1 2025 earnings due to EU duties on Chinese fasteners. |

| Technological Advancement (EVs) | Increased for specialized component suppliers | EV fastener demand CAGR projected >15% by 2025. |

| Limited Supplier Base for Niche Components | Increased | Global EV market growth from $380B (2023) to $1.5T (2030). |

What is included in the product

This analysis dissects the competitive landscape for Bulten by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the fastener industry.

Effortlessly identify and address competitive threats with a visual representation of each force, simplifying complex market dynamics.

Customers Bargaining Power

Bulten's customer base is largely comprised of leading automotive manufacturers globally. This concentration means a few large Original Equipment Manufacturers (OEMs) hold significant sway. These major players, by virtue of their massive order volumes, can exert considerable pricing pressure on suppliers like Bulten, often dictating terms and impacting profitability.

Leading automotive manufacturers leverage global procurement and multi-sourcing to drive down costs and enhance supply chain resilience. This strategy inherently empowers them to negotiate from a position of strength, frequently pitting suppliers against one another. For a company like Bulten, this translates into continuous pressure to offer competitive pricing and superior service levels to retain and win business.

Automotive manufacturers, as Bulten's key customers, wield considerable power due to their exacting demands for fastener quality, safety, and performance. These stringent requirements are non-negotiable given the critical role fasteners play in vehicle integrity and passenger safety.

This customer power necessitates substantial investment by Bulten in advanced quality control systems and continuous research and development to meet and exceed these high-performance benchmarks. Failure to comply can result in significant penalties, directly impacting Bulten's profitability and market standing.

Demand for Full-Service Solutions (FSP)

Bulten's Full Service Provider (FSP) concept, where they manage all fastener needs from development to logistics, can indeed enhance customer loyalty. However, this comprehensive offering also elevates customer expectations for integrated, efficient, and innovative solutions. This can translate into increased bargaining power for customers, as they can leverage Bulten's commitment to a complete service package during price and contract negotiations.

- Customer Expectation Management: The FSP model creates a dependency, allowing customers to negotiate on the basis of the entire value chain Bulten manages.

- Potential for Price Pressure: Customers can use the breadth of services provided as leverage to demand more competitive pricing across the board.

- Innovation Demands: Bulten's role in development means customers can push for cost-saving innovations, impacting Bulten's margins if not managed effectively.

Switching Costs vs. Platform Standardization

While switching fastener suppliers can be a costly endeavor for Original Equipment Manufacturers (OEMs) due to re-tooling and re-certification expenses, the automotive industry's move towards platform modularity is altering this dynamic. This shift allows OEMs to use standardized part numbers across various vehicle models, potentially lowering perceived switching costs over time.

This increasing interchangeability of parts, driven by platform standardization, subtly enhances the bargaining power of customers. For instance, a major automotive manufacturer adopting a new modular platform strategy in 2024 might aim to consolidate its fastener sourcing, leveraging the broader availability of standardized components to negotiate better terms.

- OEMs face substantial costs when changing fastener suppliers, including re-tooling and re-certification.

- Platform modularity enables OEMs to standardize part numbers across multiple vehicle models.

- Standardization can reduce the perceived switching costs for buyers over time.

- This trend incrementally increases customer bargaining power in the fastener market.

Bulten's primary customers, major automotive manufacturers, possess significant bargaining power due to their substantial order volumes and the critical nature of fasteners in vehicle safety and performance. These OEMs leverage global sourcing and the potential for platform modularity to drive down costs and exert pricing pressure. For example, a shift towards standardized fastener parts across multiple vehicle platforms in 2024 could reduce perceived switching costs for these large buyers, further amplifying their negotiation leverage.

The automotive industry's drive for cost efficiency means customers constantly seek competitive pricing. Bulten's Full Service Provider model, while fostering loyalty, also elevates customer expectations for integrated solutions, potentially increasing their power in negotiations by allowing them to scrutinize the entire value chain. This dynamic necessitates Bulten's continuous investment in quality and innovation to meet stringent demands and maintain profitability amidst this customer-driven pressure.

| Customer Type | Bargaining Power Factor | Impact on Bulten |

|---|---|---|

| Major Automotive OEMs | High Volume Orders | Significant Pricing Pressure |

| Critical Quality/Safety Demands | Requires Investment in R&D and Quality Control | |

| Platform Modularity & Standardization | Potential for Lower Switching Costs, Increased Leverage | |

| Full Service Provider Expectations | Elevated Service Demands, Negotiation Leverage on Value Chain |

What You See Is What You Get

Bulten Porter's Five Forces Analysis

This preview displays the complete Bulten Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape. The document you see here is precisely what you will receive immediately after purchase, ensuring no discrepancies or missing information. This professionally formatted analysis is ready for immediate download and application to your strategic planning needs.

Rivalry Among Competitors

The global automotive fastener market is quite fragmented, with a mix of very large, established companies and many smaller, regional ones. Think of giants like Würth, ITW, Stanley Black & Decker, and ARaymond, which have massive reach and advanced technology. Bulten finds itself in this competitive arena, going up against these major players.

These established companies often have significant advantages, including vast distribution networks that reach almost everywhere and deep technological know-how. This makes it challenging for any single player, including Bulten, to dominate. In 2023, the global automotive fastener market was valued at approximately USD 22.5 billion, highlighting the scale of this competition.

The automotive fasteners market is expected to grow moderately, with projections indicating a compound annual growth rate between 2.2% and 5.8% from 2025 through 2035. This steady, but not explosive, expansion means companies are often competing for a relatively fixed pool of demand.

With significant fixed costs associated with manufacturing facilities and equipment, companies in this sector are incentivized to maintain high production volumes. When market growth is only moderate, this can lead to heightened price competition as firms strive to secure existing orders and keep their operations running efficiently, sometimes at the expense of profit margins.

While fasteners can often be seen as a commodity, Bulten actively combats this by specializing in advanced fasteners and offering comprehensive service packages. This is particularly crucial for the development of new vehicle platforms, especially in the rapidly growing electric vehicle (EV) sector. For instance, Bulten's focus on solutions for EV battery pack assembly highlights this differentiation strategy.

However, the competitive landscape is dynamic. Many rivals are also investing heavily in innovation, particularly in areas like advanced materials and novel designs. This includes a strong push towards lightweighting and the development of high-strength fasteners, essential for improving fuel efficiency and vehicle performance. This ongoing innovation from competitors requires Bulten to consistently adapt and enhance its own product offerings to stay ahead.

Regional Dynamics and Chinese Competition

The Asia-Pacific region, with China at its core, represents a critical battleground for automotive fastener manufacturers. This area is not only a dominant global manufacturing hub but also the largest consumer of automotive fasteners, fueling substantial demand.

The competitive landscape within China is intensifying, characterized by aggressive pricing and innovation from both original equipment manufacturers (OEMs) and their suppliers. This heightened rivalry directly impacts global pricing benchmarks and forces companies like Bulten, which have extensive international operations, to constantly re-evaluate their competitive strategies to remain viable.

- China's automotive market size: In 2023, China's automotive production and sales both exceeded 30 million units, solidifying its position as the world's largest automotive market.

- Fastener market growth: The global automotive fastener market, heavily influenced by Asian production, was projected to reach over $25 billion by 2024.

- Competitive intensity: Reports from industry analysts in late 2023 and early 2024 consistently highlighted overcapacity and intense price competition among fastener suppliers in China, particularly for standard components.

Mergers, Acquisitions, and Strategic Alliances

Mergers, acquisitions, and strategic alliances are actively reshaping the competitive landscape in the automotive fastener market. This ongoing consolidation trend is a significant factor in competitive rivalry, as larger entities emerge with increased market power and operational scale.

For instance, Fontana Gruppo's acquisition of a stake in Right Tight Fasteners, and Bossard Group's takeover of Ferdinand Gross in early 2025, exemplify this consolidation. Such moves can significantly bolster the capabilities and market reach of the acquiring companies, thereby intensifying competition for other players in the sector.

- Fontana Gruppo's investment in Right Tight Fasteners

- Bossard Group's acquisition of Ferdinand Gross (early 2025)

- Increased scale and market power of consolidated entities

- Heightened competitive pressure on smaller or less integrated rivals

The automotive fastener market is highly competitive, featuring numerous global players and many smaller regional ones, creating a fragmented landscape. Bulten competes with established giants like Würth and ITW, who possess extensive distribution and advanced technology, making market dominance difficult for any single entity.

The market's moderate growth, projected between 2.2% and 5.8% annually from 2025-2035, intensifies rivalry as companies vie for existing demand. High fixed costs encourage high production volumes, often leading to price competition, especially when growth is modest.

While fasteners can be commoditized, Bulten differentiates through specialized, advanced solutions, particularly for electric vehicles, a strategy essential to counter competitors also investing in innovation like lightweighting and high-strength materials.

The Asia-Pacific region, particularly China, is a key competitive battleground due to its massive automotive production and consumption, with intense pricing and innovation from local players impacting global benchmarks.

| Competitor Type | Key Players | Competitive Tactics | Market Share Impact |

|---|---|---|---|

| Global Giants | Würth, ITW, Stanley Black & Decker | Extensive distribution, advanced technology, economies of scale | High, significant market influence |

| Specialized/Niche Players | Bulten (EV focus), ARaymond | Product innovation, tailored solutions, service packages | Growing, particularly in emerging segments |

| Regional/Local Suppliers | Numerous smaller firms in Asia-Pacific | Aggressive pricing, local market understanding | Significant in specific geographies, driving price pressure |

SSubstitutes Threaten

The primary threat to traditional fasteners like those Bulten produces comes from ongoing improvements in alternative joining methods. Technologies such as advanced welding techniques, high-strength structural adhesives, clinching, and riveting are becoming more sophisticated and widely adopted.

This shift is particularly evident in the automotive sector, where manufacturers are increasingly looking to reduce their dependence on mechanical fasteners. For example, by 2024, the automotive industry's adoption of lightweighting strategies, often enabled by multi-material designs, is driving the use of these alternative joining methods to simplify assembly processes and improve overall vehicle efficiency.

The automotive industry's relentless pursuit of lightweighting, driven by stringent fuel economy standards and emission reduction targets, is a significant factor. For instance, by 2025, the average fuel economy target in the U.S. is projected to be around 54.5 miles per gallon. This push encourages the use of advanced materials like carbon fiber composites and high-strength aluminum alloys.

These new materials often necessitate different joining technologies and specialized fasteners, potentially bypassing Bulten's traditional product portfolio. For example, some composite materials might utilize adhesive bonding or specialized rivets rather than traditional threaded fasteners. This shift creates a substitution threat as alternative solutions emerge that do not rely on Bulten's core competencies.

The automotive industry's shift towards modular design and integrated components presents a significant threat of substitution for traditional fasteners. For instance, megacasting techniques, which consolidate numerous parts into single, large aluminum castings, directly reduce the need for many fasteners that would have been used to join those individual components.

This trend, evident in the development of platforms like Tesla's Gigacasting, aims to streamline production and cut assembly time. In 2024, the automotive sector continues to explore these advanced manufacturing methods, potentially impacting the volume of standard fasteners required per vehicle.

3D Printing and Additive Manufacturing

The rise of 3D printing and additive manufacturing presents a growing threat to traditional fastener manufacturers like Bulten. While not yet widely adopted for high-stress automotive applications, these technologies are rapidly evolving. For instance, in 2023, the global 3D printing market was valued at approximately $19 billion, with significant growth projected in the automotive sector.

These advanced manufacturing techniques allow for the creation of complex, integrated components that can potentially replace the need for multiple discrete fasteners. Furthermore, original equipment manufacturers (OEMs) may increasingly opt to produce their own fasteners in-house using additive manufacturing, bypassing external suppliers. By 2027, the automotive 3D printing market is expected to reach over $5 billion, indicating a substantial shift in manufacturing capabilities.

- Advancing Technologies: 3D printing is becoming more capable of producing parts with the strength and durability required for automotive applications.

- Component Integration: The ability to print complex, multi-functional parts can eliminate the need for traditional fasteners altogether.

- In-house Production: OEMs may leverage additive manufacturing to produce fasteners on-demand, reducing reliance on external suppliers.

- Market Growth: The rapid expansion of the 3D printing market, particularly within the automotive industry, signals a potential disruption to established supply chains.

Shift to Electric Vehicles (EVs) and Battery Systems

The accelerating shift towards electric vehicles (EVs) presents a significant threat of substitutes for traditional automotive fasteners. While the EV market's expansion, projected to reach over 30 million units globally in 2024, creates demand for specialized fasteners in battery packs and electric motors, it also spurs innovation in vehicle design. This includes increased component integration and the exploration of alternative assembly methods that could reduce the reliance on conventional fastening solutions.

EVs' unique thermal management and electrical conductivity needs are driving the development of highly specific joining technologies. These can include advanced adhesives, welding techniques, or snap-fit designs that may bypass the need for traditional bolts and screws. For instance, battery pack assembly often utilizes thermal interface materials and specialized bonding agents, potentially replacing mechanical fasteners in certain applications.

- EV Market Growth: Global EV sales are expected to exceed 15 million units in 2024, a substantial increase from previous years, indicating a growing market for EV-specific components.

- Design Integration: Automakers are increasingly designing EVs with integrated chassis and battery enclosures, potentially reducing the number of discrete fastening points compared to internal combustion engine vehicles.

- Alternative Joining Methods: The development of advanced adhesives and welding technologies for EV battery systems and structural components poses a direct substitute threat to traditional fasteners.

The threat of substitutes for traditional fasteners like those Bulten manufactures is substantial, driven by advancements in alternative joining technologies and evolving vehicle designs. These substitutes range from sophisticated welding and adhesive bonding to innovative manufacturing processes like 3D printing and megacasting. The automotive sector, in particular, is a key battleground where lightweighting and component integration strategies directly challenge the dominance of mechanical fasteners.

The push for lighter, more efficient vehicles, especially with the rapid growth of electric vehicles (EVs), is a primary catalyst for this substitution. For instance, by 2024, the automotive industry’s focus on multi-material designs to meet fuel economy targets is accelerating the adoption of alternative joining methods. These trends mean that components previously held together by numerous standard fasteners might now be integrated or joined using entirely different technologies.

Furthermore, the rise of additive manufacturing presents a dual threat: it can create complex parts that eliminate the need for fasteners, and OEMs may even produce their own fasteners in-house. The global 3D printing market, valued at around $19 billion in 2023, is expected to see significant growth in automotive applications, signaling a potential shift in supply chain dynamics by 2027.

The increasing use of megacasting, exemplified by platforms like Tesla's, consolidates multiple parts into single castings, thereby reducing the number of traditional fasteners required. This manufacturing evolution, continuing into 2024, directly impacts the demand for conventional fastening solutions in high-volume automotive production.

| Substitution Threat | Key Driver | Impact on Bulten | 2024/2025 Data Point |

|---|---|---|---|

| Advanced Welding & Adhesives | Lightweighting, multi-material designs | Reduced demand for traditional fasteners in specific applications | Automotive industry's adoption of these methods is increasing to meet efficiency goals. |

| 3D Printing / Additive Manufacturing | Component integration, in-house production | Potential to bypass external fastener suppliers; elimination of fastener needs in printed parts | Global 3D printing market projected to grow significantly, with automotive being a key sector. |

| Megacasting & Integrated Designs | Production simplification, cost reduction | Fewer discrete components requiring fastening | Continued exploration of advanced manufacturing methods in automotive platforms. |

| EV Specific Joining Technologies | Battery thermal management, electrical conductivity | Specialized solutions may replace standard fasteners in EV components | EV sales projected to exceed 15 million units globally in 2024, driving EV-specific innovations. |

Entrants Threaten

The automotive fastener industry presents a significant barrier to entry due to the immense capital required. Establishing state-of-the-art manufacturing facilities, complete with specialized machinery for precision engineering and robust quality assurance, demands hundreds of millions of dollars. For instance, companies like Bulten invest heavily in advanced production lines to meet the exacting standards of global automakers.

Furthermore, the relentless pace of innovation in the automotive sector, particularly with the shift towards electric vehicles (EVs) and lightweight materials, necessitates continuous and substantial investment in research and development. Companies must allocate significant resources to developing new fastener solutions that can withstand higher torque, resist corrosion in new material combinations, and meet evolving safety regulations, often requiring millions in R&D annually.

The automotive sector's stringent quality, safety, and performance demands, exemplified by certifications like IATF 16949, present a significant barrier. Achieving these standards is a costly and time-intensive undertaking, requiring substantial investment in processes and infrastructure.

Newcomers must navigate a complex and lengthy certification journey, a process that can take years and significant financial outlay before they can even supply major automotive manufacturers. This rigorous validation is crucial for building the trust and credibility essential for market entry.

Established relationships with major automotive OEMs represent a significant barrier for new entrants. Companies like Bulten have cultivated these partnerships over many years, fostering trust and reliability. OEMs typically prioritize suppliers with a proven track record, making it difficult for newcomers to secure initial contracts and gain market access. For instance, in 2024, the automotive industry continued to emphasize supplier stability and long-term commitments, further solidifying the advantage of incumbents.

Economies of Scale and Cost Competitiveness

Existing players in the automotive fastener market, like Bulten, benefit significantly from established economies of scale. This scale in production, purchasing power for raw materials, and optimized logistics allows them to achieve lower per-unit costs that are hard for newcomers to replicate. For instance, in 2024, major automotive suppliers often operate with production volumes in the hundreds of millions or even billions of units annually, creating a substantial cost barrier.

New entrants would struggle to match this cost competitiveness. Without the same production volume, their purchasing power for steel and other materials is diminished, leading to higher input costs. Furthermore, the capital investment required to build manufacturing facilities and distribution networks at a comparable scale is immense, making it difficult to compete on price against incumbents who have already amortized these costs over decades of operation.

- Economies of Scale: Established firms leverage large-scale production, leading to lower per-unit costs.

- Cost Advantage: Existing players benefit from bulk purchasing of raw materials and efficient logistics.

- Barriers to Entry: New entrants face challenges in matching the cost structure of incumbents.

- Price Sensitivity: Intense price pressure from powerful customers further disadvantages smaller, less efficient new companies.

Intellectual Property and Proprietary Solutions

The threat of new entrants in the specialized fastener market, particularly concerning intellectual property and proprietary solutions, is significantly mitigated by the substantial investment required. Bulten's success, for instance, is built on specialized fastener designs and advanced manufacturing processes, often protected by patents and trade secrets. New competitors would need to replicate these innovations or develop entirely new ones, a process that demands considerable R&D expenditure and time.

Furthermore, comprehensive full-service solutions, such as Bulten's Fastening Support Program (FSP), represent a significant barrier. Developing and implementing such integrated offerings requires deep industry knowledge, established supply chains, and customer relationships that are difficult for newcomers to quickly build. For example, in 2023, Bulten reported a strong order backlog, indicating the value and stickiness of their established service models, which are hard for new entrants to immediately match.

- Proprietary Technology: New entrants face high costs in developing or licensing patented fastener designs and advanced manufacturing techniques.

- R&D Investment: Significant upfront investment in research and development is necessary to create competitive, innovative solutions.

- Service Integration: Building comprehensive, full-service offerings like Bulten's FSP requires substantial time and resources to establish.

- Market Entry Costs: The combined costs of IP acquisition, R&D, and service development present a formidable financial hurdle for potential new players.

The threat of new entrants into the automotive fastener market remains low due to substantial capital requirements for manufacturing and R&D, stringent quality certifications like IATF 16949, and the difficulty of replicating established OEM relationships. Economies of scale enjoyed by incumbents, such as Bulten, create significant cost advantages that newcomers struggle to overcome.

In 2024, the automotive industry's continued emphasis on supplier stability and long-term commitments further entrenches incumbents. New entrants also face hurdles in matching proprietary technologies and integrated service offerings, demanding considerable investment in R&D and customer relationship building.

| Barrier Type | Description | Impact on New Entrants | Example (2024/2025 Focus) |

|---|---|---|---|

| Capital Requirements | High cost of advanced manufacturing facilities and machinery. | Significant financial hurdle. | Hundreds of millions USD for state-of-the-art production lines. |

| R&D Investment | Continuous need for innovation, especially for EVs and new materials. | Requires substantial ongoing expenditure. | Millions annually for developing lightweight, high-torque fasteners. |

| Quality & Certifications | Stringent industry standards (e.g., IATF 16949). | Time-consuming and costly to achieve. | Years and significant investment for validation processes. |

| Customer Relationships | Established trust and long-term partnerships with OEMs. | Difficult for new players to secure initial contracts. | OEMs prioritize proven track records and supplier stability. |

| Economies of Scale | Lower per-unit costs from large-scale production and purchasing power. | Makes price competition challenging for newcomers. | Incumbents produce billions of units annually, lowering input costs. |

Porter's Five Forces Analysis Data Sources

Our Bulten Porter's Five Forces analysis is built upon a robust foundation of data, integrating information from Bulten's annual reports, investor presentations, and industry-specific market research reports. This approach ensures a comprehensive understanding of the competitive landscape, supplier power, buyer bargaining, threat of new entrants, and the intensity of substitutes.